Methanex

Summary

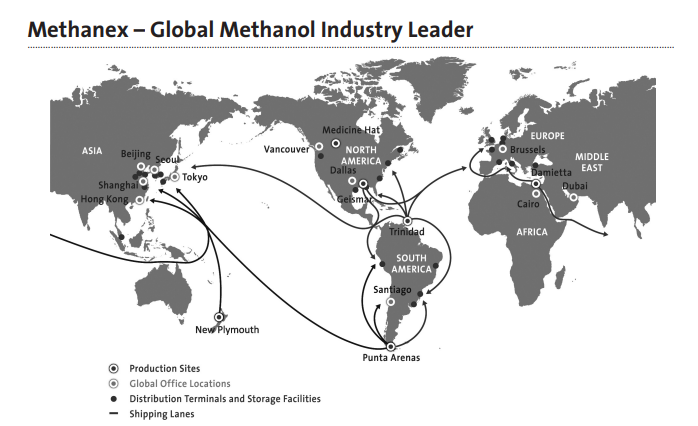

- Methanex is the world’s largest producer and supplier of methanol to major international markets in North America, Asia Pacific, Europe and South America.

- Headquartered in Vancouver, Canada, Methanex currently operates production sites in Canada, Chile, Egypt, New Zealand, Trinidad and Tobago and the United States.

- The company's extensive global supply chain and distribution network provides its customers with a secure and reliable supply of methanol.

Company Overview

Methanex (NYSE:MEOH, TSX:MX ) is the world’s largest producer and supplier of methanol to major international markets in North America, Asia Pacific, Europe and South America.1

Headquartered in Vancouver, Canada, Methanex currently operates production sites in Canada, Chile, Egypt, New Zealand, Trinidad and Tobago and the United States.

The company's global operations are supported by an extensive global supply chain of terminals, storage facilities and the world’s largest dedicated fleet of methanol ocean tankers.

The Power of Agility® is its key brand differentiator and is how its global team of approximately 1,300 employees safely and reliably delivers on its brand promise everyday by quickly adapting and responding to its customers’ needs and creating and capitalizing on opportunities in the marketplace.

Production Sites

The company's strategically located global production sites give it the ability to meet its customers' evolving needs, providing them with a reliable and secure supply of methanol.2

TRINIDAD - The company's plant in Trinidad supplies methanol markets in North and South America, Europe and Asia Pacific.

NEW ZEALAND - The company's two production facilities in New Zealand supply methanol primarily to customers in Asia Pacific.

EGYPT - The company's joint venture facility in Egypt (Methanex interest 50 per cent) is located on the Mediterranean Sea and supplies domestic and European methanol markets.

CANADA - The company's plant in Medicine Hat is located in southeastern Alberta and supplies methanol via rail and tanker truck to customers in North America.

UNITED STATES- The company's two plants in Geismar have the capability to serve customers in all major markets around the globe. Since their start-up in 2015, they have been a significant enhancement to Methanex’s global supply chain.

CHILE - The company's two plants in Punta Arenas are the world's southernmost methanol production facilities, supplying methanol to major markets in Latin America and Asia Pacific.

The company's extensive global supply chain and distribution network provides its customers with a secure and reliable supply of methanol.

ASIA

China

- Hong Kong

- Japan

- Korea

OCEANIA

- New Zealand

NORTH AMERICA

- USA – Dallas

- USA – Geismar

- Canada – Medicine Hat

- Canada – Vancouver

SOUTH AMERICA

- Chile

- Trinidad and Tobago

EUROPE

- Belgium

MIDDLE EAST

- Egypt

- United Arab Emirates

Industry Overview

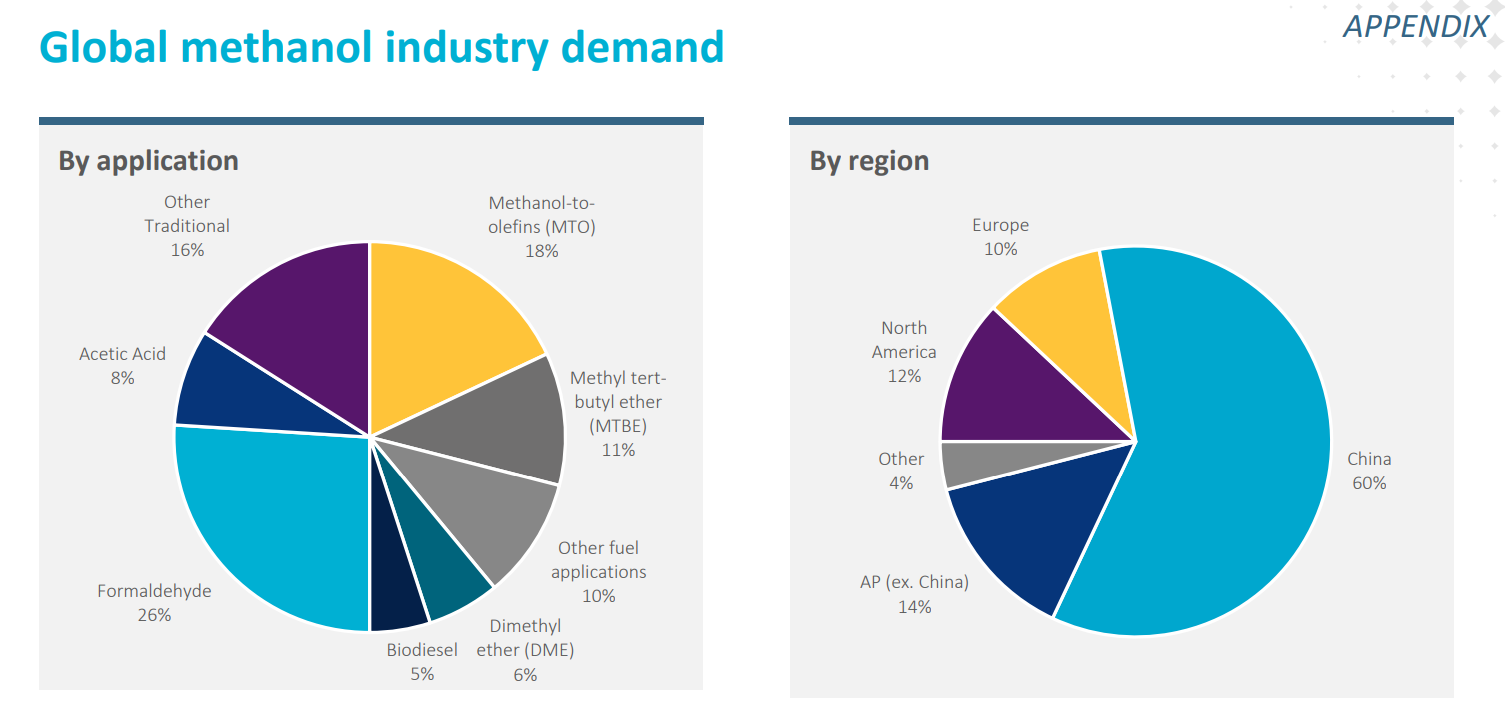

Methanol is a global commodity and its earnings are significantly affected by fluctuations in the price of methanol, which is directly impacted by changes in methanol supply and demand. Based on the diversity of end products in which methanol is used, demand for methanol is driven by a number of factors, including: strength of global and regional economies, industrial production levels, energy prices, pricing of end products, downstream capacity additions and government regulations and policies. Methanol industry supply is impacted by the cost of production, methanol industry operating rates and new methanol industry capacity additions.3

Demand

In 2021, global methanol demand continued to recover from impacts related to the COVID-19 pandemic. The company estimate that global methanol demand grew by 5% in 2021 to approximately 86 million tonnes.

Traditional chemical demand increased by approximately 9% year-over-year due to a strong recovery in manufacturing activity. Demand into energy-related applications increased by approximately 2% year-over-year, although strong demand for other energyrelated applications was offset by a decline in MTO applications. MTO production was lower due to planned maintenance activities and the impact from China’s government-mandated industrial operating rate restrictions.

There is growing interest in methanol as a marine fuel given its environmental benefits, wide availability, cost competitiveness and ease of use. Approximately 60% of its long-term shipping fleet, or 19 vessels in total, will have the capability to run on methanol by 2023. In 2021, several announcements were made by shipping companies, including Maersk, the world’s leading containership company, for orders of dual-fueled vessels that can run on methanol. The company estimate in the next three to four years there will be over 60 dual-fueled vessels on the water, including its 19. The annual demand from these dual-fueled vessels the company estimate will be approximately one million tonnes per year assuming they run on methanol 100% of the time.

Methanol is also being used as a vehicle fuel in China. Methanol can be blended with gasoline in low quantities and used in existing vehicles and can be used in high-proportion blends such as M85 in flex-fuel vehicles or M100 in dedicated methanol-fueled vehicles. Methanex is pleased to see significant interest in high-level methanol fuel blends for M100 taxis and trucks (able to run on 100% methanol fuel) in China. There are approximately 25,000 taxis and 1,000 heavy-duty trucks in China, representing approximately 600,000 tonnes of methanol demand, running on M100 fuel. Several other countries are in the assessment or near-commercial stage for using methanol as a vehicle fuel.

In China, stricter air quality emissions regulations in several provinces are leading to a phase-out of coal-fueled industrial boilers, industrial kilns, and cooking stoves in favour of cleaner fuels, creating a growing market for methanol as an alternative fuel. The company estimate that this growing demand segment already represents approximately five million tonnes of methanol demand. The company continue to support various pilot projects and the development of operational and safety standards to support the commercialization of methanol as a thermal fuel for industrial boilers, kilns and cooking stoves.

Supply

Methanol is predominantly produced from natural gas and is also produced from coal, particularly in China. The cost of production is influenced by the availability and cost of raw materials, including coal and natural gas, as well as freight costs, capital costs and government policies. An increase in economically competitive methanol supply, all else equal, can displace supply from higher cost producers and have a negative impact on methanol price.

Approximately two million tonnes of new annualized capacity, including existing capacity expansions, outside of China was introduced in 2021, including Koch Methanol in Louisiana (1.7 million tonnes) and Shchekinoazot Phase III in Russia (0.45 million tonnes). In China, the company estimate that approximately six million tonnes of new production capacity was added in 2021, including backward integration of two MTO plants and other downstream products. The methanol industry ran at lower operating rates in 2021 due to various planned and unplanned outages coupled with feedstock availability and cost issues which made it difficult for supply to recover to pre-COVID levels .

Over the next few years, the company expect the majority of large-scale capacity additions outside of China to be in North America and Iran. In North America, Methanex is building a 1.8 million tonne plant, the Geismar 3 project, which will be its third plant in Louisiana, with commercial operations targeted for the end of 2023 or early 2024. There are other large-scale projects under discussion in North America; however, the company believe that none are close to a final investment decision. In Iran, the company continue to monitor projects at various construction stages, including the Sabalan plant, which is the only project nearing completion. In China, the company anticipate some continued capacity additions over the near-to-medium term and the closure of some small-scale, inefficient and older plants. The company expect that new capacity built in China will be consumed in that country.

Price

The methanol business is a highly competitive commodity industry and future methanol prices will ultimately depend on the strength of global demand and methanol industry supply. Methanol demand and industry supply are driven by a number of factors as described above. Methanol prices have historically been, and are expected to continue to be, characterized by cyclicality. Methanex’s average realized price in 2021 was $393 per tonne compared to $247 per tonne in 2020. The increase in methanol pricing in 2021 was a result of strong demand recovery, constrained methanol industry operating rates and rising energy prices.

Business Overview

Methanol is a clear liquid commodity chemical that is predominantly produced from natural gas and is also produced from coal, particularly in China. Traditional chemical demand, which represents just over 50% of global methanol demand, is used to produce traditional chemical derivatives, including formaldehyde, acetic acid and a variety of other chemicals that form the basis of a wide variety of industrial and consumer products. Demand for energy-related applications, which represents just under 50% of global methanol demand, includes several applications including methanol-to-olefins (“MTO”), methyl tertiary-butyl ether (“MTBE”), fuel applications (including vehicle fuel, marine fuel and other thermal applications), di-methyl ether and biodiesel.

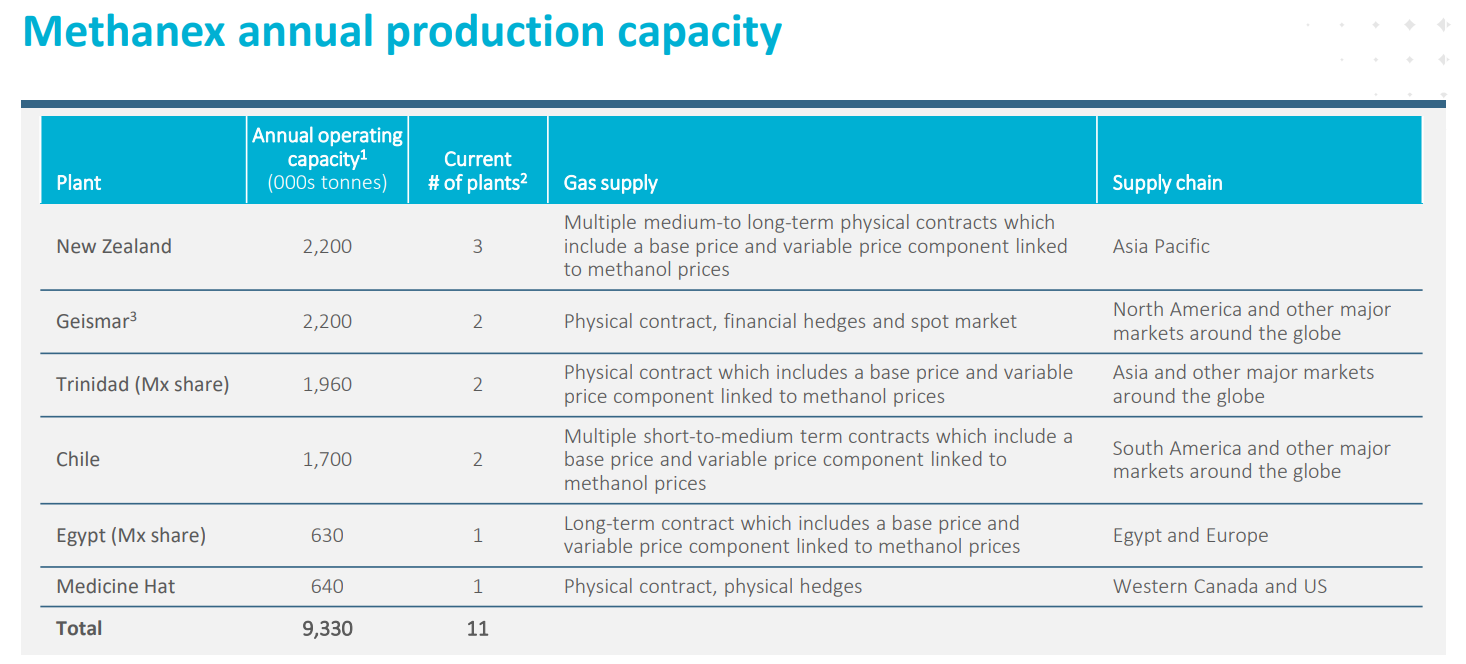

Methanex is the world’s largest producer and supplier of methanol to the major international markets in Asia Pacific, North America, Europe and South America. The company's total annual operating capacity, including Methanex’s interests in jointly owned plants, is currently 9.3 million tonnes and is located in New Zealand, the United States, Trinidad, Chile, Egypt, and Canada. In addition to the methanol produced at its sites, the company purchase methanol produced by others under methanol offtake contracts and on the spot market. This gives it flexibility in managing its supply chain while continuing to meet customer needs and support its marketing efforts. Methanex has marketing rights for 100% of the production from the jointly-owned plants in Trinidad and Egypt, which provides it with an additional 1.3 million tonnes per year of methanol offtake supply when the plants are operating at full capacity

In 2021, its strategy of operational excellence in financial management enabled the restart of its Geismar 3 project to be funded from its cash balance, while continuing to return cash to shareholders through initiating a new share repurchase program and resetting the dividend. As at December 31, 2021, the company had strong liquidity with $932 million in cash and $900 million of undrawn back-up liquidity through its revolving and construction credit facilities, and no significant debt maturities until 2024. The company actively manage its liquidity and capital structure in light of changes to economic conditions, the underlying risks inherent in its operations and the capital requirements of its business.

New Zealand

In New Zealand, the company produced 1.3 million tonnes of methanol in 2021 compared with 1.7 million tonnes in 2020. Production for 2021 was lower than 2020 due to lower gas availability and due to a short-term commercial arrangement with Genesis Energy to make natural gas available to support a tight New Zealand electricity market during the Southern hemisphere winter months. Lower gas availability led to the consolidation of New Zealand production at the two Motunui plants and an indefinite idling of its smaller Waitara Valley plant at the beginning of 2021. The company estimate production in 2022 to be approximately 1.5 million tonnes.

United States

Geismar produced 2.0 million tonnes of methanol in both 2021 and 2020. Production at the Geismar site was comparable, as the increased production capacity resulting from the successful debottlenecking projects were offset by the impact of the planned turnaround at Geismar, and a precautionary outage during Hurricane Ida. With the completion of the two Geismar debottlenecking projects, the annual operating capacity for the Geismar facilities has increased by 10%, to 2.2 million tonnes.

Trinidad

The company's ownership interest in the methanol facilities in Trinidad represents 2.0 million tonnes of annual operating capacity. The Trinidad facilities produced 1.2 million tonnes of methanol (Methanex share) in 2021, solely from Atlas, compared with 1.0 million tonnes in 2020. Production in Trinidad was higher in 2021 as the Atlas plant operated at high operating rates following the turnaround completed in 2020. Titan remains idled indefinitely.

Chile

The Chile facilities produced 0.8 million tonnes of methanol in both 2021 and 2020. Production in Chile is impacted by seasonal demand for natural gas whereby only one of its two methanol plants has operated during the Southern hemisphere winter months when seasonal demand for natural gas in the region is at its peak. The Chile IV plant was restarted in late 2021 and the company expect to have sufficient gas to operate both Chile plants through the Southern hemisphere summer months to the end of April 2022. The company estimate production in 2022 to be approximately 1 million tonnes.

Egypt

The company operate the 1.3 million tonne per year methanol facility in Egypt, in which Methanex has a 50% economic interest and marketing rights for 100% of the production. The company produced 1.2 million tonnes of methanol (Methanex share of 0.6 million) in Egypt for both 2021 and 2020, operating at high rates throughout both years.

Canada

Medicine Hat produced 0.6 million tonnes of methanol in 2021 compared with 0.5 million tonnes in 2020. Production at Medicine Hat was higher for 2021 compared to 2020 as the company completed a planned turnaround in 2020.

Financial Highlights

For the year ended December 31, 2021, the company reported a net income attributable to Methanex shareholders of $482 million ($6.13 income per common share on a diluted basis), compared with a net loss attributable to Methanex shareholders of $157 million ($2.06 loss per common share on a diluted basis) for the year ended December 31, 2020. Net income attributable to Methanex shareholders for the year ended December 31, 2021 is higher compared to the year ended December 31, 2020, primarily due to higher average realized price, partially offset by higher cash costs as its biggest feedstock, natural gas, is contracted at a majority of its production sites with links to methanol pricing, which was higher in 2021.

For the year ended December 31, 2021, the company reported Adjusted EBITDA of $1.1 billion and Adjusted net income of $460 million ($6.03 Adjusted net income per common share), compared with Adjusted EBITDA of $346 million and Adjusted net loss of $123 million ($1.62 Adjusted net loss per common share) for the year ended December 31, 2020.

Revenue

Revenue was $4.4 billion in 2021 compared to $2.7 billion in 2020. The higher revenue reflects a higher average realized price and marginally higher sales volume in 2021 compared to 2020.

Most of its customer contracts use published Methanex reference prices as a basis for pricing, and the company offer discounts to customers based on various factors. The company's average non-discounted published reference price in 2021 was $492 per tonne compared with $297 per tonne in 2020. The company's average realized price in 2021 was $393 per tonne compared to $247 per tonne in 2020.

Methanol sales volume, excluding commission sales volume, for the year ended December 31, 2021, increased by 0.3 million tonnes to 10.0 million tonnes from 9.7 million tonnes in 2020, and this increased Adjusted EBITDA by $13 million. Including commission sales volume from the Atlas and Egypt facilities, its total methanol sales volume was 11.2 million tonnes in 2021 compared with 10.7 million tonnes in 2020. Sales volume was higher for 2021 compared to 2020 primarily due to demand recovering after the impact of decreased global demand in 2020 due to the onset of the COVID-19 pandemic.

EBITDA

2021 Adjusted EBITDA was $1.1 billion compared with 2020 Adjusted EBITDA of $346 million, an increase of $762 million. The company's average realized price for the year ended December 31, 2021, was $393 per tonne compared to $247 per tonne for 2020, and this increased Adjusted EBITDA by $1.5 billion

Depreciation and Amortization

Depreciation and amortization was $363 million for the year ended December 31, 2021, and is marginally higher than $357 million for the year ended December, 31 2020.

Cash Flow

Cash flows from operating activities for the year ended December 31, 2021 were $994 million compared with $461 million for the year ended December 31, 2020. The increase in cash flows from operating activities is primarily due to higher earnings partially offset by changes in non-cash working capital.

Recent developments

Methanex And Mitsui O.S.K. Lines Announce Closing Of Strategic Partnership

February 1, 2022; Methanex Corporation (TSX:MX) (NASDAQ:MEOH) (Methanex) and Mitsui O.S.K. Lines, Ltd. (TSE:9104) (MOL) announced the completion of the previously announced strategic partnership involving Methanex’s Waterfront Shipping (WFS) subsidiary. Methanex has received proceeds of approximately US$145 million from MOL for a 40 percent minority interest in WFS. Methanex will retain the remaining 60 percent majority interest in WFS and continue to operate WFS as a key element of its global supply chain capabilities.4

Methanol is a safe, proven, cost-competitive marine fuel for the commercial shipping industry that can meet current and future emissions regulations. Through this transaction, Methanex as the world leading methanol producer, WFS as the world’s leading methanol shipper, and MOL as the provider of multimodal shipping services will strengthen a relationship established over 30 years and advance the commercialization of methanol, including renewable methanol, as a viable marine fuel.