JSW Steel Ltd

Overview

JSW Steel Ltd (NSE: JSWSTEEL) is amongst the leading conglomerates in India, JSW Group is a $12 billion company. It is an integral part of the O. P. Jindal Group, and has been a part of major projects that have played a key role in India’s growth.1

Ranked among India's top business houses, JSW's innovative and sustainable ideas cater to the core sectors of Steel, Energy, Cement and Infrastructure. The Group continues to strive for excellence with its strength, differentiated product mix, state-of-the-art technology, excellence in execution and focus on sustainability.

From its humble beginnings in steel, the JSW Group has expanded its presence across India, South America, South Africa & Europe. Through its CSR projects, it also continues to participate in and initiate activities that assist in improving those areas of its country that lack resources. JSW is known to be the “strategic first mover” to venture away from status quo, have the conviction to make fundamental changes and drive operational excellence on its quest to become better everyday.

With the largest product portfolio in steel, JSW Steel is India's largest steel exporter, shipping to over 100 countries across 5 continents. Over the last 35 years, JSW Steel has been at the forefront of science and cutting-edge technology.2

Starting with a single plant in 1982, JSW Steel is now India's leading manufacturer of value-added and high-grade steel products. With plants in Karnataka, Tamil Nadu and Maharashtra, JSW Steel has the capacity to produce 18 million tons per annum (MTPA).

Brands

- JSW Everglow (Advance Roofing Technology)

- JSW Colouron + (Premium Al-Zn Colour Coated Sheets)

- JSW Colouron (Premium Colour Coated Sheets)

- JSW Pragati + (Colour Coated Sheets)

- JSW Vishwas (Premium GC Sheets)

- JSW Vishwas + (Premium Al -Z n Sheets)

- JSW Galvos (Premium Galvalume Coil & Sheets)

- JSW Galveco (Lead-Free Galvanised Sheets)

- JSW Platina (Superior Quality Tinplate)

- JSW Neosteel (Pure TMT Bars)

- JSW Trusteel (Premium Hot Rolled sheets)

- JSW Avante (Smart Steel Doors)

- JSW Radiance (Superior Quality Colour Coated Sheets & Coils)

Products

Hot Rolled (HR)

- HR Coil

- HR Sheet

- HRPO / HRSPO

Cold Rolled (CR)

- CR Coil

- CR Sheet

Color Coated Products

- Pre-painted Galvalume Corrugated Sheets & Profile

- Pre-painted AL-ZN Sheets & Profile

- Pre-painted GI & GL Coils

Galvanized

- Galvanised Coils

- Galvanised Corrugated Sheet & Profile

Galvalume

- AL-ZN Coated Coils & Sheets for Solar Structures

- AL-ZN Coated Corrugated Sheets & Profiles

Avante Steel Doors

- Plain Finish Steel Doors

- WOOD GRAIN STEEL DOORS

- CLASSIC EMBOSSED WOOD GRAIN FINISH DOORS

- SIX PANEL EMBOSSED WOOD GRAIN FINISH DOORS

- COMBINATION STEEL DOORS

- FRAMED GLASS STEEL DOORS

Production Facilities

The Flagship company of JSW Group, JSW Steel is one of India's leading integrated steel manufacturers with a capacity of 18 MTPA. It is one of the fastest growing companies in India with footprint in over 100 countries. With state of the art manufacturing facilities located in Karnataka, Tamil Nadu and Maharashtra, it is recognised for its innovation and quality. JSW offers a wide gamut of steel products that include Hot Rolled, Cold Rolled, Bare & Pre-Painted Galvanised & Galvalume , TMT Rebars, Wire Rods and Special Steel.3

To stay on the leading edge of technical advancement, JSW has entered into technological collaboration with JFE Steel Corp. Japan, for manufacturing high strength &

advanced high strength steel for automobile sector. JSW Steel also entered into a joint venture with Marubeni-Itochu Steel Inc., Tokyo, to set up a state-of-the-art steel processing centers. To strengthen its global network, the Company has acquired a Pipe and Plate making steel mill in USA and JSW Steel Italy, Piombino

By 2025, JSW Steel aims to produce 40 million tons of steel annually

Plant Locations:

Vijayanagar, Karnataka

Located at Toranagallu village in the Ballari-Hospete iron ore belt, its 10,000-acre, with a capacity of a whopping 12 million tonnes per annum (MTPA), fully integrated Vijayanagar steelworks is well-connected to both Goa and Chennai ports. With its cutting-edge of technology and constant innovation, it has emerged as a steel plant with one of the most efficient conversion costs globally.

Dolvi , Maharashtra

The 5 MTPA integrated steel plant at Dolvi is advantageously located on the West coast of Maharashtra. It is connected to a jetty which can handle cargo of up to 15 MTPA.

JSW Dolvi Works is India’s first to adopt a combination of Conarc Technology for both steel-making and compact strip production (CSP), aiding the production of hot rolled coils. From automotive and industrial to consumer durables, Dolvi manufactures products that meet the needs of companies across sectors.

Salem, Tamil Nadu

The strategic location of the Salem plant allows it to cater to the demanding needs of the major auto hubs in South India. Located around 340 kilometers from Chennai and 180 kilometers from Bangalore, it is well connected with railway lines, highways and ports, which makes the transportation of raw materials and finished products easy. The largest special steel plant in India with 1 MTPA Capacity that Produces more than 850 special grades of steel. This, coupled with its start-of-the-art technology and unique processes, makes Salem a steel plant that’s truly a cut above the rest.

Kalmeshwar, Maharashtra

Located just 25 kilometers away from Nagpur, the Kalmeshwar Plant is spread over a massive 3,44,344 sq. m., which makes it one of the biggest industries in the MIDC area. While taking over its reins in 2010, its goal was clear - to increase the product portfolio and reach a larger client base through its state-of-the-art facilities.

Thanks to its central location, Kalmeshwar easily supplies its products to customers across the country. We’ve brought in cutting-edge Japanese technology in order to manufacture the best here. The Nippon Denro, for instance, has helped it create a continuous pickling line. The company also house two hi cold reversing mills, one supported by Hitachi, and the other, homegrown. Innovation has always been at the heart of everything the company do, and at Kalmeshwar, it helps it stay one step ahead, both in terms of technology and production.

Tarapur, Maharashtra

JSW Tarapur was acquired in 1982, and was the first plant to have a galvanising line commissioned for it. It is also recognised as India’s largest producer and exporter of coated products, and features a 30MW captive power plant. With clients spread across Europe, North and South America, Africa and the Middle East, Tarapur has both the technology and the equipment to cater to every need. First plant to specialize in ultra-thin coated products. It will soon launch a new facility of 0.20 MTPA Electrolytic Tinning Line through Continuous Annealing Route.

Vasind Maharashtra

Located 80 kilometres away from Mumbai, JSW Vasind works is a part of today India’s biggest producer & largest exporter of coated steel.

With one galvanizing line, one galvalume line and two colour coating lines, the Vasind plant is one of the leading producers of coated steel in both the domestic and international markets. Major export markets are US, Europe & Middle East. To help the export the plants has a railway siding within the premises

It is also home to the first-of-its-kind appliance grade colour coating line, which primarily produces steel for refrigerators, air-conditioners, washing machines and other home appliances. Over the years, Vasind has expanded its product range. It has also widened its reach in the community, through social and cultural initiatives that have a positive impact on thousands of lives.

JSW USA, Baytown

With one of the widest mills in North America, the JSW plate division rolls hot-rolled plate widths up to 160 inches (4.1m) and thicknesses up to six inches (152.4mm). The company service shipyards, oilfield fabricators, heavy equipment producers, windtower, railcar, storage tanks, and many other end users and distributors who need high quality carbon plate.

Using quality plate from JSW, its pipe division produces DSAW pipe (Including large diameter pipe from 24” to 48”) to service energy and petrochemical markets, including large diameter line pipe for onshore and offshore use, heavy duty casing, and piling. The Pipe division also provides OD coating (Fusion Bond Epoxy, Abrasion Resistant Outer) and ID Flow Liner coating.

Strategically located in Baytown, Texas, just 30 miles outside of Houston, the company ship its finished product via barge, rail and truck. The company's proximity to the Port of Houston gives it easy access to global markets. As a Texas corporation and an affiliate of India’s Jindal Group with more than 10 million tons of installed capacity worldwide, its facilities benefit from its parent's world class engineering expertise and product know-how.

JSW Steel USA, Ohio

JSW Steel USA - Ohio Facility made a humble beginning in June, 2018 by acquiring the Melt shop and Rolling mill of the former Wheeling Pittsburgh Steel plant at Mingo Junction, Ohio which has a long operating history dating back to 1872. The plant currently has a modernized facility with an EAF, LMF, Slab Caster and 80” Hot Rolling Mill.

The JSW management team took on the daunting task of restarting the complex within the shortest possible time after it sat idled for 10 years.

The Hot Strip Mill was restarted in July of 2018 under JSW management, and rolled purchased slabs to begin offering hot roll product into the market. The EAF/Slab caster was started up in December of 2018 and thus began to offer melted and manufactured in the USA to it’s customer base.

JSW Steel, Italy Piombino

JSW Steel Piombino (part of JSW Steel Italy/JSW Group) is an iron and steel company which bought Lucchini plant located in Piombino (Italy). Lucchini has been for long time one of the most important manufacturers in Europe, leader in the production of long steel products for high quality and special steels.

With the acquisition of Piombino Plant, JSW Group got all the brands and know how developed in over 100 years of steel history. JSW Steel Piombino's activity involves the production of a wide range of quality and special steels, with different shapes and sizes for Rails, Wire Rod and Bars. They are destined to different sectors: Railway, Automotive, Earth Moving Vehicles, Energy, Fastening, Springs, Welding.

JSW Steel Italy controls the companies JSW Steel Piombino, GSI Lucchini and Piombino Logistics. It is part of the JSW Group: Indian steel leader, also present in Europe and America, active in the steel, energy, infrastructure, ventures and cement businesses. The JSW Group is also active in the life of people with the Jindal Foundation, sustainability projects and sports.

Industry Overview

Global steel industry

The global steel industry faced a challenging CY 2019, as demand growth in a few markets was largely offset by declines in the rest of the world. An uncertain economic environment, coupled with continued trade tensions, slowdown in global manufacturing notably auto sector and intensifying geopolitical issues, weighed on investment and trade. Similarly, production growth was only visible in Asia and the Middle East and to some extent in the US, while the rest of the world witnessed a contraction.4

Crude Steel Production

Global crude steel output in CY 2019 grew by 3.4% y-o-y to 1,869.9 MnT. The global steel industry faced pricing pressure for most parts of CY 2019, in the wake of a protective market environment in key economies, including the imposition of Section 232 in the US. This was further aggravated due to country-specific demand slowdown, that fuelled market imbalances.

In line with a conservative trade sentiment, consumer industries of steel undertook active destocking. This led to stunted capacity utilisation and resulted in net excess capacity globally. This was further complemented by addition of new capacities and resulted in downward pressure on steel prices.

Update on Key Markets

China: Leading the steel industry

Chinese demand and production levels constitute more than half the global steel industry, making world steel trade significantly reliant on demand-supply drivers of the country’s economy. In CY 2019, China produced 996.3 MnT of crude steel, up 8.3% y-o-y; demand for finished steel products was estimated at 907.5 MnT, up 8.6% y-o-y. Steel demand for real estate remained buoyant, due to strong growth in Tier-II, Tier-III and Tier-IV markets, led by relaxed controls. However, the growth was partially offset by muted auto sector performance

EU28: Muted trade but outlook positive

The Eurozone was hit hard in CY 2019 by trade uncertainties due to a sharp slowdown in German manufacturing led by lower exports. Demand for finished steel products fell 5.6% y-o-y, due to the weakness in the automotive sector, which was partially offset by a resilient construction sector. Crude steel production declined 4.9% y-o-y to 159.4 MnT from 167.7 MnT.

US: Flattish growth

Demand for finished steel products in the US grew by 1.0% y-o-y to 100.8 MnT from 99.8 MnT.

Japan: Sluggish demand amid signs of gradual recovery

Notwithstanding the new sales tax regime, the Japanese economy is expected to recover gradually, supported by easing monetary policy and public investments, which is likely to support steel consumption growth in the short term. Further, Japan being an export-driven economy stands to benefit from the resolution of trade disputes. However, overall demand for steel is expected to contract slightly, on account of a weak global macroeconomic environment. Demand for finished steel products in Japan fell by 1.4% y-o-y to 64.5 MnT in CY 2019 from 65.4 MnT.

Outlook

The World Steel Association (worldsteel) forecasts steel demand to decline by 6.4% y-o-y to 1,654 MnT in CY 2020, due to the COVID-19 impact. However, it has asserted that the global steel demand could rebound to 1,717 MnT in CY 2021 and witness a 3.8% rise on a y-o-y basis. Chinese demand is likely to recover faster than in the rest of the world. The forecast assumes that lockdown measures will be eased by June and July, with social distancing continuing and major steelmaking countries not witnessing a second wave of the pandemic.

Steel demand is expected to decline sharply across most countries, especially in the second quarter of CY 2020, with a likely gradual recovery from the third quarter. However, risks to the forecast remain on the downside as economies make a graded exit from the lockdowns, without any particular cure or vaccine for COVID-19.

Chinese steel demand is expected to grow by 1% y-o-y in CY 2020, with improved outlook for CY 2021, given that it was the first country to lift the lockdown (February 2020). By April, its construction sector had achieved 100% capacity utilisation.

Developed economies

Steel demand in developed economies are expected to decline 17.1% y-o-y in CY 2020, due to the COVID-19 impact with businesses struggling to stay afloat and high unemployment levels. Thus, recovery in CY 2021 is expected to be muted at 7.8% y-o-y. Steel demand recovery in the EU markets is likely to get delayed beyond CY 2020. The US market is also likely to witness a slight recovery in CY 2021. Meanwhile, Japanese and Korean steel demand will witness double-digit declines in CY 2020, with Japan being impacted by reduced exports and halted investments in automobiles and machinery sectors, and Korea being impacted by lower exports and weak domestic industry.

Developing economies (excluding China)

Steel demand in developing countries excluding China is expected to decline by 11.6% in CY 2020, followed by a 9.2% recovery in CY 2021.

Indian steel sector

The steel industry has been one of the primary beneficiaries of India’s rapid economic growth over the past couple of decades. However, steel demand remained subdued in CY 2019, largely due to lower consumption from construction, auto, infrastructure, real estate, and manufacturing industries. Further, the slowdown in the government’s infrastructure investments and credit tightness impacted demand and consequently weighed on pricing.

Demand

India became the second-largest consumer of finished steel products in the world, surpassing the US in CY 2019. While the government’s thrust on infrastructure development provided a boost, it was largely offset by the continued weakness in the auto and real estate sectors. Finished steel consumption grew by 1.4% to 100.01 MnT during FY 2019-20, non-alloy steel accounting for 94% (94.06 MnT) and the rest being alloy steel (5.95 MnT). Within the non-alloy, non-flat segment, bars and rods consumption was up 9.6% y-o-y to 39.72 MnT, while the non-alloy flats were led by hot rolled coils (HRCs) which was 40.63 MnT, down by 2.7% during FY 2019-20.

India’s per capita steel consumption, which has a direct correlation with economic growth, grew at a CAGR of 4.12% to 68.9 kg between FY 2007-08 and FY 2017-18, driven by rapid growth in the industrial sector and robust infrastructure development (railways, roads and highways). However, compared with the global average of 208 kg, there exists a significant growth potential. Keeping this in mind, the National Steel Policy (NSP) was introduced in CY 2017 to increase per capita steel consumption to 160 kg by FY 2030-31. The NSP also set a target of achieving 300 MnT of production capacity, which translates into additional investments of ` 10 lakh crore (~US$ 156.08 billion).

Production

According to the Joint Plant Committee, crude steel production declined by 1.5% y-o-y to 109.22 MnT in FY 2019-20, with a sharp contraction of 20% in March 2020 due to COVID-19 containment measures. Finished steel production grew 0.8% y-o-y to 102.06 MnT; non-alloy steel accounted for 96% (up from 93%), or 97.66 MnT, while alloy steel contributed the balance 4.4 MnT. In the non-alloy, non-flat finished steel segment, bars and rods grew by 3.6% y-o-y to 40.48 MnT, whereas in non-alloy flats, HRC grew by 2.6% y-o-y to 43.29 MnT.

India remained a net exporter of finished steel during FY 2019-20, with exports of 8.36 MnT, up 31.4% y-o-y. Non-alloy HRC was the most exported product at 4.82 MnT, while bars and rods led the non-alloy, non-flat segment exports with 0.51 MnT.

Meanwhile, India imported 6.77 MnT of finished steel, down 13.6% y-o-y, with non-alloy HRC accounting for 34% of the total imports. Imports from Korea accounted for 40% of the total imports.

Business Overview

JSW Steel’s best-in-class technology and sustained R&D initiatives help deliver specialised and innovative offerings for its customers. The Company remained strategically focused on enriching its product mix by increasing the volume and share of high-margin VASP in its portfolio.

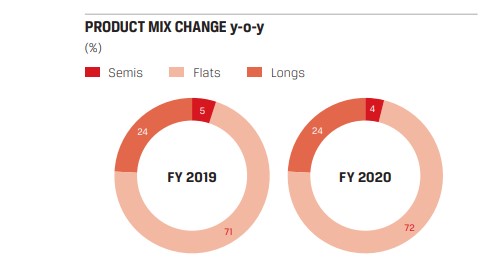

FLATS

JSW Steel produces flat sheet products that include, hot rolled coils, cold-rolled coils and coated products like galvanised, galvalume, tinplate and colour coated. The share of flat products increased to 72% in the product mix, with domestic sales of ~8.26 MnT.

Hot rolled

A wide variety of grades of hot rolled (HR) products are manufactured in Hot Strip Mills (HSMs) of Vijayanagar (Karnataka) and Dolvi (Maharashtra). Vijayanagar Works has an installed capacity of 3.5 MTPA and 5 MTPA for HSM-1 and HSM-2, respectively. The capacity at Dolvi Works stands at 3.5 MTPA, where India’s first CONARC process was implemented for steel manufacturing. In FY 2019-20, Hot Rolled Coils (HRCs) constituted 41% of the Company’s product portfolio.

Cold rolled

Cold rolled (CR) steel products are manufactured at Vijayanagar Works. The CR products segment has a 16% share in the total product mix.

Electrical steel

Electrical steel finds application across sectors such as electric motors, generators, nuclear power stations, power generation plants, domestic appliances, transformers and automotive electricals. Electrical steel sales increased by 6% y-o-y driven by consumer durables, heavy industrial motors and traction motors.

Galvanised

India’s largest manufacturer and exporter of galvanised steel, JSW Steel is also the first supplier of products with higher coating (550 gsm) to the solar sector in the country. The Company’s galvanised products are differentiated with high strength, resistance to corrosion, eco-friendly, durable and lighter weight. These products accounted for 8% of sales in FY 2019-20.

Galvalume

JSW Steel’s Galvalume has played an important role in the development of India’s renewable energy power generation capability. It has been the material of choice for use in solar mounting structures employed in various utility-scale solar projects across the country. In FY 2019-20, JSW Galvalume has been selected for use in prestigious solar project undertakings in India

Colour Coated

Colour coated products comprised 5% of the product portfolio in FY 2019-20, with domestic sales growth of 9% y-o-y.

LONGS

JSW Steel manufactures a variety of long products such as TMT bars, wire rods, and special alloy steel. The product segment comprised 24% of the product portfolio in FY 2019-20, same as last year. During the year, long products’ domestic sales stood at 3.26 MnT.

TMT

TMT rebars are manufactured in Vijayanagar Works and Dolvi Works. They comprise 17% of the product portfolio. JSW Neosteel, the TMT brand, increased penetration in semi-urban and rural areas. JSW Neosteel is one of the best-quality TMT bars available in various thickness ranges in India. Manufactured through the blast furnace route in state-of-the-art rolling mills, they are free from impurities and have uniform properties.

Wire rods

Wire rods are manufactured at Vijayanagar Works and Salem Works comprising 5% of the product portfolio.

Alloy steel

Alloy steel products are manufactured at JSW Salem Works. The Company is the largest domestic producer of spring steels flats, alloy steel rounds and bars and alloy steel wire rods.

Retail

The Group’s diversified product range is supported by a widespread sales and distribution network throughout India. The Group distributes its products in the domestic market by selling directly to customers, retail traders and company stock yards. In the export markets, the Group uses a combination of direct sales to customers and sales to international trading houses.

JSW Retail facilitates marketing and selling of steel products, including flat products (coated steel products) and long products (TMT). It was created to renew focus on branded products, network expansion and strengthen feet-on-thestreet presence. With over 11,000+ exclusive and nonexclusive retail outlets, covering 575 districts across India, JSW Steel operates one of the largest retail steel networks in the country.

The Company has 5,300 influencers and more than 3,000 end consumers. JSW Steel also regularly participates in conferences and exhibitions to display product capabilities.

Financial Highlights

The Company’s revenue from operations on a consolidated basis for FY 2019-20 was Rs 73,326 crores. Operating EBITDA at Rs 11,873 crores registered a decline of 37% y-o-y, in line with the reduction in EBITDA at the standalone entity and increase in losses at the overseas entities.

The Company made an impairment provision of Rs 725 crores for iron ore mining operations at Chile and Rs 80 crores for retirement of certain fixed assets in India.

On a consolidated basis, the Group has written back Rs 2,225 crores on account of reversal of deferred tax liability following the changes in the corporate tax regime, assuming that the Company and one of its subsidiaries would later migrate to the new tax regime. Certain companies of the Group opted for the new tax rate from FY 2019-20, resulting in a reversal of deferred tax liabilities up to March 31, 2019 amounting to Rs 98 crores for the year ended March 31, 2020.

The Company’s net profit reduced 48% y-o-y at Rs 3,919 crores for FY 2019-20 vis-à-vis a net profit of Rs 7,524 crores in the last financial year.

The performance and financial position of the subsidiary companies and joint arrangements are included in the consolidated financial statement of the Company

The Company’s net worth on March 31, 2020 was Rs 36,024 crores compared to Rs 34,345 crores on March 31, 2019. Its gearing (net debt to equity) at the end of the year stood at 1.48x (as against 1.34x as on March 31, 2019) and net debt to EBITDA stood at 4.50x (as against 2.43x as on March 31, 2019).

JSW Steel Consolidated September 2020 Net Sales at Rs 19,264.00 crore, up 9.63% Y-o-Y5

OCTOBER 27, 2020; Net Sales at Rs 19,264.00 crore in September 2020 up 9.63% from Rs. 17,572.00 crore in September 2019.

Quarterly Net Profit at Rs. 1,593.00 crore in September 2020 down 37.77% from Rs. 2,560.00 crore in September 2019.

EBITDA stands at Rs. 4,566.00 crore in September 2020 up 58.16% from Rs. 2,887.00 crore in September 2019.

JSW Steel EPS has decreased to Rs. 6.63 in September 2020 from Rs. 10.66 in September 2019.

JSW Steel shares closed at 308.30 on October 26, 2020 (NSE) and has given 95.99% returns over the last 6 months and 40.55% over the last 12 months.

JSW Steel Consolidated December 2020 Net Sales at Rs 21,859.00 crore, up 21.07% Y-o-Y 6

JANUARY 22, 2021; Net Sales at Rs 21,859.00 crore in December 2020 up 21.07% from Rs. 18,055.00 crore in December 2019.

Quarterly Net Profit at Rs. 2,681.00 crore in December 2020 up 1170.62% from Rs. 211.00 crore in December 2019.

EBITDA stands at Rs. 6,093.00 crore in December 2020 up 136.35% from Rs. 2,578.00 crore in December 2019.

JSW Steel EPS has increased to Rs. 11.15 in December 2020 from Rs. 0.88 in December 2019.

JSW Steel shares closed at 393.30 on January 21, 2021 (NSE) and has given 87.33% returns over the last 6 months and 47.17% over the last 12 months.

Recent Developments

With one more mine operational, 49% JSW Steel's iron ore requirement now met in-house 7

JANUARY 22, 2021 JSW Steel has begun production from the last of the three mines it had acquired in 2019 in Karnataka, a crucial addition to its iron ore reserves at a time when the raw material availability has hit production across the country's steel industry.

The country's leading steelmaker said the third mine started producing iron ore on December 10. "With this, all nine mines of Karnataka are operational. Mining operations at the four mining blocks at Odisha ramped up production and dispatches," the company said on January 22, when it also announced its third quarter results.

The new addition now takes care of 49 percent of the company's iron ore requirement, a marked improvement from 27 percent in October 2020.

Shortage of iron ore is seen as one reason behind the increase in steel prices. It has also impacted JSW Steel's production guidance for the year. "JSW Steel is on course to meet the annual guidance of 15 million tonnes of saleable steel sales, however, it is expected that crude steel production guidance achievement will be around 95 percent mainly due to constraints on iron ore availability in the country," the company said.

The rise in steel prices had led to many of the user industries, including those in real estate, to call upon the government to look into the matter.

Projects update

JSW Steel also gave update on three of its ongoing projects. These will be commissioned in the fourth quarter of the financial year.

Dolvi: The expansion project to double the Dolvi facility to 10 million tonnes per annum is nearing completion, with majority of operations to be commissioned in the current quarter. Full integrated operations and stabilization, the company said, will take place in the first quarter of FY22.

"The project has been affected by travel and visa restrictions for technicians from global capital equipment vendors, and the company has been trying to overcome this with a combination of physical and digital assistance from

vendors, suppliers of equipment and technology," JSW Steel said.

Vijaynagar: One of the two Continuous Galvanising Lines(CGL) has been commissioned, and the second will be commissioned by the first quarter of FY22. The 8 MTPA pellet plant is under commissioning, the company said.

Vasind and Tarapur: All expansions (except 0.45 MTPA CGL at Vasind) are under commissioning, and will be fully commissioned by March 2021.

References

- ^ https://www.jsw.in/groups/about-groups

- ^ https://www.jsw.in/steel/about-us

- ^ https://www.jsw.in/steel/jsw-steel-facilities

- ^ https://www.jsw.in/sites/default/files/assets/downloads/steel/IR/Financial%20Performance/Annual%20Reports%20Steel/JSW%20Steel_AR%202020%20Final.pdf

- ^ https://www.moneycontrol.com/news/business/earnings/jsw-steel-consolidated-september-2020-net-sales-at-rs-19264-00-crore-up-9-63-y-o-y-2-6020261.html

- ^ https://www.moneycontrol.com/news/business/earnings/jsw-steel-consolidated-december-2020-net-sales-at-rs-21859-00-crore-up-21-07-y-o-y-6385451.html

- ^ https://www.moneycontrol.com/news/business/with-one-more-mine-operational-49-jsw-steels-iron-ore-requirement-now-met-in-house-6385551.html