Berger Paints Bangladesh Limited

Summary

- Berger Paints Bangladesh Limited has been involved in business in this part of the world since 1950.

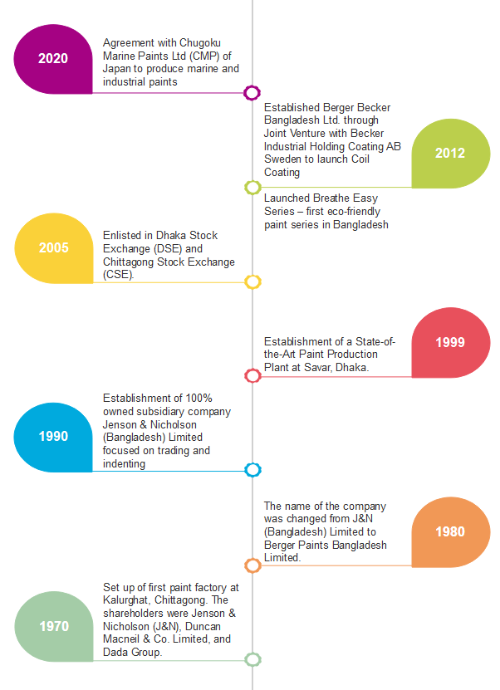

- In December 2005, Berger Paints Bangladesh Limited offloaded 5% shares to the public and got listed with Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE).

- Berger Paints Bangladesh Limited has one subsidiary namely Jenson & Nicholson (Bangladesh) Limited. The company owns 100 percent shares of Jenson & Nicholson (Bangladesh) Limited.

- The financial year of the company ends on 31 March of the year. The company has generated a revenue of Tk 1,666.98 crores for the year 2020-2021, which was Tk 1,621.90 crore (a 2.78% increase year-on-year).

- Net profit of the company for the year has been Tk 254 crore which was Tk 229 crore, a growth of 10.92%.

- EPS is Tk 54.96, latest P/E ratio is 30.23, NAV per share is Tk 213.26.

History of Berger Paints

Berger is one of the oldest paint solution providers in the world. The history of the company dates as far back as 260 years. Louis Berger, a German national, founded a dye and pigment-making business in England in 1760. Louis Berger & Sons Limited grew rapidly with a strong reputation for innovation and entrepreneurship, culminating in perfecting the process of making Prussian-Blue, a deep blue dye– a colour widely used for the uniforms of many European armies. Production of dyes and pigments evolved into production of paints and coatings, which till today, remains the core business of Berger. The company grew rapidly by establishing branches all over the world and through mergers and acquisitions with other leading paint and coating manufacturing companies.

History of Bangladesh Operation

Berger Paints Bangladesh Limited has been involved in business in this part of the world since 1950. Initially, the company imported paints from Berger UK and subsequently from Berger Pakistan. During that time, the company was known as Jenson & Nicholson. In 1970, J & N set up a paint factory in Chittagong. Initially, there were three shareholders of the company –

- Jenson & Nicholson

- Duncan Macneil & Co. Limited

- Dada Group

After independence of the country in 1971, Dada Group vested its shares to the government. Name of the company has been J & N (Bangladesh) Limited until it was changed in Berger Paints Bangladesh Limited on January 1, 1980. However, J & N Investments (Asia) Limited remained the owner of the company and reinforced its position by purchasing the Government shares in August 2000. Then in December 2005, Berger Paints Bangladesh Limited offloaded 5% shares to the public and got listed with Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE).

Company overview

Corporate profile

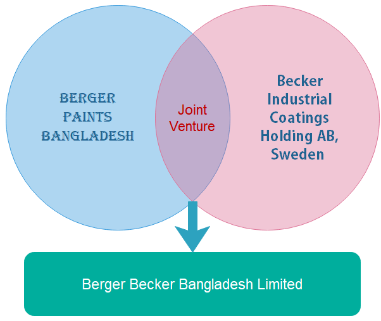

Berger Paints has invested heavily in research and development (R&D). The company purchases its raw materials from some of best-known brands in the world such as ExxonMobil, DuPont, BASF, BYK, Cristal, and Shell. The company has built a strong distribution network all over the country. The dealer network of Berger is located in all the major cities of the country including Dhaka, Chattogram, Rajshahi, Khulna, Bogura, Sylhet, Cumilla, Mymensingh, Barishal, Rangpur, Feni, and Brahmanbaria. The company has expanded its operation by forging a joint venture with Becker Industrial Coatings Holding AB, Sweden to form Berger Becker Bangladesh Limited, which produces coil coatings. Berger Fosroc Limited is another joint venture with global leader Fosroc International Limited to cater world-class construction chemicals to Bangladesh. Berger Paints Bangladesh Ltd. and Chugoku Marine Paints Ltd of Japan have entered into an agreement for the manufacture of marine and related industrial paints in Bangladesh. Berger is the first Bangladeshi company to manufacture such world-class marine paint products in the country.

Shareholding position

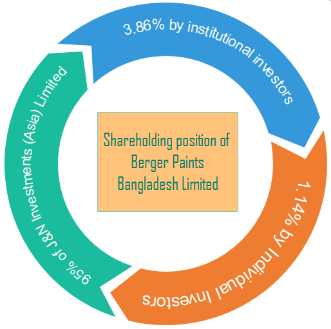

Of the total 46,377,880 shares outstanding of the company, J&N Investments (Asia) Limited holds 95%. The rest of the shares are held by institutional investors and individual investors. Bangladeshi and foreign institutional investors hold 3.73% and 0.13% of shares, respectively. Individual investors from Bangladesh hold 1.14% of the shares (number of shares equal to 526,417) and from foreign countries hold 0.01%. A summary of the shareholding position of the country is given below –

Product range

Product range of Berger Paints Bangladesh is given in the following list –

- Decorative paints

- Specialized outdoor paints to protect against adverse weather conditions

- Color bank

- Superior marine paints

- Textured coatings

- Heat resistant paints

- Roofing compounds

- Epoxies

- Powder coating

The company has introduced three new product lines as follows –

- WeatherCoat AntiDirt Supreme

- Fireguard Fire intumescent coating

- Breathe Easy Eco Series

The last product series is meant to contain green biocides that ensure an environment free from bacteria and has no VOC.

The segmentation of the products based on their usage structure is listed below –

- Interior

- Exterior

- Enamel Paints

- Illusions

- Wood Coating

- Marine Paints

- Adhesive

- Powder Coating

- Textile Auxiliaries

- Special Products

- Undercoats

Some of the brands of the company are listed below –

- Breathe Easy ViraCare

- Easy Clean

- Luxury Silk Metallic Finish

- Durocem

- WeatherCoat AntiDirt LongLife

- WeatherCoat Biowash

- Robbialac Synthetic Enamel

The company offers textile printing binders and finishing agents under the Texbond brand. Construction Chemicals is another diversification for Berger. The company has recently launched Express Painting Tools for faster, cleaner, and better painting work and introduced Express Painting Services for one-stop painting solutions. Recently, Berger has introduced printing ink in its portfolio.1

Amid the pandemic, the company has launched a sanitizer product namely Berger Expert Sanitizer which has a target to help people maintain hygiene and to curb the infection rate.

The company has a ‘Paint Express Service’. The service offer includes skilled painters painting the houses for the clients. The company mainly position this service as the solution to painful dust.

Mission and vision

Mission of the company is to increase turnover by 100 percent in every 5 years and to remain a socially committed ethical company. Vision of the company is to be the most preferred brand in the industry ensuring consumer delight.

Subsidiary of Berger Paints

Berger Paints Bangladesh Limited has one subsidiary namely Jenson & Nicholson (Bangladesh) Limited. The company owns 100 percent shares of Jenson & Nicholson (Bangladesh) Limited. The subsidiary was established in 1990 and involved in the Metal Container’s business in Bangladesh since 1995. JNBL had set up the factory at Chattogram and extended its second unit at Dhaka. Over the decades, JNBL has evolved to become the leading Metal Container manufacturer in the country and has diversified into Paint, Lubricant oil, Engine oil, Hair oil, and Food Grade container. Recently, JNBL has also invested in Fancy Container manufacturing, which is the first ever in Bangladesh.2

Dividend Distribution Policy

Bangladesh Securities and Exchange Commission (BSEC) requires the listed companies to disclose Dividend Distribution Policy. Basically, Berger Paints Bangladesh distribute dividend according to the regulatory requirements but keeping in mind the profitability, liquidity, leverage ratios, and future opportunities for growth. The company goes with the decision of the board on dividend. It can distribute dividends from accumulated profits of the previous years. The dividend can be interim and final. The company considers the followings in declaring dividend –

- Distributable surplus available as per the Companies Act, Listing Regulations and other applicable regulations and directives.

- The Company's liquidity position and future cash flow needs

- Track record of Dividends distributed by the Company

- Pay-out ratios of comparable companies

- Prevailing taxation policy and legal requirements with respect to Dividend distribution

- Capital expenditure requirements

- Stipulations/ Covenants of loan agreements, if any

- Macro-economic and business conditions in general

- Any other relevant factor that the Board may deem fit to consider

The company can distribute less dividends to pile up retained earnings to do the followings –

- Organic growth needs including working capital, capital expenditure, repayment of debt, etc.

- Inorganic growth needs such as acquisition of businesses, establishment of joint ventures, etc.

- Buyback of shares subject to applicable limits

- Payment of Dividend in future years

- Issue of Bonus shares

- Any other permissible purpose

However, when the company has not generated adequate profit, believes that the company has significant avenues of generating greater profits by using the funds rather than giving away as dividends than the shareholders can, it may decide not to declare dividends.

Industry Analysis

The paint industry in Bangladesh has about 45 players with a market size of Tk 3,700 crore as of 2019.3 The industry is playing a key role in facilitating the rapid urbanisation of the country of 167.8 million people. It is protecting the fixed assets from being rusted and increasing the longevity of them. The paint coatings add longevity to the structures and ensure lesser maintenance costs thus contribute to the economy.

In mid-2018, Japanese company Kansai Nerolac entered the Bangladeshi market. During the same time, Berger Paints has entered into three new ventures with leading international companies (vide company overview section). Kansai Nerolac entered the Bangladeshi market by acquiring 55% stake at RAK Paints for Tk 572.6 million. The CEO of the acquiring company commented that they have chosen RAK because it is a good and compliant company in Bangladesh.

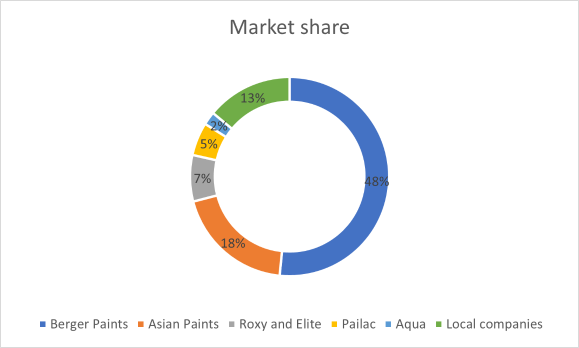

Among the companies, Berger Paints is the market leader and more than 80% of the country’s paint market is in the hands of foreign brands including Berger, Asian, Roxy, Pailac, Aqua, and Elite. According to Bangladesh Paint Manufacturers Association, Berger Paints leads the market with 48% share, followed by Asian Paints’ 18%, Roxy and Elite’s 7%, Pailac’s 5% and Aqua Paint’s 2%. Other local companies (a total of around 30) hold 13% of the market share. Yet other small companies hold the rest 7% market share.

Some of the key players in the industry are listed below –

- Ujala Paints Bangladesh

- Berger Paints Bangladesh

- RAK Paints (Pvt) Ltd

- Roxy Paints Ltd

- Asian Paints (Bangladesh) Ltd

- Elite Paint & Chemical Industries Ltd.

- BD Paints Ltd.

According to reports, the industry has virtually doubled in the last 10 years and creating employment opportunity to many in the country. The industry has recorded over 6% growth in the recent times and the industry experts believe that it will gain 7-8% annual growth in the near future. However, other estimations show that the industry is expected to grow by 8 to 10 percent per annum as there is scope for increase in consumption backed by economic growth.

The growth is supported by high concentration in the real estate sector recently in the country. The consumer awareness is increasing about the need for protection of houses and increased urbanisation. The availability of house loans, boom in the shipbuilding industry, and consistent economic growth are the drivers of high growth in the paint industry.

The industry in Bangladesh is hailing towards a greater value creation which is evident from the agreement between Berger Paints and Chugoku Marine Paints Ltd (CMP) of Japan on January 1, 2020 to produce marine and industrial paints. Berger Paints is first of its kind in producing marine paints in Bangladesh. On another development at a later date on 4 December, 2021, the oldest and leading brand in the industry of Bangladesh Elite Paint and Chemical Industries Ltd joined hands with Transocean Coatings to manufacture internationally certified high performance industrial and marine coatings in Bangladesh.

Thus, different players of the industry are entering into agreements with different companies to introduce newer product lines, updated technologies, and efficient operational procedures. A boom in the real estate sector is happening in Bangladesh. This paves a solid road for this industry to reach its peak.

Business Overview

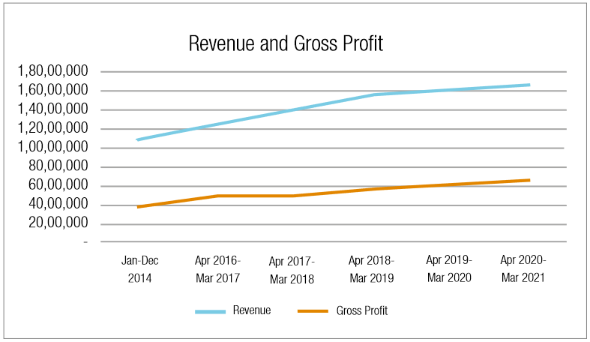

The financial year of the company ends on 31 March of the year. The company has generated a revenue of Tk 1,666.98 crores for the year 2020-2021, which was Tk 1,621.90 crore (a 2.78% increase year-on-year). It is notable that in Bangladesh, the pandemic made its way on March, 2020. Despite the lockdowns and strict measures from the government to curb the infectious disease, the company maintained a sales growth, whereas many other companies experienced a dip in sales.

Gross profit of the company during FY21 has been Tk 663 crore, while it was Tk 624 crore during the previous year. The company has experienced a gross profit growth of 6.25% in the financial year 2021 (April to March). However, net profit of the company for the year has been Tk 254 crore which was Tk 229 crore, a growth of 10.92%. The results are an outcome of the cost control since it is evident from the figures that the company has incurred total expense of 18.6% in 2020-21 of total sales which was 19.6% in the previous year.

In the previous 5 years, the company has persistently maintained a positive growth of revenue and gross profit. In the most recent year, finance cost has increased significantly compared to that of the previous year. The company has incurred a cost of Tk 30 lakhs in the year 2019-20 but incurred a finance cost of Tk 364 lakhs in 2020-21. The reasons are unexplained since the company has not borrowed long-term fund from anywhere except for some lease obligations. The notes of the company to the finance cost head in the income statement does not provide any detail.

Earnings per share (EPS) of the company is Tk 54.96 in FY21 which was Tk 49.43 in the previous year. The company had a balance of retained earnings of Tk 824.43 crore on 01 April, 2020. During the year it has distributed cash dividend of Tk 136.81 crore and newly added profit after tax to the retained earnings is Tk 254.88 crore. Thus, total equity of the company stands, along with the share capital of Tk 46.38 crore, at Tk 942.69 crore. Closing balance of net cash and cash equivalents stands at Tk 409.99 crore during FY21 which was Tk 337.31 crore in the previous year. Here it is mentionable that the company has distributed cash dividend of Tk 115.94 crore in the year 2020-19, which is less than that of the current year. Again, it has not generated any positive cash flow from financing activities. It could have been concluded that the improved cash position is purely from operational efficiency of the company. But a closer inspection shows that cash flow from operation has in fact declined from Tk 360 crore to Tk 332 crore. But the improved cash position is a result of carried forward balance of the previous year. The opening balance of cash flows for the company was Tk 337.31 crore compared to the opening balance of the previous year which was Tk 229 crore.

The company has increased its investment in property, plant and equipment during this year. Total non-current assets have also increased by about Tk 83 crore. The company has started a term deposit of Tk 10 crore during FY21. Total current assets of the company have also increased by Tk 174 crore. Size of the company in terms of total assets is Tk 1,530 in 2020-21. Total non-current liabilities of the company have decreased from Tk 73.78 crore to Tk 67.89 crore. But total current liabilities of the company have increased from Tk 348 crore to Tk 473 crore. It is notable that the working capital of the company is high. The long-term assets as well as long-term liabilities of the company is way lower than the current assets and current liabilities.

Current ratio of the company during FY21 is 2, which was 2.22 in the previous year. It can be loosely argued that the company has used more cash in investment; that is, the profitability of the company will increase as it has reduced its current ratio. Is it arguably true that the company may fall in a liquidity crisis? The answer is ‘no’ because the current ratio is well above 1. However, it is also true that the company has increased its investment as it is evident from the cash flow statement that net cash used in investing activities increased from Tk 90.48 crore to Tk 115.83 crore. The company has net asset value (NAV) per share is Tk 213.26, which was Tk 187.77 a year earlier.

Authorized capital of Berger Paints is Tk 1,000 million. Paid-up capital is Tk 463.78 million and face value per share is Tk 10. Total number of outstanding securities is 46,377,880. Latest P/E ratio based on audited financial statements of the company on March 24, 2022 is 30.23. The share of the company is trading at Tk 1,766 on March 24, 2022.

Recent developments

- Bangladesh Economic Zone Authority (BEZA) has allotted an industrial plot at Mirsarai & Feni Economic Zones to Berger Paints Bangladesh Ltd. The company has taken possession of the plot. This land will help the company optimize manufacturing process and support the growing demand for paints in Bangladesh market.

- Berger Paints has signed an agreement with Amin Mohammad Constructions Ltd (AMCL) to provide all kinds of paints and construction chemical-related solution to the Airport Extension Project.

- Berger Pains has become the most loved brand in Bangladesh 11th times in a row.