Bharat Forge Ltd

Overview

Bharat Forge Limited (NSE:BHARATFORG) is a global, technology-driven manufacturing company. A preferred Technology & Engineering driven development partner and global leader in metal forming the company serve several sectors including Automotive, Railways, Aerospace, Marine, Oil & Gas, Power, Construction and Mining. Being the world's largest forging company and amongst one of the best aerospace forging companies and automotive forging company; Bharat Forge has transcontinental presence across ten manufacturing locations spread across India, Germany, Sweden, France and North America. Bharat Forge is also a leading supplier of various components for he aviation sector making it a renowned name amongst aerospace forging companies in India and around the world.1

Part of the Kalyani Group - A USD 3 billion conglomerate with 10,000 global work force, Bharat Forge has the largest repository of metallurgical know-how, design & engineering expertise, and manufacturing prowess in the region, which has established it as one the leading forging manufacturers in India. Bharat Forge is backed by more than 50 years of experience in manufacturing a wide range of high performance, critical and safety components. The company offer full service supply capability to its geographically dispersed marquee customers from concept to product design, engineering, manufacturing, testing & validation.

Developing its own technology, constantly improving its technical processes, adopting the latest manufacturing processes and continuously training its workforce to create a talent factory has been the cornerstone of its success and has contributed towards making it a leading automotive forging company in India.

Business Segments

Bharat Forge manufactures an extensive array of critical and safety components for several sectors including Automobiles (across Commercial & Passenger Vehicle), Oil & Gas, Aerospace, Locomotives, Marine, Energy (across renewable and non-renewable sources), Construction, Mining and General Engineering.2

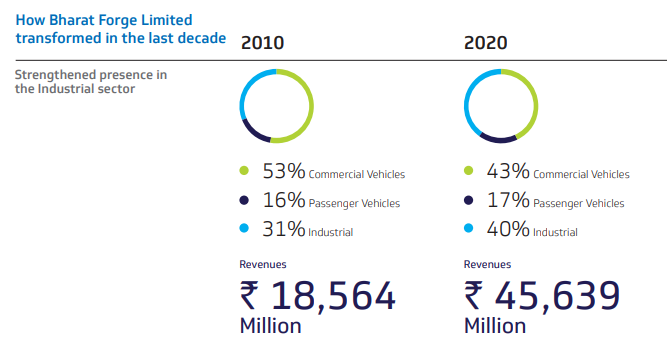

Bharat Forge has achieved its success through transformation as a leading critical component manufacturer and it continues to remain the only way forward. The company's transformational DNA is helping it leverage opportunities across the world. Bharat Forge continues to leverage its expertise built on 4M's (Metallurgy, metal forming, manufacturing and machining) and R&D capabilities, to provide agile and adaptive solutions to its customers and establish itself as one of the best critical and safety components manufacturer both in India and globally.

Automotive

Bharat Forge is India’s largest auto component exporter and one of the world’s leading technology-driven auto component manufacturer. The company's products are delivered to leading global automotive OEMs and Tier I suppliers. Bharat Forge is also amongst the few companies globally with front-line design and engineering, dual shore manufacturing and full-service supply capabilities, all of which provides it a unique edge.

The company's customer base includes virtually every global automotive OEM and Tier I supplier. As an auto forged components manufacturer, Bharat Forge has always been able to support its automotive customers by helping them meet stringent environmental norms, and improving fuel economy with its products. Today, Bharat Forge is amongst the few global auto component manufacturers in India, with capability to offer.3

- Passenger Vehicles

- Commercial Vehicles

Industrial

Power

The company manufacture critical components for thermal, wind, hydro and nuclear power applications across geographies.

Oil & Gas

The company engineer surface, sub-sea, and deep-sea applications for high-value and high-technology oil & gas. Bharat Forge is well placed for a value-addition role in this area.

s a gas forgings supplier, Bharat Forge has a wide spread supply chain capable of handling multiple primary and secondary processes including Open Die Press, Ring Rolling, Close Die Hammer, Finish Machining and Cladding which helps it to deliver turnkey services. Bharat Forge as a high technology oil forgings supplier, has extended its capabilities to component machining and mechanical assemblies to meet the demands of its ever increasing customer base.4

Defence & Aerospace

Bharat Forge is a long-standing supplier of critical components for the defence establishments in India. With state of-the-art facilities, the company manufacture world-class products for global aerospace players.

The company manufactures airframes, structural and engine parts for aeroplanes of various makes and models. As an aircraft turbine and compressor manufacturer India, the Company manufactures high end shafts, LPC Discs and HP Discs for airlines. Aero engine components - Blisk Blades, OGV Blades and Fan Blades manufactured by it are made in keeping with the latest technology and design trends while maintaining high quality standards. This has made it a renowned aircraft fan blade manufacturer in the aviation sector in India.5

Construction and Mining

The equipment used in Construction & Mining and General Engineering sector have extreme applications and hence require equally durable products. Bharat Forge has established itself as a quality construction component manufacturer by making high end construction products like tracklink, front spindles and engines.

Marine

The company supply various products to the global ship builders, including key products like crankshafts, connecting rods and propeller shafts. Bharat Forge is one of the most reliable connecting rod manufacturers in India and also rank amongst the best crankshaft manufacturers in India.6

The crankshaft is one of the most important parts of a ships engine, which is why crankshaft manufacturers take great care in manufacturing them. This is why the company use the latest technology to manufacture world class crankshafts for engines to move ships smoothly across the deepest oceans. High quality, durable conrods and piston rods manufactured by it have helped it build a reputation of being the best amongst connecting rod manufacturers in India and globally. Other marine products manufactured by it includes products for the shafts - propeller, marine motor and stem tube and products for the rudder - stock, trunk and pintel.

Rail

As a railway engine parts manufacturer, the company make a variety of railway components that are much in demand in the railway industry. These include Engine components such as crankshafts, connecting rods, pistons, deck ends, retainer cylinder heads; Turbochargers like Machined Compressor Impeller, Turbine Wheel Impeller Balance Assembly and Turbine Disc Bucket Assembly; various bogie components and Power Electronics.7

General Engineering

The company manufacture high-quality and durable products for a range of heavy engineering applications.

Plant Locations

Bharat Forge has a total of five plants in India – four for steel forging and machining and one for aluminum castings. The company's plants are ISO 9001, ISO 14001, TS 16949, AS 9100 REV C, NADCAP, API Q1 and PED 97/23/EC certified. As of March 31, 2020, the total value of its property, plant and equipment stood at Rs 36,578 Million. Capex incurred in the year amounts to Rs 5,164 Million towards forging and machining capacity in Maharashtra.

- Mundhwa, Pune, Maharashtra, India

- Kuruli Village, District Pune , Maharashtra, India

- Vadhuth, District Satara , Maharashtra, India

- Tandulwadi & Wanjarwadi, Dist. Pune , Maharashtra, India

- Tada Mandal, SPSR, Nellore District, Andhra Pradesh, India

Industry Overview

Automobile Business

Global Automobile Industry

The global automobile industry is undergoing an evolution, as stringent emission norms across major economies propel a shift from diesel to electric vehicles. Amidst this, the global auto industry continued to witness a slowdown in CY 2019. While major markets like Brazil, Russia, India and Europe declined, the impact of demand drop in China and the USA, two of the world’s largest automobile markets, was greater.8

Weak credit growth, more demand for used vehicles, new emission standards, and depressed consumer incomes contracted demand for light vehicles globally.

Though CY 2019 witnessed growth in the heavy truck market volumes, higher equipment costs, uncertain demand, enough available capacity and weak freight market will weigh on the segment in the future. After 2 years of strong growth, demand for class-8 trucks in the US has plateaued amidst economic slowdown and inventory overhang. The demand for Heavy Commercial Vehicles (HCV) in Europe also declined owing to the slower economic activity in the region.

Outlook

Covid-19 is likely to continue affecting global production for many auto producers and suppliers, impacting auto sales. Vehicle sales globally are also likely to decline due to the liquidity crunch, falling consumer sentiment, and higher than expected unemployment levels. In this backdrop, CY 2020 is likely to be a challenging year for the global automotive industry. Other negative factors are intense competition, trade disputes, excess inventory, emission norms change, and emergence of Connected, Autonomous, Shared, and E-mobility (CASE). On a positive note, easing trade tensions and accommodative monetary policies by major economies are likely to revive global economic activity and benefit the automobile industry.

Commercial Vehicles (CV)

FY 2020 was a rather challenging year for the commercial vehicles business due to weak demand in major end markets

In the USA, lower freight activity and increased freight capacity after two consecutive years (CY 2018 and CY 2019) of strong growth in US class-8 truck production have subdued the scope for fleet expansion in CY 2020. Consequently, OEMs became cautious and cut production in line with the lower demand and facilitate dealer inventory destocking.

In Europe, despite the slowdown in the second half of the year, the commercial vehicles market rose 2.5% in CY 2019. Having recorded seven consecutive years of growth, the European commercial vehicles industry is also bracing for a slowdown in CY 2020. Following the Covid-19 contagion, the heavy commercial vehicle industry is likely to remain under pressure, as consumer demand remains low for some time

Commercial vehicles export revenues for the Company stood at Rs 12,702 Million in FY 2020 as compared to Rs 15,912 Million in FY 2019, a drop of 20.2%. The Company continues to leverage its strong relationship with customers to focus on increasing content per vehicle and intensifying new product introductions globally in collaboration with OEMs.

Passenger Vehicles (PV)

The Company’s Passenger Vehicles (PV) exports business continued to perform well in FY 2020 on the back of new product introduction, increasing market share with existing clients, and endeavor to move up the value chain with new value-added products. The Company recorded sales of Rs 5,046 Million in FY 2020 in PV exports as against Rs 4,875 Million in FY 2019.

The Company expects the contribution of the PV exports business to increase, as it widens product portfolio and adds new customers.

The Company had re-entered the PV exports segment in FY 2014, a strategic move that opened up a substantial lateral opportunity to capture the shift in the PV market. In line with this strategy, it has increased the share of PV exports revenue to 12% in FY 2020 from 2% in FY 2014.

Indian Automotive Industry

India ranks as the fourth largest automobile market globally. The large working-age population, the expanding middle class, increasing urbanization, and significant infrastructure development have supported the industry’s growth. Apart from the massive structural demand, the industry’s progress in recent years can be attributed to its investment in new technologies and focus on aligning with the rapidly changing global automotive landscape.

However, FY 2020, proved to be one of the toughest for the Indian automobile industry, primarily driven by extreme weakness in the commercial vehicles segment. The industry players, in anticipation of pre-buying of BS-IV compliant commercial vehicles, ahead of BS-VI norms implementation from April 2020, ramped up their production. But the pre-buying did not materialize, hindered by unavailability of financing due to the acute NBFC crisis, and increased load carrying capacity of existing fleet due to change in axle loading norms and enhanced transport efficiency post-GST implementation. This resulted in excess BS-IV inventory, forcing OEMs to cut back on new production and instead focus on reducing the stock of BS-IV vehicles.

This resulted in a sharp year-on-year decline of 32.4% in CV production in FY 2020. Within the commercial segment, medium and heavy commercial vehicle production declined by 47.3% whereas the light commercial vehicle segment declined by 22.5%.

Passenger vehicles production in India also declined 14.8% in FY 2020 as against FY 2019, within which production of utility vehicles displayed a marginal growth of 1.9%.

Outlook

The automobile industry is cyclical in nature. However, current down cycle is expected to last a little longer due to several factors – implementation of BS-VI norms, after which automobile purchase cost will increase, a slow recovery in the macro-economy, and decline in infrastructure development. Covid-19 and the lockdown had a particularly disruptive impact on the automobile industry. Against this backdrop, the Indian PV and CV segments are likely to experience a subdued demand and production in FY 2021.

Indian Auto Industry

Commercial Vehicles

In line with the broad-based slowdown in the industry, the Company’s revenue from the commercial vehicles segment declined 52.7% to Rs 5,182 Million in FY 2020 as against Rs 10,948 Million in FY 2019.

To minimize the impact of the downturn, the Company is focusing on right-sizing production levels and reducing costs. There is now increased focus on R&D and innovation to develop new BS-VI compliant products, improve vehicle efficiency, and increase content per vehicle.

With the industry transitioning from BS-IV to BS-VI standards from April 1, 2020, the Company is fully prepared to capture this opportunity and to maintain its leading position in the domestic market.

Passenger Vehicles

The passenger vehicles segment was in a slump during the year. However, its structural trend remains extremely positive as India prepares for BS-VI transition. The Company, during the year, added new customers and increased its presence in the segment. This enabled it to perform better than the underlying market as the segment’s revenues in FY 2020 declined by 4.6% as against an industry decline of 14.8%

The Company will continue to focus on its growth trajectory in PVs by introducing value-added products, enhancing focus on R&D and building relations with new OEMs.

Industrial Business

To lower its dependence on the automotive business and to leverage its extensive R&D capabilities, the Company has diversified into synergistic industrial businesses. It engages in manufacturing components for Defence and Aerospace, Power, Oil & Gas, Construction & Mining, Agriculture, Railways, Marine and General Engineering sectors. Having built robust capabilities, the Company has established itself as one of the leading players catering to top industrial customers globally.

Export Industrial Segment

The Export Industrial business delivered a lackluster performance in FY 2020, following a slowdown in its key markets. Revenues from the segment declined 46.9% to Rs 8,753 Million in FY 2020 from Rs 16,472 Million in FY 2019.

The Oil & Gas industry in North America was severely impacted, as the advent of the pandemic and the subsequent closure of economies across the globe brought drilling activities to a halt and oil prices plunged across the world. This adversely impacted the Company’s revenues from this segment, declining from a peak of over Rs 10,000 Million in FY 2019 to less than Rs 5,000 Million in FY 2020. While this segment’s revenue is likely to decline further in FY 2021, the Company is witnessing stable demand in the high horsepower engine as well as construction & mining segments, which could support its performance.

Moving into FY 2021, the outlook for the Company’s Industrial vertical remains challenging, owing to the subdued industrial activity across its key markets. In this backdrop, the Company’s strategy will be to continue diversifying by adding new customers and products as well as pursuing inorganic growth opportunities.

Domestic Industrial Segment

In the Domestic Industrial segment, the Company caters to sectors such as Engineering, Agriculture, Construction & Mining, and Public Sector Utilities, including Defence and Power. Growth in these industries, being significantly linked to government spending, faced headwinds in FY 2020 with broad-based slowdown witnessed in economic and industrial activity of the country. This hit the segment’s performance, and revenues declined 20.5% to Rs 8,058 Million in FY 2020 from Rs 10,133 Million in FY 2019.

Even as the short-term outlook of the Domestic Industrial space is likely to be subdued, it presents significant longterm opportunities, with the structural growth triggers in place. Recent Government of India initiatives such as the Sagarmala project, National Infrastructure Pipeline (NIP), and liberalization of coal mining and the space sector to private entities, among others, will provide a much-needed fillip to the activity levels.

Defence and Aerospace Business

The Company continues on its growth trajectory in the Defence segment by diversifying into additional business opportunities, while maintaining Artillery systems and Protected Vehicles as its mainstay. It has made significant value additions, despite cycles of extreme volatility observed in the Indian Defence market. The Company has leaped forward to capitalize on the growing potential and contribute to ‘Make in India’.

Kalyani Rafael Advanced Systems (KRAS), a joint venture between Kalyani Group and Rafael Advanced Defence Systems, Israel, received its first major export order worth USD 100 Million, to make units of Barak-8 missile kits over the next four years.

During the year, the Company, with the aim of aligning itself with the evolving defence requirements and export markets, established a defence technology and research ecosystem at the Kalyani Centre for Technological Innovation (KCTI) and Kalyani Centre for Manufacturing Innovation (KCMI). This will enable the Company to foster indigenous innovation in advanced technologies involved in critical Defence systems. The dedicated R&D can be utilized to build and thereafter manufacture next-generation weapons and defence systems .

The Company established two Defence Incubation centers to imbibe technologies and build competencies in Augmented Reality (AR), RF Systems, INS, Artificial Intelligence and Data Analytics, etc. This would enable critical product design, engineering, manufacturing and produce new or upgraded defence products, thereby supporting the Company’s objective of achieving sustainable growth in the segment’s revenue and profitability levels in the following years.

The Company has also made some strategic investments/ acquisitions in Eternus, AERON and KPIT Defence, to augment its defence technological capability. The adopted model of mentoring by foreign technology experts at Defence Incubation centers and collaboration with technological start-ups have given the Company access to state-of-the-art defence technologies. It is now well-positioned to venture into additional fields of Marine systems, including Weapon Control Systems (WCS), Command & Control Systems (CMS), and product improvements/upgrades, among others

During the recently concluded Defexpo 2020 in Lucknow, Uttar Pradesh, the Company showcased its indigenously built technological capabilities and strengths across diverse spectrums of defence manufacturing, including Artillery, Protected Vehicles, Composites, and Augmented Reality. The signing of Memorandums of Understanding (MoUs) with established global defence firms like Paramount, General Atomics and an unprecedented number of business visitors to the Bharat Forge pavilion clearly indicate its growing prominence in both the Indian and global defence markets.

Financial Highlights

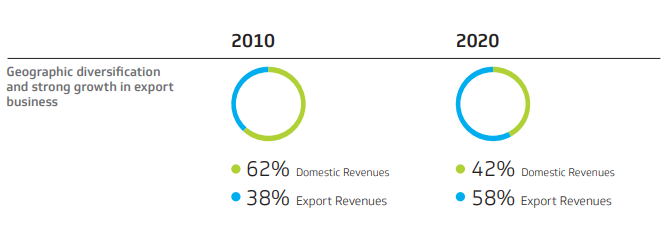

In the financial year 2019-20, the revenue of the Company declined by 30.2% and Profit after Tax decreased by 55.8%, as compared to the last financial year 2018-19 on a standalone basis. Domestic revenue decreased by 32.2% to Rs 17,818 Million as compared to last year of Rs 26,268 Million. Whereas export revenue reduced by 28.9% to Rs 26,502 Million as compared to last year of Rs 37,258 Million. On a consolidated basis, the Company, its subsidiaries and joint venture companies, achieved revenue of Rs 80,558 Million as against Rs 101,457 Million, a decline of 20.6%.

Domestic Business

Deterioration in the fundamentals of the economy throughout the year, led to a sharp decline in demand across both Passenger & Commercial Vehicles. The OEM’s started to curtail production and focus on liquidating BS IV inventory in the system. The Medium & Heavy Commercial Vehicle sector was the most impacted. Yearly production was down by 47% as compared to the financial year 2018-19. Revenues of the company from Commercial Vehicle space in financial year 2019-20 declined by 53%

In the Passenger Vehicle segment, the company continues to perform better than the underlying market. Revenues of the company from Passenger Vehicles declined by 4.6% as against an industry decline of 15%, on back of new customer addition and increasing market share.

The Industrial Sectors, which consists of Construction & Mining, PSU including Defense & Power, engineering sector, have a significant linkage to government spending on infrastructure and defence. Clearly, the past 12 months have seen some slowdown in activity levels and the same is visible in its industrial business performance. Recent Government initiatives like the Sagarmala project, National Infrastructure Pipeline (NIP), opening up of coal mining, the space sector to private entities do provide a big boost to the activity levels and also provide long term visibility

International Business

The Commercial Vehicle business for the financial year 2019-20 is down by 20.2% as compared to the last financial year 2018-19. The Passenger Vehicle segment continues its positive growth trajectory with the segmental revenues growing by 3.5% despite the lockdown towards the later part of the financial year. The company expect the passenger vehicle business to contribute more going forward as the company continue to expand its presence in this segment by increasing its product portfolio, moving up the value chain and adding new customers.

The Industrial Segment (Oil & Gas Industry and Aerospace Business) declined by around 46%. The pandemic has also severely impacted the Industrial Segment. However, the company continues to make good progress in new customer penetration including a steady expansion of product portfolio. This will not only help the company sustain period of low overall demand, but also create a solid platform for growth and potentially a platform for customer expansion.

Bharat Forge Q2 FY21 results: Reports net loss of Rs 1.32 crore

Nov 11, 2020 Bharat Forge reported a consolidated net loss of Rs 1.32 crore in the second quarter ended September 30 hit by the coronavirus pandemic induced disruptions. The company had posted a consolidated net profit of Rs 205.49 crore in the same quarter last fiscal, Bharat Forge said in a regulatory filing.9

Consolidated revenue from operations during the period under review stood at Rs 1,376.09 crore as against Rs 2,155.20 crore in the year-ago period, it added.

Commenting on the performance, Bharat Forge Chairman and Managing Director BN Kalyani said, "The consolidated quarterly weak financials reflect the full impact of Covid-19 lockdown on its overseas manufacturing operations in Europe and North America during April-June period. Despite governmental assistance, they recorded an EBITDA loss of Rs 334 million."

He further said the company's restructuring of both the Indian and international operations to enhance sustainability continues.

"Bharat Forge is focusing on incorporating more digital solutions in manufacturing and the company also are making steady progress on further optimisation of its fixed cost," Kalyani added.

Bharat Forge said the domestic automotive industry that was severely impacted by the nationwide lockdown imposed in the first quarter of FY 2021, started showing some signs of recovery from the months of July and August.

As the economy started opening up again in a phased manner and infrastructure projects got on track, fleet utilisation improved sequentially resulting in firming up of freight rates, it stated.

"As a result, every segment of the commercial vehicle (CV) industry witnessed a rise in demand, but demand was more robust on LCV and ICV as compared to the M&HCV segment. The M&HCV production was down 41 per cent in Q2 FY21 compared to the same period last year," it added.

As for the international automotive business, the company said North American and European heavy truck production recovered quicker than expected from the lows of April and May as lockdowns were eased and economies worldwide started opening up.

Demand in both the markets improved gradually over the course of the quarter on the back of increased freight volumes, higher freight rates and some pent-up replacement cycle demand. It is expected to remain stable at the present range in the near term with buyer confidence increasing as the economy recovers and generates ample freight.

On the outlook, he said, "Looking ahead to demand for the coming quarter, the outlook for domestic market is positive but is subject to continued momentum on the investment in infrastructure."

On the export front, Kalyani said there are clear signs of demand improvement, especially in the commercial vehicle segment, but the second wave of Covid-19 cases in Europe and North America and its potential impact on demand is something to keep track of.

Recent developments

DECEMBER 24, 2020; German regulator imposes Euro 32 mn fine on three Bharat Forge companies10

Three companies of Bharat Forge are among several aluminium forging companies in Germany which will pay an aggregate of Euro 175 million for "engaging in illegal competitive agreements".

Germany's national competition regulator – Bundeskartellamt (Federal Cartel Office) - announced the fines on Bharat Forge Aluminiumtechnik GmbH, Bharat Forge CDP GmbH, and Bharat Forge Global Holding GmbH in connection with two separate proceedings.

“The investigation in the above two matters pertained to the period between 2004 and 2018 and was initiated by FCO against several companies in Germany. The company's German subsidiaries were among many such companies," said a statement from Bharat Forge.

Andreas Mundt, President of the Bundeskartellamt, said, “For many years the companies had worked towards the mutual aim of passing on rising costs to their customers in an effort to avoid disadvantages caused by increased costs. For this purpose, senior staff members of the forging companies met regularly and exchanged information on cost factors which are very substantial price components. They encouraged one another to pass on possible increases to their customers.”

The companies were in general agreement that their respective procurement costs and cost increases would be passed on to their customers. At their meetings senior staff members regularly exchanged information on individual costs incurred in their procurement processes and on increased costs for aluminium, energy, and the processing of aluminium into an input material suitable for forging, Bundeskartellamt said in a statement.

The companies’ representatives also discussed how these costs could be passed on to customers and informed each other on the progress they had made in this respect. They also agreed to calculate lifetime reductions only based on their own value creation process and not to apply such reductions to procurement costs as well. Lifetime reductions, referred to as “ratio” by the parties involved, are usually agreed once a supply relationship is started and are meant to take account of future productivity gains, Bundeskartellamt added.

Well-known automotive suppliers and manufacturers are among the key customers of the forging companies as well as companies active in many other business areas, in particular the motorcycle production.

In setting the fine, the Bundeskartellamt took into account in favour of Bharat Forge Aluminiumtechnik GmbH and Presswerk Krefeld GmbH & Co. KG that the leniency applications filed by these companies later on had substantially helped to prove the alleged offence, and that they had cooperated with the authority in uncovering the infringements. These two companies have acknowledged the alleged offence and agreed to a settlement, Bundeskartellamt further added.

“Bharat Forge’s German subsidiaries have reached settlement in an aggregate amount of Euro 32 million to be paid over the next five years. The final settlement for Bharat Forge Aluminiumtechnik GmbH was signed earlier today; the settlement for Bharat Forge CDP GmbH and Bharat Forge Global Holding GmbH is in the final stage and expected to be signed early next year," Bharat Forge added.

The fining decisions are not yet final and can be appealed to the Düsseldorf Higher Regional Court.

References

- ^ https://www.bharatforge.com/company/about-us

- ^ https://www.bharatforge.com/businesses/overview

- ^ https://www.bharatforge.com/businesses/automotive

- ^ https://www.bharatforge.com/businesses/oil-gas

- ^ https://www.bharatforge.com/businesses/aerospace

- ^ https://www.bharatforge.com/businesses/marine

- ^ https://www.bharatforge.com/businesses/rail

- ^ https://www.bharatforge.com/assets/pdf/investor/annual_reports/2020/annual-report-2020.pdf

- ^ https://economictimes.indiatimes.com/markets/stocks/earnings/bharat-forge-q2-results-reports-net-loss-of-rs-1-32-crore/articleshow/79170631.cms

- ^ https://www.moneycontrol.com/news/technology/auto/mercedes-amg-glc-43-coupe-to-be-launched-on-november-3-6010851.html