Brookfield Asset Management

Summary

- Brookfield Asset Management is a leading global alternative asset manager with over $625 billion of assets under management across real estate, infrastructure, renewable power, private equity and credit.

- The company operate in more than 30 countries on five continents around the world.

- The company's Asset Management activities encompass $312 billion of fee-bearing capital across a broad portfolio of real estate, infrastructure, renewable power, private equity and credit.

- As one of the world's largest investors in real estate, the company own and operate iconic properties in the world's most dynamic markets.

- Brookfield Asset Management is one of the world’s largest infrastructure investors, owning and operating assets across the utilities, transport, midstream and data sectors.

Company Overview

Brookfield Asset Management (NYSE:BAM, TSX:BAM.A) is a leading global alternative asset manager with over $625 billion of assets under management across real estate, infrastructure, renewable power, private equity and credit. The company's objective is to generate attractive long-term risk-adjusted returns for the benefit of its clients and shareholders.1

The company manage a range of public and private investment products and services for institutional and retail clients. The company earn asset management income for doing so and align its interests with its clients by investing alongside them. Brookfield Asset Management has access to large-scale capital enabling it to make investments in sizeable, premier assets and businesses across geographies and asset classes that few managers are able to do.

Subsidiaries

| Ownership Interest Held by Non-Controlling Interests | |||

| As at December 31, | Jurisdiction of Formation | 2020 | 2019 |

| Brookfield Property Partners L.P. (“BPY”) | Bermuda | 38.30% | 44.80% |

| Brookfield Renewable Partners L.P. (“BEP”) | Bermuda | 49.30% | 39.50% |

| Brookfield Infrastructure Partners L.P. (“BIP”) | Bermuda | 71.50% | 70.40% |

| Brookfield Business Partners L.P. (“BBU”) | Bermuda | 36.50% | 37.30% |

Business Segments

Real Estate

As one of the world's largest investors in real estate, the company own and operate iconic properties in the world's most dynamic markets. The company's global portfolio includes office, retail, multifamily, logistics, hospitality, triple net lease, manufactured housing and student housing assets on five continents.2

Office

The company own, develop and manage office properties in key gateway cities in the U.S., Canada, the U.K., Germany, Australia, Brazil, India and South Korea.

- 318 Properties

- 167 M SF Commercial Space

Retail

The company's high-quality retail destinations are central gathering places for the communities they serve, combining shopping, dining, entertainment and other activities.

- 179 Locations, Predominantly In The U.S.

- 154 Million total Square Feet

Multifamily

The company's extensive multifamily portfolio makes it one of the largest owners and managers of residential apartment properties in the U.S. with ownership stakes in approximately 58,000 apartments.

- 156 Properties

- 51,595 Apartments

Hospitality

The company own and actively manage full-service hotels and leisure-style hospitality assets in high-barrier markets across North America, the U.K. and Australia.

- 16 Full-Service Hospitality Properties

- 140 Extended-Stay Hotels

- ~31,000 Rooms

Other

The company drive value in high-quality assets in other sectors such as logistics, triple net lease, manufactured housing and student housing by focusing on leasing, financing, development, construction and facilities management.

- 159 Student Housing Properties

- 306 Triple Net Lease Assets

Infrastructure

Brookfield Asset Management is one of the world’s largest infrastructure investors, owning and operating assets across the utilities, transport, midstream and data sectors.3

The company's portfolio, grounded in 120 years of investment experience, provides diversified exposure to scarce, high-quality businesses with significant barriers to entry.

The company invest in infrastructure assets that deliver essential goods and services—from the movement of passengers and freight over toll roads and rail networks to the distribution of midstream and other products through ports and pipelines, and much more.

Utilities

Regulated or contracted businesses which warn a return on asset base.

- ~7.0 Million Electricity And Gas Connections

- ~4,200 Km Natural Gas Pipeline

- ~2,700 Km Electricity Transmission Lines

Transport

Systems involved in the movement of freight, commodities and passengers.

- 32,300 Km Rail Operations

- ~3,800 Km Toll Roads

- 13 Terminals And 2 Export Facilities

Midstream

Midstream operations that provide transmission and storage services.

- 15,000 Km Transmission Pipeline

- 600 Bcf Natural Gas Storage

- 16 Natural Gas Processing Plants

Data

Businesses that provide essential services and critical infrastructure to transmit and store data globally.

- 150,100 Operational Telecom Towers And Active Rooftop Sites

- 21,500 Km of Fiber Optic Cable And Backbone

- 54 Data Centers

Renewable Power

Brookfield Asset Management is one of the world's largest investors in renewable power, with over 20,000 megawatts of generating capacity. The company's assets, located in North and South America, Europe, India and China, comprise a diverse technology base of hydro, wind, utility-scale solar, distributed generation, storage and other renewable technologies.4

Hydro

The company's hydro power assets are characterized by a perpetual asset life, high cash margins, and storage capacity.

- ~8,000 Mw Hydro Capacity

- 222 Hydro Generation Facilities

- 83 River Systems

Wind

The company's growing wind portfolio is diversified across attractive power markets in North America, South America, Europe and Asia.

- 2006 Development of First Wind Project

- ~5,500 Mw Installed Capacity

Solar

One of the fastest-growing sources of renewable energy, utility-scale solar offers high cash margins and diverse and scalable applications.

- ~2,200 Mw Installed Capacity

- 4 Continents

Energy Transition

The company's Energy Transition business includes its distributed generation and pumped storage assets.

The company's commercial and industrial distributed-solar generation portfolio offers consumers access to power at the point of consumption.

The company's pumped hydro facilities in the U.S. and U.K. help to stabilize the electrical grid.

- ~1,400 Mw Distributed Generation Portfolio

- ~2,700 Mw Pumped Storage Portfolio

Private Equity

The company's private equity business is focused on acquiring high-quality businesses with barriers to entry and enhancing their cash flow capabilities by improving strategy and execution.5

Business Services

The company's services businesses include infrastructure, healthcare, road fuel distribution and marketing, construction and real estate.

- 1000+ Completed Construction Projects

- 600 Kt Biodiesel Production Capacity

Industrials

The company's industrials have strong market positions and include manufacturers of automotive batteries, graphite electrodes, returnable plastic packaging, and sanitation management and development.

- 15 Million Clean-Water Customers In Brazil

- 170,000 Mt Returnable Plastic Packaging Production

Residential

Brookfield Asset Management has residential development operations in North America and Brazil. The company's North American business has operations in 10 key markets across the region.

- 83,000+ Single Family Lots

- 30+ Active Land Communities

Oaktree

Oaktree is a global alternative asset manager with a diversified mix of opportunistic, value-oriented and risk-controlled investments across credit and other investment offerings.6

Oaktree’s experienced team of investment professionals, global platform and unifying investment philosophy—based on its six tenets of risk control, consistency, market inefficiency, specialization, bottom-up analysis and disavowal of market timing—have made it an acknowledged leader in credit investing.

In 2019, Brookfield acquired a majority interest in Oaktree, and it continues to operate as a standalone business. The two firms share fundamental values and an approach to investing that is long-term, value-driven and contrarian, with a focus on the downside protection of capital.

Together, Brookfield and Oaktree have $600 billion of assets under management and provide investors with one of the most comprehensive offerings of alternative investment products available today.

Insurance Solutions

At Brookfield, the company provide capital efficient investment vehicles to its longstanding institutional insurance investors and the company deploy its own capital into the insurance sector through direct equity investments, reinsurance arrangements and hybrid solutions.7

The company's Insurance Solutions team is led by a group of experienced investment and insurance professionals. Leveraging its investment management capabilities across Brookfield and Oaktree, the company seek to match long-duration liabilities with portfolios of high-quality investments to generate attractive, risk-adjusted returns for it and its partners.

Business Overview

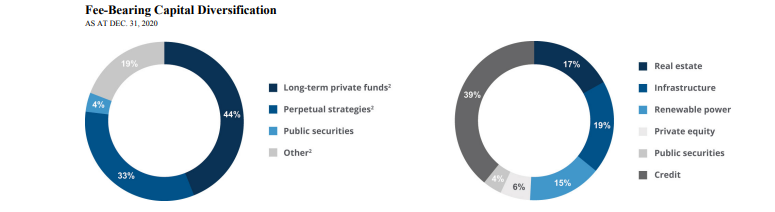

The company's Asset Management activities encompass $312 billion of fee-bearing capital across a broad portfolio of real estate, infrastructure, renewable power, private equity and credit, and Brookfield Asset Management has approximately $33 billion of additional committed capital that will be fee-bearing when invested. This capital is managed within long-term private funds, perpetual strategies and public securities1 . Together with its investment in Oaktree, Brookfield Asset Management has approximately 2,000 unique institutional investors across its private funds business.8

Long-term Private Funds – $84 billion fee-bearing capital

The company manage and earn fees on a diverse range of real estate, renewable power, infrastructure, private equity and credit funds. These funds are long duration in nature and include closed-end value-add, credit and opportunistic strategies.

Perpetual Strategies – $94 billion fee-bearing capital

The company manage perpetual capital in its publicly listed affiliates1 , as well as core and core plus private funds, which can continually raise new capital.

Credit Strategies – $121 billion fee-bearing capital

The company hold an approximate 62% interest in Oaktree, which provides a diverse range of long-term private fund and perpetual strategies to its investor base. Similar to its long-term private funds, the company earn base management fees and carried interest on Oaktree’s fund capital.

Public Securities – $13 billion fee-bearing capital

The company manage publicly listed funds and separately managed accounts, focused on fixed income and equity securities across real estate, infrastructure and natural resources. The company earn base management fees, which are based on committed capital and fund NAV, and performance income based on investment returns.

Invested Capital

Brookfield Asset Management has approximately $58 billion of invested capital on its balance sheet as a result of its history as an owner and operator of real assets. This capital provides attractive financial returns and important stability and flexibility to its asset management business.

Global Reach

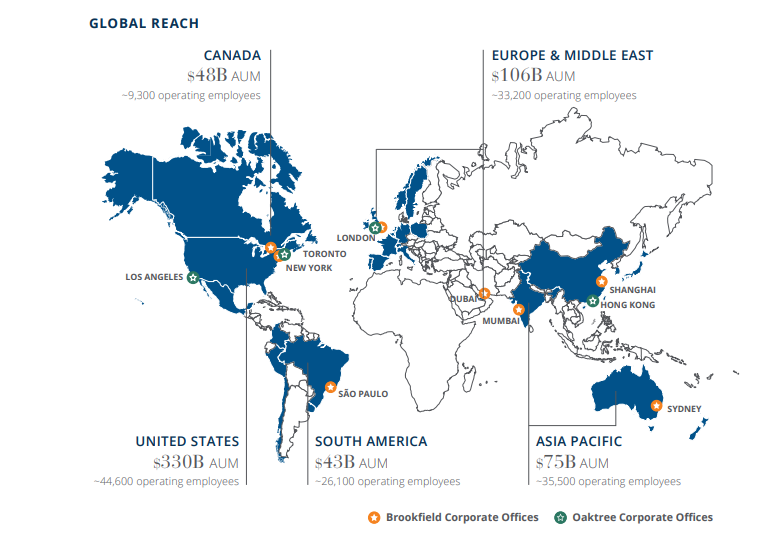

The company operate in more than 30 countries on five continents around the world.

The company's global reach allows it to diversify and identify a broad range of opportunities. Brookfield Asset Management is able to invest where capital is scarce, and its scale enables it to move quickly and pursue multiple opportunities across different markets. The company's global reach also allows it to operate its assets more effectively: the company believe that a strong on-the-ground presence is critical to operating successfully in many of its markets, and many of its businesses are truly local. Furthermore, the combination of its strong local presence and global reach allows it to bring global relationships and operating practices to bear across markets to enhance returns.

Financial Highlights

Net income was $707 million in the year 2020, with a $134 million loss attributable to common shareholders ($0.12 per share) and the remaining income attributable to non-controlling interests.

The $4.6 billion decrease in consolidated net income and the $2.9 billion decrease in net income attributable to common shareholders were primarily attributable to:

- valuation losses of $1.7 billion in its real estate business both on consolidated and equity accounted investment properties mostly within its retail properties;

- an income tax expense of $837 million compared to $495 million in the prior year. The prior period benefited from the recognition of previously unrecognized tax losses; and

- higher depreciation expense primarily as a result of recent acquisitions; partially offset by

- contributions from acquisitions over the last twelve months.

Revenues for the year were $62.8 billion, a decrease of $5.1 billion compared to 2019, primarily due to the impact of the global economic shutdown.

Direct costs decreased by 10% or $5.3 billion compared to a 7% decrease in revenues. The decrease is primarily due to the aforementioned lower volumes at Greenergy and cost saving initiatives across a number of its businesses. These decreases were offset by higher direct costs related to recent acquisitions, net of dispositions, as well as incremental costs associated with organic growth initiatives at its operations.

Other income and gains of $785 million relate primarily to the sale of Nova Cold Logistics ULC (“Nova Cold”)1 in the first quarter, Simply Storage Inc. and Healthscope’s pathology business in the fourth quarter, as well as the partial sale of Dalrymple Bay Coal Terminal (“DBCT”)1 in the fourth quarter.

Depreciation and amortization expense increased by $915 million to $5.8 billion due to businesses acquired in the year, as well as the impact of revaluation gains in the fourth quarter of 2019, which increased the current year’s opening balance of its property, plant and equipment (“PP&E”) from which the current year depreciation is determined. These increases were partially offset by the impact of recent dispositions and foreign exchange.

Income tax expense increased by $342 million primarily attributable to the absence of the prior year deferred income tax recovery of $475 million which relates to the recognition of deferred tax assets due to the projected utilization of net operating loss carryforwards.

Q2 2021 Result

August 12, 2021; Brookfield Asset Management Inc announced financial results for the quarter ended June 30, 2021.9

Nick Goodman, CFO of Brookfield, stated, “The company's business performed very well during the quarter, recording $1.2 billion of distributable earnings. Growth in its asset management franchise, steady returns on its principal investments and continued momentum on its capital recycling initiatives all contributed to the strong quarter. Subsequent to quarter end, the company held the first close of $9 billion for its fourth flagship real estate fund, and its $7 billion founders’ close for its Global Transition Fund, taking total fundraising since last quarter to $24 billion. The company expect the size of these two funds to exceed $30 billion before they close for capital.”

Funds from operations (FFO) and net income in the quarter were strong at $1.6 billion and $2.4 billion, respectively, both very large increases over last year.

The company's distributable earnings continue to show strong growth, recording $1.2 billion for the quarter, and $6.3 billion over the last twelve months, a 108% increase over the comparative period. The strong performance in the quarter is supported by a 49% increase in fee-related earnings, continued carried interest realizations, increased distributions from its principal investments, and disposition gains recognized on its principal investments.

Monetization activity continued during the quarter as the company sold $8 billion of investments, returned $6 billion to clients, and realized $335 million of gross carried interest in the process, taking the total realized since the beginning of the year to more than $1 billion. Investment performance was also very strong in the quarter with its unrealized carried interest balance, not recorded in its financial accounts, increasing to $6.2 billion.

Fee-bearing capital increased to $325 billion during the quarter, an increase of approximately $48 billion over the last twelve months, leading to a $334 million increase in fee-related earnings over the same period.

The company recorded $1.5 billion of realized carried interest into income over the last twelve months, including $335 million during the quarter.

Annualized fee revenues and target carried interest now stand at a run-rate of $6.7 billion.

As at June 30, 2021, the company had $78 billion of capital available to deploy into new investments.

Recent developments

Brookfield Asset Management and Elion Partners Announce $1 Billion Strategic Partnership 10

September 23, 2021; Brookfield Asset Management (“Brookfield”) and Elion Partners (“Elion”), a vertically integrated industrial specialist and sponsor of institutional real estate vehicles, today announced a $1 billion strategic partnership expanding Brookfield’s Real Estate Secondaries’ logistics portfolio across core infill markets.

Brookfield recapitalized Elion Logistics Park 55 (“ELP 55”), a Chicago master-planned industrial park with the potential to develop approximately $1 billion of industrial real estate. The project includes five existing Class A industrial assets totaling four million square feet that are 100% leased, as well as the potential to develop up to 15 million square feet of additional industrial properties going forward. The master-planned logistics park is located adjacent to the BNSF railway, offers numerous tenant amenities including essential travel and repair services, and benefits from tax increment financing. Park Madison Partners acted as the exclusive capital advisor for recapitalization.

“Industrial logistics real estate continues to experience positive momentum, and now is the logical time to seek long-term capital,” said Juan DeAngulo, Managing Partner at Elion. “This partnership structure and Brookfield’s support will enable Elion to fulfill the long-term development plans for ELP 55.”

“Brookfield Asset Management is excited about the partnership with Elion and the opportunity to gain exposure to high-quality industrial assets in supply-constrained markets with significant potential upside,” said Chris Reilly, Managing Partner at Brookfield.

The investment also included an $80 million equity commitment to Elion’s latest affiliated value-added fund, Elion Real Estate Fund V, which held its final closing last month achieving its hard cap of $500 million. A majority of Fund V’s portfolio was prespecified upon Brookfield’s commitment, representing more than 3.2 million square feet of logistics real estate across infill coastal markets.

Brookfield, one of the world's largest investors in real estate with over $200 billion in AUM, launched its Real Estate Secondaries business a year ago. The strategy is focused on GP investors who are looking for flexibility and liquidity in managing their private market investments.

References

- ^ https://bam.brookfield.com

- ^ https://www.brookfield.com/our-businesses/real-estate

- ^ https://www.brookfield.com/our-businesses/infrastructure

- ^ https://www.brookfield.com/our-businesses/renewable-power

- ^ https://www.brookfield.com/our-businesses/private-equity

- ^ https://www.brookfield.com/our-businesses/oaktree

- ^ https://www.brookfield.com/our-businesses/insurance-solutions

- ^ https://www.brookfield.com/sites/default/files/2021-05/BAM-2020AnnualReport.pdf

- ^ https://bam.brookfield.com/sites/brookfield-ir/files/brookfield/bam/home/q2-2021-press-release.pdf

- ^ https://www.businesswire.com/news/home/20210923005245/en/