BHP

Summary

- The company produce essential commodities through its assets, including iron ore, copper, nickel, metallurgical coal, potash and petroleum.

- BHP has approximately 80,000 employees and contractors who work in more than 17 countries around the world.

- BHP is a global business with over 9,000 suppliers around the world, many of which are small to medium-sized businesses that are local to its assets.

- Since 1851, we've been developing and contributing to industry, communities and economies around the world.

Company Overview

BHP (NYSE:BHP, LSE:BHP, ASX:BHP) is a world-leading resources company headquartered in Melbourne, Australia, its products are sold worldwide, with sales and marketing led through its Singapore and Houston locations.1

Company's focused on the resources the world needs to grow and decarbonise. Copper for renewable energy. Nickel for electric vehicles. Potash for sustainable farming. Iron ore and metallurgical coal for the steel needed for global infrastructure and the energy transition.

The company produce essential commodities through its assets, including iron ore, copper, nickel, metallurgical coal, potash and petroleum. The company's operated assets are wholly owned and operated by BHP or owned as a joint venture and operated by BHP. The company also hold interests in assets that are owned as a joint venture but are not operated by BHP.

BHP is a global business with over 9,000 suppliers around the world, many of which are small to medium-sized businesses that are local to its assets.

BHP has approximately 80,000 employees and contractors who work in more than 17 countries around the world.

Company History

Since 1851, we've been developing and contributing to industry, communities and economies around the world.2

Formed from a merger between BHP and Billiton, From two small mining companies founded in the mid-1800s, BHP is now a world leader in the diversified resources industry.

| Year | Milestone |

| 1851 | A Dutch party discovers tin at Billiton Island |

| 1860 | NV Billiton Maatschappij is established |

| 1883 | Charles Rasp discovers silver and lead at Broken Hill |

| 1885 | Broken Hill Proprietary Company Ltd is floated |

| 1902 | Invention of the flotation vessel |

| 1915 | Newcastle Steelworks opened |

| 1934 | Australian built military aircraft at Port Melbourne begin |

| 1935 | Establishment of first bauxite mine on Bintan Island |

| 1957 | BHP opens Central Research Laboratories at Shortland, Newcastle |

| 1963 | BHP and Esso collaborate in search for oil |

| 1968 | Rich iron ore is developed at Mt. Newman |

| 1970 | Royal/Dutch Shell Group purchases Billiton |

| 1984 | BHP acquires Utah International from General Electric |

| 1990 | Escondida in Chile begins producing copper |

| 1991 | BHP discovers diamonds in Canada |

| 1994 | Billiton is acquired by Gencor |

| 2000 | BHP formally becomes BHP Limited |

| 2001 | BHP and Billiton reach agreement to merge |

| 2001 | BHP Billiton's Typhoon Oilfield commences production |

| 2001 | Significant oil discovery made offshore Trinidad |

| 2002 | Demerger of BHP Steel |

| 2004 | BHP Billiton approves Spence Copper Project |

| 2004 | BHP Billiton enters joint venture with China and Japan |

| 2005 | BHP Billiton acquires Western Mining Corporation |

| 2005 | First oil production from the Greater Angostura Field |

| 2009 | First oil and natural gas production from Shenzi |

| 2010 | First oil production commences from Pyrenees project |

| 2010 | Athabasca Potash in Canada acquired |

| 2011 | First gas commences from the Angostura Gas Project |

| 2011 | EKATI Spirit discovered |

| 2012 | BHP Billiton consolidates operations |

| 2013 | BHP Billiton invests in Jansen Potash Project |

| 2013 | Daunia Metallurgical Coal Mine opens in central Queensland |

| 2013 | First gas at Macedon gas project |

| 2013 | BHP Billiton moves into new global headquarters |

| 2015 | Demerger of South32 |

| 2016 | BHP launches Prospects |

| 2017 | BHP approves extending life of Spence copper mine |

| 2017 | BHP and PEMEX sign agreement for oil discovery |

| 2018 | BHP approves South Flank project |

Products

The company's products are essential and many are key to the energy transition, to a lower carbon world3

Copper

Copper has electricity conducting, corrosion resistance and antimicrobial properties and is used in everyday household products.

Iron ore

Iron ore is one of the most sought after commodities in the world and is integral to the steel-making process.

Nickel

Nickel is a key ingredient in stainless steel and a major component in the lithium-ion batteries that are helping power the electric vehicle revolution.

Metallurgical coal

Metallurgical coal is a key component in the steel-making process.

Petroleum

Petroleum is made up of hydrocarbons, like oil and gas, which can be extracted and refined into different types of fuels.

Potash

Potash is a group of potassium compounds that will be a vital link in the global food supply chain.

Locations

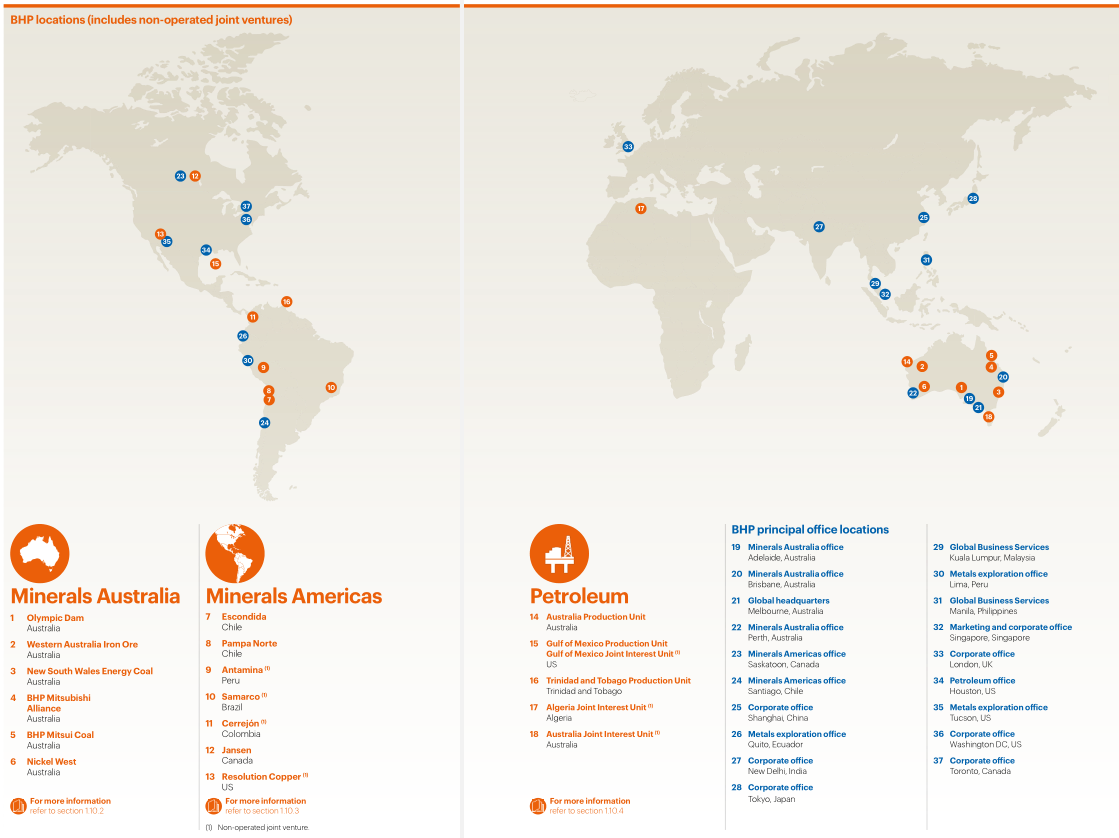

The company work in more than 90 locations including throughout Australia, Chile, the United States and Canada. The company also have production operations in Trinidad and Tobago and Algeria.4

Australia

The company's Australian business produces iron ore, copper, coal and nickel from operations in Western Australia, Queensland, New South Wales and South Australia, and oil and gas from fields in Western Australia and Victoria.

Queensland

At its Queensland operations, the company mine coal from nine assets located in Central Queensland’s Bowen Basin.

Western Australia

In Western Australia, the company mine iron ore and nickel and produce oil and gas.

South Australia

The company's Olympic Dam mine is one of the world’s largest deposits of copper. The company operate a fully integrated processing facility from ore to metal.

Victoria

The company produce oil and gas from Bass Strait.

New South Wales

The company operate the Mt Arthur Coal open-cut energy coal mine in the Hunter Valley region. The site produces coal for domestic and international customers.

Chile

The company mine copper from some of the world’s biggest copper deposits located at its Escondida, Spence and Cerro Colorado operations in Chile.

Escondida

Escondida is the largest copper producer in the world.

Pampa Norte

The company's Pampa Norte operations consist of two copper mines, Spence and Cerro Colorado.

United States

The company produce oil and gas from offshore fields in the Gulf of Mexico and are joint venture partners in an undeveloped copper project located in Arizona.

Gulf of Mexico Production Unit

The company's US Gulf of Mexico petroleum assets are large, long-life and expandable.

Resolution Copper (Arizona)

One of the largest undeveloped copper projects in the world, it has the potential to become one of the world's largest and most competitive copper mines.

Gulf of Mexico Joint Production Unit

The company hold non-operating interests in two fields in the Gulf of Mexico: Atlantis and Mad Dog.

Brazil

The company hold a 50% interest in Samarco, a non-operated joint venture in Brazil. The company employs 9,450 people directly and indirectly and produces iron ore pellets through its operating units in Minas Gerais and Espírito Santo states.

Samarco has its own integrated logistics, which includes mines, concentrators and pelletizing plants for the processing of iron ore, with pipelines that connect the two operating units and a port terminal for the export of production.

Canada

The company hold exploration permits and mining leases covering approximately 9,400km2 in the province of Saskatchewan, Canada.

The company's Canadian operation consist of the Jansen Potash Project, located approximately 140 kilometres east of Saskatoon in the province of Saskatchewan, Canada. BHP has announced an investment of US$5.7 billion in the Jansen Stage 1 project.

The company's Jansen Project in Saskatchewan, Canada is planned to be the largest potash producing mine in the world, providing a rich source of potassium to keep soils fertile and maximise food production.

Algeria

The company's Algerian operations comprise the Algeria Joint Interest Unit, located in the onshore Berkine Basin, 900 kilometres south-east of Algiers, that produces onshore oil and gas.

The company hold an effective 29.2% interest in the Rhourde Ouled Djemma (ROD) Integrated Development joint interest unit. The company process onshore oil and gas from six oil fields. The two largest fields – Rhourde Ouled Djemma (ROD) and Sif Fatima North-East (SF SFNE) – and four satellite oil fields pump oil back to a dedicated processing train. The oil is then sold on to international markets. ROD Integrated Development is jointly operated by Sonatrach and ENI.

Peru

BHP is a non-operating joint venture partner of the Antamina copper mine in Peru.

The company's Peruvian operations consist of a non-operating partnership in the Antamina mine, located in the Ancash region of the Andes Mountains in north-central Peru, 270 kilometres north of Lima.

Antamina is a large, low-cost copper and zinc mine. It is operated independently by Compañía Minera Antamina S.A. Antamina produces copper and zinc, and by-product credits of molybdenum and silver. Copper and zinc concentrates are transported 300 kilometres by pipeline to the port of Huarney. Molybdenum and lead/bismuth concentrates are transported by truck. It is one of the ten largest mines in the world in terms of production volume.

Trinidad and Tobago

The company produce offshore oil and gas in Trinidad and Tobago.

In Trinidad and Tobago, the company operate the Greater Angostura field, located offshore 40 kilometres east of Trinidad. The company own a 45 per cent interest in the production sharing contract. Crude oil from the field is sold on a spot basis to international markets while the gas is sold domestically under term contracts.

BHP announced first oil production from the Ruby Project in offshore Trinidad and Tobago in 2021. Ruby is located offshore Trinidad and Tobago in the shallow water in Block 3(a) within the Greater Angostura Field.

Financial Highlights

Profit after taxation attributable to BHP shareholders increased from a profit of US$8.0 billion in FY2020 to a profit of US$11.3 billion in FY2021. Attributable profit of US$11.3 billion in FY2021 includes an exceptional loss of US$5.8 billion (after tax), compared to an attributable profit of US$8.0 billion, including an exceptional loss of US$1.1 billion (after tax) in the prior period. The FY2021 exceptional loss mainly relates to impairment charges recognised in relation to the Group’s energy coal and Potash assets as well as the Samarco dam failure.5

Revenue of US$60.8 billion increased by US$17.9 billion, or 42 per cent, from FY2020. This increase was primarily attributable to higher average realised prices for iron ore, copper, nickel, oil, natural gas and thermal coal, partially offset by lower average realised prices for metallurgical coal and LNG. Record volumes achieved at WAIO, along with the highest annual production at Olympic Dam since its acquisition in 2005, were more than offset by the impacts of expected grade declines at Escondida and Spence, natural field decline in Petroleum and adverse weather events.

Total expenses excluding net finance costs of US$34.5 billion increased by US$5.7 billion, or 20 per cent, from FY2020. This includes a US$2.0 billion increase of net impairment charges recognised against the Group’s Potash assets of US$1.3 billion and at NSWEC of US$1.1 billion recognised in FY2021 compared to US$0.4 billion at Cerro Colorado in FY2020. The increase also included higher price linked costs of US$0.9 billion reflecting higher royalties due to higher realised prices for iron ore and US$0.5 billion of higher third party concentrate purchase costs. Depreciation and amortisation expense increased by US$0.7 billion reflecting a decrease in estimated remaining reserves at Bass Strait due to underperformance of the reservoir in the Turrum field and lower overall condensate and natural gas liquids (NGL) recovery from the Bass Strait gas fields and higher depreciation at WAIO due to a change in Yandi’s life of mine. This was combined with higher foreign exchange losses of US$1.6 billion reflecting the impact of the stronger Australian dollar and Chilean peso against the US dollar on its cost base.

Loss from equity accounted investments, related impairments and expenses of US$(0.9) billion in FY2021, increased by US$0.4 billion from FY2020. The increase was primarily due to unfavourable foreign exchange impacts in relation to the Samarco dam failure provision of US$0.5 billion combined with a US$0.5 billion impairment charge at Cerrejón, partially offset by higher current year profits from Antamina of US$0.4 billion primarily due to higher prices. Further information on the total impact of the Samarco dam failure provision and impairment charges connected with equity accounted investments.

Net finance costs of US$1.3 billion increased by US$0.4 billion, or 43 per cent, from FY2020. This was primarily attributable to premiums of US$395 million paid as part of the value accretive multi-currency hybrid debt repurchase programs completed during the year.

Total taxation expense of US$11.2 billion increased by US$6.4 billion from FY2020. The increase was primarily due to significantly higher profits and higher withholding tax on dividends, mostly driven by higher commodity prices.

Net operating cash inflows of US$27.2 billion increased by US$11.5 billion. This reflects stronger iron ore and copper commodity prices and strong operational performance across the Group’s portfolio partially offset by the impacts of a stronger Australian dollar and Chilean peso against the US dollar, lower grades at Escondida and Spence, natural field decline at Petroleum and adverse weather events.