Imperial Brands

Summary

- Imperial Brands is the fourth largest international tobacco company.

- The company has a network of 31 manufacturing sites that source and process tobacco raw materials to provide high quality products.

- The company also have powerful corporate brands: Imperial Tobacco, ITG Brands in the USA, Fontem Ventures and Logista.

Company Overview

Imperial Brands (OTC:IMBBF, LSE:IMB) is a global consumer-focused organisation and the fourth largest international tobacco company.1

The world’s one billion adult smokers are seeking new and potentially less harmful products and, across 120 markets, Imperial Brands is working to meeting their diverse and evolving needs.

The company celebrate the enduring success of its iconic, much-loved tobacco brands. At the same time, Imperial Brands is innovating to create potentially lower-risk products, delivering increasingly satisfying experiences for consumers.

Subsidiaries

The company's business is built around great consumer brands. The company also have powerful corporate brands: Imperial Tobacco, home to most of its tobacco subsidiaries around the world, ITG Brands in the USA, Fontem Ventures and Logista.2

Imperial Brands has a network of 31 manufacturing sites that source and process tobacco raw materials to provide high quality products at lowest cost

Imperial Tobacco

The company's Imperial Tobacco subsidiaries manufacture and market a range of cigarettes, fine cut and smokeless tobacco products, mass market cigars, and tobacco accessories such as papers and tubes.

Key Imperial Tobacco subsidiaries include Reemtsma in Germany, Altadis in Spain and its businesses in the UK and Australia.

ITG Brands

The company's dynamic business in the USA combines its former Commonwealth-Altadis operations with assets acquired from Reynolds American in 2015.

ITG Brands is the third largest tobacco company in the USA, which is a key market for Imperial Brands.

The business is headquartered in Greensboro, North Carolina and offers a broad portfolio of well-known cigarette and mass market cigar brands.

Fontem Ventures

Fontem Ventures is its vaping subsidiary, headquartered in Amsterdam and supported by the Nerudia research and development centre in Liverpool.

Fontem Ventures and Nerudia are focused on driving vaping technology forward to deliver potentially less harmful alternatives to combustible cigarettes.

Logista

Logista is one of the largest distribution businesses in Europe, serving 300,000 outlets across Spain, France, Italy, Portugal and Poland.

The business services tobacco and non-tobacco customers and has established a long track record of delivering sustainable value.

The Logista team continues to focus on managing costs and generating new growth opportunities to drive the profitable development of the business.

Logista is listed on the Spanish Stock Exchanges. Imperial Brands holds a majority share of the business through its subsidiary Altadis S.A.U.

Brands

The company's strong and broad portfolio gives it a presence in all key tobacco and next generation product segments. The company continue to reshape its brand portfolio to meet evolving consumer preferences.3

Among its notable cigarette brands are JPS, West, Davidoff and Gauloises, as well as Winston and Kool in the US.

Imperial Brands has a promising heated tobacco proposition with Pulze and in blu, Imperial Brands has a vapour offering that has strength in the US and Europe.

Business Segments

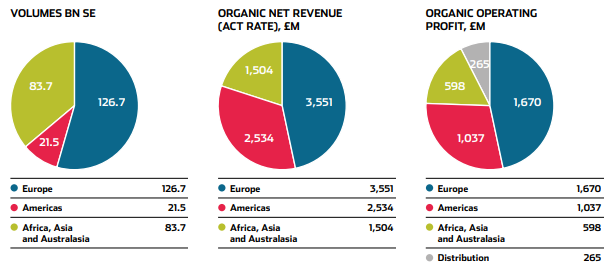

Europe Region

Europe delivered gains in regional market share and a 5.6 per cent increase in adjusted operating profit. These results have been achieved despite COVID-19 restrictions reducing travel and affecting market and channel trends, particularly the global duty free channel. Stronger market size trends in Northern Europe, together with share growth in the UK and Spain and improved NGP performance, were partly offset by lower sales in its global duty free business, despite a small second-half recovery, and in traditional holiday destination markets in Southern Europe.4

Share gains in the UK and Spain were driven by its tobacco portfolio work and a new strategic focus on local jewel brands, such as Embassy and Nobel. In Germany, investments in enhancing the effectiveness and coverage of its sales force and distribution have driven an encouraging improvement in market share trend in recent months. It will take time though for its brand initiatives and portfolio investments to rejuvenate its overall share performance.

Tobacco volumes decreased by 2.6 per cent, driven by relative market size improvements in the Northern Europe markets of UK, Germany and Norway from consumers staying at home. A gradual recovery from COVID-19 led to a modest increase in travel numbers in the second half and a small improvement to its global duty free sales and southern European markets.

Americas Region

The company delivered a strong combustible tobacco performance in the US, which is its largest single market, contributing 33 per cent of Group net revenue. Market fundamentals remain attractive, with strong cigarette pricing continuing to offset relatively reduced rates of tobacco market size decline as well as further growth in the mass market cigars segment.

Imperial Brands has increased investment behind its strategic priorities, including the recruitment and training of 200 additional sales people to enhance its coverage and distribution. Imperial Brands has also invested in brand initiatives for Winston, which Imperial Brands is trialling in Texas.

The investment and additional focus on performance management delivered a third consecutive year of share gains in the US cigarette market, up 20 basis points, to 9.1 per cent. Share growth has been driven by Sonoma and Crowns in the deep discount segment, while Imperial Brands has maintained Winston and Kool’s share of their sub-premium categories and managed the ongoing decline in its non-focus brands

Tobacco volumes were up 1.1 per cent, driven by strong mass market cigar growth, which more than offset the more moderate cigarette volume declines.

The company's mass market cigar portfolio performed well with volumes up 45 per cent and share growth of 500 basis points driven by Backwoods and the launch of a Dutch Leaf variant in the value segment. Imperial Brands is now established as the second largest manufacturer in the US market, having been number four a year ago. Sales in the premium natural leaf segment have benefited from increased activations and limited edition launches of Backwoods. Overall mass market cigar performance also benefited from manufacturing and investments in improved leaf supply

On a constant currency basis, tobacco net revenue increased by 10.4 per cent, benefiting from strong cigarette pricing and the success of its mass market cigar sales in a growing category

The company's NGP revenues were down 15.5 per cent on a constant currency basis, with second half revenues affected by the increasingly competitive environment with greater discounting in the category. In the second half, the company launched a pilot to test a new consumer marketing proposition for blu, with a new packaging and consumer communication approach.

Adjusted operating profit was 8.0 per cent higher at constant currency, driven by the strong growth in mass market cigar sales, tobacco pricing and lower NGP write-offs. Profitability was also impacted by a £52 million charge for litigation settlement costs in Minnesota and Texas, which removes uncertainty at a reasonable cost. Excluding these settlement costs, adjusted operating profit grew by 13.1 per cent at constant currency.

Africa, Asia and Australasia Region

The company's results were affected by two events: the sale of the Premium Cigar Division in October 2020 and changes to the Australian excise regime. Notwithstanding these impacts, its Africa, Middle East and Asia regions reported solid performances and supported a 30 basis point improvement in overall regional share

The results presented here are on an organic basis, excluding the contribution from the Premium Cigar Division in both periods to aid comparison of performance on a like-for-like basis. The impact of the divestment is analysed in notes 3, 6 and 10 of the financial statements on adjusted performance measures.

The company's performance was also affected by changes in the Australian excise regime, which resulted in an impact on net revenue and adjusted operating profit of £88 million. This has been driven by the Australian Government’s decision to step away from the 12.5 per cent annual excise duty accelerator and the associated reduction in inventory levels and the phasing of stock profit. Looking ahead, there will be a further net headwind of c. £10 million to net revenue and adjusted operating profit in the first half of FY22 as the lower stock profit is partially offset by favourable inventory movements.

The Africa region continues to be an attractive portfolio of markets with opportunities for further value growth. Gauloises gained share in Morocco by leveraging its international brand equity, while its focus on local jewel brands delivered share gains in Burkina Faso and the Côte d’Ivoire.

The company's results in the Middle East were driven primarily by Saudi Arabia, where travel restrictions benefited its domestic sales, driving a good performance of Davidoff and West with strong demand for fresh seal formats.

In Asia, the company delivered a stable performance in Taiwan driven by share growth of the Davidoff Absolute range supported by its strong equity and by West, which has benefited from value seeking consumers.

Organic tobacco volumes were 4.2 per cent lower, with volume declines in Turkey and Australia, partially offset by market share-driven volume gains in Morocco, the Côte d’Ivoire and Saudi Arabia.

The company's organic financial results were affected primarily by the excise duty changes in Australia. Organic tobacco price mix of -2.6 per cent contributed to the tobacco net revenue decline of 6.8 per cent at constant currency, primarily reflecting the Australian excise duty changes. Excluding this impact, organic tobacco price mix was up 2.7 per cent and tobacco net revenue was down 1.5 per cent.

NGP net revenues declined 78.3 per cent at constant currency, reflecting its strategic decision to exit the vapour market in Russia and Japan and the heated tobacco market in Japan, as the company prioritise investment in other market category combinations in line with its strategy.

Organic adjusted operating profit was down 4.7 per cent at constant currency, primarily reflecting the excise duty changes in Australia.

Distribution

Logista has continued to distribute products to customers with almost all the points of sale, products and services classified as essential by governments, even during the periods when COVID-19 still restricted movements in many of its end markets.

Net revenue grew 5.8 per cent at constant currency driven by growth in all markets and activities except tobacco distribution in France and Portugal. Pharmaceutical distribution, parcel transport (Nacex) and the distribution of convenience products in Spain and Italy recorded double-digit growth. Adjusted operating profit increased 14.8 per cent at constant currency due to efficiency improvement initiatives

The adjusted operating profit contribution to the Group, after eliminations, increased by 11.3 per cent. This reflects the positive performance of Logista’s adjusted operating profit delivery as outlined above, the benefit of inventory valuations following tax and price movements in tobacco products and the recovery from negative COVID-19 impacts last year

In line with other Imperial-owned entities, the company continue to benefit from an intercompany cash pooling arrangement with Logista, which further enhances the Group’s liquidity. On a 12-month basis, the daily average cash balance loaned to the Group by Logista was £2.0 billion, with movements in the cash position during the 12-month period varying from a high of £4.0 billion to a low of £1.3 billion, primarily due to the timing of excise duty payments. At the period end, the loan position was £1.8 billion compared to £2.4 billion at 30 September 2020.

Financial Highlights

For the year ended 30 September 2021 Reported revenue at £7,589m. Reported Group operating profit of £3,146 million grew 15.2%, driven by gains on disposal of the Premium Cigar Division.

Tobacco and NGP adjusted operating profit grew £142m or 4.3% at constant currency. Tobacco organic adjusted operating profit was down £42 million (-1.2%) at constant currency. Strong underlying performance, led by mass market cigar volumes and pricing, was more than offset by lower stock profit in Australia (£88 million) and a charge to meet US state litigation (PSS) costs (£52 million). NGP losses reduced by £184 million or 57% as the company optimised investment and as prior year write-downs (£124 million) were not repeated to the same extent.

Reported EPS increased 89.5% to 299.9 pence driven by marked to market foreign exchange accounting gains on financial instruments caused by a 6.0% weakening in the euro against sterling and the year-on-year impact of the Premium Cigar Division disposal. Organic adjusted EPS was 246.5 pence, up 2.8% at constant currency due to lower NGP losses, partially offset by an increase in the effective tax rate to 22.6%. Adjusted net finance costs are impacted by the buyback of a $1.25 billion US bond, with corresponding savings expected in 2022.

Cash flows from operating activities were £2,167 million (2020: £4,030 million), impacted primarily by an expected working capital outflow driven by changes to duty payment dates that the company announced in 2020.

The £257 million restructuring charge in 2021 comprised £226 million for the 2021 Strategic Review Programme, £23 million for COP I and II and £8 million of other costs that mainly related to Logista.

Adjusted net finance costs were lower at £417 million (2020: £429 million), reflecting lower adjusted net debt balances during the year. Reported net finance income was £81 million (2020: costs of £610 million), incorporating the impact of net fair value and exchange gains on financial instruments of £496 million (2020: losses of £176 million) and postemployment benefits net financing income of £2 million (2020: costs of £5 million). The gains on financial instruments primarily stem from foreign exchange accounting gains of £445 million as the value of euro financial instruments increased after sterling strengthened 6.0 per cent against the euro during the year

The company's adjusted effective tax rate is 22.6 per cent (2020: 20.7 per cent) and the reported effective tax rate is 10.2 per cent (2020: 28.1 per cent). The increase in the adjusted effective tax rate was due to a less favourable profit mix and remeasurement of UK deferred tax balances. The adjusted tax rate is higher than the reported rate due to recognition of tax credits arising on an internal reorganisation of the Group’s Spanish business and limited tax arising on both foreign exchange gains that arise on consolidation and on the disposal gain on the Premium Cigar Division disposal.