ICICI Prudential Life Insurance Company Ltd

Company Overview

ICICI Prudential Life Insurance Company Limited (ICICI Prudential Life) (NSE: ICICIPRULI) is promoted by ICICI Bank Limited and Prudential Corporation Holdings Limited. 1

ICICI Prudential Life began its operations in the fiscal year 2001. On a retail weighted received premium basis (RWRP), it has consistently been amongst the top companies in the Indian life insurance sector. The company's Assets Under Management (AUM) at 31st March 2021 were Rs 2,142.18 billion.

At ICICI Prudential Life, the company operate on the core philosophy of customer-centricity. The company offer long term savings and protection products to meet different life stage requirements of its customers. ICICI Prudential Life has developed and implemented various initiatives to provide cost-effective products, superior quality services, consistent fund performance and a hassle-free claim settlement experience to its customers.

In FY 2015 ICICI Prudential Life became the first private life insurer to attain assets under management of Rs 1 trillion. ICICI Prudential Life is also the first insurance company in India to be listed on National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

| Year | Particulars |

| FY2001 | Company started operations |

| FY2002 | Crossed the mark of 100,000 policies |

| FY2005 | Crossed the mark of 1 million policies |

| FY2008 | Crossed the mark of 5 million policies |

| Crossed receipt of Rs 100 billion of the total premium | |

| Crossed Rs 250 billion of assets under management | |

| FY2010 | Established subsidiary to undertake pension funds related business |

| Our company turned profitable - a registered profit of Rs 2.58 billion | |

| Crossed Rs 500 billion of assets under management | |

| FY2012 | Started paying dividends |

| FY2015 | Crossed Rs 1 trillion of assets under management |

| FY2017 | First insurance company in India to list on NSE and BSE |

| FY2021 | Crossed Rs 2 trillion of assets under management |

Insurance Plans

Term Insurance Plan

ICICI Pru iProtect Smart Term Plan

ICICI Pru SARAL JEEVAN BIMA

ICICI Pru iCare II

ICICI Pru Precious Life

ICICI Pru Life Raksha

ICICI Pru POS - iProtect Smart

ICICI Pru POS - Life Raksha

Health Insurance Plans

ICICI Pru Heart/Cancer Protect

Unit Linked Insurance Plans

ICICI Pru Signature (Online)

ICICI Pru Signature

ICICI Pru 1 Wealth

ICICI Pru LifeTime Classic

ICICI Pru Guaranteed Wealth Protector

ICICI Pru Smart Life

ICICI Pru Smart Kid Plan

ICICI Pru Smart Couple Plan

Traditional Savings/Money Back Plans

ICICI Pru Guaranteed Income For Tomorroow

ICICI Pru Cash Advantage

ICICI Pru Savings Suraksha Endowment Plan

ICICI Pru Assured Savings Insurance Plan

ICICI Pru Future Perfect Endowment Plan

ICICI Pru Lakshya Wealth

ICICI Pru Lakshya Lifelong Income

Retirement Plans

ICICI Pru Easy Retirement

ICICI Pru Guaranteed Pension Plan(Deferred Annuity)

ICICI Pru Guaranteed Pension Plan(Immediate Annuity)

ICICI Pru Easy Retirement Single Premium

Riders

ICICI Pru Corona Protect Rider

Group Plans

ICICI Pru Loan Protect Plan

ICICI Pru Loan Protect Plan Plus

ICICI Pru Group Term Plus

ICICI Prudential Group Immediate Annuity Plan

ICICI Pru Group Loan Secure

ICICI Pru Group Insurance Scheme for PMJJBY

ICICI Pru Shubh Raksha Credit

ICICI Pru Shubh Raksha One

ICICI Pru Shubh Raksha Life

ICICI Pru Super-Credit

ICICI Pru Super Protect Life

ICICI Pru Group Unit Linked Superannuation

ICICI Pru Group Unit Linked Employee Benefit Plan

ICICI Pru Group Suraksha Plus

ICICI Pru Group Suraksha Plus Superannuation

Rural Plans

ICICI Pru Sarv Jana Suraksha

ICICI Pru Anmol Bachat

Industry Overview

Insurance industry structure

The size of the Indian life insurance sector was Rs 5.1 trillion on a total premium basis in FY2019, making it the tenth-largest life insurance market in the world and the fifth-largest in Asia. The total premium in the Indian life insurance sector grew at a CAGR of approximately 15% between FY2002 and FY2019 outpacing the GDP CAGR of 13% during the same period. Based on retail weighted received premium (RWRP), new business premium of the industry has grown at a CAGR of 11% during FY2002 to FY2020. 2

The Indian Life Insurance industry has 24 companies including Life Insurance Corporation of India (LIC). The top 5 private sector companies contribute to 39.7%9 of the market.

Agency channel continues to be the predominant channel for the industry, mainly driven by LIC. There has been no significant change in the channel mix of the industry as well as the private sector from FY2019 to 9MFY2020. Increasingly, direct sales through

life insurance industry

Within Indian financial services, the life insurance industry is uniquely positioned to cover a range of customer needs. The industry can offer a variety of savings products across fixed income and equity platforms. It can also offer annuity, term plans and defined benefit health plans. The life insurance industry acts as a risk manager by providing cover against mortality and morbidity risks. Life insurance products ensure that the financial goals of an individual are met, irrespective of the occurrence of mortality or morbidity events. At December 2019, the industry had covered 253 million lives through Individual policies and 428 million through group policies.

The Indian life insurance industry plays a key role in channelising household savings to the financial markets. The industry has been able to leverage its extensive distribution network throughout the country to provide long - term funds to both debt and equity markets. The life insurance industry also provides long-term capital needed for infrastructure projects.

Insurance under-penetration

India continues to be an underpenetrated insurance market with a life insurance penetration11 (premium as % of GDP) of 2.7% in FY2019 as compared to a global average of 3.3%. At USD 54 in FY2019, the insurance density11 (premium per capita) in India also remains very low as compared to other developed and emerging market economies. The macroeconomic factors such as growth in GDP and rise in per capita income, coupled with India’s young and working population, higher financial savings as a percentage of GDP, increasing urbanisation and increase in digitalisation would continue to aid the growth of the Indian life insurance sector.

Favourable demographics

According to United Nations estimates, the working population is expected to increase by 26% by the year 2030. With a median age of 28 years, India has a very young population, especially compared to countries such as Japan, USA and China. These factors are likely to increase demand for life insurance products.

Increasing urbanization

According to United Nations Population division estimates, India’s urban population is expected to increase by 42% by the year 2030. Increased urbanisation can lead to an improvement in the standard of living and better access to financial products such as life insurance.

Financial savings

India has a large pool of household savings and in FY2019, the ratio of household savings to GDP was 18.2%. The share of gross financial savings as a proportion of household savings was 57.9% n FY2019. The share of life insurance as a proportion of financial savings (excluding currency) in India reached its peak level at 29.0% in FY2010. However, with regulatory changes in the sector and a downturn in the economic environment, the share of life insurance declined sharply to the lowest share of 18.8% of financial savings in FY2014. In FY2018, the share of life insurance increased to 23.3%, aided by the improving customer value proposition of insurance products.

High protection gap

According to Swiss Re, Mortality Protection Gap for India is at USD 8.56 trillion which is high compared to the rest of the world. Protection coverage ratio which is the ratio between protection gap and protection needs is also very high for India. Sum assured to GDP is also a measure of protection coverage in a country and sum assured to GDP ratio is significantly lower in India compared to the rest of the world. This provides significant opportunities for Indian life insurance companies to expand their protection business.

Retail credit has been growing at a CAGR of 16.3% from FY2013 to FY2019. This provides an additional opportunity for the industry for the credit cover business. This product provides mortality/morbidity cover to borrowers.

Industry in FY2020

New business premium (NBP) for the industry, based on retail weighted received premium (RWRP), grew 6.2% from Rs 691.83 billion in FY2019 to Rs 734.88 billion in FY2020. The market share of private players decreased from 58.0% in FY2019 to 57.2% in FY2020.

Financial Overview

Despite the challenges posed by the pandemic, ICICI Prudential Life Insurance posted a strong growth in the quarter ended March 31, 2021. New business Annualised Premium Equivalent (APE) grew 27% year-on-year in Q4-FY2021 to Rs 25.09 billion, on the back of 108% year-on-year growth in March 2021 to Rs 11.01 billion. 3

New business sum assured grew by 22% year-on-year in Q4-FY2021 along with an expansion in new business premium by 23% in the same period. Significantly, the Company was able to strengthen its position as the private sector market leader in terms of new business sum assured, with a market share of 13% in 11M-FY2021, up from 11.8% for FY2020.

The Value of New Business (VNB) for the quarter grew by 26% year-on-year to Rs 5.91 billion. VNB for FY2021 stood at Rs 16.21 billion with a margin of 25.1%, up from 21.7% for FY2020.

The focus on maintaining Balance Sheet resilience through a robust risk management mechanism and investment policy has helped ensure zero Non Performing Assets (NPAs) since inception and across market cycles. The solvency ratio stood at 217% on March 31, 2021, well above the regulatory requirement of 150%. Assets under Management stood at Rs 2,142.18 billion at March 31, 2021, a growth of 40% over March 31, 2020. This is an outcome of the growth in new business, strong persistency and robust fund management.

Profitability

Value of New Business (VNB) for FY2021 was Rs 16.21 billion. With an APE of Rs 64.62 billion, VNB margin was 25.1% for FY2021 as compared to 21.7% for FY2020. The increase in VNB margin is primarily on account of growth in non-linked business and increase in protection mix.

The Company’s profit before tax was Rs 10.81 billion for FY2021, a growth of 1.1% as compared to Rs 10.69 billion for FY2020. Tax charge increased from Nil in FY2020 to Rs 1.21 billion in FY2021 on account of withdrawal of dividend exemption and no final dividend paid by Company for FY2020, resulting in a higher taxable surplus. The Company’s profit after tax was Rs 9.60 billion for the year ended March 31, 2021 as compared to Rs 10.69 billion for the year ended March 31, 2020.

Embedded Value

The company's Embedded Value at March 31, 2021 was Rs 291.06 billion compared to Rs 230.30 billion at March 31, 2020, a growth of 26.4%, led by 29.0% growth in the VIF.

New business growth

New business premium was Rs 51.33 billion for Q4-FY2021, a growth of 22.9% as compared to Rs 41.76 billion for Q4-FY2020. As a result, new business premium was Rs 130.32 billion for FY2021 as compared to Rs 123.48 billion for FY2020. APE was Rs 64.62 billion for FY2021 as compared to Rs 73.81 billion for FY2020.

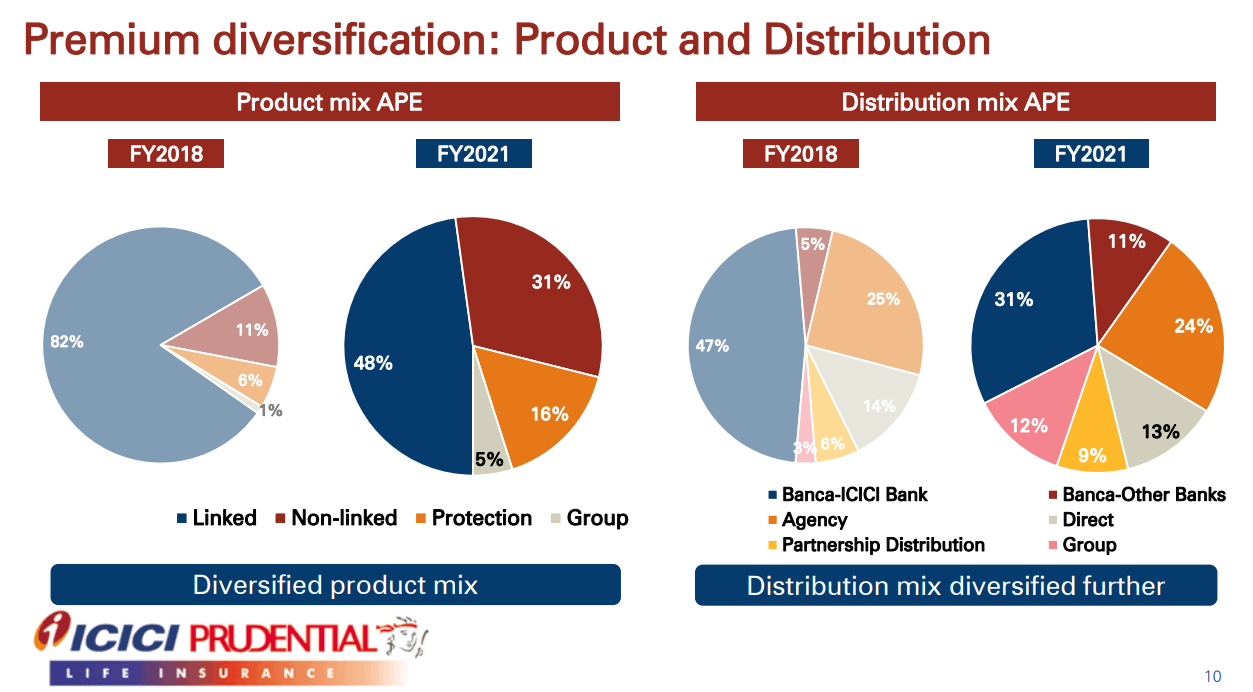

Product mix

The Company offers a range of products across protection and savings solutions to meet the specific needs of customers. During FY2021, the protection APE was Rs 10.46 billion resulting in an improvement in share of APE from 15.1% for FY2020 to 16.2% in FY2021. Retail traditional savings APE grew by 61.2% from Rs 12.46 billion in FY2020 to Rs 20.08 billion in FY2021, resulting in an improvement in share of APE from 16.9% in FY2020 to 31.1% in FY2021.

As a result, new business sum assured was Rs 2,051.84 billion for Q4-FY2021, a growth of 22.1% as compared to Rs 1,681.02 billion for Q4-FY2020. The new business sum assured was Rs 6,166.84 billion for FY2021, a growth of 8.0% as compared to Rs 5,711.84 billion for FY2020.

Persistency

The Company has strong focus on improving the quality of business and customer retention which is reflected in 13th month persistency ratios. The company's 13th month and 61st month persistency at 11M-FY2021 stand at 84.8% and 58.3% respectively.

Cost efficiency

The cost to Total weighted received premium (TWRP) ratio stood at 14.8% in FY2021 compared to 15.9% in FY2020. The cost to TWRP for the savings business stood at 9.6% in FY2021 compared to 10.4% in FY2020.

Assets under management

The total assets under management of the Company was Rs 2,142.18 billion at March 31, 2021, a growth of 40.0% over Rs 1,529.68 billion March 31, 2020. The Company had a debt-equity mix of 55:45 at March 31, 2021. 96.8% of the debt investments are in AAA rated securities and government bonds.

Net worth and capital position

The Company’s net worth was Rs 91.19 billion at March 31, 2021. The solvency ratio was 216.8% against regulatory requirement of 150%.

Mr. N S Kannan, MD & CEO, ICICI Prudential Life Insurance said; “Despite the disruptions caused by Covid-19, the company were able to demonstrate resilience in its operations. In this quarter, APE grew by 27% year-on-year with the month of March posting the best ever monthly sales for the Company in any year since inception.

ICICI Prudential Life was able to capitalise on opportunities to build a well diversified product portfolio, on the back of 114.1% and 214.7% year-on-year growth in the traditional savings and annuity product segments respectively in Q4-FY2021. The strong performance was driven in equal measure by over 100 valuable partnerships forged this year, as part of its strategy to deepen and widen distribution.

As a result, VNB grew by 26% year-on-year to Rs 5.91 billion for Q4. The VNB margin for the year improved to 25.1%, while the Embedded Value also grew 26.4% to Rs 291.06 billion during the year.

Throughout the pandemic-affected year, the company focussed on putting in place the building blocks for growth. The company's resilient Balance Sheet with zero NPAs since inception, robust risk management strategies and a strong solvency ratio of 217% provide a solid foundation for future growth. Together with its growth momentum in Q4 and its well diversified product and distribution mix, the company believe ICICI Prudential Life is well poised to achieve its stated objective to double its FY2019 VNB by FY2023, i.e. in 4 years.”