Imperial Oil

Summary

- Imperial Oil is Canada's largest refiner of petroleum products.

- Imperial Oil is an integrated energy company, we explore for, produce, refine and market products essential to society.

- Canada, as a country, was only 13 years old when The Imperial Oil Company was formed by 16 oil refiners in Ontario.

- The company refine raw hydrocarbons into about 650 petroleum products essential to consumers and businesses: gasoline, diesel, heating oil, natural gas, lubricants, and chemicals used to make plastics.

Company Overview

Imperial Oil (NYSE:IMO, TSX:IMO) is an integrated energy company, the company explore for, produce, refine and market products essential to society.1

Since 1880 Imperial has consistently demonstrated unwavering high standards, pioneering Canadian spirit, innovation and leadership in the challenging energy industry.

In its upstream business, Imperial Oil is contributing to reliable, affordable supplies of oil and gas for Canadians. From coast to coast to coast the company play a major role in developing Canada's oil and gas resources, investing billions of dollars to select the highest quality resources from opportunities in diverse geological and geographical environments.

Imperial Oil is Canada's largest refiner of petroleum products. The company refine raw hydrocarbons into about 650 petroleum products essential to consumers and businesses: gasoline, diesel, heating oil, natural gas, lubricants, and chemicals used to make plastics. It’s hard to imagine life without the products manufactured from hydrocarbons. They fuel its economies, heat its homes and make its lives easier and more enjoyable. Like you, Imperial Oil is concerned about the effects of chemicals on health and the environment and Imperial Oil has integrated Responsible Care® into its business practices.

Imperial offers these products and services to consumers across Canada as well as in export markets. In total, the company manufacture and sell about a quarter of the petroleum products used every day by Canadians. Imperial Oil is a leading marketer of fuels, lubricants, asphalts and specialty products.

Company History

Canada, as a country, was only 13 years old when The Imperial Oil Company was formed by 16 oil refiners in Ontario. As Canada has grown, Imperial has grown with it, sharing its prosperity and weathering the tough times.2

| Year | Milestone |

| 1880 | Sixteen southwestern-Ontario refiners form The Imperial Oil Company in London, Ontario, to find, produce and distribute petroleum products in Canada. |

| 1883 | Imperial operations move to Petrolia, Ontario, after lightning strikes the London refinery. |

| 1897 | Imperial Oil acquired the Bushnell refinery in Sarnia and began rebuilding it. |

| 1907 | Imperial opens Canada's first service station in Vancouver, British Columbia, where gasoline was dispensed by a garden hose. |

| 1916 | Imperial builds refineries in Regina and Montreal. Pictured: Aerial view of the Montreal Refinery. |

| 1920 | Imperial discovers oil at Fort Norman (now Norman Wells), N.W.T., on the Mackenzie River. |

| 1923 | Imperial begins operations at the Calgary refinery. |

| 1924 | Imperial hires Dr. Reginald Stratford to found the company, and industry’s, first research department. |

| 1928 | Charles Lindbergh buying Imperial Oil gasoline for his plane in Quebec City, Quebec. |

| 1942 | Imperial joins the Canadian and U.S. governments in Canol, a project to provide fuel for the U.S. war effort in the northern Pacific. |

| 1947 | Imperial discovers oil at Leduc, marking the beginning of Western Canada’s great oil development. |

| 1955 | Imperial establishes a chemical product department in Sarnia. |

| 1955 | Imperial’s first research centre in western Canada opens in Calgary. |

| 1989 | Imperial purchases Texaco Canada Inc. At the time, it was the second-largest corporate acquisition in the nation’s history. |

| 2004 | Imperial moves its head office to Calgary from Toronto. |

| 2007 | Imperial and ExxonMobil Canada acquire a multi-year exploration license, covering more than 500,000 acres, to explore for hydrocarbons in the Beaufort Sea. |

| 2012 | Imperial announces approval of an expansion of the company’s Cold Lake operation in northeastern Alberta, called Nabiye. |

| 2013 | Imperial announces the start-up of the initial development of the Kearl oil sands project. |

| 2015 | Imperial announces the successful startup of the Kearl oil sands expansion project, ahead of schedule. |

| 2016 | Imperial moves to a new campus-style office complex in southeast Calgary. A new, state-of-the-art, oil sands research centre in southeast Calgary also opens. |

| 2017 | First Mobil-branded service stations open in Canada. |

| 2018 | Imperial becomes the official fuel partner of PC Optimum loyalty program, allowing customer to earn PC Optimum points at over 2,000 Esso and Mobil stations across the country. |

| 2019 | Imperial announces multi-year agreement with the NHL, naming Esso the Official Retail Fuel of the NHL in Canada. The company also launches a nation-wide commercial and campaign “How far will you go” focusing on the hockey journey. |

Products and services

- Asphalt

- Chemical products

- Esso and Mobil stations

- Esso Commercial Cardlocks

- Lubricants

- Marine

- Safety Data Sheets

- Wholesale fuels

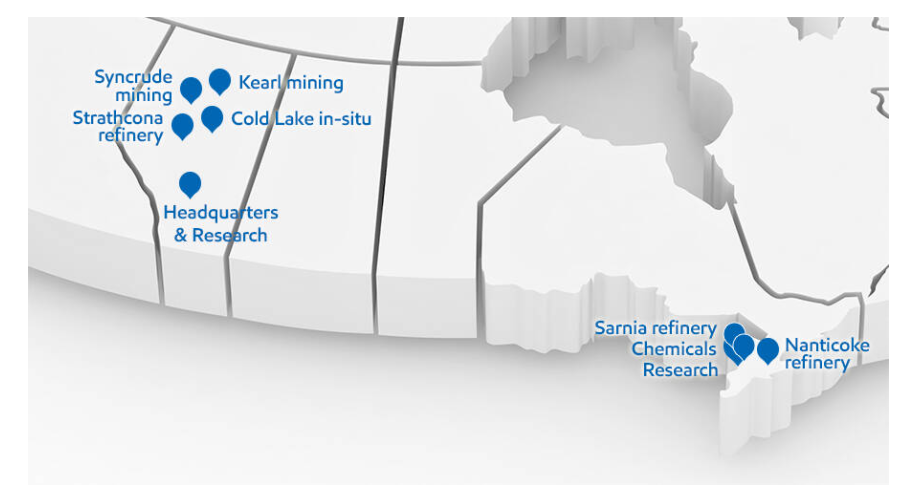

Operations Overview

The company explore for, produce, refine and market energy products which are essential to Canadians.3

Oil sands

Canada’s oil sands represent a tremendous source of secure, accessible and affordable energy to help strengthen global energy security. Imperial Oil is deploying next-generation technologies to develop this important resource.

Cold Lake in situ

Cold Lake operations is one of the largest in situ operations in the world. Sitting on a large, high-quality resource base, this highly efficient operation has continued growth potential and a track record of best-in-class operating performance.

Kearl mining

Kearl is considered one of Canada’s highest-quality oil sands deposits and is being developed using next generation mining techniques. With an estimated 4.6 billion barrels of recoverable bitumen resource, Kearl will help meet North America’s energy needs for the next 40+ years.

Syncrude mining

Imperial owns 25 percent of Syncrude Canada – a pioneer in oil sands mining. With high-value production and improvement actions ongoing, Syncrude is a strategic asset in its company’s portfolio.

Refining

Imperial Oil is Canada’s largest petroleum refiner. The company's refineries are where oil becomes something greater. Something useful, like fuel, asphalt, motor oil, waxes, and various chemicals and gases.

Strathcona refinery

Located on the outskirts of Edmonton, Alberta, Imperial’s Strathcona refinery has been supplying fuels and products for more than 60 years.

Nanticoke refinery

Approximately 25 percent of petroleum products sold in Ontario originate from the Nanticoke refinery. The refinery supplies the Quebec, Ontario and US markets with a variety of essential products. The Nanticoke refinery is located in southwestern Ontario.

Sarnia refinery

Imperial's Sarnia operation is located in southwestern Ontario and is the most integrated fuels and chemicals manufacturing and petroleum research facility in Canada.

Other operations

Norman Wells

The company's facilities include producing wells drilled from natural and artificial islands, and a central processing facility, which also generates electricity for the town of Norman Wells.

Edmonton rail terminal

The Edmonton rail terminal, next to Imperial’s Strathcona refinery, is a joint venture operated by Pembina Pipeline that started up in April 2015.

Sable

After more than 20 successful years, the Sable project ended production on December 31, 2018.

Pipelines and distribution

The company supply reliable and affordable energy to millions of people, providing fuels that generate heat, light and transportation and provide the building blocks for many products Canadians use every day.

XTO Energy Canada

Imperial is a 50-50 partner with ExxonMobil Canada in XTO Energy Canada (formerly Celtic Exploration).

Chemicals

Imperial Oil is one of Canada’s largest producers of petrochemicals. The company's Chemical mission is to provide quality petrochemical products and services efficiently and responsibly and to generate outstanding customer and shareholder value while remaining committed to the principles of sustainability.

Fuels and Lubricants marketing

Premium brands, a nationwide network of 1,700 service stations and valued customer offerings are the cornerstones of Imperial’s Fuels and Lubricants business.

Innovation and research

Technology and innovation are fundamental to unlocking the potential of future company growth opportunities. For more than a century, Imperial has been investing in research to enhance environmental performance, improve efficiency and augment bitumen recovery.

Reserves

Oil and gas reserves at year-end

| Liquids | Natural gas | Synthetic oil | Bitumen | Total oil-equivalent basis | |

| Net proved reserves: | millions of barrels | billions of cubic feet | millions of barrels | millions of barrels | millions of barrels |

| Developed | 14 | 205 | 326 | 1957 | 2331 |

| Undeveloped | 2 | 76 | 112 | 259 | 386 |

| Total net proved | 16 | 281 | 438 | 2216 | 2717 |

Financial Highlights

Net income in 2021 was $2,479 million, or $3.48 per share on a diluted basis, compared to a net loss of $1,857 million or $2.53 per share in 2020. Prior year results include unfavourable identified items of $1,171 million after tax, related to the company's decision to no longer develop a significant portion of its unconventional portfolio.

- Fourth quarter net income of $813 million with cash flow from operating activities of $1,632 million and free cash flow of $1,233 million

- Highest annual Upstream production in over 30 years, underpinned by record annual Kearl production and continued strong production performance at Cold Lake

- Continued fuel demand recovery with full-year Downstream refinery capacity utilization of 89 percent

- Highest full-year Chemical earnings in over 30 years

- Record shareholder returns of nearly $3 billion in 2021 through dividend payments and share repurchases under the company’s normal course issuer bid program

- Quarterly dividend increased by 26 percent from 27 cents to 34 cents per share

- Announced plans for 2030 oil sands greenhouse gas emission intensity reduction in support of its goal to achieve net zero emissions in its operated oil sands assets by 2050

Imperial reported estimated net income in the fourth quarter of $813 million and cash flow from operating activities of $1,632 million, down from net income of $908 million and cash flow from operating activities of $1,947 million in the third quarter of 2021. Fourth quarter results reflect continued strong operating performance and commodity prices, partly offset by extreme cold weather impacts on the company’s oil sands mining operations in December, and a number of unrelated one-time earnings charges of approximately $160 million. There are no material current or future cash impacts associated with these one-time charges. Full-year estimated net income was $2,479 million, the highest since 2014, with cash flow from operating activities of $5,476 million.4

“This past year demonstrated the strength of Imperial’s integrated business model and the value Imperial Oil has created through structural cost reductions, relentless focus on reliable operations and capital-efficient growth in its core businesses,” said Brad Corson, chairman, president and chief executive officer.

Upstream production in the fourth quarter averaged 445,000 gross oil-equivalent barrels per day, bringing annual production to 428,000 gross oil-equivalent barrels per day, the highest annual production in over 30 years. At Kearl, quarterly total gross production averaged 270,000 barrels per day with operations impacted by extreme cold weather in the month of December. On a yearly basis, Kearl’s total gross production of 263,000 barrels per day established a new annual production record, exceeding the previous record by 41,000 barrels per day. At Cold Lake, quarterly production averaged 142,000 barrels per day with annual production of 140,000 barrels per day, driven by the continued focus on production optimization and reliability enhancements.

In the Downstream, throughput in the fourth quarter continued to increase, averaging 416,000 barrels per day. Capacity utilization was 97 percent, a further three percent improvement over the third quarter of 2021. Petroleum product sales in the quarter averaged 496,000 barrels per day, reflecting continued recovery in demand for fuel products. Full-year throughput averaged 379,000 barrels per day with capacity utilization of 89 percent and petroleum product sales of 456,000 barrels per day.

Chemical fourth quarter net income was $64 million with full-year net income of $361 million, the highest full-year net income in over 30 years. Chemical results continue to be driven by strength in polyethylene margins and strong operating performance.

During the quarter, Imperial returned $949 million to shareholders through dividend payments and share repurchasing, with full-year shareholder returns of nearly $3 billion, the highest in company history. Further enhancing returns for shareholders, in November the company announced plans to accelerate share repurchasing under its normal course issuer bid program, and purchases of the remainder of the shares available under the program were completed by January 31, 2022. The company also declared a first quarter dividend increase of 26 percent to 34 cents per share.

“Imperial generated about $5.5 billion in cash flow from operating activities with about $4.5 billion in free-cash flow in 2021 and the company is committed to returning cash to shareholders, as demonstrated by its record distributions this past year,” said Corson. “Following the completion of its accelerated normal course issuer bid in January and the sizable dividend increase the company announced earlier today, Imperial is actively evaluating options for further shareholder distributions.”

Subsequent to the quarter, Imperial announced plans for further reductions in greenhouse gas emissions intensity over the next decade to help support Canada’s net zero goals. By the end of 2030, Imperial anticipates reducing Scope 1 and 2 greenhouse gas emissions intensity at its operated oil sands facilities by 30 percent, compared with 2016 levels. “I’m proud of the progress we’ve made to-date in reducing the intensity of its greenhouse gas emissions at its operated oil sands assets and its recent announcement is another big step in its journey to net zero at its operated oil sands assets by 2050,” said Corson. “As a founding member of the Oil Sands Pathways to Net Zero alliance, the company will continue to collaborate to advance lower-emission solutions.”

References

- ^ https://www.imperialoil.ca/en-CA/Company/About/Company-overview

- ^ https://www.imperialoil.ca/en-CA/Company/About/Our-history

- ^ https://www.imperialoil.ca/en-CA/Company/Operations/Operations-overview

- ^ https://news.imperialoil.ca/news-releases/news-releases/2022/Imperial-announces-2021-financial-and-operating-results/default.aspx