Unilever PLC

Summary

- Unilever PLC is a global brand in the fast-moving consumer goods (FMCG) industry in the world.

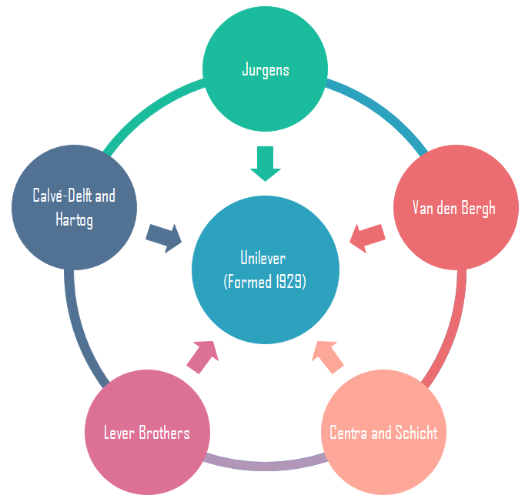

- The company was founded over 100 years ago. Through an agreement reached on September 2, 1929, the constituents of Unilever – Jurgens, Van den Bergh, Calvé and Delft and Hartog, Lever Brothers, and Centra and Schicht, gave birth to Unilever. The name comes from ‘Uni’ of Margarine Union/Unie, and ‘Lever’ from Lever Brothers.

- It is today’s FMCG giant that has over 400 brands available in 190 countries. The group has 300 factories of its own and another 700 third-party manufacturers. An estimated 2.5 billion people globally use Unilever’s products and brands.

- Unilever depend on the 148,000 talented people all over the world. It has about 53,000 supplier partners around the world in 150 countries. Other committed partners of the company include customers, governments, NGOs and other organisations.

- Financial year of Unilever ends on 31 December. Unilever has posted a profit of €52 billion, which is a 4.5% growth year-on-year. The company has reported operating profit of €8.7 billion in 2021, which was €8.3 billion in 2020, a growth of 4.8% year-on-year. Net profit of the company for the year ended 31 December, 2021 is €6.621 billion which was €6.073 billion in 2020.

Company Overview

Unilever PLC (LON:UVLR; AMS:UNA; NYSE:UL) is a global brand in the fast-moving consumer goods (FMCG) industry in the world. The company was founded over 100 years ago. It is one of the largest consumer goods companies globally. It is known for its great brands, global footprint and for doing business in a right way.1

The products of the company are available in around 190 countries in the world. About 3.4 billion use the products of Unilever every day; turnover of the company was €52 billion in 2021. It has 400 powerful brands worldwide. The company has 148,000 employees worldwide.

History of Unilever2

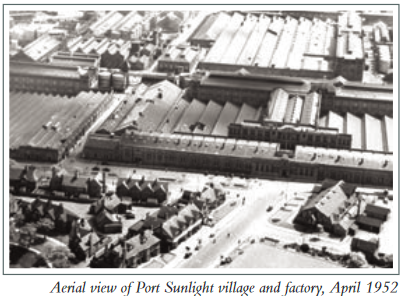

A dedicated historic home of Unilever is located at Port Sunlight, UK where a team is responsible for the management of Unilever Art, Archives and Records. According to the historic centre, the documents of Unilever dates as back as 1292.3 However, ‘material’ history of the company starts from 1990s.

To start with, it is to point towards the agreement that was signed in September, 1929 on the merger of Margarine Union and Lever Brothers Limited. Margarine Union was formed in 1927 by the Van den Bergh and Jurgens companies. The constituents of Margarine Union were based in Netherlands and they were conglomerates of a number of other Dutch and central European companies. The history of Van den Berghs and Jurgens companies is explained hereafter.

History of Van den Berghs

Simon Van den Bergh was the founder of this company. He entered his father’s barter trade at an early age. Later on, he started a thriving butter trade in the village Oss in Brabant, which he later decided to expand by exporting butter to England. In 1869, a butter substitute, margarine, made from animal fat, was invented by Mège Mouriès. Soon, Van den Bergh adopted the formula and crossed all their rivals in the same business to top the market. The development of hydrogenation, a technique for hardening vegetable oils made it possible to use a wide range of raw materials, not just animal fat. In 1891, Van den Bergh left Oss for new headquarters in Rotterdam, Netherlands.

Owing to the success of the company in late nineteenth century, and lack of financial backups in the family, Van den Bergh went public in London on 9 March, 1995, as it was easier to raise capital in London, and sold the previous partnership to the newly formed public limited company named ‘Van den Bergh’s Margarine Limited. Later in 29 May, 1897, the word Margarine was dropped to name the company Van den Berghs Limited. The English business then acted as a holding company for the family’s business interest.

The precedent for the creation of Margarine Union and then Unilever lies in a series of new company creation by Van den Bergh and some agreements. In 1919, Van den Berghs founded Van den Bergh's Fabrieken NV in Rotterdam to which the Dutch side of the family transferred their shares. The entire business then controlled Van den Bergh Group. A third company was introduced namely NV Hollandsche Vereeniging tot Exploitatie van Margarinefabrieken, whose shares were entirely held by the second company. An agreement among these three companies were signed that they will maintain a ratio in disbursing dividend, or any payment or liquidation money. The company then created two parent companies, one in England and another in Netherlands, in order to avoid problems like double taxation.

History of Jurgens Company

The history of Jurgens Company starts interestingly with the farmers paying them with butter in exchange of their carpentry works along the Dutch-German border. The Jurgens family repaired agricultural implements and farm utensils. The farmers lacked ready money hence paid them with butters which the Jurgens sold in the nearby towns. Seeing the profit in this, brother Willem, Jan and Leonard Jurgens moved to the Dutch town of Oss in 1801 to focus their attention on the butter trade.

The family business grew up and started producing margarine in 1870s. By the end of 1888, Jurgens as well as Van den Bergh was making margarine in Germany. Jurgens launched a branded margarine – Solo in 1899; in 1904, they succeeded in buying a competitor, A L Mohr of Hamburg. In the buying process, the Jurgens dodged its competitor, Van den Bergh. A general company, NV Anton Jurgens Vereenigde Fabrieken, was set up in 1906 to hold all the Jurgens’ interests in The Netherlands.

History of Lever Brothers

Lever Brothers was a British soap manufacturing company that started its journey in 1885 to become of the leading companies in the world. The company was founded by William Hesketh Lever and James Darcy Lever in 1885, as a starter it was a soap-making shop in Warrington. The brothers collaborated with Cumbrian chemist William Hough Watson, who invented a new formula for making soaps using glycerin and vegetable oils such as palm oil instead of tallow. The first soap was named ‘Honey Soap’ and later on renamed to ‘Sunlight Soap’. The demand was so high that production reached 450 tons by 1888. The company entered the US market in 1895 and in 3 years it bought a soap manufacturer in Cambridge, Massachusetts, the Curtis Davis Company. In 1925, Lever Brothers acquired Mac Fisheries, and by 1929, the company employed more than 1,000 workers in Cambridge and became third-largest soap manufacturer in the US.

The company introduced Lifebuoy soap in 1894 and ‘Lux’ in 1899. In American market, the brand Sunlight was a failure. But Lifebuoy, Lux and Rinso brought success to the company. Francis A. Countway helmed the American operation of the company. He understood very well that selling to the Americans is quite different from selling to the Europeans. He devised his new heavy promotional activities and served the company for 25 years. By 1919, the company was selling a million and a half cases of ‘Lux’ alone. Meanwhile, the parent company in England made a deal to finally become Unilever in association with Margarine Unie. The two companies would have a different set of shareholders but a single board of directors.

The pooling agreements

The three companies – Jurgens, Van den Bergh, and Lever Brothers, has been growing at their own paces at different places and in different markets. Meanwhile, in the early 20th century, Jurgens and Van den Bergh were rivals but they came to secretly pool their interests through an agreement reached on February 13, 1908. The reason behind this agreement was the stiff competition in England from Otto Monsted, as well as plentiful supply of margarine in The Netherlands. In summer of 1907, Jan Jurgens approached Arnold Van den Bergh with the proposal to cooperate closely. The agreement was roughly to split the profit into a ratio of 60:40 between Van den Bergh and Jurgens. However, although the talk was to sustain the agreement until 1926, it merely survived until 1913 when the division of profits were made equal.

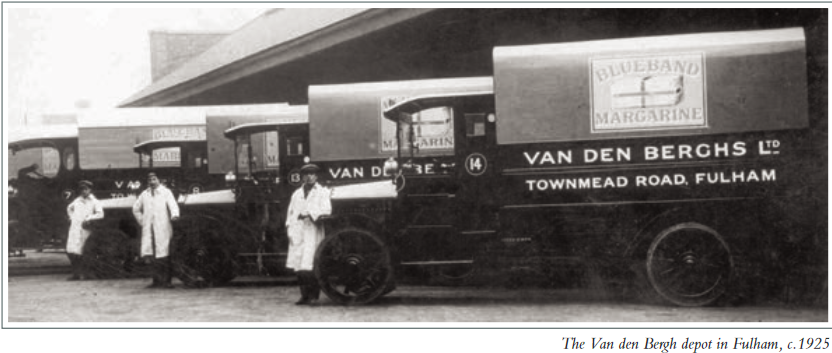

During the WWI, the oils and fats industry were under direct control of the government since the later was using it in producing supplies of soap and margarine as well as glycerine, a by-product. The glycerine was used as explosives. In the post-war time, Jurgens started their own plant in England in 1917. They also started buying their own factories to extend their production. They successfully bought Olympia Oil mill in Yorkshire over the bid put forward by lever brothers. On the other side, Van den Bergh also extended their Fulham factory. But the boom did not last since Jurgens and Van den Bergh suffered for the slump in margarine market as well as high competition from not only Otto Monsted but from Lever Brothers.

In the meantime, the pooling agreement was renewed in October 1920 and was supposed to be maintained until 1940. An Entete Agreement was signed that included two more companies – Centra and Schicht by the end of 1920 to counter the ever-increasing competition.

The merger: Formation of Margarine Union

By 1927, the margarine industry was stagnant and showed no signs of recovery. Lengthy legal processes rendered the pooling agreement between Jurgens and Van den Bergh dysfunctional. Finally, Jurgens suggested the option that had been on the cards for so long – a merger. The merger was signed on 2 August, 1927. The merged company assumed a new name – Margarine Union.

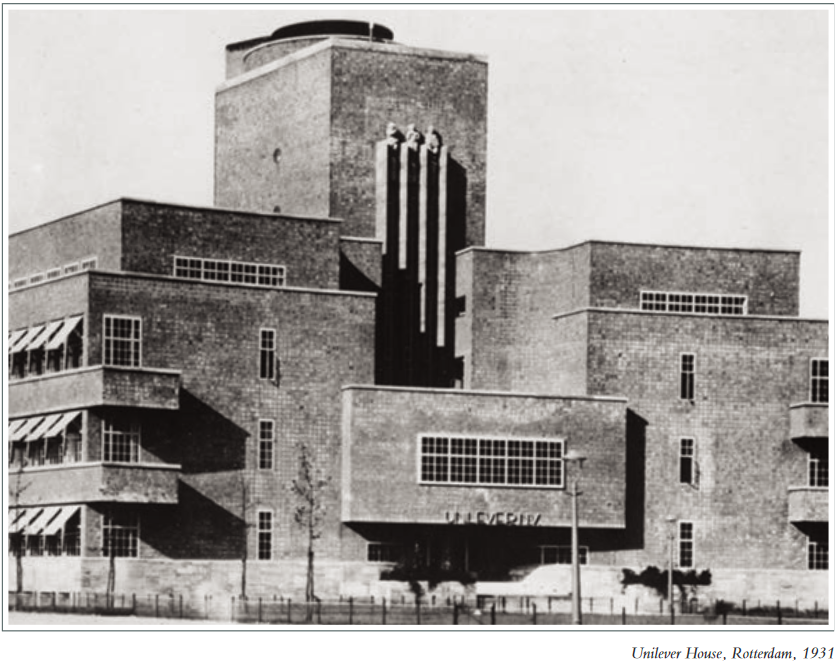

Under a complicated system ensued by the tax system of the countries, the Union had to create two holding companies – one in The Great Britain, and other in the Netherlands. The system was that the British Government would not tax the profits given as dividend to the owners; but the tax system of The Netherlands would do so. Therefore, whilst parent company was in The Netherlands, they would pay tax in The Britain on its profits, and again when the profits were distributed as dividends, the Netherland’s government would tax them. Thus, the problem of double taxation existed. But when the ownership was split, the profits from British operation would not be double taxed anymore. Two holding companies were created under same board of directors – Margarine Union Limited and NV Margarine Unie in The Great Britain and The Netherlands, respectively.

Birth of Unilever

Originally, the negotiations between Margarine Union and Lever Brothers started in order to reach an agreement on the use of raw materials. The initial discussions were about the business lines of the companies. In 1928, it was suggested that Lever Brothers should transfer their margarine interests to the Margarine Union and the Margarine Union transfer its soap companies to Lever Brothers. This expanded into discussions about regulating supplies of raw materials and co-operation in oil milling and refining, the production of edible fats other than margarine, and the disposal of by-products.

The talk about amalgamation of the two companies’ interests were placed in several forms but none worked out as the financial structure of the companies were quite different – Lever Brothers consisted of preference shares while Margarine Union was of ordinary shares. However, John McDowell of Lever Brothers and Paul Rijkens of the Margarine Union eventually came up with a solution. The solution was such – the ordinary shares of Lever Brothers would be amalgamated with that of Margarine Union companies, so that control of the both organisations would be in the hands of the holders of ordinary shares of Lever Brothers and controlling shares of the Margarine Union companies.

The agreement was reached on 2 September, 1929 and came to be known as the Equalisation Agreement. It is still in force today. The holding companies were Unilever Limited and Unilever NV.

Thus, Unilever came into being on 1 January, 1930 as the agreement was enforced on this day.

From time to time, entities in the following figure have comprised what today is known as Unilever4 -

Image gallery

Timeline of Unilever

| Year | Particulars |

| 1801 | Brothers Willem, Jan & Leonard Jurgens, move to Oss in The Netherlands to develop their butter trade |

| 1819 | Simon Van den Bergh, founder of the family’s margarine business, born |

| 1820 | Georg Schicht, founder of the family business, born |

| 1848 | Schicht acquire permission to build a soap factory in Ringelshain, Bohemia |

| 1851 | Birth of William Hesketh Leve |

| 1854 | Gebroeders Jurgens company formed in The Netherlands |

| 1869 | Invention of margarine by Mège Mouriès in France |

| 1870 | Jacob and Henry Van den Bergh move to England |

| 1871 | Jurgens family acquire the patent for making margarine |

| 1882 | Schicht build a factory in Aussig, Central Europe |

| 1884 | William Lever registers Sunlight trademark in the UK |

| 1885 | Lever Brothers started by William Lever and his brother |

| 1888 | Lever Brothers open a sales office in Sydney, Australia (Its first overseas.) |

| 1890 | Lever Brothers becomes a private limited company in the UK |

| 1891 | The Van den Bergh family leave Oss and move to Rotterdam |

| 1895 | Van den Bergh establishes a public limited company, Van den Berghs Margarine Ltd in the UK |

| 1897 | Merger of Calvé and Delft (France/Netherlands) |

| 1898 | Vitello margarine launched by Van den Bergh in Germany |

| 1899 | Jurgens launch Solo margarine in Germany |

| 1904 | Sanella margarine launched by Van den Bergh in Germany |

| 1906 | Jurgens set up NV Anton Jurgens' Vereenigde Fabrieken, comprising all the Jurgens interests in the Netherlands |

| 1908 | 1st Pooling Agreement in The Netherlands |

| 1912 | Centra formed in Central Europe |

| 1913 | 2nd Pooling Agreement in The Netherlands |

| 1916 | Blue Band launched in the UK by Van den Bergh |

| 1917 | Jurgens margarine factory opens at Purfleet in the UK |

| 1919 | Van den Bergh forms Van den Bergh's Fabrieken NV in Rotterdam, to which all the company’s continental interests are transferred |

| 1920 | Stork margarine is launched in the UK by Jurgen; 3rd Pooling Agreement in The Netherlands; The Little Entente signed between Jurgens, Van den Bergh, Centra and Schicht; The Great Entente signed between Jurgens, Van den Bergh, Centra and Schicht. |

| 1923 | Blue Band launched in the Netherlands |

| 1924 | Rama margarine launched by Jurgens in Germany |

| 1925 | Lux soap launched by Lever Brothers in the USA; Death of William Lever, 1st Viscount Leverhulme |

| 1927 | Viking, the first vitaminised margarine, launched by Lever Brothers in the UK; Formation of the Margarine Union |

| 1928 | Calvé-Delft joins Margarine Union in September; Schicht and Centra join Margarine Union at the end of the year |

| 1929 | Hartog joins Margarine Union in January; Equalisation Agreement signed between Lever Brothers Limited and NV Margarine Union on 2 September |

| 1930 | Unilever came into being on 1 January |

Corporate profile

The company came into being in 1929 through the merger of Lever Brothers and Margarine Union/Unie. It is today’s FMCG giant that has over 400 brands available in 190 countries. The group has 300 factories of its own and another 700 third-party manufacturers. An estimated 2.5 billion people globally use Unilever’s products and brands.

Unilever operates in the consumer goods industry. The company produces and markets home care, personal care, foods and refreshment products. The personal care product line includes skincare, deodorants, hair care and oral care products. The home care segment provides powder, liquids, capsules, soap bars and so on. The foods and refreshment segment offers soups, bouillons, sauces, snacks, mayonnaise, salad dressings, margarine, and spreads. The refreshment segment provides ice creams and tea-based beverages. Largest selling brands of the company are Aviance, Axe/Lynx, Ben & Jerry's, Dove, Flora/Becel, Heartbrand, Hellmann's, Knorr, Lipton, Lux/Radox, Omo/Surf, Rexona/Sure, Sunsilk, Toni & Guy, TRESemmé, VO5 and Wish-Bone.5

Headquarter of the company is located in Unilever House 100 Victoria Embankment. The company is currently headed by Alan Jope, Chief Executive Officer and Director. Share price of the company hovers around £35 as on April 2022. Market capitalization of the company as on 1 April, 2022 is £90 billion. The company has about 30 acquisitions/subsidiaries.

Business strategy

Vision of the company is to be the global leader in sustainable business. The business purports to demonstrate how their purpose-led, future-fit business model drives superior performance, and consistently delivers financial results in the top third of the industry.

Business strategy is what makes a company stands out and it is what made Unilever a world-renowned company from a merged operation. The marketing strategy of Unilever is that it integrates its global strategies with the local community. The consumers are attracted since they get a hold on to the local essence of the products. Unilever’s marketing is rooted in ‘a brand with a purpose’. The tagline of Surf Excel, for example, is ‘dirt is good’. This has helped the brand foster in different forms. At the same time, the case of Brooke Bond Red Label depicted how a social conversation over a cup of tea (or perhaps just a sip) could bring a change in the social views of the tea lover. Therefore, due to such creative methods, Unilever’s brands, despite being one of the oldest, have continued to gain consumers’ confidence.6

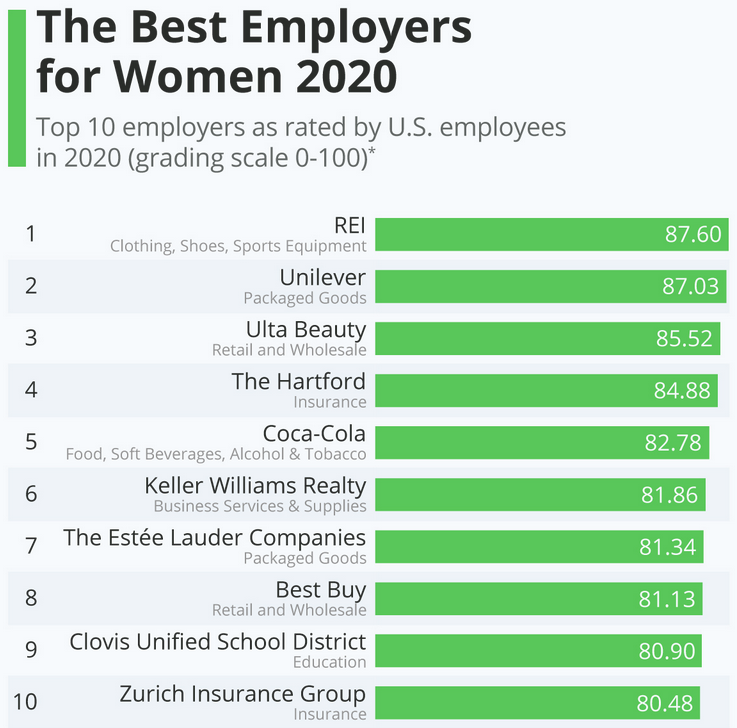

Unilever keeps sustainability at the heart of its business. It focuses on sustainable living plan for its consumers as well as climate change. The company has understood the importance of sustainability and incorporated it in all its work procedures and practices. The company believes in gender equality and has actively managed to maintain it throughout the recent decade. In 2010, only about 38% of the managerial positions were held by women whereas the number topped up in 2020 to 50%. The company focuses on eliminating inequality by removing stereotypes in its advertising.

The company has placed second in 2020 on the statistics of best employer for women.

Unilever has been honoured as the top environmentally friendly company back in 2017. It has committed to reduce food waste from the factory to shelf by half by 2025.

The company is committed to build customer-centric business strategy. The company possesses the top brands and thus achieved a unique position in the customer’s mind.

Strategic choices and actions

The strategic choices of the company comprise the overall business strategy. Below are the listed actions that the company takes as its strategy.

- Develop portfolio into high growth spaces – hygiene, skin care, prestige beauty, functional nutrition, plant-based foods.

- Win with the brands as a force for good and powered by purpose and innovation – improve health of the planet, improve people’s health confidence and wellbeing, contribute to a fairer, more socially inclusive world, win with differentiated science and technology.

- Accelerate in USA, India, China and key growth markets. The company believes in the power of the consumers therefore it focuses on the population. China and India constitute about 36% of total world population. Therefore, Unilever leverage the emerging market strength by further scaling in USA, India and China.

- Lead in the channels of the future – accelerate pure-play and omnichannel eCommerce, develop eB2B business platforms, and drive category leadership through shopper insight.

- Build a purpose-lead, future-fit organisation and growth culture – unlock capacity through agility and digital transformation, be a beacon for diversity, inclusion and value-based leadership, build capability through lifelong learning.

The company believes in 5 growth fundamentals – purposeful brand, improved penetration, impactful innovation, design for channel, and fuel for growth.

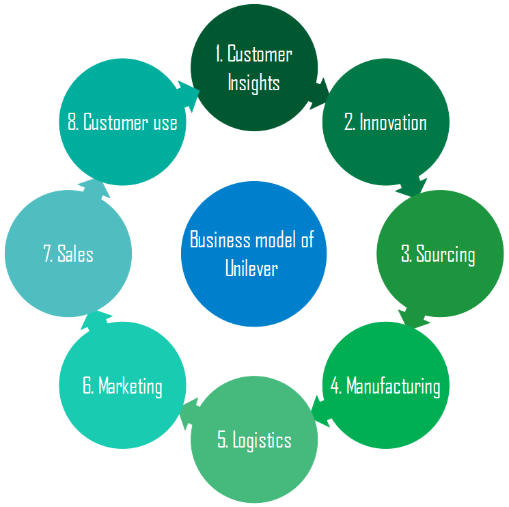

Business model

The business model of the company can be discussed in three parts. First part involves the human relationships of the company. Unilever depend on the 148,000 talented people all over the world. It has about 53,000 supplier partners around the world in 150 countries. Other committed partners of the company include customers, governments, NGOs and other organisations. Second part include the resources that go into the production of the company. Input raw materials are thousands of tonnes of agricultural raw materials, packaging materials and chemicals from around the world. Financial resources come from all the financial stakeholders of the company who invest for long-term. Unilever also has intangible assets like 400+ brands, R&D facilities and intellectual properties like patents and trademarks. The company occupies around 280 factories, 270 offices, and 450 logistics warehouses globally.7

With the abovementioned resources and capabilities, the company embark into its production and marketing, sales and other processes. The stages of the business model are illustrated below –

Step 1: The business of Unilever starts with customer insights. It listens to the customers through 37 People Data Centres around the world, through social media and traditional consumer research. The company believes that changing customer sentiment matters for them.

Step 2: The marketing and research team then uses the insights and input their best ideas and thinking from specialists to develop the products and brands of Unilever. The company spends a huge some in its research and innovation. For example, it has spent €847 million on R&D in 2021.

Step 3: The business sources raw materials for production and packaging. It also sources services such as media to run the business. Every year the company source raw materials and packaging materials worth €21 billion and €14 billion in services.

Step 4: The company turns the raw materials into final products in its own factory or in third party manufacturer’s factory.

Step 5: The logistics support network worldwide delivers the manufactured products to thousands of retailers.

Step 6: Marketing of the company uses advertisers globally to promote purposeful and inclusive brands.

Step 7: At this stage the company makes the products available to the consumers all over the 190 countries in the world. It uses the logistics channels, wholesalers, retailers and any other means to reach out to the customers.

Step 8: At the final stage, the consumers use the products and relay insights which the company collect and restarts the process of production from the beginning.

With those steps explained above, the company creates value for its shareholders, employees, consumers, customers, suppliers, business partners, and planet & society.

Risk analysis of Unilever

The risk of a business determines largely the future prospects of it. According to the analysis of the company, the principal risk of the company is climate change. The risks that could affect the business in short-term (two years), mid-term (three to ten years), and long-term (beyond ten years). Three risks are considered to have increased during this fiscal year –

- Business transformation is taking place in the company since it is trying to deliver a superior customer experience. The increased scale has caused by events like disposal of ekaterra, new organizational model, and the transformation of core business process.

- Economic and political instability have increased during the past years owing to the post-covid inflationary pressure, supply chain disruption and ongoing Covid-19 cases across different regions of the world.

- Systems and information risk has increased sing the cyber-attack industry is becoming increasingly professionalized.

The risk factors of the company are listed below along with their nature and the company’s attempt to mitigate them –

| Risk | Nature of the risk |

| Brand preference | Success of Unilever largely depends on the brand preference of the customers. But the fact is that consumer tastes, behavior and preferences are changing rapidly now than ever before. Consumers are preferring the brands that meet their needs and also has a social and environmental need. |

| Portfolio management | The investment choices that the company makes largely determines its current and future success. The profitability of the company depends on the portfolio of its divisions, channels, and geographies. |

| Climate change | Operation of the company is significantly exposed to climate change threats that currently exist in the world. The governmental actions to reduce changes can affect the demand for the products of Unilever. Regulations over energy consumption (carbon emission), energy transformation, and increased price of energy may disrupt the operation of Unilever and increase costs. |

| Plastic packaging | The products of Unilever are packaged using plastic mostly. Several factors like recyclability of the plastics used in packaging, amount of recycled plastic, and amount of virgin plastic used are critical for the operation of the company. The environmental awareness of the customers, and governments can result into disrupted operation of Unilever. |

| Customer | The relationship with customers determines the success of the business and continued growth. The management of customer relationships also determines the ability of the company to obtain pricing and competitive trade terms. However, Covid-19 has shown that more customers are driven to online shopping. Therefore, Unilever needs to develop ecommerce capabilities in order to remain competitive. |

| Talent | A skilled workforce and agile ways of working are essential for the continued operation of the company. However, there is a risk that the employees of the company are not equipped with proper sets of skills. Also, loss of management or other key personnel or the inability to identify, attract and retain qualified personnel could make it difficult to manage the business and could adversely affect operations and financial results. |

| Supply chain | Purchasing materials and efficient manufacturing and the timely distribution of products are some key to success for the company. Some physical disruption, industrial accidents, trade restrictions, or disruption of key suppliers are some risk factor that the company feel the risk of. |

| Systems and information | Unilever’s operation is increasingly becoming dependent upon IT systems and management of information. But the company considers that cyber-attack threat of unauthorized access and misuse of sensitive information is increasing therefore this risk factor of the company is increasing. |

| Economic and political instability | Unilever operates around the world and is exposed to economic and political instability that may reduce consumer demand for our products, disrupt sales operations and/or impact the profitability of our operations. Government actions such as foreign exchange or price controls can impact on the growth and profitability of our local operations. Unilever has more than half of its turnover in emerging markets which can offer greater growth opportunities but also expose Unilever to related economic and political volatility. |

Apart from these risks described above, the company is exposed to other kinds of risks such as legal and regulatory, ethical, treasury and tax, and business transformation risk.

Financial Performance

Financial year of Unilever ends on 31 December. Unilever has posted a profit of €52 billion, which is a 4.5% growth year-on-year. Based on sale volume, sales growth of the company is 1.6%. Sales of the company in 2020 was €50.7 billion, which is €52.4 billion 2021. The company has reported operating profit of €8.7 billion in 2021, which was €8.3 billion in 2020, a growth of 4.8% year-on-year. After paying all the finance costs and adjusting other incomes, the profit before taxation of the company becomes €8.556 billion, which was €7.996 billion a year earlier. Net profit of the company for the year ended 31 December, 2021 is €6.621 billion which was €6.073 billion in 2020.

Total non-current assets in the company’s balance sheet is reported €57.69 billion which was €51.502 billion a year earlier. Total current assets of the company during the year is reported €17 billion, which was €16.16 billion a year earlier. Total current liabilities of the company have increased from €20.59 billion in 2020 to €24.78 billion in 2021. Total balance of financial liabilities stayed almost static at €22 billion. Total non-current liabilities of the company at the end of 2021 is €55.35 billion which was €50 billion a year earlier. Shareholders’ equity of the company in 2021 is reported €17 billion, which was €15 billion. Total assets of the company reported in 2021 is €75 billion, which was €67.66 billion.

Total operating cash flow of the company stood at €7.97 billion in 2021, which was €9.06 billion a year earlier. The company has invested heavily in the last outgoing year which is negative €3.246 billion; it was negative €1.48 billion in 2020. The company has experienced negative cash flows in 2021 from financing activities, which is bigger than that of a year earlier. In 2021, the cash flow from financing activities of the company is negative €7.099 billion, which was negative €5.804 billion in 2020. Thus, the company ended up with less cash balance in 2021 than in a year earlier. The balances are €3.387 billion and €5.475 billion in 2021, and 2020, respectively.

Basic earnings per share (EPS) of the company is €2.33 in the latest year, while it was €2.13 a year earlier. Net asset value (NAV) per share of the company is negative €539.34 in the latest financial year. Revenue per share is €1,917.3; pre-tax profit per share is €285.48. Return on capital employed for the company is 25.11%; dividend yield and dividend per share growth rate is 2.62% and 9.63%, respectively. Price to earnings (P/E) ratio of the company is 21.57 times.

Recent developments

- SAP, Unilever pilot blockchain technology to support deforestation-free palm oil production on 21 January, 2022. A SAP solution named GreenToken will increase further the traceability and transparency of Unilever’s global palm oil supply chain.

- Unilever announced on 7 March, 2022 that it will be the first global Foods company to publicly report the performance of its product portfolio against at least six different government-endorsed Nutrient Profile Models (NPM) as well as its own Highest Nutritional Standards (HNS).

- Unilever announced on 8 February, 2022 that it will sell its direct business in Thailand – Unilever Life, to RS Group.

- A press release of the company discloses the sales growth of 4.5%, highest in nine years, on 10 February, 2022.

- Unilever’s ice cream factory in TaiCang, China the first of its kind recognised as an ‘Advanced 4th Industrial Revolution Lighthouse’ by the World Economic Forum on 27 September, 2021.

- Unilever announced on 26 April, 2021 that it has signed an agreement to acquire Onnit, a holistic wellness and lifestyle company, based in Austin, Texas (US).

- ^ https://www.unilever.com/our-company/at-a-glance/

- ^ https://www.unilever.com/files/origin/3d0982a9cc0a89b9b4834edc8023cb1e54477f4e.pdf/formation-of-unilever-brochure.pdf

- ^ https://www.unilever.com/our-company/our-history-and-archives/

- ^ For details history consult this pdf:

https://www.unilever.com/files/origin/3d0982a9cc0a89b9b4834edc8023cb1e54477f4e.pdf/formation-of-unilever-brochure.pdf - ^ https://www.devex.com/organizations/unilever-48862

- ^ https://thestrategystory.com/2021/05/19/unilever-business-strategy/

- ^ https://assets.unilever.com/files/92ui5egz/production/5e5eba8c5179bfcad19c3775a7f58db428bcaf91.pdf