Gujarat Gas Ltd

Overview

Gujarat Gas Limited (NSE:GUJGASLTD), is India's largest City Gas Distribution player with its presence spread across 23 Districts in the State of Gujarat, Union Territory of Dadra & Nagar Haveli and Thane Geographical Area (GA) (excluding already authorised areas) which includes Palghar District of Maharashtra. In 10th CGD bidding round announced by PNGRB the company has won 6 GAs comprising of 17 cities in the state of Punjab, Haryana, Madhya Pradesh and Rajasthan, making GGL a pan India Company.1

The company has India's largest customer base in Residential, Commercial and Industrial segments.

GGL is committed to reach out to every possible natural gas user in its expanded GAs. The size and scale of the combined entity gives it the ability to achieve efficiencies and effectively manage the transformational changes in the sector. This major gain in productivity would benefit all the key stakeholders i.e. Customers and Shareholders.

The company has more than 24,000 kms. of gas pipeline network. It has more than 400 CNG stations and distributes close to 10 mmscmd (as on 31/03/2020) of natural gas to over 14,50,000 households, approximately 2 lakh CNG vehicles (fueled per day) and to more than 3700 industrial customers.

Gujarat Gas Limited has received ISO 9001:2015 certification, the world’s most recognized quality management standard. The certification was awarded by M/s DNV GL on 11th May 2018.

Presently, the company supplies PNG to following major areas and surrounding villages in the state of Gujarat:2

| South Gujarat | Central Gujarat | Saurashtra |

| Pardi | Vaso | Rajkot |

| Surat | Gandhinagar | Jamnagar |

| Ankleshwar | Chandkheda-Ahmedabad | Bhavnagar |

| Bharuch | Halol | Botad |

| Tapi | Nadiad | Surendranagar |

| Vapi | Khambhat | Morbi |

| Umargam | Petlad | Thangadh |

| Bhilad | Kheda | Limbadi |

| Sarigam | Mahemdabad | Bhuj |

| Bilimora | Mahudha | |

| Valsad | ||

| Dharampur | ||

| Navsari | ||

| Hazira |

Industry Overview

Industry Structure and Developments

Natural Gas is the cleanest and most efficient of the fossil fuels. It is the only fossil fuel whose share of the primary energy mix is expected to grow, as it has the potential to play an important role in the world’s transition to a cleaner, more affordable and secure energy future due to its high energy content, which results in lower emissions of carbon and volatile organic compounds (VOCs) at combustion, relative to coal and oil. These characteristics of gas provide substantial environmental benefits such as improved air quality and reduced CO2 emissions.3

World energy demand has been increasing steadily with Natural Gas accounting nearly half of increased consumption. Gas demand growth was especially strong in China and the United States, where cheap gas continues to replace coal for electricity generation. As per the International Energy Agency, India along with China is highly dependent on natural gas imports as domestic production exceeds consumption.

Crude Oil prices have always been at the forefront for all energy prices including Natural Gas. The crude oil prices have softened in FY 2019-20 compared to FY2018-19 mainly influenced by economical and geo-political factors and off late by Pandemic COVID-19.

The oil prices in FY 2019-20 had not seen major volatility in first three quarters of FY 2019-20. The oil prices stayed range-bound between US$ 50/bbl to US$65/bbl.

There was some spike in the oil prices swing was on account of drone attack on Saudi Arabia oil installations in Sept 2019 but did not sustain for long. There had been continued rapid growth in oil production (shale oil) in the United States.

Growth of India’s share in the global energy market is expected to increase in the coming years. India has been mainly dependent on high polluting fuels viz. coal, Furnace Oil to meet its ever growing energy needs. Government of India; realizing the importance of protecting the environment has announced; one of its important initiatives for a more sustainable future; an aggressive target to increase the share of Natural Gas in the overall energy consumption mix to 15 percent from the current levels of 6 percent by 2030.

Historically the Natural Gas usage in India has seen a slowdown with power sector shifting back to coal from Natural Gas due to lower availability of cheap domestic gas and increased dependency on costly R-LNG. However, with R-LNG prices expected to be low, some of the power producers may shift back to Natural Gas.

The City Gas Distribution (“CGD”) business in India contributes around 17.57% of total natural gas consumption in India and leading the way with the highest CAGR amongst all sectors in the coming decade. The sector regulator Petroleum and Natural Gas Regulatory Board during the year awarded 50 CGD licenses for the Geographical Areas (GAs) announced during the 10th CGD Bidding Round on 8th November, 2018 covering 124 districts (112 complete and 12 part) in 14 states, 18% of India’s geographical area and 24% of its population. The company was awarded 6 new CGD licenses which are:

- Sirsa, Fatehabad and Mansa (Punjab) Districts in the States of Haryana and Punjab

- Ujjain (Except area already authorized) District, Dewas (Except area already authorized) District and Indore (Except area already authorized) District in the State of Madhya Pradesh

- Jhabua, Banswara, Ratlam and Dungarpur Districts in the States of Rajasthan and Madhya Pradesh

- Ferozepur, Faridkot and Sri Muktsar Sahib Districts in the State of Punjab

- Hoshiarpur and Gurdaspur Districts in the State of Punjab

- Jalore and Sirohi Districts in the State of Rajasthan

Business Overview

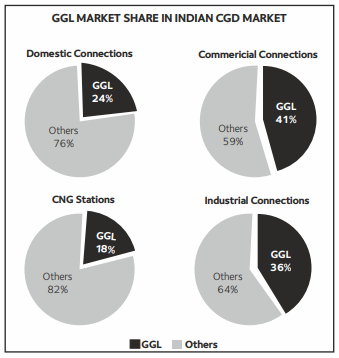

The company has total 25 CGD licenses and operates in 42 districts and six states and one Union territory which accounts to c. 11% of total CGD licenses and c. 10% total Authorized areas issued by PNGRB in India and one transportation pipeline license.

The company has an expanse of around 1,69,700 square kilometres of licensed area under its umbrella and continues to hold the leadership position of being the largest CGD Company in terms of market share with catering to more than 14.4 lakh residential consumers, over 12,600 commercial customers, dispensing CNG from 403 CNG stations for vehicular consumers and providing clean energy solutions to over 3,700 industrial units through its wide spread operations with more than 24,400 kilometres of Natural Gas pipeline network.

Despite the dynamic business environment and intensely competitive energy market; The company has been resilient to connect around 329 new industrial units during the year.

The company has witnessed steep volume growth in industrial customers of around 63% compared to previous year. The volume increase was mainly on account of Ban on usage of Coal Gasifier in the Morbi industrial cluster (which is considered as Ceramic Hub of India) resulting in switchover to natural gas. This was challenging task technically as well as commercially but the company was able to meet this challenge through concentrated efforts. For this to happen, the company laid 6 inch steel pipeline of 5 kms in record time of 28 days. However, the last week of the year witnessed drop in volumes on account of lockdown. The volume in commercial category has also grown by around 9% during the fiscal. The company has continued its focused efforts for developing and growing PNG (Domestic) and CNG business. GGL added more than 93,000 residential customers and erected / commissioned 62 new CNG stations during the year. The company has been able to sustain the volumes with growth of around 6% in the residential sector and around 10% in CNG (transport) sector. The company is aggressively planning for penetration in PNG (domestic), PNG (commercial) and CNG (transport) sector which is comparatively less volatile.

Outlook

The future outlook for natural gas in India depends on the growth in demand, the evolution of the pricing regime, and the pace of gas infrastructure expansion. With outbreak of pandemic COVID-19, the demand for oil & gas has slumped and pulling down the price. The demand will steadily rise with opening of the economy after the pandemic

The company has already adopted digitization of its critical processes and due to that these processes were least impacted during the Covid-19 lockdown period. Going forward also, the company shall leverage its endeavors for more digitization and aims to set benchmark in the CGD industry for complete E-Office, benefiting all the stakeholders viz. consumers, vendors, suppliers and employees.

India’s Natural Gas supply and demand outlook is changing. The Government of India (GoI) wants to make India a gas-based economy by boosting domestic production and buying cheap LNG. India has set a target to raise the share of gas in its primary energy mix to 15% by 2030. To improve the share of Natural Gas and promote a gas-based and clean fuel economy, the GoI has adopted a systematic approach to focus on all aspects of the gas sector viz upstream, midstream and downstream including CGD network development.

The company has been continuously growing and expanding its horizon by venturing into new geographic areas and is committed to reach every possible Natural Gas user across its licensed expanse of around 1,69,700 square kilometres through its ever growing pipeline network spread across 42 districts and six states and one UT. The company shall continue to focus on growing the penetration in the current operating areas by increasing the PNG connections and additional CNG stations while tapping the untapped potential by expeditious rollout of distribution network in the newly acquired geographic areas as well. With this focused endeavour GGL shall continue its efforts in providing clean fuel solutions across all operational area to augment an energetic top-line and bottom-line in coming years.

Financial Highlights

During the financial year 2019-20, the revenue from operations grew by 32.20% to Rs10526.49 crores from Rs 7962.48 crores in the previous year 2018-19.

The Company registered a rise in profit before tax (PBT) by 103.38% to Rs 1207.78 crores in financial year 2019-20 from Rs 593.85 crores in financial year 2018-19.

The Company registered a robust growth in profit after tax (PAT) by 186.15 % to Rs 1193.32 crores in financial year 2019-20 from Rs 417.03 crores during financial year 2018-19. This included Rs 287 crores on account of re-measurement of deferred tax liabilities pursuant to taxation ordinance dated 20th September, 2019 and company opting for concessional tax rates.

The Company recorded earnings per share (EPS) of Rs17.33 per share having Face Value of Rs 2 each in financial year 2019-20 as compared to Rs 6.06 per share having Face Value of Rs 2 each in financial year 2018-19.

Recent developments

Gujarat Gas reported a sharp surge in standalone net profit for the second quarter of fiscal 2021 at Rs 475 crore as against Rs 59 crore in the previous quarter.4

Standalone revenue from operations more than doubled to Rs 2,560 crore in Q2FY21 from Rs 1,107 crore in the previous quarter.

Q2 volumes are up 5 percent YoY and 138 percent QoQ from lows of Q1 hit due to the lockdown. The company's total gas sales volume for the quarter was at 9.85 mmscmd. During the current half year ended on 30th September 2020, company commercialised 51 new CNG stations.

The company's gas sales volume has shown a robust recovery post lockdown. In industrial category, the gas sales volume is currently above pre-lockdown level. In CNG category and commercial category currently, gas sales volumes stand at 90 percent and 70 percent of pre-lockdown level respectively. The company is currently flowing total gas volume of 10.50 mmscmd as against FY20 average sales of 9.44 mmscmd.

The company said that it currently has a comfortable liquidity position and prepaid term loan of Rs 363 crore during the current quarter while continuing to service its debt obligations.