Anglo American plc

Summary

- Anglo American is a leading global mining company.

- The company provide many of the essential metals and minerals that are fundamental to the transition to a low carbon economy and enabling a cleaner, greener, more sustainable world.

- The company has world class portfolio of mining and processing operations and undeveloped resources in 15 countries.

- Anglo American owns 85% of De Beers Group, the world's leading diamond company.

Company Overview

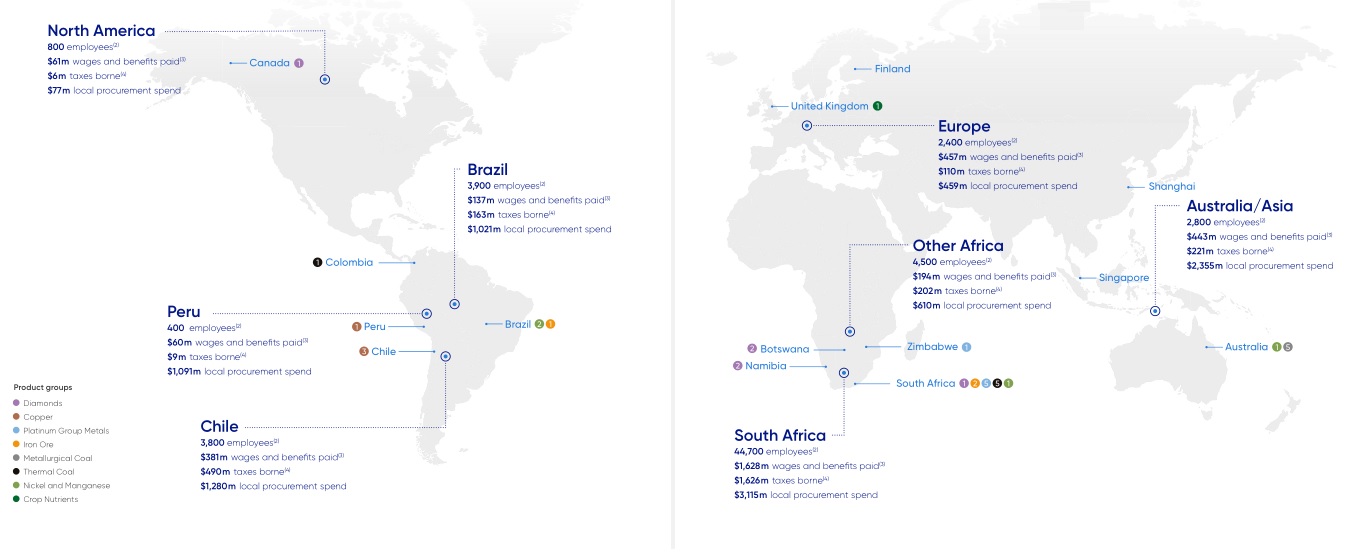

Anglo American (LSE:AAL, OTC:AAUKF) is a leading global mining company, with a world class portfolio of mining and processing operations and undeveloped resources, with more than 95,000 people working for it around the world, in 15 countries.

The company provide many of the essential metals and minerals that are fundamental to the transition to a low carbon economy and enabling a cleaner, greener, more sustainable world, as well as meeting the growing consumer-driven demands of the world’s developed and maturing economies. And the company do so in a way that not only generates sustainable returns for its shareholders, but that also strives to make a real and lasting positive contribution to society as a whole.

Products Portfolio

The quality and long life of its mineral assets are the foundations of its global business. The company actively manage its asset portfolio to improve its overall competitive position, continuing its trajectory towards products that support a fast growing population and enable a cleaner, greener, more sustainable world.1

Diamonds

Anglo American owns 85% of De Beers Group, the world's leading diamond company. The remaining 15% is owned by the Government of the Republic of Botswana (GRB). De Beers Group and its partners produce around one third of the world's rough diamonds, by value.

De Beers Group sells rough diamonds to the global diamantaires through its Diamond Trading and Auctions businesses. It sells polished diamonds and diamond jewellery via its Forevermark and De Beers Jewellers businesses.

Forevermark diamonds, for which fewer than 1% of the world's diamonds are eligible, are available globally and come with a promise that they are beautiful, rare and responsibly sourced.

De Beers Jewellers only uses the world's finest diamonds for its high-end jewellery, which is available in 16 markets around the world.

Copper

The company's copper mines are helping meet high demand across the developing world, which the company expect to increase as these new economies mature and their consumers demand copper-dependent products.

Anglo American has interests in four copper operations in Chile. The company produce copper concentrate, copper cathode and associated by-products such as molybdenum and silver.

The company's aim is to develop and operate long-life, cost-efficient, socially and environmentally responsible mining operations.

Platinum group metals

Anglo American is a leading producer of PGMs, essential metals for cleaning vehicle exhaust emissions and as the catalyst in electric fuel cell technology.

The company own and operate five mining operations in South Africa’s Bushveld complex, including Mogalakwena, Amandelbult and Mototolo, as well as the Unki mine, in Zimbabwe.

In South Africa, the company also own smelting and refining operations which treat concentrates from its wholly owned mines, its joint operations and third parties.

Metallurgical coal

Anglo American is the world’s third largest exporter of metallurgical coal for steelmaking and its operations serve customers throughout Asia, Europe and South America. The company's Australian-based metallurgical coal business includes five operating mines, along with additional development projects and joint-venture interests. The company's tier one metallurgical coal assets include the Moranbah North and Grosvenor metallurgical coal mines (both 88% ownership), located in Queensland, Australia. The mines are underground longwall operations and produce premium quality hard coking coal.

Metallurgical coal is a vital part of the steel value chain today – and steel is a material that will continue to form the backbone of the world’s infrastructure development for decades to come. Steel is also fundamental to the transition to a low carbon world – given its use in much of the required equipment and infrastructure for renewable energy – and is central to the achievement of the UN’s Sustainable Development Goals.

The metallurgical coal assets within Anglo American’s portfolio produce a high quality product ideal for serving more modern, highly-efficient, lower carbon intensity steel mills and Anglo American is well placed to supply this market. As the world transitions, the company will continue to act as responsible stewards of such natural resources, balancing the best interests of all its stakeholders.

Thermal coal

Anglo American has now demerged its thermal coal operations in South Africa to form Thungela Resources. You can find out more about Thungela here.

In June 2021, the company entered into an agreement for the sale of its 33.3% interest in Cerrejón, an independently managed associate in Colombia. Learn more here.

Thermal coal is the heat source for around 40% of all electricity generated globally today. India and China’s reliance on imported thermal coal is expected to drive continued growing demand in the long term.

Iron ore

The company's iron ore operations provide customers with high grade iron ore products which help its steel customers meet ever-tighter emissions standards.

In South Africa, Anglo American has a majority share (69.7%) in Kumba Iron Ore, while in Brazil Anglo American has developed the integrated Minas-Rio operation.

Nickel and manganese

The company's nickel business is well placed to serve the global stainless steel industry, which depends on nickel and drives demand for it. The company's mine assets are in Brazil, with two ferronickel production sites: Barro Alto and Codemin, in the state of Goiás.

The stainless steel industry uses two-thirds of the world’s nickel production and virtually all ferronickel produced each year. The balance is used mainly in the manufacture of alloy steel and other non-ferrous alloys.

In manganese, Anglo American has a 40% shareholding in Samancor, with operations in South Africa and Australia.

Polyhalite

Anglo American has made an exciting step in its journey to support a cleaner, greener, more sustainable world after securing the Woodsmith Project in North Yorkshire – the world’s largest known high-grade polyhalite deposit.

The Woodsmith Project - part of its Crop Nutrients business - is a natural fit for its portfolio as it supports its transition towards those metals and minerals that will meet the world’s evolving needs – including infrastructure and food – to support a fast-growing global population.

Polyhalite is used in fertilisers and can be mined through a relatively simple, low-energy, non-chemical production process. POLY4 is the product name of the fertiliser which will continue to be produced at the Project.

The Woodsmith Project has been successfully progressed over several years, with $1.1 billion already invested in the physical mine development, and the company look forward to working with the team to build on their progress going forward.

Financial Highlights

Anglo American’s profit attributable to equity shareholders for the year 2020 decreased by 41% to $2.1 billion (2019: $3.5 billion). Underlying earnings were $3.1 billion (2019: $3.5 billion), while operating profit was $5.6 billion (2019: $6.2 billion).2

Continued strong performances from its Minas-Rio iron ore operation in Brazil and the Collahuasi copper joint operation in Chile helped partly offset the impacts of Covid-19, leading to an overall decrease in production of 10%, on a copper equivalent basis. Covid-19 lockdowns across southern Africa in the first half of the year impacted production at PGMs, Kumba, De Beers and Thermal Coal. In response to the pandemic, comprehensive safeguarding measures were put in place at operations and in partnership with local communities across the business, enabling a return to more normal operating levels in the second half of the year. Production was also affected by operational issues at Metallurgical Coal and strike action at the Cerrejón thermal coal operation. Refined production of PGMs was impacted by an outage at the converter plant in the first half. Consequently, in the second half of the year, copper equivalent production improved by 13% compared with the first half, as lockdowns and restrictions eased and operations were able to sustain around 95% of normal capacity while maintaining Covid-19-related safeguarding measures.

De Beers’ rough diamond production decreased by 18% to 25.1 million carats (2019: 30.8 million carats), in response to lower demand due to the pandemic and Covid-19 restrictions in southern Africa during the first half of the year. Diamond demand from the midstream (cutters and polishers of rough diamonds) was affected throughout the year by Covid-19 lockdowns, travel restrictions and retail store closures.

Copper production increased by 1% to 647,400 tonnes (2019: 638,000 tonnes), driven by an 11% increase in attributable production from Collahuasi to a record 276,900 tonnes (2019: 248,800 tonnes) on the back of strong plant performance, reflecting improvement projects implemented in 2019. At Los Bronces, production decreased by 3% to 324,700 tonnes (2019: 335,000 tonnes) due to planned lower grades

PGMs' production (metal in concentrate) decreased by 14% to 3,808,900 ounces (2019: 4,440,900 ounces), due to Covid-19 restrictions, which reduced operating capacity for most of the second quarter, particularly at underground operations. PGM production was 35% higher in the second half of the year compared with the first, as the operations recovered well from the initial disruption caused by the pandemic. Refining performance had also returned to normal levels by the end of the year with the restart of the rebuilt converter plant (ACP).

At Kumba, iron ore production decreased by 13% to 37.0 Mt (2019: 42.4 Mt), owing to lower workforce levels and logistics constraints due to Covid-19 restrictions, as well as above average rainfall and operational issues at the Sishen crusher and Kolomela plant

Minas-Rio production increased by 4% to 24.1 Mt (2019: 23.1 Mt), despite a planned one-month suspension for a pipeline inspection. This reflects a strong operational performance as the asset builds towards full capacity, with productivity initiatives supported by robust operational stability.

Metallurgical coal production decreased by 26% to 16.8 Mt (2019: 22.9 Mt), principally owing to the suspension of operations at Grosvenor following a gas ignition incident in May, and challenges at Moranbah North, where a fall of ground in the first quarter and geotechnical challenges towards the end of the year limited longwall progress. Open cut operations were scaled back at Dawson and Capcoal in response to reduced demand for lower quality metallurgical coal.

Thermal coal export production decreased by 22% to 20.6 Mt (2019: 26.4 Mt), primarily due to Covid-19 operational restrictions and a three-month industrial action at Cerrejón, which ended in the first week of December.

Nickel’s production increased by 2% to 43,500 tonnes (2019: 42,600 tonnes) owing to improved operational stability, while manganese ore production was in line with the prior year at 3.5 Mt.

Group copper equivalent unit costs decreased by 2% in US dollar terms, despite lower production, due to weaker producer currencies and cost saving measures.

Despite the impact of the Covid-19 pandemic, as well as operational challenges, Group underlying EBITDA decreased by just 2% to $9.8 billion (2019: $10.0 billion). The Group mining EBITDA margin◊ was higher than the prior year at 43% (2019: 42%), due to the increase in the price for the Group’s basket of products, favourable exchange rates and cost saving initiatives. A reconciliation of ‘Profit before net finance costs and tax’, the closest equivalent IFRS measure to underlying EBITDA, is provided within note 2 to the Consolidated financial statements.

The reconciliation of underlying EBITDA, from $10.0 billion in the year ended 31 December 2019 to $9.8 billion in the year ended 31 December 2020, shows the controllable factors (e.g. cost and volume), as well as those outside of management control (e.g. price, foreign exchange, inflation and the impact of the pandemic), that drive the Group’s performance.

Average market prices for the Group’s basket of products increased by 7% compared to 2019, which served to increase underlying EBITDA by $2.2 billion. The price achieved for the PGMs basket increased by 51%, largely due to rhodium and palladium, which increased by 179% and 46% respectively, while the realised price for iron ore and copper increased by 23% and 10%, respectively. These were partly offset by a 34% reduction in the weighted average realised price for metallurgical coal.

Group underlying earnings decreased to $3.1 billion (2019: $3.5 billion), driven by an increase in net finance costs, as well as a 2% decrease in underlying EBITDA and a higher proportion of earnings attributable to non-controlling interests.

2021 Interim Results

29 July, 2021; Financial highlights for the six months ended 30 June 2021

• Underlying EBITDA* of $12.1 billion, driven by strong market demand and operational resilience

• Profit attributable to equity shareholders of $5.2 billion

• Net debt* of $2.0 billion (0.1 x annualised underlying EBITDA), reflecting strong cash generation

• $4.1 billion shareholder return, reflecting capital discipline and commitment to return excess cash:

• $2.1 billion interim dividend, equal to $1.71 per share, consistent with its 40% payout policy

• $2.0 billion additional return: $1.0 billion special dividend and $1.0 billion share buyback

• Exit from thermal coal operations: Thungela demerger completed and sale of Cerrejón interest announced

Mark Cutifani, Chief Executive of Anglo American, said:

“The first six months of 2021 have seen strong demand and prices for many of its products as economies begin to recoup lost ground, spurred by stimulus measures across the major economies. The platinum group metals and copper – essential to the global decarbonisation imperative as the company electrify transport and harness clean, renewable energy – and premium quality iron ore for greener steelmaking, supported by an improving market for diamonds, all contributed to a record half year financial performance, generating underlying EBITDA of $12.1 billion.

“Against a backdrop of ongoing Covid hardships in many countries, its commitment to do everything the company can to help protect its people and communities stands firm. It is in this spirit that Anglo American has decided to make a special contribution of $100 million to its Anglo American Foundation to fund more ambitious and longer term health, social and environmental projects, aligned with its Sustainable Mining Plan areas of focus, as the company look ahead to the post-pandemic recovery phase. With widespread health protocols in place across its operations, workplace safety has never been higher on its agenda. Building on its considerable improvements in recent years, I’m pleased to report no fatal incidents in the first half of this year.

“The resilience of its business through a tough operating environment, supported by the prevailing market conditions, increased its mining EBITDA margin* to 61%. Attributable free cash flow* of $5.4 billion helped reduce net debt to just 0.1 x annualised underlying EBITDA at the end of June. In line with its commitment to disciplined capital allocation, and in addition to its established 40% dividend payout, the company will return an additional $2 billion to shareholders, split equally between a special cash dividend and a share buyback, recognising the different preferences of its shareholders, amounting to a $4.1 billion total cash return for the half year.

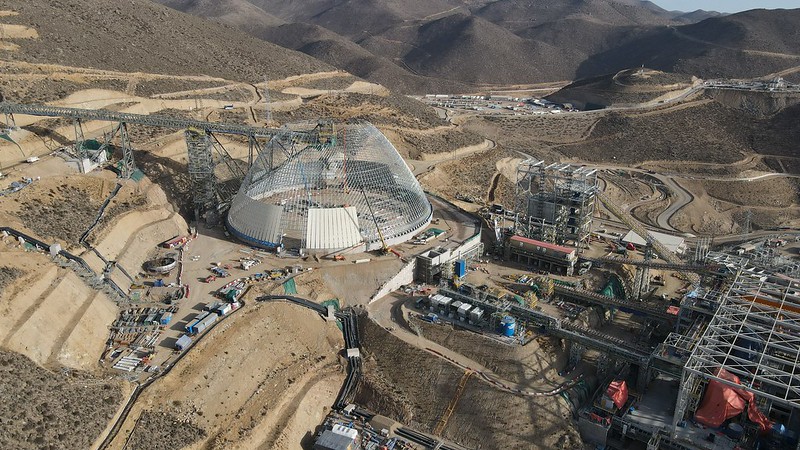

“The company's balanced investment programme is driving margin-enhancing volume growth of 20% over the next three years, including copper production from Quellaveco due to come on stream in 2022, and growth of 25–35% in the medium term. The company's business is increasingly geared towards providing the future-enabling metals and minerals for a low carbon economy and to meet global consumer demand trends. Combined with its commitment to carbon neutrality across its operations by 2040, Anglo American is working to meet the expectations of its full breadth of stakeholders.”