Deep Yellow Limited

Company Profile

Deep Yellow Limited (DYLLF) is an advanced-stage uranium exploration company with a clear growth strategy to establish a multi-project global uranium development platform. Led by Paladin Energy founder John Borshoff, Deep Yellow Limited has the expertise and capability to achieve its strategy during a countercyclical period for uranium investment.

Deep Yellow Limited has a cornerstone suite of projects in Namibia, a top-ranked African mining destination with a long, well regarded history of safely and effectively developing and regulating its considerable uranium mining industry.

Deep Yellow Limited holds four key contiguous Exclusive Prospecting Licenses (EPLs) covering 1,590km2 within the heart of what is a world-recognized, prospective uranium province of high significance. The tenements are strategically located amongst the major uranium mines of this region -- 20km south of the Husab/Rössing deposits and 40km southwest of the Langer Heinrich deposit.

Corporate Strategy

Deep Yellow Limited has a two-pronged growth strategy involving the development of its existing uranium resources in Namibia and its newly-discovered Tumas 3 deposit (March 2017). In parallel, Deep Yellow Limited will pursue accretive, counter-cyclical acquisitions to create a multi-project uranium platform. This will be conducted with a proven team led by John Borshoff who was appointed CEO & Managing Director in October 2016. This is an experienced senior management group with a unique historical record of accomplishment.

Key Achievements

- Landmark $3.4 million joint venture with Japan Oil, Gas and Metals National Corporation (JOGMEC), the minerals investment arm of the Japanese government, over two tenements in Namibia where JOGMEC can earn 39.5%.

- A new palaeochannel uranium discovery made on the 100%-owned Reptile Project (Tumas 3) with a further 100km of untested prospective palaeochannel targets delineated.

- First 10,000m drill program at Tumas 3 identified extensive uranium mineralization having potential to upgrade the current Mineral Resource base.

- Completed a successful $11.5 million capital raising, with the support of the Sprott Group, providing the base for future exploration and acquisition growth plans.

Namibian License Status

- Post reporting period, renewal confirmations were received for Exclusive Prospecting Licenses (EPLs) 3496 and 3497 (Reptile Project) granting tenure for a further two year statutory period until 5 June 2019.

- Renewal confirmations were received for EPLs 3669 and 3670 (Nova JV project) granting tenure until 19 November 2019.

- Application has been made for a Mineral Deposit Retention License (Yellow Dune JV project) to secure the Aussinanis uranium resource within EPL 3498.

Mineral Properties

Namibian Operations

Deep Yellow Limited holds an interest in three key projects in Namibia: Reptile, the Nova Joint Venture (NVJ) and the Yellow Dune Joint Venture (YDJV) project. Reptile and NJV are active exploration projects, YDJV is non-active and these projects are described below. Reptile Mineral Resources and Exploration (Pty) Ltd (RMR – wholly-owned subsidiary of Deep Yellow Limited) is the manager of all projects.

New Exploration Focus

With the change in management of the Company in late October 2016 and redirection of exploration effort on its Namibian projects to discover larger uranium deposits, the Marenica test work program (referred to later in this overview) was discontinued and a new approach was initiated. The calcrete-associated uranium mineralization in the Tumas 1 and 2 areas including the Tubas zones was reassessed. This work enabled a better understanding of the stratigraphy of the surficial cover units that can host the calcrete uranium mineralization. Improved geological characterization of the prospective palaeochannels isolated specific uranium target areas to test for increasing the uranium resource base of the project. Reinterpretation of the historic geological and drill-hole data and previous geophysical survey work identified several new prospective areas in the eastern and central parts of the palaeodrainage system in the Tumas 3, S Bend and S Bend East areas.

Importantly, the reinterpretation of existing regional data delineated 120km of palaeochannel considered prospective for this Langer Heinrich-type mineralization across the Reptile project area. The Tumas 1 & 2 deposit, and the Tubas Red Sands/calcrete deposits, contain substantial resources in the Measured, Indicated and Inferred JORC resource categories previously reported and all occur within this extensive palaeodrainage system. The newly defined 120km palaeochannel system has identified an extensive exploration target of which only 25km has been adequately tested.

Tumas 3 Uranium Discovery

In July 2017, a 10,000m drilling program was completed at the newly discovered Tumas 3 prospect on EPL 3496. The RC drilling commenced in March and was completed in early July. A total of 400 holes for 10,545m was drilled. All holes were down-hole gamma logged by a fully calibrated AUSLogger and all down-hole gamma data were converted to equivalent uranium values in ppm (eU3O8ppm).

The drilling of the Tumas 3 target zone has delineated 4.4km of uranium mineralization in calcrete rich fluvial sediments occurring within the prospective palaeochannel system. Of the 400 drill holes defining the new discovery, 284 returned positive results (defined as greater than 100ppm U3O8 over 1m) – a 71% success rate.

The Tumas 3 mineralization remains open to the west and east. This, in addition to some outlying mineralized holes from previous drilling, strongly justifies continuing with extension drilling to determine the full extent of the Tumas 3 discovery. This new uranium discovery adds significantly to the uranium deposits that Deep Yellow Limited has already identified within these palaeochannels in its Tumas 1 & 2 and Tubas Red Sands/calcrete deposits.

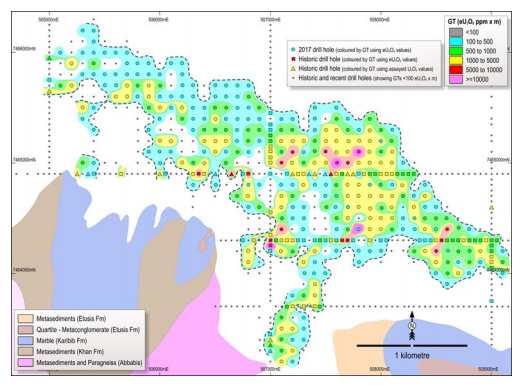

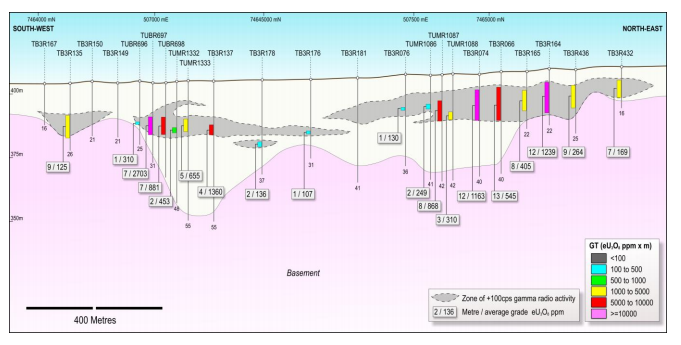

A zone of continuous uranium mineralization has been delineated with equivalent uranium grades eU3O8 ranging from 101ppm to 0.71% (7100ppm) eU3O8 over 1m occurring within the 4.4km section tested to date. The mineralization remains open to the west and east and is defined as anything having a grade thickness (GT) of greater than 100ppm eU3O8 over a 1m interval. These GT values (eU3O8ppm x thickness in meters) are shown in contoured form in Figure 1 and highlight the robust, open nature of the uranium mineralization. Also shown in Figure 2 is a SW-NE drill hole cross section indicating mineralization in relationship to palaeochannels.

Figure 1

Figure 2

The mineralized channel system that has been identified at Tumas 3 varies from 200m to 900m in width and uranium mineralization ranges in thickness from 1m to 12m occurring at depths varying between 1m to 21m.

The blind nature of the mineralization at Tumas 3, having no surface radiometric expression, highlights the opportunity for further discovery. Apart from the benefit gained by the re-interpretation of the existing airborne geophysical data delineating more accurately the broad outline of this prospective palaeochannel system, the actual discovery has only been possible by drilling.

The palaeochannels occurring away from these deposits have only been sparsely drilled along widely spaced regional lines 2km apart near Tumas 1, 2 and 3 occurrences. Elsewhere spacing varies widely with large areas undrilled, leaving ample opportunity for both expansion of Tumas 3 and for further discoveries to be made within what is now recognized as a very poorly tested, highly prospective palaeochannel system of 100km in length.

Renewal applications for EPLs 3496 and 3497 for a further statutory two years were submitted in March 2017 to the Ministry of Mines and Energy (MME), prior to their expiry date in June 2017. The Company received notification from the MME on 22 August 2017 that these renewals had been granted until 5 June 2019.

Nova Joint Venture (EPLs 3669, 3670)

JOGMEC Earn-In Agreement

The tenements EPL3669 and EPL3670 comprise the Nova Joint Venture (NJV) held in the corporate entity Nova Energy (Namibia) Pty Ltd in which Reptile Mineral Resources and Exploration (Pty) Ltd (RMR - wholly owned subsidiary of Deep Yellow Limited) holds 65% (Manager), Nova Energy Africa Pty Ltd (wholly owned subsidiary of Toro Energy Limited, ASX listed) 25% and Sixzone Investments (Pty) Ltd 10%.

On 29 March 2017 Deep Yellow Limited advised that it had entered into a strategic earn-in agreement with JOGMEC to participate in the NJV. The NJV adjoins Deep Yellow Limited’s 100% owned Reptile project (EPLs 3496, 3497) where significant uranium resources have been defined and reported. Under the terms of the NJV, JOGMEC is responsible for expenditure from 1 November 2016.

The NJV area is considered prospective for both basement related alaskite-associated uranium targets (e.g. Rössing/Husab), skarn-type (e.g. Inca) and palaeochannel-related surficial calcrete uranium targets (e.g. Langer Heinrich). JOGMEC, under the terms of the earn-in agreement, can earn a 39.5% interest in the project through the expenditure of $3.4M within four years. RMR will continue to be the NJV manager. Following the achievement of the JOGMEC earn-in, the new equity distribution in the NJV would be JOGMEC 39.5%, RMR 39.5%, Nova Africa 15% and Sixzone 6%.

JOGMEC will earn no equity unless it meets the full $3.4M expenditure obligation. The remaining JV participants will be free carried until this expenditure commitment is satisfied and thereafter, the other parties will be required to contribute on a pro-rata basis (except for Sixzone, whose 6% share will be carried and paid back from future dividends).

JOGMEC is a Japanese Government organization that collaborates with governmental agencies and companies, both domestically and overseas, to secure stable supplies of natural resources and energy for Japan. JOGMEC carries out exploration activities through joint venture with overseas exploration companies. For projects that generate promising results, JOGMEC’s position in the project may then be transferred to Japanese companies with reduced exploration risk. Projects are selected based on geological potential, quality of management, mining investment environment (including safety) and Japanese companies’ interest. The organization has entered into more than 100 projects in the past 12 years and currently has more than 25 active joint ventures, spanning grassroots exploration through to pre-feasibility level projects.

Activities

Ground geological and geophysical follow-up of the anomalous zones have commenced to define the drill target locations for the 6,000m drilling program planned to start in the last quarter of 2017. The geophysical work on the basement targets included pole-dipole induced polarization (PDIP), ground radiometric, electromagnetic (EM) and magnetic surveys.

Ground geophysics is being utilized to better establish the location of the palaeochannels identified previously in more broad form from airborne EM data interpretation. This work on palaeochannel definition includes ground magnetics, gravity, EM and passive seismic surveys.

Basement Targets

Airborne magnetic imagery is effective at mapping rocks prospective for alaskite and skarn-type deposits, and contributed significantly to the discovery of the world-class Husab deposit. A 40km strike length of prospective rock units has been identified in EPL3669 and 3670 using airborne magnetic imagery. The previous exploration strategy was to use RC drilling as a front-line approach to test the prospective stratigraphy, which, although it led to the discovery of the Ongolo alaskite-type deposit, proved costly and time-consuming. A focus of the new work therefore, is to re-evaluate existing geophysical datasets with a view to identifying rapid and cost-effective geophysical exploration methods for target definition.

Uranium deposits in the area are associated with rocks that are rich in sulphide minerals, indicating that induced polarization (IP) surveys can be used to directly detect buried deposits of this type. Systematic, gradient-array IP (GAIP) surveys were carried out over prospective zones defined by magnetic imagery. The survey tested 15km of the previously defined alaskite associated target zones. Eight anomalies have been identified in total and are distributed equally between EPL3669 and EPL3670. The significance of these conductors will also be assessed.

Review of historic exploration data highlighted the Cape Flat alaskite target located in the north central part of EPL3670. This target is defined by a 4km long airborne radiometric anomaly and contains several EM conductors. Previous drilling returned an intersection of 55m at 133 ppm U3O8. This zone will be covered by GAIP and drill-tested.

Geological mapping was carried out in tandem with the geophysical data review and generated important new information, including significant revisions to the existing Geological Survey of Namibia geology maps. This will lead to improved targeting.

Surficial Calcrete Targets

Surficial, calcrete-type uranium deposits of the Erongo district are typically hosted within abandoned river channels referred to as palaeochannels. Defining these palaeochannels is a key step to discovering further surficial-type resources. The target definition work carried out identified surficial calcrete targets and these will be drill tested late 2017 to determine their prospectively.

Airborne electromagnetic surveys have proved to be effective at delineating these targets, probably due to high volumes of conductive, saline groundwater in the pores of the palaeochannel sediments. Many of the palaeochannels were previously unknown but the Skink prospect on EPL3670 was drill-tested by Aquitaine during the 1990s. Additional drilling is warranted, particularly in deeper sections of palaeochannel. A prominent NNW-SSE tending channel on EPL3669 seems particularly prospective as it drains a uranium-rich region to the North. This channel will also be drill tested.

Yellow Dune Joint Venture (EPL 3498)

The parties to the Yellow Dune Joint Venture (YDJV) are Yellow Dune Uranium Resources (Pty) Ltd, a wholly owned subsidiary of Reptile Uranium Namibia (Pty) Ltd (RUN) (85%), Oponona Investments (Pty) Ltd (10%) and Epangelo Mining Company (Pty) Ltd (5%).

Due to the depressed uranium market outlook, the fact that EPL3498 is considered fully explored and that there is no further potential for additional discovery to add to the existing resources that have been defined, an application has been made for a Mineral Deposit Retention Licence to secure the area containing the resource within EPL 3498. Economic studies show that a mining operation at the current prevailing low uranium prices is not viable.

Revised Mineral Resource Status

In October 2016, the Company provided the revised Mineral Resource Estimate for its Tumas 1 and 2 deposits. The Inferred Resource category remains unchanged at 0.3Mlb U3O8 resulting in a total Resource of 13.3Mlb. This work did however generate a 13% increase in the Measured and Indicated Resource categories.

Mineral Resource Estimates

The Company still has a number of Mineral Resource Estimates classified under JORC 2004 and has committed to progressively reviewing previously stated resources for the other deposits and bringing all resources up to JORC 2012 standard as indicated in Table 1.

Mineral Resource Statement (Table 1.)

| Deposit | Category | U308(Mlb) |

|---|---|---|

| Basement Mineralization – Omahola Project – JORC 2004 | ||

| INCA Deposit | Indicated | 7.2 |

| INCA Deposit | Inferred | 6.2 |

| Ongolo Deposit | Measured | 6.7 |

| Ongolo Deposit | Indicated | 7.8 |

| Ongolo Deposit | Inferred | 10.6 |

| MS7 Deposit | Measured | 4.3 |

| MS7 Deposit | Indicated | 1.0 |

| MS7 Deposit | Inferred | 1.3 |

| Omahola Project Sub-Total | -- | 45.1 |

| Calcrete Mineralization – Tubas Sand Project – JORC 2012 | -- | -- |

| Tubas Sand Deposit | Indicated | 4.1 |

| Tubas Sand Project | Inferred | 8.6 |

| Tubas Sand Project Total | -- | 12.7 |

| Tumas Project – JORC 2012 | -- | -- |

| Tumas Deposit | Measured | 8.2 |

| Tumas Deposit | Indicated | 4.8 |

| Tumas Deposit | Inferred | 0.3 |

| Tumas Project Total | -- | 13.3 |

| Tubas Calcrete Resource – JORC 2004 | -- | -- |

| Tubas Calcrete Deposit | Inferred | 6.1 |

| Tubas Calcrete Total | -- | 6.1 |

| Tumas Project – JORC 2012 | -- | -- |

| Aussinanis Deposit | Indicated | 2.7 |

| Aussinanis Deposit | Inferred | 15.3 |

| ** Aussinanis Project Total** | -- | 18.0 |

| Calcrete Projects Sub-Total | -- | 50.1 |

| GRAND TOTAL RESOURCES | -- | 95.2 |

Additional Information: www.deepyellow.com.au :: www.fahy.co