British American Tobacco Bangladesh

Summary

- British American Tobacco Bangladesh (DSE: BATBC, CSE: BATBC), a part of British American Tobacco PLC, started its journey in the Indian subcontinent in 1910 at Armanitola, Dhaka.

- Currently, BATB is leading the country’s tobacco industry with a 66.6 percent market share (based on sales volume).

- The company has established some premium quality international brands during its journey which they have positioned in four segments-premium, Aspirational Premium, VFM, and low segment.

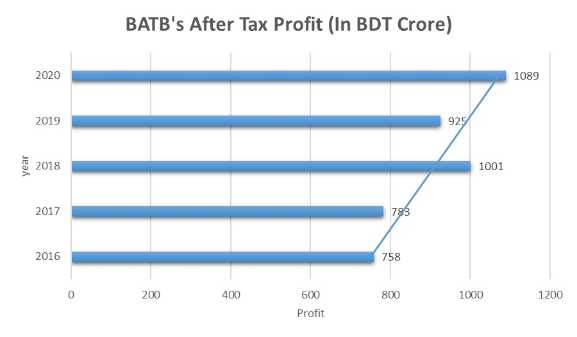

- The company has earned a profit of about BDT 1,088.6 crore in 2020 which is 36.9 percent more than that of 2019.

- BATB made its stock market debut in 1977 by getting listed on the country’s premier bourse – Dhaka Stock Exchange (DSE). In 1996, the company got listed and started trading in Chittagong Stock Exchange (CSE) – the second of the two exchanges in the country.

- The CSR activities of the company in the last couple of decades have earned it several prestigious awards.

Company Overview

British American Tobacco Bangladesh (BATB) is one of the leading multinational corporations in Bangladesh. The company is a part of the global multi-category consumer goods business “British American Tobacco PLC”. BATB started its journey in the Indian subcontinent in 1910 at Armanitola, Dhaka. After the independence of Bangladesh, the company was named Bangladesh Tobacco Company (BTC) in 1972 which was again renamed as British American Tobacco Bangladesh (BATB) in 1998.1

In its 110 years journey in this region, BATB has been committed to building the sustainable development of Bangladesh.

In its 110 years journey in this region, BATB has been committed to building the sustainable development of Bangladesh.

The tobacco industry of Bangladesh mainly has two major players. With a 66.6 percent market share currently BATB is leading the country’s tobacco industry (based on sales volume). One of the major competitors of BATB is Dhaka Tobacco Industries-owned by Akij Group, which is holding the second position in the industry with a 20.5 percent market share.2 Currently, BATB is employing around 1500 people directly and approximately 50,000 people indirectly which includes farmers, local suppliers, and distributors. The British American Tobacco PLC operates in over 180 markets worldwide.

The core business of BATB is manufacturing and selling cigarettes. The company has established some premium quality international brands during its journey. Some of its existing brands are B&H (Benson & Hedges), John Player Gold Leaf, John Player Series, Capstan, Star, Royals, Derby, Pilot, and Hollywood. Even amid the pandemic, the company has earned a profit of about BDT 1,088.6 crore in 2020.3

BATB made its stock market debut in 1977 by getting listed on Dhaka Stock Exchange (DSE). In 1996, the company got listed and started trading in Chittagong Stock Exchange (CSE). Currently, the company’s market category is “A”. BATB is considered to be amongst the first few companies to make it to both the Dhaka and Chittagong Stock Exchange. BATB became the fourth largest listed company at the DSE holding 5.76% of the total market cap. The shareholdings position of BATB is basically held by four entities. They are the govt., the local corporates, the foreign corporates, and the individual investors. The majority (72.91%) share of the company is owned by The Raleigh Investment Co. Ltd.-an investment company located in the UK, the Investment Corporation of Bangladesh (ICB) holds 6.05% of its share, 2.82% of its share is held by Sadharan Bima Corporation, 0.34% of its share is owned by Bangladesh Development Bank Limited, Govt holds 0.64% share, corporate investors hold 14.20% and individual investors own 3.03% of the company’s share.4

BATB has a mission of stimulating the senses of young adults and the vision of creating a better tomorrow. The company is determined to facilitate a transformational journey for all its stakeholders which includes-the consumers, society, employees, and shareholders. It hopes to achieve the purpose through Environmental, Social & Governance (ESG) practices which will further help to build a better Bangladesh.

The activities of BATB in the last couple of decades prove the company’s consciousness of its corporate social responsibilities. CSR activities such as launching afforestation program in 1980, initiating safe drinking water project in 2009, providing free home solar system to rural communities, etc. have earned the company Asia Responsible Entrepreneurship Award in 2014, the Chief Advisor’s Award in 2007, the prestigious Prime Minister’s National Award for four times, and other awards. BATB is the only company in Bangladesh that has received top employer recognition three times in a row. In the tax year 2020-21, the company has been recognized as the highest income taxpayer under the “Manufacturing - Others” category.5

Industry overview

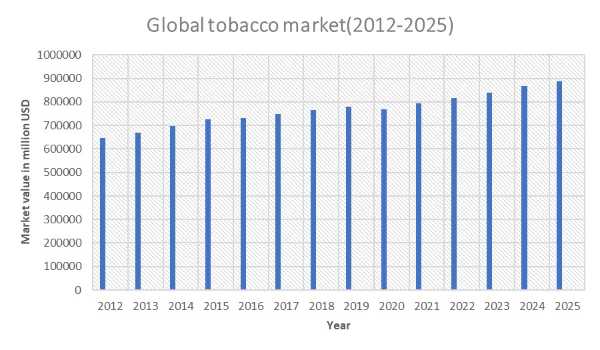

The tobacco industry is one of the most profitable industries in the world. The value of the global tobacco market has amounted to over 760 billion U.S. dollars as of 2020, according to Statista. The value is expected to exceed 888 billion U.S. dollars by 2025. Amid the pandemic, while the other industries were suffering from stagnant demand, the sales of tobacco products bumped up due to lockdowns. Thus, the pandemic barely affected the industry.6

Bangladesh, a country of only 147,570 square kilometers, currently has the eighth largest tobacco market in the world. The country has a huge tobacco consumer base that includes 37.8 million adults aged 15 years and above. Moreover, Cigarette production in the country is increasing at a rate of 2 percent per annum.7 The retail sales of cigarette sticks in Bangladesh were around 83.5 billion in 2018, which was the second-highest retail cigarette sales among 36 countries listed in the Tobacco Transformation Index 2020.

The players of the tobacco market in Bangladesh includes two major players- The British American Tobacco Bangladesh (BATB) with 66.6% market share, Dhaka Tobacco Industries under Akij group with 20.5% market share, and some Smaller domestic companies including Abul Khair Leaf Tobacco, Alpha Tobacco Company, Nasir Gold Tobacco Company, and Sonali Tobacco.

Demand drivers of the tobacco industry

The global tobacco industry is one of the growing industries in the world. Even knowing the irreparable harm tobacco products cause, the educated class comprises the major consumers of this industry. Indeed, there are several reasons responsible for this surge in demand. The key demand drivers of tobacco products are illustrated below -

- From developed regions to developing nations, The demand for tobacco has recently surged worldwide. Increasing population, elevating income levels of the consumers, lenient government regulations, etc. are the reasons behind this surge.

- Numerous premium tobacco products have been introduced in recent past years which has created a positive outlook for the growth of the tobacco market.

- The tobacco companies are spending a huge amount of money on research and development. Consequently, products with reduced levels of toxicants are being introduced which are attracting a larger consumer base.

Demand for tobacco kept increasing despite the outcry that it leads to fatal damages to the human body. It is also harmful to the environment. From growing tobacco to delivering it to retailers, the whole process causes irreversible damage to the environment. For planting tobacco, forests are burnt which causes deforestation. Moreover, the production of tobacco requires a large amount of energy, water, and other resources which causes damage to the environment. The usage of tobacco products increases carbon emissions. While consuming cigarettes, second-hand smoke (generated from burning tobacco products) is produced which contains 7,000 toxic chemicals that pollute both indoor and outdoor environments. The tobacco wastes end up scattered in the environment and cause irreparable harm to the wildlife.

Considering the potential danger of the situation, the Government of Bangladesh came up with numerous acts to control tobacco consumption in the country such as Framework Convention on Tobacco Control (FCTC) in 2003, the Smoking and Tobacco Products Usages (Control) Act in 2005, and so on. These laws have made smoking prohibited in all forms of public places and public transports. But unfortunately, the law is eventually not followed. Rather Smoking in public places and transports has become a common phenomenon and also intolerable to an extent. And so the tobacco control laws have hardly affected the tobacco industry.

Financial performance

BATB has earned an after-tax profit of about BDT 1,088.6 crore for the year ended December 2020 which is 36.9 percent more than that of 2019.8The financial year of BATB is January to December. The company’s Earnings Per Share (EPS) in the last five years shows steady growth. The company has reported BDT 42.12 EPS in 2016, BDT 43.50 in 2017, BDT 55.62 in 2018, BDT 51.37 in 2019, and BDT 60.48 in 2020.9 The Cash and cash equivalents of the company on 31 December 2020 were BDT 5,87 crore. In 2020, the company has given a 600 percent cash dividend while it was 400 percent only in 2019. The company’s final cash dividend in 2020 was BDT 1,080 crore which is the highest dividend in the last five years of the company’s history. The company’s stock dividend ratio is 1:2 and its P/E Ratio is x25.69 as of 3rd March 2021. Moreover, its Dividend Yield is 3.9 percent as of 3rd March 2021.

The interim financial report of BATB shows that the company’s after-tax profit on 30 June 2021 is BDT 862 crore while the profit was BDT 600 crore for the same period in 2020. The company’s earning per share (EPS) on 30 June 2021 was BDT 15.96 which is more than that of 30 June 2020.10 In the quarterly financial statement, the company has reported a profit of BDT 294 crore in its third-quarter this year ended on 30 September 2021 while the profit was BDT 271 crore for the same period a year earlier. The EPS of the company is BDT 21.41 for the nine months ended on 30 September 2021 while the EPS was BDT 16.15 for the same period in 2020.11

Business Overview

BATB’s sales grew by 22.2% in the first nine months of FY21 which is mainly driven by a 23.5% growth in the domestic cigarette sticks sales. The domestic cigarette sticks sales are BDT 45343.6 million in the first nine months of 2021 while the number was 48470.9 for the same period in 2020.12The gross profit margin of the company has increased from 52.9% (First nine months of 2020) to 56.2% for the same period in 2021. Moreover, the stick price of the company has increased by 2.0% in the third quarter of 2021.

Products:

BATB has some well-established international brands that represent the reputation of the company worldwide. The company has positioned its brands into four segments in the Bangladeshi market. BATB has some well-established international brands that speak for the worldwide reputation of the company. The company has positioned its brands into four segments in the Bangladeshi market. The brands with their respective segments are illustrated below -

Benson & Hedges (B&H)

Benson & Hedges is considered to be one of the leading tobacco brands in the Bangladeshi tobacco market. The brand is at the top of BATB’s premium segment. The brand was first introduced in the Bangladeshi market in 1997. The company has upgraded the quality of the product several times and came up with innovative ideas. For example, the company introduced the first-ever capsule cigarette in the market, B&H. The company has also launched the first-ever tube filter in the premium segment -B&H Platinum.

John Player Gold Leaf, John Player Series, and Capstan

BATB has positioned John Player Gold Leaf, John Player Series, and Capstan in the Aspirational Premium segment. The John Player Gold Leaf was first introduced in the Bangladeshi market in 1980 and the brand has stood the test of time with absolute leadership in this segment. The brand is also the highest-selling brand of BATB.

Star

BATB in its VFM segment has Star and Star next. Star was first introduced in the Bangladeshi market in 1964 and Star Next in 2012. Both the brands have a leading position in the market with robust performance.

Derby, Pilot, and Hollywood

BATB has three brands in its low segment. These are Debry, Pilot, and Hollywood. Among the three brands, Derby was launched in 2013, Pilot in 2009, and Hollywood in 2011. All three brands have a reputation in the market. While Derby has now become the biggest brand among target consumers Pilot and Hollywood are also very popular among consumers.

Royals

Royals is a relatively new brand of BATB which was launched in July 2019. Within a year the brand has established itself as a progressive & genuine value for money brand in consumer mind-space.

Recent developments

On December 19, 2021, the company was one of the turnover leaders in the Dhaka Stock Exchange(DSE).13 The company’s shares were closed at BDT 640.10 on 21 December 2021.

- ^ https://www.batbangladesh.com/group/sites/BAT_9T5FQ2.nsf/vwPagesWebLive/DOBVMFVH?opendocument

- ^ https://www.tobaccofreekids.org/problem/toll-global/asia/bangladesh

- ^ https://www.dhakatribune.com/business/2021/02/11/batbc-posts-a-record-year-of-profit-amid-pandemic

- ^ https://www.batbangladesh.com/group/sites/BAT_9T5FQ2.nsf/vwPagesWebLive/DO9T5KFL?opendocument

- ^ https://www.dhakatribune.com/business/2021/11/25/bat-bangladesh-named-top-taxpayer-again

- ^ https://www.npr.org/sections/coronavirus-live-updates/2021/10/27/1049638567/cigarette-sales-increase-smoking-pandemic

- ^ https://thefinancialexpress.com.bd/views/curbing-tobacco-market-through-reshaping-regulatory-policies-1629991070

- ^ https://www.batbangladesh.com/group/sites/BAT_9T5FQ2.nsf/vwPagesWebLive/DOBZKBFU/$FILE/BATB_Annual_Report_2020.pdf?openelement

- ^ https://www.batbangladesh.com/group/sites/BAT_9T5FQ2.nsf/vwPagesWebLive/DOC7PCS9/$FILE/BAT%20Bangladesh_Directors%20Report_2020.pdf?openelement

- ^ https://www.batbangladesh.com/group/sites/BAT_9T5FQ2.nsf/vwPagesWebLive/DOC5CNDH/$FILE/Half-yearly_report_2021.pdf?openelement

- ^ https://www.batbangladesh.com/group/sites/BAT_9T5FQ2.nsf/vwPagesWebLive/DOC86MKP/$FILE/Third_quarter_financial_statement_2021.pdf?openelement

- ^ https://markedium.com/british-american-tobacco-bangladeshs-sales-grew-by-22-2/

- ^ https://www.thedailystar.net/business/news/batbc-leads-drop-stock-index-2045089