Antofagasta plc

Summary

- Antofagasta is a Chile-based copper mining group with interests in transport.

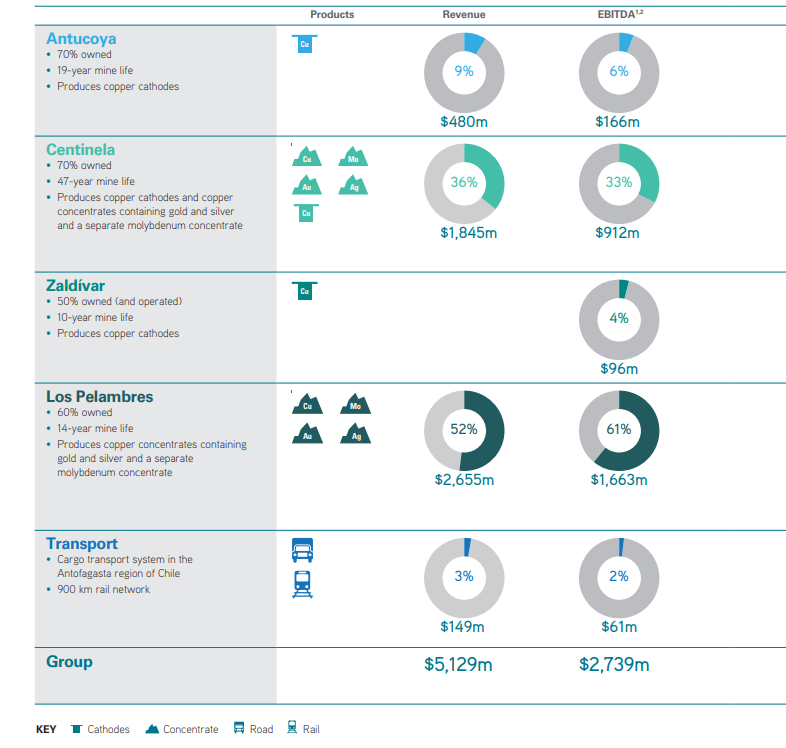

- Mining is its core business, representing over 97% of its revenue and EBITDA.

- The Group operates four copper mines in Chile, two of which produce significant volumes of by-products.

Company Overview

Antofagasta (LSE:ANTO, OTC:ANFGF) is a Chile-based copper mining group with interests in transport.

The company's vision is to be an international mining company based in Chile, focused on copper and its by-products, known for its operating efficiency, creation of sustainable value, high profitability and as a preferred partner in the global mining industry.1

Mining is its core business, representing over 97% of its revenue and EBITDA. The company operate four copper mines in Chile, two of which produce significant volumes of molybdenum and gold as by-products. The company also have a portfolio of growth opportunities located mainly in Chile.

In addition to mining, its Transport division provides rail and road cargo services in northern Chile predominantly to mining customers, which include some of its own operations.

Company History

The company's history began as the Antofagasta (Chili) and Bolivia Railway Company limited, incorporated in London in 1888. It raised money on the London Stock Exchange to build and operate a railway from Antofagasta, a port on the Pacific Coast of northern Chile, to La Paz, the capital of Bolivia.

During the 1980s Antofagasta diversified into mining and other sectors, following acquisition of control by the Luksic Group.

| 1888 | Antofagasta (Chili) and Bolivia Railway Company limited incorporated in London |

| 1979 | Luksic Group acquires controlling interest |

| 1996 | Financial and industrial interests exchanged for 33.6% interest in Quiñenco |

| 1999 | Start of low-cost copper production at Los Pelambres |

| 2003 | Demerger of 33.6% interest in Quiñenco Acquisition of Aguas de Antofagasta |

| 2006 | Acquisition of exploration interests in Pakistan Acquisition of Equatorial Mining to consolidate control of the Centinela Mining District |

| 2008 | Sale of 30% interest in Esperanza and El Tesoro to Marubeni Establish Energia Andina joint venture for geothermal opportunities |

| 2010 | Twin Metals agreement with Duluth Metals |

| 2012 | Sale of 30% of Antucoya to Marubeni |

| 2013 | Acquire interest in Alto Maipo hydro-electric project |

| 2014 | Esperanza and El Tesoro combined as Minera Centinela Acquisition of Duluth Metals Limited ("TMM") |

| 2015 | Sale of Aguas de Antofagasta Aquired 50% of Zaldívar |

| 2016 | Sale of Michilla |

| 2019 | Start construction of Los Pelambres Expansion project |

Business Segments

Mining is the Group’s core business, representing over 97% of Group revenue and EBITDA. The Group operates four copper mines in Chile, two of which produce significant volumes of by-products. The Group also has a portfolio of growth opportunities located mainly in Chile. In addition to mining, the Group has a transport division providing rail and road cargo services in northern Chile predominantly to mining customers, which include some of the Group’s own operations.2

Mining Division

All of the Group's operations are located in the Antofagasta Region of northern Chile, except for its flagship operation Los Pelambres, which is in the Coquimbo Region of Central Chile.

Los Pelambres

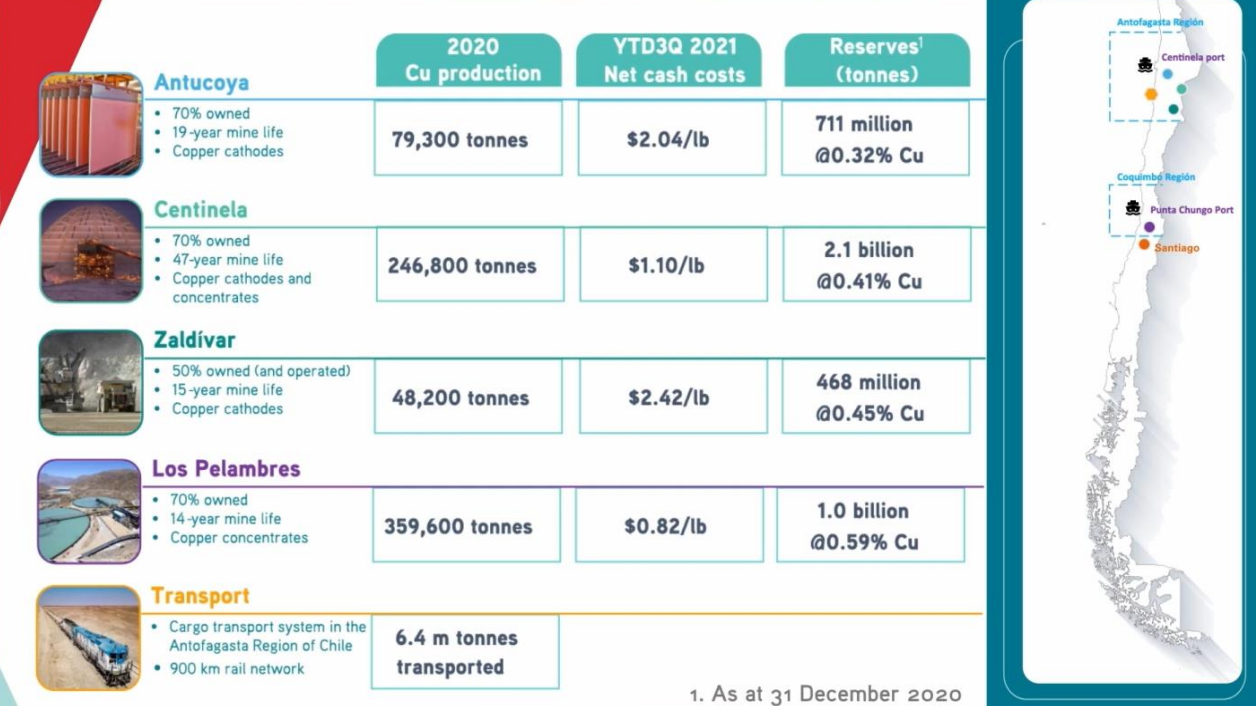

60% Owned; Los Pelambres is a sulphide deposit in Chile’s Coquimbo region, 240 km north-east of Santiago. It produces copper concentrate (containing gold and silver) and molybdenum concentrate through a milling and flotation process.

Centinela

70% Owned; Centinela mines sulphide and oxide deposits 1,350 km north of Santiago in the Antofagasta Region, one of Chile’s most important mining areas.

Centinela produces copper concentrate (containing gold and silver) through a milling and flotation process, and molybdenum concentrate. It also produces copper cathodes, using the solvent extraction and electrowinning (SX-EW) process.

Antucoya

0% Owned; Antucoya is approximately 1,400 km north of Santiago and 125 km north-east of the city of Antofagasta. Antucoya mines and leaches oxide ore to produce copper cathodes using the solvent extraction and electrowinning (SX-EW) process.

Zaldívar

50% Owned Joint Venture; Zaldívar is an open-pit, heap-leach copper mine which produces copper cathodes using the solvent extraction and electrowinning (SX-EW) process. It is located at an elevation of 3,000 metres above sea level, approximately 1,400 km north of Santiago and 175 km south-east of the city of Antofagasta.

Transport Division

The company's Transport division is known as Ferrocarril de Antofagasta a Bolivia (FCAB) and provides rail and truck services to the mining industry in the Antofagasta region, including its own mining operations.

During 2020 the division completed the investment and preparatory work for a significant new transport service contract for a mining client which will start in early 2021.

Growth Projects

The company's approach to considered growth means the company focus on value, which includes controlling capital costs and optimising production at its existing operations and the development of new mining operations to deliver replacement and new production in the future.

Current project

- Los Pelambres Expansion

- Centinela Second Concentrator

- Esperanza Sur Pit

- Zaldívar Chloride Leach

- Twin Metals Minnesota

Exploration

The exploration team has continued to conduct its activities at a reduced level in Chile and elsewhere in the Americas as it has adapted to the restrictions required under new COVID-19 protocols introduced during the year.

Exploration both in Chile and internationally remains key to the sustainable long-term growth of the Group´s copper business. In 2020, all its exploration activities were conducted in accordance with the new COVID-19 protocols, which restricted activity is some areas. The Group continued with its programme of earlyand intermediate-stage projects, managed in South America by its team based in Santiago, and in North America by its team based in Toronto. In-house teams carried out these programmes, maintaining a well-balanced portfolio of exploration properties in Chile and Peru and looking for opportunities to work with third parties in the rest of the Americas, with the aim of building a portfolio of high-quality long-term copper projects.

Chile

The Group’s exploration programmes are in the copper belts of northern-central Chile, particularly in areas with high prospectivity for porphyry copper, as well as manto and IOCG (Iron Ore Copper Gold)-type deposits. During 2020 the early-stage programmes completed more than 40,000 metres of drilling, some 50% less than in 2019.

Drilling evaluation was reduced at several of the brownfield projects in the Centinela Mining District with the focus continuing to be on identifying new high-quality oxide leach targets. As a result of the COVID-19 restrictions, more desktop evaluations were carried out than in 2019 in order to generate new land acquisition opportunities either by submitting exploration licence applications or by entering into agreements with third parties.

International

International exploration efforts remain concentrated on the key copper belts of North and South America, with a strong focus on Peru and western North America, which were also affected by COVID-19 restrictions.

.

Financial Highlights

The profit for the financial year attributable to the owners of the parent (including exceptional items and discontinued operations) increased from $501.4 million in 2019 to $506.4 million in the year 2020. Excluding exceptional items and discontinued operations the profit attributable to the owners of the parent increased by $37.9 million to $539.3 million. The $164.8 million increase in revenue from $4,964.5 million in 2019 to $5,129.3 million in the year 2020.3

Revenue from the Mining division

Revenue from the Mining division increased by $175.9 million, or 3.7%, to $4,979.9 million, compared with $4,804.0 million in 2019. The increase reflected a $264.8 million improvement in copper sales partly offset by a $88.9 million decrease in by-product revenue.

Revenue from copper sales

Revenue from copper concentrate and copper cathode sales increased by $264.8 million, or 6.5%, to $4,348.2 million, compared with $4,083.4 million in 2019. The increase reflected the impact of $348.4 million from higher realised prices and $69.7 million from lower treatment and refining charges, partly offset by $153.3 million from lower sales volumes.

Revenue from the Transport division

Revenue from the Transport division (FCAB) decreased by $11.1 million or 6.9% to $149.4 million (2019 – $160.5 million), mainly due to the effect of the weaker Chilean peso, and lower sales volumes of freight transported and industrial water.

EBITDA

EBITDA (earnings before interest, tax, depreciation and amortisation) increased by $300.3 million or 12.3% to $2,739.2 million (2019 – $2,438.9 million). EBITDA includes the Group’s proportional share of EBITDA from associates and joint ventures. EBITDA from the Mining division increased by 13.6% from $2,358.1 million in 2019 to $2,678.2 million this year. This reflected the higher revenue and lower mine-site costs, decreased exploration and evaluation expenditure and lower corporate costs, partly offset by higher other mining expenses and lower EBITDA from associates and joint ventures. EBITDA at the Transport division decreased by $19.8 million to $61.0 million in 2020 ($80.8 million – 2019), reflecting the lower revenue and decreased EBITDA from associates and joint ventures, partly offset by the lower operating costs.

nterest income decreased from $47.1 million in 2019 to $18.9 million in 2020, mainly due to the decrease in average interest rates partly offset by the higher average cash balance. Interest expense decreased slightly from $111.1 million in 2019 to $77.1 million in 2020, reflecting both a decrease in the average LIBOR rate and also a reduction in the average relevant debt balances. Other finance items were a net loss of $45.2 million, compared with a net gain of $13.0 million in 2019, a variance of $58.2 million. This was mainly due to the foreign exchange impact, which was a $28.9 million loss in 2020 compared with a $35.8 million gain in 2019, due to the retranslation of Chilean peso denominated assets and liabilities.

Profit before tax

As a result of the factors set out above, profit before tax increased by 4.7% to $1,413.1 million (2019 – $1,349.2 million).

At 31 December 2020 the Group had combined cash, cash equivalents and liquid investments of $3,672.8 million (31 December 2019 – $2,193.4). Excluding the non-controlling interest share in each partly-owned operation, the Group’s attributable share of cash, cash equivalents and liquid investments was $3,046.9 million (31 December 2019 – $1,849.7 million).

Q3 2021 Production Report

Antofagasta plc CEO, Iván Arriagada said: “The company's copper production and cost performance during the quarter was in line with its expectations despite external pressures such as the ongoing drought in Chile, the global supply chain challenges, the energy crisis and higher input costs.4

“Year-to-date production and net cash costs were very similar to last year at 542,600 tonnes at $1.15/lb and the company remain on track to deliver on its previously stated production guidance of 710-740,000 tonnes for the full year and, despite input cost pressures, its net cash costs are now expected to be lower than its original guidance of $1.25/lb.

“Since the company last reported, there has been no material rainfall at its operations and as the company head into the summer months, the company do not expect any rain until the next rainy season, which begins in June next year. The construction of the desalination plant at Los Pelambres is on track for completion in H2 2022 and the company now anticipate Group production in 2022 to be between 660,000 and 690,000 tonnes reflecting the previously advised production tonnes at risk at Los Pelambres due to the weather, and lower grades at Centinela Concentrates.

“The COVID-19 situation in Chile continues to improve but the measures the company implemented last year will stay in place as the company continue to prioritise the health and safety of its employees and surrounding communities. While the company expect the extraordinary global supply chain events and energy crisis to ease over time, the company remain focused on controlling costs while progressing its current and future growth projects.”

Production Highlights

- Group copper production in Q3 2021 was 181,100 tonnes, 1.5% higher than in the previous quarter on higher production at Centinela, partly offset by lower throughput at Los Pelambres

- Group copper production for the first nine months of the year was 542,600 tonnes, 0.2% higher than in the same period last year mainly on expected higher grades at Centinela Concentrates, offset by expected lower grades at Los Pelambres

- Gold production for the quarter was 66,800 ounces, 8.8% higher than in the previous quarter, and for the year-to-date production rose by 25.4% to 187,300 ounces, both increases as a result of higher grades at Centinela

- Molybdenum production in the quarter was 2,600 tonnes, 7.1% lower than the previous quarter on lower grades and recoveries at Centinela. For the year-to-date, production was 8,400 tonnes, 500 tonnes lower than in the same period last year

As at the end of Q3 the Los Pelambres Expansion project was 59% complete (design, procurement and construction). Completion of the desalination plant is expected in H2 2022 and of the concentrator plant expansion by the end of 2022

At Zaldívar construction of the Chloride Leach project at the end of Q3 was 90% complete and is expected to be completed on schedule and according to plan in H1 2022

During the quarter, the first autonomous trucks were delivered to the Esperanza Sur pit

Mining Operations

Los Pelambres

Copper production at Los Pelambres during the quarter was 81,100 tonnes, 3.9% lower than in the previous quarter as throughput reduced by 3.2%. This was primarily due to decreased plant run-time because of an unscheduled stoppage at one of the SAG mills and operational measures taken to optimise the use of water.

In the first nine months of 2021, copper production was 250,400 tonnes, 6.9% lower than in the same period last year. This decrease was primarily due to the expected lower copper grade, partially offset by higher throughput driven by improved plant performance.

Molybdenum production was 2,400 tonnes in Q3 2021, the same as the previous quarter, and for the year-to-date was 7,500 tonnes, 400 tonnes lower than the same period last year as a result of lower grades and recoveries.

Centinela

Centinela produced 70,700 tonnes of copper during the quarter, 8.4% higher than in the previous quarter on higher copper grades at Centinela Concentrates and higher throughput at Centinela Cathodes. Production for the year-todate was 202,800 tonnes, 14.7% higher than in the same period last year, due to higher ore grades and throughput at Centinela Concentrates.

Centinela produced 70,700 tonnes of copper during the quarter, 8.4% higher than in the previous quarter on higher copper grades at Centinela Concentrates and higher throughput at Centinela Cathodes. Production for the year-todate was 202,800 tonnes, 14.7% higher than in the same period last year, due to higher ore grades and throughput at Centinela Concentrates.

Copper cathode production during the quarter was 23,200 tonnes, 14.9% higher than Q2 2021 primarily as throughput increased by 9.0%. For the year-to-date, copper cathode production was 64,800 tonnes, 7.4% lower than in the same period last year mainly due to expected lower grades and recoveries, despite higher throughput.

Gold production was 53,400 ounces in the quarter, 12.2% higher than the previous quarter on higher grades, and for the first nine months was 145,900 ounces, 38.0% higher than the same period last year, due to higher throughput and grades.

Antucoya

Total copper production at Antucoya during the quarter was 18,300 tonnes, 4.7% lower than the previous quarter as grades decreased as expected and throughput fell 5.0%. Production in the first nine months of 2021 was 57,700 tonnes, unchanged from the same period last year with higher throughput offset by expected lower grades and resulting lower recoveries.

During the quarter, cash costs were $2.06/lb compared to $2.12/lb in Q2. For the year-to-date, cash costs were $2.05/lb, 13.9% higher than the same period last year due to a stronger Chilean peso, and higher input costs and maintenance expenditure.

Zaldívar

Copper production for the quarter was 11,000 tonnes, 14.6% higher than in the previous quarter on significantly improved throughput and higher recoveries, partially offset by lower grades. Production for the year-to-date was 31,600 tonnes, 16.2% lower than the same period last year due to expected lower grades and recoveries, partially offset by higher throughput.

Cash costs during the quarter were $2.34/lb, $0.31/lb lower than Q2 2021 as there were higher maintenance costs during Q2 and a weaker Chilean peso. Cash costs for the first nine months of the year were $2.42/lb, compared with $1.67/lb in the same period in 2020, mainly due to lower grades, higher maintenance costs and the stronger Chilean peso.

Transport Division

Total transport volumes in Q3 2021 were 1.8 million tonnes, 5.1% higher than the previous quarter, due to the ramp-up of a new transport contract and increased sulphuric acid shipments.

For the first nine months of the year, transport volumes increased by 3.0% compared to the same period in 2020 as the new transport contract took effect, partially offset by customers’ road transport disruptions.