Emera

Summary

- Emera is a North American leader in the transition to cleaner energy.

- Emera has grown into an energy leader with $34 billion in assets and serving 2.5 million customers in Canada, the US and the Caribbean.

- For more than 15 years, our strategic focus has been to safely deliver cleaner, affordable and reliable energy to our customers.

- Emera's companies include electric and natural gas utilities, natural gas pipelines and an energy marketing and trading firm.

Company Overview

Emera (TSX:EMA) is a North American leader in the transition to cleaner energy. From its origins as a single electric utility in Nova Scotia, Emera has grown into an energy leader with $34 billion in assets and serving 2.5 million customers in Canada, the US and the Caribbean.1

For more than 15 years, its strategic focus has been to safely deliver cleaner, affordable and reliable energy to its customers. The company's CO2 reduction goals and net-zero vision are fundamental to its strategy and are driving its growth. We’re focused on making investments in cleaner and renewable sources of energy, modernizing its infrastructure and customer-focused technologies while maintaining affordability, enhancing reliability, adopting emerging technologies and working constructively with policymakers, regulators, partners, investors, and its communities.

Companies

From its origins as a single electric utility in Nova Scotia, Emera has grown into an energy leader serving customers in Canada, the US and the Caribbean. Emera's companies include electric and natural gas utilities, natural gas pipelines and an energy marketing and trading firm.2

Tampa Electric

Tampa Electric has supplied the Tampa Bay area with electricity since 1899. Its West Central Florida service area covers 2,000 square miles, including Hillsborough County and parts of Polk, Pasco and Pinellas counties. The utility has more than 5,000 megawatts of generating capacity and over 765,000 residential, commercial and industrial customers who depend on Tampa Electric for safe, reliable and affordable power.

Tampa Electric is wholly owned by Emera.

Nova Scotia Power

Nova Scotia Power is a regulated electrical utility serving 500,000 residential, commercial and industrial customers in Nova Scotia, Canada. The utility provides 95 per cent of Nova Scotia’s generation, transmission and distribution services.

Nova Scotia Power is Emera’s founding affiliate and a wholly owned subsidiary.

Emera Caribbean

Emera Caribbean Inc. is parent company of Grand Bahama Power Company (GBPC) and Barbados Light & Power (BLPC) and an investor in St. Lucia Electricity Services Ltd. (LUCELEC) in St. Lucia. Together, these utilities generate and deliver electricity to more than 200,000 residential, commercial and industrial customers.

Emera Newfoundland & Labrador

Emera Newfoundland & Labrador (Emera NL) owns 100% of NSP Maritime Link Inc. (NSPML), which constructed and operates the Maritime Link Project, a subsea interconnection between the island of Newfoundland and Nova Scotia. NSPML is regulated by the NS Utility and Review Board.

Emera NL also has a minority investment in Nalcor Energy’s Labrador-Island Link (LIL) interconnection project between Muskrat Falls, Labrador and Soldier’s Pond on the island of Newfoundland.

These investments are integral to bringing cleaner electricity to the region.

Emera NL has offices in St. John’s, NL, and Halifax, NS, and is a wholly owned Emera subsidiary.

Peoples Gas

Since 1895, Peoples Gas has provided Florida residents and businesses with reliable and affordable natural gas products and service. The company has grown to become Florida’s biggest natural gas provider, serving 400,000 customers across the state. Peoples Gas operates about 13,500 miles of natural gas distribution mains and 160 miles of transmission lines.

Peoples Gas is wholly owned by Emera.

New Mexico Gas

Based in Albuquerque, New Mexico Gas Co. (NMGC) maintains 12,000 miles of natural gas pipeline to provide service to more than 513,000 residential, commercial and transportation customers. Strategically situated between two large natural gas production basins, the company’s service area encompasses 60 percent of the population of New Mexico.

NMGC is a wholly owned subsidiary of Emera.

Emera New Brunswick

Emera New Brunswick (ENB) transmits natural gas through the Brunswick Pipeline, connecting the Canaport LNG terminal in Saint John, New Brunswick, to the existing Maritimes & Northeast Pipeline near St. Stephen, New Brunswick. The 145-kilometre pipeline delivers natural gas to Maritime Canada and the Northeast US.

ENB is a wholly owned subsidiary of Emera.

Emera Technologies

Emera Technologies is a dedicated and nimble organization that's focused on developing new ways to deliver renewable energy to customers. Headquartered in Tampa, Florida, the team engages experts, research organizations and technology leaders to capitalize on the disruptive challenges and innovation opportunities in today’s energy industry.

Business Overview

Florida Electric Utility

Florida Electric Utility consists of Tampa Electric, a vertically integrated regulated electric utility engaged in the generation, transmission and distribution of electricity, serving customers in West Central Florida. Tampa Electric has $10.7 billion USD of assets and approximately 810,600 customers at December 31, 2021. Tampa Electric owns 5,919 MW of generating capacity, of which 77 per cent is natural gas-fired, 12 per cent is solar and 11 per cent is coal. Tampa Electric owns 2,165 kilometres of transmission facilities and 19,530 kilometres of distribution facilities.3

Beginning in 2022, Tampa Electric’s approved regulated ROE range is 9.00 per cent to 11.00 per cent, based on an allowed equity capital structure of 54 per cent (2021 – 9.25 per cent to 11.25 per cent based on an allowed equity capital structure of 54 per cent). An ROE of 9.95 per cent (2021 – 10.25 per cent) will be used for the calculation of the return on investments for clauses. See below for further detail.

Tampa Electric anticipates earning within its ROE range in 2022. New base rates effective January 1, 2022 will result in higher 2022 USD earnings than in 2021. Tampa Electric sales volumes are expected to be similar to 2021, which benefited from weather that was warmer than normal (a 20-year statistical degree day average). Tampa Electric expects customer growth rates in 2022 to be consistent with 2021, reflective of current expected economic growth in Florida.

On January 19, 2022, Tampa Electric requested a mid-course adjustment to its fuel and capacity charges to recover an additional $169 million USD, effective with April 2022 customer bills, due to an increase in fuel commodity and capacity costs. The FPSC is expected to issue its decision in March 2022.

Canadian Electric Utilities

Canadian Electric Utilities includes NSPI and ENL. NSPI is a vertically integrated regulated electric utility engaged in the generation, transmission and distribution of electricity and the primary electricity supplier to customers in Nova Scotia. ENL is a holding company with equity investments in NSPML and LIL: two transmission investments related to the development of an 824 MW hydroelectric generating facility at Muskrat Falls on the Lower Churchill River in Labrador.

NSPI

With $6.1 billion of assets and approximately 536,000 customers, NSPI owns 2,420 MW of generating capacity, of which approximately 44 per cent is coal-fired; 28 per cent is natural gas and/or oil; 19 per cent is hydro and wind; 7 per cent is petcoke and 2 per cent is biomass-fueled generation. In addition, NSPI has contracts to purchase renewable energy from independent power producers (“IPPs”) which own 546 MW of capacity. NSPI owns approximately 5,000 kilometres of transmission facilities and 28,000 kilometres of distribution facilities.

NSPI’s approved regulated ROE range is 8.75 per cent to 9.25 per cent, based on an actual five-quarter average regulated common equity component of up to 40 per cent. Due to continued rate base growth, NSPI anticipates earning within its allowed ROE range in 2022 and expects earnings to be consistent with 2021. Warmer than normal weather adversely affected NSPI’s sales volumes in 2021. Assuming normal weather in 2022, NSPI expects sales volumes to be higher than 2021.

NSPI is currently operating under a three-year fuel stability plan which results in an average annual overall rate increase of 1.5 per cent to recover fuel costs for the period of 2020 through 2022. These rates include recovery of Maritime Link costs (discussed below in the “ENL, NSPML” section).

On January 27, 2022, NSPI filed a General Rate Application (“GRA”) with the UARB. The GRA proposes a rate stability plan for 2022 through 2024 which includes average base rate increases of 2.9 per cent per year and average fuel rate increases pursuant to the FAM of 0.8 per cent per year on August 1, 2022, January 1, 2023 and January 1, 2024. The proposed rates would result in annualized incremental revenue (base and fuel rates) increases of $52 million in 2022 ($21 million related to August 1, 2022 through December 31, 2022), $54 million in 2023 and $56 million in 2024. A decision by the UARB is expected later this year.

In 2022, NSPI expects to invest $530 million (2021 – $388 million), including AFUDC, primarily in capital projects to support system reliability, renew hydroelectric infrastructure, and increase renewable energy

ENL

Equity earnings from the Maritime Link are dependent on the approved ROE and operational performance of NSPML. NSPML’s approved regulated ROE range is 8.75 pe

NSPML received UARB approval to collect up to $172 million (2020 – $145 million) from NSPI for the recovery of costs associated with the Maritime Link in 2021. This was subject to a holdback of up to $10 million that was dependent upon the timing of commencement of the NS Block. On January 18, 2022, the UARB directed NSPI to pay to NSPML approximately $10 million of the 2021 holdback. NSPML has deferred collection and recognition of $23 million in depreciation expense. Approximately $162 million is included in NSPI rates in 2022.

On August 9, 2021, NSPML filed a final capital cost application with the UARB, seeking approval to recover capital costs associated with the Maritime Link and approval of NSPML’s 2022 assessment. In December 2021, NSPML obtained an interim decision from the UARB approving interim rates beginning January 1, 2022, until receipt of the UARB’s decision on the application. On February 9, 2022, the UARB issued its decision relating to the Maritime Link Project, approving NSPML’s requested rate base of approximately $1.8 billion less costs that would not otherwise have been recoverable if incurred by NSPI. The UARB also approved approximately $168 million of NSPML revenue requirement in 2022 subject to a holdback of $2 million per month beginning April 1, 2022 and thereafter to the end of the year. This holdback is to be used to fund any replacement energy costs incurred by NSPI due to a 10 per cent or greater shortfall in contracted NS Block deliveries each month and will otherwise be released to NSPML. NSPML is required to provide the UARB with a compliance filing by February 16, 2022 which will confirm the impacts of this decision including the amount of the unrecoverable items which are not expected to exceed $10 million (pre-tax).

LIL

ENL is a limited partner with Nalcor in LIL. Construction of the LIL is complete and Nalcor is forecasting it will achieve final commissioning in the first half of 2022.

Equity earnings from the LIL investment are based upon the book value of the equity investment and the approved ROE. Emera’s current equity investment is $682 million, comprised of $410 million in equity contribution and $272 million of accumulated equity earnings. Emera’s total equity contribution in the LIL, excluding accumulated equity earnings, is estimated to be approximately $650 million after the Lower Churchill projects are completed.

Cash earnings and return of equity will begin after commissioning of the LIL by Nalcor, which is anticipated in the first half of 2022, and until that point Emera will continue to record AFUDC earnings.

Other Electric Utilities

Other Electric Utilities includes Emera (Caribbean) Incorporated (“ECI”), a holding company with regulated electric utilities. ECI’s regulated utilities include vertically integrated regulated electric utilities of BLPC on the island of Barbados, GBPC on Grand Bahama Island, a 51.9 per cent interest in Domlec on the island of Dominica and a 19.5 per cent interest in Lucelec on the island of St. Lucia which is accounted for on the equity basis.

BLPC

With $489 million USD of assets and approximately 132,000 customers, BLPC owns 266 MW of generating capacity, of which 96 per cent is oil-fired and four per cent is solar. The utility has an additional 12 MW of capacity from rental units. BLPC owns approximately 188 kilometres of transmission facilities and 3,800 kilometres of distribution facilities. BLPC’s approved regulated return on rate base is 10.0 per cent.

GBPC

With $349 million USD of assets and approximately 19,000 customers, GBPC owns 98 MW of oil-fired generation, approximately 90 kilometres of transmission facilities and 670 kilometres of distribution facilities. Restoration of the generating units damaged by Hurricane Dorian was completed in 2021. GBPC’s approved regulatory return on rate base for 2022 is 8.23 per cent (2021 – 8.37 per cent).

Gas Utilities and Infrastructure

Gas Utilities and Infrastructure includes PGS, NMGC, SeaCoast, Brunswick Pipeline and Emera’s non-consolidated investment in M&NP. PGS is a regulated gas distribution utility engaged in the purchase, distribution and sale of natural gas serving customers in Florida. NMGC is an intrastate regulated gas distribution utility engaged in the purchase, transmission, distribution and sale of natural gas serving customers in New Mexico. SeaCoast is a regulated intrastate natural gas transmission company offering services in Florida. Brunswick Pipeline is a regulated 145-kilometre pipeline delivering re-gasified liquefied natural gas from Saint John, New Brunswick, to markets in the northeastern United States.

Peoples Gas System

With $2.2 billion USD of assets and approximately 445,000 customers, the PGS system includes 23,150 kilometres of natural gas mains and 13,100 kilometres of service lines. Natural gas throughput (the amount of gas delivered to its customers, including transportation-only service) was 1.9 billion therms in 2021.

The approved ROE range for PGS is 8.9 per cent to 11.0 per cent, based on an allowed equity capital structure of 54.7 per cent. An ROE of 9.9 per cent is used for the calculation of return on investments for clauses.

New Mexico Gas Company

With $1.7 billion USD of assets and approximately 542,000 customers, NMGC serves approximately 60 per cent of New Mexico’s population in 24 of the state’s 33 counties. NMGC’s system includes approximately 2,424 kilometres of transmission pipelines and 17,593 kilometres of distribution pipelines. Annual natural gas throughput was approximately 839 million therms in 2021. The approved ROE for NMGC is 9.375 per cent, on an allowed equity capital structure of 52 per cent.

Gas Utilities and Infrastructure Outlook

Gas Utilities and Infrastructure USD earnings are anticipated to be higher in 2022 than 2021, primarily due to rate base growth to expand the distribution system and to continue to reliably serve customers. The PGS rate case settlement provides the ability to reverse a total of $34 million USD of accumulated depreciation through 2023. PGS has not reversed any of this accumulated depreciation to date. The reversal of accumulated depreciation is expected to occur over the 2022 and 2023 periods.

PGS anticipates earning within its allowed ROE range in 2022 and expects rate base and USD earnings to be higher than in 2021. PGS expects favourable customer growth in 2022 (following Florida’s population growth and housing demands), PGS sales volumes in 2022 are expected to increase at a level consistent with customer growth.

Financial Highlights

Emera Reports 2021 Fourth Quarter and Annual Financial Results

2/14/2022; Emera reported 2021 fourth quarter and annual financial results.4

Highlights

- Quarterly adjusted EPS was $0.64, a decrease of $0.11 from $0.75 in Q4 2020 due to the recognition of a litigation award in Q4 2020. Excluding the impact of the litigation award, adjusted EPS increased by $0.04 or 7% driven by increased contributions primarily from its gas utilities and lower corporate costs, partially offset by the impact of less favorable weather in Florida. Quarterly reported EPS increased by $0.15 to $1.24 from $1.09 in Q4 2020 primarily due to mark-to-market (“MTM”) gains.

- Year-to-date, adjusted EPS was $2.81, an increase of $0.13 from $2.68 in 2020. Reported EPS decreased by $1.80 to $1.98 from $3.78 in 2020, primarily due to the gain on sale of Emera Maine recognized in 2020 and MTM losses in 2021.

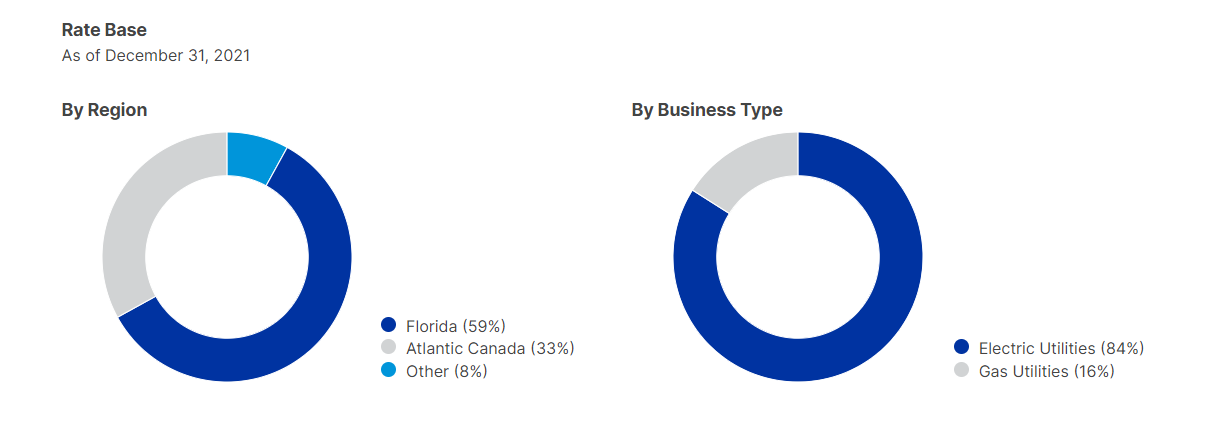

- Consistent with its capital plan, $2.4 billion of rate base investments were deployed in 2021 to drive rate base growth and advance Emera’s strategy.

“Emera is pleased with the performance of its business in 2021, as the company delivered solid financial results and achieved important regulatory outcomes, while continuing to deliver the critical energy needs of its customers during the ongoing COVID-19 pandemic,” said Scott Balfour, President and CEO of Emera Inc. “This progress highlights the strength of its business and strategy that continues to drive value and growth through investments in cleaner energy, infrastructure renewal and service reliability, all at a balanced pace to ensure affordability for its customers.”

Q4 2021 Financial Results

- Q4 2021 reported net income was $324 million, or $1.24 per common share, compared with net income of $273 million, or $1.09 per common share, in Q4 2020.

- Q4 2021 adjusted net income was $168 million, or $0.64 per common share, compared with $188 million, or $0.75 per common share, in Q4 2020.

- Decreased quarterly adjusted net income was largely due to the TECO Guatemala Holdings (“TGH”) award received in Q4 2020. Excluding the impact of the award, growth in quarterly net income was driven by higher earnings primarily at Peoples Gas System (“PGS”) lower corporate costs, partially offset by lower contributions from Tampa Electric.

Annual 2021 Financial Results

- 2021 reported net income was $510 million or $1.98 per common share, compared with a net income of $938 million or $3.78 per common share in 2020. 2021 reported net income included a $213 million after-tax MTM loss primarily at Emera Energy.

- 2021 adjusted net income was $723 million or $2.81 per common share, compared with $665 million or $2.68 per common share in 2020.

- Growth in annual adjusted net income was driven by higher earnings contribution from EES, PGS and Nova Scotia Power (“NSPI”), lower corporate costs, realized gains on foreign exchange hedges and the 2020 revaluation of deferred taxes due to a reduction in the Nova Scotia corporate income tax rate. The increase was partially offset by the impact of a stronger CAD, the TGH award received in Q4 2020, the 2020 recognition of a corporate income tax recovery at Barbados Light and Power Company (“BLPC”), and lower earnings due to the sale of Emera Maine in Q1 2020.

- Strengthening of the CAD decreased net income by $10 million ($0.04 per share) and decreased adjusted net income by $1 million in Q4 2021 compared to Q4 2020. The strengthening of the CAD decreased net income by $17 million ($0.07 per share) and adjusted net income1 by $28 million ($0.11 per share) for the year ended December 31, 2021, compared to the same period in 2020.

Outlook

Emera’s capital investment plan is $8.4 billion over the 2022-to-2024 period (including a $240 million equity investment in the LIL in 2022), with an additional $1 billion of potential capital investments over the same period. This results in a forecasted rate base growth of approximately 7 per cent to 8 per cent through 2024. The capital investment plan continues to include significant investments across the portfolio in renewable and cleaner generation, reliability and integrity investments, infrastructure modernization and customer-focused technologies.

Emera’s capital investment plan is being funded primarily through internally generated cash flows and debt raised at the operating company level. Equity requirements in support of its capital investment plan are expected to be funded through the dividend reinvestment plan, the issuance of preferred equity and the issuance of common equity through its at-the-market program. Maintaining investment-grade credit ratings is a priority of management.

References

- ^ https://investors.emera.com/corporate-profile/default.aspx

- ^ https://www.emera.com/companies

- ^ https://s25.q4cdn.com/978989322/files/doc_financials/2021/ar/Emera_2021_AR.pdf

- ^ https://investors.emera.com/news/news-details/2022/Emera-Reports-2021-Fourth-Quarter-and-Annual-Financial-Results/default.aspx