Aveva

Summary

- AVEVA, a global leader in industrial software, drives digital transformation for industrial organizations managing complex operational processes.

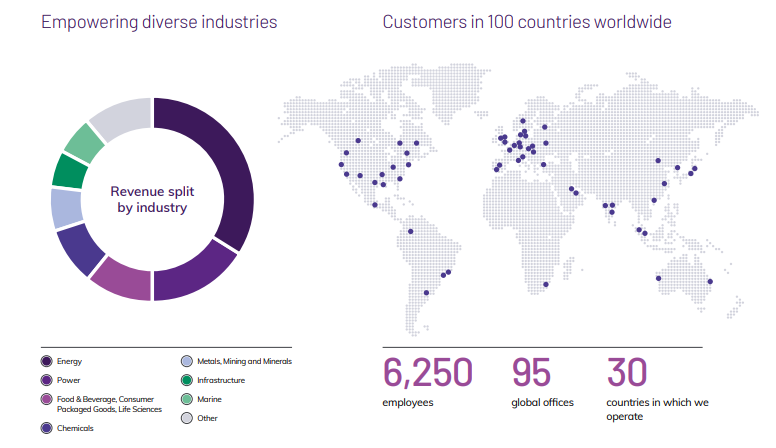

- AVEVA is headquartered in Cambridge, UK, with over 6,000 employees at 90 locations in more than 40 countries.

- The company monitoring and control solutions delivers proven business value and outcomes to over 20,000 customers worldwide.

- The company supported by the largest industrial software ecosystem, including 5,500 partners and 5,700 certified developers.

Company Overview

AVEVA, (OTC:AVEVF, LSE:AVV) a global leader in industrial software, drives digital transformation for industrial organizations managing complex operational processes. Through Performance Intelligence, AVEVA connects the power of information and artificial intelligence (AI) with human insight, to enable faster and more precise decision making, helping industries to boost operational delivery and sustainability. The company's cloud-enabled operational data management, combined with software that spans design, engineering and operations, asset performance, monitoring and control solutions delivers proven business value and outcomes to over 20,000 customers worldwide, supported by the largest industrial software ecosystem, including 5,500 partners and 5,700 certified developers. AVEVA is headquartered in Cambridge, UK, with over 6,000 employees at 90 locations in more than 40 countries.1

Offerings

VEVA Addresses Business Challenges 2

Solutions

- Digital Transformation

- Engineering

- Operations

- Performance

- Subscription Options

- Cloud Services

Products

- AVEVA E3D Design

- AVEVA Enterprise Resource Management

- AVEVA System Platform

- AVEVA InTouch HMI

- AVEVA Operations Control

- AVEVA Predictive Analytics

- AVEVA Insight

- PI System

Subscription Program

- AVEVA Flex Subscription

Financial Highlights

On 25 August 2020, AVEVA announced that it had reached agreement to acquire OSIsoft at an enterprise value of $5.0 billion. The transaction subsequently completed on 19 March 2021 and therefore the FY21 statutory results include 13 days of OSIsoft’s performance up to 31 March 2021. The finance review begins with a commentary of those statutory results.3

The statutory results for the year ended 31 March 2021 include 12 months of AVEVA trading and OSIsoft trading since the date of its acquisition (19 March 2021) compared with the FY20 results for standalone AVEVA only. OSIsoft contributed £17.4 million of revenue and £8.4 million of adjusted EBIT for the 13 days to 31 March 2021.

The Group made a profit before tax of £34.2 million (FY20: £92.0 million) and on an adjusted basis, driven by the acquisition and integration costs incurred in the year. The Group made an adjusted profit before tax of £224.0 million (FY20: £213.8 million).

Revenue for the combined Group was £1,196.1 million, representing a reduction of 1.4% (FY20: £1,213.2 million). Organic constant currency revenue grew 2.2%, adjusted for a currency translation headwind of £31.2 million and the disposals of Wonderware Italy, Germany and Scandinavia in the prior year

As previously announced, the Board believes that there is an opportunity to generate significant revenue synergies over the medium term through the combination of AVEVA and OSIsoft. These include cross-selling AVEVA’s portfolio into the OSIsoft customer base, expansion of OSIsoft’s global reach in Asia Pacific and EMEA through AVEVA’s global footprint and enhancing AVEVA’s Digital Twin offering through the combination of engineering and operations data.

Recurring revenue for the combined Group grew 7.7% to £800.2 million (FY20: £743.0 million) representing 66.9% (FY20: 61.2%) of overall revenue. This was driven by strong growth in subscription of 17.4% with maintenance flat compared with FY20. Perpetual licence revenue fell by 16.8% principally as a result of the tougher business environment and the business model transition in standalone AVEVA. AVEVA intends to continue with its strategy of increasing the combined Group’s overall levels of recurring through subscription revenue.

Adjusted EBIT increased by 8.1% to £354.7 million (FY20: £328.1 million), reflecting cost control and cost savings relating to global Covid-19 related restrictions. This resulted in an adjusted EBIT margin of 29.7% (FY20: 27.0%).

The Directors propose to pay a final dividend of 23.5 pence per share. After adjustment to reflect the bonus element of the rights issue, this represents an increase of 1% versus the FY20 final dividend. The final dividend will be payable on 4 August 2021 to shareholders on the register on 9 July 2021.

Results Six Months Ended 30 September 2021

10 November 2021; AVEVA Group plc announces its preliminary results for the six months ended 30 September 2021.

Highlights

- On an organic constant currency basis pro forma revenue for the combined Group grew 9.0% and adjusted EBIT4 grew 33.9%; while adjust diluted EPS grew 13.3% and included the tax benefit from the OSIsoft acquisition.

- Pro forma constant currency Annualised Recurring Revenue (ARR)5 increased 9.2% to £711.4m (H1 FY21: £651.2m).

- The introduction of Subscription selling at OSIsoft will support growth in ARR going forward.

- After the impact of FX translation headwinds, pro forma revenue grew by 0.8% to £516.1m (H1 FY21 £512.2m) and pro forma adjusted EBIT grew 20.5% to £125.2m (H1 FY21: £103.9m), representing a margin of 24.3% (H1 FY21: 20.3%).

- Integration of the AVEVA and OSIsoft businesses has progressed well and the Board remains excited about the growth opportunities ahead.

- Revenue was £480.9m after the impact of the deferred revenue haircut (H1 FY21: £332.6m), representing an increase of 44.6%, most of which was due to the acquisition of OSIsoft.

- Loss from operations was £74.3m (H1 FY21: £23.2m) with the loss being primarily due to the amortisation of intangible assets of £115.8m (H1 FY21: £46.2m).

- Interim dividend is being increased 4.8% to 13.0p pence (H1 FY21: 12.4 pence).

Chief Executive Officer, Peter Herweck said:

“AVEVA achieved a good first half performance, delivering a solid set of results and laying foundations for future growth. The integration of the AVEVA and OSIsoft businesses has progressed well, with both cost and revenue synergies starting to materialise as planned.

End market conditions started to improve during the period following disruption caused by the Covid crisis. As a result, Aveva is seeing the resumption of structural growth, driven by increased digitalisation and Net Zero projects, across a wide range of industry sectors. Aveva is also observing an increase in activity in the Energy and Marine sectors as energy prices recover and demand for transportation increases.

The company remain confident in the growth outlook and believe that its first half results form a strong foundation for it to build on and to meet its medium-term targets.”