Glenmark Pharmaceuticals Ltd

Company Overview

Founded in Year 1977, Glenmark Pharmaceuticals (NSE: GLENMARK) is a global pharmaceutical company with a remarkable track record of achievement and improving patients’ lives with access to affordable medicines. Established in 2003 as a North American subsidiary of Glenmark Pharmaceuticals, the company launched its first generic product in January 2005 and quickly emerged as one of the leading generic organizations in the United States. Over the course of more than 40 years, Glenmark has transformed itself into a burgeoning pharmaceutical company, with operations in more than 80 countries. 1

Glenmark has the stability, resources and talent to work on solving serious medical problems, all while doing the right thing for patients, people and communities.

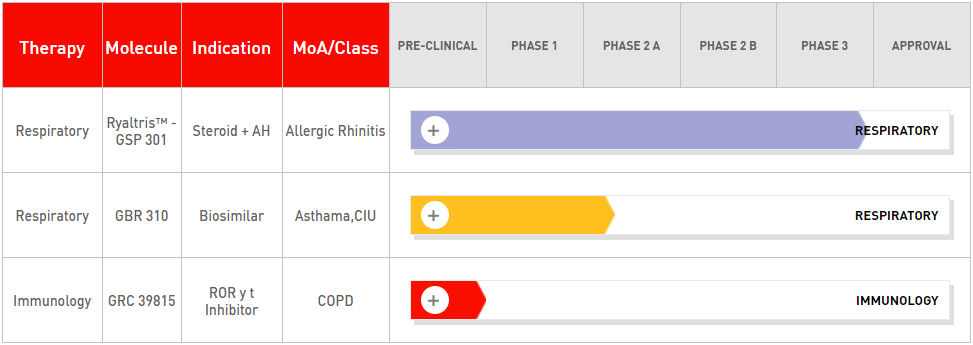

R&D Pipeline

Glenmark’s R&D is committed to identifying products that fulfill unique and unmet medical needs in inflammation disorders, especially in respiratory and dermatology therapies and also oncology.

Plant Locations

Manufacturing Facilities

Formulations

- Satpur, Nashik, Maharashtra

- Bardez, Goa

- Unit - I,Teh Baddi, Dist. - Solan, HP

- Unit - II,Teh Nalagarh, Dist.- Solan, HP

- Unit - III,Baddi-Nalagarh Road, Dist. - Solan, HP

- Pithampur, Indore, Madhya Pradesh

- Aurangabad, Maharashtra

- East Sikkim, Sikkim

- Vysoke Myto, Czech Republic

- Buenos Aires, Argentina

- Monroe,USA

R&D Centres

- Vashi, Navi Mumbai, Maharashtra

- Nashik, Maharashtra

- Raigad, Maharashtra

Clinical Research Centre

- Turbhe, Navi Mumbai, Maharashtra

ICHNOS Sciences

Global Clinical Development Centre

- Paramus, NJ, USA

R&D Centres

- Epalinges Switzerland

- La Chaux-de-fonds, Switzerland

Manufacturing Facility

- La Chaux-de-fonds, Switzerland

Glenmark Life Sciences

- Ankleshwar, Dist. Bharuch,Gujarat

- Solapur, Maharashtra

- Daund, Pune, Maharashtra

- Dahej District, Bharuch, Gujarat

Industry Overview

Global Pharma Scenario

The global pharmaceutical landscape is undergoing a major overhaul with the advent of new technologies and more efficient and cost-effective manufacturing processes. This is paving the way for a whole new world of drugs and treatments of the future. In 2019, the global pharmaceutical industry was worth approximately $1.2 trillion, a figure predicted to increase to around $1.5 trillion by 2023. And the global generic industry is expected to be worth $474 billion by 2023, a 6.8% increase from 2018. 2

API manufacturing quality is most often a key indicator for the performance of pharmaceutical markets – with many of the pharma’s developed markets still perceived as ahead of the large volume producers. According to a 2019 CPhI report, Japan has pushed ahead of Germany with a respectable growth of 2.5%, to now holding the number one spot for API manufacturing quality. With regard to innovation, the USA continues to retain its top position. It also boasts the largest growth increase (2.5%) of all assessed markets, while Japan and Germany remain in second and third position respectively. The ever-increasing demand for pharmaceuticals and the push for more accessible and affordable drugs is fueling the biosimilar market to grow exponentially in the coming years. There is also growing interest from pharma companies to tap the rare and specialty disease markets. Innovations in advanced biologics, nucleic acid therapeutics, cell therapies, bioelectronics and implantables are attracting huge investments even from non-pharma companies like Facebook, Qualcomm etc.

Business Overview

India Formulations

During the year 2019-20, the India Formulations (IF) business performed well, registering revenue of Rs. 32021.67 Mn (USD 452.41 Mn) as against Rs. 27,769.71 Mn (USD 398.07 Mn) in the previous year, recording growth of 15.31%. The India business continues to be a strong contributor to the company’s overall growth, with the fourth quarter being an exceptional quarter in terms of growth.

As per IQVIA MAT Mar 2020, the IF business is ranked 14th in the Indian pharmaceutical market. The highlight for the India business has been the launch of Remogliflozin, a novel anti-diabetic drug in the SGLT2 inhibitor class of molecules. Glenmark was the first company to launch this product in India. Since its launch, Remogliflozin continues to do exceedingly well in the market and is well received in the medical community. It has achieved impressive market penetration of 34% in the SGLT2 segment, a figure that is progressing month on month. Glenmark now ranks third in the respiratory segment in the Indian pharmaceutical market. In the cardiology space, the most notable brand remains Telma, which is the first Glenmark brand to feature in the top 20 IPM Brands. It has jumped 11 ranks in the last 12 months (IQVIA Mar’20).

US Formulations

For the financial year 2019-20, the US business registered revenue from the sale of finished dosage formulations of Rs. 31,404.49 Mn (USD 443.69 Mn) as against revenue of Rs. 31,392.70 Mn (USD 450.01 Mn) for the previous corresponding year.

In the fiscal year 2019-20, Glenmark was granted approval for 14 Abbreviated New Drug Applications (ANDA), comprising 12 final approvals and 2 tentative approvals. Additionally, Glenmark received approval on a Prior Approval Supplement (PAS) to make an over-the-counter version of their Adapalene Gel, 0.1% available. Notable approvals include: Fulvestrant Injection, 250 mg/5 mL (the company’s first injectable product), Pimecrolimus Cream, 1%, and Deferasirox Tablets for Oral Suspension, 125 mg, 250 mg and 500 mg. The company filed a total of 8 ANDA applications with the US FDA throughout the fiscal year.

As part of a distribution agreement with Elite Laboratories, Glenmark also launched Isradipine Capsules. During this financial year, the US business was significantly impacted in terms of sales on account of three products viz. Mupirocin Cream, Atomoxetine hydrochloride & Calcipotriene cream. Sales were also impacted due to the Ranitidine issue in the US market. Glenmark’s marketing portfolio through March 31, 2020 consists of 165 generic products authorized for distribution in the U.S. market. The company currently has 44 applications pending in various stages of the approval process with the US FDA, of which 24 are Paragraph IV applications.

Rest of The World

For the fiscal year 2019-20, revenue from Africa, Asia and CIS region was Rs.12,854.45 Mn (USD 181.61 Mn) as against Rs. 12,759.35 Mn (USD 182.90 Mn) for the previous corresponding year, recording growth of 0.75%.

Russia/CIS Region

According to IQVIA MAT March’20 data, Glenmark Russia recorded faster than market growth of +10.7% in value v/s overall retail market growth of +8.9%. In the dermatology segment, Glenmark ranks 11 amongst dermatology companies present in the retail market on MAT March’20 basis. The introductions under the Oflo umbrella i.e. Oflomil nail lacquer and Oflomycol cream & solution will further strengthen the company’s position in this segment. In the respiratory space, Glenmark continues to secure a strong position and ranks 4th, as per MAT March’20 data amongst the companies present on the expectorants market (retail segment) of the local pharmaceutical market. Launch of Momate Rhino OTC helped to further strengthen Glenmark’s respiratory franchise in the Russian market.

During the year under review, Glenmark’s Ukraine business showed growth of 25.5% in units

Asia & Africa

For the fiscal year 2019-20, sales in the Asia region continued to remain subdued across all markets. The Africa region recorded strong secondary sales growth during the year. All the major subsidiaries viz. South Africa and Kenya recorded good growth. The company has also made good progress in expanding its presence in the GCC region

Europe Formulations

Glenmark Europe’s operations for the fiscal year 2019-20, recorded revenue at Rs. 12,484.48 Mn (USD 176.38 Mn) as against Rs. 11,207.09 Mn (USD 160.65 Mn), recording growth of 11.40%.

Western European business continued expanding through increased penetration in the UK, Germany, Spain and the Netherlands while Nordic countries witnessed some de-growth. During the year under review, the Central Eastern European region also managed to grow well in constant currency with major markets witnessing sales growth. During the year under review, GSK concluded a settlement agreement concerning the existing litigation against Glenmark and Celon regarding the shape of their inhalation product containing salmeterol xinafoate and fluticasone propionate, named Salmex (aka Stalpex, Salflutin and Asthmex) in selected European markets.

Latin America

Glenmark’s revenue for the year from its Latin American and Caribbean operations was at Rs. 5355.57 (USD 75.66 Mn) for FY 2019-20, as against Rs. 4179.53 Mn (USD 59.91 Mn) for the previous corresponding year, recording growth of 28.14%. In June 2019, Glenmark announced that its Brazilian subsidiary has entered into an exclusive partnership agreement with Novartis AG, for three respiratory products indicated for treatment of Chronic Obstructive Pulmonary Disease (COPD) in Brazil. The products involved in the agreement are Seebri® (Glycopyrronium bromide), Onbrize® (Indacaterol) and Ultibro® (combination of Indacaterol and Glycopyrronium).

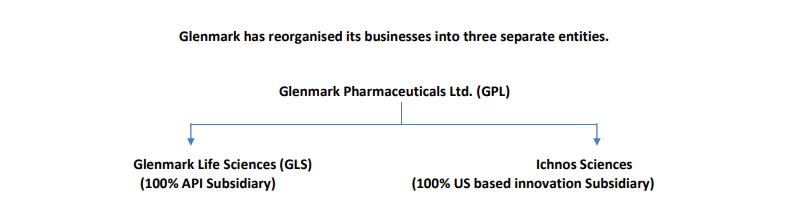

Glenmark Life Sciences

Glenmark Life Sciences primarily includes manufacturing and marketing of Active Pharmaceutical Ingredient (API) products across all major markets globally. It also includes captive sales (i.e. use of API by GPL for its own formulations).

For the fiscal year 2019-20, external sales for Glenmark Life Sciences (GLS) was at Rs. 10,239.17 Mn (USD 144.66 Mn) as against Rs. 9,493.11 Mn (USD 136.08 Mn), recording growth of 7.86% over the corresponding period last year

GLS has three US FDA approved API manufacturing facilities (Ankleshwar, Dahej and Mohol). In July 2019, the US FDA and Health Canada jointly inspected the Ankleshwar manufacturing facility of GLS. Subsequently the U.S. FDA issued the EIR for the facility and Health Canada has rated the facility as “Compliant.”

Financial Overview

On Standalone basis the Company achieved gross revenue of Rs 67,126.31 million as compared to Rs 63,048.67 million in the previous year and the Standalone operating profit before tax and exceptional item was Rs 15,160.90 million as compared to Rs 14,729.99 million in the previous year.

On Consolidated basis the Company achieved a gross revenue of Rs 106,409.69 million and the Consolidated operating profit before tax and exceptional item was Rs 10,632 million as compared to Rs 11,334.47 million in the previous year.

Highlights for Q3 FY 2020-21

February 12, 2021: : Glenmark Pharmaceuticals Limited announced its financial results for the third quarter ended December 31 of the financial year 2020-21. 3

For the third quarter of FY 2020-21, Glenmark’s consolidated sales was at Rs. 27,605.07 Mn. as against Rs. 26,574.51 Mn. recording an increase of 3.88 %.

For the third quarter of FY 2020-21, Glenmark’s consolidated revenue (incl. other revenue) was at Rs. 27,867.63 Mn. as against 27,355.62 recording an increase of 1.87 %.

Consolidated Net Profit was at Rs. 2481.79 Mn. for the quarter ended December 31, 2020 as compared to Rs. 1,908.39 Mn. in the previous corresponding quarter, registering an increase of 30.05%.

Consolidated EBITDA was at Rs. 5,300.72 Mn in the quarter ended December 31, 2020 as against Rs. 4,400.75 Mn. in the previous corresponding quarter, an increase of 20.45%.

“The company's India business continued to grow at a healthy pace in the third quarter, consistently outperforming industry growth. The US business rebounded well and the company expect the business to gradually build sales momentum. This quarter, the API business once again performed well and the company expect this business to grow in the next few years. The company also expect the European and the emerging markets business to gain traction in the coming few quarters” said Glenn Saldanha, Chairman and Managing Director, Glenmark Pharmaceuticals.

India Formulations

Sales from the formulation business in India for the Third Quarter of FY 2020-21 was at Rs. 8,821.19 Mn. as against Rs. 7,888.39 Mn. in the previous corresponding quarter, recording growth of 11.82 %.

The India business continues to significantly outperform industry growth rates, continuing the trend of the past several years. As per IQVIA data, Glenmark remains the second fastest growing company in the industry among the Top 20 players on a MAT Dec 2020 basis with growth of 15.8% as compared to IPM (Indian Pharma market) growth of 6.12%. On a quarterly basis, as per IQVIA, the business recorded growth of 15.11% as compared to 9.75% for the market.

Glenmark Pharmaceuticals Inc., USA registered revenue from sale of finished dosage formulations of Rs.7,803.87 Mn. for the quarter ended Dec 31, 2020 as against revenue of Rs.7,998.28 Mn. for the previous corresponding quarter, recording decline in revenue by (2.43%). However, the business recorded quarter on quarter growth of 4.4 % in USD terms.

Glenmark’s marketing portfolio through December 31, 2020 consists of 167 generic products authorized for distribution in the U.S. market. The Company currently has 44 applications pending in various stages of the approval process with the US FDA, of which 22 are Paragraph IV applications.

Europe Formulations

Glenmark Europe’s revenue for the third quarter of FY 2020-21 was at Rs. 3,133.29 Mn as against Rs. 3,089.36 Mn in the previous corresponding quarter, recording a growth of 1.42%.

Glenmark’s European business remained weak in the third quarter mainly impacted by the enhanced lockdown measures due to heightened pandemic concerns in most key markets. This resulted in sales decline recorded in both the Central Eastern European region and the Western European region. Glenmark continues to increase penetration across major markets in Western Europe. For the financial year, the European region signed 12 major contracts for in-licensing products from various companies across its operating markets in the region. The Czech and Slovak subsidiaries launched three products during the quarter. The German subsidiary launched two products and the Spain unit launched one product during the third quarter

Africa, Asia and CIS Region (ROW)

For the third quarter of FY 2020-21, revenue from Africa, Asia and CIS region was at Rs.3,360.37 Mn. as against Rs. 3,413.74 Mn. for the previous corresponding quarter, recording decline in revenue of (1.56%).

Latin America

Glenmark’s revenue from its Latin American & Caribbean operations was at Rs. 1,285.65 Mn. for the third quarter of FY 2020-21 as against Rs. 1,563.18 Mn., recording revenue decline of 17.75 %. The pandemic continues to impact the Brazilian business and the unit once again recorded decline in sales for the quarter as compared to the previous corresponding quarter. The Mexico subsidiary performed relatively better recording sales growth for the quarter. The entire region continues to witness a challenging environment on account of the pandemic.

Glenmark Life Sciences (GLS)

For the third quarter of the financial year, Glenmark Life Sciences Limited registered consolidated revenue including captive sales of Rs. 5,006 Mn as against Rs. 4,092 Mn, recording growth of 22.35 %.

The external sales for the API business performed well in the third quarter recording strong growth. The India API business grew over 50 % and the Latam business grew in excess of 30 % in the third quarter. GLS continues to look for opportunities for the Favipiravir API and has already started supplying in a few countries. During the quarter, GLS submitted nine new DMFs across various operating markets. The company is looking to file at least 10 -12 DMFs in the fourth quarter of the financial year.

ICHNOS Sciences

For the third quarter of the financial year, Glenmark invested Rs 1713 Mn (USD 23.3 Mn) as compared to Rs. 2,108 Mn ( USD 30.01 Mn) invested in the corresponding quarter of the previous financial year. For the first nine months of the current financial year, Glenmark has invested Rs 5693 Mn (USD 76.26 Mn) as compared to Rs 5,943 Mn ( USD 85.03 Mn) invested in the corresponding period of the previous financial year.

Recent developments

Glenmark Pharmaceuticals receives ANDA approval for Chlorpromazine Hydrochloride Tablets USP 4

March 24, 2021; : Glenmark Pharmaceuticals Limited (Glenmark) has received final approval by the United States Food & Drug Administration (U.S. FDA) for Chlorpromazine Hydrochloride Tablets USP, 10 mg, 25 mg, 50 mg, 100 mg, and 200 mg, the generic version of Thorazine®1 Tablets, 10 mg, 25 mg, 50 mg, 100 mg, and 200 mg, of GlaxoSmithKline.

Glenmark has been granted a competitive generic therapy (CGT) designation for Chlorpromazine Hydrochloride Tablets USP, 10 mg, 25 mg, 50 mg, 100 mg, and 200 mg, therefore, with this approval, Glenmark is the first approved applicant for such competitive generic therapy and is eligible for 180 days of CGT exclusivity upon commercial marketing.

According to IQVIATM sales data for the 12 month period ending January 2021, the Thorazine®1 Tablets, 10 mg, 25 mg, 50 mg, 100 mg, and 200 mg market2 achieved annual sales of approximately $108.6 million.

Glenmark’s current portfolio consists of 171 products authorized for distribution in the U.S. marketplace and 41 ANDA’s pending approval with the U.S. FDA. In addition to these internal filings, Glenmark continues to identify and explore external development partnerships to supplement and accelerate the growth of its existing pipeline and portfolio.

References

- ^ https://glenmarkpharma-us.com/about-us/who-we-are/

- ^ https://www.glenmarkpharma.com/sites/default/files/ANNUAL_REP0RT_2020_1.pdf

- ^ https://www.glenmarkpharma.com/sites/default/files/Glenmarks-consolidated-sales-risesin-q3.pdf

- ^ https://www.glenmarkpharma.com/sites/default/files/Glenmark-receives-ANDA-approval-for-Chlorpromazine-Hydroch.pdf