BSRM Limited

Summary

- BSRM Limited is one of the leading steel manufacturing companies in Bangladesh.

- Currently, the company is holding the second position in the steel re-rolling market of Bangladesh with 1.2 million metric tons unit production capacity.

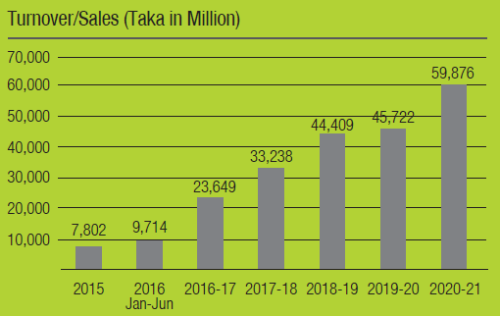

- In the financial year 2020-21, BSRM has reported a consolidated revenue of BDT 59.91 billion as compared to BDT 48.19 billion a year earlier.

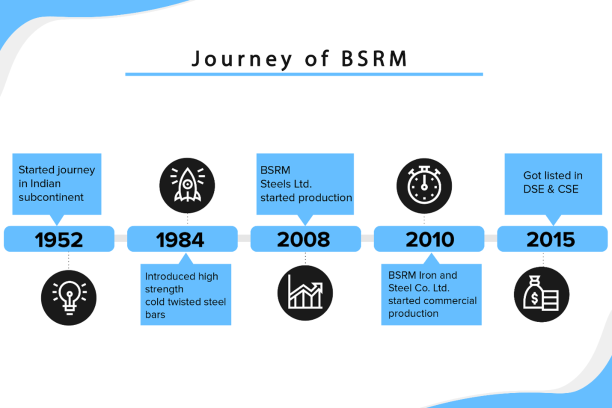

- BSRM Ltd. made its share market debut in 2015. Currently, the company is listed in Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE) – two bourses of Bangladesh.

- In FY20, BSRM Ltd. has been recognized as the “2nd Highest Tax Payer” in the engineering category in Bangladesh.

Company Overview

Bangladesh Steel Re-Rolling Mills Ltd. (DSE: BSRMLTD, CSE: BSRMLTD), known as BSRM, is one of the leading steel manufacturing companies and prominent corporate houses in Bangladesh. Based in Chittagong, the company started its journey with four manual rolling mills in the then East Pakistan in 1952. Later on, the manual rolling mills were replaced with the state-of-the-art Italian-built rolling mill in 1970. In 2002, BSRM incorporated a new company named “BSRM Steels Ltd”. Currently, 31.19% share of BSRM Steels is held by BSRM Ltd. It has a subsidiary company as well named “BSRM (Hong Kong) Limited” which is based in Hong Kong.1

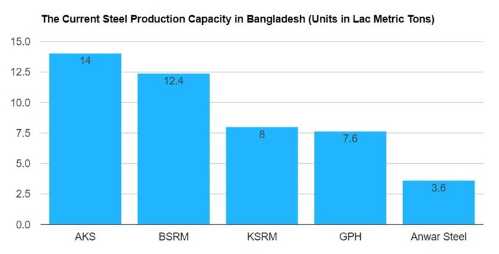

After independence, BSRM was the sole company operating in the Steel Re-rolling market in Bangladesh. In 1984, KSRM, a Concern of Kabir Group of Industries entered the market. In the year 1993, another company Abul Khair Steel started its operations in Bangladesh. Later on, more and more competitors entered the Steel Re-rolling market of the country. Currently, Abul Khair Steel is leading the steel Re-rolling market with a production capacity of 1.4 million metric tons. BSRM is holding the second position in this market with 1.2 million metric tons unit production capacity. The other top competitors of BSRM are - KSRM, GPH Steel, and Anwar Steel.

At present, BSRM owns two melting units called “Steel Melting Works (SMW)” and Melting-2 (SML) which are producing billets with a capacity of 150,000 and 8,62,000 M. Ton per annum, respectively.

For the year ended 30th June, 2021, 46.35% share of BSRM Ltd. is held by directors/sponsors, 14.91% by institutes, 17.49% by foreigners, and 21.25% is held by public.2

BSRM has a vision to be the market leader by producing the best quality steel products, enhancing customer satisfaction, and becoming a reliable business partner for its customers and suppliers. The company also aspires to be an employer of choice through preserving the trust of all its stakeholders by adopting ethical business practices. BSRM is also concerned to protect the interest of its shareholders and playing its role consciously on Corporate Social responsibilities. Currently, BSRM has more than 2800 employees which include professionals, technicians, and workers.3

BSRM Ltd. made its share market debut in 2015. Currently, the company is listed in Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE) – two bourses of Bangladesh. The market category of the company is “A” in both of the stock exchanges.

In FY20, BSRM Ltd. has been recognized as the “2nd Highest Tax Payer” in the engineering category in Bangladesh. In 2020, BSRM Ltd. has received the Best Corporate Award under the “Others Manufacturing” category, organized by ICMAB. Recently the company has achieved the “Best Brand Award” for the 10th time in a row organized by Bangladesh Brand Forum (BBF). BSRM Ltd. has also achieved CSR Award in the “Environment Category” for the best CSR Initiative in 2021.4

Industry Analysis

The steel re-rolling industry of Bangladesh is playing a significant role in developing the overall infrastructure of the country. The journey of Bangladesh steel re-rolling industry started in this region in 1952 with the establishment of BSRM. With the passage of time KSRM, AKS, GPH, Anwar Steel, and other companies entered the market. Currently, about 400 steel mills are operating in Bangladesh with a total production capacity of about 9 million metric tons. The top three steel producers – Abul Khair Steel (AKS), BSRM, and KSRM are meeting 50% of the demands in the domestic market.

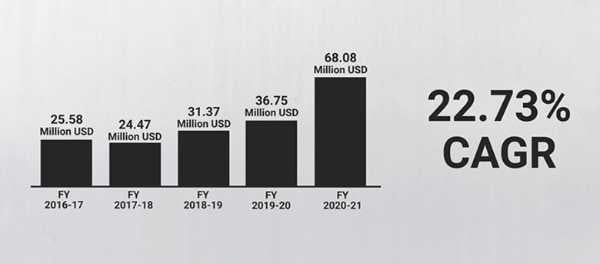

The current market size of steel re-rolling in Bangladesh is about BDT 450 billion. The demand for steel has significantly increased over the years. Only a decade ago the demand was 1.6 million metric tons which reached 7 million tons in 2018 and are expected to rise to 18 million metric tons by 2030. At present 60% of the steel is used by Bangladesh’s public sector, 25% is used by households, and 15% is used for commercial construction. The export rate of this industry is also increasing rapidly. The steel export of Bangladesh has increased at a rate of 22.73% per annum during FY17 - FY21.

Likewise other industries, the Covid-19 pandemic severely hampered the steel re-rolling industry of Bangladesh. During an interview, the president of the Bangladesh Steel Mills Owners Association (BSMOA) said that the total loss to steelmakers due to the Coronavirus epidemic in 2020 was BDT 5957.61 crore. He also added that since the situation has slowly normalized, the steel mills have begun turning around again.5

Key growth drivers of the industry

Integration with Mega-projects: The govt. of Bangladesh has a vision of transforming the country into a developing country by 2041. To implement this motto the govt. has undertaken hundreds of projects and several mega projects which have created a huge demand for the steel industry. In some mega projects for example Padma Bridge and Rooppur Nuclear Power Plant, the demand for steel has been met entirely from locally produced steel. Moreover, after meeting domestic demand steel is also exported to foreign countries. It is expected that the growth of the steel re-rolling industry of Bangladesh will continue for the next 20 to 25 years.

Increase in Purchasing Power: Bangladesh has one of the fastest-growing economies in the world. The country experienced an exemplary record of economic growth and poverty reduction in the past decade. The continuous growth in GDP indicates a significant increase in the purchasing power of the common people. Consequently people are now more incliened to building new houses which eventually left a positive impact on the steel re-rolling industry. Even a decade ago the per capita steel-rod consumption in Bangladesh was 25 kg while it has increased to 45 kg in January 2020, and expected to reach 75 kg by 2022.

Future prospects of the Industry

Development of Port Facilities: Currently Bangladesh has two ports – Chittagong and Mongla port in which the large scrap ships are unable to enter due to inadequate port facilities. Considering the situation, Bangladesh govt. has taken the initiative of building new ports such as ‘Mirsarai Ocean-Front Economic Zone’ and ‘Payra Sea Port’. Moreover, the PM has confirmed that the existing ports will also be renovated. If the steps are taken then it will certainly help the steel manufacturers to import scrap more easily.

Discovery of Iron Ore Reserve: Bangladesh doesn’t have any source of iron ore and so most of the scrap steel required for steel production has to be imported from foreign countries causing heavy expenses. But in 2019 a magnetic mine or iron ore has been discovered in the country’s Dinajpur area. This iron ore has opened up new possibilities that could supply iron ore for the next 30 years which will save expense and help the industry to grow faster.6

Financial Analysis

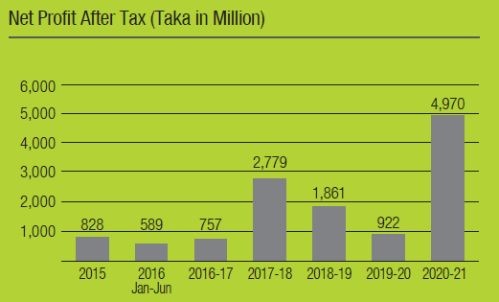

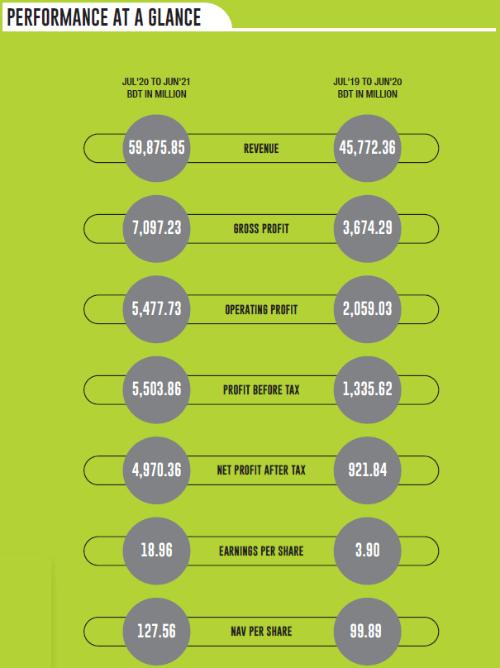

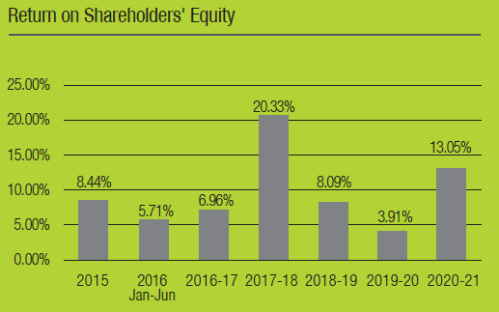

In the financial year 2020-21, BSRM has reported a consolidated revenue of BDT 59.91 billion as compared to BDT 48.19 billion a year earlier – an increase of roughly BDT 10 billion. Profit after tax of the company for the last financial year has been BDT 4.97 billion while it was only BDT 1.25 billion the previous year. The revenue of the company has grown by only 23.42% but profit after tax has grown by 298% during the same period of time. The disparity in the growth rate of these two parameters must have caused by the differences in the cost pattern. Cost of Sales, selling and distribution costs, and administrative costs remained within almost the same growth rate.

The operating profit is reported BDT 5.46 billion in FY21 and BDT 4.38 billion in FY20 – a growth of 24.65%. However, the real difference occurs in the finance cost/income section. The net finance cost of the company during FY21 is only BDT 0.711 billion while it was BDT 2.24 billion in the previous year. Therefore, after adjusting contribution to WPFF and share of profit from equity accounted investee, profit before tax of the company stood at BDT 5.50 billion in FY21, which was BDT 2.33 billion in FY20 – a growth rate of 136% occurred.

A close inspection to the finance cost of the company reveals that it has decreased long-term borrowings significantly. In FY20, long-term borrowing was BDT 2.66 billion but in the latest year FY21, the company has reduced the same to BDT 0.728 billion. The company had a syndicate term loan of BDT 2.097 billion in FY20 which it has paid and balanced to BDT 0.597 billion in FY21. Another loan of BDT 0.668 billion from United Commercial Bank Limited was fully settled on 16 March, 2021. Another loan from IPDC Finance Limited of BDT 57 million was fully settled on 22 March, 2021. BSRM earned interest income from some short-term investments as well as from advances and deposits placed in different bank and financial institutions.

Earnings per share (EPS) of the company in FY21 is BDT 18.96 while it was BDT 3.90 in FY20. Total number of shares outstanding for the company has increased from 236 million to 298 million in the course of that one year. Net asset value per share of the company was reported BDT 127.56 in FY21, while it was BDT 99.89 in FY20. It is notable that although the EPS has changed drastically during the year, NAV is within the normal growth rate limits.

The company has heavily invested in its property, plant and equipment. During FY20, total PPE was BDT 15 billion while it is increased to BDT 38 billion in FY21. BSRM has reduced the amount of investment in subsidiaries and associates by BDT 6 billion during the course of the year. In FY21 investment in subsidiaries and associates is BDT 7.33 billion, while it was BDT 13.07 billion. However, the company has increased its production during the year which is evident from its increase in sales revenue as well as a knocking increase inventory by BDT 5 billion – from BDT 9.85 billion to BDT 14.71 billion. The company has also increased the advances and deposits from BDT 2.01 billion in FY20 to BDT 7.03 billion in FY21. Thus, the total assets base of the company has increased from BDT 47.05 billion in FY20 to BDT 80.53 billion in FY21.

On the equity and liability side of the company, short-term borrowing has increased significantly during the operation year of FY21. It was BDT 9.33 billion in FY20 while it has increased to BDT 32.54 billion in FY21. This indicates that the company is decreasing its financial leverage – by decreasing long-term borrowing, but increasing its operating leverage.

The company has paid dividend of BDT 85 million from its earnings of FY21. This is 50% cash dividend on face value of its shares. In previous year, the company declared a dividend of 15% in 2020, 25% in 2019, 10% in 2018, and 10% in 2017. Authorised capital of the company is BDT 5 billion and paid-up capital is BDT 2.985 billion. Current market capitalization of the company as on 12 February, 22 is BDT 31.86 billion.

Return on equity (ROE) of the company in FY21 is 13.08% while it was 3.96% in the previous year.

Business Analysis

BSRM is the country’s first producer of 500 MPa yield strength re-bar, branded and marketed as Xtreme 500W, proving BSRM’s quest for continuous innovation as nation building partner. Beside re-bar production, BSRM rolls and markets sectional steels such as angles and channels and ribbed wire which are manufactured in separate plants of BSRM. Currently, BSRM’s steel products are being used in Padma bridge, Rooppur Nuclear Powerplant, Karnaphuli Tannel, Hatir Jheel and other mega projects. The current product list of the company has been illustrated below:

- FastBuild & SecuRing

- Xtreme B500DWR

- Xtreme B500CWR

- Centura

- Utima

- Maxima

- Xtrong

- Square Bar

- BSRM Slag

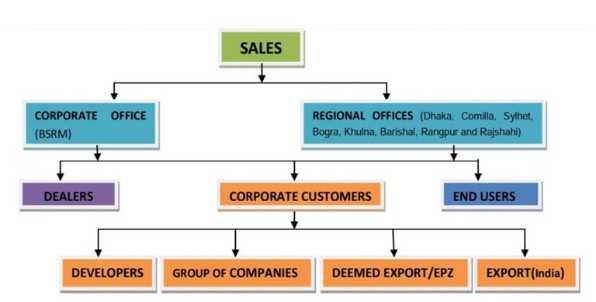

BSRM distributes these products through its 449 authorized dealers who sell its products to the end-users. The company has its own distribution channel all over the country. Moreover, the company is constantly trying to expand its distribution channel. The company has its own sales and customer service centers in 8 districts including Dhaka, Comilla, Sylhet, Bogra, Khulna, Barishal, Rangpur and Rajshahi which ensure hassle free customer experience and customer satisfaction. Here BSRM gets an competitive advantage as most of its competitors do not have such robust distribution channel.

Though BSRM has worked hard to diversify its product portfolio over the years, the company continued being only in the steel industry. The reason can be that the company senses strong scope for rising demand in this industry. As a part of its product diversification, certain steel products such as span, guarder, etc. are now produced locally while they were used to be imported from China and other countries in the past. For decreasing the company’s dependency on obtaining raw materials, BSRM established the largest billet-making plant in Bangladesh under the name of BSRM Iron & Steel Co Ltd (BISCO).7

BSRM follows the broad differentiation strategy with standardization in market segmentation. The company focus on producing premium quality products for its customers and charges higher price in return to create better brand image and reliability for best quality. For ensuring innovation the company is investing heavily on market research and its R&D. As BSRM sells similar products just like its competitors the company is trying to be more efficient in its operation. BSRM is working on the following functions to ensure efficiency –

- Infrastructure

- Production

- Material Management

- Information System

- Human Resources

BSRM Ltd. uses the price skimming strategy while setting price of its products. The company has gained reliability and a strong brand value among customers. Consequently, BSRM is successful even after charging more price than its competitors. The company has segmented its market based on age, income, occupation, and geography. The attributes of BSRM’s TG has been illustrated below:

Age:

| Criterion | Age |

| Builders 35-50 | 35-50 |

| Accumulators | 50-60 |

Income:

| Criterion |

| BDT 80000-100000 |

| Above 100000 |

Occupation:

| Criterion |

| Service Holders |

| Engineers |

| Developers |

| Architects |

| Retired Personnels |

Geography:

| Criterion |

| Dhaka |

| Khulna |

| Chittagong |

| Sylhet |

Recent Developments

In June 2021, BSRM Limited noded to merge with BSRM Steel Mills. The Bangladesh Securities and Exchange Commission (BSEC) approved the merger of non-listed BSRM Steel Mills Limited

with listed Bangladesh Steel Re-Rolling Mills Limited (BSRM) at 1:0.28 share exchange ratio. Through this merger the paid-up capital of BSRM Limited would increase to BDT 298.58 crore from existing BDT 236.06 crore.

On October 2021, BSRM Limited announced to expand its production capacity to meet growing demand. The company has planned to increase rod re-rolling capacity by six lakh tonnes, for which it will also increase its billet making capacity by 2.5 lakh tonnes. BSRM expects that the investment will make the company self-reliant for the semi-finished raw materials.

- ^ https://bsrm.com/about-us/history/

- ^ https://bsrm.com/wp-content/uploads/2021/07/Details-of-ShareholdingBSRMLTD.pdf

- ^ https://bsrm.com/wp-content/uploads/2021/12/bsrm_steels_ltd_annual_report_2020-21_re-rolling.pdf

- ^ https://bsrm.com/category/uncategorized/#:~:text=28%20Feb%202021-,Bangladesh%20Steel%20Re%2DRolling%20Mills%20Limited%20has%20been%20awarded%20%E2%80%9CICMAB,from%20on%20behalf%20of%20BSRM.

- ^ https://www.thedailystar.net/business/news/steel-sector-still-shakeout-2025153

- ^ https://www.thedailystar.net/backpage/bangladesh-discovers-first-magnetite-iron-mine-dinajpur-1758988

- ^ https://www.thedailystar.net/news-detail-55486