Barratt Developments

Summary

- Barclays operates as two divisions, Barclays UK and Barclays International, supported by service company, Barclays Execution Services.

- Barclays UK (BUK) consists of UK Personal Banking, UK Business Banking and Barclaycard Consumer UK businesses.

- Barclays International (BI) consists of Corporate and Investment Bank and Consumer, Cards and Payments businesses.

Company Overview

Barratt Developments(LSE:BDEV, OTC:BTDPF) is the nation’s leading housebuilder, creating great new places to live throughout Britain.1

The company's business is acquiring land, obtaining planning consents and building quality homes. This is supported by its expertise in land, design, construction and sales and marketing.

The company build quality homes recognised by its HBF 5 Star customer rating, the only major housebuilder to have achieved this for the twelfth consecutive year.

- Great design is at the heart of all its developments which must meet the Building for Life 12 design standards.

- The company build both private and affordable housing and in its last financial year delivered 17,243 new homes.

- Barratt Developments has a broad product offering with prices for its private homes outside of London ranging from c. £70,000 to more than £1m.

- The company's developments are planned to meet the needs of the local community, with the new homes the company build ranging from 1 bedroom flats to 6 bedroom family homes.

- The company's geographic reach and product diversity allows it to maximise development opportunities across the country whilst giving it a balanced development portfolio.

Company History

| Year | Milestones |

| 1950 | The Barratt story begins in 1953. Sir Lawrie Barratt, then a young accountant, couldn’t afford to buy the house he wanted so built one himself instead. The four-bedroom home in Newcastle upon Tyne cost £1,750 and led to the formation of his first company in 1958. |

| 1968 | During the 1960s the company grew steadily, establishing its roots in the North East before becoming listed on the London Stock Exchange in 1968. |

| 1974 | After rapid expansion in the early 1970s through acquisitions and the creation of new companies, Barratt is now “building houses to make homes in” on over 100 developments throughout England and Scotland and selling more than 3,000 new homes a year. |

| 1977 | The Mayfair one-bedroom house is launched to meet a growing need for affordable new homes. It cost £7,000 and could be bought on just £9.00 a week mortgage – far less than renting. |

| 1985 | Dulwich Gate, London SE21: this exclusive development of Georgian-style luxury homes was acclaimed as one of the capital’s finest post-war housing developments. Margaret Thatcher, then Prime Minister, bought a home here. |

| 1990 | Barratt introduced part exchange to the property market back in 1971. In the 1990s we introduced the Oakleaf brand, through which we sell these older homes at competitive prices and with benefits usually available only on new homes. |

| 1991 | Diana, Princess of Wales officially opened St Peter’s Marina Village at Newcastle upon Tyne, a new community of 361 homes and offices which spearheaded the revitalisation of the city’s Quayside. |

| 1995 | New top-of-the-range Premier Collection house styles are introduced with the opening of a show village in Northampton and the company celebrates another milestone – the sale of the 200,000th Barratt home in Britain. |

| 2005 | We developed the Barratt iPad apartment to help bridge the growing affordability gap for first-time buyers. It provides good living space, an open-plan fitted kitchen, separate double bedroom, full bathroom and a private balcony. |

| 2007 | Barratt Developments acquires Wilson Bowden PLC, comprising David Wilson Homes, a national housebuilder with a reputation for high-quality family homes; Ward Homes, a strong regional brand in Kent and the South East; Wilson Bowden Developments, commercial property developers. |

| 2009 | Following on from the Green House project, work starts on 185 energy-efficient homes at Hanham Hall, Bristol. Due for completion in 2015, the development will be England’s first large-scale housing scheme to achieve the Government’s 2016 zero-carbon standard. |

| 2021 | The Barratt Group again achieved the maximum five-star rating in the annual Home Builders Federation customer satisfaction survey. This was the twelfth year running that Barratt has won the top rating – the only major national housebuilder to do so. |

Brands

The company's three consumer brands, Barratt Homes, David Wilson and Barratt London offer a variety of properties across the UK. From stylish apartments in the city of London to luxury detached houses in the beautiful countryside. The company also have a commercial business Wilson Bowden creating spaces from industrial and office buildings to retail and leisure.

Barratt Homes

Barratt Homes focuses on providing homes perfect for first time buyers and families, offering a range of energy efficient properties across England, Scotland and Wales.

David Wilson

With decades of experience in building family homes it is no surprise that David Wilson is known for its beautifully designed houses that are built to the highest quality with fixtures and fittings to match.

Barratt London

Barratt London is one of the leading residential developers in the capital with over 30 years' experience. The company's portfolio in London is diverse and ranges from state-of-the-art apartments and penthouses in Westminster to riverside communities in Fulham, and complex, mixed-use regeneration schemes in Hendon.

Wilson Bowden Developments

Wilson Bowden Developments is the Group’s commercial development arm focused on retail, leisure, office, industrial and mixed-use schemes. Projects range from single sites to industrial developments, office parks and major town centre regeneration projects.

Industry Overview

UK economic output saw a sharp recovery through to October 2020, following the end of the initial national lockdown, but renewed restrictions on activity saw the economy then contract through to the end of January 2021. With the gradual removal of COVID-19 restrictions, the economy has shown continuous expansion since February 2021, although output has yet to recover to pre-pandemic levels. Looking forward there are clear signs of optimism with the latest HM Treasury collated economic forecasts projecting GDP growth of 6.9% in 2021 and 5.6% in 2022. Uncertainties for the wider economy do however remain, notably around employment and consumer confidence, with the gradual withdrawal of furlough arrangements for employees and income support for the selfemployed particularly important in the coming months.2

Housing demand

The UK housing market, in contrast, has shown a remarkable and continuous recovery since emerging from the initial national lockdown, aided by the industry’s ability to continue operating over this subsequent period. This reflects pent-up demand created by the lockdown and the SDLT holiday. It also reflects a recovery from the more extended period of uncertainty and suppressed housing market activity (evident since the Brexit referendum in 2016), as well as a reprioritisation of housing for many households since the onset of the pandemic. Against this backdrop the company believe that the market for housebuilding remains positive.

Housing supply

Housing remains high on the Government agenda with the shortage of housing being recognised as a critical issue for the long term health of the UK economy and its growing population. The UK Government reiterated its commitment to a target of building c. 300,000 new homes per year in October 2020. New build housing additions were 220,600 in the last reported 12 month period to 31 March 2020 which, when combined with the net additions from conversions and demolitions of 23,170, resulted in net additions to the housing stock of 243,770 homes . There remains a significant shortfall in new home additions, providing opportunity for industry growth over the coming years.

Land supply and the planning system

There remains a good supply of planning consents coming through the planning system in support of housebuilding growth despite pandemic related disruption with 277,326 new detailed planning permissions approved in England through the year to 31 December 2020.

Reflecting the good availability of land, its business model and operating framework remain focused on operating one of the shortest land banks in the industry as the company seek to optimise return on capital.

On 6 May 2021, the temporary regulations under the Coronavirus Act 2020 that allowed local authorities to hold planning committee meetings virtually expired, with no alternative arrangements in place. This has resulted in delays to the planning process

Building materials and labour

The company experienced very different rates of build cost inflation in the first and second halves of FY21. In the first half, build cost inflation was relatively muted, reflecting the fall in output created by the initial national lockdown, latent supply chain capacity, as well as its procurement planning. Building material price agreements provided cost certainty as well as visibility for its supply chain partners.

In the second half of FY21, the company saw a rebound in housebuilding activity. In addition the company saw growth in demand for commodities including steel, timber and plastics, which resulted in greater inflationary pressure on building material costs

Through its centralised procurement team, careful scheduling of building materials and the support of its long-standing supply chain partners, Barratt Developments is focused on ensuring security of supply whilst seeking to manage build cost inflation.

Housing market support

During the year, the Government’s Help to Buy scheme became available to first time buyers only with regional price caps being applied. Following the change for reservations from December 2020, first time buyer activity has been maintained and existing homeowners have migrated to traditional purchase.

The SDLT holiday, introduced in July 2020, which raised the threshold at which the tax becomes payable to £500,000, has supported housing demand throughout the year. The holiday began to taper from 1 July 2021 and is scheduled to finish at the end of September 2021. Whilst its sales activity benefited from this “call to action” in FY21, its sales reservations in recent months, for completion beyond the SDLT holiday period, have remained robust

In early 2021 the Government introduced the Mortgage Guarantee Scheme to support LTV lending in excess of 90%. This scheme has been adopted by several mainstream mortgage lenders, but as yet has not been made available to the new build housing market.

Mortgage market

Reflecting the continuing strength of the housing recovery since the end of the initial national lockdown and including the impact of the SDLT holiday from July 2020, mortgage approvals for house purchases have shown a sharp recovery and totalled more than 1,070,000 in the year to 30 June 2021. Mortgage approvals were some 61.7% ahead of the initial national lockdown interrupted year to 30 June 2020 but also 36.4% above the mortgage approvals registered in the year to 30 June 2019.

The company continue to work with building societies, banks and other financial institutions to increase lender understanding and to introduce additional lenders to the new build sector. Barratt Developments is also participating in the development of green mortgages that reflect the efficiency and environmental credentials of its homes.

Government legislation

Government advice on cladding and external wall systems continues to evolve. The Building Safety Bill, introduced to Parliament in July 2021, seeks to give residents more power to challenge developers on build quality and building safety concerns and will retrospectively extend the current period during which claims can be brought against developers from six to 15 years.

The Government announced in January 2021 that it would grant leaseholders of eligible properties the right to extend their leases free of ground rent. In addition, in June 2021 the Government published the Leasehold Reform (Ground Rent) Bill that aims to prevent ground rents from being charged on new homes. This is alongside the CMA’s ongoing investigation into the leasehold housing market.

In June 2022, changes to Part L and F of building regulations in England come into effect. This allows for a one year transition period and will require new homes to achieve a 31% reduction in carbon emissions compared to current standards. The Government has also confirmed that the 2025 Future Homes Standard will require a reduction in emissions of 75%-80%, including the prohibition of gas boilers in new homes.

Financial Highlights

Sales

The company delivered an excellent reservation performance in the year 30 June 2021 with a net private reservation rate per week of 0.78 (2020: 0.60; 2019: 0.70). In 2021 its sales centres across the country operated on an appointment only basis, although its sales offices in Wales remained closed for longer following Welsh Government guidance during subsequent lockdown periods. The physical closure of its sales centres from 23 March to 21 May 2020 in England, 1 June in Scotland and 25 June in Wales impacted its 2020 reservations, making year on year comparisons less informative, and therefore its net private reservation rate is included with comparatives to 2019:

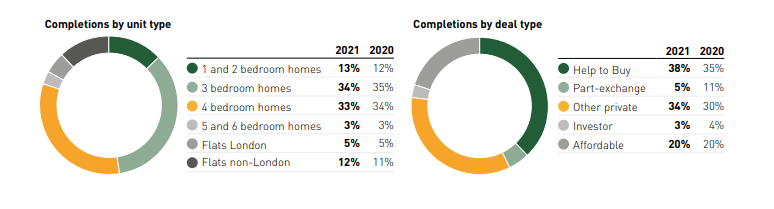

During the financial year ended 30 June 2021 the company operated from an average of 343 active outlets (2020: 366; 2019: 379 outlets) including 8 (2020: 9; 2019: 9) active JV outlets; the reduction reflecting the delay to site starts created by the initial national lockdown. Barratt Developments has made good progress on rebuilding momentum in new site openings, launching a total of 144 new outlets (2020: 75; 2019: 163 outlets) including JVs in the year, with 81 new outlets (H2 2020: 30; H2 2019: 73) opened in the second half. In FY22, the company expect to see average sales outlet growth of around 3%, reflecting its focus on growth from both land investment and land bank optimisation through additional dual branding of Barratt and David Wilson Homes on its sites. The company expect the affordable housing share of its home completions mix to increase to around 21% in FY22, a slight increase on the 20% in 2021.

Profitability

Adjusted gross profit improved to £1,114.7m (2020: £631.4m; 2019: £1,087.4m) with adjusted gross margin significantly recovering, increasing to 23.2% (2020: 18.5%; 2019: 22.8%). The adjusted gross margin improvement reflected house price inflation ahead of build cost inflation and the scale of completion volume growth, which drove incremental fixed cost efficiency, with each home completion delivering a contribution of c. 32% after land and build costs.

After adjusted items totalling £104.7m (2020: £17.1m; 2019: £3.2m) relating to legacy property costs and the reversal of CJRS grant income recognised in 2020 but repaid in 2021, gross profit was £1,010.0m (2020: £614.3m; 2019: £1,084.2m) and the gross margin was 21.0% (2020: 18.0%; 2019: 22.8%).

Net finance charges were £26.6m (2020: £29.9m). This £3.3m decrease reflected a £6.2m reduction in the imputed interest on land creditors offset by the impact of the phasing of cash balances in the year. The cash finance charge was £9.7m (2020: £7.3m) with non-cash charges of £16.9m (2020: £22.6m). In FY22, finance costs are expected to be similar to 2020 at c. £30m, of which c. £10m is cash and c. £20m is non-cash.

JVs delivered a decreased profit for the year of £27.7m (2020: £28.3m; 2019: £39.2m). The JV result in 2021 also included a release in respect of costs associated with JV legacy properties of £0.4m (2020: £nil; 2019: £7.0m charge).

As a result, profit before tax for the year increased to £812.2m (2020: £491.8m; 2019: £909.8m). The tax charge for the year increased to £152.1m (2020: £89.1m; 2019: £170.4m) reflecting the recovery in profit before tax and was at an effective rate of 18.7% (2020: 18.1%; 2019: 18.7%).

Basic earnings per share increased to 64.9 pence per share (2020: 39.4 pence per share; 2019: 73.2 pence per share). Adjusted earnings per share, before the impact of adjusting items and associated tax, increased by 81.5% to 73.5 pence per share (2020: 40.5 pence per share; 2019: 74.1 pence per share).

With the substantial recovery in Group profitability in FY21, its ROCE improved to 28.3% (2020: 15.6%; 2019: 29.7%).

Cash flow

Net cash increased to £1,317.4m at 30 June 2021 (30 June 2020: £308.2m). The increase in net cash reflected a £1,082.3m net cash inflow from operating activities (2020: £121.0m cash outflow), a £16.7m cash inflow from net investments in and dividends received from JVs (2020: £65.2m) and a reduced level of dividends paid to shareholders in the year of £76.3m (2020: £373.2m) which reflected the absence of a 2020 final dividend payment.

Balance sheet

The Group’s net assets at 30 June 2021 totalled £5,452.1m (30 June 2020: £4,840.3m) after the payment of dividends totalling £76.3m (30 June 2020: £373.2m).

At 30 June 2021, the Group had net cash balances of £1,317.4m (30 June 2020: £308.2m). As at 30 June 2021 land creditors had reduced to £658.3m (30 June 2020: £791.9m) and equated to 22.3% (30 June 2020: 25.4%) of the owned land bank, in line with its operating framework.

In FY22 the company expect year end net cash balances of between c. £1.0bn and £1.1bn. During the year, £363.4m (2020: £492.9m) of land creditors will fall due for payment. Land creditors due beyond 30 June 2022 total £294.9m at 30 June 2021 (30 June 2020: £299.0m due beyond 30 June 2021).

Net tangible assets were £4,546.2m (446 pence per share) at 30 June 2021, (30 June 2020: £3,933.3m; 386 pence per share). Land, net of land creditors, and work in progress totalled £3,963.9m (389 pence per share) at 30 June 2021 (30 June 2020: £4,172.8m, 410 pence per share).