ACI Limited

Summary

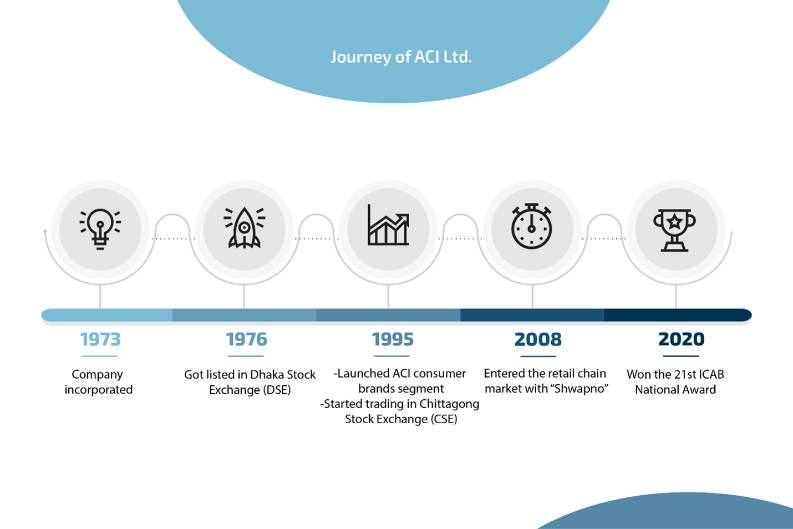

- Incorporated in 1973, Advanced Chemical Industries (ACI) Limited started its operation in Bangladesh in 1992.

- ACI made its share market debut in 1976 by getting listed in Dhaka Stock Exchange (DSE). On 21 October, 1995, the company started trading in Chittagong Stock Exchange (CSE), second of the two bourses in Bangladesh.

- For the year ended 30 June, 2021, ACI Limited has reported consolidated revenue of the BDT 80.75 billion compared to BDT 69.47 billion for the previous year – a growth of 16.23%.

- The company has achieved the first Position in 21st ICAB National Award 2020 for Best Presented Annual Reports under the Category- Diversified Holdings.

Company Overview

ACI Limited (DSE: ACI, CSE: ACI) is one of the largest diversified conglomerates in Bangladesh. In 1968, Imperial Chemical Industries (ICI) Plc, a British multinational company, started operating in Indian Subcontinent as ICI India Ltd. After the independence of Bangladesh in 1971, the company was renamed as ICI Bangladesh Manufacturers Limited in 1975. On 5 May 1992, ICI Plc, the parent company, sold 70% share of ICI Bangladesh Manufacturers Ltd. to the local shareholders. After this divestment, ICI Bangladesh Manufacturers Ltd was renamed as Advanced Chemical Industries (ACI) Limited and continued its operation in this region.1

From its inception, ACI Ltd. has constantly introduced new products and diversified its portfolio. The company launched new products almost every year and entered a new market after the divestment in 1992. Currently, ACI Ltd. is running its business in four strategic business units (SBUs). The SBUs are described below:

ACI Pharmaceuticals: Through the last three decades of successful operation in Bangladesh, ACI Pharma has become one of the top pharmaceutical companies in Bangladesh, employing more than 5,000 people all over the country. The company is determined to improve the health of the people of Bangladesh through introducing different innovative and reliable Pharmaceuticals products.

ACI Consumer Brands: ACI launched this segment in 1995 with two brands only– ACI Aerosol and Savlon which were able to gain a prestigious position in the market. Later on, ACI introduced new products through offshore trading and local manufacturing. Right now ACI is serving the daily needs of consumers through its Toiletries, Home Care, Hygiene, Electrical, Electronics, Mobile, Salt, Flour, Foods, Rice, Tea, Edible Oil, Paints, and other businesses.

ACI Agribusinesses: In 1992, ACI Agribusiness started its journey with a determination to developing the agriculture of Bangladesh for ensuring prosperity. At present, It is the country’s largest integrator in Agriculture, Livestock, Farm Mechanization, Fisheries, Infrastructure Development Services, and Motorcycle.

ACI Retail Chain: The country’s largest retail chain “Shwapno” is a concern of ACI Logistics Limited. The company entered the retail chain market with Shwapno in 2008 to fulfill the company’s “Seed to Shelf” vision of connecting farmers directly with consumers. Right now Shwapno is leading the market with its 130 outlets across the country.

Subsidiary and other companies of ACI ltd.:

ACI Formulations Ltd.:

ACI Formulations Ltd. has started its journey on 29 October 1995 as a private limited company. It was converted to a public limited company on 4 May 2005 and listed with both Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE) on 30 October 2008. The principal activities of the company are manufacturing and marketing of a number of agrochemical and consumer products. This company manufactures the majority of the products of ACI Strategic Business Limited except for the Pharmaceutical Division.

ACI Salt Limited: The company was incorporated on 13 June 2004 as a private limited company under the Companies Act 1994. The principal activity of the company is manufacturing and marketing of edible branded salt.

ACI Foods Limited: The company was incorporated on 14 September 2006 as a private limited company under the Companies Act 1994. The main objectives of the company are manufacturing, processing, and marketing of different food items including milling and processing of rice, spices, and different snack items.

ACI Pure Flour Limited: The company was incorporated on 29 August 2006 as a private limited company under the Companies Act 1994. The main objectives of the company are to carry on the business of milling, processing, packaging, and marketing of wheat flour products and lentils.

ACI Agrolink Limited: The company was incorporated on 4 July 2006 as a private limited company under the Companies Act 1994. The main objectives of the company are to carry on the business of manufacturing, formulating, and packaging of pesticide, fertilizer, plant nutrients, animal food, and other nutrient products including shrimp processing for export.

ACI Motors Limited: The company was incorporated on 11 December 2007 as a private limited company under the Companies Act 1994. The main objectives of the company are to carry on the business of buying, selling, importing, and assembling of vehicles for both agricultural and non-agricultural use including other agricultural equipment and supplying of spare parts, and providing service facilities for these vehicles and equipment. The company has also a distribution agreement with India Yamaha Motors Private Ltd. to sell and distribute YAMAHA brand motorcycles and parts in Bangladesh. The company has a manufacturing and assembling plant of YAMAHA motorcycles at Rajabari, Gazipur which started its commercial activities from May 2019.2

Creative Communication Limited: The company was incorporated on 2 September 2007 as a private limited company under the Companies Act 1994. The principal activities of the company are managing media solutions and similar services for different clients including television commercials and other advertisement and promotion related activities.

Premiaflex Plastics Limited: The company was incorporated on 11 June 2007 as a private limited company under the Companies Act 1994. The main objectives of the company are to carry out the business of manufacturing and marketing of plastic products, flexible printing and other ancillary business associated with plastic and flexible printing. The company commenced its commercial production from 1 December 2008. It has a Consumer Plastics production plant that produces home plastic products with a promise in mind to deliver premium quality plastic made products for its customers.

ACI Logistics Limited: The company was incorporated on 29 April 2008 as a private limited company under the Companies Act 1994. The main objective of the company is to set-up nationwide retail outlets in order to facilitate the improvement in goods marketing efficiency and to provide a modern self service shopping option to customers.

ACI Edible Oils Limited: The company was incorporated on 13 December 2010 as a private limited company under the Companies Act 1994. The main objective of the company is to carry out the business as manufacturing as well as trading of all kinds of crude and refined edible oils, edible fats, food grade chemicals, cleansing materials, preservatives and other allied food products.

ACI HealthCare Limited: The company was incorporated on 18 February 2013 as a public limited company under the Companies Act 1994. The principal activities of the company are to be manufacturing and marketing of pharmaceutical products for regulated markets.

ACI Chemicals Limited: The company was incorporated on 26 November 2013 as a private limited company under the Companies Act 1994. The main objective of the company is to represent foreign and local principals and market and promote their products and process and engage in the service of indenting on their behalf.

ACI Biotech Limited: The company was incorporated in Bangladesh on 22 November 2016 as a private limited company under the Companies Act 1994. The principal activities of the company are to carry out the business of manufacturing and marketing of Biosimilar pharmaceutical products. Currently the production facility is under construction process.

Infolytx Bangladesh Limited: Infolytx Bangladesh Limited is a private limited company incorporated on 23 July 2015 under the Companies Act 1994 being a 60% owned subsidiary of ACI Limited incorporated in Bangladesh having its registered office situated at 245, Tejgaon I/A , Dhaka. The main objective of the company is to develop computer software focusing on leading edge technologies with an aim of varied range of offerings.

ACI Marine and Riverine Technologies Limited: ACI Marine and Riverine Technologies Limited is a private limited company incorporated on 19 December 2019 under the Companies Act 1994 being a 77% owned subsidiary of ACI Limited incorporated in Bangladesh having its registered office situated at 245, Tejgaon I/A , Dhaka. The main objective of the company is to carry on all or any of the business of shipping, ship engineering, and other related areas.

Joint Venture and Associate Companies of ACI:

- ACI Godrej Agrovet Pvt. Ltd.

- Asian Consumer Care Pvt. Ltd. (Assoc.)

- Tetley ACI (Bangladesh) Ltd.

- ACI CO-RO Bangladesh Ltd.

- Stochastic Logic Ltd. (Assoc.)

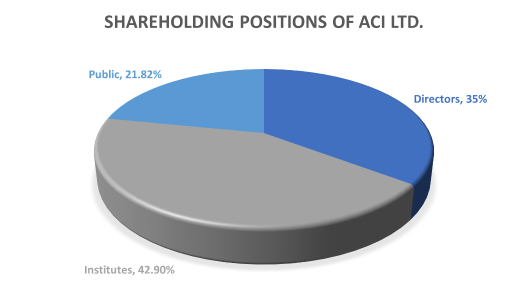

As of December 2021, 35.28% of ACI’s share is held by its directors, 42.90% by institutes, and 21.82% is held by the general public.3

ACI Ltd. has a mission of enriching the quality of the life of people through responsible application of knowledge, technology, and skills. The company is determined to achieve this mission through providing products and services of high and consistent quality, attaining a position of leadership among employees, attaining a high level of productivity in all its operations, and ensuring superior return on investment through utilising its core competencies. Currently, 8,364 employees are working at ACI Ltd.4

ACI made its share market debut in 1976 by getting listed in Dhaka Stock Exchange (DSE). On 21 October, 1995 the company started trading in Chittagong Stock Exchange (CSE), another bourse of Bangladesh. The market category of the company is “A” in both of the stock exchanges.

The company has achieved the first Position in 21st ICAB National Award 2020 for Best Presented Annual Reports under the Category- Diversified Holdings. Being the first company in Bangladesh ACI has obtained ISO 9001 Certification for Quality Management System across all categories and ISO 14001 Certification for Environmental Management System. In 2021, ACI consumer brands has received 3 awards in Digital Marketing Award 2021 organized by Bangladesh Brand Forum for designing innovative and creative campaigns.5

Industry overview

In the journey of diversifying the company’s portfolio, ACI Limited has left its footprint in multiple industries in Bangladesh. The industries have been mentioned below:

Pharmaceuticals industry

Once heavily dependent on imports and multinational companies the pharmaceuticals industry of Bangladesh is moving forward with great potential as 98% of the country’s total demand for medicine is being met by domestic companies. The rest 2% are imports like vaccines, hormone drugs, anti-cancer products, and so on. The industry has developed so much in Bangladesh that in addition to meeting domestic demands, the country is exporting medicines worldwide. In FY20 Bangladesh’s export revenue of medicines was $136 million. Some key players of this industry are Square Pharmaceuticals, Beximco Pharma, Incepta, Opsonin, Renata, and so on.

In FY20, the market size of Bangladesh’s pharma industry was 3 billion USD which accounts for 1.83% of the country’s GDP. The industry has experienced a CAGR growth of 15.6% over the last five years. According to a survey by ResearchAndMarkets the pharmaceuticals industry of Bangladesh is expected to see a growth of 114% and will reach more than 6 billion dollars by 2025.6

FMCG industry

FMCG is also known as consumer packaged goods(CPG). These products are sold quickly and at a relatively low cost. The products include toiletries, packaged foods, dry goods, over-the-counter drugs, beverages, and other consumables.

In the ocean of volatile industries, FMCG industry is considered to be the most resilient to economic shocks, which has already been proved during the pandemic. The global FMCG market is expected to reach $1.54 trillion by 2025. In Bangladesh, the consumption expenditure has clocked at 97% of the national income as of 2015 while the domestic annual consumption stands at over $130 billion. Thus, Bangladesh represents a goldmine in the FMCG industry.

Key Areas within the Industry

FMCG is a huge industry that encompasses a wide array of product segments. The most common and commercially important segments within Bangladesh are food & beverages, personal care, and household care.

Food and beverages: Food and beverages is one of the growing sectors of Bangladesh. It includes all the companies that are involved in processing the agricultural raw materials and transforming them into consumer food products. The industry employs about 2.45% of the whole labor force of the country. The food processing sector of Bangladesh is a $4.5 billion industry according to some industry analysts. Some of the key players of this sector are Pran, Nestle, Coca-cola, Square Food & Beverage Ltd., Akij Food & Beverage Ltd., and others.

Personal and home care : The personal care sector of Bangladesh was valued at $1.23 billion in 2020 which is expected to reach $2.12 billion by 2027. Moreover, the industry shows an incremental revenue growth opportunity of $960 million from 2020 to 2027. The major players of both the personal and home care industries are Unilever, Reckitt Benckiser Bangladesh Limited (RBBL), P&G, Marico Bangladesh Limited, and others.

Agro-industry

Agriculture is the base of Bangladesh’s economy that contributes about 13% of the country’s GDP and employs more than % of the overall labor force. Approximately, 70% of people rely on this sector, directly or indirectly, as the key source of income and employment. However, the growth rate of this sector in 2021 is 2.37% as against 5.99% in the manufacturing sector and 5.86% in the service sector. The contribution in GDP of this sector in the past decade ranged from 17.5% (2009) to 12.15% (2021) which is less than that of the manufacturing and service sector.

In FY19, the agro sector gained export earnings worth $1.41 billion while the agricultural export is growing at a CAGR of 18%. The domestic market size of packaged food was $5.2 billion in 2018 which is expected to reach $7.3 billion by 2023.

Retail industry

Almost a decade ago the retail industry in Bangladesh consisted of some small and individual companies. But after the rise of super shops, the industry has experienced an unparallel growth in terms of the number of consumers and also revenue. Super shops started their journey in the retail industry of Bangladesh with “Agora” almost 20 years ago back in 2001. Following the event, Meena Bazar, Shwapno, Unimart, and some other super shops started their journey as well. Even though Agora was the first mover it couldn’t hold its supremacy and has been taken over by Meena Bazar in 2020. On the contrary, Shwapno, which was launched in 2008, is leading the super shop sector with its 130 outlets across the country.

However, in comparison to the South Asian countries, Bangladesh’s retail industry is underdeveloped, structurally poor, and fragmented. The retail growth in Bangladesh has been 7% in recent years. According to TBS, the retail market value of Bangladesh was $16 billion in 2020 while the super shop sector accounted for only 1.6% of this total (around $256 million).7

Financial Performance

For the year ended 30 June 2021, ACI Limited has reported consolidated revenue of BDT 80.75 billion compared to BDT 69.47 billion for the previous year – a growth of 16.23% year-on-year. The company achieved this growth in the revenue by growing sales in 6 of its business segments – pharmaceuticals, animal health, consumer brands, seeds (local), fertilizer, and animal genetics, and others. In one of the total 7 business segments, which is seeds (import), the company experienced more than 50% decrease in sales. It is notable that the company has increased its local seeds production and sales of it increased more than 50%, year-on-year. The company is switching its ‘seed’ business from import to local production.

ACI has reported a profit of BDT 0.44 billion in FY21, which was negative BDT 1.32 billion in the previous year. The growth rate of gross profit of the company is 28.33%. The operating profit of the company in the previous year was positive, however, the profit before tax was not. The whole of operating profit got absorbed by the finance cost in FY20. But the company has significantly reduced its ‘finance cost’ for the current year. Therefore, profit after tax became positive for the company in FY21.

The company has reduced its interest on bank loans (net of interest income) significantly during this year – from BDT 4.57 billion in FY20 to BDT 3.55 billion in FY21. This is the primary reason for the company to rebound to positive profit from negative in a span of a year. In the previous year, the whole of operating profit was wiped out by the high finance cost. It is notable that the company has decreased its long-term bank loan from BDT 8.27 billion to BDT 7.84 billion. Also, it has increased its investments (long-term asset on balance sheet). Thus, the net finance cost has gone down during FY21.

The company has reported earning per share (EPS) of BDT 5.50 during FY21, while it was negative, as it should be, previous year. The net asset value (NAV) of the company is reported BDT 162.65 in FY21 and BDT 125.16 a year earlier. It is to be noted that the company has issued bonus share for the year 2019-2020 of BDT 57,372,945, which resulted in increase of the share capital to BDT 0.63 billion as on 30 June 2021. Total equity of the company stood at BDT 11.10 on 30 June 2021 billion as compared to BDT 7.29 billion a year earlier. This high jump resulted from increase in non-controlling interest, revaluation reserve, and share capital of the company. The company has received BDT 1.23 billion equity investment for ACI Motors Ltd. during the year.8 The total number of outstanding shares of the company is 72,576,788 as on 31 Jan 2022.9

For the financial year ended on 30 June, 2021, the company has invested more in property, plant and equipment, increasing the total by about BDT 3 billion. ACI Limited has increased its ‘equity-accounted investees’ asset during the year. The company amortised its intangible assets and did not add more so. However, the biological assets of the company have increased during the year. The current assets position of the company has also improved by about BDT 7 billion, mostly due to increase in inventories, and cash and cash equivalents. It is noteworthy that production of the company has bumped up during the year because the sales of the company has grown by about BDT 11 billion yet ending inventory has also increased by about BDT 5 billion.

Non-current liabilities of the company has remained more or less same during the year but current liabilities has increased by about BDT 7 billion owing to the increase in loans and borrowings, and other payables.

The company has generated negative cash flow from both operating activities and investing activities but positive from financing activities. Net cash flow during the year is BDT 287,985,204, which was negative BDT 2.63 billion a year earlier. It can be noted that the company has experienced losses and negative cash flows in the FY20. However, the company has made a strong come back by raising more funds from equity, decreasing finance cost by lowering the long-term bank loan, increasing production and sales, and by slashing relative administrative costs during FY21.

The company has declared 65% cash dividend and 15% stock dividend during 2021. Cash dividend in the previous years was 80%, 100%, 115%, 115% and 115%, respectively. Stock dividend for the previous years was 10%, 15%, 3.5%, 10%, and 10%, respectively.

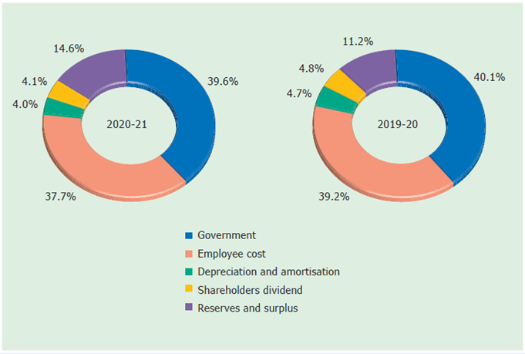

As per the annual report, the company added value of BDT 12.21 billion during the year, which was BDT 10.76 billion a year earlier. The value added is distributed among different stakeholders as per following graphs10-

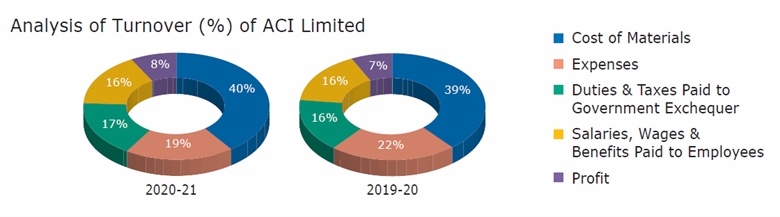

Turnover of the company is analysed in the following graph.11 The company has managed to cut expenses from 22% of the revenue to 19% of the same. Duties & taxes paid to government exchequer, and cost of materials has increased, while salaries, wages & benefits paid to employees remained same. However, the company successfully increased its profit as a percentage of total turnover by 1% from the previous year.

Business Analysis

When ACI Ltd. started operating in Bangladesh it was involved in the pharmaceuticals and pest control business only. But with the passage of time, the company entered into various segments by setting up one subsidiary company after another. Currently, the company has four SBUs. All the businesses of ACI Ltd. along with their respective details are demonstrated in this section.

Health Care Division

ACI is operating business in the pharmaceutical industry for almost thirty years. The company has a 4% market share in this industry. In FY20, ACI was able to attain a growth of 10.7% against the market growth of 1.12%. Moreover, among the top 10 pharmaceuticals, ACI registered the 3rd highest growth in the 2nd quarter of 2020. The company has launched several new products last year and also added a new export destination (Venezuela).

Consumer Brands Division

Toiletries: ACI Consumer Brands’ Toiletries business has several successful brands. Due to the Covid-19 pandemic, the demand for antiseptic products has increased. Savlon, the flagship product of ACI, alone has gained a 79.8% market share in the antiseptic category. Recently, a new addition to the Savlon family, ‘Savlon Hand Rub’, was launched that received a great response from consumers. A new category of health soap ‘Septex’ has also been launched to meet the rising demand in the antiseptic category. In FY20, ACI consumer brands toiletries business has registered an outstanding growth of 62%.

Hygiene: This segment includes Baby Hygiene, Female Hygiene, Adult Care, and Protective Care categories. The baby hygiene products Twinkle Baby Diaper and Twinkle Baby Wipes grew by 26% and 46% respectively in FY20. Freedom, a key brand of ACI female hygiene category, grew by 22%. A new product named “Savlon Respect Adult Diaper” has been added to the hygiene segment in October 2020. This segment has experienced a 24% growth over last year.

Home Care Solutions: ACI home care segment has been serving the country with a number of well-known products. This segment is comprised of both products from both Pest and Non-Pest Category products. ACI Aerosol, a blockbuster product of ACI, has continued to lead the Aerosol market with a 90.6% market share. In the non-pest category, Angelic Air Freshener is leading the market with 11 varieties of refreshing fragrances satisfying the needs of different occasions. Besides Vanish Toilet Cleaner has seen a positive growth in market share (moved to 4.5% from 4%).

Electrical and Electronics: The electrical and electronics business was severely affected by the Covid-19 pandemic. Consequently, the electrical business of ACI had experienced a negative growth of 30% last year. Moreover, ACI Consumer Electronics business had also registered a negative growth of 35% in FY20.

Paints: The dreadful effect of the pandemic is also evident in the paint market. The first 2 quarters of FY20 went well but after the outbreak of Covid-19, the company had experienced a negative growth of 30%.

Salt: Despite the obstacles that appeared due to Covid-19 ACI salt was able to hold its supremacy in the market. It is notable that ACI salt has captured the position of top brand around 8 times in the past decade. In FY20 ACI salt Ltd has gained a 10% growth.

Flour: From its inception, ACI Flour is the largest flour manufacturer in Bangladesh. While maintaining a strong market share in the retail market the company has gained a 19% growth last year.

Foods: ACI Foods has achieved a 43% growth over last year through strengthening its sales, marketing, operations, and supply chain capabilities.

ACI Rice: Through strong backward linkage, ACI Rice registered a 25% growth last year. The company expects to grow in this large sector in upcoming years.

Edible Oils: ACI edible oils include five types of edible oil: Rice Bran Oil, Sunflower Oil, Olive Oil, Soybean Oil, and Blended Oil. Recently, a new oil has been added in this segment named “Well’s Olive Oil”.

Agribusinesses Division

Crop Care and Public Health: The effect of Covid-19 is also evident in the agro-industry. The industry has registered a negative growth of 8% last year. The Crop Care business of ACI had also experienced a shrink of 5% over the last year.

Seed: In FY20, ACI Seed has attained a growth of 34%. The turnover of the company during this period was BDT 1,298 million which made ACI Seed the number one seed company amongst private seed companies in Bangladesh.

Fertilizer: ACI Fertilizer business was adversely affected by the pandemic and saw a serious downward shift in demand and prices. The company had registered a negative growth of 25% last year.

Animal Health and Genetics: This segment of ACI is divided into areas of Poultry, Cattle, Animal Biologics, Aqua, Animal Nutrition, and Feed Additives. Despite the ongoing COVID-19 pandemic and countrywide flood, ACI Animal Health has achieved a 19.3% growth with a 14% market share last year.

Agrolink: ACI Agrolink Limited started its journey with a motto to process and export 100% export quality frozen shrimps. With this motto, the company started exporting Shrimp in 2019. Currently, the company is exporting shrimp to France, Germany, Belgium, Netherlands, Denmark, and Japan.

Motors: ACI Motors entered the bike business of Bangladesh in 2016 by acquiring the motorcycle dealership of Japanese brand Yamaha. The company is operating in three major SBUs: 1) Farm Mechanization 2) Yamaha 3) Construction Equipment, Commercial Vehicles, and Others. In FY20 ACI Motors Farm mechanization unit ensured a 17% growth.

Premiaflex Plastics: Premiaflex Plastics Ltd. has started its business with a motto of manufacturing and selling Flexible Packaging products. In FY20 the company grew by 7.0%.

Premio Plastics: Starting in April 2018, ACI Premio Plastics is a new business division of Premiaflex Plastics Ltd. Since its inception the company has received an impressive response through its product design, variety, and quality. In FY20 the company has gained a 4.5% market share.

Retail division

Incorporated in 2008, ACI Logistics Ltd. is working with a motto to set up nationwide retail outlets in order to facilitate the improvement in goods marketing efficiency and to provide a modern self-service shopping option to customers. Shwapno, a concern of ACI Logistics, is the top retail brand in Bangladesh with 130 outlets countrywide, out of which 61 are their own and the rest are franchise stores. The company is leading the retail chain market in Bangladesh with a 50% market share. Even though Shwapno occupies almost half the retail chain market, the company wasn’t ever able to make a profit due to heavy expenditure in marketing and loan interests.

In 2017, Shwapno entered the e-commerce market with shwapno.com.

Recent Developments

Campaigns

Messi seed campaign: ACI Seed has recently launched a new variety of cucumber named “Messi”. This variety is highly suitable for the winter season and the company has an aim to take the leading position in the market in this winter season. To achieve this motto ACI has launched Messi seed special campaign in December 2021. The campaign was conducted at cucumber-based farming areas; like – Mymensingh, Sherpur, Jamalpur, Netrokona, Manikganj, Dinajpur, and Thakurgaon. Activities of the campaign included farmers’ meetings, retailer meetings, haat-bazaar campaign, retailer contact, and the usage of different promotional materials at retail points. With this campaign, ACI expects to gain a 10-15% yield advantage in comparison to other competitors in the market.

Sonalika Day 2021 campaign: ACI Motors had organized “Sonalika Day”, partner’s meet, network events, picnic, and countrywide service campaigns on October 2021. On this occasion free-servicing, agri-machinery product display, on-spot booking facility, spare parts sale on discount, free health check-up, and game shows were organized.

Menstrual Hygiene Day campaign: On the occasion of Menstrual Hygiene Day 2020, Freedom sanitary napkins- a concern of ACI Ltd partnered with Prothom Alo Digital to promote menstrual hygiene awareness. During the campaign, many informative contents on menstrual hygiene awareness had been published.

New product launches

ACI Tea Masala: ACI Foods has launched “ACI Pure Tea Masala” in September 2021. It is the first-ever only spice mix for tea in Bangladesh.

ACI Bumper Tricho Powder: ACI Fertilizer has launched a new product “ACI Bumper Tricho Powder” in October 2021. The product has been launched through online Zoom Platform due to Coronavirus Pandemic. The product is used against many plant pathogens, such as viruses, bacteria, fungi, nematodes, and higher parasitic plants.

Dry Fish Curry Masala and Garam Masala Powder: ACI Foods Ltd. has added Dry Fish Curry Masala and Garam Masala Powder in its Mixed Spice Category. Dry fish is a very popular food in Bangladesh. ACI is the first-ever company that understood consumer demand and came up with such an innovative product.

Magic Washer & Magic Mist Fan: ACI Motors has introduced ACI Washer and Magic Mist Fan in August 2021. With this new addition to the Water Pump Portfolio, the company expects to gain a greater market share.

Agreements and collaborations

Agreement between ACI Motors and FIREXPRESS: ACI Motors has signed a dealership agreement with FIREXPRESS – a renowned Danish fire-fighting system company in October 2019. With this agreement, ACI Motors will be the exclusive dealer for selling and marketing FIREEXPRESS’s products in Bangladesh for the solution of fire safety.

Joint Collaboration for BLFC: ACI Fertilizer and Bayer Crop Science Ltd. have conducted a collaboration meeting for Better Life Farming Centre (BLFC) in November 2021. The motto of this collaboration is to create a sound relationship between the Bayer Field force and ACI Field Force so that both can work jointly for farmers.

- ^ https://www.aci-bd.com/about-us/company-profile.html

- ^ https://www.aci-bd.com/assets/files/financial/annual-report/aci_annual_report_2020_2021.pdf

- ^ https://www.aci-bd.com/assets/files/shareholding-position/2021/aci-shp-dec-21.pdf

- ^ https://www.aci-bd.com/about-us/mission-vision-and-values.html

- ^ https://www.aci-bd.com/awards-accreditation/

- ^ https://businessinspection.com.bd/pharmaceutical-industry-of-bangladesh/

- ^ https://businessinspection.com.bd/supershop-industry-in-bangladesh/#:~:text=According%20to%20TBS%2C%20Bangladesh's%20retail,retail%20market%20in%20Sri%20Lanka.

- ^ Annual report 2020-2021, p.86

- ^ https://www.dsebd.org/displayCompany.php?name=ACI

- ^ Annual report 2020-2021, p.13

- ^ Annual report 2020-2021, p.15