Alimentation Couche-Tard

Summary

- Alimentation Couche-Tard is a global leader in the convenience sector, operating the brands Couche-Tard, Circle K and Ingo.

- The company offer fast and friendly service, providing convenience products, including food and hot and cold beverages, and mobility services, including road transportation fuel and charging solutions for electric vehicles.

Company Overview

Alimentation Couche-Tard (OTC:ANCUF, TSX:TARD) is a global leader in the convenience sector, operating the brands Couche-Tard, Circle K and Ingo. The company strive to meet the demands and needs of people on the go and to make it easy for its customers. To that end, the company offer fast and friendly service, providing convenience products, including food and hot and cold beverages, and mobility services, including road transportation fuel and charging solutions for electric vehicles. 1

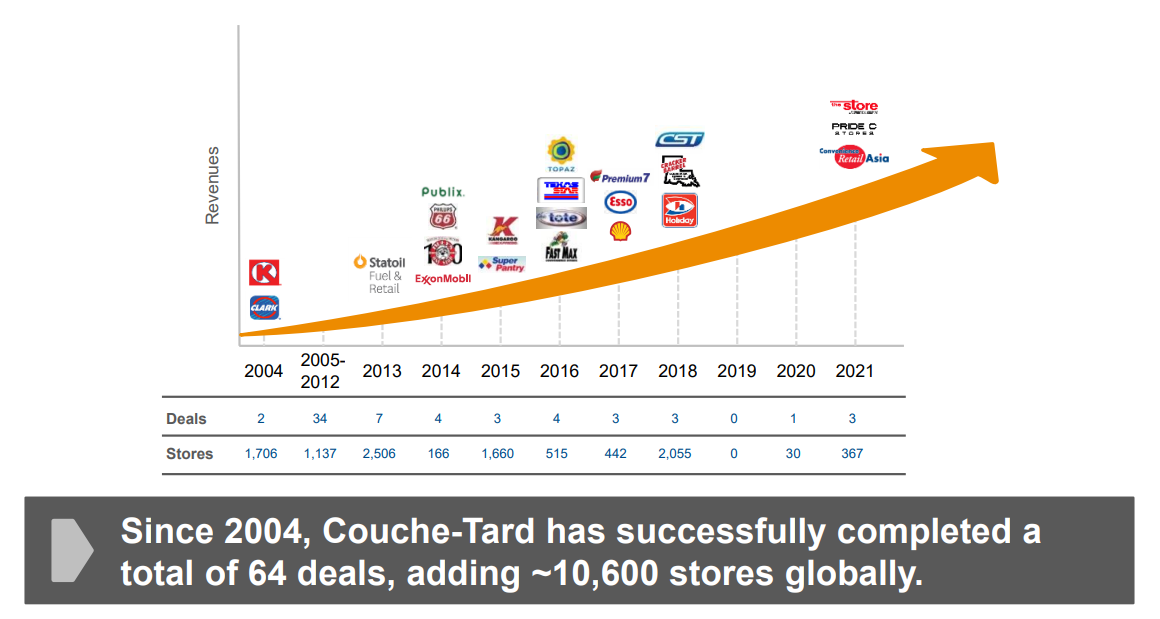

Milestones

| 1980 | Opening Of Our first store in Laval, QC. Canada |

| 2001 | Entry in the United States |

| 2003 | Purchase Of the Circle K Corporation |

| 2012 | Expansion into Europe |

| 2015 | Launch Of Our global Circle K brand |

| 2015 | Acquisition Of The Pantry Inc |

| 2016 | Acquisition Of Topaz. a leading retailer in Ireland |

| 2016 | Growth in Ontario and Québec with Esso-branded sites |

| 2017 | Acquisition Of CST grands and Holiday Stationstores in the U.S. |

| 2020 | Acquisition in Asia Of corporate stores in Hong Kong and Macau |

Brands

Alimentation Couche-Tard provide customers convenience with one of the three brands under the Alimentation Couche-Tard umbrella.2

Couche-Tard

Couche-Tard is its flagship brand in the province of Québec, Canada, where it all started for its company more than 40 years ago. Today, Couche-Tard enjoys considerable brand recognition in the province, delivering the convenience products its customers are looking for, in addition to fuel and car wash services, in approximately 650 locations.

Circle K

Circle K has been its global brand since 2015. First established in Texas in 1951, Circle K was acquired by Alimentation Couche-Tard in 2003. Now present in more than 26 countries and territories, Circle K has become one of the most widely recognized convenience store brands, known worldwide for quality products and great customer service.

Ingo

Ingo is in a network in Sweden and Denmark of more than 440 automated fuel sites.

Business Overview

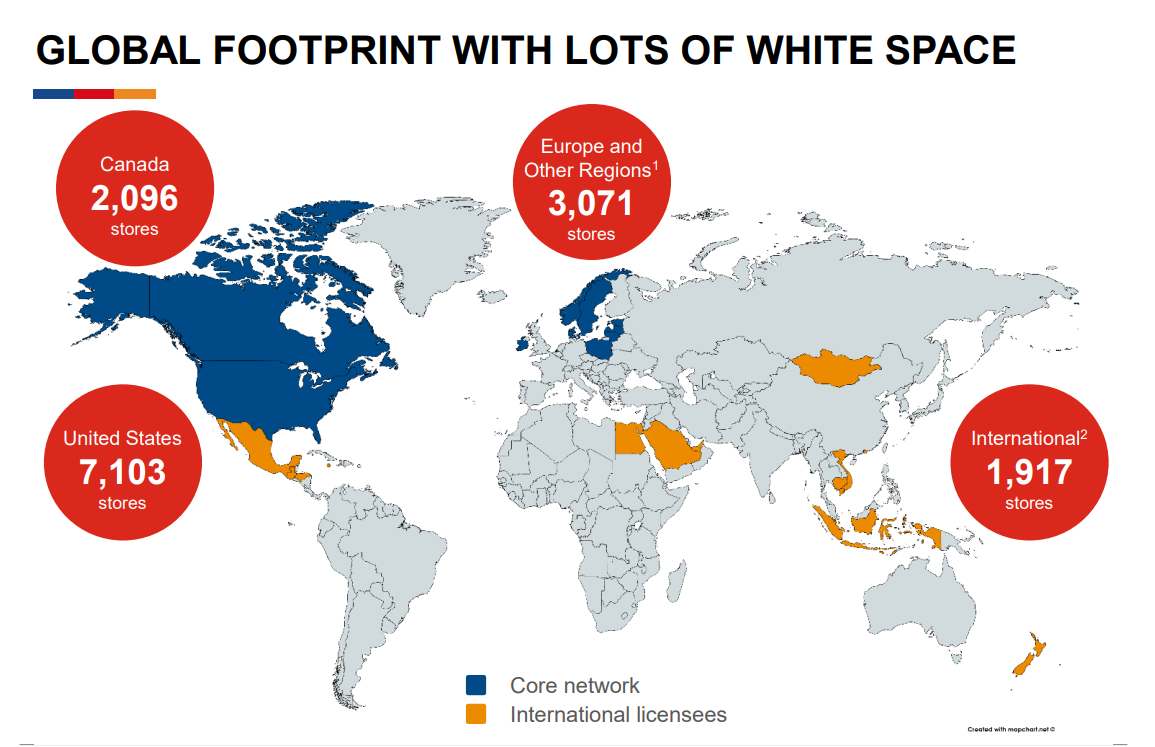

Alimentation Couche-Tard is the leader in the Canadian convenience store industry. In the United States, Alimentation Couche-Tard is one of the largest independent convenience store operators. In Europe, Alimentation Couche-Tard is a leader in convenience store and road transportation fuel retail in the Scandinavian countries (Norway, Sweden and Denmark), in the Baltic countries (Estonia, Latvia and Lithuania), as well as in Ireland, and have an important presence in Poland. In Asia, the company operate a network of company-operated convenience stores in Hong Kong Special Administrative Region of the People's Republic of China ('Hong Kong SAR') with an enviable local position.

As of October 10, 2021, its network comprised 9,199 convenience stores throughout North America, including 8,060 stores with road transportation fuel dispensing. The company's North American network consists of 18 business units, including 14 in the United States covering 47 states and 4 in Canada covering all 10 provinces. Approximately 98,000 people are employed throughout its network and at its service offices in North America.

In Europe, the company operate a broad retail network across Scandinavia, Ireland, Poland, the Baltics and Russia through 10 business units. As of October 10, 2021, its network comprised 2,727 stores, the majority of which offer road transportation fuel and convenience products while the others are unmanned automated fuel stations which only offer road transportation fuel. The company also offer other products, including aviation fuel and energy for stationary engines. Including employees at branded franchise stores, approximately 22,000 people work in its retail network, terminals and service offices across Europe. In Asia, its network comprised 344 company-operated convenience stores in Hong Kong SAR, offering a strong on-the-go food offer as well as a variety of other merchandise items and services. Approximately 4,000 people are employed in its retail network and service offices in Asia.

Furthermore, under licensing agreements, more than 1,900 stores are operated under the Circle K banner in 14 other countries and territories (Cambodia, Egypt, Guam, Guatemala, Honduras, Indonesia, Jamaica, Macau, Mexico, Mongolia, New Zealand, Saudi Arabia, the United Arab Emirates and Vietnam), which brings the worldwide total network close to 14,200 stores.

Store Network

Summary of changes in store network for the 12‑week period ended October 10, 2021

| Type of site | Company Operated | CODO | DODO | Franchised and other affiliated | Total |

| Number of sites, beginning of period | 9,906 | 397 | 689 | 1,263 | 12,255 |

| Acquisitions | 36 | — | — | — | 36 |

| Openings / constructions / additions | 7 | 3 | 9 | 11 | 30 |

| Closures / disposals / withdrawals | -33 | -1 | -5 | -12 | -51 |

| Store conversion | 9 | -7 | -2 | — | — |

| Number of sites, end of period | 9,925 | 392 | 691 | 1,262 | 12,270 |

| Circle K branded sites under licensing agreements | 1,917 | ||||

| Total network | 14,187 | ||||

| Number of automated fuel stations included in the period-end figures | 979 | — | 9 | — | 988 |

Financial Highlights

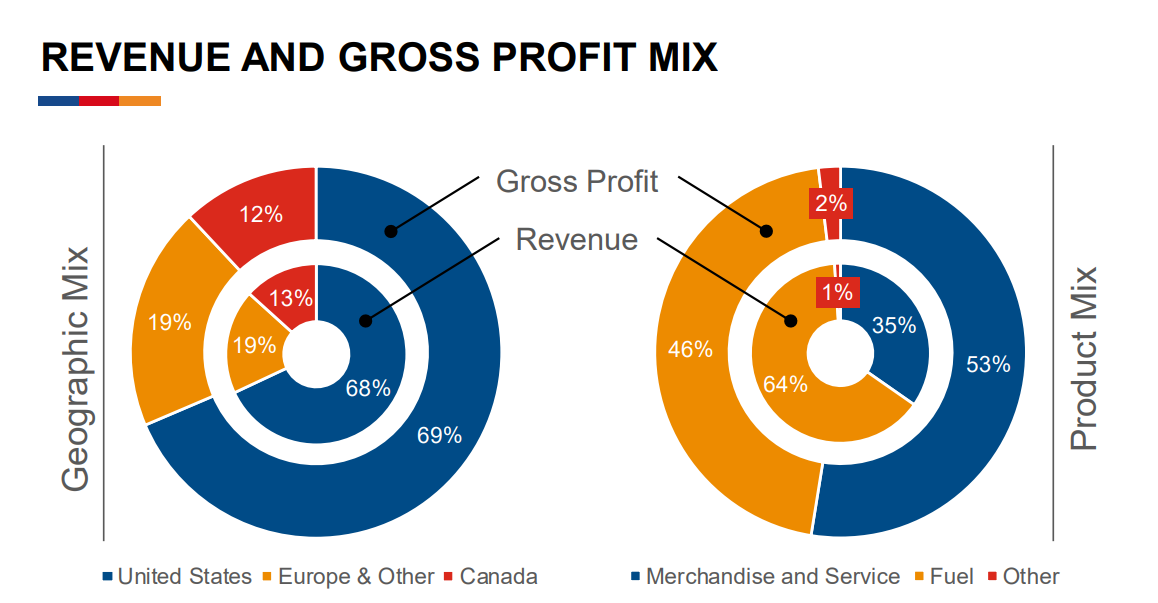

The company's revenues were $14.2 billion for the second quarter of fiscal 2022, up by $3.6 billion, an increase of 33.5% compared with the corresponding quarter of fiscal 2021. This performance is mainly attributable to a higher average road transportation fuel selling price, the contribution from acquisitions, higher fuel demand, as well as the net positive impact from the translation of revenues of its Canadian and European operations into US dollars, which had an impact of approximately $92.0 million.3

For the first half-year of fiscal 2022, its revenues increased by $7.4 billion, or 36.5% compared with the corresponding period of fiscal 2021, mainly attributable to similar factors as those of the second quarter.

Merchandise and service revenues

Total merchandise and service revenues for the second quarter of fiscal 2022 were $4.0 billion, an increase of $218.1 million compared with the corresponding quarter of fiscal 2021. Excluding the net positive impact from the translation of its Canadian and European operations into US dollars, merchandise and service revenues increased by approximately $183.0 million, or 4.9%. This increase is primarily attributable to the contribution from acquisitions, which amounted to approximately $170.0 million. Same-store merchandise revenues increased by 1.4% in the United States, 3.9% in Europe and other regions, and decreased by 2.1% in Canada. On a 2-year basis, same-store merchandise revenues increased at a solid compound annual growth rate of 2.9% in the United States, 6.3% in Europe and 4.5% in Canada.

For the first half-year of fiscal 2022, the growth in merchandise and service revenues was $428.3 million compared with the corresponding period of fiscal 2021. Excluding the net positive impact from the translation of its Canadian and European operations into US dollars, merchandise and service revenues increased by approximately $276.0 million, or 3.6%. Same- store merchandise revenues increased by 0.6% in the United States, 4.9% in Europe and other regions, and decreased by 6.1% in Canada.

Road transportation fuel revenues

Total road transportation fuel revenues for the second quarter of fiscal 2022 were $10.1 billion, an increase of $3.3 billion compared with the corresponding quarter of fiscal 2021. Excluding the net positive impact from the translation of revenues of its Canadian and European operations into US dollars, road transportation fuel revenues increased by approximately $3.2 billion, or 47.1%. This increase is mostly attributable to a higher average road transportation fuel selling price, which had a positive impact of approximately $3.0 billion, as well as to higher fuel demand. Same-store road transportation fuel volume increased by 3.3% in the United States, 2.8% in Canada, and decreased by 0.3% in Europe and other regions. On a 2-year basis, same-store road transportation fuel volume decreased at a compound annual rate of 6.5% in the United States, 2.0% in Europe and 4.9% in Canada. While Alimentation Couche-Tard is seeing improvement in fuel demand, fuel volumes are still generally under pressure across its network, with continued work from home trends, as well as evolving restrictive social measures.

For the first half-year of fiscal 2022, the road transportation fuel revenues increased by $6.9 billion compared with the corresponding period of fiscal 2021. Excluding the net positive impact from the translation of its Canadian and European operations into US dollars, road transportation fuel revenues increased by approximately $6.6 billion, or 52.6%. The positive impact of the higher average road transportation fuel selling price was approximately $5.7 billion. Same-store road transportation fuel volume increased by 7.4% in the United States, 2.8% in Europe and other regions, and 6.3% in Canada.

Other revenues

Total other revenues for the second quarter and first half-year of fiscal 2022 were $163.4 million and $279.1 million, respectively, an increase of $79.0 million and $108.1 million compared with the corresponding periods of fiscal 2021. Excluding the net positive impact from the translation of its Canadian and European operations into US dollars, other revenues increased by approximately $79.0 million and $99.0 million in the second quarter and first half-year of fiscal 2022, respectively, primarily driven by higher average selling prices and higher demand of its other fuel products, which had a minimal impact on gross profit.

Gross profit

The company's gross profit was $2.6 billion for the second quarter of fiscal 2022, up by $126.1 million, or 5.1%, compared with the corresponding quarter of fiscal 2021, mainly attributable to the contribution from acquisitions, higher fuel demand, improved merchandise and service gross margin and the net positive impact from the translation of its Canadian and European operations into US dollars, which had an impact of approximately $19.0 million.

For the first half-year of fiscal 2022, its gross profit increased by $237.5 million, or 4.8%, compared with the first half-year of fiscal 2021, mainly attributable to higher fuel demand, the net positive impact from the translation of its Canadian and European operations into US dollars and the contribution from acquisitions, partly offset by lower road transportation fuel gross margins in the United States.

Merchandise and service gross profit

In the second quarter of fiscal 2022, its merchandise and service gross profit was $1.4 billion, an increase of $83.6 million compared with the corresponding quarter of fiscal 2021. Excluding the net positive impact from the translation of its Canadian and European operations into US dollars, merchandise and service gross profit increased by approximately $72.0 million, or 5.6%, mainly attributable to the contribution from acquisitions, which amounted to approximately $49.0 million. The company's gross margin increased by 0.2% in the United States to 33.8%, and 0.4% in Canada to 32.3%, mainly due to favorable changes in product mix as customers are favoring smaller sized packaging, including single serves. The company's gross margin decreased by 1.8% in Europe and other regions to 38.4%, mainly due to the integration of Circle K Hong Kong, which has a different product mix than its European operations. Excluding Circle K Hong Kong, its gross margin in Europe and other regions would have been 42.2%, driven by favorable changes in product mix.

During the first half-year of fiscal 2022, its merchandise and service gross profit was $2.8 billion, an increase of $163.4 million compared with the first half-year of fiscal 2021. Excluding the net positive impact from the translation of its Canadian and European operations into US dollars, merchandise and service gross profit increased by approximately $111 .O million, or 4.3%. The company's gross margin was stable at 34.0% in the United States, decreased by 2.0% in Europe and other regions to 38.4%, and increased by 0.8% in Canada to 32.3%.

Road transportation fuel gross profit

In the second quarter of fiscal 2022, its road transportation fuel gross profit was $1.2 billion, an increase of $45.2 million compared with the corresponding quarter of fiscal 2021. Excluding the net positive impact from the translation of its Canadian and European operations into US dollars, its road transportation fuel gross profit increased by approximately $38.0 million, or 3.3%. In the United States, its road transportation fuel gross margin was 36.39 cents per gallon, an increase of O. 18 cents per gallon. In Europe and other regions, it was US 10.57 cents per liter, a decrease of US 0.53 cents per liter, and in Canada, it was CA 11.0" per liter, an increase of CA 1.02 cents per liter. Fuel margins remained healthy throughout its network, from a favorable competitive landscape and a strong sourcing efficiency.

EBITDA

During the first half-year of fiscal 2022, its road transportation fuel gross profit was $2.3 billion, an increase of $80.7 million compared with the first half-year of fiscal 2021. Excluding the net positive impact from the translation of its Canadian and European operations into US dollars, road transportation fuel gross profit increased by approximately $37.0 million, or 1.60/0. The road transportation fuel gross margin was 36.57 cents per gallon in the United States, US 10.4 cents per liter in Europe and other regions, and CA 11.02$ per liter in Canada.

During the second quarter of fiscal 2022, EBITDA stood at $1.3 billion, a decrease of 4.4% compared with the corresponding quarter of fiscal 2021. Adjusted EBITDA for the second quarter of fiscal 2022 decreased by $16.8 million, or 1.3%, compared with the corresponding quarter of fiscal 2021 , mainly due to higher operating expenses, partly offset by organic growth in its convenience and road transportation fuel operations, the contribution from acquisitions, as well as the net positive impact from the translation of its Canadian and European operations into US dollars, which had a net positive impact of approximately $8.0 million.

Net financial expenses for the second quarter and first half-year of fiscal 2022 were $67.3 million and $141.6 million, respectively, a decrease of $9.9 million and $23.6 million compared with the corresponding periods of fiscal 2021. Excluding the items shown in the table below, net financial expenses for the second quarter and first half-year of fiscal 2022 increased by $1.2 million and $1.5 million, respectively.

The income tax rate for the second quarter of fiscal 2022 was 21.3 % compared with 20.4% for the corresponding period of fiscal 2021. The increase for the second quarter of fiscal 2022 is mainly stemming from the impact of a different mix in its earnings across the various jurisdictions in which the company operate, as well as from prior year gains taxable at a lower income tax rate.

Net earnings and adjusted net earnings

Net earnings for the second quarter of fiscal 2022 were $694.8 million, compared with $757.0 million for the second quarter of the previous fiscal year, a decrease of $62.2 million, or 8.2%. Diluted net earnings per share stood at $0.65, compared with $0.68 for the corresponding quarter of the previous fiscal year. The translation of revenues and expenses from its Canadian and European operations into US dollars had a net positive impact of approximately $6.0 million on net earnings of the second quarter of fiscal 2022.

Adjusted net earnings for the second quarter of fiscal 2022 were approximately $693.0 million, compared with $735.0 million for the second quarter of fiscal 2021, a decrease of $42.0 million, or 5.7%. Adjusted diluted net earnings per Share were $0.65 for the second quarter of fiscal 2022, compared with $0.66 for the corresponding quarter of fiscal 2021, a decrease of 1.5%.

For the first half-year of fiscal 2022, net earnings stood at $1.5 billion, a decrease of $74.9 million, or 4.9%, compared to the first half-year of fiscal 2021. Diluted net earnings per share stood at $1.36, compared with $1.38 for the corresponding period of the previous fiscal year. The translation of revenues and expenses from its Canadian and European operations into US dollars had a net positive impact of approximately $36.0 million on net earnings of the first half-year of fiscal 2022.

Adjusted net earnings for the first half-year of fiscal 2022 stood at $1.5 billion, a decrease of $79.0 million, or 5.2%, compared with the first half-year of fiscal 2021. Adjusted diluted net earnings per Share were $1.35 for the first half-year of fiscal 2022, compared with $1.37 for the first half-year of fiscal 2021, a decrease of 1.5%.