Fortis

Summary

- Fortis is a leader in the regulated gas and electric utility industry in North America

- Fortis was incorporated in 1987 with just $390 million in assets. Today its diverse affiliated companies include ten affiliated electric and gas operations.

- The company with $58 billion in assets serving over 3 million customers in Canada, the United States and the Caribbean

- Fortis has Ten utility operating companies.

Company Overview

Fortis (NYSE:FTS, TSX:FTS) is a leader in the regulated gas and electric utility industry in North America

Fortis Inc. has its origin in the formation of St. John’s Electric Light Company in 1885 in the province now known as Newfoundland and Labrador. Fortis was incorporated in 1987 with just $390 million in assets. Today its diverse affiliated companies include ten affiliated electric and gas operations with $58 billion in assets serving over 3 million customers in Canada, the United States and the Caribbean. Looking ahead, Fortis will continue to expand and diversify while delivering safe, reliable, cost-effective energy service.1

Subsidiaries

Ten utility operations, One strong company2

ITC

ITC Holdings Corp. is the largest independent electricity transmission company in the U.S. ITC owns and operates high-voltage electric transmission systems in seven states, with an eighth in development in Wisconsin. ITC’s investments in power transmission infrastructure lower electricity costs, improve service reliability and safety, and increase economic activity and tax revenues for customers, stakeholders and communities. In 2021, the company met a peak demand of 22,920 MW.

UNS Energy

UNS Energy is a vertically integrated utility services holding company, headquartered in Tucson, Arizona, consisting primarily of three wholly owned subsidiaries: Tucson Electric Power, UNS Electric and UNS Gas. It is engaged through its subsidiaries in the regulated electric generation and energy delivery business, primarily in the State of Arizona, serving approximately 538,000 electricity customers and 165,000 natural gas customers. In 2021, the companies met a peak natural gas demand of 108 TJ and a peak electricity demand of 3,164 MW.

Central Hudson

Central Hudson is a transmission and distribution utility serving gas and electricity customers in portions of New York State's Mid-Hudson River Valley. In 2021, Central Hudson met a peak electricity demand of 1,148 MW and peak natural gas demand of 134 TJ.

FortisBC

Fortis Inc. made its first investment in British Columbia with the 2004 purchase of Aquila BC, which owned the West Kootenay Power and Light Company. Fortis Inc. then purchased Terasen Inc. in 2007, which included the Terasen Gas group of companies, a significant expansion. These utilities were renamed FortisBC, which today delivers more energy to BC customers than any other utility in the province. In 2021, the utility met a peak natural gas demand of 1,399 TJ and peak electricity demand of 777 MW.

FortisAlberta

In September 2003, Fortis Inc. entered into an agreement with Aquila, Inc. for the purchase of its regulated electric utilities in British Columbia and Alberta for $1.4 billion. This was Fortis Inc.’s first investment in Western Canada. The acquisition closed in May of 2004 and the Alberta subsidiary was renamed FortisAlberta. FortisAlberta is a pure distribution utility using approximately 90,200 km of power lines and delivered a peak demand of 2,751 MW in 2021.

Newfoundland Power

The international company known today as Fortis Inc. began in 1885 as the St. John’s Electric Light Company, supplying light to the citizens of St. John’s. It evolved to become Newfoundland Light and Power and first sold stock to the public in 1949. Today, Newfoundland Power is an integrated electric utility and the principal distributor of electricity on the island portion of Newfoundland and Labrador. Peak demand in 2021 was 1,251 MW.

Maritime Electric

In 1990, Fortis Inc. made its first investment outside the Province of Newfoundland and Labrador with the purchase of Maritime Electric Company, Limited. Maritime Electric has delivered power to customers in Prince Edward Island since 1918. Today, Maritime Electric is the principal electric utility on Prince Edward Island. Maritime Electric met a peak demand of 296 MW in 2021.

FortisOntario

Fortis Inc. first entered the Ontario market in 1996 with the purchase of a 50% interest in Canadian Niagara Power, making Fortis the only utility company to have operations in three Canadian provinces at the time.

Fortis Inc. acquired the remaining 50% of Canadian Niagara Power in 2002, creating FortisOntario. Today, FortisOntario owns and operates three local distribution companies and also owns a 10% minority interest in certain regional electric distribution companies. FortisOntario met a peak demand of 253 MW in 2021.

Caribbean Utilities

Fortis Inc. made its first investment in Caribbean Utilities in 2000 with the acquisition of a 20% interest. Today Fortis owns approximately 60% of the company, which generates, transmits and distributes electricity on Grand Cayman, Cayman Islands. The utility met a peak demand of

111 MW in 2021.

FortisTCI

Fortis Inc. made its initial investment in the Turks and Caicos Islands with the purchase of P.P.C. Limited and Atlantic Equipment and Power (Turks and Caicos) in 2006. Turks and Caicos Utility was added in 2012. Fortis TCI consists of two integrated regulated electric utilities that provide electricity to certain Turks and Caicos islands and has a diesel-powered generating capacity of 94 MW. In 2021, FortisTCI met a peak demand of 45 MW.

Industry Overview

The North American energy industry's transformation is accelerating at a rapid pace, driven by the impacts of climate change and the need for a cleaner energy future. This creates a growing need for the development of cleaner energy sources and the deployment of energy conservation measures to preserve the planet for future generations. The goal of carbon emission reduction creates the need for increased innovation, and associated advancements in technology have attracted interest from investors and customers. Renewable generation continues to be a key element in a decarbonized future, with electric transmission seen as a critical enabler of large-scale renewables. Natural gas also continues to be an important part of the energy mix, as supplemental generation to the intermittency of renewables, and as a cost-effective heating source. Longer term, advancements in the use of hydrogen and RNG may also contribute to carbon reduction. Each of these factors, as well as the increasing affordability of cleaner energy, is driving significant investment opportunity in the utility sector.3

Energy policies at the federal, state, and provincial levels continue to reflect the rising focus on climate change, with clean energy and carbon reduction goals and initiatives at the forefront. In the U.S., legislation has been approved for significant infrastructure investments, including those in the energy sector involving renewables, transmission and storage. Additional legislation is under consideration, which would further increase the investments required to meet new and aggressive federal carbon reduction goals. With states and provinces also setting ambitious carbon reduction targets, the regulatory and compliance environment continues to evolve and become increasingly complex. These changes are creating opportunities to expand investment in new, renewable generation sources, including solar and wind, as well as transmission infrastructure to interconnect renewable energy sources to the grid. As the amount of renewables grow, investment opportunities in energy storage are also being created, driven by the decreasing costs of energy storage technology. The electrification of the transportation sector is gaining momentum and represents a significant opportunity to reduce GHG emissions while increasing the output and efficiency of the grid. The Corporation's utilities are well positioned and actively involved in pursuing these opportunities which will drive significant investment well into the future.

New technology is stimulating change across all service territories. Energy delivery systems are becoming more intelligent, with upgraded advanced meters, additional grid automation and more capable operational technology, providing utilities with detailed usage data and predictive maintenance information to improve cost efficiency and safety. Energy management capabilities are expanding through emerging storage and demand response systems, and customers have been enabled with options to manage and reduce energy usage and access more affordable distributed generation technology. Grid resilience is growing in importance with the increasing frequency of extreme weather events such as hurricanes, wildfires, tornadoes and storms. As a result, investments in grid hardening and resiliency are increasing in importance to improve the grid's ability to withstand and recover from these climate events.

Fortis' culture of innovation underlies a continuous drive to find a better way to safely, reliably and affordably deliver the energy and services that customers need. To further advance innovation, Fortis is a partner in the Energy Impact Partners utility coalition, which is a strategic private equity fund that invests in emerging technologies, products, services and business models that are transforming the industry. The Corporation is also involved in the Electric Power Research Institute's Low Carbon Resources Initiative, along with other major North American utilities. By leveraging these strengths and partnerships, Fortis expects to remain at the forefront of this ever-changing industry.

Financial Highlights

2/11/2022; Fortis Inc released its 2021 fourth quarter and annual financial results

- Reported annual net earnings of $1,231 million, or $2.61 per common share in 2021

- Adjusted annual net earnings of $1,219 million, or $2.59 per common share

- Deployed capital expenditures of $3.6 billion in 2021 with $600 million invested in cleaner energy infrastructure

- Achieved 20% reduction in Scope 1 emissions through 2021, supporting 75% emissions reduction target by 2035

"In 2021, Fortis delivered steady growth and made significant progress on its long-term goals," said David Hutchens, President and CEO, Fortis Inc. "The company executed a $3.6 billion capital program, provided strong returns for its shareholders, further reduced its carbon emissions, outperformed industry averages for safety and reliability performance, and achieved gender parity on its Board of Directors."4

"The company also advanced its business strategy and adapted to the challenges and uncertainties caused by the COVID-19 pandemic," said Mr. Hutchens. "The health and safety of its people and communities remains its top priority. The company's people are the backbone of its success, and Fortis is immensely grateful for their dedication and perseverance."

Net Earnings

The Corporation reported net earnings attributable to common equity shareholders ("Net Earnings") for 2021 of $1,231 million, or $2.61 per common share, compared to $1,209 million, or $2.60 per common share for 2020. Earnings growth was tempered by the unfavourable impact of foreign exchange of $48 million, and significant one-time items recognized in 2020 of $14 million related to ITC's base return on common equity ("ROE") and U.S. tax reform. These impacts were partially offset by unrealized mark-to-market gains of $12 million in 2021 on natural gas derivatives at Aitken Creek.

The Corporation delivered earnings growth of $72 million, or $0.15 per common share, excluding the above-noted items. Rate base growth, new customer rates effective January 1, 2021 at Tucson Electric Power ("TEP"), continued economic recovery in the Caribbean, and higher sales at FortisAlberta favourably impacted Net Earnings. This growth was partially offset by lower sales and higher operating costs at TEP, lower hydroelectric production in Belize, and lower earnings at Aitken Creek due to realized losses on natural gas contracts. In addition, net earnings per common share reflected an increase in the weighted average number of common shares outstanding largely associated with the Corporation's dividend reinvestment plan.

For the fourth quarter of 2021, Net Earnings were $328 million, or $0.69 per common share, compared to $331 million or $0.71 per common share for the same period in 2020. Results for the quarter reflected a reduction in sales due to milder weather and lower investment gains in Arizona, the timing of earnings at FortisAlberta, and higher non-recoverable costs at Central Hudson and ITC. Lower hydroelectric production in Belize and the impact of foreign exchange also unfavourably impacted Net Earnings for the quarter. These factors were partially offset by growth in rate base, the finalization of Central Hudson's rate application, with retroactive application to July 1, 2021, and the favourable impact of mark-to-market accounting at Aitken Creek. The increase in the weighted average number of common shares also unfavourably impacted net earnings per common share in comparison to the fourth quarter of 2020.

Adjusted Net Earnings

Adjusted net earnings attributable to common equity shareholders ("Adjusted Net Earnings") excludes one-time items and the impact of mark-to-market accounting of natural gas derivatives at Aitken Creek. Adjusted Net Earnings of $1,219 million for 2021, or $2.59 per common share, increased by $0.02 per common share compared to 2020. The increase reflected growth, as described for Net Earnings, partially offset by the impact of foreign exchange and higher weighted average shares outstanding.

Adjusted Net Earnings for the fourth quarter of 2021 were $300 million, or $0.63 per common share, as compared to $0.69 per common share for the fourth quarter of 2020. The decrease largely reflects the factors discussed for Net Earnings, including the impact of foreign exchange and higher weighted average shares outstanding.

Capital Expenditures

Capital expenditures in 2021 were $3.6 billion, broadly consistent with the 2021 capital plan, and included investments in resiliency, modernization and sustainable energy projects, with $600 million spent on cleaner energy investments.

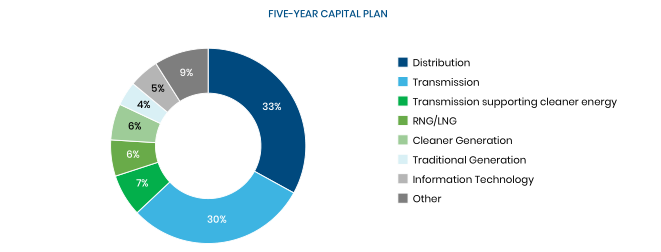

The Corporation's five-year capital plan for 2022 through 2026 is $20.0 billion. Driven by the Corporation's purpose to deliver a cleaner energy future, Fortis expects to invest $3.8 billion in cleaner energy infrastructure over the next five-years while maintaining its focus on transmission and distribution.

While the Corporation does not expect the COVID-19 pandemic to materially impact its overall five-year capital plan, the timing of forecast capital expenditures will continue to be evaluated. Depending on the severity of the pandemic, including any impacts of supply chain disruptions, certain planned expenditures may shift within the 2022-2026 capital plan. Funding of the capital plan is expected to be primarily through cash from operations, debt issued at the regulated utilities and common equity from the Corporation's dividend reinvestment plan.

Outlook

The Corporation's long-term outlook remains unchanged. Fortis continues to enhance shareholder value through the execution of its capital plan, the balance and strength of its diversified portfolio of utility businesses, and growth opportunities within and proximate to its service territories. While uncertainty exists due to the COVID-19 pandemic, the Corporation does not currently expect it to have a material financial impact in 2022.

Fortis is executing on the transition to a cleaner energy future and is on plan to achieve its corporate-wide target to reduce carbon emissions by 75% by 2035. Upon achieving this target, 99% of the Corporation's assets will be focused on energy delivery and renewable, carbon-free generation.

The Corporation's $20 billion five-year capital plan is expected to increase midyear rate base from $31.1 billion in 2021 to $41.6 billion by 2026, translating into a five-year compound annual growth rate of approximately 6%. Above and beyond the five-year capital plan, Fortis continues to pursue additional energy infrastructure opportunities.

Additional opportunities to expand and extend growth include: further expansion of the electric transmission grid in the United States to facilitate the interconnection of cleaner energy including infrastructure investments associated with MISO's long-range transmission plan; natural gas resiliency investments in pipelines and liquefied natural gas infrastructure in British Columbia; the fully permitted, cross-border, Lake Erie Connector electric transmission project in Ontario; and the acceleration of cleaner energy infrastructure investments across its jurisdictions.