Larsen & Toubro Ltd

Company Overview

Larsen & Toubro (NSE: LT) is an Indian multinational engaged in EPC Projects, Hi-Tech Manufacturing and Services. It operates in over 50 countries worldwide. A strong, customer-focused approach and the constant quest for top-class quality have enabled L&T to attain and sustain leadership in its major lines of business for over eight decades. 1

L&T is engaged in core, high impact sectors of the economy and its integrated capabilities span the entire spectrum of ‘design to delivery’.

Every aspect of L&T's businesses is characterised by professionalism and high standards of corporate governance. Sustainability is embedded into its long-term strategy for growth.

The Company’s manufacturing footprint extends across eight countries in addition to India. L&T has several international offices and a supply chain that extends around the globe.

L&T is a team of more than 50000 professionals spread across the globe. The company combine a proven track record and professional skills, woven together with a culture of trust & caring.

Business Overview

Infrastructure Business

FY 2019-20 was a challenging year both for the Indian economy, which performed below its true potential, as well as the construction sector, which recorded a six-year low growth of 1.3%. 2

Cement production saw a marginal decrease of 0.8% in FY 2019-20 as compared to 13.3% increase in FY 2018-19. India’s crude steel production was down by 1.5 percent and finished steel production was flat at 109.2 MT in FY 2019-20 against 110.9 MT in FY 2018-19.

The construction of highways slowed to 28 km a day during FY 2019-20, from 29.7 km a day achieved in FY 2018-19. The Ministry of Road Transport & Highways is hopeful of increasing it to 32 km a day in FY 2020-21.

Public sector spending on the Infrastructure sector, as a whole, continues to witness focused attention through a combination of Central, State Government and PSU capex. The combined Budgetary Capex spends (including PSU Capex) amount to over Rs 16 lakh crore for FY 2020-21, which translates to over 7% of expected nominal GDP. The COVID-19 crisis is likely to adversely affect revenue collections and GDP growth in FY 2020-21, which in turn could lead to contraction of spends on Infrastructure. The Central and State Governments are attempting to mitigate the impact of lower tax collections through significantly higher market borrowings than originally budgeted for the year FY 2020-21, and the increase could be in the region of Rs 9 lakh crore. Multi-lateral funding of projects, which has increased in recent years, is providing additional resources for building infrastructure within the country.

Buildings And Factories

L&T’s Buildings & Factories (B&F) business is the leader in Engineering, Procurement and Construction (EPC) of airports, hospitals, stadiums, retail spaces, educational institutions, IT parks, office buildings, datacentres, residential buildings, highrise structures, mass housing complexes, cement plants, industrial warehouses, and other factory structures in India and overseas. The business is well-known for its capabilities in constructing engineering marvels and landmark structures.

Using 3D-printing technology, the team successfully printed a 2.8 m-high residential building at Kancheepuram, the first full-scale 3D-printed building in India. The mix design developed by the team enabled the use of crusher sand in 3D printing of concrete for the first time in the world. Further research is in progress.

Transportation Infrastructure

L&T’s Transportation Infrastructure business (TI) is one of the oldest, largest and most reputed EPC contractors in India in the Road, Railway and Airport sectors and has two Strategic Business Groups (SBGs), namely, Roads, Runways & Elevated Corridors (RREC) and Railways Business Group (RBG).

Over the last 5 years, the budgetary support for road construction has seen a steady increase. However, the award of contracts has shrunk significantly in FY 2019-20 owing to land- acquisition issues. The delay in the financial closure of Hybrid Annuity Model (HAM) projects has impacted the Government’s ambition to infuse private investment into the sector. Any shift towards a higher proportion of EPC projects will impact NHAI’s awarding capability due to higher funding requirement for civil works related to EPC projects. Due to difficult contractual terms, the working capital requirement for road projects is becoming very high. The delays in settling contractual issues like extension of time, arbitration award, etc., are compounding problems. In FY 2019-20, approximately 5,100 km of road were awarded and 9,855 km of road were constructed. Construction of highways at 28 km/day in 2019-20, has been steady from FY 2017-18 onwards, with an increased focus on delivery of projects. The market continues to have many small EPC contractors, consequently intensifying the competition.

In the year 2019-20, a few major airports have been initiated, such as the Delhi International Airport and Navi Mumbai International Airport, providing opportunities for the business.

Heavy Civil Infrastructure

L&T’ s Heavy Civil Infrastructure business is a market leader in Engineering, Procurement, and Construction (EPC) projects in core civil infrastructure segments that are crucial to the economy, viz. Metros, Nuclear, Special Bridges, Hydel and Tunnels, Ports and Harbours and Defence.

As an industry leader in augmenting capabilities for urban mass rail transit systems, the business is involved in the construction of metro rail systems in almost all the major Indian cities. It provides extensive end-to-end engineering and construction services for both elevated and underground metro systems. During the year, the construction of the Hyderabad Metro was completed.

FY 2019-20 saw a steady increase in projects tendered out by the Government in the Hydel, Tunnel and Irrigation segments, as the Government introduced a few structural policy changes to promote the Hydropower sector based recommendations of the Standing Committee on Energy (2019).

India’s total nuclear power generation capacity is 6,780 MWe, which comprises 2 percent of the country’s overall power generation. The Energy policy of the country calls for 25 percent of electricity to be generated from nuclear power by 2050. The business is expecting the Government to move forward with a proposal for 10 pressurized heavywater reactor (PHWR) fleet. Major tenders in the Nuclear industry were delayed and were pushed to FY 2020-21 due to lack of clarity about The Civil Liability for Nuclear Damage Act, 2010 amongst civil contractors.

Power Transmission & Distribution

L&T’s Power Transmission and Distribution (PT&D) business vertical is a leading EPC player in the field of power transmission & distribution and solar energy. It offers integrated solutions and end-toend services – ranging from design, manufacture, supply, installation and commissioning of transmission lines, substations, underground cable networks, distribution networks, power quality improvement projects, infrastructure electrification and fibre optic backbone infrastructure, to solar PV plants including floating solar, battery energy storage systems and mini / micro grid projects. Besides being a dominant player in the Indian subcontinent, the business enjoys a significant share and a strong reputation in the Middle East, Africa and ASEAN markets.

On the power distribution front in India, the achievement of electrical connectivity to all villages and the near closure of centrally sponsored schemes such as Saubhagya and R-APDRP redirected the focus to strengthening of urban distribution networks and intensification of electrification in select States. As the State DISCOMS depended mainly on multilateral funding, finalization delays were witnessed. However, the business was able to maintain its market share and garner significant orders from Karnataka, Tamil Nadu and Uttar Pradesh.

Despite the fact that the solar industry faced a lower capacity addition in FY 2019-20 as compared to the previous year, in the face of political changes in some States and the dependence on China for modules, the solar business portfolio surpassed a cumulative capacity of 2.3 GW. Measures such as the removal of the ceiling on tariff, acceptance of corporate guarantees in lieu of bank guarantees, etc., boosted the confidence of the developers. Central PSU tenders with a domestic content requirement gave a fillip to prospects.

The containerized integration facility for battery energy storage systems set up at Kancheepuram was commissioned successfully and started despatch. The ready-for -commissioning cell that was created to quicken the handing-over of completed transmission line stretches has started to have a beneficial impact on customer delight. Improvised modularization initiatives such as kitting of tower components and remote electrification items continue.

Water & Effluent Treatment

The Water & Effluent Treatment business undertakes the construction of water infrastructure for the efficient usage, conservation and treatment of water. The business has proven to be a lead player in the domestic market and has also had successes in international markets.

The business accounts for an average of more than 35% share of the domestic market. Over the years, it has emerged as a strong contender in the water segment, meeting the requirements of the public at large. Each business unit is independent, and faces stiff competition in the market including international competition from Chinese and European players.

A revision of the National Water Policy 2012 with key changes in the water governance structure and regulatory framework is anticipated in FY 2020-21, with more emphasis on water management and river interlinking. This is expected to give impetus to the business.

Smart World & Communication

L&T’s Smart World & Communication (SWC) vertical was created in 2016 to address the emerging need for a safe, smart and digital India.

A growing number of cities is adopting elements of smart city infrastructure, such as intelligent traffic management and surveillance systems, smart electric grids and lighting, fibre optic cabling and transport and logistics systems. Out of the 100 Smart Cities planned in the Smart Cities Mission, an integrated command and control centre along with various Smart City solutions is operational in 47 cities, with 17 more cities being in the process of implementation.

To provide 100% population coverage for telecom and high-quality broadband services for the socio-economic empowerment of every citizen and end-to-end online delivery of government services, the Government will continue its investment in the Bharat Net Programme.

The business won a large order to establish the first-ofits-kind, state-of-the-art Unified Network Management System to Manage, Support and Operate a countrywide Armed Forces Network under the Network for Spectrum (NFS)

The business successfully rolled out 1 million+ Smart Meters, with Meter Data Management System and Head End System hosted on the cloud, in the states of Uttar Pradesh and Haryana as part of the ongoing project to deploy 5 million Smart Meters.

The Infrastructure Vision 2025 includes the goal of ‘Digital Services: Access for all’, amongst others. The current pandemic has opened new opportunities to leverage digital services owing to the necessity of social distancing, which is going to be the new normal.

Metallurgical And Material Handling

L&T’s Metallurgical and Material Handling (MMH) business offers complete EPC solutions for the metal (ferrous and non-ferrous) sectors across the globe. The business undertakes end-to-end engineering, procurement, manufacture, supply, construction, erection and commissioning, covering the complete spectrum from mineral processing to finished metal products with state of the art Process Plants.

With expected growth pick-up in the coal and cement sectors, core products like Crushing Plants, Surface Miners and Material Handling equipment are expected to grow at a good pace, especially in the second half of FY 2020-21.

Power Business

L&T has established itself as one of the leading EPC players in the Power Plant business in India and is known to deliver complete turnkey business solutions from concept to commissioning for the thermal power industry.

The business has built on its core competencies and capabilities and has emerged as a major player in new technologies such as Flue Gas Desulphurization (FGD) in the thermal power plant industry. It now has a sizeable presence in the FGD business.

L&T’s integrated power equipment manufacturing facility at Hazira, Gujarat, is one of the most advanced in the world. The facility manufactures ultra-supercritical / supercritical boilers, turbines and generators, pulverisers, axial fans and air preheaters, components of FGD and electrostatic precipitators.

In the wake of the Government’s increasing emphasis on renewable energy, the thermal power sector is growing at a slow pace. However, compared to the previous year, this year witnessed improved ordering in coal-based power projects with the advent of major hydel players like SJVN Limited and THDC India Limited in the coal sector

Going forward, the power sector will continue to face challenges like availability of funds, lowering plant load factor, financial stress, load balancing, coal and water availability issues, payment assurances, etc. Further, muted demand from the private sector and excess manufacturing capacity of suppliers continues to put pressure on prices.

Heavy Engineering Business

L&T Heavy Engineering (HE) is amongst the top 3 global fabricators to supply engineered-to-order critical equipment, piping and systems for core sector industries – Refinery, Petrochemical, Oil & Gas, Gasification, Fertilizer, Thermal & Nuclear Power including critical revamp and up-gradation projects.

The business faced fierce competition from European, Korean and domestic fabricators, while Korean, Chinese and European companies continued to get preference due to ECA (Export Credit Agency) financing requirements. Excess global capacities and limited demand put pressure on pricing and deliveries.

In the domestic market, the business has secured the order for the first Coal Gasifier using Air Product Technology solutions for the Talcher Gasification Project. During the year, the country’s heaviest hydrocracker reactor weighing 1858 MT was dispatched to HPCL’s Vizag Refinery.

On the international front, the business dispatched 16 critical Chrome-Moly-Vanadium reactors for ADNOCTakreer refinery, Abu Dhabi – all delivered before time. The MRU business vertical executed a benchmark project – revamp of an FCCU reactor for the ORPIC Refinery in Oman.

For the ongoing domestic bids, the company expect slow progress in project finalization on account of the COVID-19 pandemic. In the domestic market, the company expect new projects in the sectors of Coal to Chemicals, Petrochemical and the Specialty Chemicals industry, and increased demand for MRU services. Nuclear fleet procurement opportunities (700 MThe company PHWR projects) are expected to be tendered in FY 2021.

Defence Business

L&T has been active in the Defence and strategic sector since the mid-80s, well ahead of the opening up of the sector for private industry participation, by associating with the Defence Research & Development Organisation (DRDO) and Naval indigenisation programmes. Having built a portfolio of technologies, products, systems, platforms and solutions, today L&T Defence provides design-todelivery solutions across chosen defence segments with a focus on indigenous design, development and production of Naval (Submarines and Warships) and Land Platforms (Armoured Systems, Howitzers), Weapon Systems, Engineering Systems, Missile & Space Launch Vehicle subsystems, Sensors, Radar Systems and Avionics. These are complemented by R&D and Design & Engineering Centres for targeted Platforms, Systems & Solutions development.

L&T purchased the 3% stake held by the Tamil Nadu Industrial Development Corporation Ltd (TIDCO) in L&T Shipbuilding Ltd (LTSB) in April 2019, making it a wholly owned subsidiary. In July 2019, the L&T Board approved the Scheme of Amalgamation of LTSB with L&T wef 1st April, 2019 as record date. The NCLT permissions have since been obtained and LTSB has now been merged with parent Larsen & Toubro Limited.

Electrical & Automation Business

L&T’s Electrical & Automation (E&A) business, is a leading supplier of electrical equipment in India. It is engaged in manufacturing low and medium voltage electrical switchgear products (both standard & customized) and energy meters, and executes projects in the control & automation space.

Clients of the business span a wide range of sectors including Metro Rail, Airports, Renewable Energy/ Solar, Defence, Hospitals, Educational Institutions, Data Centres, Realty, Auto, Food & Beverages, Chemical, Pharma, Textile, Sugar, Automobile and Steel.

The growing trade-tensions between the US and China and the world’s changing perception towards China may result in the shifting of manufacturing bases for some of industries to India, Indonesia, etc. The business is likely to benefit from this.

Hydrocarbon Business

L&T Hydrocarbon Engineering Limited (LTHE), a wholly-owned subsidiary of L&T, provides integrated ‘design-to-build’ turnkey solutions for the hydrocarbon industry globally. The business executes projects for oil and gas extraction and processing, petroleum refining, chemicals and petrochemicals, fertilizers, cross-country pipelines and terminals. In-house capabilities range from front-end design through detailed engineering, procurement, fabrication, project management, construction and installation up to commissioning services.

LTHE has a fully integrated capability chain, including in-house engineering and R&D centres, world-class modular fabrication facilities, as well as onshore construction and offshore installation capabilities. Major facilities in India include Engineering & Project Management Centres at Mumbai, Vadodara, and Chennai, as well as Fabrication Yards at Hazira (near Surat) and Kattupalli (near Chennai). The business has an overseas presence in the Middle East, i.e. in the UAE (Sharjah), Saudi Arabia (Al-Khobar), Kuwait and Oman (Muscat), as well as in Algeria. The business also has a major Modular Fabrication and Heavy Engineering Facility at Sohar in Oman.

It & Technology Services

L&T Infotech (LTI) is a global technology consulting and digital solutions company helping more than 420 clients succeed in a converging world. With operations in 32 countries, the business goes that extra mile for its clients and accelerates their digital transformation with its Mosaic platform – enabling their mobile, social, analytics, IoT and cloud journeys. Founded in 1997 as a subsidiary of Larsen & Toubro Limited, its unique heritage gives it an unrivalled real-world expertise to solve the most complex challenges of enterprises across all industries. Each day, the team of more than 30,000 LTItes enables clients to improve the effectiveness of their business and technology operations and deliver value to their customers, employees and shareholders.

The global Information Technology-Business Process Management (IT-BPM) market, excluding hardware and Engineering, Research & Development (ER&D), grew 5.6% over the last year and stood at USD 1.5 trillion in 2019. Indian IT-BPM industry revenues including hardware and ER&D spend stood at USD 191 billion in FY20. The industry added ~USD 14 billion in incremental revenues last year, representing year-on-year growth of ~ 7.7% in USD terms. IT-BPM export revenues for the industry for FY 2019-20 are expected to reach USD 147 billion, a growth of 8.1% over the past year.

In FY 2019-20, LTI further strengthened its partnership and alliances ecosystem. LTI received the AWS SAP Competency partner certification, positioning it on an exclusive list of AWS global partners. Elevation of LTI to ‘Gold’ partnership with Pega and ‘Premier’ partnership with MuleSoft reaffirms the resolve of the business to remain relevant to clients.

Mindtree

During the year, subsequent to acquisition of control, Mindtree was consolidated as a subsidiary in the L&T Group, from the second quarter of the financial year.

Mindtree is a global technology consulting and services company, helping Global 2000 corporations marry scale with agility to achieve a competitive advantage. ‘Born digital’ in 1999, more than 340 enterprise clients rely on the entity’s deep domain knowledge to break down silos, make sense of digital complexity and bring new initiatives to market faster. Mindtree enables IT to move at the speed of business, leveraging emerging technologies and the efficiencies of continuous delivery to spur business innovation.

Mindtree offers an extensive range of technologydriven customized solutions. Mindtree’s digital strategy is pivoted on multiple solutions, IPs, and frameworks cutting across several service offerings, covering areas such as real-time recommendations, social media intelligence, workforce productivity, customer analytics, and sales enablement. The entity’s expertise in digital solutions span across Adobe, Salesforce, and Sitecore. It services clients in diverse industries such as Retail, CPG and Manufacturing, Travel & Hospitality, Banking, Financial Services & Insurance, High-Technology and Media.

The IT BPM sector in India grew at the rate of 6.1% year-on-year. The IT and ITES industry grew from USD 170 billion in FY19 to USD 181 billion in FY20. India’s IT industry contributed around 7.7% of the country’s GDP. India has become the largest digital capabilities hub in the world with about 75% of the global digital talent being present here.

L&T Technology Services

L&T Technology Services Limited (LTTS) is a leading global pure-play Engineering Research & Development (ER&D) services company. It offers design and development solutions throughout the product development chain and provides services and solutions in the areas of mechanical and manufacturing engineering, embedded systems, engineering analytics and plant engineering. LTTS’ customer base includes 69 Fortune 500 companies and 53 of the world’s top ER&D companies across industrial products, transportation, telecom & hi-tech, medical devices and plant engineering. The business also provides digital engineering advisory services to some of the world’s leading enterprises. The key differentiators for LTTS’ business are its customer-centric industry innovations, domain expertise, and multi-vertical presence spanning major industry segments.

LTTS’ service portfolios have well-defined offerings in the ER&D sector. Through its services and solutions in the areas of Core Engineering, Digital Engineering and Digital Advisory Practice combined with its Innovation Engine, the entity is well- positioned to provide customers with business value propositions throughout their value chain needs across domains and industries. This is further corroborated through its positioning as an established technology leader by industry experts such as Zinnov, ISG, ARC, IDC, NelsonHall, and Frost & Sullivan.

Financial Services Business

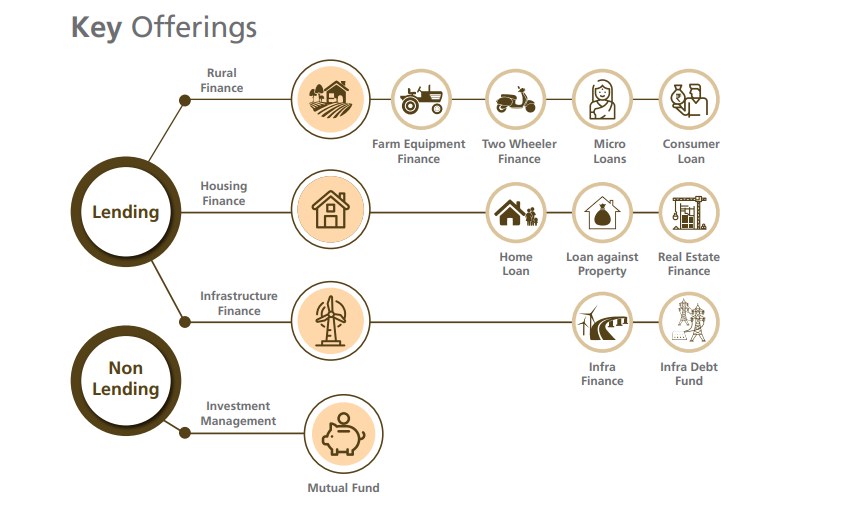

L&T Finance Holdings (LTFH) is the holding company for the financial services businesses of the Larsen & Toubro Group. It is one of India’s most valued and diversified NBFCs, having a strong presence across the Lending & Investment management businesses. LTFH is a financial solutions provider catering to the diverse needs of its customers across various sectors.

- Rural Finance, comprising Farm Equipment Finance, Two-Wheeler Finance, Micro Loans and Consumer Loans

- Housing Finance, comprising Home Loans, Loan against Property and Real Estate Finance

- Infrastructure Finance

- Mutual Funds

The Indian economy in FY 2019-20 began on a downward trajectory, and continued to slow down further, weighed by structural stresses, such as sluggish private investment, a significant decline in savings rate and the highest unemployment rate ever recorded. A broad-based breakdown in consumption further accentuated the slowdown

Overall, FY 2019-20 was a very challenging year, with funding markets seeing multiple periods of disruption and risk aversion from Mutual Funds and Banks especially towards NBFCs. However, in these difficult times, LTFH has been able to time the markets and has successfully raised highest annual long-term incremental borrowing (across various instruments) since FY 2016.

LTFH, through rigorous execution of digital proposition and domain expertise, has been able to capture a 9.3% market share in the Two-Wheeler Finance segment in FY 2019-20. A new scheme, ‘Sabse Khaas Loan’ was introduced to target the unfinanced sector with no hypothecation and a lower rate of interest as compared with credit cards. LTFH focussed on touch-free collections, which accounted for 32% of the total collection in FY20. LTFH has been able to maintain its market share of 14% in Farm Loans and strengthen its position as the #2 player in the Farm Equipment Finance industry. The rich customer base in Tractor Financing services, built over the years, is further strengthened by extending the refinancing facility to its prime customers with a good credit and payment history.

LTFH disbursed Rs 9,884 crore of micro loans in FY 2019-20, benefiting over 28 lakh women in rural and semi-urban areas who depend on dairy, grocery shops and similar allied activities for earning their daily livelihood.

Despite the challenging environment witnessed in the housing market, direct sourcing initiatives have helped scale up home loans from 69% in FY 2018-19 to 72% in FY 2019-20.

Asset origination with a clear perspective of ‘Churn’, the business achieved a key milestone of Rs 25,000 crore of cumulative sell-down since FY’17. Further, while there was a reduction in overall sell-down volumes during the year due to the liquidity challenges being faced by NBFCs and the consolidation of PSU banks, it managed to sell down Rs 780 crore of Hybrid Annuity Model (HAM) road projects to public sector banks.

LTFH expects that disbursements in retail will start gradually as the economy opens up, and in Infrastructure and Real Estate will be largely limited to tranche disbursements, while fresh disbursements are subject to higher risk controls.

Development Projects Business

L&T Infrastruture Development Projects Limited

L&T Infrastructure Development Projects Limited (L&T IDPL) is a pioneer of the Public-Private Partnership (PPP) model of development in India, which involves the development of infrastructure projects by private-sector players in partnership with the Central and State Governments. Since its inception in 2001, the entity has completed landmark infrastructure projects across key sectors like roads, bridges, transmission lines, ports, airports, water supply, renewable energy and urban infrastructure. It is one of India’s largest road developers, as measured by lane kilometres under concession agreements signed with Union and State Government authorities. Currently, L&T IDPL has 10 operational road assets and the Kudgi Transmission Project in its portfolio. It also manages 5 operational road assets transferred to Indinfravit Trust, an InvIT that the entity sponsored and launched in May 2018 as the first privately placed InvIT in India, with 77% holding from an international pension fund and insurance investors.

MoRTH has instituted the ‘National Highways Excellence Awards’ to recognize the country’s best-performing road assets and toll plazas, both concessionaire-managed and NHAI-managed. For the year 2019-20, Krishnagiri Thoppur Tollways Ltd (KTTL) managed by IDPL won the Silver award, while several others owned/managed by IDPL figured in various categories as Champions. These road assets are highlighted in the annual calendar and dossier of MoRTH, which are widely distributed across the country.

Prior to COVID-19, toll revenue was expected to increase to the tune of 6%. However, in the near term, the toll revenues are expected to contract as compared to the previous year due to lower traffic growth and lower WPI. COVID-19 has presented an unprecedented challenge, resulting in a nationwide lockdown and hence a sharp decline in traffic across the country. This event has been categorised as a force majeure event under the concession agreement, the cashflow for the year will be stressed, and hence cash conservation will be the key.

L&T Metro Rail (Hyderabad) Limited

L&T Metro Rail (Hyderabad) Limited (L&TMRHL) is a Special Purpose Vehicle (SPV) incorporated on 24th August, 2010 to undertake the business to construct, operate and maintain the Metro Rail System including the Transit Oriented Development (TOD), in Hyderabad under the Public Private Partnership model on Design, Build, Finance, Operate and Transfer (DBFOT) basis. L&TMRHL entered into a Concession Agreement with the erstwhile Government of Andhra Pradesh on 4th September, 2010.

During the year, the construction of 1.28 million sq. ft. of Transit Oriented Development (TOD) consisting of 4 malls and an office block has been completed and has commenced commercial operations. Construction work of 0.5 million sq. ft. of office space at Raidurg site is currently under way. The entity is chalking out plans for phased development of the balance TOD.

L&T Power Development Group

L&T Power Development Limited, a wholly-owned subsidiary of L&T, is engaged in developing, operating and maintaining power generation assets. The portfolio comprises projects in thermal and hydel power generation projects aggregating to 1499 MW. In the hydel sector, L&T Uttaranchal Hydropower Limited is executing a hydel power project of capacity 99 MW in the state of Uttarakhand, which is at an advanced stage of construction and is expected to be commissioned in FY 2020-21. The hydel projects in L&T Himachal Hydropower and L&T Arunachal Hydropower have been shelved. In the thermal sector, Nabha Power Limited owns and operates a 2 X 700 MW supercritical thermal power plant at Rajpura, Punjab.

India’s Installed Capacity rose to 3,70,106 MW in FY 2019- 20, a marginal increase of 1.41% over the previous year, of which the Installed Capacity of thermal power plants is 55%. Dependence on the thermal generation is clearly reflective, as it fulfils 71% of the total power requirement in the country.

The Average Power Demand in Punjab was 6486 MW in FY 2019-20 and NPL contributed to 14% of the demand. The Average Power Purchase rate was Rs 3.60 per KWh in FY20 vs Rs 3.48 per KWh in FY19.

Others

Realty Business

L&T Realty is positioned amongst the top real estate developers in India, with a total portfolio of over 70 Mn sq. ft. across segments like residential, commercial and retail in key metro cities, viz. Mumbai, Bengaluru and Chennai. L&T Realty is focused on delivering higher value to its customers through efficient designs, cutting-edge technologies and superior project management skills. The business model involves development of large land banks in metro cities, partnership with co-developers and sale/lease of commercial spaces.

In FY 2019-20, the residential segment witnessed an increase of 21% in new launches in key metro cities, with affordable housing contributing significantly to this supply. Residential sales also gained momentum, recording a y-o-y rise of 5%. Nearly 52 Mn. sq. ft. of Grade A office space was completed, of which 46 Mn. sq. ft. was absorbed in the top 7 cities in the year 2019. The office space market grew at a robust 40% y-o-y with net absorption across the top seven cities – creating a new record. This growth in demand was led mainly by the expansion of IT/ITeS (42% of overall leasing) and co-working operators (14% of overall leasing) in cities with robust fundamentals and planned infrastructure improvements. However, retail sector leasing was hit as consumer spending went down, resulting in 35% reduction in retail leasing activity in the top 7 cities.

L&T Valves Limited

L&T Valves (LTVL) is a leading manufacturer of industrial valves with a global manufacturing presence. The business leverages six decades of manufacturing excellence to serve key sectors of the economy – such as oil and gas, defence, nuclear & aerospace, power, petrochemicals, chemicals, water and pharmaceuticals – in India and overseas. L&T Valves manufactures a wide range of products, such as Gate, Globe, Check, Ball, Butterfly, Plug and Control valves, as well as automation solutions. The business also runs a global after-market business to support its installed base with service and spares needs.

Construction Equipment & Others

The Construction Equipment & Others (CE&O) business manufactures, distributes and provides after-sales support for construction and mining equipment for diverse industries and applications. The business also manufactures and markets Tyre Curing Presses and Tyre Building Machines and provides solutions for the tyre manufacturing industry globally.

CMB plans to strengthen its position in the premium segment and increase its focus on large contractors, large irrigation projects and coal OB (over burden) removal contractors. With a targeted spend plan of over Rs 100 lakh crore by the government in the next 5 years in infrastructure, there is a large scope for CMB to achieve higher business volumes.

Financial Overview

As at March 31, 2020, L&T Group comprises 117 subsidiaries, 6 associates, 25 joint venture companies and 35 joint operations. Most of the group companies are strategic extensions of the project and product businesses of L&T, while the Hydrocarbon business is housed in a separate set of group companies to provide the desired focus and independent functioning. The majority of the subsidiaries support L&T’s core businesses and enable access to new geographies, products and business segments. Certain distinct service businesses such as Information Technology, Technology Services, and Financial Services are housed in separate listed subsidiaries. The development projects business resides in separate subsidiaries and joint venture companies.

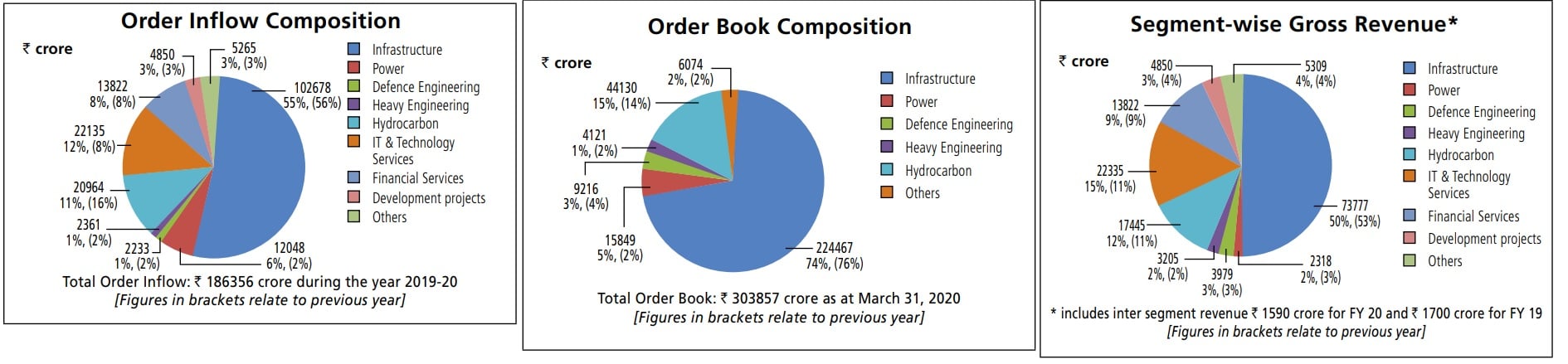

L&T Group achieved order inflows of Rs 186356 crore during the year 2019-20, registering a growth of 9.1% over the previous year, growth largely being driven by international business. The year witnessed some noteworthy order wins in thermal power, affordable mass housing, a substation & transmission line project in Africa, gold beneficiation order in Saudi Arabia, residue upgradation in refinery modernisation and an order for offshore oil facilities in Saudi Arabia. Despite deferral of various prospects, Infrastructure contributed 55% of the total order inflow, while the share of Power increased from 2% in previous year to 6% in the current year on receipt of a large value thermal order and increased ordering by thermal power plants for emission control equipment to meet environmental norms.

The Group crossed the Rs 3 lakh crore mark as at March 31, 2020 with the Order Book standing at Rs 303857 crore. Infrastructure segment constitutes the highest proportion of the consolidated Order Book at 74% share, though reduced from 76% as at March 2019, with increase in the share of the Power segment from 2% to 5% on higher order inflows during the year.

FY 2019-20 order inflow growth being driven by international business, the share of the international Order Book grew from 21% to 25%, with Saudi Arabia and Africa contributing the majority of the growth – resulting in their increased share in the overall international Order Book to 28% and 24% respectively.

L&T Group recorded revenue of Rs 145452 crore during the year, registering a growth of 7.6%. The growth however, was below expected levels with execution impediments of Covid-19 in the last few weeks of the year, coupled with delayed clearances, right of way constraints and the review of awarded tenders by some state governments leading to stoppage of work in the Infrastructure segment for a prolonged period of time during the year. With the consolidation of Mindtree Limited acquired in early July 2019, the composition of international revenue at the Group level increased to 33% in year FY 2019-20.

Manufacturing, Construction and Operating (MCO) expenses for FY 2019-20 at Rs 97363 crore increased by 1.8% over the previous year. These expenses mainly comprise cost of construction material, raw materials and components, subcontracting expenses and interest costs in Financial Services business. This represent 66.9% of revenue, a decrease by 380 bps, mainly on account of increased share of IT&TS segment as well as cost control initiatives at the Group level.

The Group operating profit at Rs 16329 crore for the year 2019-20 registered growth of 6.5% y-o-y. The EBITDA margins for the year was lower by 10 basis points at 11.2%. Cost overruns encountered in some projects coupled with slow progress in some jobs mainly in Infrastructure segment impacted the operating margin. The drop was partially offset by a favourable job mix, coupled with execution efficiencies in Defence and Hydrocarbon segments, and the reversal of provision on a favourable arbitration award in the Power business.

Aided by profit on sale of liquid investments, interest earnings and dividend income from treasury investment, Other income at Rs 2361 crore, increased by 28.6% over Rs 1837 crore in the previous year.

The interest expenses for the year 2019-20 at Rs 2797 crore was higher by 55.2% over Rs 1803 crore for the previous year. The increase was mainly attributable to the higher interest cost in L&T Hyderabad Metro Rail upon commencement of full operations, interest on lease liability on application of Ind AS 116 and higher level of borrowings in the standalone entity to fund the higher level of working capital caused by the tight liquidity conditions. Average borrowing cost for the year FY 2019-20 increased to 8.1% from 7.9% in the previous year.

Income Tax charge for FY 2019-20 (excluding tax charge on discontinued operations) decreased to Rs 3263 crore compared to Rs 4067 crore in FY 2018-19 on adoption of tax ordinance resulting in lower effective tax rate, partially offset by write-down of opening DTA for the rate differential and write-off of opening MAT credit, due to its unavailability under the new tax regime. Creation of DTA in 2019-20 for set-off of capital losses has also contributed to the lower tax charge.

Consolidated Profit after Tax (PAT) at Rs 9549 crore for the year 2019-20 rose by 7.2% over the previous year at Rs 8905 crore.

Consolidated Basic Earnings per Share (EPS) from continuing operations and discontinued operations for the year 2019-20 at Rs 68.04 registered growth over previous year at Rs 63.51.

The Net Worth, as on March 31, 2020, at Rs 66723 crore, reflects net increase of Rs 4348 crore, as compared to the position as on March 31, 2019. Return on Net Worth (RONW) for the year 2019-20 was lower at 14.8%, compared to 15.3% in the previous year. RONW for the current year has been adversely affected by Covid impact and provisions in financial services business.

L&T Q4 result

May 14, 2021; Profit rises 3% to Rs 3,293 crore, order inflow drops 12% to Rs 50,651 crore 3

Engineering and infrastructure major Larsen & Toubro on May 14 reported consolidated profit at Rs 3,292.81 crore for the quarter ended March 2021, registering a 3 percent growth compared to the year-ago quarter. This profit was from continuing as well as discontinued operations.

Profit from continuing operations at Rs 3,820.16 crore increased 11.4 percent YoY in Q4. Higher tax cost (up 116 percent YoY to Rs 2,086.71 crore) and lower-than-expected revenue growth impacted profitability.

The company in its BSE filing said the order inflows for January-March 2021 at Rs 50,651 crore lowered by 12 percent over the corresponding period of the previous year with the deferment of awards.

"Significant orders during the quarter were received in various segments like factories, hydel and tunnel, metros, special bridges, nuclear power, rural water, renewable energy, hydrocarbon offshore and minerals and metal sector," the company explained.

International orders at Rs 18,439 crore during the quarter is at 36 percent of the total order inflow, with receipt of biggest solar PV plant order and Transmission line orders, said the company.

At the group level, during the year ended March 2021, L&T said received orders worth Rs 1,75,497 crore, registering decline of 6 percent compared to the previous year in the face of COVID disrupted business environment in first half of the year.

International orders at Rs 47,951 crore during the year dropped to 27 percent of the total order inflow, with subdued overseas opportunities, especially in Middle East, the company added.

The consolidated order book of the group stood at Rs 3,27,354 crore as of March 2021, a robust growth of 8 percent over March 2020.

Consolidated revenue from operations grew by 8.7 percent year-on-year to Rs 48,087.9 crore in January-March 2021 quarter, missing CNBC-TV18 poll estimates which was pegged it at Rs 51,700 crore for the quarter.

"The year-on-year 9 percent growth in revenue evidenced return to pre-COVID levels of activity. The sequential growth in quarterly revenue was at 35.1 percent, with execution activities normalising on easing of COVID-19 restrictions, prior to onset of the second wave of the pandemic, L&T said.

In the pandemic year, FY21, consolidated profit including profit from discontinued operations at 11,583 crore registered growth of 21 percent YoY. The consolidated PAT included a charge of Rs 3,620 crore towards exceptional items and profit from discontinued operations Rs 8,238 crore, mainly comprising of gain on divestment of electrical and automation business.

Consolidated revenue during the year declined 6.5 percent to Rs 1,35,979.03 crore compared to previous year. "The decline in revenue attributed to revenues lost due to lockdown related disruptions in the first two quarters of the year and new norms of social distancing, quarantine procedure and safety protocols, coupled with supply chain disruption impacting project execution progress, though with declining severity, throughout the year," the infrastructure major said.

Infrastructure segment, which contributed 55 percent to total revenue, registered a 4.4 percent year-on-year growth in revenue at Rs 26,436.69 crore and its earnings before interest and tax (EBIT) grew by 6.9 percent YoY to Rs 2,795.52 crore for the quarter ended March 2021.

Hydrocarbon business grew by 8.9 percent YoY to Rs 5,421.69 crore with EBIT rising 31.1 percent to Rs 658.32 crore in Q4FY21.

Heavy Engineering segment recorded healthy 54.2 percent YoY growth at Rs 1,081.94 crore in revenue and 165.6 percent increase in EBIT at Rs 280.61 crore for the quarter.

Defence engineering also witnessed massive 42.8 percent increase in revenue at Rs 1,140.84 crore with EBIT growing 225.2 percent to Rs 302.83 crore compared to year-ago quarter.

References

- ^ https://www.larsentoubro.com/corporate/about-lt-group/overview/

- ^ https://investors.larsentoubro.com/upload/AnnualRep/FY2020AnnualRepL&T%20Annual%20Report%202019-20.pdf

- ^ https://www.moneycontrol.com/news/business/earnings/lt-q4-profit-rises-3-to-rs-3293-crore-order-inflows-drop-12-to-rs-50651-crore-6894241.html