HDFC Bank

Overview

HDFC Bank (NSE:HDFCBANK) is one of India’s leading private banks and was among the first to receive approval from the Reserve Bank of India (RBI) to set up a private sector bank in 1994.1

Today, HDFC Bank has a banking network of 5,345 branches and 14,533 ATMs spread across 2,787 cities and towns.

Businesses

HDFC Bank caters to a wide range of banking services covering commercial and investment banking on the wholesale side and transactional / branch banking on the retail side. The bank has three key business segments:2

Retail Banking

The objective of the Retail Bank is to provide its target market customers a full range of financial products and banking services, giving the customer a one-stop window for all his/her banking requirements. The products are backed by world-class service and delivered to customers through the growing branch network, as well as through alternative delivery channels like ATMs, Phone Banking, NetBanking and Mobile Banking.

The HDFC Bank Preferred program for high net worth individuals, the HDFC Bank Plus and the Investment Advisory Services programs have been designed keeping in mind needs of customers who seek distinct financial solutions, information and advice on various investment avenues. The Bank also has a wide array of retail loan products including Auto Loans, Loans against marketable securities, Personal Loans and Loans for Two-wheelers. It is also a leading provider of Depository Participant (DP) services for retail customers, providing customers the facility to hold their investments in electronic form.

HDFC Bank was the first bank in India to launch an International Debit Card in association with VISA (VISA Electron) and issues the MasterCard Maestro debit card as well. The Bank launched its credit card business in late 2001. By March 2015, the bank had a total card base (debit and credit cards) of over 25 million. The Bank is also one of the leading players in the "merchant acquiring" business with over 235,000 Point-of-sale (POS) terminals for debit / credit cards acceptance at merchant establishments. The Bank is well positioned as a leader in various net based B2C opportunities including a wide range of internet banking services for Fixed Deposits, Loans, Bill Payments, etc.

Wholesale Banking

The Bank's target market is primarily large, blue-chip manufacturing companies in the Indian corporate sector and to a lesser extent, small & mid-sized corporates and agri-based businesses. For these customers, the Bank provides a wide range of commercial and transactional banking services, including working capital finance, trade services, transactional services, cash management, etc. The bank is also a leading provider of structured solutions, which combine cash management services with vendor and distributor finance for facilitating superior supply chain management for its corporate customers. Based on its superior product delivery / service levels and strong customer orientation, the Bank has made significant inroads into the banking consortia of a number of leading Indian corporates including multinationals, companies from the domestic business houses and prime public sector companies. It is recognised as a leading provider of cash management and transactional banking solutions to corporate customers, mutual funds, stock exchange members and banks.

Treasury

Within this business, the bank has three main product areas - Foreign Exchange and Derivatives, Local Currency Money Market & Debt Securities, and Equities. With the liberalisation of the financial markets in India, corporates need more sophisticated risk management information, advice and product structures. These and fine pricing on various treasury products are provided through the bank's Treasury team. To comply with statutory reserve requirements, the bank is required to hold 25% of its deposits in government securities. The Treasury business is responsible for managing the returns and market risk on this investment portfolio.

Financial Highlights

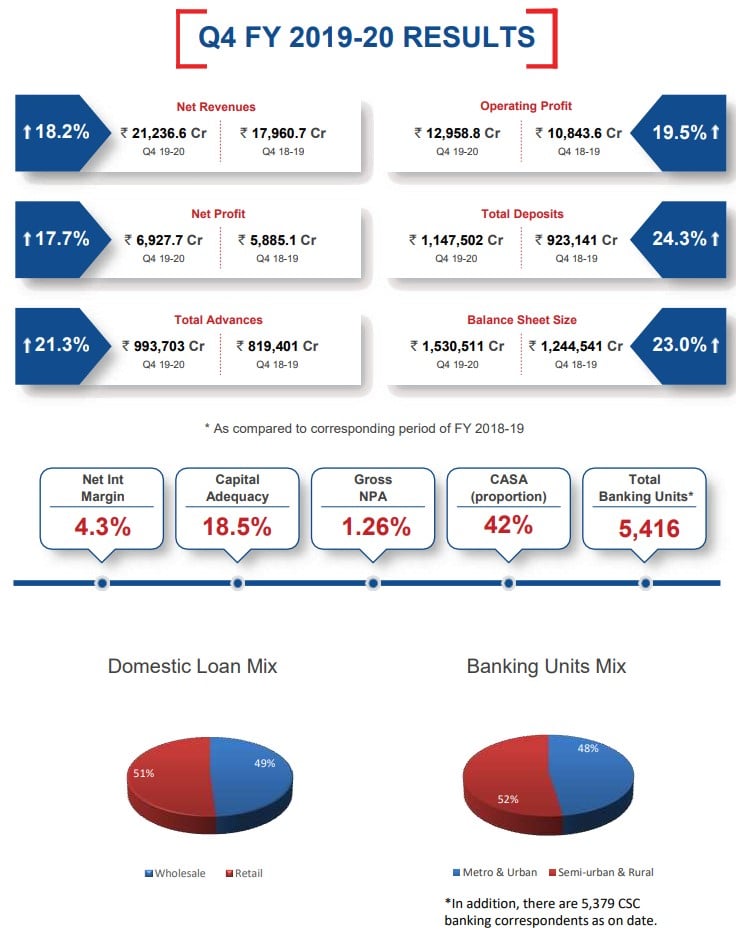

The Bank’s net revenues (net interest income plus other income) increased by 18.2% to ₹ 21,236.6 crore for the quarter ended March 31, 2020 over the corresponding quarter of the previous year.3

Net interest income (interest earned less interest expended) for the quarter ended March 31, 2020 grew to ₹ 15,204.1 crore from ₹ 13,089.5 crore for the quarter ended March 31, 2019, driven by growth in advances of 21.3%, and a growth in deposits of 24.3%. The net interest margin for the quarter was at 4.3%.

Profit & Loss Account: Quarter ended March 31, 2020

Other income (non-interest revenue) at ₹ 6,032.6 crore was 28.4% of the net revenues for the quarter ended March 31, 2020 as against ₹ 4,871.2 crore in the corresponding quarter ended March 31, 2019. The four components of other income for the quarter ended March 31, 2020 were fees & commissions of ₹ 4,200.8 crore (₹ 3,665.4 crore in the corresponding quarter of the previous year), foreign exchange & derivatives revenue of ₹ 500.8 crore (₹ 403.3 crore for the corresponding quarter of the previous year), gain on sale / revaluation of investments of ₹ 565.3 crore (gain of ₹ 228.9 crore in the corresponding quarter of the previous year) and miscellaneous income, including recoveries and dividend, of ₹ 765.7 crore (₹ 573.6 crore for the corresponding quarter of the previous year).

Operating expenses for the quarter ended March 31, 2020 were ₹ 8,277.8 crore, an increase of 16.3% over ₹ 7,117.1 crore during the corresponding quarter of the previous year. The cost-to-income ratio for the quarter was at 39.0% as against 39.6% for the corresponding quarter ended March 31, 2019.

Pre-provision Operating Profit (PPOP) at ₹ 12,958.8 crore grew by 19.5% over the corresponding quarter of the previous year.

Provisions and contingencies for the quarter ended March 31, 2020 were ₹ 3,784.5 crore (consisting of specific loan loss provisions of ₹ 1,917.8 crore and genera provisions and other provisions of ₹ 1,866.7 crore) as against ₹ 1,889.2 crore (consisting of specific loan loss provisions of ₹ 1,430.3 crore and general provisions and other provisions of ₹ 459.0 crore) for the quarter ended March 31, 2019. Total provisions for the current quarter included credit reserves relating to COVID-19 in the form of contingent provisions of approximately ₹ 1550 crore. The Core Credit Cost ratio was 0.77%, as compared to 0.92% in the quarter ending December 31, 2019 and 0.69% in the quarter ending March 31, 2019.

Profit before tax (PBT) for the quarter ended March 31, 2020 was at ₹ 9,174.3 crore. After providing ₹ 2,246.6 crore for taxation, the Bank earned a net profit of ₹ 6,927.7 crore, an increase of 17.7% over the quarter ended March 31, 2019.

Profit & Loss Account: Year ended March 31, 2020

For the year ended March 31, 2020, the Bank earned a total income of ₹ 138,073.5 crore. Net revenues (net interest income plus other income) for the year ended March 31, 2020 were ₹ 79,447.1 crore, up by 20.6% over ₹ 65,869.1 crore for the year ended March 31, 2019. The net interest margin for the year ended March 31, 2020 was 4.3%. The cost to income ratio for the year ended March 31, 2020 was at 38.6%, as against 39.7% for the year ended March 31, 2019. The Bank’s net profit for the year ended March 31, 2020 was ₹ 26,257.3 crore, up 24.6% over the year ended March 31, 2019.

Balance Sheet: As of March 31, 2020

Total balance sheet size as of March 31, 2020 was ₹ 1,530,511 crore as against ₹ 1,244,541 crore as of March 31, 2019, a growth of 23.0%.

Total deposits as of March 31, 2020 were ₹ 1,147,502 crore, an increase of 24.3% over March 31, 2019. CASA deposits grew by 23.9% with savings account deposits at ₹ 310,377 crore and current account deposits at ₹ 174,248 crore. Time deposits were at ₹ 662,877 crore, an increase of 24.6% over the previous year, resulting in CASA deposits comprising 42.2% of total deposits as of March 31, 2020. The Bank’s continued focus on deposits helped in the maintenance of a healthy liquidity coverage ratio at 132%, well above the regulatory requirement.

Total advances as of March 31, 2020 were ₹ 993,703 crore, an increase of 21.3% over March 31, 2019. Domestic advances grew by 21.4% over March 31, 2019. As per regulatory [Basel 2] segment classification, domestic retail loans grew by 14.6% and domestic wholesale loans grew by 29.3%. The domestic loan mix as per Basel 2 classification between retail:wholesale was 51:49. Overseas advances constituted 3% of total advances.

Capital Adequacy:

The Bank’s total Capital Adequacy Ratio (CAR) as per Basel III guidelines was at 18.5% as on March 31, 2020 (17.1% as on March 31, 2019) as against a regulatory requirement of 11.075% which includes Capital Conservation Buffer of 1.875%, and an additional requirement of 0.20% on account of the Bank being identified as a Domestic Systemically Important Bank (D-SIB). Tier 1 CAR was at 17.2% as of March 31, 2020 compared to 15.8% as of March 31, 2019. Common Equity Tier 1 Capital ratio was at 16.4% as of March 31, 2020. Risk-weighted Assets were at ₹ 994,716 crore (as against ₹ 931,930 crore as at March 31, 2019).

Network:

As of March 31, 2020, the Bank’s distribution network was at 5,416 banking outlets and 14,901 ATMs / Cash Deposit & Withdrawal Machines (CDMs) across 2,803 cities / towns as against 5,103 banking outlets and 13,489 ATMs / CDMs across 2,748 cities / towns as of March 31, 2019. Of the total banking outlets, 52% are in semi-urban and rural areas. In addition, HDFC Bank has 5,379 banking outlets managed by the Common Service Centres. Number of employees were at 116,971 as of March 31, 2020 (as against 98,061 as of March 31, 2019).

Asset Quality:

Gross non-performing assets were at 1.26% of gross advances as on March 31, 2020, (1.1% excluding NPAs in the agricultural segment) as against 1.42% as on December 31, 2019 (1.2% excluding NPAs in the agricultural segment) and 1.36% as on March 31, 2019 (1.2% excluding NPAs in the agricultural segment). Net non-performing assets were at 0.36% of net advances as on March 31, 2020.

The Bank held floating provisions of ₹ 1,451 crore and contingent provisions of ₹ 2,996 crore as on March 31, 2020. Total provisions (comprising specific, floating, contingent and general provisions) were 142% of the gross non-performing loans as on March 31, 2020.

COVID-19 effect:

During the quarter, there was a considerable slowdown in economic activities following the outbreak of COVID-19. Furthermore, with the government initiating lockdown in the latter half of March, and its strict adherence to social distancing, not only did the company see an impact on business volumes - in terms of loan originations, distribution of third party products, and payments product activities, but the company also could not optimize its collection efforts, and as a result of which fees/other income were lower by ₹ 450 crore.

In accordance with the RBI guidelines relating to COVID-19 Regulatory Package dated March 27, 2020 and April 17, 2020, the Bank would be granting a moratorium of three months on the payment of all installments and / or interest, as applicable, falling due between March 1, 2020 and May 31, 2020 to all eligible borrowers classified as Standard, even if overdue, as on February 29, 2020. For all such accounts where the moratorium is granted, the asset classification shall remain standstill during the moratorium period (i.e. the number of days past-due shall exclude the moratorium period for the purposes of asset classification under the IRACP norms). The Bank holds provisions as on March 31, 2020 against the potential impact of COVID-19 based on the information available at this point in time and the same are in excess of the RBI prescribed norms. As a result, GNPA and NNPA ratios were lower by 10 bps and 6 bps respectively.

Bank’s subsidiary companies

HDFC Securities Limited (HSL) is amongst the leading retail broking firms in India. As on March 31, 2020, the Bank held 96.6% stake in HSL.

HDB Financial Services Limited (HDBFSL) is a non-deposit taking non-banking finance company (‘NBFC’) offering wide range of loans and asset finance products to individuals, emerging businesses and micro enterprises. As on March 31, 2020, the Bank held 95.3% stake in HDBFSL.

The consolidated net profit for the quarter ended March 31, 2020 was ₹ 7,280 crore, up 15.5%, over the quarter ended March 31, 2019. Consolidated advances grew by 20.1% from ₹ 869,223 crore as on March 31, 2019 to ₹ 1,043,671 crore as on March 31, 2020.

The consolidated net profit for the year ended March 31, 2020 was ₹ 27,254 crore, up 22.0%, over the year ended March 31, 2019.

HDFC Bank Consolidated December 2020 Net Interest Income (NII) at Rs 17,328.92 crore, up 14.55% Y-o-Y 4

January 19, 2021; Reported Consolidated quarterly numbers for HDFC Bank are:

- Net Interest Income (NII) at Rs 17,328.92 crore in December 2020 up 14.55% from Rs. 15127.65 crore in December 2019.

- Quarterly Net Profit at Rs. 8,769.33 crore in December 2020 up 14.49% from Rs. 7,659.65 crore in December 2019.

- Operating Profit stands at Rs. 16,136.25 crore in December 2020 up 17.55% from Rs. 13,727.08 crore in December 2019.

- HDFC Bank EPS has increased to Rs. 15.90 in December 2020 from Rs. 14.00 in December 2019.

References

- ^ https://www.hdfcbank.com/personal/about-us/overview

- ^ https://www.hdfcbank.com/personal/about-us/overview/our-businesses

- ^ https://www.hdfcbank.com/content/api/contentstream-id/723fb80a-2dde-42a3-9793-7ae1be57c87f/d1ddd264-8448-4376-a727-a57829040f16

- ^ https://www.moneycontrol.com/news/business/earnings/hdfc-bank-consolidated-december-2020-net-interest-income-nii-at-rs-17328-92-crore-up-14-55-y-o-y-6364061.html