Automatic Data Processing Inc

Summary

- Automatic Data Processing is a global provider of cloud-based human capital management solutions.

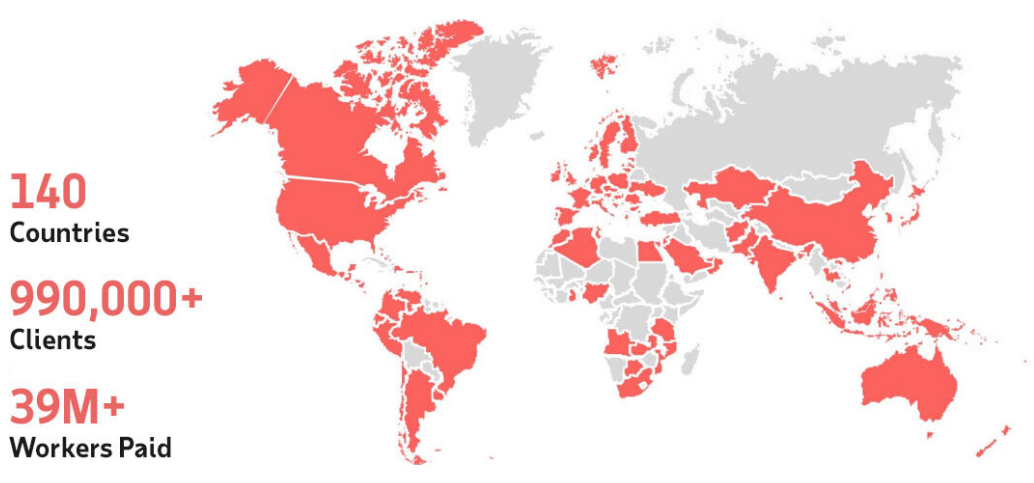

- It serves over 990,000 clients and pay over 39 million workers in 140 countries and territories.

- It provides a full range of payroll and HR solutions, from basic payroll to HR management, tax and compliance, outsourcing, HRIS and more.

Automatic Data Processing (Nasdaq: ADP) is of the world’s leading global technology companies providing comprehensive cloud-based human capital management (HCM) solutions that unite HR, payroll, talent, time, tax and benefits administration. The company serve over 990,000 clients and pay over 39 million workers in 140 countries and territories.

Financial Highlights

September 2022 Results

October 26, 2022; ADP announced its first quarter fiscal 2023 financial results and updated its fiscal 2023 outlook.1

First Quarter Fiscal 2023 Consolidated Results

- Revenues increased 10% compared to last year's first quarter to $4.2 billion; 11% organic constant currency

- Net earnings increased 11% to $779 million, and adjusted net earnings increased 11% to $775 million

- Adjusted EBIT increased 11% to $1.0 billion, and adjusted EBIT margin increased 30 basis points to 24.1%

- Diluted earnings per share ("EPS") increased 13% to $1.87; adjusted diluted EPS increased 13% to $1.86

- Raising full year guidance for revenue, adjusted EBIT margin, and adjusted diluted EPS, following strong start to fiscal year

Compared to last year’s first quarter, revenues increased 10% to $4.2 billion and 11% on an organic constant currency basis. Net earnings increased 11% to $779 million, and adjusted net earnings increased 11% to $775 million. Adjusted EBIT increased 11% to $1.0 billion, representing an adjusted EBIT margin increase of 30 basis points in the quarter to 24.1%. ADP’s effective tax rate for the quarter was 22.9% on a reported and an adjusted basis. Diluted EPS increased 13% to $1.87, and adjusted diluted EPS increased 13% to $1.86.

Fiscal 2023 Outlook

- Revenue growth of 8% to 9%

- Adjusted EBIT margin expansion of 125 to 150 basis points

- Adjusted effective tax rate of approximately 23.0%

- Diluted EPS growth of 15% to 17%

- Adjusted diluted EPS growth of 15% to 17%

Annual Results

Total revenues in the fiscal year ended June 30, 2022, include interest on funds held for clients of $451.8 million, as compared to $422.4 million in fiscal 2021. The increase in interest earned on funds held for clients resulted from an increase in its average client funds balances of 18.7% to $32.5 billion in fiscal 2022 as compared to fiscal 2021, partially offset by the decrease in its average interest rate earned to 1.4% in fiscal 2022, as compared to 1.5% in fiscal 2021.2

Operating expenses increased due to the increase in its PEO Services zero-margin benefits pass-through costs to $3,514.4 million from $3,092.0 million for the year ended June 30, 2022, and 2021, respectively. Additionally, operating expenses increased due to increased costs to service its client base in support of its growing revenue, partially offset by a net reduction of $28.8 million in its estimated losses related to ADP Traditional Incorporated Cell, formerly known as ADP Indemnity, Inc. and the impact of foreign currency.

Interest expense increased primarily due to the issuance of 7-year fixed-rate notes totaling $1.0 billion issued in the fourth quarter of fiscal 2021, as compared to the year ended June 30, 2021. Additionally, there was an increase in average interest rates for commercial paper borrowings to 0.4% for the year ended June 30, 2022, as compared to 0.1% for the year ended June 30, 2021. This was coupled with an increase in average daily borrowings under its commercial paper program to $2.0 billion for the year ended June 30, 2022, as compared to $1.6 billion for the year ended June 30, 2021.

Other (income)/expense, net, decreased $13.5 million in fiscal 2022, as compared to fiscal 2021 primarily as a result of losses on available-for-sale securities, net, in the current year, compared to gains in the prior year, and the items described below, partially offset by the change in non-service components of pension income, net.

In fiscal 2022, the Company recorded impairment charges of $23.0 million which is comprised of a write down of $12.1 million related to software and customer lists which were determined to have no future use and impairment charges of $10.9 million related to operating right-of-use assets associated with exiting certain leases early.

In fiscal 2021, the Company recorded impairment charges of $19.9 million, which is comprised of $10.5 million related to internally developed software which was determined to have no future use, impairment charges of $9.4 million related to operating right-of-use assets and certain related fixed assets associated with exiting certain leased locations early, and recognizing certain owned facilities at fair value given intent to sell and accordingly classified as held for sale.

Company Overview

ADP is a comprehensive global provider of cloud-based human capital management (HCM) solutions that unite HR, payroll, talent, time, tax and benefits administration, and a leader in business outsourcing services, analytics and compliance expertise. The company's cutting-edge technology making human resources from a back-office administrative function to a strategic business advantage.3

Product and Services

A full range of payroll and HR solutions, from basic payroll to HR management, tax and compliance, outsourcing, HRIS and more.4

Payroll

- Time & Attendance

- Talent

- Benefits & Insurance

- HR Services

- HR Outsourcing & PEO

- Compliance Services

- Integrations

- App Marketplace

ADP Worldwide

The company serve over 990,000 clients and pay over 39 million workers in 140 countries and territories.5

References

- ^ https://s23.q4cdn.com/483669984/files/doc_financials/2023/q1/ADP-1Q23-Earnings-Release.pdf

- ^ https://fintel.io/doc/sec-automatic-data-processing-inc-8670-10k-2022-august-03-19208-5318

- ^ https://www.adp.com/about-adp.aspx

- ^ https://www.adp.com/what-we-offer/products.aspx

- ^ https://www.adp.com/worldwide-locations.aspx