Life Insurance Corporation - LIC

Summary

- The Life Insurance Corporation of India was created on 1st September, 1956

- LIC had 8 zonal offices, 133 divisional offices and 2048 branch offices

- The total number of Agents on Roll is 13,53,808 as on March 2022

- LIC's IPO will closed on 09 May 2022 having Price range of Rs 902 – 949 and started trading on May 17, 2022

Company Overview

the Life Insurance Corporation of India (NSE:LICI) was created on 1st September, 1956 by The Parliament of India passed the Life Insurance Corporation Act on the 19th of June 1956, with the objective of spreading life insurance much more widely and in particular to the rural areas with a view to reach all insurable persons in the country, providing them adequate financial cover at a reasonable cost.1

As on 31.03.2021, there were 8 Zonal Offices located at Mumbai, Delhi, Kolkata, Chennai, Hyderabad, Kanpur, Bhopal and Patna. There were 113 Divisional Offices, 2,048 Branch Offices, 1,546 Satellite Offices (SOs) and 1,173 Mini Offices.. Since life insurance contracts are long term contracts and during the currency of the policy it requires a variety of services need was felt in the later years to expand the operations and place a branch office at each district headquarter. Re-organization of LIC took place and large numbers of new branch offices were opened. As a result of re-organisation servicing functions were transferred to the branches, and branches were made accounting units. It worked wonders with the performance of the corporation. It may be seen that from about 200.00 crores of New Business in 1957 the corporation crossed 1000.00 crores only in the year 1969-70, and it took another 10 years for LIC to cross 2000.00 crore mark of new business. But with re-organisation happening in the early eighties, by 1985-86 LIC had already crossed 7000.00 crore Sum Assured on new policies.

Subsidiaries

- LIC Pension Fund Limited

- LIC Cards Services Limited

Foreign Joint Venture Co

- Life Insurance Corporation (International) B.S.C. (c), Bahrain

- Life Insurance Corporation (Nepal) Ltd

- Life Insurance Corporation (Lanka) Ltd

- Kenindia Assurance Company. Ltd

- Saudi Indian Company for Co-operative Insurance

- Life Insurance Corporation (LIC) of Bangladesh Limited

Foreign Wholly Owned Subsidiary

- Life Insurance Corporation (Singapore) Pte. Ltd

Products

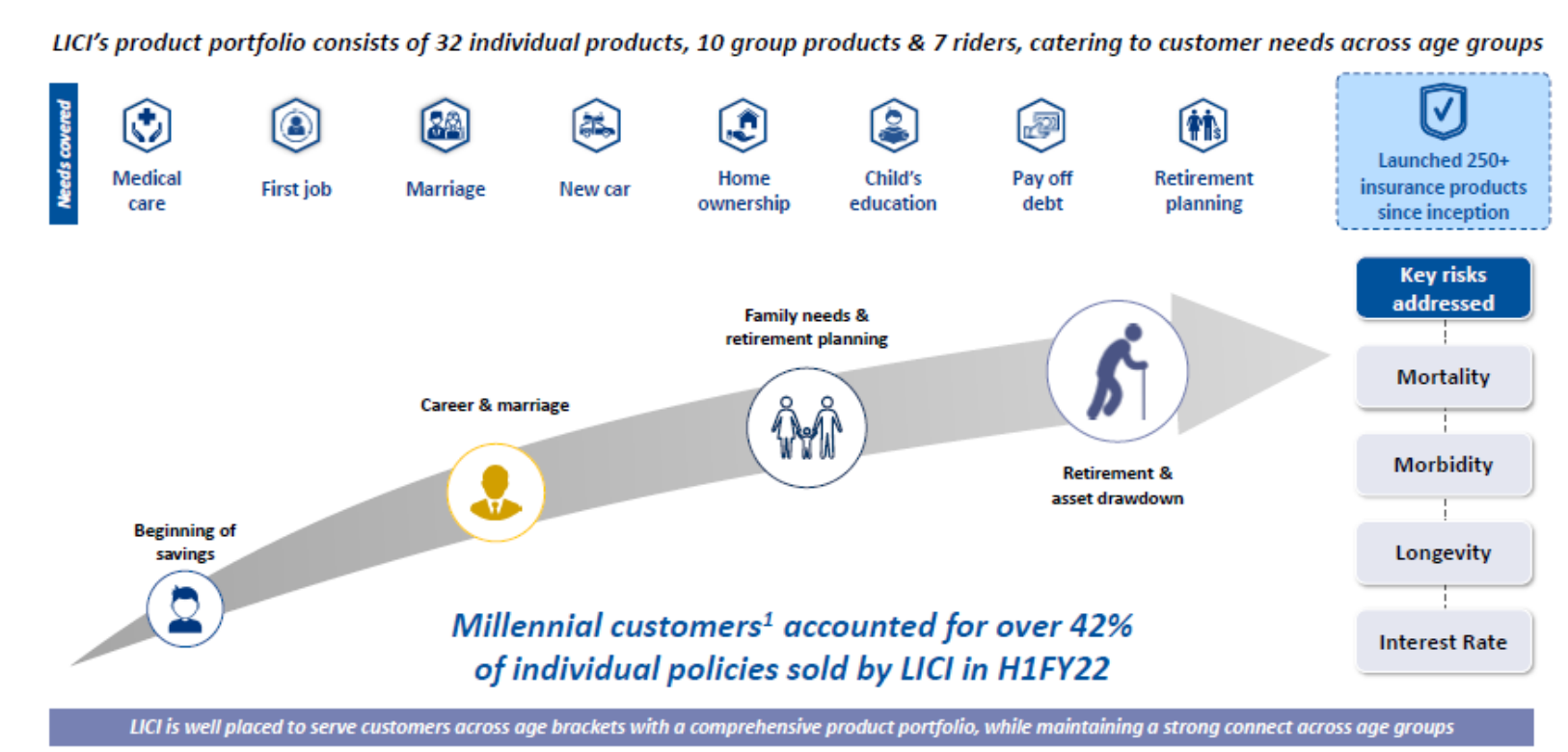

LIC India has a broad, diversified product portfolio covering various segments across individual products and group products

- Insurance Plan

- Pension Plan

- Unit Linked Plans

- Micro Insurance Plans

- Withdrawn Plans

- Health Plans

Group Schemes

- Pension & Group Schemes

- Gratuity Plus NAV

Industry Overview

Structural Reforms in India

According to the World Bank’s Global Findex Database 2017, the global average of adult population with a financial services account (either with a bank, financial institution, or mobile money providers) was approximately 69% in 2017. India’s financial inclusion has improved significantly between 2014 and 2017, with the adult population with bank accounts rising from 53% (as per Global Findex Database 2014) to 80% in 2017 with concentrated efforts by the government to promote financial inclusion and the proliferation of supporting institutions. That said the rise in the number of bank accounts has not translated into a corresponding increase in the number of transactions and fruitful usage of those accounts. As per the World Bank’s Global Findex Database 2017, 40% of the accounts did not make any deposit or withdrawal in the past year (2016).

Pradhan Mantri Jan Dhan Yojana (PMJDY)

This scheme, launched in August 2014, is aimed at ensuring that every household in India has a bank account which can be accessed from anywhere and be used to avail all financial services such as savings and deposit accounts, remittances, credit and insurance affordably. PMJDY focuses on household coverage compared with the earlier schemes that focused on coverage of villages. It aims to extend banking facilities to all within a reasonable distance in each sub- service area (consisting of 1,000-1,500 households) across India. As on March 31, 2021, 422 million PMJDY accounts had been opened, of which, 66% were in rural and semi-urban areas, with total deposits of Rs. 1,455 billion.

PMJJBY (Pradhan Mantri Jeevan Jyoti Bima Yojana)

This scheme, launched in May 2015, is aimed at creating a universal social security system, targeted especially at the poor and under-privileged. PMJJBY is a one-year life insurance scheme, renewable from year to year that offers a life cover of Rs. 0.2 million for death due to any reason and is available to people in the age group of 18 to 50 years (life cover up to 55 years) at a premium of Rs. 330 per annum per member. This scheme is offered/administered through LIC and other Indian private life insurance companies.

PMSBY (Pradhan Mantri Suraksha Bima Yojana)

This scheme, launched along with PMJJBY in May 2015, is aimed at creating a universal social security system, targeted especially at the poor and under- privileged. PMSBY is a one-year accidental death and disability insurance cover, renewable from year to year that offers an accidental death and full disability cover of Rs. 0.2 million (Rs. 0.1 Million for partial disability). This cover is available to people in the age group of 18 to 70 years at a premium of Rs. 12 per annum per member. The scheme is being offered by public sector general insurance companies or any other general insurance company that is willing to offer the product on similar terms with necessary approvals.

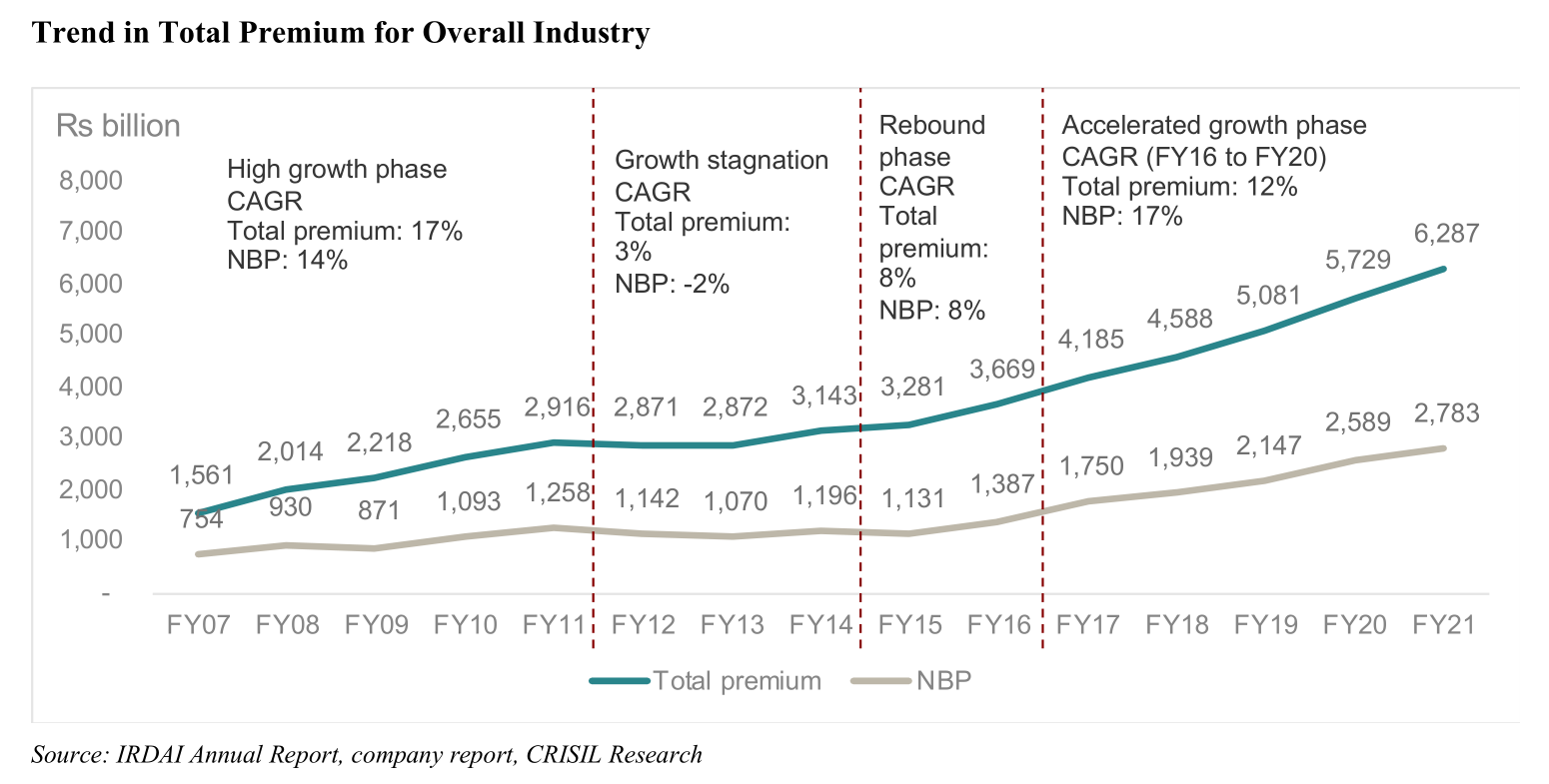

India is the Fifth Largest Insurance Market in Asia and Has Exhibited Consistent Growth in Insurance Premiums

Based on life insurance premium, India is the tenth largest life insurance market in the world and the fifth largest in Asia, as per Swiss Re’s sigma No 3/2021 report for July 2021. The size of the Indian life insurance industry was Rs. 6.2 trillion based on total premium in Fiscal 2021, up from Rs. 5.7 trillion in Fiscal 2020. The industry’s total premium has grown at 11% CAGR in the last 5 years ending in Fiscal 2021. New business premiums (NBP) grew at 15% CAGR during Fiscals 2016 to 2021, to approximately Rs. 2.78 trillion. In fact, in Fiscal 2021 – a year impacted by the COVID- 19 pandemic, the NBP of the industry rose by 7.5%. Within the NBP, group business premium grew at approximately 15.4% CAGR from Fiscals 2016 to 2021, whereas individual premium rose approximately 14% CAGR during the same period.

Total premium to cross Rs. 12 trillion by Fiscal 2026

CRISIL Research forecasts the total premium for life insurers to grow at 14-15% CAGR over the next five years. At this level of premium, life insurance as a proportion of GDP is projected to reach 3.8% by Fiscal 2026, up from 3.2% in Fiscal 2021. NBP is expected to grow at a CAGR of 17-18% during the same period ending Fiscal 2026. Further in the long term, life insurance NBP is expected to grow at robust growth of 14-16% CAGR between Fiscal 2021 to Fiscal 2032.

Business Overview

LIC has been providing life insurance in India for more than 65 years and is the largest life insurer in India, with a 64.1% market share in terms of premiums (or GWP), a 66.2% market share in terms of New Business Premium (or NBP), a 74.6% market share in terms of number of individual policies issued, a 81.1% market share in terms of number of group policies issued for Fiscal 2021, as well as by the number of individual agents, which comprised 55% of all individual agents in India as at March 31, 2021. LIC had the highest gap in market share by life insurance GWP relative to the second-largest life insurer in India as compared to the market leaders in the top seven markets globally (in 2020 for the other players and in Fiscal 2021 for LIC). (Source: the CRISIL Report). According to CRISIL, this is owing to its enormous agent network, strong track record, immense trust in the brand ‘LIC’ and LIC’s 65 years of lineage. LIC is ranked fifth globally by life insurance GWP (comparing LIC’s life insurance premium for Fiscal 2021 to its global peers’ life insurance premium for 2020) and 10th globally in terms of total assets (comparing LIC’s assets as at March 31, 2021 with other life insurers’ assets as at December 31, 2020).

LIC is the largest asset manager in India as at September 30, 2021, with AUM (comprising policyholders’ investment, shareholders’ investment and assets held to cover linked liabilities) of ₹39,558,929.24 million on a standalone basis, which was (1) more than 3.3 times the total AUM of all private life insurers in India, (2) approximately 16.2 times more than the AUM of the second-largest player in the Indian life insurance industry in terms of AUM, (3) more than 1.1 times the entire Indian mutual fund industry’s AUM and (4) 18.5% of India’s annualised GDP for Fiscal 2022. As per the CRISIL Report, as at September 30, 2021, LIC’s investments in listed equity represented around 4% of the total market capitalisation of NSE as at that date.

LIC dominant in group insurance with approximately 80% market share In terms of segments, the share of group NBP in total NBP has increased from 58% in Fiscal 2016 to 62% in September 30, 2021. LIC continues to dominate the group NBP segment with 78% market share for Fiscal 2021. On the other hand, private players have increased their market share in individual NBP from 44% in Fiscal 2016 to 50% in Fiscal 2021 and further to 56% in September 30, 2021 Customers can also approach its branch offices and satellite offices and purchase products through its intermediaries. As at September 30, 2021, LIC had 2,048 branch offices and 1,554 satellite offices in India.

LIC’s individual policies are primarily distributed by its individual agents. In Fiscal 2019, Fiscal 2020, Fiscal 2021 and the six months ended September 30, 2021, individual agents were responsible for sourcing 96.69%, 95.73%, 94.78% and 96.42% LIC’s NBP for its individual products in India, respectively.

As at March 31, 2019, March 31, 2020, March 31, 2021 and September 30, 2021, LIC had 1.18 million, 1.21 million, 1.35 million and 1.34 million individual agents in India, respectively. As at March 31, 2021, LIC’s individual agency force accounted for 55% of the total agent network in India and was 7.2 times the number of individual agents of the second largest life insurer in terms of agent network. The number of LIC’s individual agents in India increased at a CAGR of 7% between March 31, 2019 and March 31, 2021, compared to the next best player’s agency force CAGR of 5% during the same period.

LIC has the most productive agent network in the Indian life insurance sector by both NBP and policies sold. As per the CRISIL Report, in Fiscal 2021, LIC’s individual agents had an average NBP of ₹412,934 per agent compared to the average NBP of ₹322,442 per agent for the best performing of the top five private players and ₹124,892 per agent for the median of the top five private players. In Fiscal 2021, LIC’s individual agents sold 15.3 policies per agent on average compared with the average of 3.9 individual policies sold by the individual agents of the best performing of the top five private players and the average of 1.6 individual policies sold by the individual agents of the median of the top five private players.

Financial Highlights

During the year 2020-21, the Corporation under Individual New Business, has procured 2,09,75,439 Policies with a First Year Premium Income of Rs 56,406.51 Crore. The achievement to budget in NOP was 95.34% and in FYPI 109.95 %. Rs 18,640.21 crore premium earned under 2,28,153 policies of Pradhan Mantri Vaya Vandana Yojana. In Agency recruitment, the Corporation registered a net addition of 1,44,982 agents.2

In the financial year 2020-21, the B&AC channel has garnered First Year’s Premium Income (FYPI) of Rs 1,900.76 crore under 2,46,910 policies showing positive growth of 23.43% in premium and 0.58% in policy. Share of the channel in Corporation’s performance (Individual Insurance) also increased and stood at 3.38% in premium and 1.18% in policy.

Currently the channel has tie-up with 8 PSU Banks, 6 Private Banks, 13 Regional Rural Banks, 41 Cooperative Banks and 1 Foreign Bank under Corporate Agency agreement with 57,919 outlets of these Banks all over the country. In addition to Banks, the channel has tie-up with 69 other Corporate Agents, 79 Brokers and 145 Insurance Marketing Firms (IMF). During the year 4 Banks, 6 Corporate Agents and 24 Insurance Marketing Firms were added to the channel.

Bank partners have contributed 92.37% in FYPI and 85.93% in policy by procuring Rs 1,755.76 crore FYPI under 2,12,182 policies in B&AC channel. Other Corporate Agents have contributed Rs 65.01 crore FYPI under 24,865 policies with percentage share of 3.42% and 10.07% respectively. Brokers share is Rs 37.14 crore FYPI under 1,554 policies with share contribution of 1.96% in FYPI and 0.63% policy. The contribution of IMF stood at Rs 42.85 crore in FYPI and 8,309 in NOP with share contribution of 2.25% and 3.37% in FYPI and policy respectively. IDBI Bank stood at top with contribution of Rs 863.42 crore in total first premium income under 82,521 polices.

357 Bank branches procured Rs 1 crore and above TFPI while 423 Bank branches procured between Rs 50 lacs to Rs 99 lacs during the year.

In the Financial Year 2020-21, the Channel has procured First Year Premium Income (FYPI) for Rs 1,242.86 crore only with completion of 97,788 Policies (Including online PMVVY Policies).

The total number of Agents on our Roll is 13,53,808 as at 31.03.2021 as against 12,08,826 as on 31.03.2020. The number of Active Agents is 10,86,000 as at 31.03.2021 as compared to 10,80,809 as on 31.03.2020

| ₹ in million | For the Nine months ended 31-Dec-21 | 31-Mar-21 | 31-Mar-20 | 31-Mar-19 |

| Total Assets | 40,907,867.78 | 37,464,044.68 | 34,141,745.74 | 33,663,346.17 |

| Total Revenue | 17,573.50 | 29,855.71 | 27,309.56 | 26,449.96 |

| Profit After Tax | 17,153.12 | 29,741.39 | 27,104.78 | 26,273.78 |

| Earnings per Share FV Rs 10 | 3.6 | 4.7 | 4.29 | 4.15 |

LIC IPO

LIC Listing Highlights

Shares Lists at Discount; Weak LIC Listing Due to Unpredictable Market Conditions, Says DIPAM Secy3

May 17, 2022; Life Insurance Corporation of India (LIC) shares made a tepid debut on the stock exchanges on Tuesday, May 17, listing at a discount to the IPO price. LIC shares started trading at Rs 865 apiece, down 8.65 per cent from its IPO price of Rs 949 on BSE. The share opened at Rs 872 on NSE, an 8.8 per cent discount over the premium.

The sell-off in the global and domestic market, the hike in interest rates by the central banks and the accelerating inflating statistics, and an ongoing global war have dampened the euphoria around the listing of mega IPO.

The government offloaded 3.5 per cent of its stake in the insurance behemoth to raise Rs 21,000 crore from the share sale. LIC IPO opened for subscription from May 4-9 with a price band of Rs 902-949 per share. For LIC employees and retail investors, there was a discount of Rs 45 per equity share. LIC policyholders were eligible for a discount of Rs 60 per share.

“As observed, the majority of big IPOs have not given strong listing debut gains. Considering previous trends, LIC has continued to take the same path with listing at a discount,” said Mohit Nigam, head – PMS, Hem Securities.

“We believe that personal savings and awareness regarding insurance will increase enabling the sector to outperform in the long run and will indirectly benefit LIC as it is the market leader in this sector,” he further mentioned.

On LIC IPO valuation, Yash Gupta, Equity Research Analyst, Angel One Ltd said, “At the upper end of the price band the LIC IPO is priced at P/EV (embedded value) of 1.1x which is at a significant discount to other listed private life insurance companies line HDFC Life, ICICI Pru Life and SBI Life.

For LIC investors, Parth Nyati, founder, Tradingo, said, “LIC enjoys many competitive advantages like strong brand value, extremely large scale of operations, a huge network of agents, and an envious distribution network, further, the company’s issue was priced at a Price to Embedded value of 1.1x, providing a valuation comfort, so we suggest investors to stay with the company for the long term despite the negative listing. Those who applied for listing gains can maintain a stop loss of Rs. 800. New investors can take advantage of the dips to accumulate this share for the long term. We would like to add that the company’s further downside will be limited due to low float post listing.”

LIC's IPO Likely To Open On May 4, But Exact Timelines Post April 27

April 25, 2022; LIC's IPO is likely to open on May 4 and close on May 9, according to sources, who said the exact timelines will be confirmed post April 27th.4

The Life Insurance Corporation's (LIC) long-awaited public issue offer is likely to open on May 4 and close on May 9, according to sources, who said the exact timelines would be confirmed post-April 27.

The exact date ranges and other details of the LIC's initial public offering (IPO) will be confirmed next week, the sources added.

That comes on the heels of the LIC board approving a cut in its IPO issue size to 3.5 per cent from 5 per cent, according to sources on Saturday.

The government is now expected to sell 3.5 per cent of its stake in LIC for ₹ 21,000 crore, subject to the approval of the capital markets regulator Securities and Exchange Board of India, SEBI.

That would value the insurance behemoth at 6 lakh crore.

A significant cut in valuation from a previous estimate of around ₹ 17 trillion for the 66-year old company.

The draft red herring prospectus filed with the SEBI and approved showed the government had proposed a sale of its 5 per cent equity.

Still, despite that setback and lowering of the company's valuation, it would be India's most significant to date.

Indeed, the public issue size of the insurance behemoth at the lowered ₹ 21,000 crore will be larger than the amount mobilised from the IPO of Paytm in 2021 was the largest ever at ₹ 18,300 crore, followed by Coal India (2010) at nearly ₹ 15,500 crore and Reliance Power (2008) at ₹ 11,700 crore.

The stake sale was initially planned to be launched in March 2022, but the Russia-Ukraine crisis derailed those plans as stock markets were highly volatile.

Previously, the government was expecting to garner over ₹ 60,000 crore by selling about 31.6 crore or 5 per cent stake in the life insurance firm to meet the curtailed disinvestment target of ₹ 78,000 crore in 2021-22. But the drastic lowering of ambitions for the IPO would be a setback for the government and challenge its fiscal balances as the disinvestment was positioned and aimed at replenishing the state's coffers.

LIC IPO sees ‘excellent’ response from anchor investors

May 2, 2022; LIC’s initial public offering on Monday saw ‘excellent’ response from anchor investors, an official said.5

The government is selling 22,13,74,920 shares in Life Insurance Corporation (LIC) at a price band of Rs 902-949 a share, targeting to raise about Rs 21,000 crore. The issue would be open for subscription for institutional and retail buyers from May 4-9.

The issue opened for anchor investor subscription on Monday and saw ‘excellent’ response, an official said, adding that the details of price bids would be known later in the day.

The LIC share sale would be the biggest ever amount raised through an initial public offering in the Indian stock market. The previous such high fund raising was seen in IPO of PayTM in 2021 at Rs 18,300 crore and Coal India in 2010 at Rs 15,200 crore.

Of the over 22.13 crore LIC shares on offer, over 9.88 crore shares are reserved for qualified institutional buyers and over 2.96 crore shares for non-institutional buyers.

Up to 15,81,249 shares and 2,21,37,492 shares are reserved for employees and policyholders.

While retail investors and LIC employees will get a discount of Rs 45 per share, LIC policyholders bidding in IPO would get a discount of Rs 60 a share.

LIC would start trading on the stock exchanges on May 17.

LIC’s embedded value, which is a measure of the consolidated shareholders value in an insurance company, was pegged at about Rs 5.4 lakh crore as of September 30, 2021, by international actuarial firm Milliman Advisors.

Based on investor feedback, the market value of government-owned LIC has been pegged at 1.1 times its embedded value or Rs 6 lakh crore.

References

- ^ https://licindia.in/Top-Links/about-us/History

- ^ https://licindia.in/getattachment/Bottom-Links/annual-report/LIC-Annual-Report-2021.pdf.aspx

- ^ https://www.news18.com/news/business/markets/lic-listing-live-updates-lic-share-price-lic-share-price-on-bse-nse-lic-stock-listing-price-lic-listing-day-strategy-livenews-5187967.html

- ^ https://www.ndtv.com/business/lic-ipo-likely-to-open-on-may-4-and-close-on-may-9-sources-2919445

- ^ https://www.financialexpress.com/market/ipo-news/lic-ipo-sees-excellent-response-from-anchor-investors/2510902/