GlaxoSmithKline (GSK)

Summary

- GSK a science-led global healthcare company.

- GSK develop and deliver medicines, vaccines and consumer healthcare products.

- The company employ over 100,000 people across 92 countries and work directly with 37,500 suppliers

- In 2021 GSK delivering 1.7 billion medicines, over 767 million vaccines and 3.7 billion consumer healthcare products.

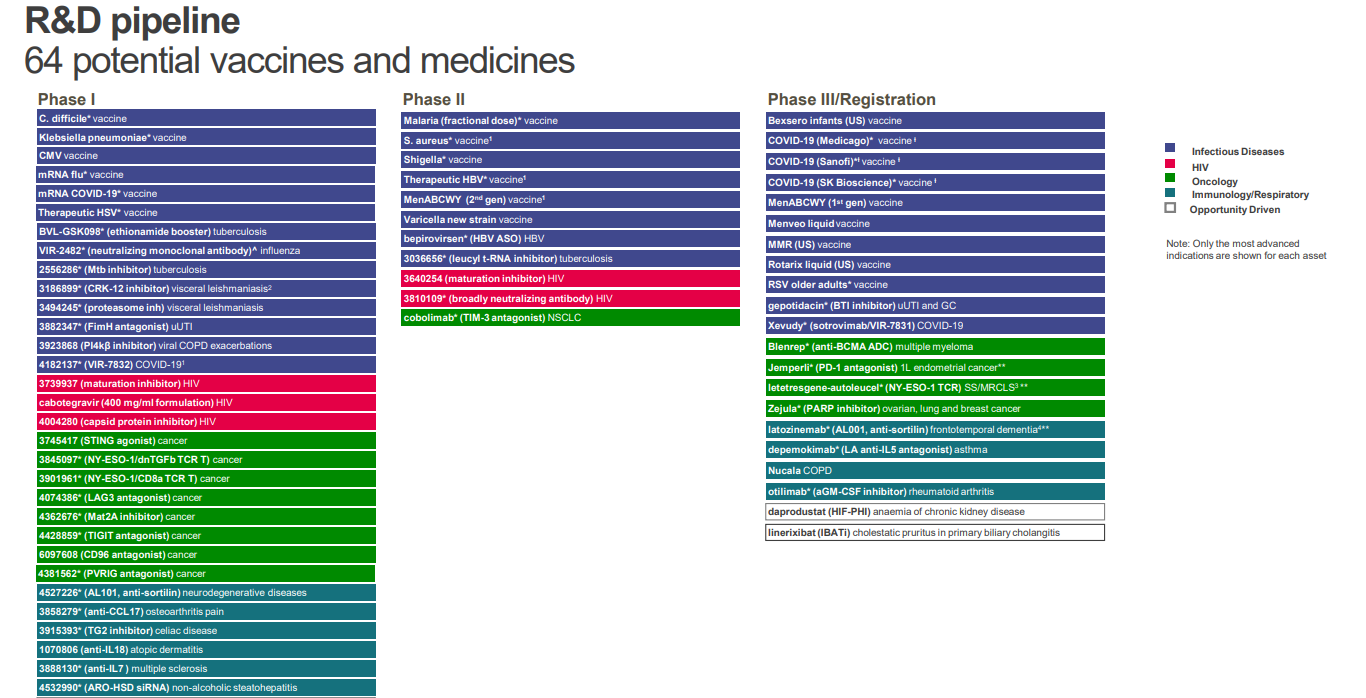

- GSK had 13 major new vaccines and medicines approved since 2017 and current pipeline comprises 64 potential vaccines and medicines at FY 2021

GSK (NYSE:GSK, LSE:GSK) a science-led global healthcare company.1

The company develop and deliver medicines, vaccines and consumer healthcare products. The company's operations span from identifying, researching, developing and testing, to regulatory approval, manufacturing and commercialisation.

Recent developments

Completion of the demerger of Haleon and share consolidation of GSK2

18 July 2022; GSK plc completed the demerger of the Consumer Healthcare business from the GSK Group to form the Haleon Group. The shares of Haleon plc (ticker "LSE: HLN"). It is expected that American Depositary Shares representing shares of Haleon plc (ticker: “NYSE: HLN”) (“Haleon ADSs”) will commence “regular-way” trading on the New York Stock Exchange (the “NYSE”) at market open on Friday 22 July 2022.

Proposed demerger of the Consumer Healthcare business from GSK to form Haleon 3

1 June 2022; GSK plc intention to separate its Consumer Healthcare business from the GSK Group to form Haleon plc (“Haleon”), an independent listed company. It is proposed that the separation will be effected by way of a demerger (the “Demerger”) of at least 80 per cent. of GSK’s 68 per cent. holding in the Consumer Healthcare business to GSK shareholders. The Consumer Healthcare business is currently a joint venture between GSK and Pfizer Inc (“Pfizer”), with GSK holding a majority controlling interest of 68 per cent. and Pfizer holding 32 per cent.

GSK today confirms that the Circular in relation to the proposed Demerger, the consolidation of GSK shares (the “GSK Share Consolidation”) and certain new arrangements with Haleon and Pfizer to give effect to the Demerger (the “Related Party Transactions”), as well as the Prospectus in relation to the proposed admission of the Haleon ordinary shares, have each been submitted to the Financial Conduct Authority (“FCA”) for approval. It is expected that the Haleon ordinary shares will be admitted to the Premium listing segment of the Official List of the FCA and admitted to trading on the Main Market of the London Stock Exchange on Monday 18 July 2022. Application will also shortly be made to list American Depositary Shares (“ADSs”) representing Haleon ordinary shares on the New York Stock Exchange.

The proposed Demerger is the most significant corporate change for GSK in the last 20 years, creating two new leading companies, each with clear targets for growth and the ability to positively impact the health and lives of billions of people.

Following the Demerger, GSK will focus purely on biopharmaceuticals, prioritising investment towards the development of innovative vaccines and specialty medicines. Its R&D approach will continue to focus on the science of the immune system, use of human genetics and advanced technologies. Over the next five-year period, GSK expects to deliver compound annual growth in sales and adjusted operating profit of more than 5 per cent. and more than 10 per cent., respectively, at constant exchange rates (with 2021 as the base year).

Haleon is a new, world-leader in consumer healthcare with a clear strategy to outperform and run a responsible business. For prospective investors, it will offer an exceptional and focused portfolio of category-leading brands with an attractive footprint and competitive capabilities; a highly attractive financial profile of above market, medium-term annual organic revenue growth of 4 to 6 per cent. combined with sustainable moderate, adjusted margin expansion on a constant currency basis, with strong cash generation and conversion.

GSK announces US FDA approval of Priorix for the prevention of measles, mumps and rubella in individuals 12 months of age and older.4

6 June 2022; GSK plc announced that the US Food and Drug Administration (FDA) has approved Priorix (Measles, Mumps and Rubella Vaccine, Live) for active immunisation for the prevention of measles, mumps and rubella (MMR) in individuals 12 months of age and older.

Priorix is currently licenced in more than 100 countries worldwide, including all European countries, Canada, Australia and New Zealand, with more than 800 million doses distributed to date.

Measles, mumps and rubella are acute and highly-contagious viral diseases responsible for considerable morbidity and mortality throughout the world. In recent years, measles outbreaks have occurred in the US and globally, with more than 400,000 cases confirmed in 2019, reversing decades of progress toward measles elimination in many countries.

According to a recent US Centers for Disease Control and Prevention (CDC) report, vaccine ordering in the past two years through the CDC’s Vaccines For Children programme, the federal programme through which about half of the children in the country are immunised, dropped more than 10%, indicating that fewer vaccinations in children were occurring. The report also noted 400,000 fewer children entered kindergarten in the 2020-2021 school year than expected nationally, meaning those children may not be up to date on childhood immunisations like their MMR vaccination.

The safety of Priorix was evaluated in six clinical studies, in which a total of 12,151 participants (6,391 in the US) received at least one dose of Priorix: 8,780 children (4,148 in the US) 12 through 15 months of age; 2,917 children (1,950 in the US) 4 through 6 years of age; and 454 adults and children (293 in the US) 7 years of age and older. The most commonly reported adverse reactions were pain, redness, swelling, loss of appetite, irritability, drowsiness and fever. The efficacy of Priorix was demonstrated based on immunogenicity data versus the comparator vaccine.

Priorix will provide US healthcare professionals with another MMR vaccine choice. Priorix may be administered as a first dose, followed by a second dose of Priorix. Priorix may also be administered as a second dose to individuals who have previously received the first dose of another MMR-containing vaccine.

Financial Highlights

Group turnover was £34,114 million in the year, stable at AER but up 5% CER. Sales of COVID-19 solutions (sales of Xevurdy and pandemic adjuvant) contributed approximately 4 percentage points to growth in the year.5

Pharmaceutical turnover in the year was £17,729 million, up 4% AER and 10% CER. Sales of Xevudy, the monoclonal antibody treatment for COVID-19 of £958 million contributed approximately 6 percentage points to total Pharmaceuticals growth.

Vaccines turnover was £6,778 million in the year, down 3% AER but up 2% CER, primarily driven by pandemic adjuvant sales, partially offset by lower demand for routine adult vaccination due to COVID-19 vaccination programme deployment and disease circulation across regions. Vaccines turnover excluding pandemic vaccines decreased 9% AER, 5% CER to £6,331 million.

Consumer Healthcare turnover was £9,607 million, down 4% AER but remained stable at CER reflecting dilution from divestments given the completion of the portfolio rationalization at the end of Q1 2021. Sales excluding brands divested/under review decreased 1% AER but increased 4% CER reflecting the underlying strength of brands across the portfolio and categories and continuing growth in e-commerce.

Total operating profit was £6,201 million compared with £7,783 million in 2020. This primarily reflected an unfavourable comparison to the net profit on disposal in Q2 2020 of Horlicks and other Consumer brands and resultant sale of shares in Hindustan Unilever. This was partly offset by lower major restructuring costs, lower re-measurement charges on the contingent consideration liabilities and the unwind in 2020 of the fair market value uplift on inventory arising on completion of the Consumer Healthcare Joint Venture with Pfizer.

Adjusted operating profit was £8,806 million, 1% lower than 2020 at AER, but 9% higher at CER on a turnover increase of 5% CER. The Adjusted operating margin of 25.8% was 0.3 percentage points lower at AER, 0.9 percentage points higher on a CER basis than in 2020. The increase in Adjusted operating profit primarily reflected the benefit from incremental pandemic sales, sales growth in Pharmaceuticals and tight control of ongoing costs, favourable legal settlements and benefits from continued restructuring across the business. This was offset by lower sales in Vaccines, higher supply chain costs in Vaccines and Consumer Healthcare, divestments in Consumer Healthcare and increased investment in R&D across Vaccines and Pharmaceuticals.

Total EPS was 87.6p, compared with 115.5p in 2020. This primarily reflected an unfavourable comparison as 2020 benefited from the net profit on disposal of Horlicks and related transactions, partly offset by a credit of £397 million to Taxation in 2021 resulting from the revaluation of deferred tax assets, lower major restructuring costs and lower re-measurement charges on the contingent consideration liabilities. Adjusted EPS was 113.2p compared with 115.9p in 2020, down 2% AER but up 9% CER, on a 9% CER increase in Adjusted operating profit primarily reflecting incremental pandemic sales, sales increases in Pharmaceuticals, tight cost control and favourable legal settlements and lower interest costs, partly offset by lower sales in Vaccines, higher supply chain costs in Vaccines, increased R&D investment and a higher effective tax rate.

The net cash inflow from operating activities for the year was £7,952 million (2020 – £8,441 million). The decrease primarily reflected adverse exchange impacts, increased trade receivables, adverse timing of returns and rebates (RAR) and increased separation costs, partly offset by improved adjusted operating profit at CER and reduced tax payments including tax on disposals.

Q1 2022 Results

Total turnover in the quarter was £9,780 million, up 32% AER, 32% CER, reflecting a strong performance in Commercial Operations in the three product groups and Consumer Healthcare. Sales of Xevudy were £1,307 million and contributed 25 percentage points of growth in the quarter to Commercial Operations. Specialty Medicines included the positive impact of international tender phasing, Vaccines benefited from Shingrix post-pandemic recovery and retail buy-in in the US and General Medicines reflected growth from Trelegy and recovery of the antibiotics market.6

Specialty Medicines turnover was £3,135 million, up 98% AER, 97% CER, driven by consistent growth in all therapy areas including sales of Xevudy. Sales growth was up 16% AER, 15% CER excluding Xevudy.

Vaccines turnover grew 36% AER, 36% CER to £1,669 million, driven primarily by Shingrix in the US and Europe reflecting strong performance and the benefit of a favourable comparator in Q1 2021 when sales were impacted by COVID-19 related disruptions in several markets and lower Centre for Disease Control (CDC) purchases.

General Medicines turnover was £2,343 million, up 2% AER, 3% CER, with growth from Trelegy in all regions, recovery of the antibiotics market and the benefit of a favourable prior period returns and rebates (RAR) adjustment, offsetting the impact of generic competition in US, Europe and Japan.

Consumer Healthcare grew 14% AER, 14% CER to £2,633 million. Total sales grew 15% AER, 16% CER, excluding the impact of brands divested, with strong growth across all categories.

Total operating profit was £2,801 million compared with £1,693 million in Q1 2021. This included £924 million upfront settlement income from Gilead, increased profits on turnover growth of 32% at CER, partly offset by higher remeasurement charges for contingent consideration liabilities and lower profits on disposals. Adjusted operating profit was £2,613 million, 39% higher than Q1 2021 at AER and at CER. The Adjusted operating margin of 26.7% was 1.4 percentage points higher at AER and 1.3 percentage points higher on a CER basis than in Q1 2021. The benefit from COVID-19 solutions sales (Xevudy) contributed approximately 11% AER, 11% CER to Adjusted Operating profit growth.

Total EPS was 35.9p compared with 21.5p in Q1 2021. This primarily reflected leverage from significant sales growth during the quarter, with the upfront income of £924 million from the settlement with Gilead partly offset by an increase in finance costs.

Adjusted EPS was 32.8p compared with 22.9p in Q1 2021, up 43% at AER, 43% CER, on a 39% CER increase in Adjusted operating profit primarily reflecting sales of Specialty Medicines and Vaccines, including COVID-19 solutions sales, tight cost control and a lower effective tax rate. These were partly offset by higher supply chain costs, increased R&D investment, favourable legal settlements in Q1 2021 and higher interest costs. The contribution to growth from COVID-19 solutions was approximately 15% at AER, 15% at CER.

The cash generated from operations for the quarter was £2,755 million (Q1 2021: £486 million). The increase primarily reflected a significant increase in operating profit including the upfront income from the settlement with Gilead, favourable timing of collections and profit share payments for Xevudy sales and a lower seasonal increase in inventory

Company Overview

Research and Development

The company discover, develop and manufacture innovative pharmaceutical medicines, vaccines and consumer healthcare products.7

- Over 12,000 people working across its three global businesses

- £4.8bn its adjusted R&D investment in 2021

- The company's pipeline comprises 64 potential vaccines and medicines at FY 2021

The company's current therapy areas of focus are Oncology, HIV, Infectious Diseases, Immuno-inflammation, Respiratory and Vaccines.

GSK had 13 major new vaccines and medicines approved since 2017. This puts it in the top quartile in its industry. For 2018-20, the company had a greater than 90% success rate for its pivotal studies, compared to 77% across the industry. The company's 2017-20 number of launches per billion dollars of R&D spending was over 50% better than peer median.

Products

The company make a wide range of prescription medicines, vaccines and consumer healthcare products.8

The company research and develop a broad range of innovative products in three primary areas of Pharmaceuticals, Vaccines and Consumer Healthcare

Prescription Medicines

The company's pharmaceuticals business discovers, develops and makes medicines to treat a broad range of the most common acute and chronic diseases.

Vaccines

The company's vaccines business develops, produces and distributes around 2 million vaccines every day to people across over 160 countries covering all age groups.

- Infants and children

- Adolescents and adults

- Travellers

- Older adults

Consumer Healthcare Products

GSK is one of the world's largest providers of specialist oral health. With a broad range of science-based products, such as Sensodyne, parodontax and Polident, its goal is to make the world's mouths healthier.

The company's portfolio of leading brands in cold and flu, nasal decongestant and allergy helps people worldwide with a range of respiratory issues.

Whether using Otrivin to clear a blocked nose or Theraflu to fight multiple cold and flu symptoms like fever, nasal congestion and cough, its respiratory products use cutting-edge science to help people breathe more easily.

GSK is a leader in first-line pain relief and other brands such as Panadol, Voltaren and Advil.

GSK has a portfolio of brands for everyday health and wellness.

Centrum is a popular multivitamin and mineral brand globally, available in more than 70 markets. The company also have leading brands within the category in areas like calcium supplements through its Caltrate brand and vitamin C supplements through Emergen-C brand in the US.

The company's digestive health products brands, including Eno and Tums with a strong heritage in treating heartburn, acid indigestion and gastric discomfort.

ViiV Healthcare

The company's HIV business is managed through ViiV Healthcare, a global specialist HIV company established in 2009, that the company majority own, with Pfizer and Shionogi as shareholders. The company focused on advancing science into HIV treatment, prevention and care, ViiV Healthcare has had significant recent successes with regulatory approvals and industry leading launches of new antiretrovirals.

ViiV Healthcare’s current portfolio of 15 HIV treatments generated annual sales of £4.777 billion in 2021. A pipeline of potential future antiretroviral medicines is also in clinical development.

Stiefel dermatology

Stiefe dermatology R&D focused in acne, psoriasis, eczema, atopic dermatitis and superficial skin infections.

The company's portfolio ranges from prescription to daily skincare.

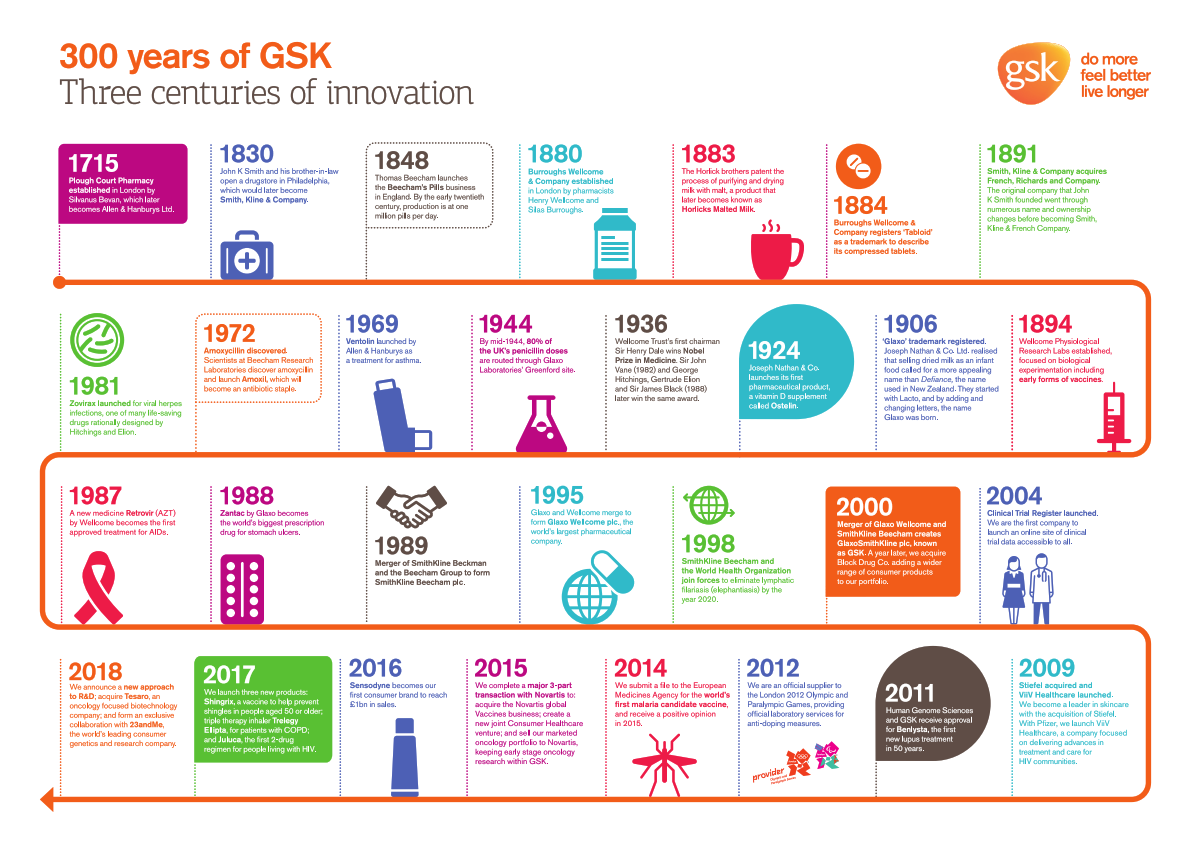

Company History

Beginning in 1715 with the opening of an apothecary shop in London to a global company of around 100,000 employees, The company developed a variety of medicines and healthcare products that form the foundations of today’s GSK.

In 2021 that included delivering 1.7 billion medicines, over 767 million vaccines and 3.7 billion consumer healthcare products. Looking ahead, GSK has plan to support the health of more than 2.5 billion people over the next ten years.

The company employ over 100,000 people across 92 countries and work directly with 37,500 suppliers. In 2021 the company paid £1.3 billion in corporation tax, as well as a significant amount of other business and employment-related taxes.

With its three global businesses of Pharmaceuticals, Vaccines and Consumer Healthcare, the company aim to bring differentiated, high-quality and needed healthcare products to as many people as possible.

References

- ^ https://www.gsk.com/en-gb/about-us/

- ^ https://www.gsk.com/en-gb/media/press-releases/completion-of-the-demerger-of-haleon-and-share-consolidation-of-gsk/

- ^ https://www.gsk.com/en-gb/media/press-releases/update-proposed-demerger-of-the-consumer-healthcare-business-from-gsk-to-form-haleon/

- ^ https://www.gsk.com/en-gb/media/press-releases/gsk-announces-us-fda-approval-of-priorix-for-the-prevention-of-measles-mumps-and-rubella-in-individuals-12-months-of-age-and-older/

- ^ https://www.gsk.com/media/7462/annual-report-2021.pdf

- ^ https://www.gsk.com/media/7639/q1-2022-announcement.pdf

- ^ https://www.gsk.com/en-gb/research-and-development/

- ^ https://www.gsk.com/en-gb/products/