Info Edge (India) Ltd

Company Overview

Info Edge (India) Ltd. (NSE NAUKRI) was incorporated on May 1, 1995 as Info Edge (India) Private Limited and became a public limited company on April 27, 2006. Starting with a classified recruitment online business, naukri.com, Info Edge has grown and diversified rapidly, setting benchmarks as a pioneer for others to follow. Driven by innovation, creativity, an experienced and talented leadership team and a strong culture of entrepreneurship, today, it is India’s premier online classifieds company in recruitment, matrimony, real estate, education and related services.1

Its business portfolio comprises:

Recruitment: Online recruitment classifieds, www.naukri.com, a clear market leader in the Indian e-recruitment space, www.naukrigulf.com, a job site focused at the Middle East market, offline executive search (www.quadranglesearch.com) and a fresher hiring site (www.firstnaukri.com). Additionally, Info Edge provides jobseekers value added services (Naukri Fast Forward) such as resume writing.

Matrimony: Online matrimony classifieds, www.jeevansathi.com, is among the top three in India’s online matrimonial space, and has offline Jeevansathi Match Points and franchisees.

Real Estate: Online real estate classifieds, www.99acres.com, is India’s largest property marketplace covering almost all the major cities and a large number of agents and developers.

Education: Online education classifieds, www.shiksha.com, is the smartest gateway for students to achieve their goals.

The company's spirit of entrepreneurship has also been evident in the investments it has made in early stage companies/start-up ventures to tap into the growing and vibrant Indian internet market. Currently, the company has investments in Zomato Media Private Limited (www.zomato.com); Applect Learning Systems Private Limited (www.meritnation.com); Etechaces Marketing and Consulting Private Limited (www.policybazaar.com); Kinobeo Software Private Limited (www.mydala.com); Canvera Digital Technologies Private Limited (www.canvera.com); Happily Unmarried Marketing Private Limited (www.happilyunmarried.com); Goa-based Mint Bird Technologies Private Limited (www.vacationlabs.com); Mumbai based Green Leaves Consumer Services Private Limited (www.bigstylist.com); and Rare Media Company Private Limited (bluedolph.in).

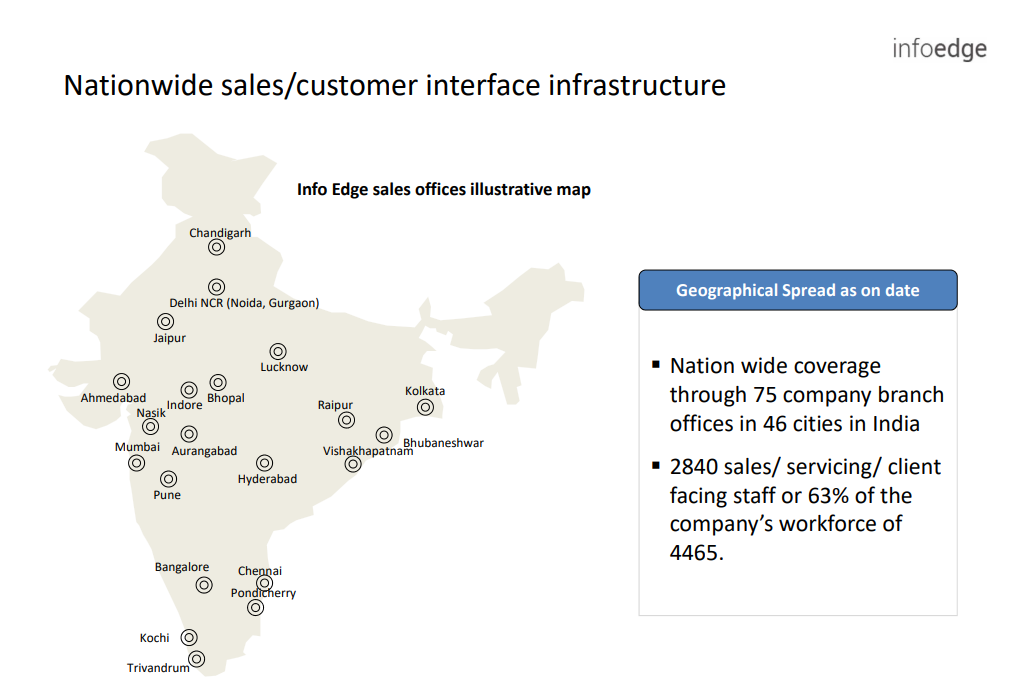

With a network of 75 offices located in 46 cities throughout India, Info Edge has 4,049 employees engaged in innovation, product development, integration with mobile and social media, technology and technology updation, research and development, quality assurance, sales, marketing and payment collection. It has also made forays abroad into the Gulf market with the website www.naukrigulf.com and currently has offices Dubai, Bahrain, Riyadh and Abu Dhabi.

Info Edge has the following subsidiary companies:

Naukri Internet Services Private Limited and Jeevansathi Internet Services Private Limited, which own internet domain names and related trademarks;

Allcheckdeals India Private Limited which provides brokerage services in the real estate sector in India;

Info Edge (India) Mauritius Limited primarily to make overseas investments of the company (under liquidation);

Applect Learning Systems Private Limited which is engaged in business of kindergarten to class12 (K-12) assignment and tuitions through its online portal Meritnation.com;

Zomato Media Private Limited, which operates an online food guide portal zomato.com; and

MakeSense Technologies Private Limited, owner of proprietary software for semantic search which augments search capabilities for both recruiters and job seekers, principally on naukri.com.

Additionally investments made by Info Edge in other companies may have been routed through some of these subsidiaries.

Business Overview

Recruitments Solutions

Recruitment solutions is the Company’s principal business. Today, the business is rapidly moving into the next stage of evolution. The core brand naukri.com is a clear market leader and the primary source of income and profits for Info Edge. 2

The recruitment market has several specialised requirements and these can be segmented in terms of grade, type, industry and quality of jobs. Consequently, Info Edge is further evolving its recruitments business by enhancing its brand architecture. This includes developing several sub-brands and different platforms within the recruitment space that support the core ‘naukri’ brand. Through this multi-tiered brand architecture, the Company strives to provide differentiated products that can further penetrate the market and create multiple avenues of revenue streams.

The recruitment space comprises the following portals:

- naukri.com:This is the Company’s flagship brand and India’s largest online jobsite.

- naukrigulf.com: works on replicating the naukri.com model in the Middle East. While the initial focus was on the Indian diaspora, today people from several nationalities use the site.

- iimjobs.com: This is a newly acquired brand that focuses on middle and senior management of specific skillsets.

- hirist.com: The brand was acquired alongwith iimjobs and caters to the engineering profiles and jobs.

- iimjobs.com and hirist.com are operating through wholly owned subsidiary.

- bigshyft.com: A newly developed specialised platform that targets the premium end of the job market with personalised services.

- Quadrangle offers off-line placement services to middle and senior management, with revenues based on a success fee model. It complements the online recruitment business.

- firstnaukri.com was launched in Q4, FY2010. The site focusses on campus hiring. Today, much of this hiring is done offline, and the focus on this business is to convert the existing offline activities to online and build on the potential of online campus hiring. This is at a nascent stage of development.

- Hiring Campaigns is a personalized CV shortlisting service, offered to corporate organizations. Shortlisting relevant candidates and conducting interviews are the two core hiring solutions provided by e-hire. Servicing over 5,000 clients every year, the product caters to hiring needs of varied kinds including mass and bulk recruitments, mid-to-senior level management vacancies and premium positions.

- Naukri fastforward:This provides value added services to jobseekers on Naukri.

- jobhai.com: A newly developed portal offering for blue and grey collared jobs.

- Ambitionbox collects reviews and interview questions from real employees to help jobseekers make informed career decisions.

The market leadership has contributed to the generation of healthy profits and good cash flows that have been reinvested in the business to create greater competitive edge in the market. Continuous investments are made in product innovation, engineering, brand support, sales network, servicing back office and hiring superior talent to regularly take on the competition.

To enhance offering in this space, FY2020 saw Info Edge acquiring 100% stake in Highorbit Careers Pvt. Limited that owns the domain iimjobs.com through an all cash deal. With 10,000 active jobs and 1.46 million job applicants, iimjobs.com is India’s leading recruitment platform for management and engineering professionals and caters to over 400 leading corporate customers. This business is being gradually integrated into the Info Edge system and there was steady quarter-on-quarter growth till COVID-19.

To provide certain career related value added services in mid-premium end of the job segment, the Company has launched the Bigshyft platform. With the objective of creating greater engagement for the premium end of the naukri.com clientele, this is envisaged as a value added service. It is a ‘recommendation only’ platform which has been developed by researching into the naukri.com and other database and providing relevant value added services to a segment of its members.

To service the blue collar segment, the Company has launched jobhai.com, which is a platform for this large untapped market. This was launched in FY2020 with primary focus on Delhi NCR. The business is in a very preliminary developmental stage and is going through the first phase of incubation.

Real Estate: 99acres.com

The real estate sector in India has seen a slowdown in growth over the last few years. The industry, which was already struggling because of the avarices of some bad players, had faced several setbacks over the last few years due to policy changes such as RERA, demonetization and GST. When it was finally starting to recover, Covid pandemic struck. COVID-19 induced lockdown brought construction activities and site visits to almost a complete halt. It gravely affected developers cash situation whereas forced many brokers to shut shop. Due to larger economic uncertainty, buyers also stayed away from making large ticket purchases such as real estate. The present slowdown in real estate will certainly affect new project launches and reduce overall advertising spends from developers of new homes in the short run. There is also likely to be a migration of buyer interest to more ready to move in properties. However, over a medium time horizon, this could prove beneficial for the online real estate advertising segment, as sellers would need to create much longer engagement with customers that cannot be done well through the print media.

Real estate companies spend nearly 2-6% of their revenue on advertisements. The advertising spends, however, differ from small and mid-size (revenues Rs 15 billion) companies. Small and mid-size companies generally spend 2-4%, on the other hand large companies spend around 4-6% of their annual revenue on advertising. The share of online advertisements has been comparatively higher for the small and mid-sized companies as of FY2019 compared to large developers. Large developers have traditionally relied more on offline advertising media such as TV, radio and outdoor .Online media accounted for only around 10-20 of their overall spends on advertising in FY2019. But this is changing fast. Over the past few years, even though the total spend by the real estate industry on advertising has remained same or in some cases declined, the online real estate classifieds industry (excluding Google and Facebook) in India has grown at a CAGR of 20-21% from ~`2.7 billion in FY2016 to ~`5.7 billion in FY2020 . This has been largely

99acres.com is already one of the leading brands in this segment . The focus is on further developing the brand to reach a level where it attains clear leadership in all the markets, which then gets into its own virtuous cycle of growth —gets the most real estate listings, secure the most traffic, get the most responses, generate more clients, which in turn takes the site to a higher level of listings. Primary focus of 99acres.com is on getting to clear leadership position in the big cities, and at the same time driving deeper penetration into the smaller towns and cities.

Billings in FY2020 grew by 3.5% to Rs 2,139.47 million. In fact, after mid-March 2020, in the aftermath of the COVID slowdown, there was sharp downturn affecting overall growth momentum. Till mid-March, collection growth was 13% for Q4 FY2020, which turned negative post the lockdown. The business requires long term investments in areas like data quality, technology, brand and analytics to break away from competition.

In terms of traffic share, too, 99acres.com continues to maintain its clear leadership positioning. During the course of FY2020, as per traffic share data from similarweb.com, it maintained an overall traffic share in excess of 40%.

As of March 31, 2020, total project listed, including ready to move in and under construction, were over 170,000, while total listings was around 942,000.

While in terms of number of customer, the broker community is dominant with 21,600 out of a total of 26,600 customers, in terms of billing they contribute 52%, while builders contribute 42%, with much higher revenue per customer compared to brokers.

Matrimonial: jeevansathi.com

CRISIL estimates suggest that the online matrimony classifieds industry in India is estimated to have grown from ~ Rs 4.4 billion in FY2016 to ~ Rs 6.7 billion in FY2020, logging a CAGR of 10-12%, due to an increase in paid subscribers (subscription fee is a main revenue stream for players). On an average, nearly 12-14 million weddings take place in India every year, of which 80% are arranged marriages. With increasing internet and smartphone penetration in India, the domestic online matrimony classifieds industry is expected to grow strong over fiscals 2020-2023. CRISIL Research expects the industry to continue to clock a healthy 14-15% CAGR during the period to reach Rs 9.8-10.0 billion by FY2023. This growth will come from an increase in the number of paid subscribers and the portals’ ability to charge subscribers a premium on account of advanced and enhanced technological features.

Marriage matchmaking is a highly fragmented market in terms of regions within India and communities. Consequently, there are several players present in the market — over 1,500 sites in India (according to The New York Times). Unfortunately, with the plethora of offerings, there are several issues relating to the quality of data posted, support services offered, match-making algorithms, issues related online cheating and the like. Consequently, only a few of these sites have managed to garner customer confidence. Having said so, many of these sites also cater to a specific region or community, instead of becoming pan-Indian, cross-community players.

jeevansathi.com has been one of the few sites that have managed to overcome the market complexities and built scale. Today, it is one of the three principal players in this market. In this highly competitive market, where different players are investing heavily to establish their niche, jeevansathi has reoriented its business with a focus on certain specific communities with a clear thrust in North and West India. Within this segment, double digit growth is witnessed in metros, while the smaller towns (typically with populations under 10 lakh) are growing at even higher rate.

The website offers a free platform for listing, searching, expressing interest and accepting others expression of interest in the online matrimonial space. Freemium model allow growth in traffic for the website. Revenues are generated by allowing users to connect and communicate on the platform, increase their profile visibility and other value added services.

More than 90% of users accessed jeevansathi.com from their mobile, and the mobile app continues to be the best in the industry.

The brand looks to consolidate its position as it penetrates deeper in the key regions that it operates in. It continued to spend more on marketing activities in FY2020 to strengthen brand positioning. Specific campaigns were done in different geographic segments. This also included outdoor campaigns in smaller cities. Several online events have been introduced to create more buzz on the site — some 25-30 such events being held on a monthly basis.

Education: shiksha.com

The online education classifieds and counselling business in India is expected to grow rapidly in the near future. Consequently, it is attracting newer players and competition is starting to get intensive. While education institutions and foreign universities are big spenders in the print media, their online spend is increasing at a gradual pace.

shiksha.com is the Company’s offering in the online education classifieds space. The website has been strategically positioned as a platform that helps students research and apply undergraduate and postgraduate programs, by providing useful information on careers, exams, colleges and courses.

The business generates revenues from the following sources:

- Branding and advertising solutions for colleges and universities (UG, PG, post-PG). It gets advertising revenues from both Indian and foreign institutions.

- Lead generation: Potential student/applicants details are bought by colleges and their agents. Full counselling services are provided for some international university partners.

Shiksha.com’s business strategy is focused on driving growth by becoming platform of choice for students and parents to research colleges and courses and by encouraging educational institutions to shift their advertisement investments from the print media to the digital platform. This is being pursued by adopting a four-pronged strategy.

During the year under review, the Company made strategic investments in related and adjacent business in companies named- Metis Eduventures Pvt. Ltd. and Sunrise Mentors Pvt. Ltd. and follow on investment in International Educational Gateway Pvt. Ltd.

Investee Companies

Info Edge has widened the scope of its business by investing as a financial investor in brands that have been conceptualised and developed by separate enterprises. These investments are into new ideas and products integrated with a sound and enterprising management teams.

While adopting a cautious approach to these investments, Info Edge recognises the importance of fostering creativity, new ideation and technology development to essentially incubate, develop and grow such new business models in the internet based services industry. In doing so, the Company is aware of the risks and the requirement to fund losses during initial phases of development. Indeed, most of the investee companies happen to be in such initial phases of development that require investments for enhanced value creation.

The net value (Cost less dimunition / monetisation) of investments into these companies was Rs 10,810 million (including investments through AIF) as of March 31, 2020. While nurturing this investment portfolio, some investments get written off given the lack of progress in the businesses. So far, since inception till March 31, 2020, a total of Rs 3,147 million worth of investments were written off or provisioned for in the books.

Financial Highlights

The Revenue from operations for FY 2020 increased by 15.9% to Rs 12,726.95 million from Rs 10,982.56 million for the FY 2019, primarily on account of increases in sales of services from recruitment solutions services, real estate services as a result of increased subscription from new customers and from its existing customers subscribing to higher priced packages. This increase was partly offset due to impact of COVID-19 in mid-March on its business.

The total income of the Company increased by 12.5% to Rs 13,603.13 million for FY 2020 from Rs 12,094.08 million for FY 2019, on account of increase in its revenue from operations. The other income of the Company contributed Rs 876.18 million to the total income for FY 2020.

The total expenses for the year increased by 18.1% to Rs 9,180.31 million for the FY 2020 from Rs 7,773.78 million for the FY 2019, primarily on account of increase in employee benefit expenses, higher spend on advertising and promotion costs and depreciation and amortization expenses.

Operating EBITDA, for the year, recorded an increase of around 18.0% over previous year and stood at Rs 4,027.31 million in comparison with Rs 3,413.42 million in FY 2019. Profit before tax (PBT) from ordinary activities (before exceptional items) is Rs 4,422.82 million in FY 2020 as against Rs 4,320.30 million in FY 2019.

Recruitment Solutions

During the year under review, Recruitment Solutions grew by 15.4% from Rs 7,858.49 million in FY 2019 to Rs 9,067.60 million in FY 2020. Operating EBITDA from Recruitment Solutions in FY 2020 was Rs 5,041.16 million as compared to Rs 4,295.33 million in FY 2019.

99ACRES

During the year under review, real estate business grew by 18.8% from Rs 1,919.64 million in FY 2019 to Rs 2,279.61 million in FY 2020. Operating EBITDA from real estate business stood at Rs 84.02 million in FY 2020.

Others

With revenues from these other verticals increasing by 14.6%, their combined contribution to the Company’s revenue was 10.8% in FY 2020. Jeevansathi.com grew by 17.1% & Shiksha.com grew by 10.8%. The Company would continue to invest more to scale up these businesses.

Consolidated Financial

The company, on a consolidated basis, achieved net revenue of Rs 13,119.30 million during the year under review as against Rs 11,509.32 million during the previous financial year, a growth of 14% year on year. The total consolidated income for the year is Rs 14,163.95 million as compared to Rs 12,712.45 million in FY 2019.

Operating EBITDA, for the year, stood at Rs 3,726.23 million in comparison with Rs 3,127.59 million in FY 2019. Total Comprehensive loss, in FY 2020, is reported to be Rs 2,405.34 million in comparison to Total Comprehensive Income of Rs 6,005.97 million in FY 2019.

Q3 FY21 results

Info Edge (India) Limited announces Q3 FY21 results for the quarter ended Dec 31, 2020, Q3 Net Sales (Revenue) down by 15.0%, Billing down by 1.0%, Total Income down by 10.9%, Operating EBITDA down by 35.6%. 3

- Billing at ₹297.0 crore, down by 1.0% over the corresponding quarter in FY 2019- 20

- Net sales (Revenue) at ₹272.3 crore, down by 15.0% over the corresponding quarter in FY 2019-20.

- Total Income at ₹303.9 crore, down by 10.9% over the corresponding quarter in FY 2019-20.

- Operating EBITDA at ₹68.2 crore, down by 35.6% over the corresponding quarter in FY 2019-20.

Info Edge recorded Billing of ₹297.0 crore for the quarter ended Dec 31, 2020 compared to ₹299.9 crore in quarter ended Dec 31, 2019, down by 1.0%. Net Sales (Revenue) of ₹272.3 crore for the quarter ended Dec 31, 2020 compared to ₹320.5 crore in quarter ended Dec 31, 2019, down by 15.0%. The deferred sales revenue (amount collected in advance) as at Dec 31, 2020 is ₹393.5 crore, down by 13.9% over the quarter ended Dec 31, 2019. Operating EBITDA has decreased by 35.6% from ₹105.9 crore (Q3, FY 2019-20) to ₹68.2 crore. The company reported PBT (before exceptional item) of ₹87.5 crore for the quarter ended Dec 31, 2020 compared to ₹114.3 crore for quarter ended Dec 31, 2019.