Indian Oil Corp Ltd

Company Overview

Indian Oil Corporation Limited (IndianOil) (NSE: IOC) is one of India’s largest commercial enterprises and the country’s flagship integrated and diversified energy major. The Company’s philosophy is embedded in the principles of strong customer connect, quality consciousness and transparency, where energy is tapped responsibly and delivered to the consumers most affordably.

IndianOil is listed among the world’s largest corporates in Fortune’s prestigious ‘Global 500’ listing, and is also ranked among the top 10 strongest brands of India in 2019 by Brand Finance, UK. Guided by the corporate vision to establish itself as ‘a globally admired company’ and energised by a committed team of 32,998 high-calibre people, IndianOil’s business interests encompass the entire hydrocarbon value chain – from exploration & production (E&P) of oil & gas, refining, pipeline transportation and marketing to natural gas, petrochemicals, alternative energy sources and globalisation of downstream operations.

IndianOil accounts for the largest market share of India’s petroleum products consumption, with domestic sales of 78.54 million metric tonnes (MMT) in 2019-20. In addition, the Company achieved sales of 4.72 MMT in natural gas and 2.08 MMT in petrochemicals.

The Company’s refineries achieved a combined throughput of 69.42 MMT in 2019-20, exceeding their total installed capacity. Its retail network expanded to 29,085 fuel stations (including 8,515 Kisan Seva Kendra outlets in rural areas) and 755 CNG-dispensing stations. Its cross-country pipelines network posted a throughput of 85.35 MMT of crude oil and petroleum products during the year. The Company’s share of production from its eight producing E&P assets in 2019-20 was 4.257 million tonnes of oil equivalent (mtoe).

Indian Oil Company Ltd, was set up as a governmentowned enterprise, formed on 30 June, 1959, and was entrusted with the task of supplying petroleum products to government organisations all over the country by establishing adequate storage and distribution facilities, and undertaking imports, as required.

Group Companies

| Name | Business |

| Indian Subsidiaries | |

| Chennai Petroleum Corporation Limited | Refining of petroleum products |

| Indian Catalyst Private Limited | Manufacturing of FCC catalyst / additive |

| Foreign Subsidiaries | |

| IndianOil (Mauritius) Ltd. Mauritius | Terminalling, Retailing & Aviation refuelling |

| Lanka IOC PLC,Sri Lanka | Retailing, Terminalling & Bunkering |

| IOC Middle East FZE, UAE | Lube blending & marketing of lubricants |

| IOC Sweden AB, Sweden | E&P Investment in Carabobo Heavy Oil Project in Venezuela |

| IOCL (USA) Inc., USA | E&P investment in Carrizo, US [Niobrara Shale Project]. |

| IndOil Global B.V. Netherlands | E&P Investment in Pacific North West LNG Project, Canada & in Lower Zakum, Offshore Concession, Abu Dhabi |

| IOCL Singapore Pte. Ltd. | E&P Investment in Taas & Vankor Project, Russia & in Mukhaizna Oil Field, Oman & Trading operation for procurement of crude oil Import / Export of petroleum products |

Business

IndianOil is India's flagship Maharatna national oil company with business interests straddling the entire hydrocarbon value chain - from refining, pipeline transportation & marketing, to exploration & production of crude oil & gas, petrochemicals, gas marketing, alternative energy sources and globalisation of downstream operations. It also has global aspirations, fulfilled to an extent by the formation of subsidiaries in Sri Lanka, Mauritius, the UAE, Sweden, USA and The Netherlands. It is pursuing diverse business interests with the setting up of over 15 joint ventures with reputed business partners from India and abroad to explore global opportunities. 1

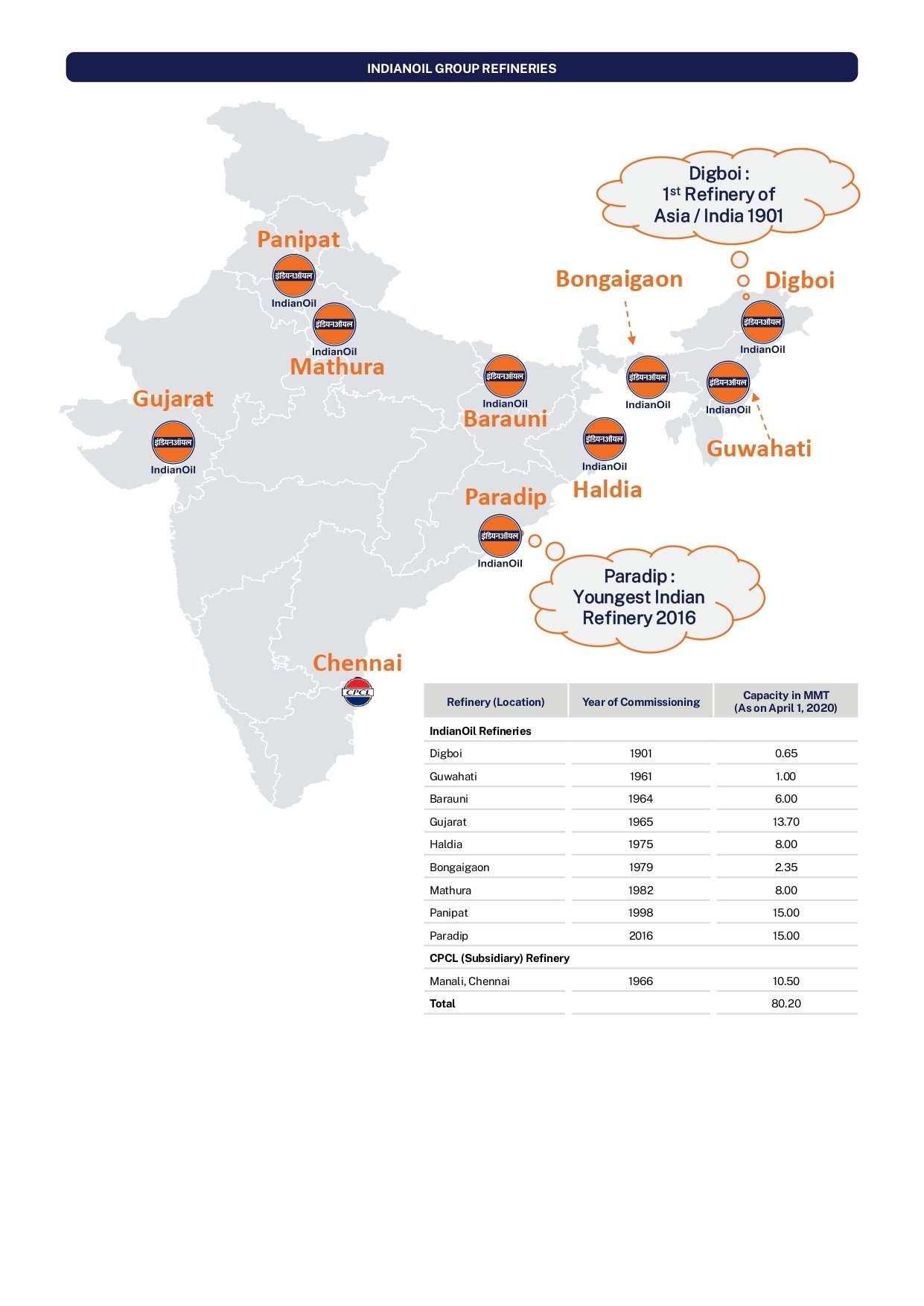

Refining

Born from the vision of achieving self-reliance in oil refining and marketing for the nation, IndianOil has gathered a luminous legacy of more than 100 years of accumulated experiences in all areas of petroleum refining by taking into its fold, the Digboi Refinery commissioned in 1901. 2

The group refining capacity is 80.2 million metric tonnes per annum (MMTPA) - the largest share among refining companies in India. It accounts for approx. 32% share of national refining capacity.

The strength of IndianOil springs from its experience of operating the largest number of refineries in India and adapting to a variety of refining processes along the way. The basket of technologies, which are in operation in IndianOil refineries include: Atmospheric/Vacuum Distillation; Distillate FCC/Resid FCC; Hydrocracking; Catalytic Reforming, Hydrogen Generation; Delayed Coking; Lube Processing Units; Visbreaking; Merox Treatment; Hydro-Desulphirisation of Kerosene&Gasoil streams; Sulphur recovery; Dewaxing, Wax Hydro finishing; Coke Calcining, etc.

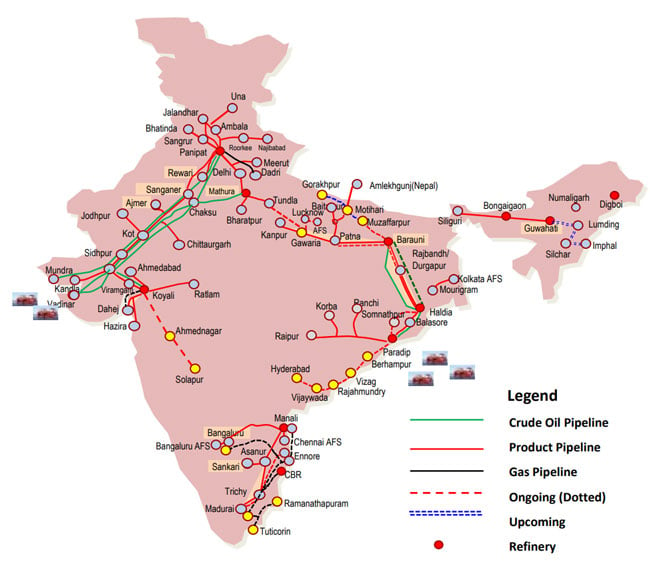

Pipelines

ndianOil operates a network of more than 14,600 km long crude oil, petroleum product and gas pipelines with a throughput capacity of 94.42 million metric tonnes per annum of oil and 21.69 million metric standard cubic meters per day of gas. Cross-country pipelines are globally recognized as the safest, cost-effective, energy-efficient and environment-friendly mode for transportation of crude oil and petroleum products. 3

As a pioneer in oil pipelines in the country, managing one of the world's largest oil pipeline networks, IndianOil achieved a throughput of 85.35 million metric tonnes during the year 2019-20.

IndianOil added 437 km of additional pipeline length during the year 2019-20, as part of its plans to continuously expand the network in line with growth in business. Projects currently under implementation would further increase the length of the pipelines network to about 21,000 km, and throughput capacity to 102 million tonnes per annum.

With due emphasis being given to scaling up of natural gas pipelines, IndianOil is planning to lay a 1,244 km pipeline to reach LNG imported at Ennore to Nagapattinam, Tuticorin, Madurai and Bengaluru. This pipeline, along with three other upcoming gas pipelines - Mallavaram-Vijaipur, Mehsana-Bhatinda and Bhatinda-Srinagar pipelines would ensure a significant presence of IndianOil in gas transmission business.

Adding another feather to its cap, IndianOil commissioned Motihari-Amlekhganj Pipeline, the first transnational pipeline of the country in July 2019, 8 months ahead of the scheduled completion. The pipeline was jointly dedicated to nation by Hon'ble Prime Ministers of India and Nepal.

Marketing

IndianOil has one of the largest petroleum marketing and distribution networks in Asia, with over 50,000 marketing touch points. Its ubiquitous fuel stations are located across different terrains and regions of the Indian sub-continent. From the icy heights of the Himalayas to the sun-soaked shores of Kerala, from Kutch on India's western tip to Kohima in the verdant North East, IndianOil is truly 'in every heart, in every part'. IndianOil's vast marketing infrastructure of petrol/diesel stations, Indane (LPG) distributorships, SERVO lubricants & greases outlets and large volume consumer pumps are backed by bulk storage terminals and installations, inland depots, aviation fuel stations, LPG bottling plants and lube blending plants amongst others. The countrywide marketing operations are coordinated by 16 State Offices and over 100 decentralised administrative offices. 4

Products

- AutoGas

- Petrol/Gasoline

- Diesel/Gasoil

- Indane Cooking Gas

- Commercial / Reticulated LPG

- Bulk/Industrial Fuels

- Aviation Fuel

R&D Centre

IndianOil's world-class R&D Centre is focused on developing, demonstrating and deploying novel, innovative, environment friendly, customer centric products and process technologies for addressing issues of national importance to attain self reliance in field of energy and allied areas. Apart from carrying out path breaking research in core petroleum activities like Lubricants, Refining, Petrochemicals and Pipeline; IndianOil R&D is pursuing pioneering work in promising & futuristic Alternate Energy segments like Bio-Energy, Solar Energy, Hydrogen, Energy Storage, Battery, CCU Technologies etc. 5

The state-of-the-art R&D facilities is located on a sprawling 65 acre campus in Faridabad, Haryana on the outskirts of the National Capital. An impressive array of most advanced equipment is available to experienced researchers and scientists round-the-clock.

Petrochemicals

Petrochemicals have been identified as a prime driver of future growth by IndianOil. The Corporation is envisaging an investment of Rs 30,000 crore in the petrochemicals business in the next few years. These projects will utilise product streams from the existing refineries of IndianOil, thereby achieving better exploitation of the hydrocarbon value chain.

IndianOil has set up a world-scale Linear Alkyl Benzene (LAB) plant at Gujarat Refinery and an integrated Paraxylene/Purified Terephthalic Acid (PX/PTA) plant at Panipat. A Naphtha Cracker complex with downstream polymer units is also in operation at Panipat. IndianOil has recently come up with Polypropylene plant at Paradip, Odisha.

Mega Plants

- Linear Alkyl Benzene (LAB) plant, Gujarat Refinery

- Paraxylene/Purified Terephthalic Acid (PX/PTA), Panipat

- Naphtha Cracker Plant, Panipat

- Polypropylene Plant, Paradip

Major Facilities

- Product Application Development Centre (PADC), Panipat

- Product Application Development Centre (PADC), Paradip

Natural Gas

IndianOil took up natural gas marketing in 2004 and has established itself as the second largest player in natural gas in India. The Corporation has been investing across the Natural Gas value chain, scaling up LNG sourcing, import terminals, pipelines, city gas distribution networks and 'LNG at the Doorstep' service on a continuous basis. 6

As co-promoter of PLL (Petronet LNG Ltd.), which has set up LNG (Liquefied Natural Gas) import terminals at Dahej and Kochi, IndianOil has marketing rights for 30% of the LNG procured by PLL.

IndianOil currently operates city gas distribution (CGD) networks in Agra and Lucknow through Green Gas Ltd., its joint venture with GAIL (India) Ltd. It is also implementing CGD projects in Chandigarh, Allahabad, Panipat, Ernakulam, Daman, Udhamsingh Nagar and Dharwad through a joint venture with M/s. Adani Gas Ltd. (M/s. IndianOil-Adani Gas Private Limited (IOAGL) . IOAGL's CGD networks in Chandigarh, Allahabad have already been commissioned.

IndianOil, through its Joint Venture Company, IndianOil LNG Pvt. Ltd., has developed a 5-million metric tonnes per annum (MMTPA) capacity Liquefied Natural Gas (LNG) Terminal at Kamarajar Port, Ennore in Tamil Nadu, at a cost of Rs. 5,150 crore. The Ennore Terminal is the first LNG terminal on the east coast in South India, located in Tamil Nadu, which is an untapped natural gas market.

IndianOil holds equity LNG of 1.3 MMTPA on FOB basis for a minimum of 20 years in the Pacific NorthWest (PNW) LNG Project in British Columbia, Canada.

IndianOil is developing three natural gas pipelines - Mehsana-Bhatinda, Bhatinda-Jammu-Srinagar and Mallavaram-Bhopal-Bhilwara-Vijaipur - through JVCs.

Exploration and Production

IndianOil's business development initiatives continue to be driven by the emerging opportunities and guided by its corporate vision of becoming a diversified, transnational, integrated energy company. Its business strategy focuses primarily on expansion across the hydrocarbon value chain, both within and outside the country. 7

To enhance upstream integration, IndianOil has been pursuing exploration & production activities both within and outside the country in collaboration with consortium partners.

IndianOil has built a sizeable portfolio of oil & gas assets, with participating interest in 12 domestic and 12 overseas blocks. These overseas blocks are located in USA, Canada, Venezuela, Libya, UAE, Israel, Gabon, Nigeria and Russia.

Explosives

IndianOil is the pioneer and largest provider of Bulk Explosives and Blast based Services in country. A commitment to innovation and technology is driving differentiation in key mining sectors. With a truly pan country reach, presently, the business operates from 11 Bulk Explosives Plants catering the demand of coal, iron ore and copper mines across the country.

IndianOil's INDOGEL is the market leader in bulk explosives in surface mining

Cryogenics

IndianOil has a thriving Cryogenics business with expertise in design & production of state-of-the-art vacuum super-insulated cryogenic storage and transport vessels. IOC is one of the largest manufacturers of cryogenic containers in the country. 8

The company offer a diverse range of products for long-term cryogenic preservation of biological samples as well as for use in industries, laboratories, and oilfield service applications. A market leader with nearly four decades of experience in cryogenic and vacuum engineering, the company serve various industries such as Refineries, Chemicals, Aviation, Lubricants, Animal Husbandry, Gas etc., through specialised and custom-built product lines.

Products

- Cryocan - Liquid Nitrogen Dewars (0.5 to 55 Ltrs.)

- Cryovessels - Pressurised large capacity cryogenic containers

- Pressure Vessels

- Custom-built Special Cryogenic Projects

- LNG logistics and regassification systems

- Aviation Equipment

Industry Overview

Global Energy Scenario

The growth of global primary energy consumption slowed to 1.3% in 2019, less than half that of 2018 (2.8%). Renewables contributed 41% of the increase in energy demand, the largest among energy sources, followed by natural gas. Apart from nuclear energy, all fuels grew at a slower rate in 2019 than their 10-year average. 9

The growth in primary energy demand was driven by China, which accounted for more than three-quarters of net global growth, while India and Indonesia were the other two largest contributors. US and Germany posted the largest declines in energy terms.

Carbon emissions from energy use grew by 0.5%, which is less than half of the 10-year average growth of 1.1% per year.

Oil

Global macroeconomic growth was impacted during the year by trade tensions and other geopolitical issues, leading to a slower growth rate in oil consumption. Global oil consumption in 2019 increased by 0.8 million barrels per day (mb/d) to 99.8 mb/d for the year, growing at 0.7% compared to 1.0% in the previous year.

In the first quarter of 2020, the negative impact of COVID-19 further brought down global oil demand to 93.3 mb/d, a decline of 5.6 mb/d compared to the same quarter in 2019.

Global oil production remained flat at 100.5 mb/d, but exceeded demand with rising oil production from nonOPEC countries, especially US, offsetting the loss of oil supplies from Iran. Crude oil prices averaged at $64 per barrel (Dated Brent) in 2019, a 9% decrease from those of 2018.

Natural Gas

The growth of natural gas consumption too slowed down in 2019, with an increase of 78 billion cubic metres (bcm), or 2.0%, compared to a higher growth of 5.3% in 2018. The increase in gas demand was driven by the US (27 bcm) and China (24 bcm).

Gas production grew by 132 bcm in 2019, or 3.4% yearon-year, with the US accounting for most of the increase (85 bcm). US natural gas production grew by 10% from the 2018 level.

Global LNG supply grew at a record of 12.7% year-on-year in 2019 (+54 bcm) driven by record increases from the US (19 bcm) and Russia (14 bcm) as well as continued growth from Australia (13 bcm), plunging the market into oversupply. In 2019, due to a combination of factors, including lower gas demand in Asia, a recovery in Japan’s nuclear power production, larger global supplies of LNG, mild global temperatures and increased US production, gas prices in the global markets fell by a far bigger amount than crude oil prices. Henry Hub prices decreased by almost 20% to $2.53/mmbtu in 2019 from $3.13/mmbtu in 2018. Asian spot prices too declined to $5.49/mmbtu in 2019 from $9.76/mmbtu in 2018 on the back of global LNG over-supply, declining demand in Japan and Korea, and a slowdown in Chinese imports.

India Energy Scenario

The oil & gas sector is among the eight core industries in India and plays an important role in influencing decisionmaking for all the other important sectors of the economy.

Oil

India’s petroleum products consumption had been growing at a healthy CAGR of 5.2% in the last five years (2014-15 to 2019-20). In 2019-20, consumption growth slowed down to 0.2% from 3.4% in 2018-19. Consumption in 2019-20 was 213.69 MMT as compared to consumption of 213.22 MMT in 2018-19.

During the period April 2019-February 2020, petroleum products consumption grew at a modest 2.0% year-on-year. But the demand slowed down significantly in the latter half of March 2020, with the implementation of a nationwide lockdown in the face of the COVID-19 pandemic, leading to a steep decline of 17.8% during the month. Restrictions on movement of people and goods, as well as slowdown in industrial activity affected the demand of petroleum products in all sectors, including manufacturing, aviation, transport, tourism, hospitality, e-commerce and real estate. This sudden sharp reduction in demand affected the overall growth of POL consumption for the year 2019-20.

Motor Spirit (MS or petrol) consumption grew by 6% in 2019-20 as compared to 8.1% in the previous year. High Speed Diesel (HSD) consumption declined by 1.1% in 2019-20 compared to a 3.0% growth in the previous year. In fact, HSD registered negative growth in 2019-20 after five years of positive growth. Apart from lower sales in March 2020, persistent slowdown in the automotive industry, with falling sales and piling inventory, contributed to the overall decline in MS and HSD sales. Slowdown in the economy, problems in financing vehicle after the NBFC crisis, increase in insurance cost, and anticipation of BS-VI transition from April 2020 were among the factors that led to the poor performance of the automobile industry.

The civil aviation sector was the worst hit due to the pandemic, resulting in fall in ATF demand by 32.4% in March 2020. ATF sales had also endured the effect of grounding of Boeing 737 Max and closure of Jet Airways earlier during the year 2019-20. The overall ATF demand fell by 3.6% during the year.

While LPG consumption continued to grow, it was lower at 5.9% in 2019-20 as compared to 6.7% in the previous year. Other products that contributed to the overall POL growth during the year were naphtha (2.2%), light diesel oil (5.0%) and petcoke (1.5%), whereas sales contracted for bitumen (-4.9%), furnace oil & low-sulphur heavy stock (-7.2%), lubes & greases (-0.8%) compared to the previous year.

Domestic crude oil production during 2019-20 was lower by 5.9% at 32.2 MMT, as the diminishing phase of many fields continued. Crude oil and condensate production by public sector entities decreased by 2.5% while production by private sector entities decreased by 14.5% in 2019-20 as compared to the previous year. However, improvement in production levels is expected in the near future with the Government’s thrust on ramping up domestic production through investment-friendly policies.

Indian refiners processed 254.4 MMT of crude oil in 2019-20 as compared to 257.2 MMT in 2018-19, a decline of 1.1%. Cheaper, high-sulphur crudes to the extent of 75.5% were processed during the year.

Crude oil imports registered 0.2% growth over the previous year in quantity terms, rising to 227 MMT. In value terms, the crude oil import bill was US$ 101.4 billion during the year compared to US$ 111.9 billion in 2018-19. POL products imports increased by 29.9% during 2019-20 to 43.3 MMT as compared to 33.3 MMT in the previous year, while their import bill rose from US$ 16.3 billion in 2018-19 to US$ 17.9 billion in 2019-20. The rise was due to increase in imports of all products except naphtha and aviation turbine fuel (ATF). The total import bill of crude oil and products for the year 2019-20 was US$ 119.2 billion, down from US$ 128.2 billion in the previous year.

Exports of POL products increased by 7.5% to 65.7 MMT in 2019-20 from 61.1 MMT in 2018-19 primarily due to increase in exports of naphtha and HSD. However, in value terms, products exports decreased to US$ 35.8 billion in 2019-20 as compared to US$ 38.2 billion in 2018-19.

Natural Gas

India’s natural gas consumption during the year increased to 63.9 billion cubic metres (bcm), registering a growth of 5.2% as against a growth of 2.8% in the previous year. On the supply side, gross natural gas production during the year was 31.2 bcm, 5.14% lower than that of the previous year. LNG imports rose by 17.2% to 33.7 bcm during the year, from 28.7 bcm in 2018-19. LNG demand saw a surge due to fall in spot prices, leading to increased buying.

Despite the near-term challenges due to the pandemic, gas volumes are expected to rebound owing to the large-scale rollout of city gas distribution (CGD) networks, setting up of fertilizer plants, expansion of pan-India trunk pipelines network, the proposed launch of a gas trading hub, and the Government’s thrust on a gas-based economy.

Business Overview

Refineries

The year 2019-20 was the year in which all the refineries of the Company achieved BS-VI fuels (MS & HSD) upgradation. During the year, the nine refineries of the Company achieved a throughput of 69.42 MMT equivalent to 100.32% of installed capacity.

The performance on parameters like capacity utilisation, distillate yield and energy performance was slightly lower as compared to the previous year due to shutdown of refineries for implementation of BS-VI projects.

During the year, Digboi Refinery was the first refinery to produce & supply BS-VI compliant fuels in August 2019 using indigenously developed R&D Catalyst. Mathura Refinery upgraded to the BS-VI club in January 2020 along with Panipat, Gujarat, Haldia and Bongaigaon Refineries in February 2020. This was followed by the other remaining refineries going BS-VI, producing the upgraded fuel which was made available through the Company’s retail outlets across the country w.e.f. March 16, 2020, ahead of April 1, 2020, the deadline stipulated by the Government of India.

During the year, six new crude oil grades were included in the crude oil basket of the Company, taking their number to 186, to improve flexibility in refinery operations / crude purchases.

With long term energy demands in horizon, Barauni Refinery will also witness expansion from current installed capacity of 6 MMTPA to 9 MMTPA at an estimated project cost of ₹ 14,000 crore, as a part of the company’s capacity augmentation plans.

Pipelines

The robust logistics network of the Company is strengthened by its formidable network of pipelines transporting crude oil to its refineries and finished products to high-consumption centres across the length and breadth of the country. The extensive network was further expanded by 438 km during the year to span more than 14,670 km, with a combined throughput capacity of 94.56 million tonnes per annum for crude oil / product and 21.69 MMSCMD (million metric standard cubic metres per day) for gas pipelines.

The Product pipelines recorded the highest ever throughput of 37.92 MMT as against 37.20 MMT achieved during the previous year, registering a growth of 1.9%. The gas pipelines also achieved the highest ever throughput of 2,400 MMSCM during the year, as against a throughput of 1834 MMSCM in 2018-19.

The Company commissioned the Motihari - Amlekhganj products pipeline, the first transnational pipeline of the country, in July, 2019, eight months ahead of the schedule. The pipeline has enabled supply of petroleum products to Nepal in a safe and cost-efficient manner.

For the first time in India, the first batch of 10% ethanol - blended petrol was pumped through the Mathura - Tundla pipeline in April, 2019. Subsequently, the same was carried out in the Mathura - Delhi pipeline in October, 2019 and in Mathura - Bharatpur pipeline in February, 2020.

Marketing

The Company has the largest share towards meeting the domestic petroleum product demand of India that leverages its behemoth customer base catered to by its ever expanding touchpoints. The Company achieved domestic sales of 78.54 MMT of petroleum products during the year, with footfall of 2 crore per day at retail outlets and delivery of 25 lacs LPG cylinders per day, as against 79.45 MMT in the previous year, registering a drop of 1.1% mainly due to the countrywide lockdown in March 2020 leading to a significant drop in overall sales.

During the year, the country’s first Compressed Bio-Gas dispensing station was commissioned by the Company in Pune, followed by another station in Kolhapur. As a part of the Company’s plan to foray into alternative energy segment, 54 battery charging / swapping stations were also set up in partnership with various companies.

To cater to the rising fuel demand, the Company commissioned new state-of-the-art automated bulk storage terminals at Una (Himachal Pradesh) and Doimukh (Arunachal Pradesh) during the year. In addition, new LPG bottling plants were commissioned at Bhatinda (Punjab), Banka (Bihar) and Tirunelveli (Tamil Nadu) to improve turnaround of LPG cylinders.

During the year, the Company released more than 75 lakh LPG connections, of which 41 lakh connections were released under Pradhan Mantri Ujjwala Yojana (PMUY) to women from poor households. The target of releasing 8 crore LPG connections on industry basis under PMUY was achieved in September 2019, seven months ahead of the targeted timeline. Out of the 8 crore PMUY connections, the Company has released 3.75 crore connections.

The Company also commissioned 524 new LPG distributorships, taking their total number to 12,450. The Company achieved the highest ever annual sale of 12.33 MMT of LPG during the year.

SERVO, the lubricant brand of the Company, continued to be the market leader in finished lubricants segment with sale of 407 Thousand Metric Tonnes (TMT) during the year. 110 SERVO grade approvals were obtained from Original Equipment Manufacturers (OEMs) like Tata Motors, Mahindra & Mahindra, KIA Motors, Nissan, Honda, etc., during the year. With the appointment of lubricant distributors in four new countries, i.e., Myanmar, Indonesia, Qatar and Vietnam, SERVO exports increased by 12.7% during the year.

The Aviation Service of the Company continued to maintain its leadership position with a market share of 63.8% during the year. With the commissioning of four new Aviation Fuel Stations (AFS), the Company is now providing aircraft refuelling services at 119 airports in the country. The Company continued to be the reliable fuel supplier of Indian Air Force during the relief operations carried out during natural calamities.

The Cryogenics group of the company sold 33,000 units of cryo-cans and cryo-vessels during 2019-20, as against the previous year’s sale of 29,555 units, registering a growth of 13%. During the year, the Cryogenics group also fabricated 16 aviation refuellers.

Research & Development

During the year, 133 lubricant formulations were developed, of which 112 were commercialised. 66 approvals were also received from Original Equipment Manufacturers (OEMs) during the year.

The R&D Centre filed for 128 patents (37 Indian and 91 overseas) and was granted 123 patents during the year, taking the tally of active patents to 929.

Financial Highlights

IOC Q4 results

Indian Oil Corp Ltd on May 19, 2021 reported a fourth-quarter profit that beat analysts' estimates by a huge margin as higher crude prices boosted the inventory value of the country's biggest refiner. 10

The state-owned company reported a standalone net profit of Rs 8,781 crore for the quarter ended March 31, compared with a loss of Rs 5,185 crore a year ago.

Analysts were expecting the refiner to log a profit of Rs 5,506 crore, according to Refinitiv IBES data.

Inventory gains are booked when oil prices rise by the time a company processes oil into fuel. Brent crude prices jumped about 23% during the March quarter.

Revenue rose 18% to Rs 1.64 trillion.

IOC's April-to-March 2021 average gross refining margin - the difference between the cost of crude oil processed and the selling price of refined products - jumped to $5.64 per barrel against $0.08 a barrel a year ago.

The company, along with subsidiary Chennai Petroleum, controls about a third of India's 5 million-barrels-per-day (bpd) refining capacity.

Reported Consolidated quarterly numbers for Indian Oil Corporation are: 11

- Net Sales at Rs 119,747.09 crore in March 2021 up 1.47% from Rs. 118,007.32 crore in March 2020.

- Quarterly Net Profit at Rs. 9,026.49 crore in March 2021 up 215.98% from Rs. 7,782.55 crore in March 2020.

- EBITDA stands at Rs. 15,053.31 crore in March 2021 up 907.87% from Rs. 1,863.34 crore in March 2020.

- IOC EPS has increased to Rs. 9.83 in March 2021 from Rs. 8.48 in March 2020.

References

- ^ https://iocl.com/AboutUs/Business.aspx

- ^ https://iocl.com/AboutUs/Refineries.aspx

- ^ https://iocl.com/AboutUs/Pipelines.aspx

- ^ https://iocl.com/AboutUs/Marketing.aspx

- ^ https://www.iocl.com/AboutUs/Research_Development.aspx

- ^ https://www.iocl.com/AboutUs/NaturalGas.aspx

- ^ https://www.iocl.com/AboutUs/e_and_p.aspx

- ^ https://www.iocl.com/Products/Cryogenics.aspx

- ^ https://www.iocl.com/download/IndianOil-Annual-Report-2019-20.pdf

- ^ https://www.business-standard.com/article/companies/indian-oil-corporation-reports-net-profit-of-rs-8-781-cr-in-fourth-quarter-121051900651_1.html

- ^ https://www.moneycontrol.com/news/business/earnings/ioc-consolidated-march-2021-net-sales-at-rs-119747-09-crore-up-1-47-y-o-y-6915311.html