Canara Bank

Overview

Canara Bank (NSE:CANBK) was founded by Shri Ammembal Subba Rao Pai, a great visionary and philanthropist, in July 1906, at Mangalore, then a small port town in Karnataka. The Bank has gone through the various phases of its growth trajectory over hundred years of its existence. Growth of Canara Bank was phenomenal, especially after nationalization in the year 1969, attaining the status of a national level player in terms of geographical reach and clientele segments. Eighties was characterized by business diversification for the Bank. In June 2006, the Bank completed a century of operation in the Indian banking industry. The eventful journey of the Bank has been characterized by several memorable milestones. Today, Canara Bank occupies a premier position in the comity of Indian banks.1

Over the years, the Bank has been scaling up its market position to emerge as a major 'Financial Conglomerate' with as many as ten subsidiaries/sponsored institutions/joint ventures in India and abroad. As at Sep 2020, the Amalgamated Canara Bank services over 11.83 crore customers through a network of 10495 branches and 13023 ATMs spread across all Indian states and Union Territories.

Not just in commercial banking, the Bank has also carved a distinctive mark, in various corporate social responsibilities, namely, serving national priorities, promoting rural development, enhancing rural self-employment through several training institutes and spearheading financial inclusion objective. Promoting an inclusive growth strategy, which has been formed as the basic plank of national policy agenda today, is in fact deeply rooted in the Bank's founding principles. "A good bank is not only the financial heart of the community, but also one with an obligation of helping in every possible manner to improve the economic conditions of the common people". These insightful words of its founder continue to resonate even today in serving the society with a purpose. The growth story of Canara Bank in its first century was due, among others, to the continued patronage of its valued customers, stakeholders, committed staff and uncanny leadership ability demonstrated by its leaders at the helm of affairs. The company strongly believe that the next century is going to be equally rewarding and eventful not only in service of the nation but also in helping the Bank emerge as a "Preferred Bank" by pursuing global benchmarks in profitability, operational efficiency, asset quality, risk management and expanding the global reach.

Significant Milestones

| 1983 | Overseas branch at London inaugurated, Cancard (the Bank’s credit card) launched |

| 1985 | Takeover of Lakshmi Commercial Bank Limited and Commissioning of Indo Hong Kong International Finance Limited (now a full fledged branch) |

| 1987 | Canbank Mutual Fund & Canfin Homes launched |

| 1989 | Canbank Venture Capital Fund started |

| 1989-90 | Canbank Factors Limited, the factoring subsidiary launched |

| 2002-03 | Maiden IPO of the Bank |

| 2003-04 | Launched Internet Banking Services |

| 2004-05 | 100% Branch computerization |

| 2007-08 | Launching of New Brand Identity. Incorporation of Insurance and Asset Management JVs. Launching of 'Online Trading' portal. Launching of a ‘Call Centre’. Switchover to Basel II New Capital Adequacy Framework. |

| 2010-11 | The Bank’s aggregate business crossed Rs. 5 lakh crore mark. Net profit of the Bank crossed Rs. 4000 crore. 100% coverage under Core Banking Solution. The Bank’s 4th foreign branch at Leicester and a Representative office at Sharjah, UAE, opened. The Bank raised Rs. 1993 crore under QIP. Govt. holding reduced to 67.72% post QIP. |

| 2011-12 | Total number of branches reached 3600. The Bank’s 5th foreign branch at Manama, Bahrain opened. |

| 2013-14 | 1027 branches and 2786 ATMs opened during the year. Global business crossed the Rs.7 lakh crore milestone. Switchover to Basel III New Capital Adequacy Framework. Branch Network and Atms increased to 4755 branches and 6312 ATMs. |

| 2014-15 | Global Business of the Bank crossed Rs.8 lakh crore. |

| 2015-16 | The Bank’s 8th foreign branch at DIFC (Dubai) opened. |

| 2016-17 | Branch network crossed 6000 milestones.Total number branches rose to 6083.Canara Bank (Tanzania) Ltd., a foreign subsidiary, opened. |

| 2019-20 | Domestic Business of Canara Bank crossed Rs. 10 Lakh Crore. |

Services

Personal Banking

- Savings & Deposits

- Loan Products

- Technology Products

- Mutual Funds

- Insurance Business

- International Services

- Card Services

- Consultancy Services

- Depository Services

- Ancillary Services

- Approved Housing Projects

Corporate Banking

- Accounts & Deposits

- Supply Chain

- Loans & Advances

- Syndication Services

- IPO Monitoring Activity

- Merchant Banking

- TUF Schemes

- Canara eTax

Industry Overview

Indian Economy

The domestic economy grew at 4.2% in FY2020, lower than 6.1% in FY2019, as the Covid-19 pandemic adversely impacted economic activity in the last month of the fiscal year, especially manufacturing and construction. Agriculture was the only sector which saw a healthy growth of 4% y.o.y, led by normal monsoon and robust food production. The essential services status of agriculture produce contributed to the near normal functioning of the sector in last two weeks of March even during the lockdown. Sluggishness in tourism and financial services pulled down the service sector growth to 5.5% y.o.y from 7.7% y.o.y in March 2020. The lower growth in financial services can be attributed to prolonged liquidity crisis in the NBFC segment. On the expenditure front, private consumption expenditure decelerated to 5.3% y.o.y, while Government expenditure increased at a pace of 11.8% y.o.y and investments contacted to 2.8% y.o.y in FY2020.2

The headline inflation rose in the later part of the year and stood at an elevated level of 4.8% in FY2020 owing to the reversal in food prices. However, the core inflation remained low at 4.0%, highlighting lower underlying inflationary pressure in the economy.

With changing landscape of domestic macroeconomic fundamentals amid pandemic challenge, economic activities other than agriculture are expected to be muted in the near term. The revival of commercial activities, restoration of supply chains and improved demand impulses are the prerequisite to keep economy back on growth track. Thus, with lingering uncertainty in the current fiscal, downside risk to domestic growth is pronounced in FY2021 and by FY 2022, it is likely to be in the positive zone as pandemic concerns ebb off. The expansionary fiscal and monetary policy of the Government and RBI will remain supportive for few more quarters to support economic growth.

RBI provided significant monetary stimulus to support economic growth. The central bank cut the repo rate, by a cumulative 200 basis points since April 2019 to the current 4.0% level and maintained an accommodative policy stance. In a bid to mitigate the economic impact of the pandemic, RBI resorted to several measures including auctioning under TLTRO.1 and 2 to the tune of `1.5 lakh crore to infuse adequate liquidity.

Government also announced several measures to arrest the slide in growth and support the economy during the first half of the year. The most important among those measures was the cut in corporate tax from 30% to 22% without any exemptions.

Keeping the economic risk emanating from the pandemic, Government has rolled out `20 lakh crore plus stimulus package for all significant sectors in the economy, out of which `6 lakh crore will be financed through banking channel. This effective complementarity of fiscal and monetary policies will indeed give impetus to economic growth in the coming years.

The credit guarantee provided by the central Government for lending to MSMEs, and slew of measures taken for liquidity support to NBFCs, HFCs and MFIs in the special economic package is likely to stimulate bank credit off take. The credit growth is expected to pick up in tandem with rebound in economic growth.

Major Banking Sector Developments

The fiscal 2020 witnessed structural reforms with respect to banking sector. In order to tap the economies of scale, the Central Government announced mega merger of 10 Public Sector Banks (PSBs). Consequently Oriental Bank of Commerce (OBC) and United Bank of India (UBI) merged into Punjab National Bank (PNB), Syndicate Bank merged with Canara Bank, Andhra Bank and Corporation Bank merged with Union Bank of India and Allahabad Bank merged into Indian Bank. An upfront capital infusion of `70,000 crore in state-run banks was made in the last fiscal by way of recapitalisation bonds.

Digitalization being recognized as the driver of the banking industry in the wake of upgradation and implementation of EASE agendas, majority of the banks resorted to online service provisions such as psbloansin59minutes launched in FY2020. Even the India Post who entered into banking services stepped up the digital services by providing mobile facilities for PPFs and Savings Account. There is a paradigm shift witnessed across the banking sector in turning more digital to support cashless economy initiatives.

In FY2020, RBI made it mandatory for banks to link all new floating rate loans to micro and small enterprises (MSME) and loans to buy homes, vehicles and for personal consumption to an external interest rate benchmark effective from October 1st.

Outlook For 2020-21

Given the extent of crisis emanated from the pandemic, outlook for the next fiscal remains uncertain at this juncture. Notwithstanding, a recovery is most likely with resuming of commercial activities and easing of lockdown. The fiscal and monetary stimulus will remain growth supportive in the coming year.

The banking sector continues to serve as the backbone of the economy ensuring smooth recovery path. To strive for better performance in the coming years, the Bank gives thrust on shoring up of CASA while consciously reducing the reliance on bulk deposits. The Bank focuses on balanced advance portfolio with proper mix of retail, agriculture, MSME and corporate credit. The bank has provided hundred per cent guaranteed MSME lending to give unrelenting support to this segment in tandem with Government guidelines. The Bank takes adequate efforts for NPA management with ardent credit monitoring, contain fresh slippages and strengthen recovery efforts. Further strengthening of digital capabilities is in the anvil ensuring best services to customers with end-to-end digital solutions. The bank will continue to strive for process and product improvements in view of changing requirements and circumstances. Bank has already rationalised the organisational structure and plans to further optimize its branch network. Separate verticals and dedicated workforce will support in augmentation of business. In the coming years, the Bank looks forward for leveraging amalgamation benefits for maximizing the efficiency and productivity.

Financial Overview

During FY2020, the global business of the Bank increased to Rs 1076574 crore, up by 3.19% y.o.y with global deposits growing at a pace of 4.39% y.o.y at Rs 625351 crore and global advances growing 1.58% y.o.y at Rs 451223 crore.

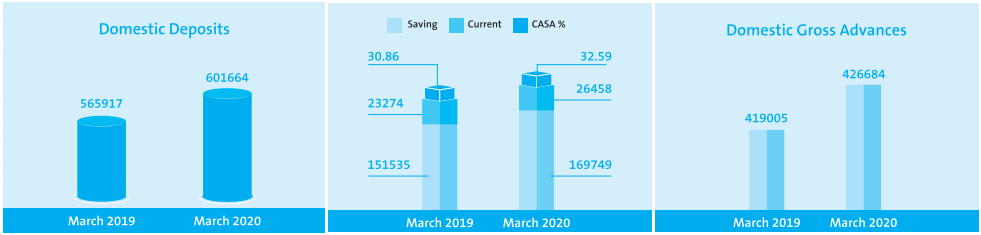

Deposits

Total Deposits increased to Rs 625351 crore as at March 2020 compared to Rs 599033 crore a year ago, with a y.o.y growth of 4.39%. Current and Saving (CASA) deposits of the Bank increased by 12.24% y.o.y. to Rs 196207 crore on March 2020. The Bank’s CASA deposits share to domestic deposits stood at 32.59% from the last year’s 30.86%. Savings deposits grew by 12.02% to Rs 169749 crore. Current deposits grew by 13.68% to Rs 26458 crore.

The focus on premier CASA products, like, Canara Galaxy, Canara Privilege, SB Powerplus and NRI accounts were given to improve the average balances under CASA. Pursuing a strategy of expanding deposit clientele, the Bank added 39 lakhs deposit clientele during the year, taking the total number of deposit clientele to 7.37 crore.

Advances

The Bank expanded its asset base in a well-diversified manner comprising of the productive segments of the economy, like, Agriculture and Micro, Small and Medium Enterprises (MSMEs) and other productive sectors in addition to Retail assets, including Housing, Education, and Vehicle loan segments.

Advances (Gross) of the Bank grew by 1.58 % to reach Rs 451223 crore as at March 2020 compared to Rs 444216 crore a year ago. The number of borrowal clientele increased to 82.75 lakhs as at March 2020.

Total business of the Bank increased to Rs 1076574 crore, with a y.o.y. growth of 3.19% compared to Rs 1043249 crore in the previous year.

Net Income

Operating profit of the Bank stood at Rs 9360 crore compared to Rs 10591 crore last year. Bank reported a net loss of Rs 2236 crore for 2019-20 compared to a net profit of Rs 347 crore during last year. Net Interest income of the bank stood at Rs 13124 Crore compared to Rs 14478 crore generated during last year. NIM stood at 2.29% and Yield on Advances at 8.18%.

During the year, total income increased by 6.30% y.o.y to Rs 56748 crore, comprising Rs 36076 crore interest from advances, Rs 11336 crore interest from investments, Rs 7813 crore from non-interest income and Rs 1523 crore from other interest income.

Capital and Reserves

Net worth of the Bank, as at March 2020 stood at Rs 28969 crore compared to Rs 26180 crore as at March 2019.

While the total paid-up capital of the Bank stood at Rs 1030.23 Crore, the reserves and surplus increased to Rs 38262.73 crore.

Capital Adequacy Ratio, under Basel III was 13.65% as at March 2020 against the regulatory requirement of 10.875%, including capital conservation buffer of 1.875%. Within the capital adequacy ratio, CET I ratio was at 9.39% and Tier I capital ratio was at 10.12%.

Ministry of Finance, Government of India has infused Capital of Rs 6571 Crore in the Bank during the current financial year by way of preferential allotment of equity shares. The Bank issued 27, 69, 88,576 fully paid-up equity shares of Rs 10/- each at an issue price of Rs 237.23 per equity share including premium of Rs 227.23 aggregating Rs 6571 crore, on preferential basis to the Government of India and there by Government of India holding in the bank increased to 78.52%.

Canara Bank Q2 results FY21 - Reports net profit of Rs 444 crore 3

Oct 29, 2020; Canara Bank reported a standalone net profit of Rs 444.41 crore for the three months to September. The lender had posted a net profit of Rs 364.92 crore during the same quarter of the previous fiscal year.

Total income (standalone) of the bank stood at Rs 20,836.71 crore in July-September period of 2020-21, as against Rs 14,461.73 crore in the same quarter of 2020-19, it said in a regulatory filing.

It further said the figures of September 2019 and March 2020 are related to standalone Canara Bank financials of pre-amalgamation period, and thus are not comparable with post-amalgamation financials of June 2020 and September 2020.

Canara Bank amalgamated Syndicate Bank with itself with effect from April 1, 2020.

Canara Bank's gross non-performing assets (NPAs) fell marginally to 8.23 per cent of the gross advances as of September 30, 2020, as against 8.68 per cent by end of September 2019.

In value terms, the gross NPAs or bad loans were at Rs 53,437.92 crore, up from Rs 38,711.33 crore.

Net NPAs fell substantially to 3.42 per cent (Rs 21,063.28 crore) from 5.15 per cent (Rs 22,090.04 crore).

Provisions for bad loans and contingencies for the reported quarter rose to Rs 4,016.81 crore as against Rs 2,037.97 crore.

Of this, the provisions for NPAs stood at Rs 3,532.81 crore as against Rs 2,295.61 crore.

On a consolidated basis, the net profit in Q2 FY21 came in at Rs 465.88 crore, from Rs 405.49 crore earlier. Total income stood at Rs 22,681.05 crore, as against Rs 15,509.36 crore.

The consolidated financial statements (CFS) of the group companies comprise the results of nine subsidiaries, five associates, including 4 Regional Rural Banks (RRBs) and a joint venture, Canara Bank said.

The lender said it had declared fraud accounts amounting to Rs 3,981.63 crore as of March 30, 2020 and provided Rs 1,465.64 crore in FY20 and deferred the balance of Rs 2,515.99 crore for subsequent quarters.

"During the half year ended on September 30, 2020, Rs 2,515.99 crore is fully amortised by debiting Profit & Loss account and crediting to other reserves," it said.

With regard to the Delhi Airport Metro Express account, the lender said it has kept it as standard in terms of a Supreme Court order and necessary guidelines issued by the Reserve Bank.

However, necessary provisions of Rs 14.64 crore have been made while amount not treated as NPA stands at Rs 58.55 crore, it added.

The overall Provision Coverage Ratio (PCR) as on September 30, 2020 was 81.48 per cent, Canara Bank said.

On the Covid-19 impact, it said the bank is evaluating the situation on an ongoing basis.

"The major identified challenges for the bank would arise from eroding cash flows and extended capital cycles. Despite the challenges, the management believes that no adjustments are required in the financial results as it does not significantly impact the current quarter.

"Despite these events and conditions, there would not be any significant impact on Bank's results in future and going concern assumptions as at presently made," it said.