CGI

Summary

- Founded in 1976 and headquartered in Montréal, Canada, CGI is among the largest information technology (IT) and business consulting services firms in the world.

- CGI employs approximately 82,000 consultants and professionals worldwide.

- CGI delivers end-to-end services that cover the full spectrum of technology delivery; from digital strategy and architecture to solution design, development, integration, implementation, and operations.

Company Overview

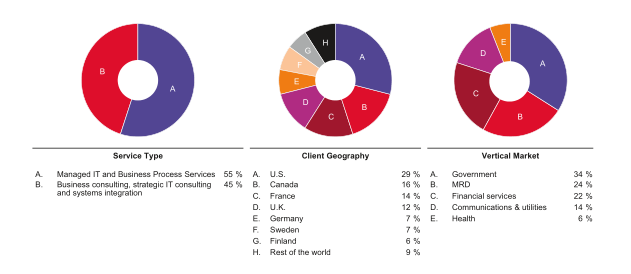

Founded in 1976, CGI (NYSE:GIB, TSX:GIB) is among the largest independent IT and business consulting services firms in the world. With 82,000 consultants and professionals across the globe, CGI delivers an end-to-end portfolio of capabilities, from strategic IT and business consulting to systems integration, managed IT and business process services and intellectual property solutions. CGI works with clients through a local relationship model complemented by a global delivery network that helps clients digitally transform their organizations and accelerate results. CGI Fiscal 2021 reported revenue is $12.13 billion.1

Services and Solutions

CGI delivers end-to-end services that cover the full spectrum of technology delivery; from digital strategy and architecture to solution design, development, integration, implementation, and operations.

- Business consulting, strategic IT consulting and systems integration: CGI helps clients define their digital strategy and roadmap, and advance their IT modernization initiatives through an agile, iterative approach that facilitates innovation, connection and optimization of mission-critical systems to deliver enterprise-wide changes.

- Managed IT and business process services: The company's clients entrust it with full or partial responsibility for their IT and business functions to help them become more agile and to build resilience into their technology supply chains. In return, the company deliver innovation, significant efficiency gains, and cost savings. Typical services in an end- to-end engagement include: application development, integration and maintenance; technology infrastructure management; and business process services, such as collections and payroll management. Managed IT and business process services contracts are long-term in nature, with a typical duration greater than five years, allowing its clients to reinvest savings, alongside CGI, in their digital transformation.

- Intellectual property (IP): Designed in collaboration with clients, its IP solutions act as business accelerators for the industries the company serve. These include business solutions, some of which are cross industry, encompassing commercial software embedded within its end-to-end-services, and digital enablers such as methodologies and frameworks to drive change across business and IT processes. IP solutions are embedded within Business consulting, strategic IT consulting and systems integration, as well as within Managed IT and business process services

Services

- Business consulting

- Systems integration

- Managed IT services

- Application services

- Infrastructure services

- Business process services

Key Topics

- Digital transformation

- Advanced analytics

- Intelligent automation

- Cloud & IT modernization

- Cybersecurity

- Sustainability

Solutions

- CGI Collections360

- CGI Advantage

- CGI Trade360

- CGI OpenGrid360

- CGI All Payments

Subsidiary

| Name of subsidiary | Country of incorporation |

| CGI Technologies and Solutions Inc. | United States |

| CGI France SAS | France |

| CGI Federal Inc. | United States |

| CGI IT UK Limited | United Kingdom |

| CGI Information Systems and Management Consultants Inc. | Canada |

| Conseillers en gestion et informatique CGI Inc. | Canada |

| CGI Deutschland B.V. & Co KG | Germany |

| CGI Sverige AB | Sweden |

| CGI Suomi OY | Finland |

| CGI Information Systems and Management Consultants Private Limited | India |

| CGI Nederland BV | Netherlands |

Financial Overview

CGI has long-standing and focused practices in all of its core industries, providing clients with a partner that is not only an expert in IT, but also an expert in their respective industries. This combination of business knowledge and digital technology expertise allows it to help its clients navigate complex challenges and focus on how to create value. In the process, the company evolve the services and solutions the company deliver within its targeted industries.2

On December 31, 2020, the Company acquired the assets of Harris, Mackessy & Brennan, Inc.’s (HMB) Professional Services Division, a division focused on high-end technology consulting and services for commercial and government clients, based in the United States and headquartered in Columbus, Ohio. The acquisition added approximately 165 professionals to the Company.

On October 1, 2021, the Company acquired Array Holding Company, Inc. a leading digital services provider that optimizes mission performance for the U.S. Department of Defense and other government organizations, based in the United States and headquartered in Greenbelt, Maryland. The acquisition added approximately 275 professionals to the Company.

On October 28, 2021, the Company acquired Cognicase Management Consulting, a leading provider of technology and management consulting services and solutions for over 25 years, primarily in the Spanish market, headquartered in Madrid, Spain. The acquisition added approximately 1,500 professionals to the Company. The Company completed these acquisitions for a total purchase price of $156.4 million

Bookings for the year were $13.8 billion representing a book-to-bill ratio of 114.2%.

Revenue

For the year ended September 30, 2021, revenue was $12,126.8 million, a decrease of $37.3 million, or 0.3% over the same period last year. On a constant currency basis, revenue increased by $132.1 million or 1.1%. The increase was mainly due to growth within the government, financial services and communications & utilities vertical markets, mainly driven by the Central and Eastern Europe, Canada and Western and Southern Europe segments, as well as recent business acquisitions. This was partially offset by the impact of COVID-19 in the first half of Fiscal 2021, mainly affecting the MRD vertical market.

Western and Southern Europe

For the year ended September 30, 2021, revenue in its Western and Southern Europe segment was $1,963.8 million, an increase of $52.3 million or 2.7% over the same period last year. On a constant currency basis, revenue increased by $47.2 million or 2.5%. The increase in revenue was driven by growth within the government and financial services vertical markets, as well as the prior year's acquisition. This was partially offset by the impact of COVID-19 in the first half of Fiscal 2021, mainly affecting the MRD and communications & utilities vertical markets.

U.S. Commercial and State Government

For the year ended September 30, 2021, revenue in its U.S. Commercial and State Government segment was $1,800.7 million, a decrease of $62.7 million or 3.4% over the same period last year. On a constant currency basis, revenue increased by $51.4 million or 2.8%. The increase was due to recent acquisitions, as well as higher work volumes within the financial services vertical market. This was in part offset by lower work volume in the state and local government market, including adjustments due to a reevaluation of cost to complete on a project.

Canada

For the year ended September 30, 2021, revenue in its Canada segment was $1,755.8 million, an increase of $69.5 million or 4.1% compared to the same period last year. On a constant currency basis, revenue increased by $68.8 million or 4.1%. The increase was mainly due to growth within the financial services, communications & utilities and MRD vertical markets.

U.S. Federal

For the year ended September 30, 2021, revenue in its U.S. Federal segment was $1,607.4 million, a decrease of $104.8 million or 6.1% over the same period last year. On a constant currency basis, revenue decreased by $1.6 million or 0.1%. The change was driven by lower transaction volumes from its travel related IP business process services, mainly due to the impact of COVID-19, and a decrease in project related equipment sales. This was partially offset by higher work volumes in application support and cybersecurity services, as well as the prior year's acquisition.

U.K. and Australia

For the year ended September 30, 2021, revenue in its U.K. and Australia segment was $1,355.6 million, a decrease of $2.9 million or 0.2% over the same period last year. On a constant currency basis, revenue decreased by $16.3 million or 1.2%. The change was mainly due to the successful completion of projects within the communications & utilities vertical market, in part offset by growth within the government vertical market.

Central and Eastern Europe

For the year ended September 30, 2021, revenue in its Central and Eastern Europe segment was $1,303.9 million, an increase of $91.7 million or 7.6% over the same period last year. On a constant currency basis, revenue increased by $87.9 million or 7.3%. The increase in revenue was primarily due to higher work volume and new managed IT service revenues within the government and financial services vertical markets, the prior year's acquisition and additional IP license sales. This was partially offset by the impact of COVID-19 in the first half of Fiscal 2021, mainly affecting the MRD vertical market.

Scandinavia

For the year ended September 30, 2021, revenue in its Scandinavia segment was $1,027.9 million, a decrease of $76.2 million or 6.9% over the same period last year. On a constant currency basis, revenue decreased by $115.1 million or 10.4%. The decrease was mainly driven by lower work volume and projects successfully completed within the government and MRD vertical markets, in part due to the impact of COVID-19, as well as the sale of a non-profitable business related to a past acquisition.

Finland, Poland and Baltics

For the year ended September 30, 2021, revenue in its Finland, Poland and Baltics segment was $769.0 million, a decrease of $8.2 million or 1.0% over the same period last year. On a constant currency basis, revenue decreased by $11.3 million or 1.4% due to lower work volumes in both government and MRD vertical markets, in part impacted by COVID-19 in the first half of Fiscal 2021.

Asia Pacific

For the year ended September 30, 2021, revenue in its Asia Pacific segment was $680.6 million, an increase of $5.6 million or 0.8% over the same period last year. On a constant currency basis, revenue increased by $46.7 million or 6.9%. The increase was mainly driven by the continued demand for its offshore delivery centers, predominantly within the financial services and communications & utilities vertical markets, primarily in North America.

Costs of Services, Selling

For the year ended September 30, 2021, costs of services, selling and administrative expenses amounted to $10,178.2 million, a decrease of $123.9 million over the same period last year. As a percentage of revenue, costs of services, selling and administrative expenses decreased to 83.9% from 84.7%. As a percentage of revenue, costs of services improved compared to the same period last year due to improved utilization and actions taken to lower expenses due to COVID-19, in part offset by lower performance based compensation in the prior year. As a percentage of revenue, selling and administrative expenses increased compared to the same period last year due to lower performance based compensation in the prior year.

During the year ended September 30, 2021, the translation of the results of its foreign operations from their local currencies to the Canadian dollar favourably impacted costs by $130.9 million, partially offsetting the unfavourable translation impact of $169.4 million on its revenue

EBIT

For the year ended September 30, 2021, adjusted EBIT increased to 1,952,16 form 1,862,94 and margin increased to 16.1% from 15.3% for the same period last year. The increase was mainly due to improved utilization, lower discretionary expenses mainly due to COVID-19, decrease in amortization of client relationships, as well as prior year non-recurring adjustments on client contracts. This was partly offset by the impact of lower performance based compensation in the prior year, mainly due to COVID-19.

Income Tax Expense

For the year ended September 30, 2021, income tax expense was $468.9 million compared to $398.4 million over the same period last year, while its effective tax rate decreased to 25.5% from 26.3%. The decrease in the income tax rate is mainly attributable to lower acquisition-related and integration costs, as well as restructuring costs.

Net earnings excluding specific items for the year ended September 30, 2021 $1,374,873 and $1,300,072 for the last year.

For the year ended September 30, 2021, the company increased its long-term debt by $1,885.3 million, mainly driven by the issuance of senior unsecured notes for an amount of $1,847.3 million as outlined in the section 2.5. of the present document, and repaid $1,888.8 million of its long-term debt mainly driven by the repayment in full of the 2020 Term Loan in an amount of $1,583.5 million (US$1,250.0 million), and the scheduled repayments of senior unsecured notes in the amount of $259.7 million. The company also paid $169.7 million of lease liabilities. For the year ended September 30, 2020, the Company received through the 2020 Term Loan an amount of $1,764.7 million (US$1,250.0 million), repaid $334.4 million under its unsecured committed revolving credit facility, and made scheduled repayments of senior unsecured notes in the amount of $65.9 million. In addition, the company paid $175.3 million of lease liabilities and used $28.3 million to repay debt assumed from business acquisitions.

Q1-F2022 results

For the first quarter of F2022, the Company reported revenue of $3.09 billion, representing a year-over-year increase of 2.4% when incorporating unfavorable impacts from foreign currency fluctuations. On a constant currency basis, revenue grew by 6.8% year-over-year.3

Adjusted EBIT was $521.5 million, up 5.2% year-over-year, with an EBIT margin of 16.9% representing an improvement of 50 basis points from 16.4% in the same period last year.

On a GAAP basis, net earnings were $367.4 million, up 7.0% compared with the same period last year. Diluted earnings per share, as a result, were $1.49 compared to $1.32 last year, representing an increase of 12.9%.

Excluding acquisition-related and integration costs, net of tax, net earnings were $369.4 million, representing an increase of 6.4% or $22.2 million year-over-year and a margin of 11.9%. On the same basis, diluted earnings per share expanded by 12.8% to $1.50, up from $1.33 from the same period last year.

Bookings were $3.60 billion, representing a book-to-bill ratio of 116.5%. As of December 31, 2021, the Company's backlog stood at $23.58 billion or 1.9x annual revenue.

Cash provided by operating activities was $484.3 million, or 15.7% of revenue. Over the last twelve months ending December 31, 2021, cash provided by operating activities was 2,002.8 million, or 16.4% of revenue.

As at December 31, 2021, net debt stood at $2.69 billion, up from $2.67 billion at the same time last year. The net debt-to-capitalization ratio stood at 27.8% at the end of December 2021.

Recent developments

CGI completes acquisition of Unico

1-Mar-22; CGI announces that its subsidiary, CGI Technology and Solutions Australia Pty Limited, has completed its planned acquisition of Unico, a technology consultancy and systems integrator based in Melbourne, Australia, following successful approval by Australia’s Foreign Investment Review Board.4

Unico, which was established in 1984, brings approximately 130 largely Melbourne-based professionals to CGI, significantly increasing its headcount in Australia. The team will join CGI’s existing business in Australia, which forms part of the UK and Australia Strategic Business Unit.

“Joining forces with Unico will help its clients further realize new opportunities through the digital transformation of their value chains. Unico’s services, solutions and highly skilled employees strengthens its services portfolio and united end-to-end services capabilities in Australia. I warmly welcome the Unico team to the CGI family.”

Tara McGeehan, CGI’s UK & Australia President.

“It’s clear that its organisations have a similar corporate culture and shared values,” said Mark Aston, Senior Vice President and Business Unit Leader for UK North and Australia at CGI. “The company expect its integration to be smooth and successful, quickly delivering value to its three stakeholders – its clients, its shareholders and its professionals.

“The company strongly believe that this merger will accelerate its diversification into new industries and provide the best growth opportunity across both organisations, including new career opportunities, access to extensive training and development, offshore expertise, and an extended client base.”

The merger, combined with the recent opening of CGI’s Space, Defence and Intelligence Hub in Adelaide, will expand and accelerate CGI’s footprint in Australia and its position as a leading provider of secure and flexible end-to-end services, including business and strategic IT consulting, systems integration, managed services and intellectual property-based business solutions.