Algonquin Power & Utilities

Summary

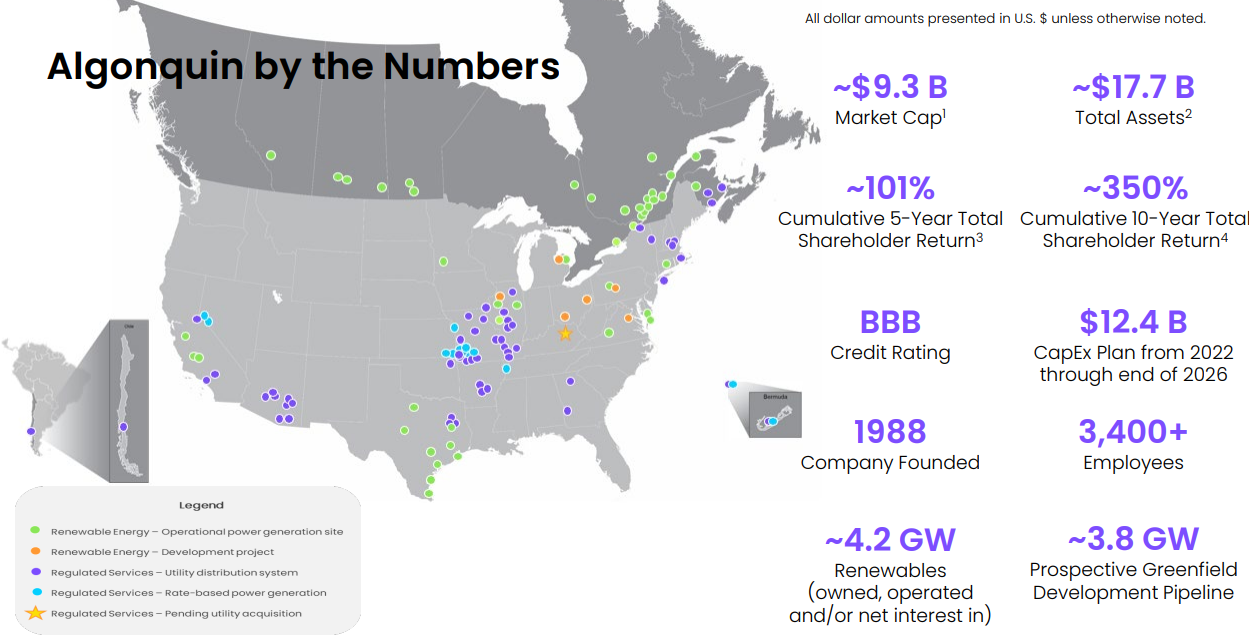

- Algonquin Power & Utilities Corp. is a renewable energy and utility company with over $16 billion1 of assets across North America and internationally.

- Recently the company acquired Renewable Natural Gas (RNG) platform of Sandhill Advanced Biofuels

Algonquin Power & Utilities Corp. (TSX: AQN, NYSE: AQN) is a renewable energy and utility company with over $16 billion1 of assets across North America and internationally.

Recent developments

Liberty completes acquisition of Renewable Natural Gas (RNG) platform and partners on Hydrogen Hub project.1

8/16/2022; Liberty a wholly-owned subsidiary of Algonquin Power & Utilities Corp. ("AQN") (TSX: AQN) (NYSE: AQN) , announced today the recent completion of its acquisition of Sandhill Advanced Biofuels, LLC ("Sandhill"). Sandhill is a developer of renewable natural gas ("RNG") anaerobic digestion projects located on dairy farms, with a portfolio of four projects in the state of Wisconsin. The completion of this acquisition represents the Company's first investment in non-regulated renewable natural gas.

Once all four projects are fully operational, they will sequester methane from dairy operations to produce an aggregate of ~500 MMBTU/day of RNG for the transportation sector. The farm-based biodigesters and upgrading systems use anaerobic digestions to produce negative carbon-intensity RNG which is injected into the natural gas pipeline system, displacing carbon-based natural gas. Additionally, the projects are expected to provide local farmers with ancillary revenue and support their efforts to optimize waste management and reduce greenhouse gas (GHG) emissions.

Financial Highlights

2022 Second Quarter Results

Aug. 11, 2022; Algonquin Power & Utilities Corp announced financial results for the second quarter ended June 30, 2022.2

For the three months ended June 30, 2022, AQN experienced an average exchange rate of Canadian to U.S. dollars of approximately 0.7834 as compared to 0.8143 in the same period in 2021, and an average exchange rate of Chilean pesos to U.S. dollars of approximately 0.0012 for the three months ended June 30, 2022, as compared to 0.0014 for the same period in 2021. As such, any quarter over quarter variance in revenue or expenses, in local currency, at any of AQN’s Canadian and Chilean entities is affected by a change in the average exchange rate upon conversion to AQN’s reporting currency. For the three months ended June 30, 2022, AQN reported total revenue of $624.3 million as compared to $527.5 million during the same period in 2021, an increase of $96.8 million or 18.4%.

For the six months ended June 30, 2022, AQN experienced an average exchange rate of Canadian to U.S. dollars of approximately 0.7865 as compared to 0.8017 in the same period in 2021, and an average exchange rate of Chilean pesos to U.S. dollars of approximately 0.0012 for the six months ended June 30, 2022 as compared to 0.0014 for the same period in 2021. As such, any year-over-year variance in revenue or expenses, in local currency, at any of AQN’s Canadian and Chilean entities is affected by a change in the average exchange rate upon conversion to AQN’s reporting currency. For the six months ended June 30, 2022, AQN reported total revenue of $1,360.0 million as compared to $1,162.1 million during the same period in 2021, an increase of $197.9 million or 17.0%.

Net earnings (loss) attributable to shareholders for the three months ended June 30, 2022, totaled $(33.4) million as compared to $103.2 million during the same period in 2021, a decrease of $136.6 million or 132.4%. Net earnings attributable to shareholders for the six months ended June 30, 2022, totaled $57.6 million as compared to $117.2 million during the same period in 2021, a decrease of $59.6 million or 50.9%.

Adjusted for the three months ended June 30, 2022 totaled $289.3 million as compared to $244.9 million during the same period in 2021, an increase of $44.4 million or 18.1%. Adjusted EBITDA for the six months ended June 30, 2022 totaled $619.7 million as compared to $527.7 million during the same period in 2021, an increase of $92.0 million or 17.4%.

Business Overview

Algonquin Power & Utilities operate through Liberty. The company provide regulated water, electricity, and natural gas utility services to over 1 million customer connections, primarily in North America. And, its growing portfolio of clean, renewable wind, solar, hydro and thermal power generation facilities represents over 4 GW1 of renewables in operation and under construction. Algonquin Power & Utilities is supported by more than 3,400 skilled and motivated employees who work within its Regulated Services and Renewable Energy Groups.

Regulated Services Group

Through its Regulated Services Group, the company operate a diversified portfolio of rate-regulated electric, natural gas, water, and wastewater collection utility systems and transmission operations, which collectively serve the needs of over 1 million customer connections, primarily in North America.

The Regulated Services Group provides safe, high-quality, and reliable services to its customers. In addition to encouraging and supporting organic growth within its service territories, the Regulated Services Group seeks to deliver continued growth in earnings through accretive acquisitions of additional utility systems.

Renewable Energy Group

The Renewable Energy Group owns and operates a diversified portfolio of non-regulated renewable and clean power generation assets located across Canada and the United States.

Its diversified fleet of hydroelectric, wind, solar, and thermal facilities have a combined gross generating capacity of approximately 2.3GW, with approximately 82% of the electrical output is sold pursuant to long-term contractual agreements which have a production-weighted average remaining contract life of approximately 12 years.

Capital Investment

The Company anticipates making capital investments of between approximately $4.34 billion and $4.68 billion in 2022.

The Company has also announced an approximately $12.4 billion capital plan for the period from 2022 through the end of 2026, with approximately 70% expected to be invested by the Regulated Services Group and approximately 30% expected to be invested by the Renewable Energy Group

References

- ^ https://investors.algonquinpower.com/news-market-information/news/news-details/2022/Liberty-completes-acquisition-of-Renewable-Natural-Gas-RNG-platform-and-partners-on-Hydrogen-Hub-project/default.aspx

- ^ https://s25.q4cdn.com/253745149/files/doc_financials/2022/q2/2021-Algonquin-Q2-Web_version-b.pdf