Cholamandalam Investment & Finance Co. Ltd.

Company Overview

Cholamandalam Investment and Finance Company Limited (Chola) (NSE: CHOLAFIN), incorporated in 1978 as the financial services arm of the Murugappa Group. Chola commenced business as an equipment financing company and has today emerged as a comprehensive financial services provider offering vehicle finance, home loans, home equity loans, SME loans, investment advisory services, stock broking and a variety of other financial services to customers.1

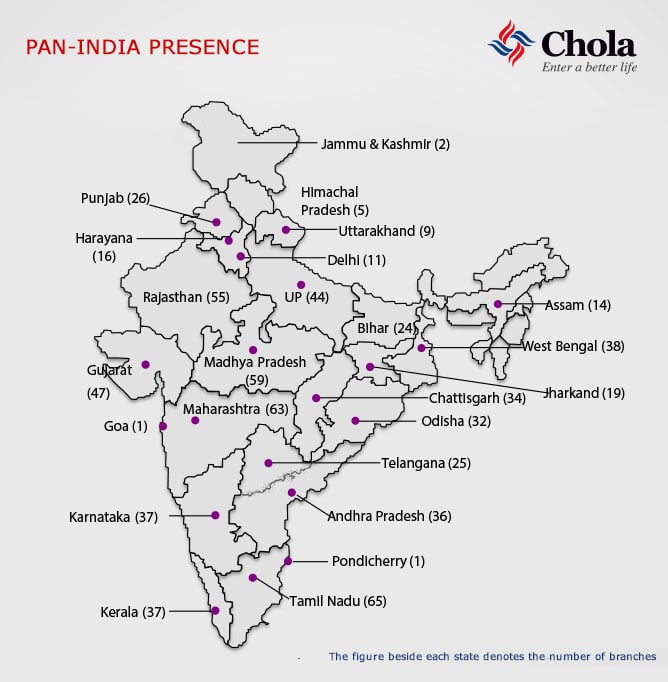

Chola operates from 1098 branches across India with assets under management above INR 63,501 Crores. The subsidiaries of Chola are Cholamandalam Securities Limited (CSEC) and Cholamandalam Home Finance Limited (CHFL).

The vision of Chola is to enable customers enter a better life. Chola has a growing clientele of over 8 lakh happy customers across the nation. Ever since its inception and all through its growth, the company has kept a clear sight of its values. The basic tenet of these values is a strict adherence to ethics and a responsibility to all those who come within its corporate ambit - customers, shareholders, employees and society.

Products and Services

Vehicle Finance Loans - Loans to customers against purchase of new/used vehicles, tractors, construction equipments and loan to automobile dealers.

Home Equity - Loans to customer against immovable property

Others - Loans given for acquisition of residential property, loan against shares, and other unsecured loans & security broking and insurance agency business.

Vehicle Finance

- Two Wheeler Loans

- Commercial vehicle loan

- Tractor Loans

- Car & MUV Loans

- Construction Equipment Loans

Loans against property

- Home Loans

- SME Loans

- Rural & Agri Loans

Wealth Management

- Mutual Funds

- Stock & Derivatives

- Internet broking

- Demat Services

- Exchange Traded Funds

- Bonds

Industry Overview

Auto Industry

The domestic commercial vehicle industry was faced with the impact of multiple headwinds in FY 20 like reduced freight demand due to the revised axle load norms, lesser market load availability due to lower GDP growth, dampened BS VI pre buying in Q4 and the COVID-19 impact which led to full lockdown from 24 March, 2020. The commercial vehicle industry closed FY 20 with a 29% degrowth which is the steepest degrowth in more than 15 years with medium and heavy commercial vehicle (MHCV’s) contributing to 47% degrowth followed by light commercial vehicle (LCV’s) at 21% degrowth and buses with 7% degrowth. Domestic commercial vehicle sales is expected to fall by 20% - 25% in FY 21 considering the macroeconomic challenges posed by the pandemic outbreak. The extent of recovery in construction, manufacturing, industrial output and consumption demand are key factors to watch out for a quicker recovery in FY 21. MHCV (Truck) sales are expected to close FY 21 with further decline of 12-14%. Despite the expectation of uptick in rural demand due to good rabi output, the outbreak of COVID-19 has led to restricted movement of goods and lesser demand for consumption goods. Due to these factors, the LCV (Truck) segment is expected to contract further by 7-9% during FY 21. The passenger carrier segment (buses) would also continue to face challenges due to curbs in operation of schools, colleges and offices due to the pandemic, leading to a 8-10% contraction during FY 21. Any prolonged disruptions and delay in recovery of macro-economic factors will further dampen the recovery in FY 21. However, used commercial vehicle sales is likely to be less impacted in FY 21 considering lower market prices, BS VI transitioning and extended time gap in regularization of the new vehicle supply chain. 2

Tractor industry had a de-growth of 10% in FY 20 due to weak farm sentiments in the first half of the year along with erratic rainfall and onslaught of COVID-19 during March, 2020. A faster recovery of the rural sector which has been mostly insulated from the impact of COVID-19 together with a good rabi harvest, normal monsoon, government support through farm subsidies and direct income support to farmers will aid the tractor demand in H2 FY 21. Clearing supply chain bottlenecks and availability of labor for Original Equipment Manufacturers (OEMs) is key to ensure supply post lockdown. Tractor sales is expected to degrow in FY 21 by 5-10% based on current trends. Government’s thrust towards doubling farm income is expected to drive long term growth in this segment.

Two-wheeler industry had a degrowth of 18% in FY 20 due to weak consumer sentiment, subdued rural demand and increase in cost of ownership. The industry is staring at another year of degrowth due to the impact of COVID-19 which has impacted income of individuals leading to lesser discretionary spends. However, expectation of better Kharif prospects and normal rainfall shall help the demand from rural areas which is expected to be higher when compared to urban areas.

Home Equity

The COVID-19 pandemic and the resultant lockdown is likely to impact MSME credit growth majorly during first half of FY 21. However, the initiatives taken by Government and RBI towards allowing for moratorium on payment of instalments, priority sector lending, credit guarantee scheme and clearance of past payable dues to MSMEs are expected to help the sector recover. Despite these measures, the COVID related impact is expected to affect the business continuity of a significant share of MSMEs in the country.

Home Loans

The Indian Housing Finance market is estimated about ₹ 21 lakh crore and grew at around 10-14% in FY 20. ₹ 3 lakh crore of the housing finance market comprises Low Cost Housing Finance. 70% of the Low Cost Housing market is located in Tier II, III , IV cities. The growth in the affordable housing finance segment continued to out-pace the housing sector and is estimated between 15-20%. The disbursements for the year were also impacted by the COVID-19 related lockdown in March 2020.

Business Overview

Vehicle Finance

The Vehicle Finance (VF) disbursements during the year were ₹ 23,387 crores as against ₹ 24,983 crores in the previous year with a marginal de-growth of 6% which was directly attributable to the drop in Industry volumes especially commercial vehicles. The VF division was able to grow in segments like car, MUV (Multi Utility Vehicle), tractor, two wheeler and used vehicles business over last year. The PBT during the year was ₹ 945 crores as against ₹ 1,269 crores in the previous year. The drop in PBT is on account of additional provisions made for bracing the COVID-19 impact and its aftermath. The VF division continued its focus on maintaining asset quality through an aggressive collection strategy, which helped in restricting gross stage 3 assets to 2.91% inspite of being a very challenging year due to a stressed macro-economic environment which had impacted customer cash flows coupled with the COVID-19 impact in the month of March, 2020.

The business has implemented a bunch of steps to shift more customers towards alternate modes of collections through digital payment links, collection through local Kirana stores, creating customer awareness for making online payments through RTGS, NEFT transfers, PayTM etc. This will help the company in the new normal way of business where there might be restricted mobility in most places on account of the pandemic.

The business has a branch network of 1,091 branches which will support in growing market share across product segments through enhanced dealer coverage. These branches will also help in acquiring new customers and creates a closer proximity with customers helping in collection efficiency improvement and increasing repeat business. The business has a robust collection mechanism in place aided with a strong credit risk assessment framework which will help in steering through the strong currents of the COVID-19 pandemic in the fiscal of FY 21.

Home Equity

The business continues to focus on a systematic approach to build a healthy portfolio mix, with more than 80% of the portfolio as SORP and an average loan ticket size of less than ₹ 50 lakhs. Portfolio LTV ratio at origination is consciously maintained around 50% levels which provides adequate security cover to the business. Amidst challenging macro-economic situation, AUM for Home Equity business managed to grow by 11% to ₹ 12,960 crores in FY 20 compared to ₹ 11,626 crores in FY 19. Disbursements recorded year-on-year (Y-o-Y) growth of 10% for YTD Q3 FY 20. However, with the onset of COVID-19 pandemic and lockdown during Q4 FY 20, the business faced 5% decline in disbursements to reach ₹ 3,662 crores for full year FY 20 compared to ₹ 3,837 crores in FY 19.

In order to improve the accessibility to customers, the business has expanded its branch network pan India, with focus on Tier II, III and IV cities. Majority of these branches are co-located/ shared with other business verticals, which will help in optimising for the branch operating costs.

Home Loans

As of March 31, 2020, the Home Loans (HL) business had 24,000 live accounts (68% growth Y-o-Y) with an AUM of ₹ 3,125 crores (63% growth Y-o-Y). 90% of this portfolio is Tier II, III, IV cities and towns. The disbursements grew 30% Y-o-Y in FY 20 from ₹ 1,157 crores in FY 19 to ₹ 1,505 crores in FY 20.

99% of the portfolio comprises HL and is focused to be end-use driven. The target group remains the Middle-Income Group (MIG) customer. The average ticket size is ₹ 15 lakhs with an average LTV of 60% which reflects the quality of houses and marketability. 95% of the portfolio comprises business owners with semi-formal income and significant business vintage buying their first home. 30% of customers are first time borrowers. The HL business has built on Chola’s inherent strength in lending to the lower middle income (LMI) segment with a customized eligibility program for business owners and salaried customers.

Chola enjoys a significant presence in the Tier II, III, IV towns and cities. The business has a 5,000+ connector network that facilitates passing on leads and a 500+ direct sales team (feet on street) members to source and offer doorstep delivery to the customer. Given that these customers are mostly first-time buyers the direct sales team guides and facilitates the customer through the entire purchase process.

Market Borrowing

During FY 20, the company raised ₹ 18,510 crores and repaid ₹ 16,885 crores of CPs. CP outstanding as at the end of the year was ₹ 1,625 crores. Medium and long-term secured NCDs to the tune of ₹ 895 crores were mobilised at competitive rates. At the end of FY 20, outstanding NCD stood at ₹ 5,359 crores.

During the year, the company raised its maiden unlisted, unrated, 10-year, Tier II rupee denominated bonds (commonly known as masala bonds) in the offshore market with CDC Group PLC for a total of ₹ 400 crores.

Including the above, the Tier II borrowings during the year constituted ₹ 450 crores and as at the end of FY 20, stood at ₹ 4,263 crores.

Financial Highlights

The company’s aggregate disbursements declined by 4% from ₹ 30,451 crores in FY 19 to ₹ 29,091 crores in FY 20. The AUM for the company grew by 16% (YoY) and the growth of on-balance sheet assets was 11%. The business AUM (including on book and assigned net of provisions) in FY 20 grew by 12% stood at ₹ 60,549 crores as against ₹ 54,279 crores recorded in FY 19.

Asset quality as on March, 2020 stage 3 assets had stood at 3.8% with adequate provision coverage 41.5% ECL provision, as against 2.7% of last FY with provision coverage of 38%. Stage 3 provisions for March, 2020 include additional provisions towards macro factors for ₹ 225 crores.

Profit after tax (PAT) for the year ended March, 2020 were at ₹ 1,052 crores after creation of one time provision of ₹ 504 crores (net of tax - ₹ 335 crores) towards COVID-19 contingencies and the macro factors (one time provision). On a comparable basis, PAT for the year ended March, 2020 were at ₹ 1,387 crores before considering one time provision, as against PAT of ₹ 1,186 crores last year, registering a growth of 17%.

Comparable PBT-ROTA for FY 20 before adjusting one-time COVID and macro provisions was at 3.5% for the year as against 3.7% in FY 19.

Cholamandalam Consolidated December 2020 Net Sales at Rs 2,520.18 crore, up 10.1% Y-o-Y 3

February 02, 2021; Reported Consolidated quarterly numbers for Cholamandalam Investment and Finance Company are:

Net Sales at Rs 2,520.18 crore in December 2020 up 10.1% from Rs. 2,289.06 crore in December 2019.

Quarterly Net Profit at Rs. 409.79 crore in December 2020 up 5.3% from Rs. 389.16 crore in December 2019.

EBITDA stands at Rs. 1,718.49 crore in December 2020 down 1.63% from Rs. 1,747.00 crore in December 2019.

Cholamandalam EPS has increased to Rs. 5.00 in December 2020 from Rs. 4.98 in December 2019.