HSBC Holdings plc

Summary

- HSBC is one of the largest banking and financial services organisations in the world.

- It has assets of $3.0 tn and operations in 64 countries and territories,

- The bank serves approximately 40 million customers.

- Headquartered in London, HSBC is listed on the London, Hong Kong, New York and Bermuda stock exchanges.

- HSBC announces net zero to achieve by 2050

Company Overview

HSBC (NYSE:HSBA, LSE:HSBA) is one of the largest banking and financial services organisations in the world HSBC has assets of $3.0 tn and operations in 64 countries and territories. Approximately 40 million customers bank with it and the company employ around 220,000 full-time equivalent staff. HSBC has around 187,000 shareholders in 128 countries and territories.

The company has three reporting segments

Wealth and Personal Banking (’WPB’)

The company offers customers to manage their day-to-day finances and wealth.

Commercial Banking (‘CMB’)

The company's serves domestic and international businesses with its global reach.

Global Banking and Markets (’GBM’)

The company provide a comprehensive range of financial services and products to corporates, governments and institutions.

Recent Developments

HSBC announces net zero steps

16 Mar 2022; HSBC Holdings plc (‘HSBC’) today announces plans to turn its net zero for its business across the bank.1

In 2022 the company will undertake a review of and update its wider financing and investment policies critical to achieving net zero by 2050.

Financial Highlights

HSBC Holdings plc 1Q 2022 Earnings2

- Reported profit after tax down $1.1bn to $3.4bn and reported profit before tax down $1.6bn to $4.2bn. Adjusted profit before tax down $1.6bn to $4.7bn.

- Reported revenue down 4% to $12.5bn Adjusted revenue down 3% to $12.5bn.

- Net interest margin (‘NIM’) of 1.26% increased by 5 basis points (‘bps‘) compared with 1Q21, and by 7bps compared with 4Q21.

- Reported ECL were a charge of $0.6bn, compared with a release of $0.4bn in 1Q21

- Reported operating expenses down 3%, and adjusted operating expenses down 2%.

- Customer lending balances up $9bn in the quarter on a reported basis and $21bn on an adjusted basis,

- Common equity tier 1 (‘CET1’) capital ratio of 14.1%, down 1.7 percentage points from 4Q21

- The share buy-back of up to $2bn announced at its third quarter 2021 results concluded on 20 April 2022,

2021 Full Year Results

Reported revenue of $49.6bn was $0.9bn or 2% lower than in 2020. The reduction primarily reflected a fall in net interest income as a result of the impact of lower global interest rates, notably affecting its deposit franchises in WPB and in Global Liquidity and Cash Management (‘GLCM’) in CMB and GBM. In GBM’s MSS business, revenue decreased in Global Foreign Exchange and Global Debt Markets, compared with a strong 2020, although revenue increased in Equities from higher volatility and there were favourable movements in credit and funding valuation adjustments. In addition, revenue was lower in Corporate Centre. These reductions were in part mitigated by revenue growth in Wealth in WPB of $1.2bn, notably from a net favourable movement in market impacts in life insurance manufacturing, and growth in investment distribution, asset management and new business in insurance. GBM revenue also benefited from favourable valuation gains in Principal Investments. In CMB, revenue increased in Credit and Lending as margins improved, and a recovery in trade volumes resulted in higher fee income in Global Trade and Receivables Finance (‘GTRF’).3

Reported operating expenses of $34.6bn were broadly unchanged compared with 2020. This included the impact of its cost saving initiatives, as well as lower impairments of goodwill and other intangible assets, as 2021 included a $0.6bn impairment of goodwill related to its WPB business in Latin America to reflect the macroeconomic outlook, as well as the impact of foreign exchange rate deterioration and inflationary pressures, notably on its Argentina business. However, 2020 included a $1.3bn impairment of intangible assets, mainly in Europe. There was also a $0.6bn reduction in the UK bank levy due to a change in the basis of calculation to only include the UK balance sheet rather than the global balance sheet, as well as a credit of $0.1bn relating to the 2020 charge.

Reported profit before tax of $18.9bn was $10.1bn higher than in 2020. The increase was primarily due to a net release in reported ECL, reflecting an improvement in the forward economic outlook, notably in the UK, compared with the significant build-up of stage 1 and stage 2 allowances in 2020. The company also reported an increase in the share of profit from associates, while reported operating expenses remained broadly unchanged. Reported profit after tax of $14.7bn was $8.6bn higher than in 2020.

At 31 December 2021, its total assets of $3.0tn were $26bn or 1% lower than at 31 December 2020 on a reported basis and included adverse effects of foreign currency translation differences of $46bn. Reported loans and advances to customers of $1.0tn were 61.1% as a percentage of customer accounts, compared with 63.2% at 31 December 2020, primarily reflecting growth in customer account balances.

Business Overview

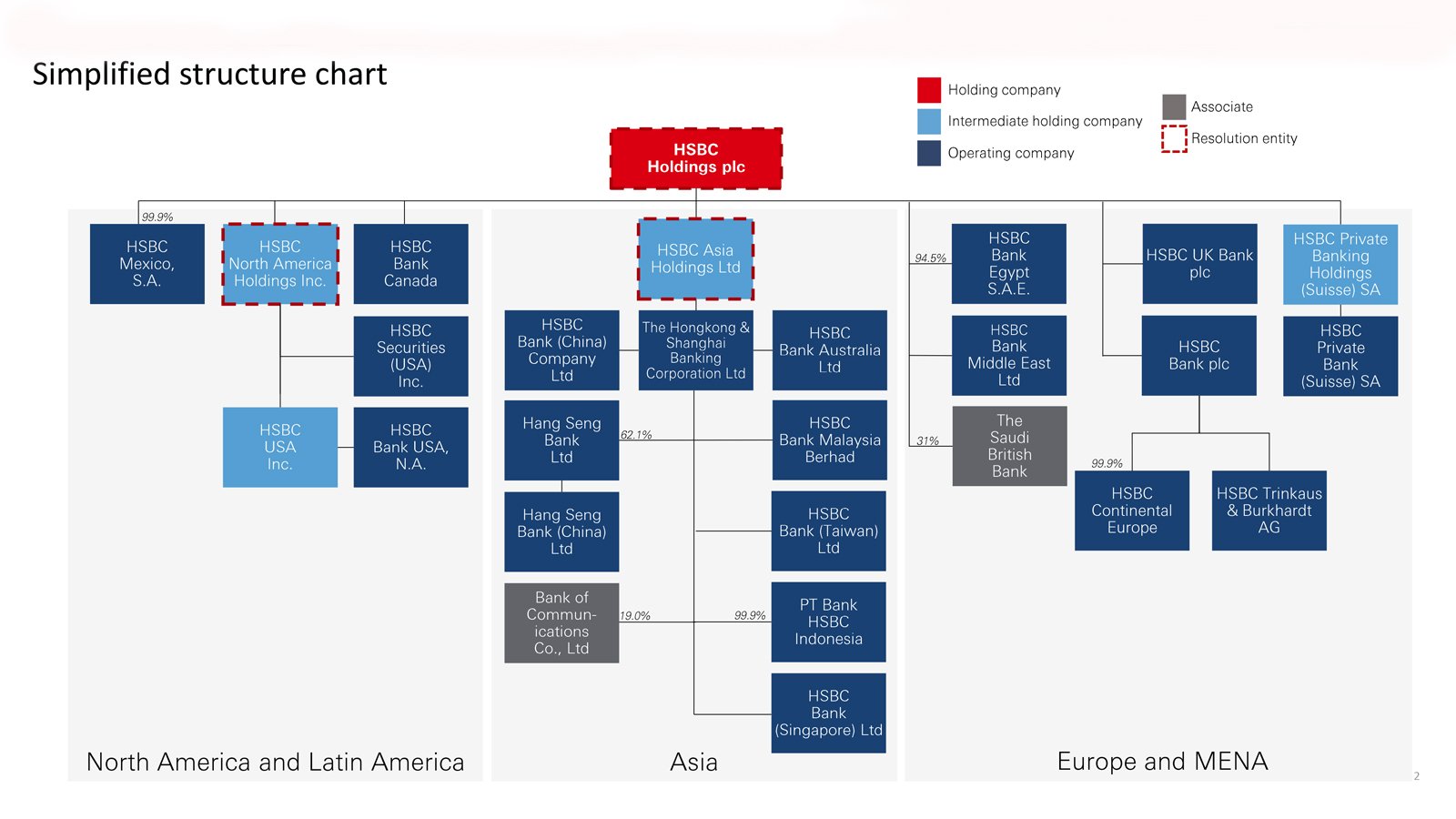

HSBC operates via a number of legal entities and branches across the world.

Global Businesses

The company's principal holding company, HSBC Holdings plc, is a public limited company incorporated in England.4

Headquartered in London, HSBC is listed on the London, Hong Kong, New York and Bermuda stock exchanges. The entities that form the HSBC Group provide a comprehensive range of financial services.

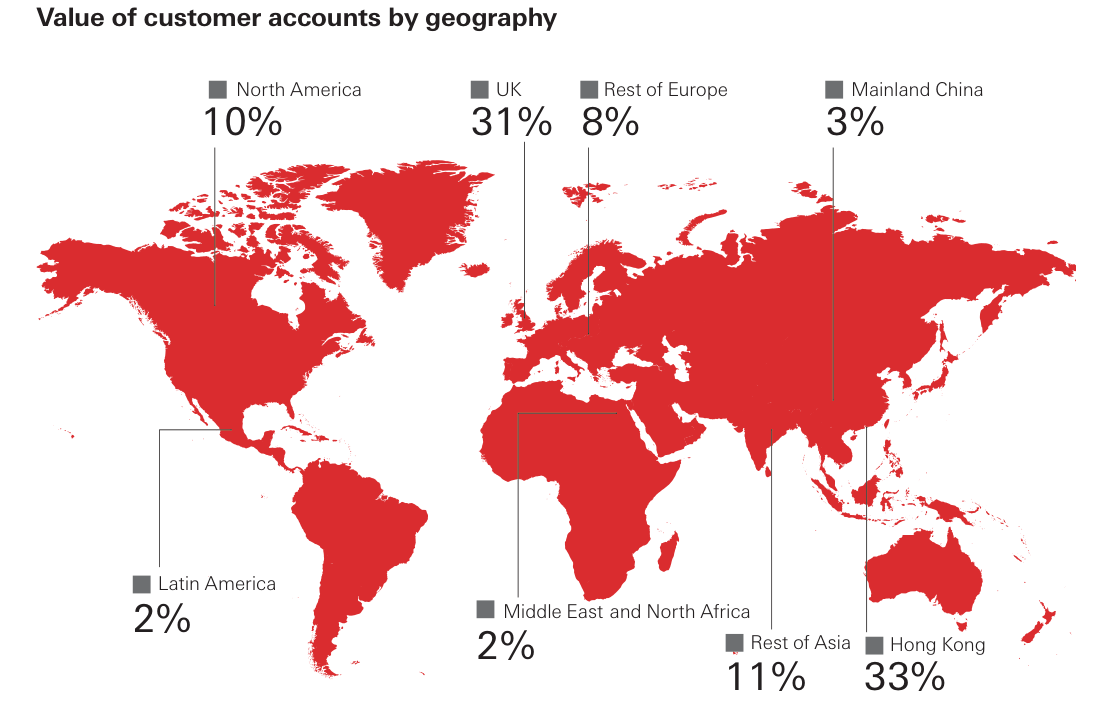

HSBC is one of the world’s largest banking and financial services organisations. The company's global businesses serve around 40 million customers worldwide through a network that covers 64 countries and territories.5

Wealth and Personal Banking

The company offer customers to take care of their day-to-day finances and wealth. The company's international network and breadth of expertise enable it to support individuals, families, business owners, investors and entrepreneurs around the world.

Commercial Banking

The company's serves domestic and international businesses with its global reach.

HSBC Commercial Banking operates in 53 countries and territories, covering the developed and developing markets that matter most to its customers.

Global Banking & Markets

HSBC Global Banking & Markets provides financial services and products to corporates, governments and financial institutions and offer a full range of banking services.

Company History

HSBC was founded by Thomas Sutherland, a young Scotsman working in Hong Kong for a large shipping firm. Sutherland decided to set up a bank that would be owned and managed locally and would support international trade. So the dynamic Scot created a prospectus and used his standing and connections in the Hong Kong business community to gain support for the venture. By the time the prospectus was published, Sutherland had the backing of 14 of the biggest firms operating in Hong Kong.

The founding capital was HKD5 million, consisting of 20,000 shares at HKD250 each. The shares sold quickly and The Hongkong and Shanghai Banking Corporation Limited was born. HSBC opened its doors in Hong Kong on 3 March 1865 and in Shanghai a month later.

By 1875, the bank had expanded into seven countries across Asia, Europe and North America. It opened branches in the ports of Yokohama, Japan; Kolkata, India; Ho Chi Minh City, Vietnam; and Manila, Philippines. The bank financed the export of a variety of exports including tea and silk from China, cotton and jute from India, and sugar from the Philippines.

The Thomas Jackson was HSBC’s Chief Manager for three periods between 1876 and 1902. The bank prospered under his management and by the turn of the 20th century was operating in 16 countries and territories. It had also expanded its government finance business and had issued many loans for government railway and other infrastructure projects, including China’s first public loan in 1874.

After the First World War, the bank expanded in Asian markets, where trade in rubber and tin was booming. The expansion of branches in Bangkok, Manila and Shanghai underlined its confidence in business in the region. But along with its customers, HSBC suffered during the Great Depression. In the 1930s, its inner reserves were drawn down and the bank focused most of its resources on survival rather than expansion. Staff bonuses were cut or cancelled and shareholder dividends were reduced.

The second half of the 20th century was a period of great change and growth for HSBC. During the 1950s the bank closed its China network – apart from its Shanghai branch – following the establishment of the People’s Republic of China. The bank started to make its first acquisitions, such as The British Bank of the Middle East. By the time of its centenary in 1965, HSBC had a network of 170 offices across the globe.

HSBC accelerated its transformation into a global business in 1959 when it bought The British Bank of the Middle East, a pioneer in the Gulf states. Later that year it also expanded its footprint in India with the acquisition of the Mercantile Bank.

In 1980, HSBC took an important step outside Asia when it bought a controlling stake in the American bank, Marine Midland. Marine had been established in Buffalo in 1850 to finance US trade in corn and wheat and had grown to become one of the most important banks in New York State. HSBC took full ownership in 1987, putting it on the path to becoming a truly global bank.

HSBC bought Midland in 1992 in one of the biggest deals in banking history. To comply with the conditions of the takeover, HSBC established HSBC Holdings plc in London as a parent company for the expanding group.

References

- ^ https://www.hsbc.com/news-and-media/media-releases/2022/hsbc-announces-net-zero-steps

- ^ https://www.hsbc.com/news-and-media/media-releases/2022/hsbc-holdings-plc-1q-2022-earnings-release

- ^ https://www.hsbc.com/-/files/hsbc/investors/hsbc-results/2021/annual/pdfs/hsbc-holdings-plc/220222-annual-report-and-accounts-2021.pdf

- ^ https://www.hsbc.com/investors/investing-in-hsbc/group-structure

- ^ https://www.hsbc.com/who-we-are/businesses-and-customers