Castrol India Ltd

Company History

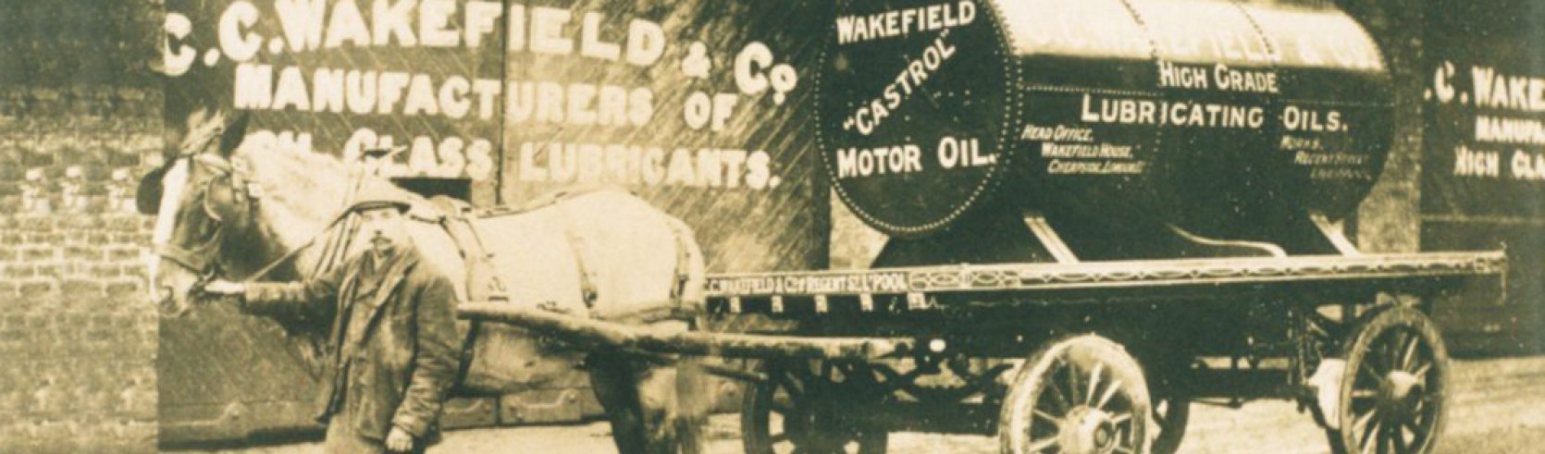

Castrol (NSE: CASTROLIND) was founded by Charles “Cheers” Wakefield under the name of ‘CC Wakefield & Company’. In 1899 Charles left a job at Vacuum Oil to start a new business selling lubricants for trains and heavy machinery. 1

Early in the new century, Wakefield took a personal interest in two sporty new motorised contraptions – the automobile and the aeroplane. The company started developing lubricants for these new engines, which needed oils that were runny enough to work from cold at start-up and thick enough to keep working at very high temperatures. Wakefield researchers found that adding a measure of castor oil, a vegetable oil made from castor beans, did the trick nicely. They called the new product “Castrol.” In 1919 John Alcock and Arthur Brown choose Castrol to lubricate their engine on the first trans-Atlantic flight.

Having helped pioneer a new kind of motor oil, CC Wakefield pioneered a new method of getting customers to notice the product: sponsorship. The Castrol name appeared on banners and flags at competitive aviation events, auto races and at attempts to break the land speed record.

By 1960, the name of the motor oil had all but eclipsed that of the company’s larger-than-life founder, and so ‘CC Wakefield& Company’ became, simply, Castrol Ltd. In 1966 The Burmah Oil Company bought Castrol and in 2000 Burmah-Castrol was purchased by BP.

As well as having a heritage of passion and speed, the Castrol brand also stands for innovation and performance:

- 2008, Castrol launched its Marine Bio range with improved environmental performance to help protect ocean life

- 2012 NASA's Curiosity rover began its mission on Mars, lubricated by a Castrol grease

- 2015 Castrol launched Nexcel, an oil change system designed to reduce tailpipe emissions, recycle used oil and simplify oil changes

- 2017 Castrol launched its first bio-synthetic engine oil with 25% renewable plant-based oil

Plant Locations

The Company’s plants are located at

- Patalganga in Maharashtra;

- Paharpur in West Bengal and

- Silvassa (Union Territory).

Product

Car Engine Oil & Fluids

- Engine Oils

- Axle Lubricants

- Brake Fluids

- Auto Transmission Fluids

- Greases

Motorcycle Oil & Fluids

- Motorcycle Engine Oils

- Brake Fluids

- Chain Lubricants

- Fork Oil

- Gear Oils

- Greases

Commercial Vehicle Oil & Fluids

- Diesel Engine Oils

- Driveline Fluids

- Greases

- Coolants

- Diesel Exhaust Fluid (Def)

- Hydraulic Fluids

Industry Overview

India is the world’s third largest lubricants market after US and China with approximately 2.8 billion litres of annual consumption . The lubricants market in India is highly competitive and fragmented comprising national oil companies, several international majors and a large number of local companies. The Company operates in all major categories such as automotive, industrial and marine & energy applications. It is a well-entrenched leading international player in retail automotive lubricants and has a significant presence in specialized industrial lubricants. 2

Demand drivers

Lubricants play a major role in reducing friction generated by metal to metal contact. It also helps in reducing noise and heat generation of metal parts - such as engines in automotive industry and cutting or honing parts in industrial applications. Detergents and dispersants in a lubricant help cleaning, while anti-wear agents help protect the metal surface from wear and tear as well as corrosion.

Automotive vehicles require engine oils, transmission fluids, brake fluids, hydraulic oils and greases, while industrial and manufacturing applications require lubricants for metal working, rust preventives and coolants.

Demand for automotive lubricants is driven by the expansion of vehicle population as well as the usage of vehicles in the country. This demand is also linked to economic growth and performance of the manufacturing and agricultural sector. Industrial lubricants demand is observed to have a strong co-relation with the Index of Industrial Production (IIP), which is largely driven by economic activity. In case of marine and energy lubricants, the demand drivers include global and local ship movements which facilitate large scale movement of cargo as well as the installed base of offshore rigs and their uptime.

Supply drivers

Lubricants are manufactured by blending base oils with additives. This blending involves highly advanced formulations as per the specific purpose the lubricant serves, as well as in line with the OEM specifications and industry norms.

India is a net base oil deficit market leading to large scale import of base oil and additives. This exposes the lubricants business to fluctuations in foreign exchange rates.

Overall lubricants market

Overall vehicle sales declined severely compared to the previous year by ~24% ytd November 2020. This was largely due to the tough operating environment and restricted activity in the first half of 2020 which showed subsequent signs of recovery in the latter half.

On the regulatory front, compliance with BS VI emission norms for all new vehicles sold from April 2020 has been a significant development within the year.

Industrial production, measured by the IIP, contracted sharply within the second quarter of 2020. It gradually recovered in October growing by 4.2% over the same month in 2019 with a phased re-opening of activities.

Globally, the shipping industry continued to face challenges with changes in fuel landscape, falling freight rates, Covid-19 induced slowdown and increasing lubricants and bunker prices.

Business Overview

Automotive lubricants: The Company continued to drive premiumization and synthetization in the personal mobility segment, despite a challenging operating context.

The Company pursued growth opportunities and launched new products for cruiser bikes (Castrol Activ Cruise) and full synthetic performance oils in the premium segment for twowheelers (Castrol POWER1 ULTIMATE).

In car oils, the Company drove synthetic products across mass and premium segments and launched Castrol GTX SUV oils for sports utility vehicles. It also ran a digital brand campaign for Castrol MAGNATEC SUV supplemented through on-ground mechanic engagements.

In commercial vehicle oils, the Company promoted Castrol CRB TURBOMAX with presence in mass media and engagement with mechanics virtually as well as through ground activations. It also stayed connected with farmers through local rural activations.

While the Company continued working in close association with its strategic OEM partners, it leveraged new channels like the Jio-bp retail network and the independent workshop channel, further increasing its footprint nationally.

Industrial lubricants: The Company worked closely with its customers in the industrial lubricants segment as operations slowly scaled up to build momentum, while aiding learning through virtual technical sessions, to support restart of their operations smoothly.

Marine and energy lubricants: The Company focused on providing bestin-class products and services, and offered value-added services, along with best practices from its marine businesses globally, which strengthened customer confidence.

Quality: The Company focused on building a zero defect mindset across the organization through state-ofthe-art testing facilities, application of international standards and concepts, as well as skill development and awareness programmes. The company successfully ended the year without any major quality incidents despite disruptions in operations due to the pandemic and natural calamities like cyclones Amphan and Nisarga.

The company completed the re-certification audit of ISO 9001: 2015 and IATF 16949:2016 standards, and the Silvassa plant was the proud recipient of the Ford Q1 re-certification, a recognition of the plant’s focus and delivery of quality excellence.

Financial Highlights

Castrol India Announces 4q 2020 (Oct - Dec) and Fy 2020 (Jan - Dec) Results 3

1 February 2021; Castrol India Limited delivered a resilient financial performance for FY 2020 in a difficult year marked by the pandemic and ensuing external challenges.

2020 has been a story of two halves. While the company continued with its priorities through the year, keeping safety and wellbeing of its people and supporting communities the company operate in at the fore, the company gained good momentum in the second half with the partial revival of demand. In 2H 2020, revenue improved by 54% at INR 1,818 crs while profit from operations was 122% higher at INR 501 crs versus 1H 2020.

In 4Q 2020, the company continued to invest in its key brands with a significant increase in its marketing and advertising spends year-on-year (INR 65 crs in 4Q 2020 versus INR 11 crs in 4Q 2019), which helped in achieving a top-line growth of 6% versus 3Q 2020. The company expect the positive impact of this investment to continue going forward.

Castrol India has also taken actions to prepare the business for growth in the future including corrective pricing actions for its commercial vehicles portfolio which has yielded double digit volume growth in the last quarter as well as inventory reduction for distributors to help improve their working capital.

The company continued to invest in digital technology and efficiency programmes leading to robust working capital management and judicious cost management thus generating healthy cash flow from operations for FY 2020 of INR 893 crs which is 1.5 times of Profit After Tax.

With the pioneering and innovative spirit that Castrol is known for, the company continued to invest in cutting edge technology, as the company launched its all new premium range of two-wheeler lubricants in 4Q 2020, Castrol POWER1 ULTIMATE, developed with full synthetic technology for bikes, sports bikes and scooters offering both protection and performance for riders.

Castrol lubricants is now available across over 1,350 Jio-bp sites and has seen good uptake, ensuring a much wider reach and easy accessibility of its premium quality lubricants in the recently launched Jio-bp channel.

The Castrol India business has been focused on driving sustained profitable growth displaying operational resilience and performance in 2020. We

were recognised externally for consistent delivery and performance as JCB awarded it as best supplier for 2020.

The company thank the team for their extraordinary efforts in a tough year and are confident that the actions Castrol India has taken in this year will be the building blocks to aid its growth in 2021 as and when the economic environment returns to normalcy.

The Board of Directors of the company has at its meeting held on 1 February 2021 recommended a final dividend of INR 3.00 per share (2019: second interim dividend INR 3.00 per share) for financial year ended 31 December 2020. This is in addition to an interim dividend of INR 2.50 per share (2019: INR 2.50 per share).

The register of members and share transfer books of the company will remain closed for the purpose of final dividend from 24 April 2021 to 30 April 2021 (both days inclusive). The final dividend, if approved by the shareholders of the company at the 43rd Annual General Meeting, will be paid on or before 30 May 2021.