Dalmia Bharat Ltd

Overview

Dalmia Bharat Limited (NSE:DALBHARAT) (Formerly known as Odisha Cement Limited) founded by Jaidayal Dalmia in 1939, Dalmia Cement is one of India’s pioneering cement companies. Headquartered in New Delhi, the company operates as Dalmia Cement (Bharat) Ltd., which is in turn is a 100% subsidiary of Dalmia Bharat Ltd.1

It is a part of the Dalmia Bharat Group, one of India’s most respected business conglomerates- the other businesses of which include Sugar and Refractory products.

Product and Brand portfolio

Dalmia Cement’s availability spans across 22 states and union territories, mainly in East, North East and Southern India, with selective presence in Uttar Pradesh and Maharashtra.

The company offer a range of cement variants through its brand portfolio of three marquee brands: Dalmia Cement, Dalmia DSP and Konark Cement. These brands are available as Portland Pozzolona Cement, Portland Slag Cement, Composite Cement, and Ordinary Portland Cement in select markets.

The company is a category leader in super-specialty cements used for oil well, railway sleepers and air strips. The company work with engineers and technocrats around the country to develop a wide variety of customized cement which is manufactured for specific engineering and construction needs.

Manufacturing:

The company operates a manufacturing capacity of 26.5 million tonnes per annum (MTPA), across 13 cement plants and grinding units, spread across nine states. The company invest heavily in research and development, operating three R&D centers equipped with cutting edge robotic labs (called Dalmia Cement Future Labs) at its regional hubs.

Dalmia Cement is:

- The largest producer of slag cement in India

- The largest producer of specialty cement in the country

Plant locations

The Group has manufacturing plants at thirteen locations in Southern, North Eastern and Eastern regions of India as detailed below in Table

| Plant location | State | Plant Type |

| Southern Region | ||

| Dalmiapuram | Tamil Nadu | Integrated |

| Ariyalur | Tamil Nadu | Integrated |

| Kadappa | Andhra Pradesh | Integrated |

| Belgaum | Karnataka | Integrated |

| Eastern Region | ||

| Rajgangpur | Odisha | Integrated |

| Kapilas | Odisha | Grinding |

| Medinipur | West Bengal | Grinding |

| Bokaro | Jharkhand | Grinding |

| Banjari | Bihar | Integrated |

| North Eastern Region | ||

| Meghalaya | Meghalaya | Integrated |

| Lanka | Assa m | Grinding |

| Umrangshu | Assa m | Integrated |

| Marigaon | Assa m | Grinding |

Brands

Dalmia Cement’s availability spans 22 States in East, North East and Southern India, with a selective presence in Uttar Pradesh and Maharashtra.2

Dalmia Bharat is a category leader in super-speciality cements used for oil well, railway sleepers and air strips. The company work with engineers and technocrats to develop a wide variety of customised cement manufactured for specific engineering and construction needs.

The company offer a range of cement variants through its portfolio of three marquee consumer cement brands: Dalmia Cement, Dalmia DSP and Konark Cement; its institutional brands comprise Dalmia InfraPro, Dalmia Infragreen and Dalmia InstaPro.

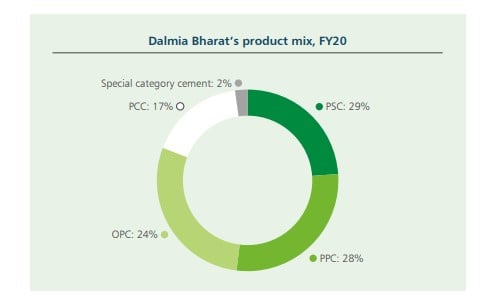

These brands are available in variants as per local demand and resource availability in selected markets:

- Portland Pozzolana Cement (PPC)

- Portland Slag Cement (PSC)

- Portland Composite Cement (PCC)

- Ordinary Portland Cement (OPC).

.

Dalmia Cement

Dalmia Cement has been one of India’s best recognised cement brands for over 80 years, leading through breakthrough innovation and best-in-class technology. Keeping its values of innovation, co-creation and sustainability in mind, all Dalmia Cement products have been designed to last a lifetime. Available in PSC, PPC and OPC 43 & 53.

Dalmia DSP Cement

Dalmia DSP Cement is a specialised, best-in-class offering for high strength concrete applications – such as foundations, columns and slabs. The product is a culmination of Dalmia’s strong R&D efforts, combined with over 80 years of experience in serving customers with unique solutions. Available in PSC and PPC.

Konark Cement

A trusted brand with a heritage of reliable performance, Konark Cement prides itself in giving the consumer a consistent quality, which helps build long lasting homes. Crafted using state-of-the-art technology, it has been shaping the foundation of happiness for more than 65 years. Available in PSC and PCC.

Dalmia Infra Pro

Dalmia Infra Pro is a specialised offering focusing on the B2B market. It offers cement variants, which perfectly match institutional customer needs. It not only caters to domestic customers but is also exported to SAARC and Middle East markets. Available in OPC 53 & 43, PPC, PSC, PCC and a range of speciality cements.

Dalmia Infragreen

Dalmia Infragreen is an innovative blended cement that not only outperforms any blended cement but also OPC cement on all performance parameters. This cement consumes 25% less water and is engineered for concrete to be made with 15- 20% lower cement content, making it ideal for heavy-duty infrastructure construction.

Speciality Cements

Dalmia Bharat has been a pioneer in specialty cement products in India. Dalmia Bharat was the first to develop cement products for use in the construction of air strips, concrete railway sleepers and oil wells, among others. The company possess a wide portfolio of speciality cements including Sulphate Resisting Portland Cement, Railway Sleeper Cement, Oil Well Cement and special cements for air strips and nuclear power plants construction.

Industry Overview

India is the second largest producer of cement in the world following China, with an annual installed capacity which is pegged at 545 million tonnes per annum (MTPA), accounting for 8% of the global production of cement.

The major share of cement production comes from South India, which contributes ~35% of the total production followed by North India which account for 20%, East 18%, West 14% and Central 13%. The Indian cement industry is also one of the biggest employment generators, generating 20,000 downstream jobs for every million tonnes of cement produced.

The demand drivers of cement in India are primarily the housing and real estate sectors (65%), public infrastructure (20%) and industrial development (15%). The increasing spend by the Government on infrastructure and housing is driving cement demand in India. The per capita consumption of cement in India is a mere ~225 kgs compared to a global average of 575 kgs, indicating headroom for the cement industry. It would be pertinent to note that a number of Indian cement companies are among the world’s ‘greenest’ cement manufacturers and at par with Japan in energy consumption and the adoption of environment friendly practices.

The cement production in India was pegged at 334 million tonnes for FY20, clocking a 1% decline over the previous fiscal. An increased government focus on real estate growth (Smart Cities and Housing for All) coupled with better roads and highways are expected to catalyse the demand for cement. Construction under PMAY-Urban and PMAY-Gramin are expected to generate 80-85 million tonnes of cement demand over the next 18-24 months.

There was a hike in prices of cement in January 2020, following which the average prices in the northern, western and central region were pegged at Rs 340-345 per bag, while in eastern India was pegged at Rs 320-330 per bag.

The year under review was marked by the spread of the COVID-19 virus, giving rise to a global pandemic, which, in turn, forced countries to close their borders and enforce a lockdown. India was no different and the impact of lockdown was evident in the last week of FY20. The lockdown severity impacted the cement industry in India, moderating cement production in FY20 and capacity utilisation from 70% in FY19 to 61% in FY20.

Global refractory market

The global refractory market was estimated at US$ 30 billion in 2018. The sector is classified into clay-based and non-clay based products. In 2018, the clay-based segment accounted for ~US$ 16 billion and the non-clay-based for another US$ 14 billion in revenues. Strong product demand from the aerospace, electrical, automotive, glass and cement industries are expected to drive the global refractory market. The sector is also gaining traction due to its ability to withstand extreme temperatures. Being heat-resistant than most metals, they are used for lining hot surfaces found inside industrial processes.

Indian refractory market

Refractories are products used for high temperature insulation and erosion/ corrosion, made mainly from nonmetallic minerals. They are processed and made heat-resistant to the corrosive and erosive action of hot gases, liquids and solids at high temperatures in various types of kilns and furnaces. These refractories find downstream applications in iron and steel, cement, glass, non-ferrous metals, petrochemicals, fertiliser, chemicals, ceramics and even thermal power stations and incinerator sectors

The size of the Indian refractory industry is estimated at nearly Rs 9,000 Cr. India is the second-largest steel producer and the largest producer of sponge iron globally. India’s steel production witnessed an upward trend from 15 million tonnes (MT) in 1990 to 111 MT in 2019 on the back of investments in infrastructure, construction, and automobile sectors. The steel industry is one of the essential downstream sectors of the refractory industry, expected to drive the demand for refractories. (Source: Economic Times, Financial Express)

Financial Highlights

Dalmia Bharat is committed to the twin strategic principles of ‘Building a strong and sustainable business foundation’ and ‘Growth for tomorrow’. I am pleased to report that its company did not just address the challenges of the day but also strengthened its business in a sustainable forward-looking way during the year under review. Dalmia Bharat reported a credible performance during the year under review. Even as the cement sector reported volume de-growth in a challenging FY20, its company’s sales volume grew by 3%.

Revenues increased 2% to Rs 9,674 Cr., EBITDA increased 8% to Rs 2,106 Cr., EBITDA margin was 21.8% compared to 20.5% in the previous year. The company's company’s fiscal discipline reflected in a decline in finance costs from Rs 542 Cr. in FY19 to Rs 438 Cr. in FY20.

The company finished the year with a stronger Balance Sheet despite market challenges. The company's Net Debt/EBITDA declined from 1.6 in FY19 to 1.34 in FY20

On a standalone basis, the company recorded net revenue of Rs 151 crores for the FY 2019-20 registering a decline in growth by 7.92% as compared to the net revenue of Rs 164 crore in the FY 2018-19 and earned profit before tax of Rs 153 crore during the FY 2019-20 registering a growth of 28.57% as compared to Rs 119 crore profit earned in the FY 2018-19. Profit before finance cost, taxes, depreciation and amortisation stood at Rs 166 crore in FY 2019-20 as compared to Rs 125 crore in FY 2018-19.

On a consolidated basis, the company recorded net revenue of Rs 9674 crores for the FY 2019-20 registering a growth of 2.00% as compared to the net revenue of Rs 9484 crore in the FY 2018-19 and earned profit before tax of Rs 357 crores during the FY 2019-20 registering a growth of 5.31% as compared to Rs 339 crore earned in the FY 2018-19. Profit before finance cost, taxes, depreciation and amortisation stood at Rs 2323 crore in FY 2019-20 as compared to Rs 2186 crore in FY 2018-19.

Dalmia Bharat Consolidated September 2020 Quarterly Result 3

November 10, 2020; Net Sales at Rs 2,410.00 crore in September 2020 up 7.78% from Rs. 2,236.00 crore in September 2019.

Quarterly Net Profit at Rs. 232.00 crore in September 2020 up 759.26% from Rs. 27.00 crore in September 2019.

EBITDA stands at Rs. 744.00 crore in September 2020 up 43.08% from Rs. 520.00 crore in September 2019.

Dalmia Bharat EPS has increased to Rs. 12.24 in September 2020 from Rs. 1.40 in September 2019.