Ford Motor Company

Summary

- Ford Motor Company is an multinational automobile company incorporated in the U.S. in 1903. The company sells automobiles, commercial vehicles and luxury cars.

- Currently, the company has presence in over 125 countries all over the world and it employs 173,000 employees as of the end of 2022.

- Effective from January 1, 2023, the company renamed the operating segments where the automotive segment was split into Ford Blue, Ford Model e, and Ford Pro, mobility segment was renamed Ford Next, and the company has another business segment namely Ford Credit.

- The company has reported revenue of $39.09 billion, net income of $1.76 billion in the first quarter of 2023, revenue up $6.89 billion and net income up $4.87 billion from the same quarter of the previous year.

- Ford Motor Company has reported annual revenue of $158.06 billion in 2022, up from $136.34 billion a year earlier. Ford reported $1.98 billion in loss in 2022, as compared to $17.94 billion a year earlier.

Brief Company Overview

Ford Motor Company (NYSE:F) is an American multinational automobile company incorporated in 1903. The company is headquartered in Dearborn, Michigan, United States. This company was acquired in a management buyout by another separately created Ford Motor Company that was incorporated in Delaware in 1919.1 The company sells automobiles, commercial vehicles and luxury cars. Currently, the company has presence in over 125 countries all over the world and it employs 173,000 employees as of the end of 2022. The company had two operating segments - automotive, and mobility; effective from January 1, 2023, it renamed the operating segments where the automotive segment was split into Ford Blue, Ford Model e, and Ford Pro, mobility segment was renamed Ford Next, and the company has another business segment namely Ford Credit.2

Ford is one of the oldest American automobile manufacturer and is currently second-largest US-based automaker after General Motors. Globally, Ford holds about 5.0% of the total automobile market share. In 2022, the company sold approximately 4,231,000 vehicles at the wholesale points throughout the world.

William Clay Ford Jr. is the executive chairman and James D. Farley, Jr. is the current President & CEO of Ford Motor Company. The Ford family still holds a minority stake but significant voting power in the company.

As on April, 2023, Return on Equity (TTM) of the company is -4.32%, Return on Assets (TTM) -0.84%, annual dividend yield is 5.48%, basic and diluted earnings per share (EPS) for 2022 is $0.49. As of March 31, 2023, the company had 4,082 million shares of common stock issued, as well as 71 million shares of Class B Stock issued and outstanding.

Recent Developments

- Tata Motors has completed acquisition of Ford India's manufacturing plant at Sanand in January, 2023.3

- Ford is constructing a new production plant outside Memphis, Tennessee that will have a capacity to produce 500,000 EVs annually.4

- Ford lost its second place in the race of selling EVs in the USA to General Motors (GM) as GM has reported strong first-quarter sales of the Chevrolet Bolt.5

- Ford is losing billions in its EV business. The company lost $900 million in 2021, $2.1 billion in 2022, and expects to lose around $3 billion in 2023. The company says to consider the EV business as a start-up. However, all the operations combined the company still expects to make a profit of $9 billion to $11 billion in 2023.6

- Ford held an 11.4% stake in the electric-vehicle maker Rivian at the end of 2021. In 2022, the company cut its stake in Rivian Automotive Inc to 1.15% and wrote down the investment by $7.4 billion. Ford declared on the first week of February, 2023 that the monetization of its stake in Rivian was "nearly complete".7

- Ford recorded a pre-tax impairment of $2.7 billion in the second half of 2022 regarding winding down the operation of Argo AI, which the company assessed to be nonviable.

Recent Financial Activities

- In September 2022, the company redeemed approximately $1.1 billion principal amount of public unsecured debt securities for an aggregate cost of approximately $1.2 billion. In effect, the company recorded $135 million of pre-tax loss (net of unamortized discounts, premiums, and fees) in 2022.

- In August 2022, the company issued $1.8 billion aggregate principal amount of green bonds at the interest rate of $6.1%.

Financial Performance Highlights

Q1'23 Highlights

The company has reported revenue of $39.09 billion, net income of $1.76 billion in the first quarter of 2023, revenue up $6.89 billion and net income up $4.87 billion from the same quarter of the previous year. Adjusted EBIT during the quarter is $3.38 billion, up $0.5 billion; adjusted FCF is $2.4 billion, up $1.05 billion; EPS $0.44, up $1.22. During the first quarter of 2023, revenue is up by 21.40% mainly due to increased volume and higher net pricing, offset partially by weaker currencies.

Ford Blue segment of the company has sold 706,000 wholesale units during the first quarter which was 663,000 during the same quarter a year earlier. Revenue during the periods are $25,124 million and $20,810 million, respectively; EBIT is $2,623 million (10.4% margin) and $1,328 million (6.4% margin), respectively. The wholesales units increased due to improvements in production-related supply constraints. Increased revenue is driven by favorable mix as well as higher wholesales and net pricing, offset partially by weaker currencies. The higher EBIT was driven by favorable mix as well as higher wholesales and net pricing

Ford Model e segment of the company has sold 12,000 wholesale units during the first quarter which was 18,000 during the same quarter a year earlier. Revenue during the periods are $707 million and $972 million, respectively; EBIT is $(722) million and $(380) million, respectively. In the first quarter of 2023, Ford Model e’s wholesales decreased 32% from a year ago, driven by downtime at the Cuautitlan assembly plant for changes to increase production capacity of Mustang Mach-E. First quarter 2023 revenue decreased 27%, primarily driven by lower wholesales, offset partially by favorable mix. The lower EBIT was driven by higher engineering and spending-related expense, inflationary cost increases on commodities and materials, and lower wholesales.

Ford Pro segment of the company has sold 337,000 wholesale units during the first quarter which was 285,000 during the same quarter a year earlier. Revenue during the periods are $13,249 million and $10,324 million, respectively; EBIT is $1,366 million (10.3% margin) and $491 million (4.8% margin), respectively. In the first quarter of 2023, Ford Pro’s wholesales increased 18% from a year ago, driven by improvements in production-related supply constraints. The improvement in EBIT was driven by higher net pricing and wholesales.

In the Ford Next segment (formerly Mobility), the first quarter 2023 EBIT loss was $44 million, a $198 million improvement from a year ago. Ford Next has evolved from primarily investing in the development of autonomous vehicle capabilities to focus exclusively on incubating and launching new businesses creating strategic value for Ford.

First-quarter regular dividend of 15 cents per share declared, plus supplemental dividend of 65 cents per share, enabled by strong FCF, due to the "nearly complete" monetization of stake in Rivian.

Annual Performance Highlights

Ford Motor Company has reported annual revenue of $158.06 billion in 2022, up from $136.34 billion a year earlier. Of the total revenue, Automotive segment represents 94%, Ford credit segment 5.68% and Mobility segment 0.32%. Operating income of the company stood at $6.28 billion, up from $4.52 billion a year earlier. Ford reported $1.98 billion in loss in 2022, as compared to $17.94 billion a year earlier. The big difference (recovery) happened mainly due to the difference in other income or loss whereby the company earned $14.73 billion in 2021, and incurred a loss under the same head of $5.15 billion in 2022. In 2021, Ford's income (realized or unrealized) from cash equivalents, marketable securities, and other investments was $9.16 billion, which was a loss of $7.52 billion. Also, from net periodic pension and OPEB income during 2021 and 2022 has been $5.99 billion and $1.34 billion, respectively.

Total cash and cash equivalents of the company on December 31, 2022 is $25.13 billion as compared to $20.54 billion a year earlier. Total current assets during the years 2022 and 2021 are $116.48 billion and $108.99 billion, respectively. Total assets size for the years is $255.88 billion and $257.04 billion, respectively.

Net cash provided by operating activities during 2022 is $6.85 billion, which was $15.78 billion a year earlier. Net cash used in investing activities in 2022 is $4.35 billion, which was net cash provided by investing activities in 2021 of $2.74 billion.

Segment-wise performance

The Automotive segment generated total revenue of $148,980 million in 2022 and $126,150 million in 2021. EBIT reported for the years are $9,692 million and $7,397 million, respectively. The EBIT improvement was driven by higher net pricing and higher wholesales, offset partially by inflationary increases on commodity, material, and

freight costs, higher structural costs (including growth-related investments), unfavorable mix, weaker currencies, and higher warranty costs.

The Mobility segment primarily includes development costs for Ford’s autonomous vehicles and related businesses, Ford’s equity ownership in Argo AI (a developer of autonomous driving systems), and other mobility businesses and investments. EBIT loss of the company from this segment improved by $104 million from a year ago. The $926 million EBIT loss reflects the company's strategic investments in autonomous vehicle capabilities and support of mobility initiatives.

The Ford Credit Segment has a total net receivables profile of $122,000 million as compared to $118,000 million. EBT from this segment is $2,657 million in 2022 and $4,717 million a year earlier.

Business Overview

Ford Motor Company generates revenue primarily from sales of vehicles, parts, and accessories. The company sales the vehicles from its manufacturing facilities to the dealers and the distributors who are financed at wholesale by Ford Credit. Ford Credit pays cash to the relevant Automotive legal entity in payment of the dealer’s obligation for the purchase price of the vehicle. The dealer then pays the wholesale finance receivable to Ford Credit when it sells the vehicle to a retail customer. The company also generates revenue from the interest on finance receivables and revenue from operating leases through Ford Credit.

Ford Motor Company has introduced new operating model and reporting structure starting from January 1, 2023. Previously Automotive Segment is broken down into three new segments - Ford Blue, Ford Model e, and Ford Pro; previously Mobility segment is transformed into Ford Next; and the Ford Credit segment remains as it was.

Automotive Segment

The Automotive segment primarily includes the sale of Ford and Lincoln vehicles, service parts, and accessories worldwide, together with the associated costs to develop, manufacture, distribute, and service the vehicles, parts, and accessories. This segment includes revenues and costs related to the electrification vehicle programs and enterprise connectivity. The segment includes the following regional business units: North America, South America, Europe, China (including Taiwan), and the International Markets Group.

In 2022, the company sold approximately 4,231,000 vehicles at wholesale throughout the world. The vehicles, parts and accessories of the company are sold through distributors and dealers, majority of which are independently owned. As on December 31, the company had 8,596 Ford dealers, 408 Lincoln dealer and 607 Ford-Lincoln combined dealers worldwide. Ford's business doesn't depend on any single customer or a few customers to the extent that of loss of them would result into loss of Ford. The automotive industry is highly competitive with no single dominant producer commanding a big market share. In the year 2022, the company owned about 5.0% of the total market share, selling approximately 4.0 million vehicles from 79.6 million vehicles of the whole industry. Profit of the company depends on its market share, total wholesale unit volumes, margin of profit on each vehicle sold, cost of raw materials, and other cost structures. In the US, during 2022 the company sold 1,051,900 trucks (51.25%), 911,203 SUVs (44.38%), and 49,242 cars (2.4%).

Mobility Segment

The Mobility segment primarily includes development costs for Ford’s autonomous vehicles and related businesses, Ford’s equity ownership in Argo AI (a developer of autonomous driving systems), and other mobility businesses and investments. Effective January 1, 2023, Ford Next segment (formerly Mobility) primarily includes expenses and investments for emerging business initiatives aimed at creating value for Ford in complementary market segments.

Argo AI

In 2017, Ford Motor Company began investing in Argo AI, an artificial intelligence company that became a consolidated subsidiary, with a commitment to fund $1 billion over five years to develop autonomous vehicle technology. In 2020, Ford completed a transaction with Volkswagen AG (“VW”) that resulted in Ford and VW holding equal interests in Argo AI, which together comprised a majority ownership of the entity. As a result of this transaction, which included $500 million of proceeds from the sale to VW of a portion of the company's interest in Argo AI, Ford deconsolidated Argo AI, remeasured their retained investment in the entity at fair value, and, net of the carrying value in Argo AI’s net assets, recognized a $3.5 billion pre-tax gain in Other income/(loss), net. Immediately following this transaction, Ford's retained investment consisted of a $2.4 billion equity method investment and a $400 million preferred equity security investment, which were reflected on the consolidated balance sheets of the company in Equity in net assets of affiliated companies and Other assets, respectively.

Argo AI had made progress in developing highly automated driving technology (L4). But it turned out that to develop that technology, the company needs significant capital and time as well as development of partial or conditional automated driving technology (L2/L3) to be transformative for customers and for business in the short term. In the third quarter of 2022, the company has made a decision to shift its attention from L4 to L2/L3 development. But Argo AI has failed to attract new investors for the capital needed towards its L4 dreams. In the third quarter of 2022, Ford Motor assessed the business of Argo AI in terms of possibility of other companies acquiring its investments and the so-far-developed technology, also assessed internally the value of Argo AI as a going concern. But Ford found that Argo AI does not carry value as a going concern. Thereby, Ford and VW initiated the process of exiting the joint development of L4 technology through Argo AI. On October 26, 2022, the companies announced that Argo AI plans to wind down operations, which is in progress.

Accordingly, Ford recorded a $2.7 billion pre-tax impairment in the second half of 2022. The non-cash charge was reported in Equity in net income/(loss) of affiliated companies. The carrying value of the company's investment in Argo AI is $0 as of December 31, 2022; in addition, the company has $65 million in Other liabilities and deferred revenue related to funding commitments in 2023 for the share of Argo AI’s expenses incurred in 2022.

Ford Credit Segment

The Ford Credit segment is comprised of the Ford Credit business on a consolidated basis, which is primarily vehicle-related financing and leasing activities. This segment offers a wide variety of financing options to support the financing of vehicles and supporting the dealers of Ford. Ford Credit earns its revenue primarily from payments made under retail installment sale and finance lease (retail financing) and operating lease contracts that it originates and purchases; interest rate supplements and other support payments from the company and its affiliates; and payments made under dealer financing programs.

As a result of these financing activities, Ford Credit has a large portfolio of finance receivables and operating leases which it classifies into two portfolios —“consumer” and “non-consumer.” Finance receivables and operating leases in the consumer portfolio include products offered to individuals and businesses that finance the acquisition of the vehicles from dealers for personal and commercial use. Retail financing includes retail installment sale contracts for new and used vehicles and finance leases (comprised of sales-type and direct financing leases) for new vehicles to retail and commercial customers, including leasing companies, government entities, daily rental companies, and fleet customers. Finance receivables in the non-consumer portfolio include products offered to automotive dealers. Ford Credit makes wholesale loans to dealers to finance the purchase of vehicle inventory, also known as floorplan financing, as well as loans to dealers to finance working capital and improvements to dealership facilities, finance the purchase of dealership real estate, and finance other dealer vehicle programs.

The majority of Ford Credit’s business is in the United States and Canada. Outside of the United States, Europe is Ford Credit’s largest operation. Ford Credit’s European operations are managed primarily through its United Kingdom-based subsidiary, FCE Bank plc (“FCE”). Within Europe, Ford Credit’s largest markets are the United Kingdom and Germany.

Company Brands and Products

Ford Vehicles

| SUVs & Cars | Trucks | Electrified | Performance Vehicles | Commercial Vehicles | Future Vehicles |

| 2024 Mustang | Super Duty® | Mustang Mach-E® | F-150® Raptor® | E-Series Stripped Chassis | |

| Bronco® Sport | F-150 Lightning® | Explorer Limited | FordGT | Transit Connect® | |

| Escape® | E-TransitTM | E-TransitTM | Ford GT Mk II | Stripped Chassis | |

| Bronco® | Transit | F-150 Lightning® | E-Series Cutaway | ||

| Explorer | Transit CC-CA | ||||

| Edge | Transit | ||||

| Mustang Mach-E® | Super Duty® | ||||

| Expedition | Chassis Cab | ||||

| E-TransitTM | |||||

| F-650 F-750 |

Lincoln Vehicles

- Navigator

- Aviator

- Nautilus

- Corsair

- Star (Concept: Not available for purchase)

- L100 (Concept: Not available for purchase)

Service & Parts

| Ford Certified Collision Network | Ford Credit | Ford Parts |

| FordPass | Ford Protect | Ford Service |

| Lincoln Access Rewards | Lincoln Finance | Lincoln Protect |

| Lincoln Service | Motorcraft | Omnicraft |

| Professional Service Network | Quick Lane |

Others

| Commercial: Ford Fleet | Commercial: Lincoln Fleet Program | Mobility: Ford Autonomous Vehicles and Mobility |

| Community: Ford Driving Skills For Life | Community: Ford Motor Company Fund | Community: Ford Proud to Honor |

| Community: Ford Warriors in Pink | Other: Ford Performance Racing |

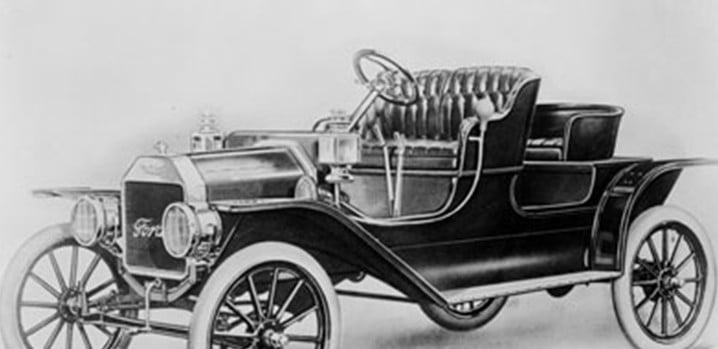

Company History

Henry Ford built his first vehicle in 1896 - a quadricycle power by four-horsepower engine. In 1901, Henry Ford defeated the top race-car driver of the era Alexander Winton with 26-horsepower Sweepstakes. The victory lead to Henry Ford's second short-lived attempt at auto manufacture, the Henry Ford Company. In 1903, Henry Ford found the Ford Motor Company with 11 associate investors and reincorporated the company in 1919 through a management buyout to make the company fully owned by the Ford family. Ford family, and the Ford Foundation (formed 1936) were sole stakeholders of the company until January 1956, when the company offered IPO.

The company assembled first Ford car, the original Model A, is Mack Avenue plant in July 1903. In 1908, the highly successful Model T was introduced. In 1911, the company opened its first US branch assembly plant in Kansas City, Missouri and its first overseas production plant in Manchester, England. The demand for Model T was so high that the Ford had to develop new mass production method in order to manufacture it in sufficient quantities. In 1913, Ford introduced the world's first moving assembly line for cars which allowed the car price to fall from $850 in 1908 to $300 or less in 1925. The innovation eventually reduced the Model T's chassis assembly line from 12.5 to 1.5 hours.

In 1914, the company has raised the pay rate of the employees from $2.4 per hour to $5 per hour, which would later come to be known as "$5 Day". The company also reduced work hour from 9 hours a day to 8 hours a day, which resulted into running three shifts per day instead of two. The changes reduced the turnover of the employees which was triggered by the monotonous and strenuous work of the moving assembly line. The company brought to life of employees higher pay, increased leisure and higher mobility since the employees were buying the cars they were producing with their increased salary.

By mid-1914, there were more than 500,000 Model Ts on the roads of the world. By 1923, Ford Motor Company was producing more than half of America's automobiles. In 1927, the company has produced the last Model T (total 15 million since start) and the first new Model A followed by the first Ford V-8 in 1932. In the meantime, Ford Motor Company had acquired Lincoln Motor Company (founded 1917) in 1922. Lincoln Motor Company would then produce Ford's luxury Lincolns and Continentals. In 1938 Ford introduced the first Mercury, a car in the medium price range between Ford and Lincoln.

In 1942, Ford Motor Company stopped production of civilian cars to concentrate on building cars, planes, and tanks for the U.S. military. After the death of Edsel in 1943, Henry Ford again assumed the presidency of the company but two years later handed it over to Henry Ford II. Under Henry Ford II’s leadership, the company introduced such models as the Thunderbird (1954) and the Mustang (1964). However, the failed introduction of the Edsel (model years 1958–60), which was so disastrous that “Edsel” became a slang synonym for fiasco, occurred amid these successes.

In the 1950s and ’60s the Ford Motor Company began limited diversification, such as in its purchase of the electronics company Philco in 1961, but by the 1990s it had refocused attention on its automotive concerns and financial services. In 1989–90 Ford acquired Jaguar, a British manufacturer of luxury cars. Aston Martin became a wholly owned subsidiary in 1993. Later acquisitions included the rental car company Hertz Corporation in 1994, the automobile division of Volvo in 1999, and the Land Rover brand of sport utility vehicles (SUVs) in 2000. Ford also purchased a significant share of the Mazda Motor Corporation. However, as Ford struggled in the early 21st century, it began selling these brands. Ford sold Hertz in 2005 and Aston Martin in 2007. It sold Jaguar and Land Rover to Tata Motors Ltd. of India in 2008. Ford started selling its Mazda shares in 2008 and completely divested in 2015.8

In December 2008, U.S. government announced emergency rescue plan of the "Big Three" automakers in the country which included Ford Motor Company. The plan made $13.4 billion immediately available in government loans under Troubled Assets Relief Program (TARP), and $700 billion funds approved by congress to aid the financial industry following the financial crisis during that time. However, Ford did not require any of the funds and it had enough money to continue its operation. The sales of the company saw growth in 2009 following the avoidance of bankruptcy during that year of financial crisis.

During the 2010s, the company made some changes to its business line. It sold Volvo to the Chinese company Zhejiang Geely Holding; discontinued its Mercury line; started initiatives to develop car-sharing ventures and self-driving vehicles; announced its intention to develop its line of electric cars.

However, in 2018 Ford announced that it was phasing out all its passenger cars, except the Mustang and Ford Focus Active. Instead, the company was going to focus on pickups (Ford’s F-series of pickups were the best-selling vehicles in the United States in the late 20th and early 21st centuries), SUVs, and crossover vehicles.

In 2019, Ford debuts its all-electric Mustang Mach-E. In 2020, Jim Farley replaced Jim Hackett as CEO. The company launches its all-electric E-Transit during the same year. In 2021, Ford revealed the all-electric F-150 Lightning.

References

- ^ https://www.linkedin.com/pulse/tch-fords-1919-management-buyout-daniel-dematos/

- ^ https://media.ford.com/content/fordmedia/fna/us/en/news/2023/03/23/_refounded_-ford-to-show-how-customer-focused-segments-will-driv.html

- ^ https://economictimes.indiatimes.com/industry/auto/auto-news/tata-motors-completes-acquisition-of-ford-indias-sanand-plant/articleshow/96888553.cms

- ^ https://www.cnbc.com/2023/03/24/ford-tennessee-campus-ev-capacity.html

- ^ https://kitchener.citynews.ca/2023/04/04/gm-passes-ford-to-take-no-2-spot-in-ev-sales-behind-tesla/

- ^ https://edition.cnn.com/2023/03/23/business/ford-ev-losses/index.html

- ^ https://www.reuters.com/markets/deals/ford-cuts-rivian-stake-about-1-amid-production-woes-ev-maker-2023-02-10/

- ^ https://www.britannica.com/topic/Ford-Motor-Company/Reorganization-and-expansion