Franco-Nevada

Summary

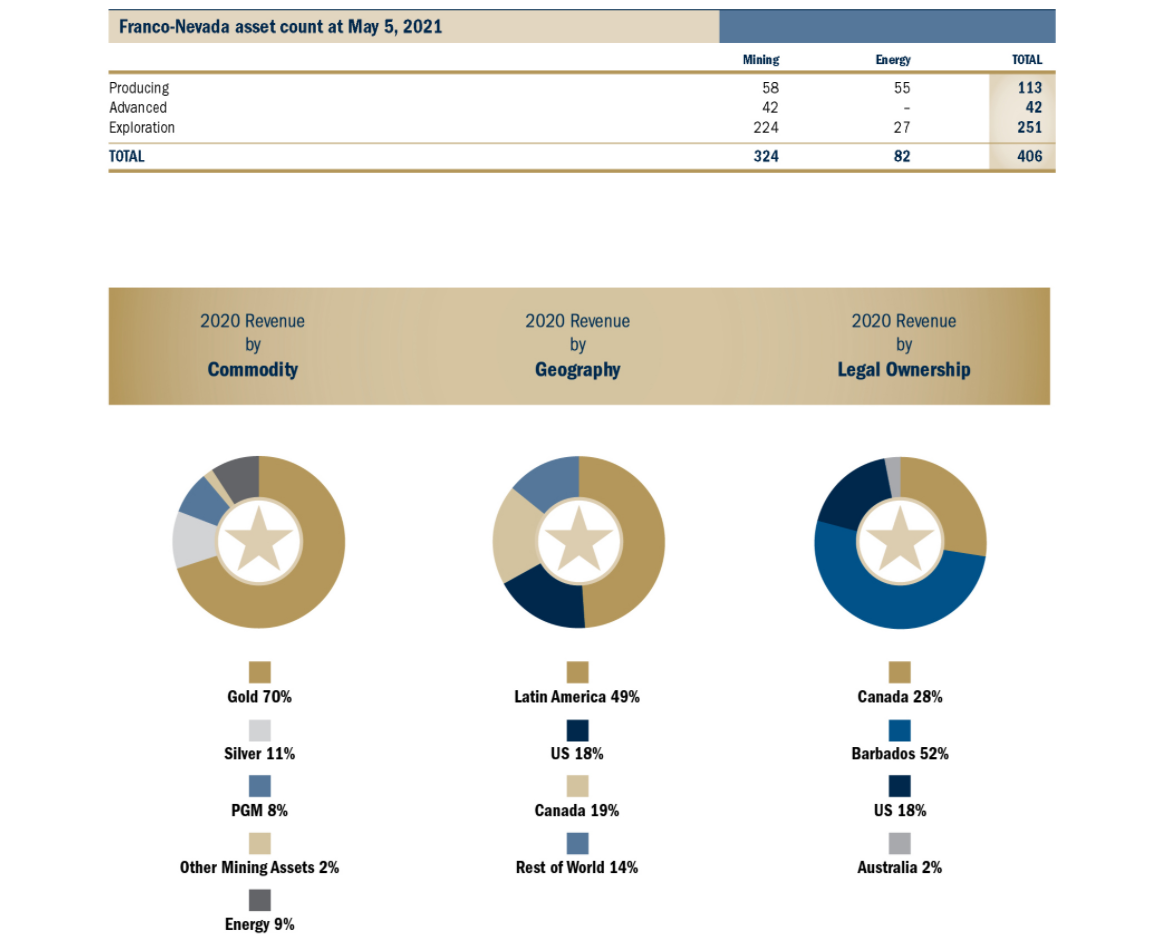

- Franco-Nevada Corporation is the leading gold-focused royalty and streaming company with the largest and most diversified portfolio of cash-flow producing assets.

- Franco-Nevada’s roots go back to 1983 and created the first public mining royalty business with the acquisition of the Goldstrike royalty in 1985.

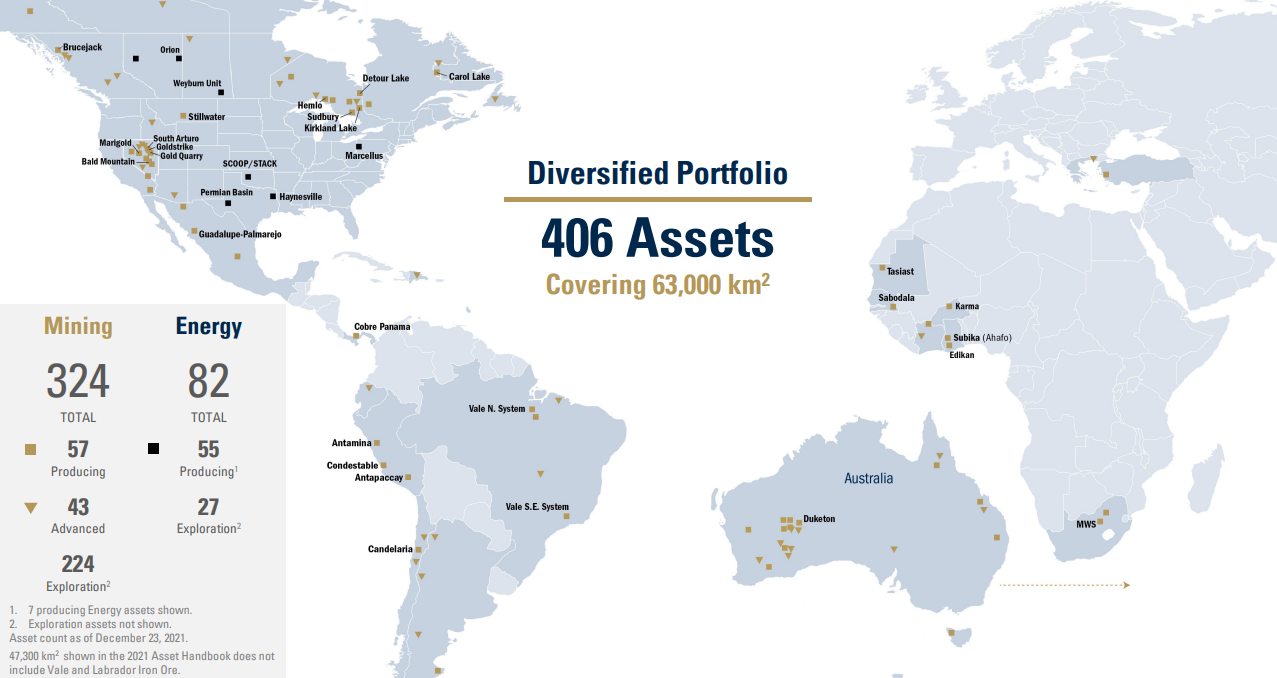

- Franco-Nevada has the largest and most diversified global portfolio of royalties and streams by commodity, geography, revenue type and stage of project with more than 400 assets in total.

- Franco-Nevada has interests in 223 exploration stage mining properties as at March 31, 2021.

Company Overview

Franco-Nevada Corporation (NYSE:FNV, TSX:FNV) is the leading gold-focused royalty and streaming company with the largest and most diversified portfolio of cash-flow producing assets. Its business model provides investors with gold price and exploration optionality while limiting exposure to cost inflation.1

Franco-Nevada' diversified portfolio of royalties and streams by commodity, geography, revenue type and stage of project.

Company History

Franco-Nevada’s roots go back to 1983 when Seymour Schulich and Pierre Lassonde formed the original “Franco-Nevada Mining Corporation Limited” with an initial capitalization of $2 million. They created the first public mining royalty business with the acquisition of the Goldstrike royalty in 1985. It was the leading public mining royalty company until 2002 when it was acquired by Newmont Mining for $2.5 billion.2

The original Franco-Nevada team continued to manage royalty assets as part of Newmont Capital, led by David Harquail. In 2007, Newmont offered a package of many original Franco-Nevada royalties along with other royalties for sale. The original Franco-Nevada team incorporated a new Franco-Nevada, launched an initial public offering (IPO) and on December 20, 2007, acquired the royalty portfolio for $1.2 billion. The Company has traded under the symbol FNV on both the Toronto and New York stock exchanges since 2007 and 2011, respectively. Franco-Nevada has since expanded the original IPO portfolio to become the leading gold-focused royalty and streaming company with the largest and most diversified portfolio of cash-flow producing assets.

The Company has avoided any long-term debt on its balance sheet to maximize its available capital through bull and bear resource markets. This strategy has paid handsome dividends. During the 2008 financial crisis, Franco-Nevada acquired a stream on the Palmarejo mine in Mexico and a royalty on the Gold Quarry Mine in Nevada and benefitted tremendously as gold prices surged following the crisis. When the Chinese economy slowed abruptly in 2015, base metal prices sank presenting a new set of opportunities to Franco-Nevada. Owing to its strong balance sheet, the Company was able to acquire precious metal streams on three world class copper deposits; Candelaria, Antamina and Antapaccay. These long-dated mines make up three of the company’s four core assets.

Streaming has grown to be a material source of project financing for the resource industry. In 2012, Franco-Nevada acquired a $1 billion precious metal stream to help Inmet finance the planned $6 billion Cobre Panama project in Panama. Following Inmet’s acquisition by First Quantum, Franco-Nevada provided a further $356 million in financing to help complete construction of the expanded project and finance the buyback of one of the minority party interests. Cobre Panama was successfully commissioned in 2019, is the company’s largest revenue contributor and the largest growth driver in the medium term.

While gold and gold equivalents are its focus, investments in other resources allow it to be opportunistic through the commodity cycles, adding growth and diversity to its portfolio. Seymour Schulich made Franco-Nevada’s first investments in oil and gas with a focus on Canada’s Western Sedimentary Basin. Franco-Nevada has also been active acquiring interests in a number of the major US oil and gas basins following the sharp fall in oil prices in 2014. The Company has also accumulated royalty interest on producing nickel properties, large prospective copper development properties and much of the chromite resource in Ontario’s Ring of Fire. Most recently in 2021, Franco-Nevada acquired a tranche of debentures which are effectively a royalty on Vale’s world class iron ore operations in the Carajás region and elsewhere in Brazil.

Assets and Portfolio

Franco-Nevada has the largest and most diversified global portfolio of royalties and streams by commodity, geography, revenue type and stage of project with more than 400 assets in total. The company's focus is growing investor exposure to gold and other precious metals, although the company also make limited countercyclical investments in energy and other metals. This strategy adds to its growth options and increases its exposure to resource sector optionality. In 2020, 91.0% of revenue was earned from gold and gold equivalents.3

Franco-Nevada has interests in 223 exploration stage mining properties as at March 31, 2021. Exploration assets represent interests on projects where technical feasibility and commercial viability of extracting a mineral resource are not demonstrable. Some of these assets have associated Mineral Resources that, to be economic, may require additional Mineral Resources, higher commodity prices, permitting approval, lower geopolitical risk or a better financing environment.

| Gold & Gold Equivalents | Energy Assets | |||

| South America | United States | Canada | Rest of World | United States |

| Candelaria | Stillwater | Sudbury | MWS | SCOOP/STACK (Continental) |

| Antapaccay | Goldstrike | Detour Lake | Sabodala | SCOOP/STACK (Other) |

| Antamina | Gold Quarry | Hemlo | Tasiast | Permian Basin |

| Condestable | Marigold | Brucejack | Subika (Ahafo) | Marcellus |

| Vale | Bald Mountain | Kirkland Lake | Karma | Haynesville |

| Cerro Moro | South Arturo | Labrador Iron Ore | Duketon | |

| Salares Norte | Mesquite | Dublin Gulch (Eagle) | Edikan | Canada |

| Cascabel (Alpala) | Castle Mountain | Musselwhite | Mt Keith | Weyburn Unit |

| NuevaUnión (Relincho) | Fire Creek/Midas | Timmins West | Matilda (Wiluna) | Orion |

| Taca Taca | Hollister | Canadian Malartic | South Kalgoorlie | |

| CentroGold (Gurupi) | Rosemont | Island Gold | Agnew (Vivien) | Other |

| Calcatreu | Stibnite Gold | Golden Highway | Flying Fox | Other Producing Energy Assets |

| San Jorge | Pinson | Greenstone (Hardrock) | Kiziltepe | Energy Exploration Assets |

| Robinson | Valentine Lake | Pandora | ||

| Central America & Mexico | EaglePicher | Red Lake (Bateman) | Yandal (Bronzewing) | |

| Cobre Panama | Sterling | Ring of Fire | Aphrodite | |

| Guadalupe-Palmarejo | Courageous Lake | Séguéla | ||

| Milpillas | Goldfields | Perama Hill | ||

| Falcondo | Monument Bay | Ağı Dağı | ||

| Red Mountain | ||||

| Cariboo | ||||

| New Prosperity | ||||

Market Overview

The price of gold and other precious metals are the largest factors in determining profitability and cash flow from operations for Franco-Nevada. Historically, the price of gold has been subject to volatile price movements and is affected by numerous macroeconomic and industry factors that are beyond the Company’s control. Major influences on the gold price include interest rates, fiscal and monetary stimulus, inflation expectations, currency exchange rate fluctuations including the relative strength of the U.S. dollar, and the supply of and demand for gold.4

Commodity price volatility also impacts the number of GEOs when converting non-gold commodities to GEOs. Silver, platinum, palladium, and other mining commodities are converted to GEOs by dividing associated revenue, which includes settlement adjustments, by the relevant gold price. The price used in the computation of GEOs earned from a particular asset varies depending on the royalty or stream agreement, which may make reference to the market price realized by the operator, or the average price for the month, quarter, or year in which the mining commodity was produced or sold.

Gold prices have softened in the latter part of 2021 reflecting expectations of rising interest rates and a stronger U.S. dollar, though market sentiment remains positive. Gold prices increased 3.8%, averaging $1,801/oz in YTD/2021, compared to $1,735/oz in YTD/2020, and ended the quarter at $1,743/oz. Silver prices averaged $25.78/oz in YTD/2021, an increase of 34.1% compared to $19.22/oz in YTD/2020. Platinum and palladium prices averaged $1,122/oz and $2,551/oz, respectively, in YTD/2021, compared to $865/oz and $2,142/oz, respectively, in YTD/2020, an increase of 29.7% and 19.1%, respectively

Oil and gas prices have rallied in 2021, reflecting increased demand and supply shortages as economies continue to recover from the COVID-19 pandemic. WTI prices averaged $64.82/bbl in YTD/2021, a 69.5% increase from YTD/2020. Edmonton Light prices averaged C$76.35/bbl in YTD/2021, up 71.7% compared to YTD/2020. Henry Hub natural gas prices averaged $3.34/mcf in YTD/2021 compared to $1.92/mcf in YTD/2020, up 74.0%.

Iron ore prices reached record highs in mid-2021 but fell in the latter part of 2021. Average prices for 65% iron ore fines were $205/tonne in YTD/2021 compared to $114/tonne in the same period in 2020, up 79.8%.

Financial Highlights

Revenue in 2020 was $1,020.2 million, up 20.9% from 2019 due to higher metal prices and an increase in GEOs sold. Mining revenue comprised 91.0% of total revenue in 2020, compared to 86.3% in 2019. The company continue to earn the majority of its revenue from the Americas, at 86.0% in 2020, compared to 83.2% in 2019.

GEOs sold in 2020 totaled 521,564 ounces, compared to 516,438 GEOs in 2019.

The Company’s Energy assets contributed revenue of $91.7 million (60.7% oil, 26.6% gas and 12.7% NGLs) in 2020, a decrease of 20.9% compared to $115.9 million (75.3% oil, 15.6% gas and 9.0% NGLs) in 2019.

Depletion and depreciation expense totaled $241.0 million in 2020, compared to $263.2 million in 2019. While GEOs sold increased year-over-year, depletion expense decreased as the incremental GEOs were earned from assets carrying lower depletion rates.

Income tax expense in 2020 totaled $13.3 million (2019 - $61.8 million), comprised of a current income tax expense of $48.5 million (2019 - $39.1 million) and a deferred income tax recovery of $35.2 million (2019 - $22.7 million deferred income tax expense). T

Net income in 2020 was $326.2 million, or $1.71 per share, compared to $344.1 million, or $1.83 per share, for the same period in 2019. The decrease in net income reflects the impairment charges recorded on the Company’s Energy assets, largely offset by higher mining revenue. Adjusted Net Income was $516.3 million, or $2.71 per share, compared to $341.5 million, or $1.82 per share, earned in 2019.

5-Year Outlook

Franco-Nevada expects its existing portfolio to produce between 600,000 and 630,000 GEOs by 2025, and additional revenue of $150 and $170 million from its Energy assets. This outlook assumes that the Cobre Panama project will have expanded its mill throughput capacity to 100 million tonnes per year during 2023. It also assumes continued deliveries from Sudbury into 2025, the commencement of production at Salares Norte, Hardrock, Stibnite Gold and Valentine Lake, and that the stream at MWS will have reached its cap. It is expected the remaining committed capital of $114.0 million for the Royalty Acquisition Venture with Continental will be funded. The commodity price assumptions are the same as those used for its 2021 guidance and assume no other acquisitions other than the Condestable stream.

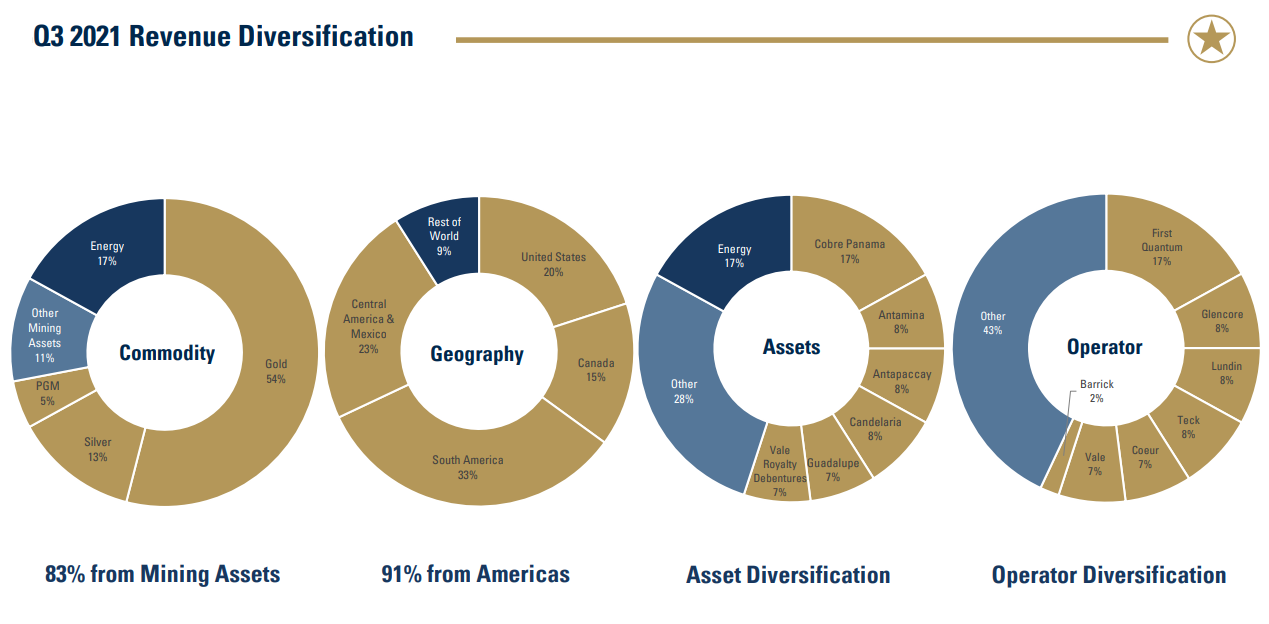

3Q 2021 Results

November 3, 2021; Franco-Nevada Reports Strong Q3 Results5

commenting on results Paul Brink, President & CEO said: “Franco-Nevada delivered a strong third quarter, setting the stage for a record year in 2021. The company's diversified portfolio continues to serve it well with strong contributions during the quarter from precious metals, energy and iron ore. Higher energy prices have led it to increase its 2021 Energy guidance for the second time this year. Margins have moved higher this year due to the inflation-protected nature of its business model. Franco-Nevada is debt-free and is growing its cash balances.

For Q3/2021, revenue was sourced 82.6% from Mining assets (53.5% gold, 13.1% silver, 5.3% PGM and 10.7% other Mining assets). Energy assets contributed 17.4% (8.8% oil, 6.7% gas and 1.9% NGL). The company's current acquisition focus is to grow the precious metal side of its business, but the company will also add opportunistically in other mining commodities if good assets are available. A strength of its diversified portfolio is that the company benefit from the relative outperformance of different commodities over time. Geographically, revenue was sourced 91.2% from the Americas (33.1% South America, 23.6% Central America & Mexico, 19.8% U.S. and 14.7% Canada).

Revenue for Q3/2021 was $316.3 million, up 13.0% from Q3/2020, and comprised $261.2 million from Mining assets and $55.1 million from Energy assets. Mining revenue in Q3/2021 was relatively flat, as increases in GEOs sold from the additions of the Vale Royalty Debentures and Condestable stream were largely offset by weaker gold prices compared to Q3/2020. Production in the prior year period was also affected by the temporary suspension of production at several of its assets due to the COVID-19 pandemic. Energy revenue increased 141.7% compared to the same period in 2020, reflecting increasing oil and gas prices, as well as royalties from the Haynesville asset acquired in late 2020.

Mining assets contributed 82.6% (53.5% gold, 13.1% silver, 5.3% PGM and 10.7% other mining assets) of the Company’s total revenue in Q3/2021, compared to 91.9% (73.7% gold, 9.3% silver, 7.6% PGM and 1.3% other mining assets) in Q3/2020. Geographically, the Company remains heavily invested in the Americas, representing 91.2% of revenue in Q3/2021, compared to 85.3% in Q3/2020.

GEOs sold in Q3/2021 totaled 146,495 ounces, compared to 134,817 GEOs in Q3/2020.

Energy Revenue

Energy assets earned revenue of $55.1 million (50.7% oil, 38.6% gas and 10.7% NGLs) for the quarter, an increase of 141.7% compared to $22.8 million (70.8% oil, 16.9% gas and 12.3% NGLs) in Q3/2020. U.S. assets generated 69.9% of Franco-Nevada’s Energy revenue.The increase in Energy revenue was primarily due to an increase in oil and gas prices relative to the prior period, as well as the acquisition of the Haynesville asset in late 2020.

Income Taxes

Income tax expense was $30.2 million in Q3/2021 (Q3/2020 - $25.2 million), comprised of a current income tax expense of $31.9 million (Q3/2020 - $6.9 million) and a deferred income tax recovery of $1.7 million (Q3/2020 - income tax expense of $18.3 million).

Net Income

Net income for Q3/2021 was $166.0 million, or $0.87 per share, compared to $153.9 million, or $0.81 per share, for the same period in 2020. Adjusted Net Income, which adjusts for impairment charges and reversals, foreign exchange gains and losses and other income and expenses, among other items, was $165.6 million, or $0.87 per share, compared to $152.3 million, or $0.80 per share, earned in Q3/2020.

References

- ^ https://www.franco-nevada.com/Home/default.aspx

- ^ https://www.franco-nevada.com/about-us/Our-History/default.aspx

- ^ https://www.franco-nevada.com/our-assets/portfolio-overview/default.aspx

- ^ https://s21.q4cdn.com/700333554/files/doc_financials/2021/q3/2021-Q3-Report.pdf

- ^ https://s21.q4cdn.com/700333554/files/doc_financials/2021/q3/2021-Q3-Report.pdf