Exide Industries Ltd

Overview

For more than six decades, Exide Industries Ltd (NSE: EXIDEIND) has been one of India's most reliable brands, enjoying unrivalled reputation and recall. The company's constant emphasis on innovation, extensive geographic footprint, strong relationship with marquee clients and steady technology upgradations with global business partners have made it a distinct frontrunner in the lead-acid storage batteries space for both automotive and industrial applications.1

Exide designs, manufactures, markets and sells the widest range of lead acid storage batteries in the world from 2.5Ah to 20,600Ah capacity, to cover the broadest spectrum of applications. Using the latest technological inputs, the company manufacture batteries for the automotive, power, telecom, infrastructure projects, computer industries, as well as the railways, mining and defence sectors.

Exide has nine factories strategically located all over India out of which 7 factories are dedicated to batteries and the other 2 factories manufacture Home UPS Systems. It is the only company with multi-locational manufacturing units spread across the country and equipped with cutting edge technology machines.

The company's R&D centre, set up in 1976, is considered one of the premier battery research facilities in the world and is recognized by the department of Scientific & Industrial Research under Ministry of Science & Technology, Government of India.

Recognition of its pursuit of quality was achieved when RWTUV of Germany awarded it the ISO 9001. Exide Industries has also received ISO 14001 Certificate in recognition of its eco-friendly production processes. The company's Automotive Division is certified to ISO/TS-16949.

Brands

Plant Locations

With nine factories spread across the country, Exide's range and scale of manufacturing operations can be matched by very few companies in the world. Out of the nine factories, seven factories are dedicated to manufacturing batteries and the other two for Home UPS Systems. Together, the manufacturing plants produce an annual output of 8 Million Units in Automobile batteries (including batteries for motor-cycle applications), and over 600 Million Ampere-Hours of Industrial Power. 2

Exide's manufacturing facilities are equipped with world's latest and most advanced machineries. The Company is constantly upgrading its technology and also acquiring new technology to meet the ever increasing demands of its customers. In addition to the state-of-the-art in-house R&D center recognised by the Department of Scientific and Industrial Research, Government of India, Exide also acquires new technology through technical collaboration agreements with leading international battery manufacturers.

West Bengal

(I) Shamnagar,Parganas

(II) Haldia, Dist Midnapore,

Haryana

(I) HSIIDC Growth Centre,Bawal

Maharashtra

(I) Chinchwad East,Pune

(II) Industrial Area,Taloja

(III) Nagpur Taluka, Ahmednagar

Tamil Nadu

(I) Hosur Taluk, Dist Krishnagiri

Uttarakhand

(I) Roorkee, Dist-Haridwar

(II) Ranipur, Haridwar

Business Overview

The Indian automotive sector reported one of its worst-ever performances during the year 2019-20. The entire financial year was quite challenging for the automotive industry because of reduced liquidity, economic slowdown and poor consumer sentiment, among others. The impending switch from BS4 to the less-polluting BS6, scheduled from April 2020, also led to serious uncertainties. Then, in January 2020, the first case of COVID-19 reached India. As more cases were reported, the government ordered a complete lockdown from 25th March 2020 to prevent the spread of the highly infectious disease. Sales crashed in all the vehicle segments in March and the automotive industry, which was already going through a difficult period, posted a severe decline in all the segments.3

Domestic sales of passenger vehicles recorded a degrowth of 17.8 per cent during the year, as compared with a growth of 2.7 per cent in the previous year. The commercial vehicle segment has seen the biggest fall of 28.8 per cent, against a robust growth of 17.6 per cent last year. Domestic sales of three-wheelers have de-grown by 9.2 per cent compared with a growth of 10.3 per cent last year. Two-wheeler sales saw a massive de-growth of 17.8 per cent compared with a growth of 4.9 per cent last year

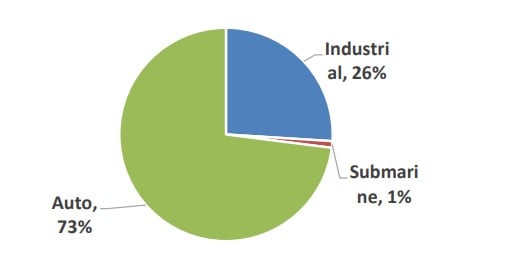

Automotive Batteries

Amidst the challenging and tough market conditions witnessed by its domestic automotive industry, the company continued to dominate the automotive battery business and sustained its leadership position. With a wide array of products covering diverse market segments, the company managed to register growth across vehicular, nonvehicular and two-wheeler segments.

Original equipment (OE) sales slowed down as demand for automobiles fell. However, Exide managed to maintain its high share across almost all leading vehicle manufacturers. Significantly, the two new companies that began operations successfully in India this year – MG Motor with its Hector model and KIA Motor with its Seltos - started with 100 per cent use of Exide batteries

Industrial Batteries

The company registered a slight de-growth in the Industrial Division during the financial year.

The UPS or Uninterruptible Power Supply vertical, which is the largest business vertical of the Industrial Division, registered single-digit growth. It has become the growth engine of the Industrial Division, with continuous product and process upgradation backed by a strong sales and service network across India.

The Original Equipment (OE) business suffered due to lack of project orders during the year.

The company's Solar vertical maintained decent sales momentum by utilising its widespread channel network, with the objective of being the country’s most preferred Energy Solution Provider. The focus is to provide reliable and affordable storage solutions for Rural Electrification, Mini and Micro grids & other off-grid and decentralised energy storage in those parts of the country with no electricity grid supply. It is also a part of the “Make in India” initiative. A decline in solar PV additions in 2019 was caused by elections, a slowing economy, liquidity issues, lack of financing and payment delays.

The financial stress in the Indian telecom sector speeded up the consolidation of the industry, and its country witnessed a number of shut-downs and mergers & acquisitions of mobile telephony operators and tower infrastructure companies. The Company’s sales to the telecom sector were subdued as the M&A of the telephony companies led to a rationalisation of towers.

2019-20 started with the promise of good growth in the Power & Projects vertical with several new projects lined up. The company has continued its dominance over the competition in this division both, in the new and replacement markets. The company continued to maintain its market share with its wide range of products, continuous product upgrades and a wide sales and service network. However, the Power & Projects business vertical reported a slight de-growth during the last financial year.

In Traction, the Company is working on an Opportunity Rapid Charge (ORC) battery for specific application areas such as airports, where quick re-charging the batteries of luggage trolley pushers and passenger transporters is a challenge.

In other business verticals of its Industrial division, the railways and mining cap-lamps reported robust growth and Exide continues to be the preferred brand for most of its customers.

Batteries for Submarines

During the year the Company successfully manufactured and delivered submarine batteries to the Indian Navy. It manufactured and supplied two sets of Type-II batteries for the Type 209 submarine and one set of Type-IV batteries for the Scorpene-class submarine. The first set of indigenous Type-IV submarine batteries manufactured and supplied earlier by the Company to the Indian Navy passed all the sea trials successfully. The second set of these batteries was also installed and commissioned successfully.

During the year, the Company also manufactured and exported one set of submarine batteries along with all accessories and spares for the Type 636 submarine to a foreign navy. Two sets of such batteries exported last year were installed and commissioned, passing all sea trials. During 2019-20 it also manufactured and exported one set of mini-submarine batteries.

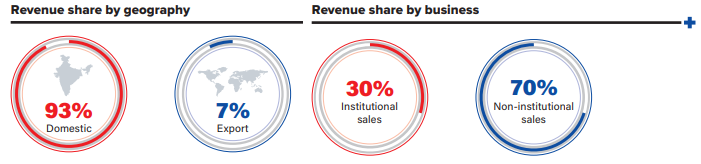

Exports

Exports of automotive batteries to the Middle East and South-East Asia continued to grow. The company made significant inroads into GCC countries, especially Saudi Arabia and the UAE, where a branch office has been set-up.

The Company also entered new markets in Nigeria and Greece this year with its automotive batteries. It focused on expanding the distributor base in South-East Asian countries and invested in brand-building to strengthen its presence in key ASEAN markets for significant export growth in the coming years.

However, the COVID-19 pandemic has severely affected its key export markets in the ASEAN and GCC region since February 2020 and it is likely to impact its growth momentum in the coming financial year.

The company expects good opportunities in South American countries such as Peru, Chile, Argentina and Brazil. The company also expect big demand in Africa and the Middle East for the solar business, as the supplies from Europe are likely to be disrupted. However, in these continents too much will depend on the route the pandemic takes

The traction battery business in Europe will depend on the post-COVID-19 situation. We, however, expect steady growth in the standby battery business in Africa, the Middle East and South-East Asia.

Financial Highlights

The company recorded net sales of Rs. 9,857 Crores in 2019-20, against Rs. 10,588 Crores in the previous year, and a profit before tax of Rs. 1,035 Crores against Rs. 1,238 Crores in the previous year.

Exide Industries Q2 results: Net profit declines 4% to Rs 229 crore 4

Nov 10, 2020; Exide Industries Ltd reported a 3.59% drop in its standalone net profit at Rs 228.77 crore in the second-quarter (Q2) ended September 30, 2020, compared to Rs 237.29 crore profit clocked in the corresponding period last year. On consolidated basis Net Sales at Rs 4,011.39 crore in September 2020 up 6.16% from Rs. 3,778.51 crore in September 2019.

Revenue from operations grew by 5.5 % on a standalone basis to Rs 2,753.38 crore during the period under review as against Rs 2,610.86 crore same period last year.

According to Exide Industries MD & CEO G Chatterjee, demand for replacement sales of automotive and UPS batteries during the second quarter has improved. Demand of OEM and other institutional customers has also started showing some positive traction towards the latter part of the quarter. Operations at some manufacturing plants were intermittently disrupted due to the pandemic, affecting supplies.

The company is focussing on cost control, technology upgradation and cash flow management as strategies to improve profitability and liquidity, Chatterjee said in a press statement.

On a consolidated basis, net profit was up by 3.81% at Rs 256.62 crore (Rs 247.18 crore) during the quarter under review.

References

- ^ https://www.exideindustries.com/about/about-exide.aspx

- ^ https://www.exideindustries.com/about/manufacturing-facilities.aspx

- ^ https://docs.exideindustries.com/AnnualReport/dd85741f-ef3f-4ed5-9330-ccf0e1c4879f.pdf

- ^ https://economictimes.indiatimes.com/markets/stocks/earnings/exide-industries-q2-results-net-profit-declines-4-to-rs-229-crore/articleshow/79150784.cms