Adani Total Gas Ltd

Summary

- Adani Group is one of the fastest growing industrial conglomerates in India.

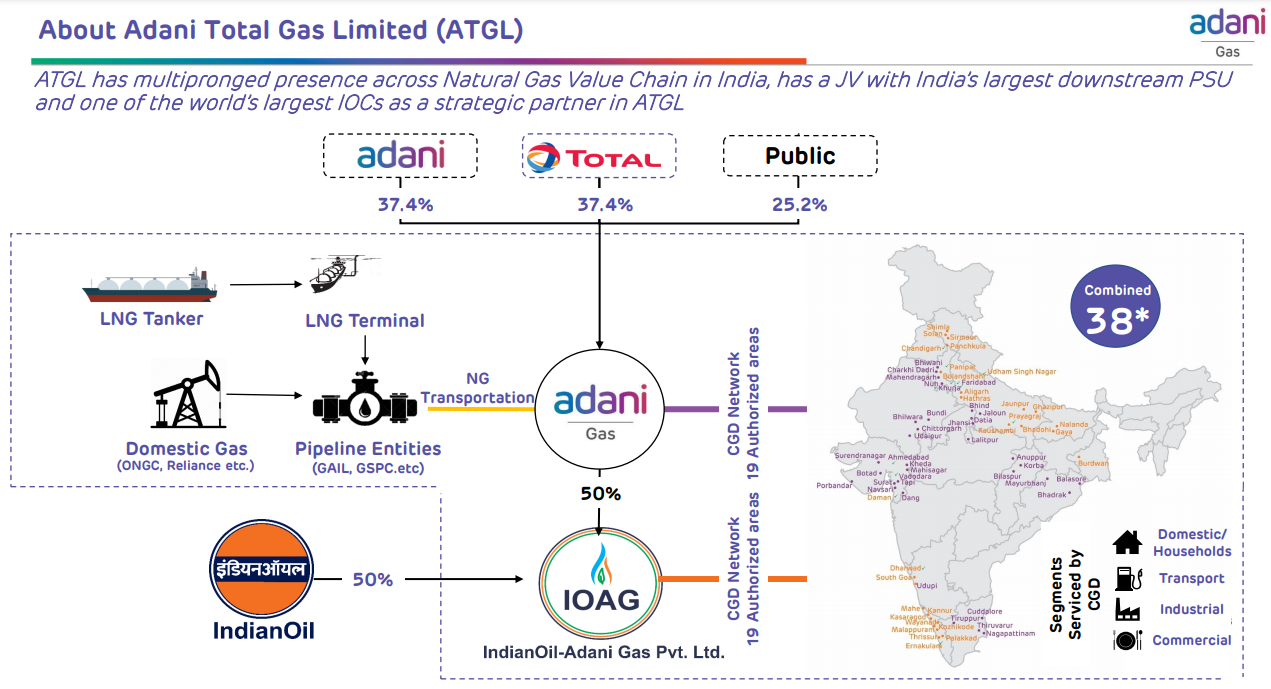

- Adani Total Gas has distribution Networks to supply the Piped Natural Gas (PNG) to the Industrial, Commercial, Domestic (residential) and Compressed Natural Gas (CNG) to the transport sector.

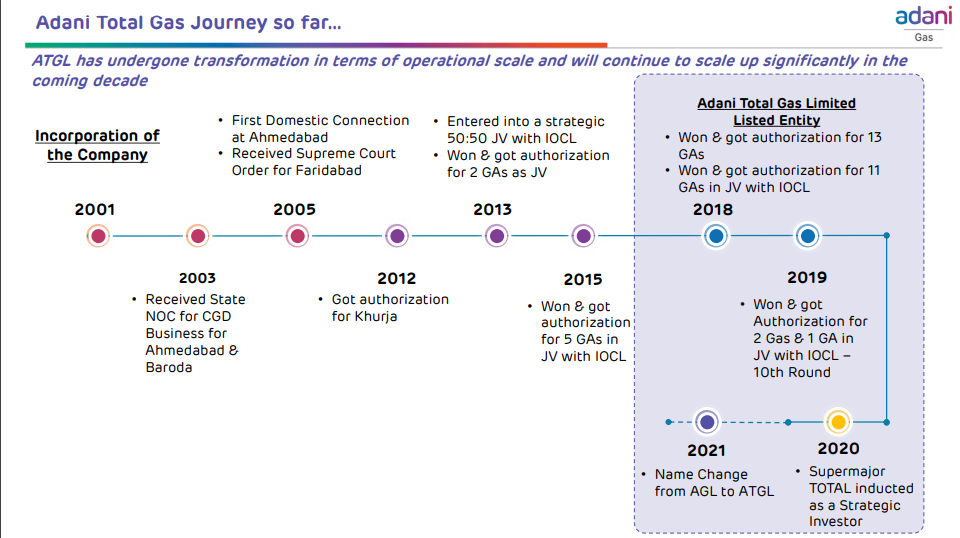

- The name of the Company has been changed from Adani Gas Limited to “Adani Total Gas Limited” on 1 January, 2021.

Company Overview

Adani Total Gas (NSE:ATGL) is developing City Gas Distribution (CGD) Networks to supply the Piped Natural Gas (PNG) to the Industrial, Commercial, Domestic (residential) and Compressed Natural Gas (CNG) to the transport sector. Natural Gas is a convenient, reliable and environment friendly fuel that allows consumers to enjoy a high level of safety, convenience and economic efficiency.1

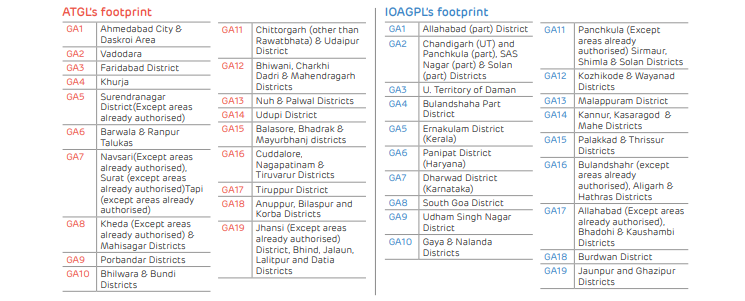

The company has already set up city gas distribution networks in Ahmedabad and Vadodara in Gujarat, Faridabad in Haryana and Khurja in Uttar Pradesh. In addition, the development of Allahabad, Chandigarh, Ernakulam, Panipat, Daman, Dharwad, and Udhamsingh Nagar gas distribution is awarded to consortium of Adani Gas Ltd and Indian Oil Corporation Ltd.

The Company has city gas distribution networks in Ahmedabad & Vadodara in Gujarat, Faridabad in Haryana and Khurja in Uttar Pradesh. AGL has started Commercial Operations in 8 GAs allotted under the 9th Round of CGD Bidding by PNGRB namely Navsari, Porbandar, Barwala, Kheda, Surendranagar in Gujarat, Udaipur in Rajasthan, Palwal and Mahendragarh in Haryana. Further, the Company has also started Commercial Operations in 1 out of 2 GA allotted under 10th Round of GCD Bidding by PNGRB i.e Bhind, Madhya Pradesh. As on March 31, 2020, the Company has 115 CNG filling stations providing gas to over a million vehicles. The Company also supplies PNG to over 0.44 million PNG customers, through a connected pipeline network that spans over 7,600 kms, including 470 km of steel and 7,130 km of polyethylene pipeline.

Indian Oil-Adani Gas Private Limited (IOAGPL)

A 50:50 joint venture between Adani Gas Limited and Indian Oil Corporation Limited was entered in 2013-14 to capitalise on growing opportunities in natural gas demand, leveraging each other’s infrastructure and domain expertise. Indian Oil Corporation Limited’s operational track record, existing infrastructure terminal for LNG imports and expansive retail outlets is complimented by CGD experience of Adani Gas Limited.2

Business Segments

A well connected and state-of-the-art infrastructure with high and low pressure piped network meet the growing natural gas demands of its expanding customer base.

Residential PNG

PNG provides the advantage of uninterrupted supply, saves the effort involved in booking a refill or changing cylinders, and helps consumers enjoy more kitchen space. Moreover, PNG ensures safety, without the fear of spillage. Pilferage can be easily avoided with its safe piped network infrastructure and transparency of billing the exact units of usage. Residential PNG is offered to domestic consumers for cooking and heating water in gas geysers.

AGL is responsible for managing, transporting and selling PNG to more than 0.44 million domestic households across 5 GAs. The company continue to engage and grow its customer base with its deep-rooted infrastructural presence and local market understanding. Some of the operational highlights during the year were:

- Added - 56,167 household connections to its existing customer base

- Convenient instalment based payment system for customers

- Adani Gas has launched My Adani Gas App with better features and add-ons

- Introduced POS payments and expanded the digital payments infrastructure

- Regular safety and health guidelines shared through social media and dedicated customerchannels

- Yearly safety and audit checks for leakages or pilferages conducted at customer sites

Outlook

- New feature of Bill on WhatsApp will be added which will support AGL’s go green initiative

- Self-billing by customer which will enable customer to generate their own bill by submitting their meter reading with photo and getting the actual bill on WhatsApp and My Adani Gas application

- Online name transfer form features to be added on its website to enable customer to transfer their connection in their name online.

- Dynamic UPI QR code on bill and UPI link on WhatsApp to boost digital transactions

Commercial PNG

Commercial PNG is offered to customers operating Hotels, Restaurants, Fast Food Joints, Hospitals and Corporate Offices (including Canteen and Pantries).

There are increasing laws and regulations to promote the safety and conservation of environment while promoting economic growth. The cost and safety benefits of using PNG at commercial sites is increasingly shifting consumers towards the adoption of natural gas over liquid fossil fuels. The company's presence in key markets, with an integrated CGD network, allowed it to penetrate deep into customer pockets and capitalize on opportunities stemming from growing demand from commercial end-users. Some of the operational highlights during the year were:

- Added 520 commercial connections to its existing customer base

- Adani Gas has launched My Adani Gas App with better features and add-ons

- Introduced POS payments and expanded the digital payments infrastructure

- Regular safety and audit checks conducted at customer sites for leakage or pilferage

Outlook

Going ahead, Digitization of commercial customer registration to move-in process by My Adani Gas app will be streamlined. Adani Gas is exploring more opportunities in expanding its market presence by identifying sectors like laundry, government segments and street vendor supply (urban chowks). This will be backed by exciting offers to give added comfort to the prospective customers.

Industrial PNG

Industrial PNG is primarily offered to industries that use Boilers, Thermic Fluid Heaters, Direct Fired Dryers, Textile Processing, Heat Treatment, Wire Drawing, Casting and Forging Application, amongst others

A successful transition towards eco-friendly energy resources will significantly reduce carbon emissions from industries and manufacturing units. The company's network across industrial belts in operating GAs, assuring users an uninterrupted supply of natural gas to decelerate carbonisation and reduce emission across the value-chain. Despite the low growth of Industrial sector primarily due to manufacturing sector which registered a negative growth of 0.2 per cent in 2019-20 H1, Adani Gas has added 236 new industrial units during the year. Adani Gas has recorded a robust growth of around 9% in Industry volume compared to previous year. Slowdown in Automobiles & Textile sector was somehow overcome by upswing in Dyes & Chemicals and Engineering sector. However, outbreak of pandemic Covid 19 at fag end of financial year deprived it to end the financial year with better figures. Some of the operational highlights during the year were

- Added 236 industrial connections to its existing customer base

- Adani Gas has launched My Adani Gas App with better features and add-ons

- Regular safety and audit checks conducted at customer sites for leakage or pilferage

Outlook

For the coming year, the company plan to come out with some flexibility programs to support its existing industrial customers and adopt a dynamic marketing strategy to attract new customers in existing and new GAs.

CNG

Compressed Natural Gas (CNG) is a gaseous fuel and is a mixture of hydrocarbons, mainly comprising Methane. It consists of natural gas compressed to pressures of 200-250 Kg/cm² to enhance vehicle on-board storage capacity. As a result, the compressed form of natural gas is used as a fuel for transportation purposes.

The company continue its resolve to drive towards a low-carbon future. In the last five years, the increasing use of liquid fuels have also increased the threat to its environment. The rise of CNG based-vehicles has emerged as a preferred mode of transport, given the economic and environmental benefits it brings along. The company also increased the number of CNG stations during the year and undertook initiatives to widen its market presence.

- 33 New CNG Stations added in FY 2019-20

- Set-up 24x7 emergency help-line

- Upgraded My Adani Gas app with better features and add-ons

- Introduced POS payments and expanded the digital payments infrastructure

- Drivers’ health check-up camps organized

Outlook

Post the 9th and 10th round bidding, Adani Gas has aggressively scaled up its Infrastructure roll-out of CNG stations into the authorized GAs. For the coming year the company plan to aggressively reach potential customers by doing various awareness campaign through digital, print, radio, personal mediums

Industry Overview

Global Natural Gas Industry

Natural gas is the cleanest among available fossil fuels. It is used as feedstock for manufacturing fertilizers, plastics and other commercially important organic chemicals. It is also used as a fuel for electricity generation and for heating purposes in industrial and commercial units. Natural gas is also used for cooking in households and as a transportation fuel for vehicles.

Global demand for energy is increasing rapidly, owing to population increase and economic growth, especially driven by emerging market economies. Energy security concerns may also arise as energy consumption increases. Consumption of natural gas has gone up worldwide and is projected to increase from 3,702 billion metres (Bcm) in 2017 to 6,154 Bcm by 2050 (For details refer graph 2), supported by broad-based demand, abundant low-cost supplies, and the increasing availability of gas globally, aided by the growing supply of Liquefied Natural Gas (LNG).

Natural gas remains a key fuel for the power sector and other industrial sectors. In the power sector, natural gas is an attractive choice for new generating plants due to its enhanced fuel efficiency. Natural gas is also cleaner than coal or petroleum products, significantly reducing carbon dioxide emissions. Countries, all over the world, have started to implement national or regional plans to reduce carbon dioxide (CO2) emissions, encouraging the use of natural gas to displace carbon-intensive coal and liquid fuels.

It is expected that around 88% of the 2,452 Bcm natural gas consumption growth between 2017 and 2050 will be accounted for in the emerging markets and developing economies and their share of global natural gas consumption will expand to 68% by 2050. Countries such as China, India, and the Middle East and North Africa region (MENA) region, among the emerging markets and developing economies, are most likely to post remarkable growth in this segment. However, challenges remain and it will be critical to overcome them to sustain the rapid growth of gas markets in future

Indian Gas Industry

Currently natural gas accounts for relatively less percentage in the total energy mix due to its low per capita consumption. Despite good infrastructure coverage, pan-India penetration remains low, compared to other emerging markets. However, the government has set an ambitious target of increasing the share of natural gas from 6.2% to 15% by 2030, in the total energy mix. Moreover, with favourable government policy and increasing consumption of gas, penetration level and per capita consumption is expected to increase.

India currently ranks among the top energy consumers in the world. According to BP Energy Outlook 2019, India is the world’s third-largest energy consumer after the USA and China. It is projected that the country’s energy consumption will jump from the current 6% to 11% by 2040 and is expected to cross China as the largest energy consumption market by 2020. With India’s population and GDP expected to grow in future, energy demand will see a significant rise, leading to associated greenhouse gas (GHG) emissions as well.

In line with these developments, numerous policy measures are being discussed, focused on increasing access to energy and aimed to keep emissions in check. The population of India is expected to grow to 1.44 billion by 2024 from 1.35 billion in 2019. With the increase in population, demand for energy is also expected to increase. The increased consumption is expected to result in an alteration of the primary energy mix, on account of a growing substitution of oil by natural gas.

Globally It is projected that the US and China will be the two largest individual contributors to supply growth of natural gas by 2024, together accounting for over 50% of total production increase. However, due to strong domestic demand, increase in production will only meet this increased demand in case of China. With the United States, Australia and Russia together accounting for the vast majority of gas exports growth by 2024, exports are likely to be concentrated in some regions

Looking at LNG specifically, the market is set to undergo profound changes in the coming years. China and India are likely to emerge as major LNG buyers, while also increasing imports to Europe. On the supply side, the emergence of a trio of leading exporters will result in United States leading the supply by 2024, followed by Australia and Qatar.

- Global Liquefaction Capacity ~430 MTPA,

- Global LNG regasification capacity ~920 MTPA

- Global LNG Trade grew at a 13.0% rate

In India, demand for natural gas is projected to grow at a CAGR of 7-10% between FY 2019-24.

Natural Gas Grid and City Gas Distribution Sector Outlook

To promote the usage of natural gas as a fuel/feedstock across the country and move towards a gas-based economy, the government of India has initiated the development of additional gas pipelines to complete the Natural Gas Grid (NGG). Presently, the NGG predominantly connects the western, northern and south-eastern gas markets with major gas sources. The government has also approved a capital grant of 5,176 crore (40 per cent of the estimated capital cost of 12,940 crore) under Pradhan Mantri Urja Ganga, as part its commitment to provide clean energy in the eastern part of the country

City gas distribution (CGD) networks supply compressed natural gas (CNG) for vehicles and piped natural gas (PNG) for domestic, industrial and commercial use. The CGD sector has relatively high affordability and has the capacity to absorb higher gas prices, as compared to the power and fertilizer sectors. Usage of natural gas has proved to be economical vis-a-vis competing fuels, for most user segments within the CGD space. The Government of India strongly emphasizes the need for expanding City Gas Distribution (CGD) coverage across the country, to make natural gas available to a larger section of the population.

Only around 19% of the country’s population, spreading over 11% of the country’s area, was covered for development of CGDs in 96 geographical areas till 2017. However, to boost the CGD sector, the 9th round of CGD Bidding was launched in April, 2018 for 86 Geographical Areas (GAs), covering 174 districts in 22 States/ Union

Territories of the country. This round saw participation from 38 entities (Public and Private) and submitted a total of 406 bids for all 86 GAs. Presently, 84 GAs have been authorized for the development of CGD networks. Another round of CGD bidding for 50 GAs was initiated in November, 2018 and it laid the foundation for the development of CGDs in 50 newly authorized GAs, covering 124 districts spreading over 14 States/UTs. With the conclusion of the 10th round, about 70% of the country’s population is being covered by CGD networks spreading over 50% of India’s total area.

The CGD sector is one where demand has remained in few pockets where CGD infrastructure was available. More than ~80 % of the PNG Connections are in Delhi, Maharashtra and Gujarat along with ~76 % of the CNG Stations and ~87 % of CNG powered Vehicles.

India has ~278 mn active LPG users with an annual consumption of 23.0 mn tons of LPG (FY20E) as against 6.0 mn PNG users providing a lucrative market.

Natural gas demand for CGD sector is expected to rise steadily due to the addition of gas networks in new cities, price advantage of CNG and increased use of PNG in domestic, industrial and commercial sectors. Environmental concerns will further push the use of natural gas, especially in the automotive and industrial segment (coal replacement). Demand for natural gas from CGD networks has consistently increased over the last few years and stood at ~30 mmscmd (~16.5% of the total gas demand) in FY 2019-20 (Up to February, 2020). As of March, 2020, 2200 CNG Stations, 6.07 Million domestic connections and ~41,000 industrial and commercial connections.

National Gas Grid - The Government has envisaged the development of a National Gas Grid. At present, about 16,200 Km natural gas pipeline is operational and it is expected to increase to 27,000 km to increase the availability of natural gas across the country. The objectives of the grid would be

- To remove regional imbalance

- To connect gas sources to major demand centers

- Development of City Gas Distribution Networks in various cities for the supply of CNG and PNG

City Gas Distribution (CGD) network - Petroleum and Natural Gas Regulatory Board (PNGRB) grants the authorization to develop a City Gas Distribution (CGD) network (including PNG network) in a specified Geographical Area (GA) of the country

CGD sector has four distinct segments - Compressed Natural Gas (CNG) predominantly used as autofuel, and Piped Natural Gas (PNG) used in domestic, commercial and industrial segments

The revised regulatory framework helped in expanding the coverage of CGD to 228 GAs spread over 406 districts with the potential to cover about 53% of the country’s area and 70% of the country’s population, with an aim to make environmentfriendly fuel like CNG/PNG available to the public

It has been decided to meet 100% gas requirement of CNG and PNG Domestic segments through the supply of domestic gas which is cheaper than imported gas

Investment plan of $60 billion – The government of India has set an ambitious target to increase the share of environment-friendly fuel to 11% from 6% in the country’s energy basket. To do this, an estimated investment of $60 billion is underway, to build a gas pipeline and terminal infrastructure that is nearing completion or remains in advanced stages of completion. The investment is going to be used for building LNG import terminals, laying pipelines and expanding city gas distribution networks to facilitate the usage of non-polluting fuels. This move will have a dual advantage of utilizing a cleaner as well as a cheaper fuel (when compared with liquid fuels like diesel and furnace oil), and could help steer India towards a ‘low carbon future’.

Financial Highlights

The annual sales volume were at 515.13 MMSCM as compared to 582.21 MMSCM. The degrowth was on account of Covid-19 and was majorly in the first half of the year. In the second half of the year the company saw a V-shaped recovery in volume and touched a peak volume of over 2 MMSCMD. 3

For the year ended 31st March, 2021, revenue stood at 1,784.47 Crore as compared to 1990.90 Crore in 2019-20. Despite the volume impact, with the efficient gas sourcing and cost optimisation, the company was able to grow its profitability. EBITDA grew by 17.14% from Rs 639.15 Crore to Rs 748.68 Crore while PAT grew by 8% from Rs 436.24 Crore in 2019-20 to Rs 471.95 Crore 2020-21.

Operations Update

- Total number of CNG stations reached at 217, the addition of 102 new CNG stations in 2020-21

- Cumulative steel pipeline network was 705 Km, with 170 kms laid in 2020-21

- Number of domestic customers were 0.48 Million, 40939 customers added in 2020-21

- Number of Industrial and Commercial Customers at 4966, with added 500 customers in 2020-21

- Commissioned 3 CGS in new Gas

- In 2020-21 the company has achieved Sales Volume of 515.13 MMSCM which is @ 88% of 2019-20 Volume mainly due to nationwide Coivd-19 pandemic impact.

- The company has achieved the PNG Sales Volume 287.95 MMSCM which @ 99% of 2019-20 Sales Volume of 290.61 MMSCM.

IOAGPL was formed to implement City Gas Distribution projects across the country for the distribution of environment friendly fuel (natural gas) through a network of underground pipelines. IOAGPL has authorisations for 19 GAs across India.

The revenue from operation grew by 15% YoY to Rs 354.28 Crore in 2020-21 from Rs 309.30 Crore in 2019-20. EBITDA grew 19% YoY from Rs 62.00 Crore to Rs 74.48 Crore in 2019-20 to Rs 74 Crore in 2020-21. Sales volume grew 19% from 93.61 MMSCM in 2019-20 to 111.38 MMSCM in 2020-21

Your Directors have recommended a dividend of 25% (Rs 0.25/- per Equity Share of Rs 1 each) on the Equity Shares out of the profits of the Company for the financial year 2020-21. The said dividend, if approved by the shareholders, would involve a cash outflow of Rs 27.50 Crores.

Recent developments

Adani Gas to change name to Adani Total Gas 4

Nov 26, 2020; Adani Gas Ltd, the city gas distribution firm of billionaire Gautam Adani's group, will change its name to Adani Total Gas to reflect French energy giant Total's stake in the firm.

Adani Gas has through a postal ballot sought shareholders' nod to change the name as well as alter its memorandum and articles of association, according to the firm's filing to stock exchanges.

After the French giant buying stake, Adani Gas is now "a joint venture company of Adani Group and TOTAL Group, France with 37.40 per cent stake by each promoter and remaining 25.20 per cent with public shareholders," it said.

"In order to reflect the names of both promoter groups, it is proposed to change the name of the company from ' Adani Gas Limited' to ' Adani Total Gas Limited' to reflect the holding structure," the filing said.

The Board of the firm, which retails CNG to automobiles and piped natural gas to household kitchens and industries in 15 geographical areas, had on November 3 approved the name change.

The company board is headed by Adani and has two nominees of Total - its India head Alexis Thelemaque and Jose-Ignacio Sanz Saiz.

Adani's nephew Pranav Adani is the other promoter director on the board from Adani's side.

Adani Gas said its present business objective includes carrying out the business of natural gas, liquefied natural gas, compressed natural gas (CNG) and other forms or natural gas, associated gaseous substance, etc.

"The company proposes to carry on the business of biogas, biofuel, bio mass, liquid to compressed natural gas (LCNG), hydrogen compressed natural gas (HCNG), hydrogen, electric vehicle (EV), manufacturing of various equipments and provision of value-added services relating to city gas distribution (CGD) business, etc," it said.

For this, the Memorandum of Association of the company is being sought to be altered.

The company has already set up city gas distribution networks in Ahmedabad and Vadodara in Gujarat, Faridabad in Haryana and Khurja in Uttar Pradesh. In addition, the development of Allahabad, Chandigarh, Ernakulam, Panipat, Daman, Dharwad, and Udhamsingh Nagar gas distribution is awarded to a consortium of Adani Gas Ltd and Indian Oil Corporation Ltd, according to the company website.

References

- ^ https://www.adanigas.com/about-us

- ^ https://www.bseindia.com/bseplus/AnnualReport/542066/5420660320.pdf

- ^ https://www.bseindia.com/bseplus/AnnualReport/542066/68596542066.pdf

- ^ https://economictimes.indiatimes.com/industry/energy/oil-gas/adani-gas-to-change-name-to-adani-total-gas/articleshow/79425964.cms