Indian Hotels Co Ltd

Company Overview

The Indian Hotels Company Limited (IHCL) (NSE: INDHOTEL) and its subsidiaries bring together a group of brands and businesses that offer a fusion of warm Indian hospitality and world-class service. These include Taj – the hallmark of iconic hospitality, SeleQtions, a named collection of hotels, Vivanta, sophisticated upscale hotels and Ginger which is revolutionizing the lean luxe segment. 1

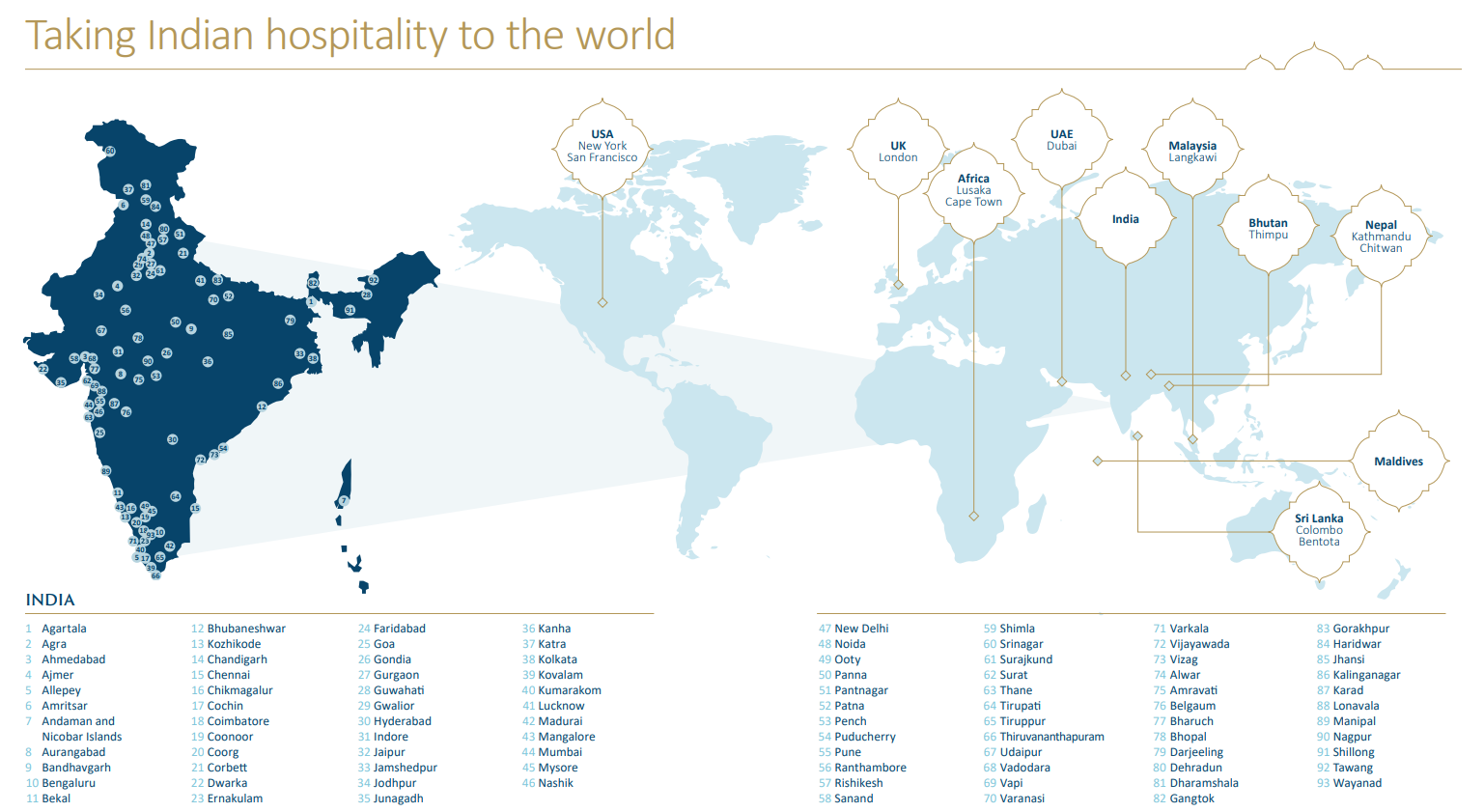

Incorporated by the founder of the Tata Group, Jamsetji Tata, the Company opened its first hotel - The Taj Mahal Palace, in Bombay in 1903. IHCL has a portfolio of 196 hotels including 40 under development globally across 4 continents, 12 countries and in over 80 locations.

The Indian Hotels Company Limited (IHCL) is South Asia’s largest hospitality company by market capitalization. It is primarily listed on the BSE and NSE.

Tata Group

Founded by Jamsetji Tata in 1868, the Tata group is a global enterprise, comprising over 100 independently operating companies. The group operates in more than six continents with a mission to improve the quality of life of the communities it serves globally. Through long-term stakeholder value creation based on ‘Leadership with Trust', the Tata brand stands as a lasting promise behind its businesses, many of which are industry leaders. IHCL is honoured to be one of the first of those timeless and tireless initiatives. 2

IHCL is reimagining itself by leveraging its strong brand equity to multiply its portfolio while aligning to high-growth segments. This includes manoeuvering excellence and reinvigorating the portfolio across all brands.

Awards

- Gallup Great Workplace Award 7th Consecutive year

- 67 Hotels Awarded with Gold Certification by Earthcheck

- Best Hospitality Governance Award 2018 by CFI.CO

Brands

The Indian Hotels Company Limited is South Asia’s largest hospitality-focussed enterprise with Indian origins, relentlessly redefining opportunities in the best interest of all its stakeholders. With businesses ranging from iconic luxury to upscale and budget stopovers as well as in-flight catering; IHCL’s pioneering leadership is backed by a rich 115-year legacy. IHCL’s emerging initiatives in urban leisure, service retail, and concept travel are a part of its evolution, one that is continuously recrafted for future generations. IHCL through all its vivid brands - Taj, SeleQtions, Vivanta, The Gateway, Ginger, Expressions, and TajSATS - believes in adding passion to the process. And thus, crafting delight with people at its heart.3

Hospitality

Taj

The hallmark of Indian hospitality, Taj personifies tradition and warmth. With hotels ranging across iconic locations, living palaces, exotic resorts and scenic safaris, Taj delivers unmatched experiences and lasting memories for guests around the world. With a service culture that has been nourished over 116 years and practised across 50 global destinations, Taj is all about the heart behind the process.

- 86 Hotels

- 12,695 Keys

- 59 Destinations

SeleQtions

An ensemble of curated experiences, SeleQtions encapsulates an inimitable collection of properties with a distinct character. With a strong story beneath; either of its historic lineage, design principle or just the creative premise, these spaces make for matchless experiences for the experiential traveller. The theme, décor, service and even the cuisine is special and peculiar to its premise.

- 16 Hotels

- 1,476 Keys

- 14 Destinations

Vivanta

A smart collective of business and leisure hotels, Vivanta celebrates the uniqueness in one’s individuality. Disruptive in their purpose and persona, these destinations hold inside them, many hints of surprises that make one feel special.

- 31 Hotels

- 4,176 Keys

- 35 Destinations

Ginger

As a chain of smartly designed staying spaces, Ginger offers seamless switching between work and play. These stopovers are essentially for millennials and centennials, getting them to explore and enrich their everyday. Catering to the new Indian, this sassy range of new-age nodes across the country are designed for a smooth transit through a variety of extremes - individual and community, binge and detox, global and local.

- 74 Hotels

- 6,755 Keys

- 48 Destinations

amã Stays & Trails

Combining the grace and grandeur of the bygone era with contemporary comforts and warm service, amã Stays & Trails is India’s first branded product in the homestay market, comprising of a group of heritage bungalows, guesthouses and home-stays at unique locations across the country. The first such stay experience, amã Stays & Trails, is a group of bungalows situated in the verdant hills of Coorg and Chikamagalur, offering authenticity and a strong connect with the destination, tranquillity in the midst of nature, and experiences such as bean to cup tours, inviting guests to savour the distinct hints of India’s coffee..

- 24 Bungalows

- 97 Keys

- 10 Destinations

Volume Catering

TajSATS

A collaborative venture of IHCL and SATS (formerly Singapore Airport Terminal Services), TajSATS combines expertise and warmth that delights customers through every interaction. Its state-of-the-art kitchens ensure hygienic food production and handling, while meticulously serving an assortment of cuisines. Living by its quality and delivery commitment, TajSATS is India’s leading airline caterer and a leading institutional player.

- 6 Cities

- 88,000 Meals per day

- 42% Market share

Retail Services

Jiva - Wellness - Number of spas - 43

Khazana - Lifestyle Boutique - Number of boutiques - 15

Salon - Beauty - Number of salons - 34

The Chambers -Established in 1975, The Chambers is an exclusive business club that operates in seven locations across India and Dubai. The club provides its members the choicest facilities, backed by Taj’s iconic service.

Food & Beverages - IHCL has some of the most distinguished fine-dining and multi-cuisine restaurants and lounge bars in its portfolio. With more than 380 restaurants and bars around the world, it offers a multitude of speciality cuisines flavoured with tradition and innovation through its signature brands such as Bombay Brasserie, Golden Dragon, Wasabi, Thai Pavilion and House of Ming.

Other Services

Taj Holidays

Taj Holidays offers a wide selection of distinct holiday packages to guests with unique holiday requirements.

Taj Experiences Gift Card

Taj Experiences Gift Cards are innovative prepaid cards, redeemable across Taj, Vivanta and Gateway hotels in India.

Taj InnerCircle

Taj InnerCircle is an award-winning loyalty programme designed to offer its guests a gamut of unparalleled services and experiences.

Timeless Wedding at Taj

Taj Wedding Studio is a platform connecting wedding planners and brides/ grooms to make their dream weddings a timeless memory.

Warmer Welcomes

Warmer Welcomes is a loyalty partnership programme offering members of Shangri-La’s Golden Circle and Taj InnerCircle reciprocal benefits.

Industry Overview

Global Hospitality and Tourism Industry (Pre-Covid-19)

Globally, international tourism witnessed 1.5 billion arrivals in 2019, recording a 4% growth in overnight visitors, which was lower than the growth rate of 6% in 2018. This was partly because of the slackening demand in advanced economies, particularly in Europe. Geopolitical stress, social unrest and a global economic slowdown contributed to a lower growth in 2019. With an 8% growth in arrivals and double the global average, the Middle East emerged as the fastest-growing region for international tourism. Although Europe continued to lead, with 743 million international tourists last year and a command of 51% of the global market, Asia and the Pacific saw a healthy 5% increase in international arrivals. In spite of the global economic slowdown, tourism spending continued to grow, with France reporting the strongest increase in international tourism expenditure among the world's top 10 outbound markets with an 11% increase, while the US, with a 6% increase, led growth in absolute terms, aided by a strong dollar. 4

Global Hospitality Outlook (Post-Covid-19)

According to UNWTO, a global organisation for promotion of tourism, the pandemic has already caused a drop of 22% in international tourist arrivals from January-March 2020, and could lead to a further decline of 60-80% due to COVID-19 during the year. With 67 million less international arrivals owing to lockdowns, March 2020 saw a sharp drop of 57% in arrivals and a loss of USD 80 billion in tourism exports. The Asia-Pacific region bore the biggest impact with a decline of 33 million arrivals, while the drop in Europe was 22 million.

UNWTO has given three scenarios for 2020 based on possible dates for the gradual opening up of international borders in early July, early September or in early December. The impact translates into 850 million-1.1 billion less international tourists, loss of US$ 910 billion-1.2 trillion in revenues from tourism exports and risk to 100-120 million direct tourism jobs. Domestic leisure demand is expected to recover faster than the international demand, according to a survey by a UNWTO panel of experts. (Source: UNWTO, May 2020). As a sign of hope, Europe, China and South Korea seem to be easing up for domestic tourism, while Iceland has already confirmed that it would welcome international guests from June, 2020 after health checks, which could be the new normal.

Indian Hospitality and Tourism Industry (Pre-Covid-19)

India is a tourism hotspot, given its diverse landscape, rich cultural heritage, and the opportunities it offers to businesses with its start-up culture and availability of a young, educated workforce. During 2019, foreign tourist arrivals (FTAs) in India stood at 10.9 million, an increase of 3.2% over 2018. Of this, 2.9 million tourists arrived on e-tourist visa as compared to 2.4 million during 2018, registering a growth of 21%.

Indian Hospitality Outlook (Post-Covid-19)

FTA footfall in India, particularly that of leisure travellers, started softening in February 2020, as COVID-19 spread across the globe. Although domestic flights resumed in June 2020, the restrictions on the entry of international travellers means that FTA is not about to pick up any time soon. Even though some countries are reopening, travel bans are expected to be rolled down only by the end of the year. The situation may not improve drastically for the hospitality sector. Except for the smaller-sized hotels, which are now covered under the MSME (micro, small and mediumsized enterprises) the hospitality sector in India has not benefited from the stimulus packages rolled out by the government.

India ranks 3rd in World Travel & Tourism Council’s list for Travel & Tourism Power and Performance. It markedly improved its position from the 40th rank in 2018 to 34th in 2019 in the World Economic Forum’s Travel and Tourism Competitive Index (TTCI).

Business Overview

IHCL continued its execution of ‘Aspiration 2022’ during the year. With a clearly defined and re-imagined brandscape catering to diverse customer segments through Taj, SeleQtions, Vivanta, Ginger and amã Stays and Trails, its increased presence in cities and resorts, consolidation in destinations like Delhi, Dubai and Goa and entry in new destinations such as Andaman, Shimla and Tirupati, IHCL has further diversified its geographical footprint and is strategically placed to achieve its set goals. The year also saw strong performance of international hotels in the UK and the US until the onset of COVID-19 pandemic towards the end of FY 2019-20.

Brandscape

Taj saw the addition of the iconic Taj Fateh Prakash Palace, Udaipur, under a lease agreement. Four other hotels opened under the Taj brand in Agra, Dubai, Goa and Tirupati, taking the tally to five openings during the year. The brand also had five hotel signings with 966 rooms during the year.

SeleQtions was launched in April, 2019, as part of IHCL’s named collection of hotels. During the year, two more hotels— Cidade de Goa - IHCL SeleQtions, Goa and Devi Ratn - IHCL SeleQtions, Jaipur — were opened and two hotels were signed under the brand. The Connaught - IHCL SeleQtions, New Delhi is scheduled to open during FY 2020-21.

Vivanta had nine hotel agreements signed during the year with an aggregate of just under 1,000 rooms.

Ginger pursued an aggressive growth strategy with five openings to reach a milestone of 50 hotels under operation. Ginger now has an aggregate inventory of 4,410 rooms across 35 locations. The brand also had 13 signings in the year, the highest number of rooms signed under a single brand in India. (Source: JLL Hotels Brand Signings Tracker)

Hotels are planned in clusters to drive economies of scale. With a refurbished portfolio of 12 Lean Luxe Hotels, constituting 24% of the portfolio, and a new concept restaurant, Ginger is ready to harness the opportunities the midscale segment has to offer, especially in the new normal. Ginger’s fully fitted lease model optimises capital expenditure and minimises cash outflow in the early stages of operations of the hotels. For FY 2019-20, the Lean Luxe portfolio achieved a growth of 21% in average room rates, a rating of 4.62 on Tripadvisor and 75% of its hotels in the Top 10 city rank in competitive benchmarking reports.

Expressions constitutes an ecosystem of hospitality brands. Initiatives under this umbrella of brands constituted scaling of Jiva at hotels, relaunching 'niu&nau', a re-imagined salon, and scaling homestays under 'amã Stays and Trails', which is a portfolio of 22 bungalows that has 14 bungalows in operation.

TajSATS has consolidated its position in the air catering business by securing a higher number of international airlines and is now poised to scale its non-aviation business.

Growth

IHCL expanded the portfolio with 12 openings at an average of one hotel a month. It also signed 29 hotels with an inventory of over 3,700 rooms, completing more than 50 signings in the past two years. IHCL’s portfolio, constituting operational and pipeline hotels, has reached a key milestone of 200 hotels, with more than 25,000 rooms at over 100 locations.

Revenue Saliency

Room revenue constitutes 45% of the turnover. With high margins, room revenue grew with increase in RevPAR driven by occupancies. IHCL hotels were leaders in the micro markets they operated in during the year. A strategy of multiple hotels in various cities, and leadership position in key cities, helped maximise its market share. A drop in GST slab rates for accommodations priced above ₹7,500 from 28% to 18% also assisted IHCL in improving room demand.

IHCL enjoys RevPAR dominance across key markets in which it operates and is well poised to further strengthen this metric on its path to recovery from the current environment in the post COVID-19 economy.

F&B revenue constitutes 40% of the turnover and is backed by the strength of IHCL’s banqueting business. The Company has always been a pioneer in F&B in India, being the first to introduce new cuisines. During FY 2019-20, IHCL signed new hospitality concepts viz. Brew Pub with AB InBev, Paper Moon and GTR. It also expanded key F&B brands such as Shamiana, House of Ming, Thai Pavilion and Golden Dragon across the network.

The Chambers - Taj’s exclusive business club was launched globally with enhanced features. The initiative saw a good response by way of new memberships, migration of existing members that has increased both annual and initiation membership fees during the year. Members also use regular facilities of accommodation, F&B, meeting rooms, and banquets, etc. With more than 100 new members, and a total of over 2,000 members, the club has the potential to be a ₹100 Crore business that will help grow revenues and contribute to improving margins.

Management fees - IHCL’s set target is to have 50% share of its portfolio as hotels under management contracts by 2022. The Company’s hotel signings under management contracts comprise approximately 80% of the pipeline. In FY 2019-20, managed hotels contributed ₹218.77 Crore in management fees and reimbursements, a source of high margin that provides a high Return on Capital Employed (ROCE) since it involves minimal incremental capital.

Monetisation of Noncore Assets

₹205 Crore was monetised through the sale of residential apartments, a vacant land and sale of investments in a Joint Venture Company

IHCL’s Response to Covid-19

Following WHO’s declaration of the COVID-19 outbreak as a pandemic, the Government of India undertook a series of measures to contain the outbreak, which included imposing multiple lockdowns across the country. Governments all across the globe had undertaken similar measures since February and March, 2020. The lockdowns and restrictions imposed on various activities, have posed a serious challenge to the businesses of the Company and its subsidiaries, JVs and associates, given the mandated closure of hotel operations and cessation of air traffic and other forms of public transport. This has resulted in low occupancies/ shutdown of hotels.

Financial Highlights

Consolidated Financials FY 2019-20

Income

Revenue from operations decreased by 1% from ₹4,512.00 Crore to ₹4,463.14 Crore. The operations and profitability of the Group were impacted by COVID-19 during the last quarter of the year which peaked across all nations in March, 2020. Up to the nine months ended December, 2019, the Group reported a growth of 4% in revenue from operations. Increase in Other Income was mainly due to disposal of non-core assets.

Operating Expenses

Operating Expenditure decreased by ₹110.27 Crore or 3% to ₹3,899.85 Crore. Food and beverage consumed decreased commensurate with business volumes. Employee benefit expenses increased by 2% in line with industry and local requirements.

The Group adopted Ind AS 116 “Leases” to all lease contracts existing on and effective April 1, 2019. Under this Standard, it has recognised Lease Liabilities and associated Right-of-Use assets on the Balance Sheet using discounted cashflows of lease payments over the lease term. The cumulative effect of this on the Statement of Profit and Loss was that lease costs for the year recognised under “Other Expenditure” was lower by ₹179.27 Crore, which had the impact of increasing the EBITDA, while a higher combined cost of amortisation and interest of ₹226.07 Crore reduced Profit before Tax by ₹46.80 Crore in comparison with the previous year.

Finance Costs

Finance Costs for the year ended March 31, 2020, at ₹341.12 Crore was higher than the previous year by ₹150.99 Crore due to interest on lease liabilities accounted under Ind AS 116 “Leases”.

Profit after Tax

Profit after Tax, Non-Controlling Interest and share of profit of equity accounted investees for the year was higher at ₹354.42 Crore as compared to ₹286.82 Crore for the previous year. This was mainly due to increase in operating earnings during the first nine months, profit from sale of non-core assets and an increase in deferred tax benefit arising from a lower Indian corporate income-tax rate which was offset in part by the impact of COVID-19 on business performance for the fourth quarter, including that of associates and joint ventures as well as adjustments on account of Ind AS 116 “Leases” for the year.

Consolidated Financials FY 2020-21

APRIL 30, 2021; The Indian Hotels Company Limited (IHCL), reported its financials for the fourth quarter ending March 31 st, 2021 and the full year FY 2020-21.5

Reported Consolidated quarterly numbers for Indian Hotels Company are:

Net Sales at Rs 615.02 crore in March 2021 down 42.14% from Rs. 1,062.98 crore in March 2020.

Quarterly Net Loss at Rs. 91.30 crore in March 2021 down 222.85% from Rs. 74.32 crore in March 2020.

EBITDA stands at Rs. 82.76 crore in March 2021 down 66.35% from Rs. 245.95 crore in March 2020.

Key Highlights of FY 2020-21

- IHCL signed 17 hotels in the current fiscal, adding over 2,200 rooms to its portfolio, including strengthening its presence in the East with three new Taj hotels

- Opened seven hotels in FY 2020-21, adding over 700 rooms to its operational inventory.

- Signed a binding agreement to acquire 100% shareholding in ELEL Hotels and Investments Limited (ELEL) for the famous Sea Rock hotel

- Restructured holding of Taj Cape Town by acquiring 50% of holding in Tata Africa Holdings (TAH), making it a wholly owned subsidiary of IHCL

- The iconic Taj Mahal, New Delhi completed its first phase of renovations with the re-imagined and relaunched Machan, Emperor’s Lounge, tastefully done rooms and The Chambers

- Launched Machan’s first outpost at Taj West End, Bengaluru

- Launched India’s first on-site brewpub at Taj MG Road, Bengaluru in partnership with AB InBev, the first of 15 locations to be launched across IHCL hotels over the next five years

- Supported the community’s effort in combating the pandemic by delivering over 3 million meals to healthcare and migrant workers, and hosting over 70,000 room nights for the medical community

- With 78 EarthCheck Certified hotels, set a benchmark for environmental sustainability in hospitality with the highest number of EarthCheck Platinum certified hotels globally, with 47 hotels awarded the EarthCheck Platinum certification

- Partnered with Tata Power to provide solar energy for Mumbai hotels, saving energy costs and reducing carbon footprint

- Introduced bottling plants at 15 hotels across the globe, which can reduce the utilization of 0.2 million kg of plastic

- Expanded Qmin, IHCL’s culinary home delivery platform to 14 locations across India

- Ginger reached 75 hotel milestone and reported the highest number of signings in the midscale segment in India

References

- ^ https://www.ihcltata.com/company/

- ^ https://www.ihcltata.com/company/about-us/

- ^ https://www.ihcltata.com/our-brands/

- ^ https://www.nseprimeir.com/z_INDHOTEL/files/Ihcl_Integrated_Annual_Report_2019-20.pdf

- ^ https://www.nseprimeir.com/z_INDHOTEL/files/INDHOTEL_30042021200805_PressReleaseApril302021.pdf