Enertopia Corp

Business History

Enertopia Corp. (ENRT) was formed on November 24, 2004 under the laws of the State of Nevada and commenced operations on November 24, 2004.

From inception until April 2010, the company were primarily engaged in the acquisition and exploration of natural resource properties. Beginning in April 2010, the company began its entry into the renewable energy sector by purchasing an interest in a solar thermal design and installation company. In late summer 2013, the company began its entry into medicinal marijuana business. During its 2014 fiscal year end its activities in the clean energy sector were discontinued. During fiscal 2015 its activities in the Medicinal Marijuana sector were discontinued. During fiscal 2016 its activities in the Women’s personal healthcare sector were discontinued.1

The Company is actively pursuing business opportunities in the resource sector, whereby the company signed a definitive agreement for a Lithium Brine Project in May 2016. In May 2017 the Company dropped the Lithium Brine Project and subsequently acquired the Clayton Valley, NV Lithium Project announced in August 2017.The Company’s main focus is in natural resource sector and licensed patent pending technology from Genesis Water Technologies, used for Lithium extraction through brines.

The address of its principal executive office is 156 Valleyview RD, Kelowna, British Columbia V1X 3M4. The company's telephone number is (250) 765-6412. The company's current location provide adequate office space for its purposes at this stage of its development.

Due to the implementation of British Columbia Instrument 51-509 on September 30, 2008 by the British Columbia Securities Commission, Enertopia has been deemed to be a British Columbia based reporting issuer. As such, Enertopia is required to file certain information and documents at www.sedar.com.

Effective September 25, 2009, the company effected a one (1) for two (2) share consolidation of its authorized and issued and outstanding common stock. As a result, its authorized capital decreased from 75,000,000 shares of common stock with a par value of $0.001 to 37,500,000 shares of common stock with a par value of $0.001 and its issued and outstanding shares decreased from 29,305,480 shares of common stock to 14,652,740 shares of common stock. The consolidation became effective with the Over-the-Counter Bulletin Board at the opening for trading on September 25, 2009 under the new stock symbol “GLCP”. The company's new CUSIP number at that time was 38079Q207.

On February 8, 2010, the Company changed its name from Golden Aria Corp. to Enertopia Corp. The company's new CUSIP number is 29277Q1047

On February 22, 2010, the Company increased its authorized share capital to 200,000,000 common shares.

On February 28, 2010, the Company entered into an Asset and Share Purchase Agreement with Mr. Mark Snyder to acquire up to 20% ownership interest of Global Solar Water Power Systems Inc. (“GSWPS”).

Effective March 26, 2010, Enertopia Corp. (the “Company”) had its stock quotation under the symbol “GLCP” deleted from the OTC Bulletin Board. The symbol was deleted for factors beyond the Company’s control due to various market makers electing to shift their orders from the OTCBB to the Pink OTC Markets Inc. As a result of these market makers not providing a quote on the OTCBB for four consecutive days the Company was deemed to be deficient in maintaining a listing standard at the OTCBB pursuant to Rule 15c2-11. That determination was made entirely without the Company’s knowledge.

On April 7, 2010, FINRA confirmed the name change from Golden Aria Corp. to Enertopia Corp., and approved the Company’s new symbol as ENRT. On February 5, 2010, the Company’s shareholders approved an amendment to the Company’s articles of incorporation to change its name from Golden Aria Corp. to Enertopia Corp. The name change was effected with the Nevada Secretary of State on February 8, 2010.

On May 31, 2010, the Company closed a private placement financing of 557,500 units at a price of $0.15 per unit for gross proceeds of $83,625. Each unit consisted of one common share in the capital of the Company and one non-transferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share in the capital of the Company until May 31, 2012, at a purchase price of $0.30 per share.

On August 12, 2010, the Company was approved for listing on the Canadian National Stock Exchange (“CNSX”). Trading date commenced on August 13, 2010 with the symbol TOP.

On October 25, 2010 Company disposed of the Coteau Lake interests for cash consideration of $100,000 plus an additional potential payout which shall be based on a 10% profit interest on any and all productive wells drilled on the property, up to $150,000. No receivable was recorded as the future potential payout cannot be reasonably determined.

On January 31, 2011, the Company entered into a letter of intent and paid $7,500 deposit to Wildhorse Copper Inc. and its wholly owned subsidiary Wildhorse Copper (AZ) Inc. (collectively, the “Optionors”). On April 11, 2011, the Company signed a Mineral Purchase Option Agreement (“Option Agreement”) with the Optionors respecting an option to earn a 100% interest, subject to a 1% NSR capped to a maximum of $2,000,000 in a property known as the Copper Hills property. The Copper Hills property is comprised of 56 located mining claims covering a total of 1,150 acres located in New Mexico, USA. The Optionors hold the Copper Hills property directly and indirectly through property purchase agreements between the Optionors and third parties (collectively, the “Indirect Agreements”). Pursuant to the Option Agreement the Optionors have assigned the Indirect Agreements to the Company. In order to earn the interest in the Copper Hills property, the Company is required to make aggregate cash payments of $591,650 over an eight year period and issue an aggregate of 1,000,000 shares of its common stock over a three year period. As at August 31, 2013, the Company has issued 500,000 shares at price of $0.15 per share and 150,000 shares at price of $0.10 per share to the Optionors and made aggregate cash payment of $106,863 (August 31, 2012-$106,863); the Company has expensed exploration costs of $143,680 (August 31, 2012-$143,680). On June 26, 2013, the Company announced the termination of its Option Agreement. the Company had made aggregate cash payments of $106,863 and issued 500,000 shares at price of $0.15 per share and 150,000 common shares at $0.10 per share to Wildhorse Copper Inc. On June 26, 2013, the Company terminated its Option Agreement with Wildhorse Copper Inc. on Copper Hills property.

On March 3, 2011, the Company closed a private placement of 8,729,000 units at a price of CAD$0.10 per unit for gross proceeds of CAD$872,900, or US$893,993. Each unit consisted of one common share in the capital of its company and one non-transferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share in the capital of its company until March 3, 2013, subject to accelerated expiry as set out in the warrant certificate, at a purchase price of CAD$0.20. As per the terms of the Subscription Agreement, its company grants to the Subscribers a participation right to participate in future offerings of its securities as to their pro rata shares for a period of 12 months from the closing of the Private Placement. The company paid broker commissions of $48,930 in cash and issued 489,300 brokers warrants. Each full warrant entitled the holder to purchase one additional common share in the capital of its company that expired on March 3, 2013, which was subject to accelerated expiry as set out in the warrant certificate, at a purchase price of CAD$0.20.

On March 16, 2011, the company entered into a debt settlement agreement with an officer of its company, whereby the company issued 78,125 shares of common stock in connection with the settlement of $12,500 debt at a deemed price of $0.16 per share pursuant to a consulting agreement. The company recorded $12,422 in additional paid in capital for the gain on the settlement of the debt.

On April 14, 2011, the company held its Annual and Special Meeting of Shareholders for the following purposes:

- To elect Robert McAllister, Dr. Gerald Carlson and Chris Bunka as directors of the Company for the ensuing year.

- To ratify Chang Lee LLP, independent public accounting firm for the fiscal year ending August 31, 2011, and to allow directors to set the remuneration.

- To approve, ratify and confirm the consolidation of the 2007 Stock Option Plan and the 2010 Equity Compensation Plan into one plan and approve the terms of this new plan, the 2011 Stock Option Plan.

All proposals were approved by the shareholders. The proposals are described in detail in its definitive proxy statement filed with the Securities and Exchange Commission on March 9, 2011.

On April 27, 2011, the company entered into a debt settlement agreement with the President of its Company, who is a related party, in the amount of $46,000, whereby $25,000 was settled by issuing common shares of 100,000, and $21,000 was forgiven for Nil consideration. In connection with the debt settlement, the company recorded $100 in share capital and $45,900 in additional paid in capital for the gain on the settlement of the debt.

On May 31, 2011, the Company settled the amount due to related parties into two promissory notes of $80,320 (CAD$84,655) and $90,000. Both promissory notes were unsecured, non-interest bearing and due on May 31, 2012 at an imputed interest rate of 12% per annum upon the settlement. On April 27, 2011, the company entered into debt settlement agreement with one of the holders, a company controlled by the Chairman/CEO of the Company, whereby the Company issued common shares of 360,000 to the holder, and the holder agreed to accept the shares as full and final payment of the promissory note of $90,000. On the same day, the company entered into a debt settlement agreement with another holder, a company controlled by the Chairman/CEO of its Company, whereby the holder agreed to forgive the repayment of debt for Nil consideration. In connection with the settlements and forgiveness of the above promissory notes, the Company recorded $79,997and $77,415 in additional paid in capital for the gain on settlement of debt, respectively.

On June 22, 2011, Change Lee LLP (“Chang Lee”) resigned as its independent registered public accounting firm because Chang Lee was merged with another company: MNP LLP (“MNP”). Most of the professional staff of Chang Lee continued with MNP either as employees or partners of MNP and will continue their practice with MNP. On June 22, 2011, the company engaged MNP as its independent registered public accounting firm.

On July 19, 2011, the Company entered into a letter of intent and paid US$15,000 deposit to Altar Resources. Subsequent to August 31, 2011, on October 11, 2011, the Company signed a Mineral Purchase Option Agreement with Altar Resources with respect to an option to earn 100% interest, subject to a 2.5% NSR in a property known as Mildred Peak. The mining claims are in Arizona covering approximately 7,148 acres from Altar Resources which holds the mining claims directly and indirectly through federal mining claims and state mineral exploration leases; or, represented that it would hold such claims in good standing at the time of closing a definitive agreement. The Company is required to make aggregate cash payments of $881,000 over a five year period and issue an aggregate of 1,000,000 shares of its common stock over a four year period. As at February 28, 2013, the Company had made aggregate cash payments of $124,980 (August 31, 2012-$84,980) and issued 100,000 shares at price of $0.10 per share and 100,000 common shares at $0.06 per share to Altar Resources; along with expensed incurred exploration costs of $13,380. On May 30, 2013, the Company terminated the Option Agreement and has written off $140,980 of capital costs.

On March 19, 2012, the Company’s Board has appointed Dr. John Thomas as Director and Mr. Tony Gilman and Dr. Stefan Kruse as Advisors of the Company. The Company has granted additional 450,000 stock options to Directors and Advisors of the Company. The exercise price of the stock options is $0.15, of which are 225,000 options vest immediately, 225,000 options vest on August 15, 2012. The options expire March 19, 2017.

On April 10, 2012, Enertopia Corporation (“Enertopia” or the “Company”) held its Annual and Special Meeting of Shareholders for the following purposes:

- To elect Robert McAllister, Donald Findlay, Greg Dawson and Chris Bunka as directors of the Company for the ensuing year.

- To ratify MNP LLP, independent public accounting firm for the fiscal year ending August 31, 2012, and to permit directors to set the remuneration.

- To transact such other business as may properly come before the Meeting.

All proposals were approved by the shareholders. The proposals are described in detail in the Company’s definitive proxy statement filed with the Securities and Exchange Commission on March 13, 2012.

On April 10, 2012, the Company issued 93,750 common shares in connection with the settlement of debt of $9,375 at a price of $0.10 per common share pursuant to a consulting agreement.

On April 13, 2012, the Company closed an offering memorandum placement of 2,080,000 units at a price of CAD$0.10 per unit for gross proceeds of CAD$208,000, US$208,000. Each Unit consisted of one common share of the Issuer and one common share purchase warrant. One warrant will be exercisable into one further common share at a price of US$0.15 per warrant share for a period of twelve months following closing; or at a price of US$0.20 per warrant for the period that is twelve months plus one day to twenty-four months following closing. The Company paid broker commissions of $14,420 in cash and issued 144,200 brokers warrants in connection with the private placement.

On August 24, 2012, the Company closed the second tranche of an offering memorandum placement of 160,000 units at a price of CAD$0.05 per unit for gross proceeds of CAD$8,000 or US$8,000. Each warrant will be exercisable into one further share at a price of US$0.10 per warrant share for a period of twelve months following closing; or at a price of US$0.20 per warrant share for a period that is twelve months and one day to thirty-six months following closing. The Company’s President participated in the private placement for $4,000.00 dollars. The Company issued 16,000 brokers warrants in connection with the private placement for broker commissions.

On September 28, 2012, the Company closed an offering memorandum placement of 995,000 units at a price of CAD$0.05 per unit for gross proceeds of CAD$49,750 or US$49,750. Each Unit consisted of one common share of the Issuer and one common share purchase warrant. One warrant will be exercisable into one further common share at a price of US$0.10 per warrant share for a period of twelve months following closing; or at a price of US$0.20 per warrant for the period that is twelve months plus one day to twenty-four months following closing. The Company issued 79,500 shares, 79,500 warrants and 79,500 broker warrants in connection with the private placement.

On October 24, 2012, the Company issued 100,000 common shares in connection with Altar Resources, Mildred Peak property for an amount of $6,000 at a price of $0.06.

On November 15, 2012, the Company closed an offering memorandum placement of 1,013,000 units at a price of CAD$0.05 per unit for gross proceeds of CAD$50,650 or US$50,650. Each Unit consisted of one common share of the Issuer and one common share purchase warrant. One warrant will be exercisable into one further common share at a price of US$0.10 per warrant share for a period of twelve months following closing; or at a price of US$0.20 per warrant for the period that is twelve months plus one day to twenty-four months following closing. The Company issued 38,000 common shares, 101,300 units, and 101,300 broker warrants in connection with the private placement. On March 1, 2013, the Company settled the debt incurred of $16,000 from September 1, 2011 to February 28, 2013 for consulting fees with Mr. Mark Snyder by issuing 160,000 restricted common shares of the Company at a price of $0.10 per share.

On March 1, 2013, the Company settled the debt incurred of $16,000 from September 1, 2011 to February 28, 2013 for consulting fees with Mr. Mark Snyder by issuing 160,000 restricted common shares of the Company at a price of $0.10 per share.

On May 30, 2013, the Company terminated its Option Agreement with Altar Resources on Mildred Peak property. On June 26, 2013, the Company terminated its Option Agreement with Wildhorse Copper Inc. on Copper Hills property.

On September 17, 2013 the company entered into an AMI Participation Agreement with Downhole Energy LLC to participate in 100% gross interest and 75% net revenue interest for drilling, completion and production of up to 100 oil wells on certain oil and gas leases covering 2,924 in the historic field located in Forest and Venango counties, Pennsylvania. On execution of this agreement the company issued 100,000 of its common shares to Downhole Energy LLC. The Company decided not to continue with the agreement and wrote off the asset.

On October 4, 2013 the company entered into a consulting agreement with Olibri Acquisitions and issued 750,000 of its common shares to Olibri.

The company entered into a Letter of Intent Agreement (“LOI”) on November 1, 2013 with 0786521 BC Ltd. (also known as World of Marijuana Productions Ltd.) (the “Vendor”) to acquire 51% of the issued and outstanding capital stock of the Vendor. The Vendor is the owner, operator of a Medical Marijuana operation located at 33420 Cardinal Street, Mission, British Columbia, Canada. The LOI was not comprehensive and subject to the negotiation of a definitive agreement. On the execution of the LOI, the company issued 10,000,000 of its common shares to the Vendor. The LOI was superseded by its joint venture agreement with World of Marijuana Productions Ltd. dated January 16, 2014, described below.

On November 5, 2013 the company granted 675,000 stock options to directors, officers, and consultant of its Company with an exercise price of $0.06 vested immediately, expiring November 5, 2018.

On November 18, 2013, the company granted 25,000 stock options to consultant of its with an exercise price of $0.09 vested immediately, expiring November 18, 2018.

On November 18, 2013, the company entered into an investor relations contract with Coal Harbour Communications Inc. The initial term of this agreement shall begin on the date of execution of this Agreement and continue for two months. Thereafter the agreement will continue on a month-by-month basis pending cancelation by written notification with 30 days notice. In consideration for the services the Company will pay the Provider a one-time payment of two hundred thousand shares (200,000) of restricted common stock in Enertopia Corporation. The stock will be issued in the name of Dale Paruk for 100,000 shares and Neil Blake for 100,000 shares. In consideration of the services provided, the Company shall pay. The company also agree to pay to Coal Harbour Communications a monthly fee of $5,000 payable on the 1st day of each monthly period starting 60 days from the signing of the agreement and $500 per month to cover expenses incurred on its Company’s behalf. Any expenses above $500 per month must be pre-approved.

On November 26, 2013, its Company closed the first tranche of a private placement of 2,720,000 units at a price of CAD$0.05 per unit for gross proceeds of CAD$136,000 ($136,000). Each warrant is exercisable into one further share at a price of US$0.10 per warrant share for a period of thirty-six month following the close.

On November 29, 2013, its wholly-owned subsidiary, Target Energy, Inc was discontinued and dissolved.

On December 23, 2013, the company closed the final tranche of a private placement of 2,528,000 units at a price of CAD$0.05 per unit for gross proceeds of CAD$126,400 ($126,400). Each warrant is exercisable into one further share at a price of $0.10 per warrant share for a period of thirty six months following closing. The company also paid a cash finders’ fee of $10,140 and 202,800 broker warrants to Canaccord Genuity and Wolverton Securities that are exercisable into one common share at a price of $0.10 that expire on December 23, 2016.

On January 1, 2014, the company entered into a Social Media/Web Marketing Agreement with Stuart Gray. The initial term of this agreement shall begin on the date of execution of this Agreement and continue for three months. In consideration for the services the company will pay Stuart Gray a monthly fee of $5,000. As additional compensation the company issued 200,000 stock options to Mr. Gray. The exercise price of the stock options is $0.075, with 100,000 stock options vested immediately, 50,000 stock options vested 30 days after the grant and 50,000 stock options vested 60 days after the grant, expiring January 1, 2019.

On January 13, 2014, the company entered into a corporate development agreement with Don Shaxon for an initial term of twelve months. Thereafter the agreement continued on a month-by-month basis pending cancelation by written notification with 30 days notice. In consideration for the services the company paid to Mr. Shaxon a signing stock bonus of 250,000 of its common shares, a one-time cash bonus of $40,000, and a monthly fee of $3,500 plus $500 in monthly expenses. Upon execution of the Agreement the company also granted 250,000 stock options. to Mr. Shaxon with an exercise price of $0.16, vesting immediately and expiring January 13, 2019.

On January 16, 2014 the company entered into a Joint Venture Agreement with World of Marijuana Productions Ltd. (“WOM”) to acquire up to a 51% ownership interest in a joint venture between WOM and its company. WOM was to acquire a medical marijuana production licence from Health Canada to in order to establish a medical marijuana production facility to be located at 33420 Cardinal Street, Mission, British Columbia.. The Joint Venture Agreement superseded the Letter of Intent between its company and WOM dated November 1, 2013 (the "LOI"). The company's company issued 16,000,000 common shares and paid a total of $375,000 to WOM to acquire a 31% interest in the joint venture. Subsequent to year end, on October 16, 2014 the company entered into a termination and settlement agreement, dated effective October 14, 2014, with WOM and Mathew Chadwick (the “Settlement Agreement”), pursuant to which the parties have entered into mutual releases, Mr. Chadwick has resigned from its board of directors and as an officer of its company, and WOM has returned for cancellation 15,127,287 of its common shares that had been issued to it. Given the foregoing, all relationships between the parties, including but not limited to the joint venture, have been terminated.

On January 31, 2014, the company accepted and received gross proceeds of CAD$40,500 (US$37,500), for the exercise of 350,000 stock options; 100,000 at $0.075 each, 150,000 stock options at $0.10 each, and 100,000 stock options at $0.15 each; into 350,000 common shares of its Company.

On January 31, 2014, the company closed the first tranche of a private placement of 4,292,000 units at a price of US$0.10 per unit for gross proceeds of US$429,200. Each Unit consists of one share of its common stock and one half (1/2) of one non-transferable common share purchase warrant Each whole warrant is exercisable to purchase one common share at a price of US$0.15 per share for a period of twenty four (24) months following closing. A cash finders’ fee consisting of $29,616 and 296,160 full broker warrants that expire on January 31, 2016 with an exercise price of $0.15 was paid to Canaccord Genuity, Leede Financial and Wolverton Securities.

On February 5, 2014, Ryan Foster joined its Company as an advisor. The company granted 50,000 stock options to Mr. Foster with an exercise price of $0.35 per common share expiring February 5, 2019. 25,000 of the stock options vested immediately and 25,000 vested on July 1, 2014.

On February 13, 2014, the company closed the final tranche of a private placement by issuing 12,938,000 units at a price of US$0.10 per unit for gross proceeds of US$1,293,800. Each unit consists of one common share and one half (1/2) of one non-transferable share purchase warrant with each whole warrant exercisable into one common share at a price of US$0.15 per share for a period of twenty four (24) months following closing. One director and one officer of its Company participated in the final tranche for $30,000. A cash finders’ fee consisting of $98,784; 8,000 common shares in lieu of $800 and 995,840 full broker warrants that expire on February 13, 2016 with an exercise price of $0.15 was paid to Canaccord Genuity, Global Market Development LLC and Wolverton Securities.

On February 13, 2014, 50,000 stock options were exercised at a price of $0.06 by a Director and 50,000 stock options were exercised at a price of $0.075 by a Consultant for net proceeds to its Company of CAD$7,050 (US$6,750) into 100,000 common shares of the Company.

On February 13, 2014, 541,500 warrants from previous private placements were exercised into 541,500 common shares of its Company for net proceeds of $101,100.

On February 27, 2014, 585,000 warrants from previous private placements were exercised into 585,000 common shares of its Company for net proceeds of $115,000.

On February 27, 2014, the company signed a $50,000 12 month marketing agreement with Agoracom payable in shares of its common stock. The first quarter payment of $12,500 was paid with the issuance of 54,347 common shares of its Company at a market price of $0.23 per share.

On February 28, 2014, the company entered into a Joint Venture Agreement with The Green Canvas Ltd. ("GCL") pursuant to which the company may acquire up to a 75% interest in the business of GCL, being the business of legally producing, manufacturing, propagating, importing/exporting, testing, researching and developing, and selling marijuana for medical purposes. The company paid $100,000 to the GCL upon execution of the agreement. Subsequently, the company issued to GCL an aggregate of 10,000,000 of its common shares at a price of $0.235 per share; and paid to GCL the aggregate sum of $500,000, to earn a 49% interest in GCL’s business. With the exception of $113,400 payable to Wolverton Securities, the full amount of the $500,000 is to be used by GCL to upgrade the its existing medical marijuana production facility to meet the standards introduced by the Marijuana for Medical Purposes Regulations (“MMPR”) administered by Health Canada. Subsequent to quarter end, this agreement has been terminated.

On March 5, 2014, its Company and its CEO and Director, Robert McAllister, entered into a Joint Venture Agreement with Lexaria Corp. to jointly source and develop business opportunities in the medical marijuana industry. Pursuant to the terms of the agreement, Lexaria Corp. issued to its Company 1 million restricted common shares and issued 500,000 common shares to Mr. McAllister for his participation as a key representative for the joint venture. Additionally Lexaria agreed to issue to Mr. McAllister options to purchase 500,000 common shares of Lexaria in consideration for Mr. McAllister’s participation on the Lexaria Advisory Board.

On March 10, 2014, its Company’s Board appointed Mathew Chadwick as Senior Vice President of Marijuana Operations and its company entered into a Management Agreement with Mr. Chadwick for his services. The initial term of the agreement began on the date of execution of this agreement and continued for six months. Thereafter the agreement continued on a month-by-month basis until it was terminated on October 16, 2014 pursuant to a termination and settlement agreement, dated effective October 14, 2014, with World of Marijuana Productions Ltd. and Mr. Chadwick. The company paid in total $125,000 to Mr. Chadwick pursuant to the Management Agreement. Mr. Chadwick resigned as a director and officer of its Company on October 16, 2014.

On March 11, 2014, Robert Chadwick and Clayton Newbury joined the Company as advisors and were paid a $1,000 honorarium each. Robert Chadwick was issued a one-time 100,000 common shares of its Company. On March 11, 2014, the company granted 100,000 stock options to Robert Chadwick with an exercise price of $0.68 per share expiring March 11, 2019. 50,000 of the stock options vested immediately, and 50,000 vested on September 11, 2014. The company also granted 100,000 options to Clayton Newbury on the same terms.

On March 11, 2014, as per the terms of the Joint Venture Agreement dated January 16, 2014 with World of Marijuana Productions Ltd. (“WOM”), its company made a payment of $200,000 and issued 1,000,000 common shares at a price of $0.60 per share to 0984329 B.C. LTD. As a result its company acquired 31% of the Joint Venture business interest. The company subsequently relinquished the 31% interest pursuant to the Termination and Settlement Agreement with WOM and Mathew Chadwick dated October 14, 2014. WOM returned for cancellation 15,127,287 previously issued shares of its common stock in consideration for its 31% interest.

On March 14, 2014, the company signed a six month contract for $21,735 with The Money Channel to provide services for national television, internet and radio media campaign.

On March 14, 2014, 815,310 warrants from previous private placements were exercised into 815,310 common shares of its Company for net proceeds of $163,062.

On March 14, 2014, the company accepted and received gross proceeds from a director of its Company of CAD$8,250 (US$7,500), for the exercise of 50,000 stock options at an exercise price of $0.15, into 50,000 common shares of its Company.

On March 17, 2014, 1,548,000 warrants from previous private placements were exercised into 1,548,000 common shares of its Company for net proceeds of US$289,475.

On March 25, 2014, the company accepted and received gross proceeds of $67,750, for the exercise of 325,000 stock options at $0.06 to $0.25 each, into 325,000 common shares of its Company.

On March 25, 2014, 1,095,000 warrants from previous private placements were exercised into 1,095,000 common shares of its Company for net proceeds of US$114,250.

On March 26, 2014, its Board appointed Dr. Robert Melamede as an Advisor to the Board of Directors. The company paid to Dr. Melamede, an honorarium of $2,500 for the first year of participation on its Advisory Board and issued 250,000 shares of its common stock. On March 26, 2014 the company granted to Dr. Melamede 500,000 stock options with an exercise price of $0.70 and expiring March 26, 2019., 250,000 of the stock options vested immediately and the remaining 250,000 stock options vested on September 26, 2014, Subsequent to quarter end, Dr. Robert Melamede is no longer an Advisor to the Board of Directors.

On April 1, 2014, the company entered into a one year consulting agreement with Kristian Dagsaan to provide controller services for CAD$3,000 (plus goods and services tax) per month. The company also granted 100,000 fully vested stock options with an exercise price of $0.86, expiring April 1, 2019. The agreement was cancelled on August 31, 2014.

On April 1, 2014, the company entered into a 90 day investor relations contract for CAD $9,000 with Ken Faulkner. The company also granted 100,000 fully vested stock options to Mr. Faulkner with an exercise price of $0.86, expiring April 1, 2019.

On April 3, 2014, the company entered into another 3 month Social Media/Web Marketing Agreement with Stuart Gray. In consideration for the services the Company the company agreed to pay Mr. Gray a monthly fee of $5,000. Upon execution of the Agreement, the company issued 100,000 stock options to Mr. Gray with an exercise price of $0.72, expiring on April 3, 2019. The agreement was terminated on July 31, 2014.

On April 3, 2014, 1,293,500 warrants from previous private placements were exercised into 1,293,500 common shares of its Company for net proceeds of US$177,950.

On April 3, 2014, the company accepted and received gross proceeds from past consultant of its Company of US$1,500 for the exercise of 25,000 stock options at an exercise price of $0.06, into 25,000 common shares of its Company.

On April 8, 2014, the company granted 50,000 fully vested stock options to a consultant of its Company, Taven White. The stock options are exercisable at $0.50 per share and expire on April 8, 2019.

On April 10, 2014, a Letter of Intent ("LOI") was signed by Enertopia Corporation, or its wholly-owned subsidiary ("Enertopia") and Lexaria Corp., or its wholly-owned subsidiary ("Lexaria") (collectively, the "Parties") with regard to the ownership by Enertopia of a 51% interest in the business, and the ownership by Lexaria of a 49% interest in the business of legally producing, manufacturing, propagating, importing/exporting, testing, researching and developing, and selling marijuana for medical purposes under the MMPR (the "Business") Acquisition Structure. Whereby, Lexaria issued 500,000 common shares to Enertopia. In accordance with the terms of a formal and definitive Agreement to be entered into between Enertopia and Lexaria (the "Definitive Agreement"), Enertopia shall own 51% ownership interest in the Business (the "Enertopia Ownership") and Lexaria shall own 49% ownership interest in the Business (the “Lexaria Ownership”). Within 10 days, Enertopia shall contribute $45,000 and Lexaria shall contribute $55,000 to the Business. Upon the execution of this LOI, Enertopia and Lexaria shall structure a joint venture for legally producing, manufacturing, propagating, importing/exporting, testing, researching and developing, and selling marijuana for medical purposes under the MMPR. At such time the Parties will be deemed to have formed a joint venture for the operation, management and further development of the Business (the "Joint Venture"). Lexaria will pay 55% of all costs to earn its 49% net Ownership Interest and Enertopia will pay 45% of all costs to earn its 51% Ownership Interest. A total of 500,000 Definitive Agreement Shares shall be issued to Enertopia, held in escrow (the "Escrow Shares") by Lexaria's solicitors until such date as the License (as hereinafter defined) has been obtained by Enertopia (the "Effective Date"). Upon occurrence of the Effective Date, the Escrow Shares will be released from escrow. In the event the Effective Date does not occur within 12 months of the date of the Definitive Agreement (the "Execution Date"), the Definitive Agreement Shares shall be cancelled and returned to treasury. Subsequent to quarter end, this agreement has been terminated.

On April 10, 2014 a letter of intent, was executed on behalf of a corporation to be incorporated by Lexaria Corp. and Enertopia Corporation(Lessee) and Mr. Jeff Paikin of Ontario Inc. (Lessor) sets out the Lessee’s and Lessor’s shared intent to enter into a lease agreement (the “Lease”) for warehouse space (the “Leased Premises”) in the building located in Ontario (the “Building”). The Company issued the 38,297 common shares at a deemed price of $0.47 per the terms of the Letter of Intent to lease space in Ontario. On August 1, 2014 the Company signed an extension to the Letter of intent executed on April 10, 2014 on behalf of a corporation to be incorporated by Lexaria Corp. and Enertopia Corporation(Lessee) and Mr. Jeff Paikin of 1475714 Ontario Inc. (Lessor) sets out the Lessee’s and Lessor’s shared intent to enter into a lease agreement (the “Lease”) for warehouse space (the “Leased Premises”) in the building located at Burlington, Ontario (the “Building”). On August 5, 2014, as per the terms of the extension, 118,416 common shares of the Company were issued at a deemed price of $0.19 per share. Subsequent to quarter end, this agreement was not renewed.

On April 14, 2014, the Company appointed Mr. Jeff Paikin to its Advisory Board for a period of not less than one year, but to be determined by certain performance thresholds described in the letter. Upon signing of the letter of acceptance the Company issued 90,000 common shares at a deemed price of $0.34. Based on the milestones listed in the letter, Mr. Paikin can be eligible to receive up to a total of 472,500 common shares of the Company. Consulting agreement amended on June 18, 2014, Mr. Paikin can be eligible to receive up to a total of 1,350,000 common shares of the Company. Based on the milestones listed in the amended contract, the Company issued Mr. Paikin 135,000 common shares at a deemed price of $0.14 on July 14, 2014. On February 4, 2015, Mr. Paikin resigned as an Advisor to the Board and the agreement was terminated.

On April 17, 2014, its Company accepted and received gross proceeds from a director of CAD$8,475 (US$7,500), for the exercise of 50,000 stock options at $0.15 into 50,000 common shares of its Company.

On April 17, 2014, 651,045 warrants from previous private placements were exercised into 651,045 common shares of its Company for net proceeds of $110,209.

On April 24, 2014 its Company entered into a one year consulting contract with Clark Kent as Media Coordinator for a monthly fee of CAD$2,250 plus GST. The company issued 90,000 common shares to the consultant at a deemed price of $0.34. Based on the milestones listed in the contract, Mr. Kent can be eligible to receive up to a total of 472,500 common shares of its Company. On June 18, 2014, the consulting agreement was amended so that Mr. Kent can be eligible to receive up to a total of 1,350,000 common shares of its Company. Based on achievement of the milestones listed in the amended contract, the company issued to Mr. Kent 135,000 common shares at a deemed price of $0.14 on July 14, 2014. This agreement was terminated on February 4, 2015.

On April 24, 2014 the company entered into a one year consulting contract with Don Shaxon as Ontario Operations Manager for a monthly fee of CAD$3,375 plus GST. Upon signing of the contract the company issued to Mr. Shaxon 90,000 common shares at a deemed price of $0.34. Based on the milestones listed in the contract, Mr. Shaxon can be eligible to receive up to a total of 472,500 common shares of its Company. The company amended the consulting agreement on June 18, 2014, following which Mr. Shaxon became eligible to receive up to a total of 1,350,000 common shares of its Company. Based on achievement of the milestones listed in the amended contract, the company issued to Mr. Shaxon 135,000 common shares at a deemed price of $0.14 on July 14, 2014. Subsequent to quarter end, the agreement was not renewed.

On April 24, 2014 the company entered into a one year consulting contract with 490072 Ontario Ltd. operating as HEC Group, for the services of Greg Boone as Human Resources Manager. Upon signing of the contract the company issued 90,000 common shares at a deemed price of $0.34. Based on the milestones listed in the contract, Mr. Boone or his company can be eligible to receive up to a total of 472,500 common shares of its Company. The company amended the agreement on June 18, 2014, further to which Mr. Boone became eligible to receive up to a total of 1,350,000 common shares of its Company. Based on achievement of the milestones listed in the amended contract, the Company issued Mr. Boone 135,000 common shares at a deemed price of $0.14 on July 14, 2014. This agreement was terminated on February 4, 2015.

On April 24, 2014 the company entered into a one year consulting contract with Jason Springett as Master Grower for Ontario Operations for a monthly fee of $3,375 plus GST. Upon signing of the contract the company issued 90,000 common shares at a deemed price of $0.34. Based on the milestones listed in the contract, Mr. Springett was eligible to receive up to a total of 472,500 common shares of the Company. The company amended the agreement on June 18, 2014 further to which Mr. Springett became eligible to receive up to a total of 1,350,000 common shares of its Company. Based on achievement of the milestones listed in the amended contract, the company issued Mr. Springett 135,000 common shares at a deemed price of $0.14 on July 14, 2014. Subsequent to quarter end the agreement was not renewed.

On April 24, 2014 the company entered into a one year consulting contract with 2342878 Ontario Inc. for the services of Chris Hornung as Assistant Operations Manager. Upon signing of the contract the company issued 90,000 common shares to the consultant at a deemed price of $0.34. Subject to achievement of the milestones listed in the contract, Mr. Hornung or his company were eligible to receive up to a total of 472,500 common shares of its Company. Mr. Hornung resigned on July 14, 2014 prior to the accrual of additional compensation. The 90,000 common shares of the Company that were issued have been returned back to treasury on September 24, 2014.

On April 30, 2014, 200,000 warrants from previous private placements were exercised into 200,000 common shares of its Company for net proceeds of $40,000.

On May 3, 2014 the company entered into a one year consulting contract with Bmullan and Associates wholly owned company by Brian Mullan as Security Consultant. Upon signing of the contract the company issued to the consultant 45,000 common shares at a deemed price of $0.28. Subject to achievement of the milestones listed in the contract, Mr. Mullan or his company are be eligible to receive up to a total of 225,000 common shares of its Company. Subsequently, the company issued an additional 45,000 common shares to the consultant at a deemed price of $0.14 on July 14, 2014. This agreement was terminated on February 4, 2015.

On May 28, 2014, its company and Lexaria entered into a definitive agreement to develop a joint business for the production, manufacture, propagation, import/export, testing, research and development of marijuana in the Province of Ontario under the MMPR, Pursuant to the Agreement, ownership, revenues, and liability related to the Joint Venture is 51% to Enertopia and 49% to Lexaria. Expenses incurred by the joint venture shall be allocated 45% to Enertopia and 55% to Lexaria. Enertopia shall be responsible for management of the joint venture for as long as it maintains majority ownership. To date, Lexaria and Enertopia have contributed $55,000 and $45,000 to the joint venture, respectively. The joint venture has identified a production location in Burlington, Ontario and received municipal approval for the site in July, 2014. The company intend to engage an architect to design the production facility upon acceptance of its application. Construction is anticipated to cost approximately $3,000,000; Enertopia will be responsible for $1,350,000 of this cost. The joint venture is unable to estimate at this time when a production license might be granted by Health Canada, however it is seeking assurances from Health Canada prior to commencement of construction. Subsequent to quarter end, this agreement was terminated.

On May 29, 2014, the company accepted and received gross proceeds of $20,000 for the exercise of 200,000 warrants at $0.10 each into 200,000 common shares of its Company.

On June 2, 2014, the company signed a 30 day contract for $10,000 with TDM Financial to provide services for original video production, original coverage, network placement of video and article, article and video syndication, email distribution, and reporting.

On June 9, 2014, Pursuant to its 12 month marketing agreement with Agoracom dated February 27, 2014, the company made a second quarter payment to Agoracom of $12,500 plus GST paid by the issuance of 72,917 common shares of the Company at a market price of $0.18 per share.

On July 1, 2014, the company entered into a one year services agreement with TDM Financial for $120,000 payable in common shares of its Company. TDM Financial will provide marketing solutions and strategies to its Company. Upon the signing of the contract with TDM Financial, the company issued 750,000 common stock of its Company at a deemed price of $0.16.

On July 23, 2014, 252,000 warrants from previous private placements were exercised into 252,000 common shares of its Company for net proceeds of $25,200.

On August 1, 2014 the company entered into a three month Investor Relations and Marketing Agreement with Neil Blake with a monthly fee of CAD$2,500.

On September 18, 2014, the company entered into a contract with its joint venture partner Lexaria Corp., and Maureen McGrath pursuant to which Ms. McGrath will lead the National Medical Marijuana Awareness and Outreach Strategy, a public awareness program jointly administered by Lexaria and its company.

On October 16, 2014 the company entered into a termination and settlement agreement, dated effective October 14, 2014, with World of Marihuana Productions Ltd. (“)WOM” and Mathew Chadwick (WOM’s representative and its former director), pursuant to which the company relinquished its 31% interest in the joint venture and exchanged mutual releases with WOM and Mr. Chadwick. Mr. Chadwick resigned from its board of directors and as an officer of its company, and WOM returned for cancellation 15,127,287 of its common shares that had been issued to it. Given the foregoing, all relationships between the parties, including but not limited to the joint venture, have been terminated. No production license under the MMPR had been awarded or was forthcoming at the time of termination.

On November 3, 2014, the Company granted 2,100,000 stock options to directors, officers and consultants of the Company, vesting immediately with an exercise price of $0.10, expiring November 3, 2019.

On November 18, 2014, the Company granted 100,000 stock options to a consultant of the Company, vesting immediately with an exercise price of $0.10, expiring November 18, 2019.

On January 30, 2015, the company closed the first tranche of a private placement of 1,665,000 units at a price of CAD$0.06 per unit for gross proceeds of US$79,920 (CAD$99,900). Each Unit consists of one common share of the Company and full non-transferable Share purchase warrant. Each Warrant will be exercisable into one further Share at a price of US$0.10 per Warrant Share at any time until the close of business on the day which is 24 months from the date of issue of the Warrant, and thereafter at a price of US$0.15 per Warrant Share at any time until the close of business on the day which is 36 months from the date of issue of the Warrant.

On February 6, 2015, the Company’s Board has appointed Bal Bhullar as a Director of the Company. Ms. Bhullar has been and continues to be the Chief Financial Officer of the Company since October 9, 2009.

February 6, 2015, the Board of Directors accepted the resignation of John Thomas as Director of the Company.

On February 9, 2015, the company entered into a one year contract with Maureen McGrath/McGrath Group as Lead Medical Strategist, with a monthly fee of CAD$3,000.

On February 9, 2015, Enertopia announced the launch of a new product line V-Love TM for women’s sexual pleasure. V-Love TM is a brand new water based, silky smooth fragrance free personal lubricant and intimate gel especially designed for women.

On March 12, 2015, the Company closed its final tranche of a private placement of 590,000 units at a price of CAD$0.06 per unit for gross proceeds of CAD$35,400. Each unit consists of one common share of the Company and one non-transferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of the Company for a period of 36 months from the date of issuance, at a purchase price of US$0.10 during the first 24 months and at US$0.15 after 24 months. A cash finders’ fee of CAD$2,832 and 47,200 full broker warrants that expire on March 12, 2018 was paid to Canaccord Genuity.

In May, 2015, V-LoveTM was available to the retail market for purchase in stores and at various events.

On June 11, 2015, the company entered into a mutual Termination Agreement with The Green Canvas Ltd. pursuant to which the company terminated its relationship and relinquished its 49% interest in the joint venture to establish a medical marijuana production facility near Regina, Saskatchewan. In consideration of the termination, The Green Canvas returned for cancellation 6,400,000 shares of its common stock previously issued to GCL.

On June 11, 2015, the company entered into a Letter of Intent dated June 10, 2015 with Shaxon Enterprises Ltd. to sell its 51% interest in its Burlington Joint Venture with Lexaria Corp., including its interest in MMPR application number 10QMM0610 for the proposed Burlington, Ontario production facility. The sale would be completed by the sale of its wholly owned subsidiary, Thor Pharma Corp.

Subsequent to the LOI with Shaxon Enterprises Ltd., the Burlington Joint Venture between Enertopia and Lexaria which was entered into on May 28, 2014 was terminated due to the pending sale of the project. As a result of the termination, 500,000 restricted and escrowed common shares of Lexaria issued to its Company at a deemed price of $0.40 will be returned to treasury and cancelled. The Enertopia and Lexaria Master Joint Venture Agreement entered into on March 5, 2014 is still effective and governs the relationship between the parties.

On June 26, 2015, the company signed a Definitive agreement to sell its wholly owned subsidiary, Thor Pharma Corp along with the MMPR application number 10MMPR0610. The Burlington MMPR license application will continue in the application process under new ownership. Pursuant to the agreement, the company received a non-refundable $10,000 deposit and are entitled to receive up to $1,500,000 in milestone payments upon the Burlington facility becoming licensed under the MMPR. These monies would be split equally with Lexaria Corp. Notwithstanding the foregoing, the company can neither guarantee nor provide a meaningful time estimate regarding the potential grant of a production license for the Burlington facility.

On June 29, 2015, the company that announced V-LoveTM became available at London Drugs Limited stores. V-LoveTM is currently available at London Drugs stores across Western Canada in the provinces of British Columbia, Alberta, Saskatchewan and Manitoba.

On July 7, 2015 the company announced that V-Love TM became available for purchase online in Canada at Amazon.ca.

On July 30, 2015 the company announced the launch of V-Love.co, its product website for V-LoveTM.

On October 23, 2015, the Company’s Board has appointed Kevin Brown as a Director of the Company and Victor Lebouthillier as an advisor to the Board of Directors.

On October 23, 2015, the Board of Directors accepted the resignation of Donald Findlay as Director of the Company.

On October 23, 2015, the company granted 1,850,000 stock options to Directors, Executives and Consultants of the Company. The exercise price of the stock options is $0.05, vested immediately, expiring October 23, 2020.

On December 16, 2015, the company extended two classes of warrants by two years with all other terms and conditions remaining the same. The company approved the expiry extension from January 31, 2016 till January 31, 2018 on 2,167,160 warrants that remain outstanding from the non-brokered private placement that closed on January 31, 2014. The Company approved the expiry extension from February 13, 2016 till February 13, 2018 on 7,227,340 warrants that remain outstanding from the non-brokered private placement that closed on February 13, 2014.

On February 4, 2016, the Company’s Board has appointed Olivier Vincent as an Advisor the Board of Directors and a consultant for a term of one year and granted 100,000 stock options to Olivier Vincent. The exercise price of the stock options is $0.05, vested immediately, expiring February 4, 2021. The company issued 100,000 common shares at a price of $0.05 per share on exercise of these options.

On March 9, 2016, the company closed a binding Letter Of Intent to acquire 100% of an established profitable private nutritional vitamin/supplement company. The private nutritional vitamin/supplement company has been in business for over 5 years showing good positive cash flows. All products are manufactured by a GMP, NSF, FDA approved manufacturer in the United States. Enertopia has agreed subject to further due diligence, review of financials and financing to a total amount of $350,000 for the acquisition, with $300,000 due on the signing of the Definitive Purchase Agreement. The Definitive Purchase Agreement is expected to be completed before the end of April. The Company did not further pursue this.

On April 21, 2016, Enertopia has signed a binding letter of intent with a to enter into negotiations to effect the optional acquisition of certain placer mining claims (the “Claims”) in Nevada covering approximately 2,560 acres from S P W Inc. S P W Inc. holds the Claims directly (“Underlying Owner”). Upon the closing date of the transaction (the “Effective Date”) S P W Inc. will have the right to transfer, option, sell or assign the Claims to Enertopia. The Placer mining claims and any underlying agreements will be acquired by Enertopia through a mineral property option agreement, an assignment agreement or an asset acquisition (the “Transaction”).

On May 12, 2016 Enertopia has signed the Definitive Agreement with the Vendor respecting the option to purchase a 100% interest in approximately 2,560 acres of placer mining claims in Churchill, Lander and Nye Counties Nevada, USA. These placer mining claims are subject to a 1.5% NSR from commercial production with the Company able to buy back the NSR at the rate of $500,000 per 0.5% NSR.

On May 20, 2016, Enertopia closed the first tranche of a private placement of 6,413,333 units at a price of CAD$0.015 per unit for gross proceeds of USD$74,074 (CAD$96,200). Each Unit consists of one common share of the Company and full non-transferable Share purchase warrant (each whole warrant, a “Warrant”). Each Warrant will be exercisable into one further Share (a “Warrant Share”) at a price of US$0.05 per Warrant Share at any time until the close of business on the day which is 18 months from the date of issue of the Warrant, and thereafter at a price of US$0.10 per Warrant Share at any time until the close of business on the day which is 36 months from the date of issue of the Warrant. A cash finders’ fee of USD$5,421 (CAD$7,040) and 469,333 full broker warrants that expire May 20, 2019 was paid to Canaccord Genuity and Haywood.

On June 8, 2016, Enertopia closed its final tranche of a private placement of 3,016,667 units a price of CAD$0.015 per unit for gross proceeds of US$34,390 (CAD$45,250). Each Unit consists of one common share of the Company and full non-transferable Share purchase warrant (each whole warrant, a “Warrant”). Each Warrant will be exercisable into one further Share (a “Warrant Share”) at a price of US$0.05 per Warrant Share at any time until the close of business on the day which is 18 months from the date of issue of the Warrant, and thereafter at a price of US$0.10 per Warrant Share at any time until the close of business on the day which is 36 months from the date of issue of the Warrant. A cash finders’ fee of USD$2,508 (CAD$3,300) and 286,666 full broker warrants that expire June 8, 2019 was paid to Canaccord Genuity, Leede Jones Gable, PI Financial and Mackie Research.

On August 9, 2016, the company closed the first tranche of a private placement of 4,500,000 units at a price of CAD$0.035 per unit for gross proceeds of USD$120,078 (CAD$157,500). Each unit consists of one common share of its Company and one non-transferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of its Company for a period of 24 months from the date of issuance, at a purchase price of USD$0.07.

On August 10, 2016, the company retained a private consulting firm to assist with mergers, acquisitions and market awareness for a 12 month contract. The consulting firm operates a resource holding company that has been active in acquiring out of favor mining assets over the past several years. It also provides breaking news, commentary and analysis on listed companies. The company engaged and paid the consulting firm USD$75,000.

On August 15, 2016 binding Letter of Intent was signed by it and Genesis Water Technologies, Inc. ("GWT") with regard to the acquisition by Enertopia (the "Acquisition") of the exclusive worldwide licensing rights (the "Licensing Rights") of all of the technology used in the process of recovering and extraction of battery grade lithium carbonate powder Li2CO3 grading 99.5% or higher purity from brine solutions (the "Technology") and covered under patent pending process #XXXXXX (the "Pending Patent"). On August 15, 2016, the company issued 250,000 common shares at an exercise price of $0.05 per share as per the binding LOI signed with Genesis Water Technologies Inc.

On September 19, 2016, the company entered into a one year Investor Relations Consulting agreement with Duncan McKay. Based on the terms of the agreement, Mr. McKay can earn up to a maximum of 10% commissions on capital raised. The company issued 800,000 stock options with an exercise price of $0.07.

On September 23, 2016, the company closed the final tranche of a private placement of 3,858,571 units at a price of CAD$0.035 per unit for gross proceeds of CAD$135,050. Each unit consists of one common share of its Company and one non-transferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of its Company for a period of 24 months from the date of issuance, at a purchase price of US$0.07. A cash finders’ fee of CAD$3,300 and 286,666 full broker warrants that expire June 8, 2019 was paid to Canaccord Genuity and Leede Jones Gable.

On October 7, 2016, the company issued 175,000 common shares of its Company and paid $5,000 to comply with the Definitive Agreement signed May 12, 2016.

On December 6, 2016, the company signed a Definitive Commercial Agreement with Genesis Water Technologies with regard to the acquisition of exclusive licensing rights of the technology as outlined in the agreement.

On January 20, 2017, the Company closed the first tranche of a private placement of 1,000,000 units at a price of CAD$0.04 per unit for gross proceeds of CAD $40,000. Each unit consists of one common share of the Company and one-nontransferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of the Company for a period of 24 months from the date of issuance, at a purchase price of $0.06. A cash finders’ fee of CAD$800 and 20,000 full broker warrants that expire January 20, 2019 was paid to Leede Jones Gable Inc.

On January 20, 2017, the Company granted 1,535,000 stock options to directors, officers and consultant of the Company with an exercise price of $0.07 which vested immediately, expiring January 20, 2022.

On January 31, 2017, the Company granted 1,500,000 stock options to consultant of the Company with an exercise price of $0.07 vested immediately, expiring January 31, 2022.

On February 28, 2017, the Company closed the first tranche of a private placement of 4,250,000 units at a price of CAD$0.04 per unit for gross proceeds of CAD $170,000. Each unit consists of one common share of the Company and one-nontransferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of the Company for a period of 24 months from the date of issuance, at a purchase price of $0.06. A cash finders’ fee of CAD$11,100 and 227,500 full broker warrants that expire February 28, 2019 was paid to Leede Jones Gable Inc., Canaccord Genuity and Duncan McKay.

On February 28, 2017, the Company signed a Letter of Engagement with Adam Mogil and issued 1,000,000 warrant options to convert to 1,000,000 common shares to Adam Mogil to provide corporate services. The warrants have an exercise price of $0.09 and expire August 28, 2017. These warrant options expired without being exercised.

On April 21, 2017, the Company issued 95,500 shares for gross proceeds of $5,685 from the exercise of warrants of previous financings at $0.05 and $0.07.

On April 30, 2017 the Company issued 166,500 shares for gross proceeds of $11,655 from the exercise of warrants from a previous financing at $0.07.

On April 30, 2017, the Company closed the first and final tranche of a private placement of 3,224,000 units at a price of CAD$0.09 per unit for gross proceeds of CAD $290,160. Each unit consists of one common share of the Company and one-nontransferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of the Company for a period of 24 months from the date of issuance, at a purchase price of $0.12. A cash finders’ fee of CAD$20,736 and 230,400 full broker warrants that expire April 28, 2019 was paid to Leede Jones Gable and Canaccord Genuity.

On May 5, 2017, the Company granted 500,000 stock options to consultant of the Company with an exercise price of $0.10 vested immediately, expiring May 5, 2022.

On May 5, 2017, the Company terminated the Definitive Agreement dated May 12, 2016 with the Vendor on the Nevada Lithium brine properties.

On May 8, the Company announced it would be conducting a lithium exploration program in Argentina. However, after receiving assays from several project areas the Company decided not to proceeds with further exploration on the projects. The Company is still reviewing 3rd party data from vendors and has signed an NDA with a 3rd party to further evaluate the Genesis Water Technologies lithium extraction technology.

On July 31, 2017, the Company announced the resignation of CFO and Director Bal Bhullar, the appointment of Kristian Ross as director and president Robert McAllister assuming the interim duties of CFO.

On August 14, 2017 the Company announced the appointment of Davidson and Company, LLP, Chartered Professional Accountants as its new independent registered auditing firm which replaced MNP LLP independent registered auditing firm.

On August 30, 2017 the Company announced the Staking of lode and placer claims covering approximately 160 acres for Lithium in Clayton Valley, NV.

Current Business

Enertopia is an exploration stage company with respect to its mineral project in Nevada and concurrently are working on the development of Lithium Carbonate technology that Enertopia has the licensing rights to sell in the USA, Argentina, Bolivia and Chile with its technology partner Genesis Water Technologies Inc.

On October 27, 2017 the company entered into a one year Investor Relations Consulting agreement with FronTier Merchant Capital Group. Terms of the agreement, FronTier Capital Group has been retained for a 12-month period at $87,000 (plus applicable sales tax) per annum plus direct expenses. The company will also grant 300,000 stock options to FronTier at an exercise price of 0.05 per share expiring 5 years from the date of grant.

On November 1, 2017, the company closed the first tranche of a private placement of 2,600,000 units at a price of CAD$0.05 per unit for gross proceeds of CAD$130,000. Each unit consists of one common share of its Company and one non-transferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of its Company for a period of 24 months from the date of issuance, at a purchase price of $0.06.

On November 1, 2017, the company granted 500,000 stock options to a director of the company at an exercise price of 0.05 per share expiring 5 years from the date of grant.

On December 8, 2017, the company closed the second tranche of a private placement of 3,954,000 units at a price of CAD$0.05 per unit for gross proceeds of CAD $197,700. Each unit consists of one common share of its Company and one non-transferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of its Company for a period of 24 months from the date of issuance, at a purchase price of $0.06. A cash finder’s fee for CAD $12,770 and 230,400 full broker warrants was paid to third parties. Each full broker warrant entitling the holder to purchase one additional common share of its Company for a period of 24 months from the date of issuance, at a purchase price of $0.06.

On December 8, 2017 the company issued 240,000 common shares of its Company on the exercise of 240,000 stock options that were exercised by a director of the Company at $0.05 for $12,000 for net proceeds to the company.

On December 15, 2017 the company paid Genesis Water Technologies (GWT) $96,465 for the second and final payment for the Second phase of the second bench test and $8,998 for the bill of materials for the bench test.

On January 12, 2018, the company closed the final tranche of a private placement of 1,611,000 units at a price of CAD$0.05 per unit for gross proceeds of CAD$80,550. Each unit consists of one common share of the Company and one non-transferable share purchase warrant, each full warrant entitling the holder to purchase one additional common share of the Company for a period of 24 months from the date of issuance, at a purchase price of $0.06. A cash finder’s fee of CAD$3,880 and 77,600 broker warrants was paid to a third party. The broker warrants have the same terms as the warrants issued as part of the unit offering.

On February 2, 2018 the company issued 50,000 common shares of its Company on the exercise of 50,000 warrants that were exercised at $0.07 for $3,500 for net proceeds to the company.

Mineral Property

Lithium Property

Enertopia (Optionee) has signed the Definitive Agreement on May 12, 2016 with the Vendor respecting the option to purchase a 100% interest in approximately 2,560 acres of placer mining claims in Churchill, Lander and Nye Counties Nevada, USA. These placer mining claims are subject to a 1.5% NSR from commercial production with the Company able to buy back the NSR at the rate of $500,000 per 0.5% NSR.

Purchase Price for the Claims

The consideration payable by Enertopia to the Optionor pursuant to this Offer shall consist of:

- paying $7,000 on signing the Offer; (paid)

- paying $12,000 on signing of the definitive agreement (the “Agreement”) and issuing 3,500,000 common shares in the capital stock of Enertopia as soon as practicable following the execution of the Agreement, (paid)

- paying an optional $12,000 on or before the six month anniversary of the Agreement (paid $5,000 and issued 175,000 common shares of the Company),

- paying an optional $22,500 on or before the one year anniversary of the Agreement (not paid, property returned to vendor),

- issuing additional common shares in the capital of the Optionee, as constituted on the date hereof, to be issued to the Optionor pursuant to the discovery of a Lithium enriched brine with an average 300ppm Li over 100 foot vertical interval in the enriched lithium brine in the Central Nevada Brine Project. 1,000,000 Bonus Shares will be issued per each successful property discovery meeting the foregoing criteria up to a maximum 3,000,000 Bonus Shares.

NSR

There is a 1.5% Net Smelter Return (“NSR”) payable on all Placer mining claims from commercial production to be paid according to the terms and conditions as set forth in the Transaction Documents. The NSR can be re purchased for $500,000 per every 0.5% .

On May 5, 2017, the Company terminated the Definitive Agreement dated May 12, 2016 with the Vendor on the Nevada Lithium brine properties.

On August 30, 2017 the Company announced the staking of Lode and Placer claims of BLM lands in Esmeralda county Nevada covering approximately 160 Acres subject to adjustment. The Company has an 100% interest in the lands and is only responsible for the yearly maintenance fees to the BLM (estimated to be $2,635) and County (estimated to be $212) due November 1, 2018 to keep its 100% interest. The claims are in good standing until August 31, 2018. As at February 28, 2018, the Company has incurred BLM and county costs of $6,239 and associated surface sampling, assaying and 3rd party lab testing of $6,082.

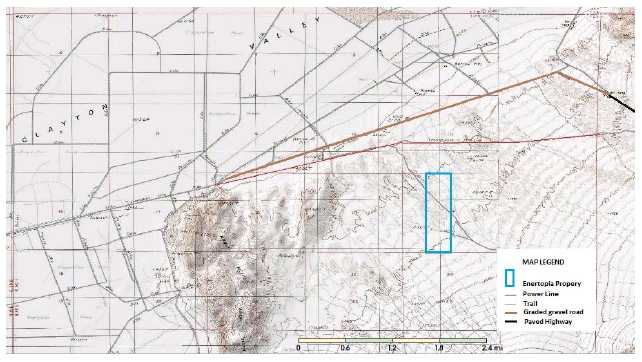

Access to the property can be achieved by paved Hwy 265 to Silver Springs, NV or paved Hwy from north of Goldfields, NV. Access is then by graded gravel road. The last 1.8 miles to the property is by trail road using 4x4 vehicle. The property is covered with extensive outcroppings of the Esmeralda Formation. Power transmission line is within ½ mile of the northern property boundary. Water would have to be trucked in or by pipe line if a processing facility was built onsite. Of particular interest is a section of green, volcanoclastic, evaporate-rich mudstone strata known as the Frontera Verde zone that host lithium of potential economic significance. The Frontera Verde Zone is exposed over approximately 100 acres of the northern two thirds of the property, and underlies the rest of the property at shallow depths. Third party drilling adjacent to the west and eastern boundaries of the property supports this analysis. The property is without known reserves and the current work programs are exploratory in nature.

Current exploration is at the grass roots stage with surface sampling and two small 250 pound bulk samples being taken in 2017. The Company intends to complete additional field exploration and collection of reconnaissance samples to locate lithium rich strata and bulk samples for laboratory testing. Extensive laboratory analysis is expected to be completed on the bulk samples to determine lithium content and a preferred method of taking lithium into solution in synthetic brine. Continued testing of synthetic brines by Genesis Water Technologies will determine the preferred methods for potentially producing commercial products from the processing of synthetic brines.

Property Map

Esmeralda County Lode and Placer Claims:

| Claim Name | Claim Type | BLM Serial # |

|---|---|---|

| STEVE 1 | PLACER | NMC 1148769 |

| STEVE 2 | PLACER | NMC 1148770 |

| STEVE 3 | PLACER | NMC 1148771 |

| STEVE 4 | PLACER | NMC 1148772 |

| STEVE 5 | PLACER | NMC 1148773 |

| STEVE 6 | PLACER | NMC 1148774 |

| STEVE 7 | PLACER | NMC 1148775 |

| STEVE 8 | PLACER | NMC 1148776 |

| DAN 1 | LODE | NMC 1148760 |

| DAN 2 | LODE | NMC 1148761 |

| DAN 3 | LODE | NMC 1148762 |

| DAN 4 | LODE | NMC 1148763 |

| DAN 5 | LODE | NMC 1148764 |

| DAN 6 | LODE | NMC 1148765 |

| DAN 7 | LODE | NMC 1148766 |

| DAN 8 | LODE | NMC 1148767 |

| DAN 9 | LODE | NMC 1148768 |

LITHIUM TECHNOLOGY

On August 15, 2016, a binding Letter of Intent (“LOI’) was signed by Enertopia and Genesis Water Technologies, Inc. ("GWT") with regard to the acquisition by Enertopia of the exclusive worldwide licensing rights (the "Licensing Rights") by Enertopia of all of the technology used in the process of recovering and extraction of battery grade lithium carbonate powder Li2CO3 grading 99.5% or higher purity from brine solutions.

Upon the execution of this LOI, Enertopia issued 250,000 common shares valued at $12,500 to GWT.

On December 6, 2016, and amended on October 9, 2017, Enertopia and GWT signed a Definitive Commercial Agreement with regard to the acquisition by Enertopia of the exclusive licensing rights in the United States of America, Argentina, Bolivia and Chile of all of the technology used in the process of recovering and extraction of battery grade lithium carbonate powder Li2CO3 grading 99.5% or higher purity from brine solutions.

The following are key points of the terms of the formal Definitive Commercial Agreement:

- Enertopia to pay within 30 days to GWT $10,000 (paid) for the bench testing of four lithium brine samples to confirm the June 2016 feasibility report. During the six month period ended February 28, 2018, the Company signed a Lab Testing Service Agreement with GWT and paid $192,950 for the purpose of additional bench testing services plus materials costs of $8,998. Within 30 days of successful independent 3rd party lab testing of the bench test results, Enertopia will issue 250,000 common shares to GWT.

- Upon successful test pilot facility results, start the construction of commercial Lithium recovery production facility.

- Upon receipt of a patent for the process for extracting lithium from wastewater, Enertopia will issue 250,000 common shares to GWT.

- GWT has granted Enertopia exclusive rights and relicensing rights to the usage of GWT’s patent pending technology covering United States of America, Argentina, Bolivia and Chile as per the Commercialization Agreement in return for 10 per cent of net sales royalty payments for battery grade Lithium Carbonate Li2CO3 produced.

- In order to maintain its exclusive rights, Enertopia will need to make the following minimal payments to GWT on the anniversary of bench testing achieving 99.5% battery grade Li2CO3 recovery verified by independent laboratory testing:

- On or before the first anniversary, the greater of 10 per cent of Enertopia net Lithium Carbonate Li2CO3 sales from brine sources or $50,000;

- On or before the second anniversary, the greater of 10 per cent of Enertopia net Lithium Carbonate Li2CO3 sales from brine sources or $150,000;

- On or before the third anniversary annually until the seventh anniversary, the greater of 10 per cent of Enertopia net Lithium Carbonate Li2CO3 sales from brine sources or $200,000;

- ight of first refusal to renew exclusive rights and relicensing rights for another 10 years after the first seven year licensing period on the same net sales terms as those of 2023 or $250,000 per annum.

Genesis Water Technologies Ltd. (GWT) is a USA based manufacturer of advanced, innovative and sustainable treatment solutions for applications in process water, drinking water, water reuse and waste water for the energy, agriculture processing, industrial, municipal infrastructure, and building/hotels sectors. GWT will provide management and technical expertise and access to its patent pending ENERLET for exclusive USA, Argentina, Bolivia and Chile for license by the Company.

The ENERLET process consists of six main steps 1) Clarification / filtration, 2) Electrocoagulation, 3) Ion-exchange, 4) Evaporation, 5) Rehydration / precipitation, 6) Drying

The company has had a 3rd party laboratory conduct testing on the two bulk samples collected by using various water rock ratio’s and varying Ph levels. The data from these technical testing programs will be the basis for the creation of the synthetic brines for the current bench testing program.

Investments

The company currently hold the following investment interests:

Equity Investment in Global Solar Water Power Systems Inc. During the year ended August 31, 2013, based on the management’s assessment of GSWPS’s current operations, the Company decided to write down long-term investment in GSWPS to $1.

Employees

The company primarily used the services of sub-contractors and consultants for its intended business operations. The company's technical consultant is Mr. McAllister, its president and a director.

The company entered into a consulting agreement with Mr. Robert McAllister on December 1, 2007. During the term of this agreement, Mr. McAllister is to provide corporate administration and consulting services, such duties and responsibilities to include provision of oil and gas industry consulting services, strategic corporate and financial planning, management of the overall business operations of the Company, and supervising office staff and exploration and oil & gas consultants. Mr. McAllister is reimbursed at the rate of $2,000 per month. On December 1, 2008, the consulting fee was increased to $5,000 per month. The company may terminate this agreement without prior notice based on a number of conditions. Mr. McAllister may terminate the agreement at any time by giving 30 days written notice of his intention to do so. Effective March 1, 2014, the Company entered into a new Management Consulting Agreement replacing the original agreement with a consulting fee of $6,500 plus GST per month. Effective July 1, 2017, the Company entered into a new Management Consulting Agreement replacing the March 1, 2014 agreement with a consulting fee of $3,500 plus GST per month. On July 31, 2017 Mr. McAllister agreed to be intern CFO until such time as a replacement could be sourced.

The company do not expect any material changes in the number of employees over the next 12 month period. The company do and will continue to outsource contract employment as needed.

Going Concern

Enertopia has suffered recurring losses from operations. The continuation of its Company as a going concern is dependent upon its Company attaining and maintaining profitable operations and/or raising additional capital. The financial statements do not include any adjustment relating to the recovery and classification of recorded asset amounts or the amount and classification of liabilities that might be necessary should its Company discontinue operations.

The continuation of its business is dependent upon it raising additional financial support and/or attaining and maintaining profitable levels of internally generated revenue. The issuance of additional equity securities by it could result in a significant dilution in the equity interests of its current stockholders. Obtaining commercial loans, assuming those loans would be available, will increase its liabilities and future cash commitments.