Cameco

Summary

- Cameco is one of the largest global providers of the uranium fuel needed to energize a clean-air world.

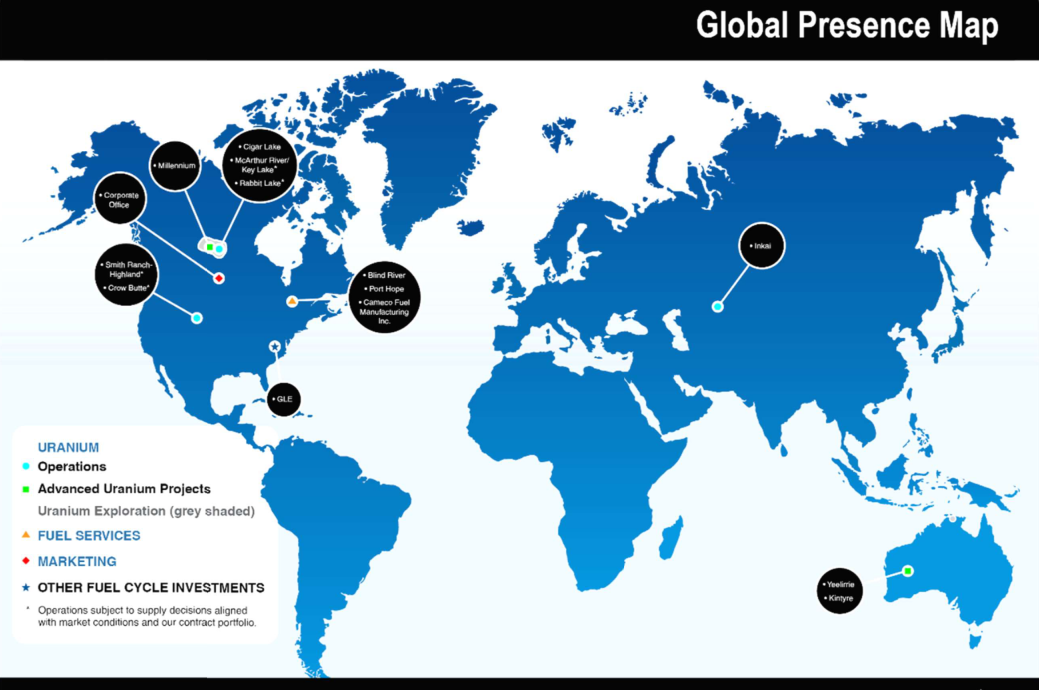

- Cameco's uranium assets are located on three continents – North America, Asia and Australia

- Cameco has the licensed capacity to produce more than 30 million pounds of uranium concentrates annually

- The company is one of Canada’s largest employers of Indigenous people, and land holdings, including exploration, span about 2.1 million acres

Company Overview

Cameco (NYSE:CCJ, TSX:CCO) is one of the largest global providers of the uranium fuel needed to energize a clean-air world. Utilities around the world rely on its nuclear fuel products to generate safe, reliable, emissions-free nuclear power. Together, Cameco is meeting the ever-increasing demand for clean, baseload electricity while delivering energy solutions to support the world's net-zero goals. 1

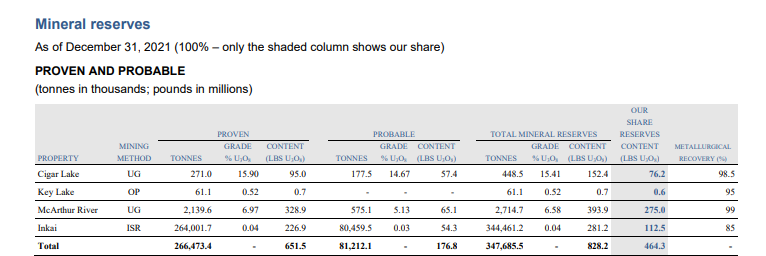

Cameco has interests in tier-one mining and milling operations that have the licensed capacity to produce more than 30 million pounds of uranium concentrates annually, backed by more than 464 million pounds of proven and probable mineral reserves. Cameco is also a leading supplier of uranium refining, conversion and fuel manufacturing services.

Cameco is proud to be one of Canada’s largest employers of Indigenous people, and its land holdings, including exploration, span about 2.1 million acres, the majority near its existing operations in northern Saskatchewan.

Company History

Cameco is created by the merger of two Crown corporations—Saskatchewan Mining Development Corporation and Eldorado Nuclear Limited.2

| Year | Milestones |

| 1988 | Cameco is created by the merger of two Crown corporations—Saskatchewan Mining Development Corporation and Eldorado Nuclear Limited. |

| 1991 | Cameco completes its initial public offering and shares begin trading on the Toronto and Montreal stock exchanges |

| 1996 | Cameco shares begin trading on the New York Stock Exchange |

| 1998 | Cameco acquires Canadian-based Uranerz Exploration and Mining Limited and Uranerz U.S.A., Inc., increasing its reserves and resources and production levels by about 30% |

| 1999 | Cameco sells a 14% interest in McArthur River and 17% in Key Lake to Cogema Resources Inc. Cameco begins mining at McArthur River, the world's largest high-grade uranium mine. |

| 2001 | Cameco announces that reserves at McArthur River increased by more than 50%. |

| 2002 | Cameco increases its stake in Bruce Power to 31.6% |

| 2004 | Cameco announces development of uranium mine at Inkai, Kazakhstan. |

| 2004 | Cameco decides to proceed with construction of a new mine at Cigar Lake in northern Saskatchewan. |

| 2005 | Cameco negotiates a toll-processing agreement with British Nuclear Fuels plc (BNFL) to secure 5 million kgU of additional conversion services from BNFL's Springfields plant in the United Kingdom. |

| 2006 | Cameco acquires a 100% interest in Zircatec Precision Industries, Inc. Zircatec's primary business is manufacturing nuclear fuel bundles and other components for Candu reactors. |

| 2007 | Cameco signs a non-binding memorandum of understanding with Kazatomprom to co-operate on the development of uranium conversion capacity and to pursue additional uranium production. |

| 2008 | Cameco acquires a 70% interest in the Kintyre uranium exploration project in Western Australia. |

| 2010 | Cameco signs two key uranium supply agreements with China Guangdong Nuclear Power and China Nuclear Energy Industry Corporation for a total commitment of 52 million pounds of uranium concentrate. |

| 2011 | Cameco announces that agreements have been signed with the owners of the Cigar Lake project and McClean Lake mill to process all Cigar Lake ore at McClean Lake. |

| 2011 | Cameco has signed two agreements to buy uranium produced at the Sotkamo nickel-zinc mine in eastern Finland owned by the Talvivaara Mining Company Plc. (LSE: TALV). |

| 2012 | Cameco announces the completion of the acquisition of the Yeelirrie uranium project in Western Australia. |

| 2013 | Cigar Lake receives operating licence. |

| 2013 | Cameco starts production from North Butte uranium mine. |

| 2014 | Cameco announces start of ore production at Cigar Lake mine. |

| 2015 | Cameco and Areva officially mark the grand opening of Cigar Lake on September 23rd |

| 2016 | Athabasca Basin Communities Renew Partnership with the Uranium Mining Industry |

| 2016 | Cameco and Kazatomprom Sign Agreement to Restructure JV Inkai |

| 2018 | JV Inkai Restructuring Takes Effect January 1, 2018 |

| 2021 | Cameco Sells Shares of UEX Corporation |

Operations

Cameco's uranium assets are located on three continents – North America, Asia and Australia - and its operations span the nuclear fuel cycle from exploration to fuel manufacturing.3

The company's geographically diverse uranium assets include a large portfolio of low-cost mining operations, extensive mineral reserves and resources, as well as exploration and development projects.

Uranium Operations

Cameco is one of the largest global providers of the uranium fuel needed to energize a clean-air world.

Cameco has interests in tier-one mining and milling operations that have the licensed capacity to produce more than 30 million pounds of uranium concentrates annually, backed by more than 464 million pounds of proven and probable mineral reserves. The company's operations and projects are diversified by geography and deposit type, backed up by extensive mineral reserves and resources. All of Cameco's operations demonstrate the company's high standards for safety, health and environmental performance.

Canada

The Athabasca Basin in northern Saskatchewan, Canada, is home to high-grade uranium reserves with ore grades up to 100 times the world average. Cameco's operations here include the two highest grade mines in the world.

- Cigar Lake

- McArthur River/Key Lake

- Rabbit Lake

Kazakhstan

Cameco owns a 40% share in Joint Venture Inkai's in situ recovery uranium mine in south central Kazakhstan. The remaining 60% belongs to Kazatomprom, majority-owned by the government of Kazakhstan.

- Inkai

United States

The Smith Ranch-Highland and Crow Butte operations use in situ recovery methods.

- Crow Butte

- Smith Ranch-Highland

Uranium Projects

Cameco's uranium projects are properties that may be developed into uranium-producing operations at some point in the future. The most significant are Yeelirrie and Kintyre in Australia, and the Millennium deposit in the Athabasca Basin of Saskatchewan. Work on all of its projects has been scaled back and will continue at a pace aligned with market signals.

The stage-gate process includes several defined decision points in the assessment and development stages. At each point, the company re-evaluate the project based on current economic, competitive, social, legal, political and environmental considerations. If a project continues to meet its criteria, the company proceed to the next stage. This process allows it to build a pipeline of projects ready for a production decision and minimize expenditures on projects whose feasibility has not yet been determined.

Millennium

The Cree Extension-Millennium project is a Cameco-operated joint venture located in the southeastern portion of Canada's Athabasca Basin. It is approximately 35 km north of Cameco's Key Lake operation.

Yeelirrie

Yeelirrie is one of Australia's largest undeveloped uranium deposits. The deposit is located approximately 650 km northeast of Perth and approximately 750 km south of Cameco's Kintyre project.

Kintyre

Kintyre is an advanced-stage exploration project located at the western edge of the Great Sandy Desert in the East Pilbara region of Australia.

Fuel Services

Cameco is a prominent supplier of uranium processing services required to produce fuel for the generation of clean electricity. The company operate the world's largest commercial refinery in Blind River, have about 21% of the world UF6 primary conversion capacity in Port Hope, and are a leading manufacturer of fuel assemblies and reactor components for CANDU reactors at its facilities in Port Hope and Cobourg.

The company's focus is on cost-competitiveness and operational efficiency. The company's fuel services segment is strategically important because it helps support the growth of the uranium segment. Offering a range of products and services to customers helps it broaden its business relationships and expand its uranium market share.

Refining

Cameco's Blind River operation is the world's largest uranium refinery producing an intermediate product in the nuclear fuel cycle.

Conversion

The Port Hope Conversion Facility provides uranium dioxide (UO2) and uranium hexafluoride (UF6) conversion services for nuclear operators around the world.

Fuel Manufacturing

Cameco Fuel Manufacturing produces fuel bundles for CANDU reactors and also provides reactor components and consulting services to CANDU operators around the world.

Industry Overview

In 2021, there was a significant improvement in uranium prices and market sentiment. Spot uranium prices for the year were up nearly 40%, reaching their highest level in nine years. The uranium available in the spot market thinned driven by record spot market purchases primarily by the Sprott Physical Uranium Trust, which has purchased approximately 26 million pounds since its inception in 2021, but also including other financial funds, producers and junior uranium companies who have indicated that the long-term fundamentals point to growing demand and supply uncertainty. The thinning of material available in the spot market and rising spot uranium prices motivated some utilities to return to the term market both with on-market RFPs as well as continued off-market contracting. As a result, the long-term price increased by 22%, ending the year at $42.75 (US) per pound. Despite an increase in contracting in the long-term market, the volume of uranium executed under long-term contracts remained well below annual consumption levels, continuing the inventory destocking that was already underway in the industry and adding to the growing wedge of uncovered requirements that the company believe will need to be filled at a time when the availability of sufficient supply is not guaranteed. With a renewed focus on security of supply the company believe Cameco is in the early stages of a market transition, with utilities turning to proven producers and assets to meet their uncovered requirements.4

Durable demand growth

The benefits of nuclear energy came clearly into focus with a durability the company believe has not been previously seen, driven by the accountability created by the net-zero carbon targets being set by countries and companies around the world. These targets are turning attention to a triple challenge. First, is to lift one-third of the global population out of energy poverty by growing clean and reliable baseload electricity. Second, is to replace 85% of the current global electricity grids that run on carbonemitting sources of thermal power with a clean, reliable alternative. And finally, is to grow global power grids by electrifying industries, such as private and commercial transportation, home, and industrial heating, largely powered with carbon-emitting sources of thermal energy today. Additionally, the energy crisis experienced in some parts of the world has amplified concerns about energy security and highlighted the role of energy policy in balancing three main objectives: providing a clean emissions profile; providing a reliable and secure baseload profile; and providing an affordable levelized cost profile. Too much focus on one objective, has left some jurisdictions struggling with power shortages and spiking energy prices. There is increasing recognition that nuclear power, with its clean emissions profile, reliable and secure baseload characteristics and low, levelized cost has a key role to play in achieving decarbonization goals.

According to the International Atomic Energy Agency there are currently 439 reactors operating globally and 52 reactors under construction. Several nations are appreciating the clean energy benefits of nuclear power. They have reaffirmed their commitment to it and are developing plans to support existing reactor units and are reviewing their policies to encourage more nuclear capacity. Several other non-nuclear countries have emerged as candidates for new nuclear capacity. In the EU, specific nuclear energy projects have been identified for inclusion under its sustainable financing taxonomy and therefore eligible for access to low-cost financing. Even in countries with phase-out policies, there is growing debate about the role of nuclear power, with public opinion polls showing growing support for it. The growth in demand is not just in the form of new builds, it is medium-term demand in the form of reactor life extensions, and it is near-term growth as early reactor retirements are prevented. And Cameco is seeing momentum building for non-traditional commercial uses of nuclear power around the world such as development of small modular reactors and advanced reactors, with numerous companies and countries pursuing projects.

Supply uncertainty

Low uranium prices, government-driven trade policies, and the COVID-19 pandemic have had an impact on the security of supply in its industry. Despite the recent increase in uranium prices, years of underinvestment in new capacity has shifted risk from producers to utilities. In addition to the decisions many producers, including the lowest-cost producers, have made to preserve long-term value by leaving uranium in the ground, there have been a number of unplanned supply disruptions related to the impact of the COVID-19 pandemic and associated supply chain challenges on uranium mining and processing activities. In addition, according to industry transport experts, there is a risk of transport disruptions for Class 7 nuclear material. Uranium is a highly trade-dependent commodity. Adding to security of supply concerns is the role of commercial and state-owned entities in the uranium market, and trade policies that highlight the disconnect between where uranium is produced and where it is consumed. Over 80% of primary production is in the hands of state-owned enterprises, after taking into account the cuts to primary production that have occurred over the last several years. Furthermore, nearly 90% of primary production comes from countries that consume little-to-no uranium, and nearly 90% of uranium consumption occurs in countries that have little-to-no primary production. As a result, government-driven trade policies can be particularly disruptive for the uranium market.

UxC reports that over the last five years approximately 400 million pounds U3O8 equivalent have been locked-up in the longterm market, while approximately 810 million pounds U3O8 equivalent have been consumed in reactors. The company remain confident that utilities have a growing gap to fill.

The company believe the current backlog of long-term contracting presents a substantial opportunity for commercially motivated suppliers like it who are proven reliable suppliers with tier-one productive capacity and a record of honouring its supply commitments. As a low-cost producer, the company manage its operations to capture value throughout these price cycles.

Financial Highlights

2022 First Quarter Results

May 5, 2022; the company reported its consolidated financial and operating results for the first quarter ended March 31, 2022 in accordance with International Financial Reporting Standards (IFRS).5

“With the recent uranium price increase, Cameco is beginning to enjoy the benefits of the strategic and deliberate decisions Cameco has made. And, with leverage to rising prices, Cameco is well-positioned to continue to capture value from the market transition the company believe is underway, and that is supported by the fundamentals; fundamentals characterized by durable, full-cycle demand against a backdrop of growing concerns about security of supply,” said Tim Gitzel, Cameco’s president and CEO.

“Durable demand is being driven by the accountability for achieving net-zero carbon targets, while balancing the need for affordable, reliable and secure baseload electricity, all while diversifying away from reliance on Russian energy supplies. Governments and policy makers are increasingly recognizing the role that nuclear plays in achieving those objectives. It is why, since the start of 2022, Cameco has seen announcements from countries like the United States, the United Kingdom, France, South Korea and Belgium focused on preserving and expanding the life of their existing reactor fleets as well as on building new reactors. There is also momentum building for non-traditional commercial uses of nuclear power around the world such as development of small modular reactors and advanced reactors, with numerous companies and countries pursuing projects. We’re seeing countries and companies turn to nuclear with an appetite that I’m not sure I’ve ever seen in my four decades in this business.

“The supply side is quite a different picture. For some time now Cameco has said that the company believed the uranium market was as vulnerable to a supply shock as it has ever been due to persistently low prices. The low prices and resulting lack of investment have put productive capacity at risk and not just for uranium, but for conversion and enrichment as well. Cameco has seen the deepening of geopolitical and origin risk as supply has become increasingly concentrated. With Russia’s invasion of Ukraine, whether because of sanctions or because of conflict with company values, the industry now faces the challenge of disentangling its supply chain from dependence on Russian nuclear fuel supplies. It is still early days, but Cameco is seeing what the company believe is an unprecedented geopolitical realignment occurring in the nuclear fuel cycle.

“With geopolitics complicating and potentially bottlenecking nuclear fuel supplies, Cameco is seeing not just utilities but some of the intermediaries and service providers beginning to shift their attention to securing material for their uncovered requirements, and to derisk some of their origin dependencies. And Cameco is seeing the continued thinning of the spot market by physical uranium investors. As a result, uranium prices have increased significantly with the spot price up 38% and the long-term price up 15% since the start of the year. The conversion spot price is up 65% and the long-term price is up 25%.

“As the market continues to transition, the company expect to continue to place its uranium and conversion services under long-term contracts and to meet rising demand with production from its best margin operations. While Cameco has not concluded any new contracts in 2022 beyond the 40 million pounds disclosed in its fourth quarter MD&A, Cameco has a significant pipeline of contract discussions underway. However, the company will continue to exercise strategic patience in its contracting activity.

“The company will also take a balanced and disciplined approach to its supply decisions. Even though Cameco has seen considerable pricing pressure resulting from the geopolitical uncertainty, the company will not change its production plans. The company will not front-run demand with supply. As the company announced in February, Cameco is continuing with indefinite supply discipline. Starting in 2024, with McArthur River/Key Lake and Cigar Lake operating at less than licensed capacity, the company plan to be operating at about 40% below its productive capacity (100% basis). This will remain its production plan until the company see further improvements in the uranium market and have made further progress in securing the appropriate homes for its unencumbered, in-ground inventory under long-term contracts, once again demonstrating that Cameco is a responsible supplier of uranium fuel.

“Thanks to its deliberate actions and conservative financial management Cameco has been and continue to be resilient. The company's strong balance sheet, with $1.5 billion in cash and cash equivalents and short-term investments, positions it well to self-manage risk, including any global macro-economic or geopolitical uncertainty and volatility that may arise.

“Cameco is optimistic about Cameco’s role in capturing long-term value across the fuel chain and supporting the transition to a net-zero carbon economy. Cameco has tier-one assets that are licensed, permitted, long-lived, are proven reliable, and that have expansion capacity. These tier-one assets are backed up by idle tier-two assets and what the company think is the best exploration portfolio that leverages existing infrastructure. Cameco is vertically integrated across the nuclear fuel cycle. Cameco has locked in significant value for the fuel services segment of its business and Cameco is exploring opportunities to further its reach in the nuclear fuel cycle and in innovative, non-traditional commercial uses of nuclear power in Canada and around the world.

“The company believe Cameco has the right strategy to achieve its vision of ‘energizing a clean-air world’ and the company will do so in a manner that reflects its values. Embedded in all its decisions is a commitment to addressing the environmental, social and governance risks and opportunities that the company believe will make its business sustainable over the long term.”

- Net earnings of $40 million; adjusted net earnings of $17 million: first quarter results are driven by normal quarterly variations in contract deliveries and the continued execution of its strategy in a market that the company believe is in the early stages of transition. Adjusted net earnings is a non-IFRS measure,

- Strong performance in the uranium and fuel services segments: First quarter results reflect the impact of increased average realized prices in both the uranium and fuel services segments. In its uranium segment the company produced 1.9 million pounds during the quarter and sold 5.9 million pounds at an average realized price 34% higher than the same period last year. In its fuel services segment average realized prices were 8% higher than in the first quarter of 2021.

- Significant pipeline of contract discussions in strengthened price environment: As the company announced in February, in its uranium segment, since the beginning of 2022, the company had been successful in adding 40 million pounds to its portfolio of long-term uranium contracts. While Cameco has not concluded any additional contracts in 2022, the company continue to have a significant pipeline of contract discussions underway. Origin risk is driving interest in securing uranium supply as well as conversion services. Cameco is being strategically patient in its discussions to capture as much value as possible in its contract portfolio. In addition to the off-market contracting interest, there has been a re-emergence of on-market requests for proposals from utilities looking to secure their future requirements and reduce origin risk.

- Operational readiness for McArthur River/Key Lake is on-track: During the first quarter, at the McArthur River mine and Key Lake mill the company focused on recruitment and training activities. There are now approximately 600 employees and long-term contractors employed at the mine and mill. When the company resume operations later this year, the company expect to have approximately 850 employees and long-term contractors. In addition, the company advanced the work necessary to complete critical projects and the maintenance readiness checks at both the mine and mill. The company expensed the operational readiness costs directly to cost of sales, which totaled approximately $40 million during the quarter. The company continue to expect the company could produce up to 5 million pounds (100% basis) this year depending on its success in completing operational readiness activities and managing the potential risks of the COVID-19 pandemic and related supply chain challenges.

- JV Inkai shipments: The geopolitical situation arising as a result of the Russian invasion of Ukraine is creating transportation risk in the region. Sanctions on Russia and restrictions on and cancellations of some cargo insurance coverage create uncertainty about the ability to ship uranium products from Central Asia, potentially complicating the logistics for deliveries from those areas, including JV Inkai’s final product. Cameco is working with Inkai and its joint venture partner, Kazatomprom, to secure an alternate shipping route that doesn’t rely on Russian rail lines or ports. In the meantime, Cameco has decided to delay a near-term delivery for its share of production from JV Inkai. In the event that it takes longer than anticipated to secure an alternate shipping route, the company could experience further delays in its expected Inkai deliveries this year. To mitigate the risk, Cameco has inventory, long-term purchase agreements and loan arrangements in place that the company can draw on. See Uranium 2022 Q1 updates in its first quarter MD&A for more information.

- 2022 guidance updated: The company's outlook has been amended to reflect the increases in uranium prices. See Outlook for 2022 in its first quarter MD&A for more information.

- Strong balance sheet: As of March 31, 2022, the company had $1.5 billion in cash and cash equivalents and short-term investments and $996 million in long-term debt. In addition, Cameco has a $1 billion undrawn credit facility.

- Received dividends from JV Inkai in April: On April 28, the company received dividend payments from JV Inkai totaling $83 million (US). JV Inkai distributes excess cash, net of working capital requirements, to the partners as dividends.

Recent developments

Cameco Increases Ownership Stake in Cigar Lake Mine6

May 10, 2022; Cameco and Orano Canada Inc. (Orano) have reached agreement with Idemitsu Canada Resources Ltd. (Idemitsu) to acquire Idemitsu’s 7.875% participating interest in the Cigar Lake Joint Venture. Upon closing, Cameco’s ownership stake in the Cigar Lake uranium mine in northern Saskatchewan will increase by 4.522 percentage points to 54.547%, while Orano’s share will rise by 3.353 percentage points to 40.453%. TEPCO Resources Inc. retains the remaining 5% interest in the property.

“As the world’s largest high-grade uranium mine, Cigar Lake is quite simply one of the best and most prolific uranium producing assets on the planet,” said Cameco president and CEO Tim Gitzel. “Cameco is very pleased to increase its ownership stake in this outstanding tier-one operation. As the operator of Cigar Lake since 2002, it’s an asset the company know incredibly well. It’s a proven, permitted and fully licenced mine in a safe and stable jurisdiction that operates with the tremendous participation and support of its neighbouring Indigenous partner communities.”

Cameco’s purchase cost to acquire its respective share of Idemitsu’s interest in Cigar Lake is approximately $107 million CDN, subject to customary closing adjustments. The acquisition is subject to certain regulatory approvals and other standard closing conditions. The transaction is expected to close in the second quarter of 2022.

The 2022 production outlook for the Cigar Lake mine is 15 million pounds of uranium concentrate (U3O8) on a 100% basis, which would make it the largest uranium producing operation in the world this year. The Cigar Lake reserve and resource base includes proven and probable reserves estimated at 152.4 million pounds of U3O8, measured and indicated resources of approximately 103.7 million pounds, and inferred resources of 22.9 million pounds. Cameco’s increased share in the operation will therefore provide the company with access to an additional 6.9 million pounds of proven and probable reserves, 4.7 million pounds of measured and indicated resources, and 1 million pounds of inferred resources.

The company's present plan is to reduce annual production at Cigar Lake to 13.5 million pounds of U3O8 (100% basis), 25% below licenced capacity, starting in 2024. Extending the mine life at Cigar Lake by aligning production with market opportunities and its contract portfolio is consistent with Cameco’s tier-one strategy, and is expected to allow more time to evaluate the feasibility of extending the mine life beyond its current reserve base while continuing to supply ore to Orano’s McClean Lake mill. This will remain its production plan until the company see further improvement in the uranium market and contracting progress, demonstrating Cameco’s ongoing commitment to be a responsible supplier of uranium fuel.

References

- ^ https://www.cameco.com

- ^ https://www.cameco.com/about/history

- ^ https://www.cameco.com/businesses

- ^ https://s3-us-west-2.amazonaws.com/assets-us-west-2/annual/cameco-2021-annual-report.pdf

- ^ https://www.cameco.com/media/news/cameco-reports-2022-first-quarter-results

- ^ https://www.cameco.com/media/news/cameco-increases-ownership-stake-in-cigar-lake-mine