Aurobindo Pharma Ltd

Overview

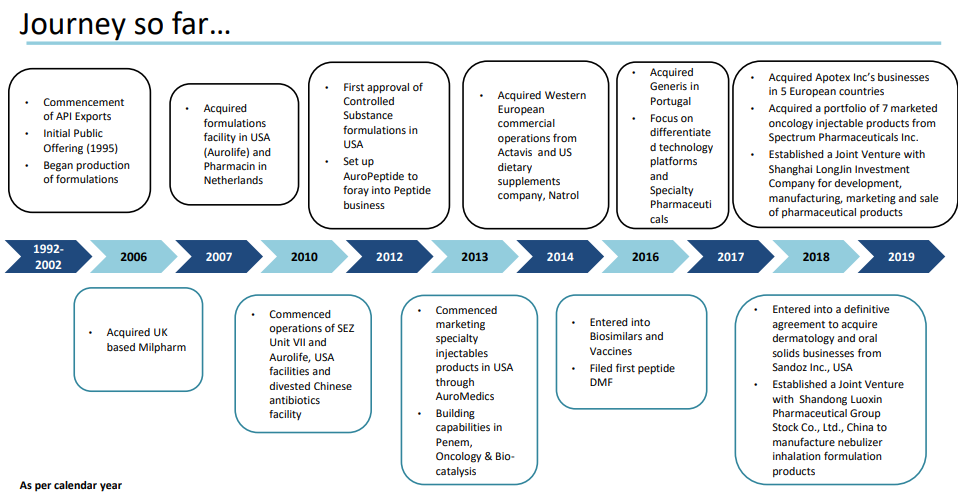

Founded in 1986 by Mr. P.V. Ramprasad Reddy, Mr. K. Nityananda Reddy and a small group of highly committed professionals, Aurobindo Pharma (NSE: AUROPHARMA) was born of a vision. The company commenced operations in 1988-89 with a single unit manufacturing Semi-Synthetic Penicillin (SSP) at Pondicherry. 1

Aurobindo Pharma became a public company in 1992 and listed its shares on the Indian stock exchanges in 1995. In addition to being the market leader in Semi-Synthetic Penicillin’s, Aurobindo Pharma has a presence in key therapeutic segments such as neurosciences (CNS), cardiovascular (CVS), anti-retroviral, anti-diabetics, gastroenterology and Anti-biotics

Through cost effective manufacturing capabilities and a few loyal customers, the company also entered the high margin specialty generic formulations segment. Today Aurobindo Pharma has evolved into a knowledge driven company manufacturing active pharmaceutical ingredients and formulation products. It is R&D focused and has a multi-product portfolio with manufacturing facilities in several countries.

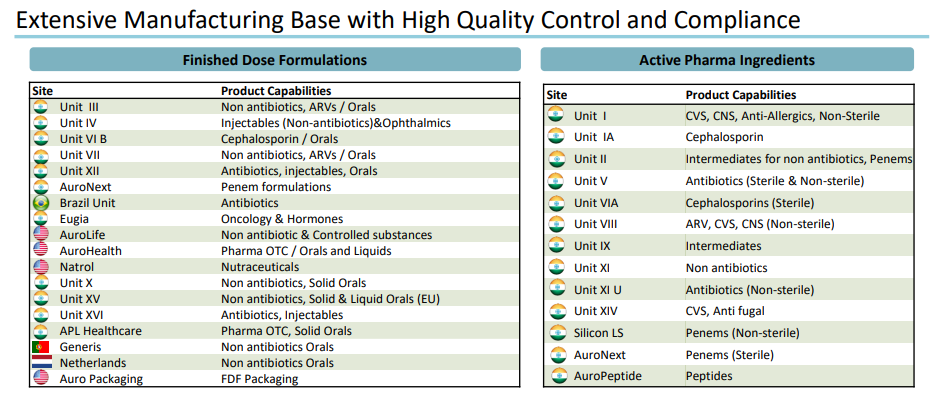

The formulation business is systematically organized with a divisional structure, and has a focused team for key international markets. Leveraging its large manufacturing infrastructure for APIs and formulations, wide and diversified basket of products and confidence of its customers, Aurobindo achieved revenue of USD 2.6 billion in FY2017-18. Aurobindo’s 11 units for APIs / intermediates and 15 units (10 in India, 3 in USA, 1 in Brazil and 1 in Portugal) for formulations are designed to meet the requirements of both advanced as well as emerging market opportunities.

A well-integrated pharma company, Aurobindo Pharma features among the top 2 Pharmaceutical companies in India in terms of consolidated revenues. Aurobindo exports to over 150 countries across the globe with around 90% of revenues derived from international operations. The company's customers include premium multi-national companies. With multiple facilities approved by leading regulatory agencies such as USFDA, EU GMP, UK MHRA, South Africa-MCC, Health Canada, WHO and Brazil ANVISA, Aurobindo makes use of in-house R&D for rapid filing of patents, Drug Master Files (DMFs), Abbreviated New Drug Applications (ANDAs) and formulation dossiers across the world. Aurobindo Pharma is among the largest filers of DMFs and ANDAs in India.

Company History

Manufacturing Capabilities

Aurobindo has retained the same drive for growth that marked its early days. Starting with a small SSP manufacturing unit in 1988, Aurobindo has grown to become the market leader in SSPs, non penicillins, cephalosporins, and non cephalosporins. In the global market, the company believe in retaining its leadership in SSPs, cephalosporins, new anti-infectives and lifestyle disease drugs.

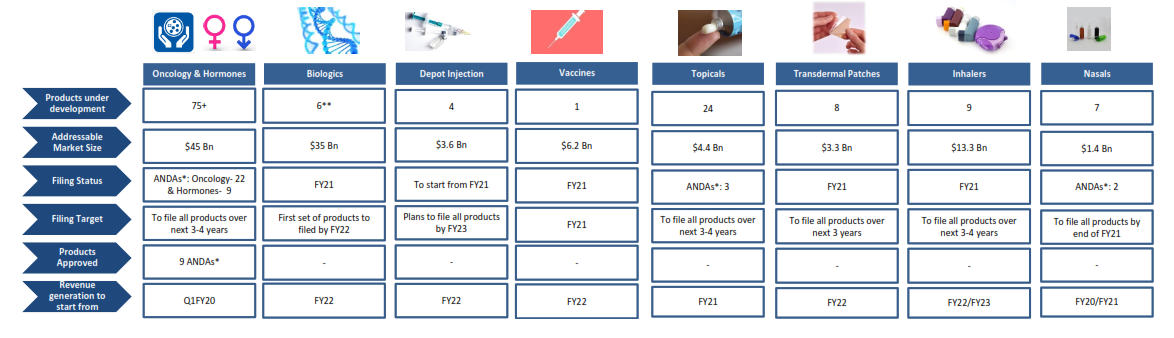

Research and Development

The Company’s R&D strengths are in developing intellectual property in non-infringing processes and resolving complex chemistry challenges.Aurobindo Pharma is in the process of developing new drug delivery systems, new dosage formulations, and applying new technology for better processes.2

The R&D Center, in Hyderabad covers over 13,000 sq.m, and provides a nurturing environment to a multi-disciplinary team of over 700 scientists striving for excellence.

The Centre meets cGLP requirements, and is focused on the areas of organic synthesis, analytical research, dosage form development, pharmacology, bio-equivalence studies and drug delivery systems.

The Centre is capable of developing, scaling up and commercializing various dosage forms spread across tablets, capsules, soft gels, oral liquids, injectables (solutions, suspensions, lyophilized, etc.), and ophthalmic (three piece and BFS) and nasal delivery systems.The focus is to develop products for the US and EU followed by other international markets, including specialized markets like Japan.The company can develop complex in-vitro analytical as well as bio- analytical methods for various molecules including extremely potent drug combinations to support the formulation development team.The R&D Centre has developed products and filed more than 200 ANDA’s, around 124 EU Dossiers for products and hundreds of Dossiers in other countries including Brazil, South Africa, Australia and China.The product range covers various pharmacological categories with special focus on anti-retroviral, anti-biotic, CNS and CVS drugs.

Business Segment

Formulations

Aurobindo Pharma Ltd. is a vertically integrated pharmaceutical company that delivers innovative solutions. From discovery to development to commercialization, its growth is aided by cost-effective drug development and substantial manufacturing.3

Leveraging India’s globally competitive cost base and talented team of scientists, Aurobindo Pharma has successfully launched a range of affordable products which are accessible across the globe.

Aurobindo Pharma is well-known as a global supplier of generic Antiretroviral (ARV) drugs because of its strong customer centricity. The company's products are updated continuously to suit the changing needs of its customers. The company market more than 300 products in various therapeutic segments over 150 countries. Aurobindo Pharma is building and establishing its brands as the company develop significant strength in its chosen markets. The company also have strategic alliances with global pharmaceutical majors to cater to their formulation manufacturing needs.

Custom Synthesis

AuroSource® is the Custom Research and Manufacturing division of Aurobindo Pharma Limited. AuroSource® offers the global bio-tech and pharmaceutical community a refreshing new approach for the outsourcing of chemistry services with a dedicated focus on enhancing value for its customers. AuroSource® offers customer centric project-based chemistry services.4

The company's team is committed to simplifying the outsourcing experience with exceptional customer service, while ensuring transparency, accountability and reliability in terms of cost and delivery. Every project is a privilege, and its team compromise on nothing in order to provide an efficient and unparalleled outsourcing experience.

Aurobindo Pharma is its parent company and has twenty-two years of experience serving North American, European and Asian markets for over a decade. Aurobindo is one of India’s largest pharmaceutical companies with over USD $1 billion in annual sales.

Through its modern development and manufacturing facilities with a dedicated team of Project Managers, R&D and manufacturing personnel, AuroSource® offers comprehensive outsourcing options in registered starting materials, intermediates and APIs along with stability study activities. IP may be granted to customers depending on the type of business agreement entered into at the time a specific project is awarded.

The company's portfolio includes many specialized R&D capabilities, with particular expertise in customized APIs, intermediates, starting raw materials and stability studies. The company also offer solutions to manage the complete product lifecycle including extensions and regulatory support. Aurobindo Pharma has experience in over 1,000 regulatory filings, export to over 125 countries and have commercialized over 200 products.

Peptides

Auro Peptides Ltd. is the subsidiary division of Aurobindo Pharma that delivers innovative solutions from discovery to development and commercialization through to cost-effective drug development and manufacturing. 5

Auro Peptide’s aims “to deliver cGMP material in a timely, transparent, reliable manner and in a facilitative environment, through streamlined processes and talented workforce.”

Located approximately 40km from Hyderabad, the facility is supported by state-of-the-art infrastructure which enables end-to-end GMP services so as to deliver the services in line with customer expectations and regulatory requirements. The facility houses a highly experienced team of scientists who develop chemical synthesis processes for peptides which are commercially viable and eco-friendly. The entire manufacturing facility is HVAC controlled.

AuroZymes

AuroZymes is the biocatalysts division of Aurobindo Pharma Ltd.AuroZymes develops and produces biocatalysts for use in the Pharmaceutical and Chemical Industries. These biocatalysts were originally developed for use internally but are now available for use by its customers. 6

API

Aurobindo is one of the top API manufacturing companies in the world and also one of the very few pharmaceutical companies that are vertically integrated with a presence in the API and Formulations segments. This makes Aurobindo a truly unique and fully integrated global pharmaceutical company.By maintaining cost leadership and competitiveness in various therapeutic domains, Aurobindo’s API business has ensured the profitability and growth of the company’s Formulation business, in addition to becoming a top API supplier globally.Aurobindo Pharma is one among the very few players present across beta lactams and non-beta lactams. In beta lactams the company offer both sterile and non-sterile penicillin and cephalosporins along with penams. This was achieved by focusing on improving operational efficiencies with a careful and meticulous product selection strategy based on real time market requirements. By maintaining cost leadership, the flexibility to switch manufacturing operations and, the competitiveness in various therapeutic domains, Aurobindo’s API business is in the top league globally.7

Industry Overview

Global Pharmaceutical Industry

Globally, the use of medicines has grown considerably in the past decade, particularly in chronic and high-priority segments. The spending for pharmaceuticals registered an invoice value of US$1.25 trillion in 2019, and is expected to grow at 3-6% CAGR through 2024, reaching US$1.5-1.6 trillion. The rise in spending is partly due to increased usage and partly driven by changes in the speciality and innovative product composition of new brands.8

Developed markets are expected to see enhanced spending from US$821.6 billion in 2019 to US$985-1,015 billion in 2024, at 2-5% CAGR. On the other hand, pharmerging markets are likely to grow from US$357.7 billion in 2019 to US$475-505 billion in 2024, at 5-8% CAGR.

The front-ranking nations in pharma spending in 2024 are likely to be the US, China, Japan, Germany, Brazil, Italy, France, the UK, India and Spain.

Key Industry Trends

Specialty medicines: Specialty drugs are used to treat complex or rare chronic conditions. In developed markets, around 44% of spending in 2019 was focused on specialty products; and is likely to touch 52% in 2024. In pharmerging markets, specialty medicines accounted for 14% of spending in 2019, and are expected to reach 15% in 2024. Of the US$354 billion spent by developed markets on speciality products in 2019, 30% was on oncology products. Oncology spending is likely to be the largest contributor to speciality spending, with a projected increase of 51% through 2024, indicating faster innovation and rapid launch of new pipeline of drugs. Autoimmune therapy spending comprised 17% of total spending in 2019, while HIV accounted for 8% of speciality products; going forward both the segments are likely to witness faster growth.

Biosimilars: Biosimilars are similar versions of biologics, which are made from microorganisms found in plant or animal cells. There has been an ever-increasing demand for pharmaceuticals and for cost effective and more accessible drugs. This makes the biosimilar market an attractive growth proposition in the foreseeable future. The USFDA expects to review more biosimilar applications in 2020, as 66 biologic US patents are expiring within the next five years. This will eventually bolster the growth of the biosimilar segment.

Big data and Artificial Intelligence (AI): Big data and Artificial Intelligence now have a presence in almost every industry. The International Society for Pharmacoepidemiology (ISPE) and its members are working on the roadmap to implement Pharma 4.0 model for the future. Through enhanced digitalisation, Pharma 4.0 will connect the medical fraternity much more cohesively, creating new levels of transparency and speed for a digitalised plant floor. This will not only enable faster decision-making, but also provide in-line and in-time control over business, operations and quality. Robotic technology and Artificial Intelligence (AI) would soon be used to reduce manufacturing floor downtime and product waste. Besides, single-use disposable solutions are gaining momentum, replacing open transfer manufacturing techniques for safer drug storage and transport.

Precision medicine: Precision medicine, also known as personalised medicine, is a process of diagnosing and providing customised medicines and treatment based on an individual’s predicted response. Considered niche, these medicines are slowly gaining traction with more and more of such medicines passing the clinical stage and getting ready for the newage market. In the last five years, investment in personalised medicine has doubled in size and its production is expected to increase by approximately 33% by 2025.

Mergers and acquisitions (M&A): Despite a global slowdown in most other sectors, M&A in the pharma industry remained vibrant throughout 2019. The total value of deals during 2019 stood at US$1.2 trillion. Some of the biggest companies in the industry are consolidating to elevate their position in a highly competitive environment. Increased regulatory pressure from the governments to reduce drug prices and remove potential monopolies is likely to impact margins.

Key Global Markets

USA

USA continues to rank at the apex of the world’s pharmaceutical spending, contributing about 41% of the total market. The spending is likely to grow from US$510 billion in 2019 to US$ 605-645 billion by 2024, at a CAGR of 3-6%. However, the US market was ranked fourth in overall growth potential, trailing behind high-growth emerging markets such as China, India and Germany. Encouragingly noteworthy is the fact that the country has the highest biological processing quality and is perceived to have the largest growth potential for biologics manufacturing.

With the raging COVID-19 pandemic disrupting supply chains and the government’s increased attention on drug pricing, the market is likely to be volatile and margins will be under constant pressure. The US Department of Health and Human Services (HHS) and the USFDA are making concerted efforts to drive speciality product development and expedite regulatory pathways that recognise unmet clinical needs. Besides, support for the generics market will be considerably higher in the forecast period (2020-2024), with the patent expiry of existing drugs

Europe

In 2019, the total pharma spending in the top five European countries stood at US$174 billion, registering a 4% CAGR over the previous five years. In 2019, the launch of new products in Germany and measures by France to improve biosimilar uptake with an aim to achieve 80% penetration by 2022, have played an important role.

Europe has adopted globally acknowledged standards and the authorities’ efforts to seek out new interest to create a more competitive and therefore more accessible market. During the year, the European Union adopted manufacturing waivers to supplementary protection certificates (SPCs), a move supported by generics and biosimilars producers and Active Pharmaceutical Ingredient (API) manufacturers. The manufacturing waiver for SPCs had been a subject of great debate between the generics/biosimilars industry and innovator drug companies. The companies would now be able to start manufacturing under the waiver from July 2022, which provides a positive outlook for the years to come.

Going forward, with a 3-6% CAGR, pharmaceutical spending in the top five European Union (EU5) markets is projected to grow to US$210-240 billion by 2024. The main driver behind this growth would be the launch of latest generation innovative specialty products. However, government led price control initiatives to improve patient access to these specialty products is expected to act as a counter-balancing force to this growth.

Pharmerging markets

During 2014-19, spending on pharmaceuticals has increased at a CAGR of 7%, reaching US$358 billion by the end of 2019. Pharmerging markets comprised 28% of global pharmaceutical spending in 2019. A significant proportion of this spending and market growth has been driven by enhanced access to chronic and specialty medications, leading to the ramp-up of volumes and adoption of more novel therapies.

Going forward, pharmaceutical spending in pharmerging markets is expected to account for 30-31% of global pharmaceutical spending in 2024. These markets are expected to continue to grow with a 5-8% CAGR through 2024, as against historical 7% CAGR during the period 2014-19.

The growth in pharmerging markets is likely to be driven by a higher volume growth for branded generics and pure generic medicines. The volume growth would be led by increasing access to the newly introduced medicines by the consumers in these markets. Also, some of the latest generation innovative drugs are likely to be launched in these markets, but expecting that the prices of such products would be high, the rise in their purchases is likely to be limited.

India

India is now looked upon as the pharmacy of the world. Besides being the largest provider of generic drugs globally, India’s pharmaceutical industry meets 50% of the global vaccines demand, 40% of the generic medicine demand in the US and 25% of the entire demand for medicines in the UK.

During 2014-19, the domestic market grew at a CAGR of 9.5% to reach US$22 billion. Presently, over 80% of the antiretroviral drugs being used globally to combat acquired Immunodeficiency syndrome (AIDS), are supplied by Indian pharmaceutical firms. Pharmaceuticals exports from India stood at US$20.6 billion in FY20 up from US$19.1 billion in FY19. Pharmaceutical exports include bulk drugs, intermediates, drug formulations, biologicals, Ayush & herbal products and surgicals.

The Government of India has been taking several steps to reduce costs of medicines and bring down healthcare expenses. Accelerated introduction of generic drugs into the market has remained in focus, which is expected to benefit both the consumers as well as the Indian pharmaceutical companies

In the Union Budget 2020-21, the government allocated US$ 9.30 billion (`650.1 billion) to the Ministry of Health and Family Welfare and US$4.88 billion (`341.2 billion) towards the National Health Mission to benefit all sections of the society, especially the economically disadvantaged

Going forward, India’s pharmaceutical industry is expected to grow at 8-11% CAGR to US$31-35 billion by 2024. The country has a good mixture of high-end chemistry skills, cost effective labour and the ability to manufacture quality drugs as per the requirements of international regulatory agencies. In addition, there has been a constant focus on rural health programmes, lifesaving drugs and preventive vaccines by the Government of India. India will continue to be an important player in the global generics market.

Financial Overview

On a standalone basis, the company’s revenue registered a growth of 8.2% reaching Rs 132,664.8 million in FY20, compared to Rs 122,578.9 million in FY19. The Formulations business witnessed a growth of 14.2% to Rs 100,253.4 million led by exports, which are up by 14.3% to Rs 99,698.5 million. The API business declined by 6.9% to Rs 32,242.1 million due to higher captive consumption. EBITDA for FY20 increased by 11.5% to Rs 26,857.5 million vs. Rs 24,092.9 million in FY19. Profit before Tax for the year at standalone level was increased by 21% to Rs 23,777.0 million. The company’s net profit (before OCI) increased by 22.4% to Rs 18,727.4 million as against Rs 15,297.3 million in FY19. The diluted Earnings Per Share stood at Rs 31.96 compared to Rs 26.11 in FY19.

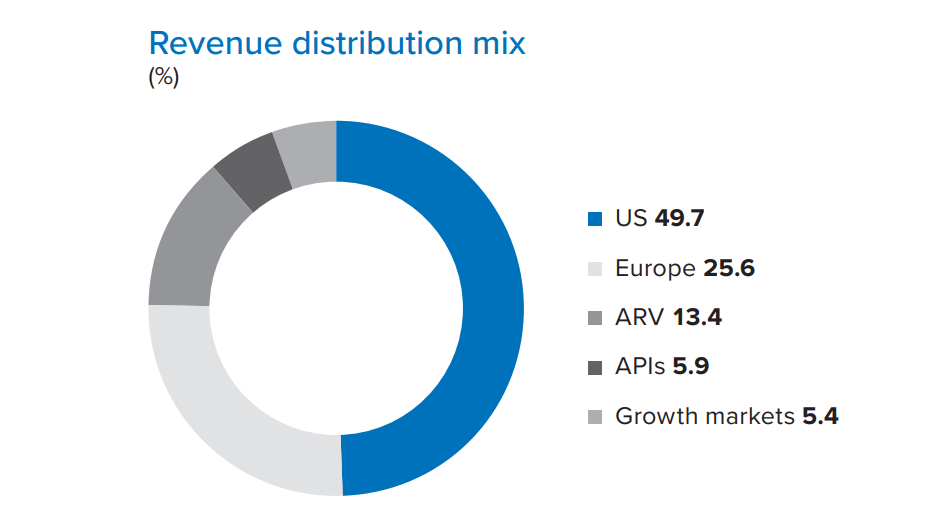

On a consolidated basis, revenues for FY20 grew by 18.1% from Rs 195,635.5 million in the previous year to Rs 230,985.1 million. The healthy growth in revenues was driven by new product launches across markets and increased market share of existing products. The Formulations business registered a revenue growth of 23.9% and improved to Rs 200,119.3 million from Rs 161,570.3 million in the previous year. The Active Pharmaceutical Ingredients (APIs) business sales stood at Rs 30,833.7 million down from Rs 34,030.3 million in the corresponding previous period.

EBITDA margin was at 21.1% vis-à-vis 20.2% in FY19. EBITDA before forex and other income stood at Rs 48,643.1 million, witnessing a 23.1% growth year-on-year. The company reported a Net Profit of Rs 28,309.7 million, an increase of 19.7% over the corresponding previous period. The Diluted Earnings Per Share stood at Rs 48.32 compared to Rs 40.36 in FY19.

The company’s strong performance for the year was driven by healthy growth across key geographies in the Formulations segment. The company's Formulations sales increased by 23.9% to Rs 200,119.3 million. FY20 is the first full year of consolidation of businesses acquired from Apotex Inc and Spectrum Pharmaceuticals. Excluding the sales from acquired businesses, the company has witnessed a strong growth in the Formulations segment.

The US is the largest market for the company and accounted for 49.7% of total revenue. The US business reported 27.2% growth at Rs 114,835.4 million. It has a presence across segments such as oral solids, injectables, branded injectables, dietary supplements and over-the-counter (OTC) businesses. With the acquisition of branded injectables from Spectrum Pharmaceuticals, the company’s presence in injectables has significantly increased. The share of injectables (both branded and generic) has grown to 23.3% of US sales in FY20, up from 17.2% of US sales in FY19. The dependency on oral solids has reduced; the share of oral solids at 64.1% in FY20 is down from 69.2% in FY19.

The US business has maintained its growth momentum across business segments. New product launches coupled with an increase in the market share of existing products led to an improvement in the revenues. The company has launched 34 products in FY20. The Rx share in USA has increased to 8.5% for the 12 months ending April 2020 from 7.0% for the 12 months ending April 2019, as per IQVIA data.

The company continues to strengthen its pipeline for the global markets including US market. As on 31 March 2020, the company filed 586 Abbreviated New Drug Applications (ANDAs) on a cumulative basis. Of the total count, 397 have received final approvals and 28 have got tentative approvals, including 8 ANDAs, which are tentatively approved under the US President’s Emergency Plan for AIDS Relief (PEPFAR), while 161 ANDAs are currently under review.

The company registered a 19.4% growth in its Europe formulations business, as revenue touched Rs 59,218.3 million in FY20 compared to the previous year’s revenue of Rs 49,601.7 million on account of an increased portfolio of offerings. The company reported healthy performance in Spain, the UK, Italy, the Netherlands and France. The integration of Apotex Inc.’s businesses with Aurobindo, has strengthened its presence in Europe. The company now operates in 11 countries and is present across multiple channels including pharmacy (Rx), hospital (Hx) and tender (Tx). The company’s focus will remain on filing more products on a consistent basis, diversifying its existing product portfolio, reaching out to critical markets, and streamlining of sales, marketing and channels of operation.

The company’s Formulations sales in Growth Markets including Brazil, Canada, Columbia and South Africa grew by 13.5% to Rs 13,550.8 million as compared to Rs 11,936.5 million in FY19. In Canada, the company is the eighth largest generic company in terms of value for the 12 months ended March 2020 as per IQVIA data. During the year, the company has launched 13 products and submitted dossier filings for 13 products.

The ARV Formulations business reported a growth of 28.7% with revenues of Rs 12,514.8 million vis-à-vis Rs 9,724.8 million, a year ago. The significant early mover advantage Aurobindo had in TLD (Tenofovir 300mg + Lamivudine 300mg + Dolutegravir 50mg tablet) single pill regimen along with rapid conversion of TLE to TLD in the institution segment has contributed towards this growth. South Africa being the single largest PLHIV market, has adopted the new TLD combination in its National Guideline this year as the first line, and began administering TLD therapy to both new and existing patients taking TEE (Emtricitabine based regimen). Aurobindo has secured a good percentage share in national ARV tender for both - TLD as well as for Dolutegravir single dose. It is expected to generate more sales in the coming two years. The number of patients on TLD is expected to move above 4 million, since the time national procurement for the Dolutegravir regimen began in Q4FY20.

Recent developments

Aurobindo Pharm Consolidated December 2020 Net Sales at Rs 6,364.91 crore, up 7.97% Y-o-Y 9

February 11, 2021; Reported Consolidated quarterly numbers for Aurobindo Pharma are:

Net Sales at Rs 6,364.91 crore in December 2020 up 7.97% from Rs. 5,895.00 crore in December 2019.

Quarterly Net Profit at Rs. 2,946.46 crore in December 2020 up 317.67% from Rs. 705.45 crore in December 2019.

EBITDA stands at Rs. 1,501.98 crore in December 2020 up 21.23% from Rs. 1,238.97 crore in December 2019.

Aurobindo Pharm EPS has increased to Rs. 50.29 in December 2020 from Rs. 12.04 in December 2019.

Aurobindo Pharma gets USFDA nod for generic Droxidopa capsules 10

February 19, 2021; Drug major Aurobindo Pharma on Friday said it has received final approval from the US health regulator to manufacture and market Droxidopa capsules, used to treat dizziness and lightheadedness.

The approved product is a generic version of Lundbeck NA Ltd's Northera capsules.

The company has received final approval from the US Food and Drug Administration (USFDA) to manufacture and market Droxidopa capsules in the strengths of 100 mg, 200 mg and 300 mg, Aurobindo Pharma said in a regulatory filing.

The company said the product will be launched immediately.

Droxidopa is indicated for the treatment of orthostatic dizziness and lightheadedness in adult patients with symptomatic neurogenic orthostatic hypotension (low blood pressure).

Quoting IQVIA data, Aurobindo Pharma said the approved product has an estimated market size of USD 352 million for the twelve months ending December 2020.

Aurobindo now has a total of 469 abbreviated new drug application (ANDA) approvals (440 final and 29 tentative) from USFDA.

References

- ^ https://www.aurobindo.com/about-us/at-a-glance/business-overview/

- ^ https://www.aurobindo.com/about-us/business-units/rd/

- ^ https://www.aurobindo.com/about-us/business-units/formulations/

- ^ https://www.aurobindo.com/about-us/business-units/custom-synthesis/

- ^ https://www.aurobindo.com/about-us/business-units/peptides/

- ^ https://www.aurobindo.com/about-us/business-units/aurozymes/

- ^ https://www.aurobindo.com/about-us/business-units/api/

- ^ https://www.aurobindo.com/wp-content/uploads/2020/08/Aurobindo-Pharma-Limited-Annual-Report-2019-20.pdf

- ^ https://www.moneycontrol.com/news/business/earnings/aurobindo-pharm-consolidated-december-2020-net-sales-at-rs-6364-91-crore-up-7-97-y-o-y-6491151.html

- ^ https://www.moneycontrol.com/news/business/aurobindo-pharma-gets-usfda-nod-for-generic-droxidopa-capsules-6544411.html