Compass Group

Summary

- Compass Group is global leader in food services providing food and support services to millions of people around the world.

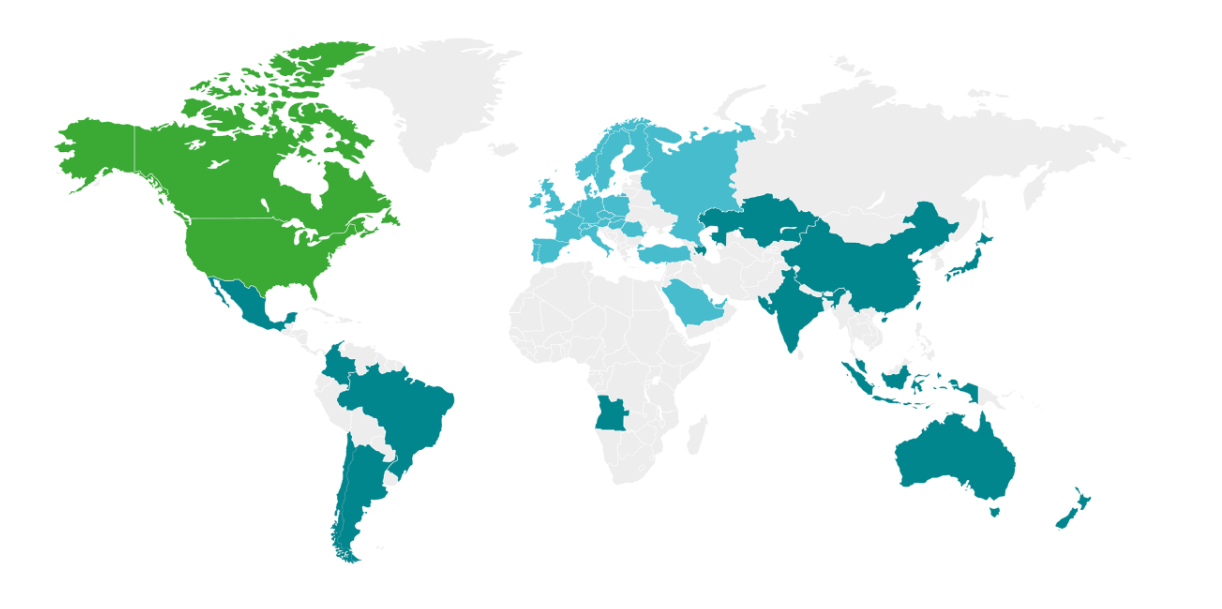

- Compass Group operate in around 45 countries across the world having 55,000 client locations serving 5.5 bn meals per year

Company Overview

Compass Group (LSE:CPG, OTC:CMPGF) is global leader in food services providing great food and support services to millions of people around the world, every day.1

The company operate in around 45 countries across the world having 55,000 client locations serving 5.5 bn meals per year

Services

The company operate at thousands of client locations around the world, from hospitals, schools and oil rigs to corporate headquarters and the world’s biggest entertainment venues.2

The company can also support its clients beyond food with a range of soft services.

The company provide food and support services across five market sectors.

The company provides customised services to clients and consumers by sectorising and sub-sectorising its business, allowing it to deliver bespoke, innovative and cost effective solutions.

Business & Industry

The company bring employees together to share delicious well balanced food at thousands of companies around the world. Utilising its scale, experience and evolving digital capabilities, the company can offer attractive cost benefits, tailored menus and a wide range of digital solutions that can add flexibility to operating models around the world.

Healthcare & Senior Living

The company work directly with healthcare providers to prepare food services that improve patient and senior living experiences – from restaurant-style cafés to in-room patient dining and specialist feeding. The company firmly believe that good quality, nourishing food can transform experiences for both patients and visitors.

Education

From kindergarten to colleges and universities, the company provide innovative, nutritious dining solutions that help support academic achievement at the highest levels.

The company strive to provide healthy, balanced meals right through the learning journey, from nursery, through to higher education. The company's catering solutions come in multiple formats, from traditional onsite dining, to retail convenience stores and vending and takeaway options.

Sports & Leisure

Compass Group has vast catering experience within this market – providing food, beverages and hospitality across large stadiums, conference venues, museums and galleries, at high profile events and private parties. The company cater to all sizes of event, working closely with clients to meet their specific requirements.

Defence, Offshore & Remote

Compass Group is an industry leader in supplying food and support services to many of the major companies in the oil, gas, mining and construction industries. The company's clients and customers rely on it to provide uninterrupted support, however challenging the conditions.

Brands

Business Overview

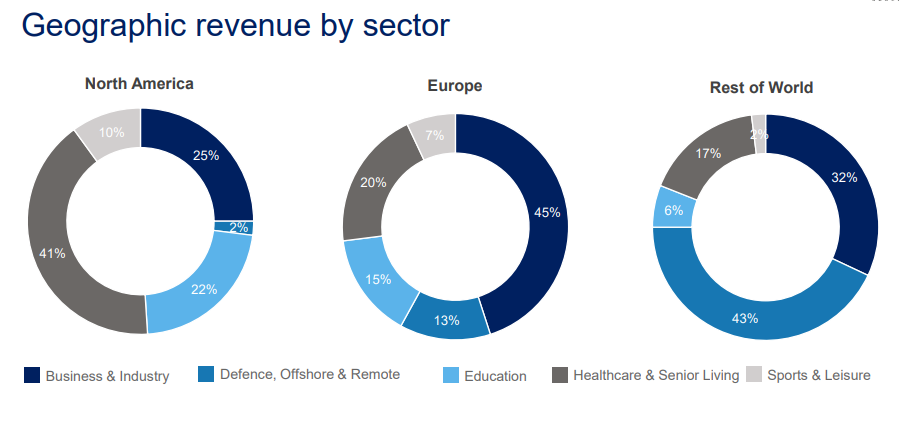

North America

Full year 2021 organic revenue declined by 6.7% and the company saw revenues at c.76% of 2019 revenue, with the fourth quarter exit rate at around 90%. Reported new business at 7.5%, with double digit new business growth in Healthcare & Senior Living and Sports & Leisure and continued high retention rates at 96.4%, saw net new business of 3.9% with the second half of the year at 7.3%. Of the top 10 new business wins by value, eight were from first time outsourcing.3

The company's Sports & Leisure business performed well in the second half of the year benefiting from improved attendance, particularly of outdoor sports events, with strong per capita spend. The company's Education sector has seen strong reopening numbers following the summer break and high on campus spend. The company's Business & Industry sector, being weighted towards business, continued to be significantly impacted by the pandemic with a slow recovery and gradual return to offices. The company's Healthcare & Senior Living business has been resilient throughout the pandemic, particularly in support services, and continued to trade above 100% of 2019 revenues. The company's remaining laundries business was disposed of during the year.

Underlying operating profit was £608 million, which represents 6.1% year on year growth on a constant currency basis. The actions taken to rebuild the margin and its continued focus on efficiency and cost control, have allowed the underlying operating margin to improve by 60bps from 2020 to 5.4%, with an underlying operating margin of 6.2% in Q4 2021, an improvement of 330bps over the fourth quarter of 2020.

Europe

Organic revenue declined 9.6% with net new business broadly flat albeit with the retention rate improving year on year. Encouragingly, net new business in the second half of the year was positive at 3.5% driven by improving trends in the UK, Turkey and Iberia. Overall revenue was c.75% of 2019 levels reflecting the adverse impact of national and local lockdowns on its Business & Industry, Education and Sports & Leisure sectors. The more resilient sectors of Healthcare & Senior Living and Defence, Offshore & Remote were broadly in line with 2019 levels.

Governments across Europe continued to provide ongoing support to protect jobs during the pandemic and, where appropriate, the company utilised these schemes. The company ceased participation in the UK Government’s Coronavirus Job Retention Scheme and have repaid the funds its employees benefited from in the year.

There remains uncertainty in the current trading environment, especially as to the pace of office reopenings in its major markets. Compass Group has continued with its resizing actions to adjust its cost base and have incurred a £149 million non-underlying charge in the year. No further resizing charges are expected, although the cash cost will continue into 2022.

The region returned to profitability with underlying operating profit at £147 million and the underlying operating margin improving by 380bps to 3.2%. The actions taken, including resizing, continued contract renegotiations and the focus on cost control as client sites reopened, resulted in an underlying operating margin of 5.7% in Q4 2021, an improvement of 980bps over the fourth quarter of 2020.

Rest of the World

The 3.0% organic revenue increase in its Rest of World region reflects double digit growth in LATAM and New Zealand and in its Defence, Offshore & Remote sector in Australia, partially offset by Japan where around 50% of revenues are from the Business & Industry sector. New business growth was 9.3% and retention was 94.3%, an improvement of 90bps from the prior year. Net new business improved during the year with the second half of the year at 6.1%. Revenues were around 86% of 2019 levels, with Q4 revenues at around 90%.

The region continues to be relatively protected from the impact of COVID-19 with around 60% of revenues from the more resilient sectors of Healthcare & Senior Living and Defence, Offshore & Remote. Slower vaccination roll out in LATAM has impacted the Business & Industry recovery along with localised lockdowns across the wider region.

Underlying operating profit was £130 million, an increase of 41.3% on a constant currency basis, resulting in an underlying operating margin of 5.6%, a 170bps year on year improvement. The focus on actions to control costs and improve efficiency, as well as a return to seasonal trading norms, has resulted in an underlying operating margin of 7.3% in Q4 2021, an improvement of 450bps over the fourth quarter of 2020.

Financial Highlights

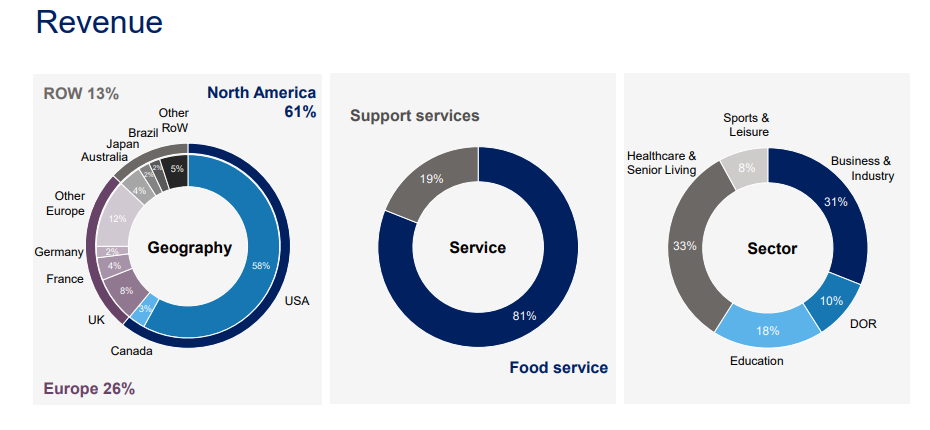

Revenue

For the year ended 30 Sept 2021, its underlying revenue was £18,136 million, an organic decline of 6.3% as the pandemic continued to impact its volumes, with lockdowns and restrictions being imposed and relaxed across its markets.

New business was 7.2% with retention improving to 95.4% and, encouragingly, net new business in the second half of the year was 6.2%, higher than the historical trend of around 3% and, although benefiting from a lower denominator, indicates positive momentum into 2022.

The company further progressed on rebuilding revenue in the second half, with the fourth quarter at 88% of its 2019 revenues reflecting significant improvements in Sports & Leisure and a strong return to Education after the summer break. Defence, Offshore & Remote and Healthcare & Senior Living continued to operate at over 100% of 2019 revenues, however, in Business & Industry, the pace of recovery remained subdued.

Operating profit

Throughout 2021, the company continued to control the controllable, including resizing the cost base and increasing labour flexibility. These actions, along with continued contract renegotiations, a focus on procurement and purchasing compliance, as well as general cost control, allowed its margin to rebuild quarter on quarter despite subdued volume recovery. The company's underlying operating margin improved to 4.5% compared with 2.9% in the previous year.

The company's underlying operating profit was £811 million (2020: £561 million), an increase of 44.6%.

If the company restate 2020’s underlying operating profit at the 2021 average exchange rates, it would decrease by £39 million to £522 million and, therefore, on a constant currency basis, underlying operating profit has increased by £289 million or 55.4%.

Net finance costs

Underlying net finance costs decreased to £113 million (2020: £134 million) mainly due to a reduction in net debt following the placing of shares in May 2020 and lower interest rates compared with the prior year.

Tax expense

On an underlying basis, the tax charge was £171 million (2020: £116 million), equivalent to an effective tax rate of 24.5% (2020: 27.2%) and, based on current tax rates, the company expect the effective tax rate to be around the same level next year. The decrease in rate from last year primarily reflects the remeasurement of deferred tax balances as a result of the increase in the UK corporation tax rate from 19% to 25% enacted in the Finance Act 2021 for profits arising after 1 April 2023.

Earnings per share

On a constant currency basis, underlying basic earnings per share increased by 72.5% to 29.5 pence (2020: 17.1 pence) mainly as a result of the higher profit for the year, partly offset by an increase in the number of ordinary shares in issue following the placing of shares in May 2020.

Free Cash Flow

Free cash flow totalled £464 million (2020: £105 million). During the year, the company made cash payments of £186 million in relation to the programmes aimed at resizing the business (2020: £108 million). Adjusting for this, and acquisition transaction costs of £10 million included in free cash flow in 2021, underlying free cash flow was £660 million (2020: £213 million), a £447 million or 209.9% increase, with underlying free cash flow conversion of 81% (2020: 38%).

Acquisitions

The total cash spent on acquisitions in the year, net of cash acquired, was £172 million (2020: £479 million), comprising £28 million of bolt-on acquisitions and investments in associates, £134 million of deferred consideration relating to prior years’ acquisitions and £10 million of acquisition transaction costs (included in net cash flow from operating activities in 2021).

The main acquisition during the prior year was the purchase of 100% of the issued share capital of Fazer Food Services, a leading food service business in the Nordic region, for an initial consideration of £363 million net of cash acquired. The remaining contingent consideration is payable within seven years and is dependent on the operation of an earn-out. The net present value of the contingent consideration was £49 million at 30 September 2021 (2020: £53 million).

Disposals

The Group has continued to simplify its portfolio of businesses and sold its remaining US laundries business during the year. The Group received £32 million (2020: £41 million) in respect of disposal proceeds net of exit costs and paid £43 million (2020: £12 million) of tax in respect of prior year business disposals.

Net debt

Net debt at 30 September 2021 was £2,538 million (2020: £3,006 million). The ratio of net debt to market capitalisation of £27,210 million at 30 September 2021 was 9.3% (2020: 14.4%). At 30 September 2021, the ratio of net debt to underlying EBITDA was 1.6x. The company's leverage policy is to maintain strong investment grade credit ratings and to target net debt to EBITDA in the range of 1x-1.5x.

Net debt decreased by £468 million to £2,538 million at 30 September 2021 (2020: £3,006 million) mainly reflecting free cash flow of £464 million. In the prior year, net debt reduced by £1,261 million to £3,006 million mainly reflecting free cash flow of £105 million and the net proceeds of the share placing (£1,972 million), partially offset by business acquisitions net of disposal proceeds (£450 million) and the final dividend for the 2019 financial year (£427 million).

Q1 2022 Update

03 February 2022; Compass Group PLC’s performance for the three months ended 31 December 20214

Group organic revenue grew by 38.6%1 in the first quarter, with revenues reaching 97% of their pre-COVID level. The quarterly improvement was largely driven by new business, continued strong client retention along with some ongoing recovery in the base business. The emergence of the Omicron variant had a limited impact on the Group during the period.

Performance improved across all regions with four out of five sectors now trading above 100% of 2019 revenues. Growth was particularly strong in North America in Sports & Leisure and Education. In Europe, all sectors traded well except for Business & Industry which continues to be impacted by reopening delays. The Rest of World region continued to benefit from a higher exposure to the more resilient Defence, Offshore & Remote sector.

Future growth

In the first quarter, the Group spent c. £87 million on bolt-on acquisitions in North America, further strengthening its capabilities in delivered-in solutions. There is a strong pipeline of exciting opportunities across all regions and sectors, and the company remain disciplined in its approach to acquisitions.

The acceleration in new business wins seen in FY21 continued into the new year, with three out of the five top wins globally coming from first time outsourcing.

Summary and outlook

Compass Group has seen strong start at the year, excellent new business wins and continued strong client retention. However, Compass Group is mindful of some impact from the Omicron variant in Q2, with Business & Industry clients delaying their return to work, some Sports & Leisure events being postponed and Education facilities extending remote learning.

The company's guidance for FY22 remains unchanged. The company expect full year organic revenue growth of 20 - 25%, with quarterly growth rates moderating through the year, reflecting more challenging comparatives. As previously stated, full year underlying operating margin is expected to be over 6%, returning to around 7% by the year end. Margin progression will be second half weighted, with the first half margin anticipated to be around the Q4 2021 exit rate.

Looking further ahead, the company remain excited about the significant structural growth opportunities globally, leading to the potential for revenue and profit growth above historical rates, returning margin to pre-pandemic levels, and rewarding shareholders with further returns.

References

- ^ https://www.compass-group.com/en/who-we-are/at-a-glance.html

- ^ https://www.compass-group.com/en/what-we-do/services.html

- ^ https://www.compass-group.com/content/dam/compass-group/corporate/ar-updates-2021/annual-report-pdf/CompassGroupPLC_AnnualReport2021.pdf.downloadasset.pdf

- ^ https://www.compass-group.com/en/media/news/2022/agm-and-q1-trading-update-.html