FirstService Corporation

Summary

- FirstService Corporation is a North American leader in the essential property services sector serving its customers through two industry leading platforms; FirstService Residential and FirstService Brands.

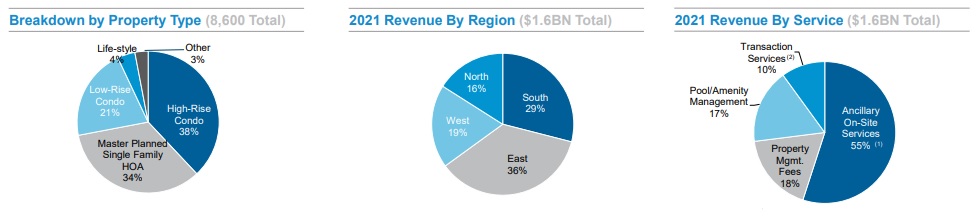

- FirstService Residential North America's largest manager of residential communities, managing 8,600 properties representing more than 1.7 million residential units.

- Started in 1972 FirstService became a publicly traded company in 1993 public offering on The Toronto Stock Exchange.

Company Overview

FirstService Corporation (NYSE:FSV, TSX:FSV) is a North American leader in the essential property services sector serving its customers through two industry leading platforms; FirstService Residential and FirstService Brands.1

FirstService Residential

North America's largest manager of residential communities, managing 8,600 properties representing more than 1.7 million residential units. Its mission is to deliver exceptional client service and solutions that enhance the value of every property and the lifestyle of every resident in the communities it manages.

FirstService Brands

FirstService Brands is one of North America's largest providers of essential property services to residential and commercial customers delivered through individually branded franchise systems and company-owned operations.

Company History

The company history began when its Founder and Chairman, Jay Hennick, launched a commercial swimming pool and recreational facility management business as a teenager in 1972. His early success led him to acquire other property services companies, which formed the basis for FirstService Corporation.2

FirstService became a publicly traded company in 1993 via an initial public offering on The Toronto Stock Exchange in 1993 and subsequently listed on the NASDAQ Exchange in 1995. On June 1, 2015, the businesses currently owned by FirstService today were separated from Colliers International via a spin-off transaction and FirstService became a new, independent company publicly traded on the TSX and NASDAQ.

| Years | Key milestones |

| 1989 | Jay Hennick established FirstService with a Toronto-based swimming pool management company |

| 1989 | FirstService acquired College Pro Painters franchise system and established FirstService Brands |

| 1995 | Scott Patterson joined FirstService as Vice President, Corporate Development and soon thereafter became Chief Financial Officer |

| 1996 | FirstService established FirstService Residential platform by acquiring two Florida-based property management firms, with follow-on acquisitions in the New York City and Northeast U.S. regions shortly thereafter |

| 1997 | FirstService Brands acquired Paul Davis Restoration franchise system |

| 1998 | FirstService Brands acquired California Closets franchise system |

| 2005 | FirstService Brands exceeded 1,000 franchises |

| 2008 | FirstService adopted Net Promoter System (NPS) across all of its businesses |

| 2010 | FirstService Residential expanded into Canada |

| 2015 | California Closets opened its Western Manufacturing Center in Phoenix, Arizona |

| 2015 | Paul Davis Restoration launched its company-owned strategy and acquired its first |

| 2016 | FirstService acquired Century Fire Protection |

| 2017 | California Closets opened its Eastern Manufacturing Center in Grand Rapids, Michigan |

| 2019 | FirstService acquired Global Restoration Holdings |

| 2021 | Global Restoration re-branded to FIRST ONSITE |

Brands

The company's Brands both rely on the same operational foundations for success - a core competency in managing and growing market-leading, value-added outsourced property services businesses; significant scale advantages that are leveraged to create more value for clients; a culture focused around customer service excellence; and strong brand recognition.3

Paul Davis

Paul Davis provides services to cleanup and repair damage to residential and commercial properties caused by water, fire, mold, storm or other disasters. Paul Davis is known for its innovation and pioneered many processes and services that have helped shape the property damage restoration industry.

First Onsite

First Onsite was started with the acquisition of Global Restoration Holdings in 2019 has emerged through a rebrand as one of the fastest growing and largest commercial property restoration firms in North America - FIRST ONSITE.

California Closets

California Closets California Closets originated the customized home storage category in 1978. Today the company is the most recognized brand of its type in the world. California Closets brings customized storage solutions to any room, including media, home office, garage, bedroom and more.

Century Fire Protection

Century Fire Protection is one of the largest, most successful, full-service fire protection companies in the Southeast United States. The company helps owners, property managers and end users mitigate risk and maintain compliance while protecting people and their property.

CertaPro Painters

CertaPro Painters is the largest residential painting contractor in North America. The backbone of the company is its operational requirement to deliver the Brand of Certainty to both its franchisees and its customers.

Pillar To Post

Pillar To Post Home Inspectors is North America's leading home inspection company. This fast-growing concept works with both the real estate community and the buyer or seller of a home to provide on-the-spot inspection reports that allow for rational thinking about an emotional purchase.

Floor Coverings International

Floor Coverings International is a boutique brand in a very large category. The company has developed its difference by bringing the design and decision-making process into the home of the customer. The customer experience creates an enviable success ratio, and with it, the opportunity for repeat and referral business.

Financial Highlights

The company's revenues were $3.25 billion for 2021, up 17% relative to 2020. The increase included organic revenue growth of 10%, with the balance coming from recent acquisitions.4

The company acquired controlling interests in eighteen businesses in 2021, including four in its FirstService Residential segment and fourteen in its FirstService Brands segment. The total initial cash consideration for these acquisitions was $163.2 million. The company's tuck-under acquisitions increase the geographic footprint and broaden its service offering at FirstService Residential.

Operating earnings for the year were $201.6 million versus $169.4 million in the prior year period, with the increase attributable to growth in profitability in both divisions. Adjusted EBITDA rose 15% to $327.4 million in 2021 versus $283.7 million in the prior year. Performance in its FirstService Residential division was driven by growth in labour-related services revenue and amplified by the reopening of client amenity management facilities that were initially closed due to the COVID pandemic. The company's FirstService Brands division was driven by strong, broad-based organic growth, including double-digit growth in its restoration and home improvement businesses, together with contribution from recent tuck-under acquisitions.

Depreciation expense was $55.1 million in 2021 relative to $51.9 million in the prior year, with the increase primarily related to recently acquired company-owned operations in its FirstService Brands segment.

Net interest expense decreased to $16.0 million in 2021 from $24.3 million in the prior year, with the difference primarily attributable to a decrease in its average outstanding debt. The company's weighted average interest rate also decreased to 2.8% in 2021 from 3.4% in the prior year.

Other income was $23.4 million versus $0.4 million in the prior year. Other income in the current year included a $12.5 million pre-tax gain from the divestiture of its immaterial, non-core pest control operation in the FirstService Residential segment. Also included in other income was a pre-tax gain of $7.3 million from the sale of a building located in South Florida, also in the FirstService Residential segment.

The company's consolidated income tax rate for the period was 25%, flat versus the prior year, and relative to the statutory rate of 27% in both periods.

Net earnings for the period were $156.1 million versus $109.6 million a year ago. The increase was attributable to earnings growth in both of its segments, as well as lower interest expense and the significant increase in other income.

At FirstService Residential, revenues were $1.59 billion in 2021, up 12% versus the prior year, with the increase comprised of 8% organic growth and the balance from acquisitions. Organic growth was primarily driven by labor related services compared to the prior year. Adjusted EBITDA for this segment was $156.7 million or 9.9% of revenues, relative to $138.2 million or 9.8% of revenues in the prior year. Operating earnings for 2021 were $127.3 million or 8.0% of revenues, relative to $112.6 million or 8.0% of revenues a year ago. Operating margins remained relatively flat versus the prior year.

The company's FirstService Brands operations reported revenues of $1.66 billion in 2021, an increase of 23% versus the prior year, comprised of 13% organic growth and the balance from tuck-under acquisitions. Organic revenue growth was broad-based across the division and included double-digit organic growth in its restoration and home improvement operations. Adjusted EBITDA for this segment was $187.9 million in 2021 or 11.3% of revenues, relative to $155.1 million or 11.4% of revenues in the prior year. Operating earnings were $106.6 million or 6.4% of revenues, versus $78.8 million or 5.8% of revenues a year ago, with the prior year having increased amortization expense in connection with recently completed acquisitions.

Corporate costs, as presented in Adjusted EBITDA, were $17.2 million in 2021 relative to $9.8 million in the prior year. On a GAAP basis, corporate costs were $32.2 million versus $21.9 million in the prior year. The year-over-year increase is primarily due to increased compensation expense relative to the prior year when significant COVID related cost reductions were incurred, as well as the impact of foreign exchange.

The Company generated cash flow from operating activities of $167.3 million for the year ended December 31, 2021, relative to $291.8 million in the prior year. Operating cash flow, before the impact of working capital, was favourably impacted by strong profitability at both of its segments. Increases in non-cash working capital to support growth across its operations, particularly in its FirstService Brands segment, resulted in a year-over-year decline in operating cash flow after working capital. The prior year operating cash flow also benefited from COVID-related payroll tax deferrals which were paid in the current year, and therefore resulted in a negative impact to operating cash flow in 2021. The company believe that cash from operations and other existing resources, including its revolving credit facility described below, will continue to be adequate to satisfy the ongoing working capital needs of the Company.

Capital expenditures for the year were $58.2 million (2020 - $39.4 million), which consisted primarily of service vehicle fleet replacements and additions in the FirstService Brands segment, as well as information technology system and hardware investments in both of its operating segments.

First Quarter 2022 result

April 27, 2022; FirstService Corporation reported operating and financial results for its first quarter ended March 31, 2022. All amounts are in US dollars.5

Consolidated revenues for the first quarter were $834.6 million, up 17% relative to the same quarter in the prior year, including 10% from organic growth. Adjusted EBITDA increased 4% to $62.3 million, and Adjusted EPS was $0.73, representing 11% growth over the prior year quarter. GAAP Operating Earnings were $29.0 million, relative to $33.9 million in the prior year period. GAAP diluted earnings per share was $0.32 per share in the quarter, versus $0.50 in the same quarter a year ago.

“FirstService is pleased to have opened the year with strong results, driven by top-line growth that exceeded its expectations,” said Scott Patterson, Chief Executive Officer of FirstService. “The company's operations delivered very strong organic growth across the board reflecting market share gains and continued momentum with all of its brands,” he concluded.

FirstService Residential revenues were $394.1 million for the first quarter, an increase of 12% versus the prior year, including 7% organic growth. Top-line performance was driven by core management and sited labour contract growth, particularly in its Florida, California, New York and Mid-Atlantic markets. Adjusted EBITDA for the quarter was $30.4 million, up from $29.4 million in the prior year period. GAAP Operating Earnings were $23.4 million, versus $23.2 million in the first quarter of last year. Operating margins were impacted by wage inflation, together with the increased mix of labour-driven services relative to higher margin ancillaries.

FirstService Brands revenues for the first quarter totalled $440.5 million, up 22% relative to the prior year period. The revenue increase was comprised of 12% organic growth, with the balance from recent tuck-under acquisitions. Top-line organic growth was exceptionally strong within its home improvement and Century Fire service lines. Adjusted EBITDA was $36.1 million, up from $33.4 million in the prior year quarter. GAAP Operating Earnings were $15.8 million, versus $16.5 million in the prior year quarter. Operating margins declined as a result of higher labour costs and supply chain disruptions at several of its brands, as well as job mix at its restoration brands.

Corporate costs, as presented in Adjusted EBITDA, were $4.2 million in the first quarter, relative to $3.0 million in the prior year period. On a GAAP basis, corporate costs for the quarter were $10.1 million, relative to $5.9 million in the prior year period, with the increase due to the timing of stock-based compensation expense realized in the current quarter, compared to the second quarter in 2021.