Natco Pharma Ltd

Summary

- NATCO Pharma Ltd. is a vertically integrated and R&D focused enterprise, engaged in developing, manufacturing and marketing FDF and active pharmaceutical ingredients (APIs) and intermediates.

- The Company has also initiated plans to diversify into niche agrichemical business.

- Its market, spread over 40 countries. It sells FDF products in the US, India, Europe and Rest of the World

- It holds a leading market share in the domestic oncology segment.

- Natco has six formulation locations across India

Company Overview

Natco Pharma Limited was incorporated in Hyderabad in the year 1981 with an initial investment of INR 3.3 million. With a modest beginning of operations as a single unit with 20 employees, Natco today has seven manufacturing facilities spread across India with dedicated modern research laboratories, capabilities in New Drug Development, etc. 1

Natco family currently consists of around 5000 employees, Natco Pharma is consistently ranked among fastest growing pharmaceutical companies in India. Natco is well recognized for its innovation in Pharmaceutical R&D.

Milestone

| 1981 | Incorporated Natco Pharma Division at Kothur, Mahaboobnagar Dist, Telangana, India |

| 1984 | First Full year in operationss - sales of Rs. 0.5 million |

| 1986 | Inaugurated parentals manufacturing facility at Nagarjunasagar, Telangana, India |

| 1993 | Inaugurated NATCO's chemical division at Mekaguda in Telangana |

| 1997 | Inaugurated Natco Research Center (NRC) at Sanathnagar, Hyderabad, India |

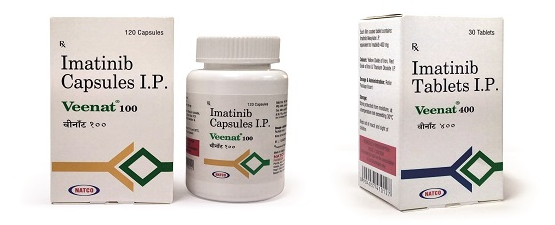

| 2003 | Launched Oncology division with introduction of flagship brand VEENAT (generic Imatinib Mesylate) for the treatment of chronic myelogenous leukemia. |

| 2006 | Incorporated a finished dosage facility at Dehradun, Uttarakhand. |

| 2007 | Natco launched its first ever ANDA in the US Market. Natco acquired Savemart Pharmacy in USA. |

| 2011 | Incorporated NATCOfarma do Brazil LTDA |

| 2013 | Established Natco Pharma Canada Inc for sales & distribution in Canada. |

| 2014 | Established Natco Pharma Australia Pty Ltd for sales & distribution in Australia. |

| 2019 | Commercial manufacturing operations begin in NATCO's Visakhapatnam Formulation Facility. NATCO launches Crop Health Sciences Division. |

| 2020 | NATCO's Visakhapatnam Formulation Facility receives USFDA approval. NATCO supplies Chloroquine Phosphate tablets to the US market in support Of COVID-19 treatment. |

Products

- Glatiramer Acetate

- Liposomal Doxorubicin

- Oseltamivir

- Hepcinat and its combinations

- Sorafenat

- Geftinat

- Veenat (Imatinib)

Facilities

Headquartered in Hyderabad, India, Natco has six formulation locations across India – two in Dehradun (Uttarakhand), one in Kothur (Mahboobnagar, Telangana), one in Nagarjuna Sagar (Nalgonda Dist, Telangana), one in Visakapatnam (Andhra Pradesh), and one in Guwahati (Assam); two chemicals manufacturing locations – one in Mekaguda (Mehboobnagar, Telangana), and another in Manali (Chennai). Natco Research Center (NRC), its R&D facility is located in Sanathnagar (Hyderabad). The company's manufacturing plants are spread across India and certified by stringent global regulatory authorities. 2

APIs

- Mekaguda

- Chennai

Formulations

- Kothur

- Nagarjuna Sagar

- Dehradun Unit 6

- Dehradun Unit 7

- Guwahati

- Visakhapatnam

Contract Manufacturing

- Nagarjuna Sagar

- Dehradun Unit 6

- Dehradun Unit 7

Research & HQ

- Research Center (NRC)

- Corporate Office

Crop Health Sciences

- Formulation Plant Attivaram

Business Segments

inished dosage formulations (“FDF”) and active pharmaceutical ingredients (“APIs”). The company's focus is primarily on niche therapeutic areas and complex products. The company market and distribute its products in over 40 countries. The company sell its FDF products in the United States, India, Europe and the rest of the world (“RoW”). The company also operate in certain key geographies through its subsidiaries. 3

The company manufacture API products which are primarily used for captive consumption in its FDF products and are also sold to customers for various international markets such as Brazil, Europe and USA. In the API segment, Natco Pharma has capabilities to develop and manufacture products with multi-step synthesis, semi synthetic fusion technologies, high-potency APIs and peptides.

Natco Pharma is also engaged in contract manufacturing business, whereby the company undertake selected contracts with pharmaceutical companies to manufacture and supply pharmaceutical products. Natco Pharma has recently diversified into the business of crop health sciences to leverage its skills in organic chemistry.

After carefully assessing the market potential and understanding its own strengths, Natco is targeting a unique set of molecules for the Indian market, which have a potential to expand to other regions. Natco has also entered strategic alliances with partners who will help in making inroads into the segment. The activities related to the construction of facilities in Nellore area, Andhra Pradesh has been initiated for both active ingredient and crop protection products.

Industry Overview

Global spending on medicine has increased steadily at a 10-year CAGR of 4.2% from 2009 to 2019, reaching $955 billion in 2019. This growth is expected to exceed $1.1 trillion by 2024, driven by the increased use of specialty and innovative drugs and formulations reaching the market. 4

Specialty medicines account for 36% of global spending, with projections to touch 40% by 2024. New product growth too is projected to contribute $165 billion over the next five years, up from $126 billion. The rise in global pharmaceutical spending would be due to increased usage and because of changes in the specialty and innovative product composition of new brands coming up in the market. However, factors countering this growth may include, to an extent, overall pricing pressures and patent expiry in the developed markets.

While the developed markets currently include 10 countries with pharmaceutical spending greater than $10 billion, namely the US, Japan, Germany, France, Italy, Spain, the UK, Canada, South Korea and Australia, pharmerging markets include countries with per capita income below $30,000 per year and five-year absolute growth in pharmaceutical spending greater than $1 billion. India, China, Russia, South Africa, Saudi Arabia, Thailand, Turkey and Vietnam are key phamerging markets, among others.

The pharmerging market is expected to reach $345 billion by 2024, and this would be majorly driven by expansion in market accessibility, leading to usage in greater volumes and adoption of more specialty medicines. The developed markets are likely to reach a market size of $695 billion by 2024, supported by pricing and market access controls.

USA

The US continues to be the largest pharmaceutical market, capturing ~41% of global pharmaceutical spending. It also dominates pharmaceutical trends, both in consumption and development. During the period from 2014 to 2019, the US has recorded CAGR of ~4% in its spending on medicines. According to estimates, prescription drug spending stood at $500 billion in 2019. The probability of this touching $600 billion by 2023 is high. Despite it being a mature market for years, the US pharmaceutical industry is still ranked fourth in the overall growth potential, trailing high-growth emerging markets like China, India and Germany.

Pharmerging markets

Pharmerging markets have seen the greatest growth, with a 12.2% CAGR between 2009 and 2014 and 7.7% CAGR between 2014 and 2019. In 2019, pharmerging markets comprised 26% of spending, which is expected to rise to 28-30% of that in 2024. Most of this growth has been driven by expansion of access to drugs and healthcare, leading to greater volume use and increasing adoption of novel therapies. This is expected to lead to rise in consumption of specialty medicines.

India

India commands a strong position in the global pharmaceuticals sector. Being the largest manufacturer of generic drugs globally, catering to ~40% of the demand for generic medicines in the US and 25% of all medicinal requirements in the UK. Indian pharmaceutical sector meets more than 50% of the world’s demand for vaccines.

Indian pharmaceuticals domestic market sales reached $20.03 billion in 2019, from $18.12 billion in 2018, a growth of 9.8%. India’s pharmaceutical exports stood at $13.69 billion in FY 2019-20 (up to January 2020). By 2020, these are expected to touch $100 billion, whereas the medical device market is expected to be valued at $25 billion.

The Indian government has been proactive in encouraging the pharmaceuticals sector. It accounted for allocation of Rs 650.12 billion under the Union Budget 2020-21 by the Ministry of Health and Family Welfare, boosting the confidence of the industry. The government also unveiled the ‘Pharma Vision 2020’ aimed at making India a global leader in end-to-end drug manufacturing.

Business Overview

NATCO Pharma Ltd. is a vertically integrated and R&D focused enterprise, engaged in developing, manufacturing and marketing FDF and active pharmaceutical ingredients (APIs) and intermediates. The Company has also initiated plans to diversify into niche agrichemical business.

The Company focuses on niche therapeutics areas and complex products, which gives it a unique positioning in the market, spread over 40 countries. It sells FDF products in the US, India, Europe and Rest of the World (RoW); with substantial clientele in Canada and Brazil as well. It holds a leading market share in the domestic oncology segment.

In India, NATCO sells its products through its own salesforce and branding whereas, in the US and RoW markets, business is done through local partnerships or subsidiaries. The Company’s pharma segment has eight manufacturing facilities, which include six FDF and two API facilities that offer several advantages and help to optimise costs.

NATCO operates in two business categories, FDF and APIs. Its formulations business caters to international markets, with key focus on the US and Europe while increasing foothold in Brazil and Canada, and domestic markets, with products in oncology, pharma specialties and cardiology and diabetology (CnD). NATCO’s API business leverages its unique capabilities that include multi-step synthesis, semi-synthetic fusion technologies, high-potency APIs and peptides. NATCO is also into contract manufacturing. The Company is leveraging its expertise in organic chemistry to drive its foray into agrichemicals to help improve crop health.

Domestic formulations

NATCO has a strong domestic formulations business led by its presence in the oncology segment and a strong portfolio of products in its non-Oncology segment including Hepatitis C portfolio products. The Company made significant progress in its cardiology and diabetology segment through the launch of five niche products during the year. Overall, during FY 2019-20, the Company launched eight products across the three key business segments. Oncology as well as the pharma speciality business faced downward revenue trends in FY 2019-20 on account of tepid demand. Despite the challenges, the Company was able to launch products catering to different therapies and segments. NATCO has established its presence in all three business segments and is geared up to launch 8-10 products every year across all its segments in the near future.

During the year, NATCO’s domestic business faced multiple macro headwinds, including channel pricing controls for the oncology products and continued decline in the patient pool for the acute disease caused by Hepatitis-C leading to a decline in its pharma specialty segment. Lastly, there was COVID-19-related business decline during the fourth quarter of the year.

Domestic FDF sales

Oncology

NATCO’s product portfolio is among the most extensive in the Indian oncology market, with 33 active products as on 31st March, 2020, During the year, the Company launched three products with several more launches expected in the future. The company has 10 brands which have recorded sales over Rs 100 million during FY 2019-20.

The oncology segment is core to NATCO’s base business and is expected to continue its growth trajectory over the next several years. The Company’s revenues from this business segment fell from Rs 3,968 million in FY 2018-19 to Rs 3,078 million in FY 2019-20, primarily due to certain macro pressures. These include new pricing controls by National Pharmaceutical Pricing Authority (NPPA), which impacted the margin along the sales channels and the pressures surrounding COVID-19 during the fourth quarter. The company expect to regain growth momentum for the segment going forward.

Non-Oncology business

This comprises of products from its pharma specialty and C&D divisions apart from third party manufactured products. The Company’s revenues from the non-oncology business fell from Rs 3,379 million in FY-2018-19 to Rs 2,327 million in FY 2019-20.

International formulations

It’s been more than a decade that NATCO established a presence in the US and other international markets. In the US, it follows a partnership-driven business model, wherein, NATCO brings the manufacturing strength and know-how while its partner brings the marketing strength. In Canada, Singapore and Brazil, NATCO functions through its subsidiaries.

During FY 2019-20, the Company’s revenue from international business stood at Rs 9,334 million, as compared to Rs 9,933 million in FY 2018-19. Of this, earnings from exports from India stood at Rs 8,249 million, whereas subsidiaries contributed Rs 1,085 million of net revenue.

US

The exports (including FDFs and APIs) to the US clocked revenue of Rs 7,834 million in FY 2019-20. NATCO is positioned strongly in its business in the US, which is primarily driven by the continued growth of revenue coming from Glatiramer Acetate and Liposomal Doxorubicin. The revenues from Oseltamivir continue to be appreciable in spite of competition and the launch of the product over three years ago. During the year, the Company filed for four niche ANDAs with several others in the pipeline.

All NATCO’s manufacturing facilities which cater for the US business continue to be in good standing from USFDA. NATCO’s Vizag facility, which is part of an SEZ for the export market was also successfully inspected during the financial year by USFDA.

RoW markets

Canada

During FY 2019-20, NATCO Pharma Canada Inc. did a business of Rs 1,283 million, as against Rs 960 million in FY 2018-19. In spite of global headwinds, its subsidiary in Canada has shown resilience and growth. NATCO had total 12 active products with 18 approvals as of 31st March, 2020. As of Q1 FY21 Board meeting, the Company has disclosed a settlement with Celgene (now part of Bristol-Myers Squibb) for the product Lenalidomide Capsules in Canada. The Company is excited about its growth in the next few years in Canada.

Brazil

In Brazil, the government and regional tenders account for most of the medicine sales. NATCO services this market through its subsidiary NATCOFARMA Do Brasil. During the year, the Company witnessed four filings. As on 31st March 2020, NATCO had nine filings in Brazil. During FY 2019-20, it has registered a business of Rs 390 million. Regulatory factors remain a key challenge in this market apart from the tender to sale conversion challenges. The Company expects incremental growth in the coming years.

Other RoW markets

NATCO is venturing into newer territories in RoW markets, apart from strengthening its presence in markets where it already operates.

The Company has gradually gained market in Singapore with its generic branded products in spite of the strong affiliation towards innovator brands prevalent in the market.

FY 2019-20, however, turned out to be the year of a breakthrough and NATCO won a major tender worth more than SGD$1 million.

Active Pharmaceutical Ingredient (API)

NATCO enjoys a strong reputation for its API products. Generally, the Company focuses on the manufacture of niche APIs to support its formulation business.

The Company’s move to vertically integrate its API facility helps to ensure business sustainability both in periods of margin pressure as well as disruption in raw material supply.

Revenues from the API division during FY 2019-20 stood at Rs 3,552 million as compared to Rs 3,019 million in FY 2018-19. As of 31st March, 2020, NATCO has a total of 49 active DMFs with the USFDA for products in the areas of oncology, cardiology and orthopaedic therapies. The company filed for four DMFs for the US market in FY 2019-20.

Crop Health Sciences

NATCO has forayed into the agrichemical space through its Crop Health Sciences Division recently. Currently it is in the process to complete the manufacturing facilities for both technical (active ingredient) and formulations. NATCO is targeting the release of a key technical product from its CHS division for Chlorantraniliprole (CTPR), a broad-spectrum insecticide used in several crops, and is hoping to bring formulations based on this product with affordability and accessibility to farmers across the country. NATCO is awaiting regulatory approval for the CTPR product and litigation outcome.

Financial Overview

During FY 2019-20, NATCO’s consolidated revenue from operations stood at Rs 20,224 million, growing at a CAGR of 16.7% over the last four years. The EBITDA for the year was Rs 6,900 million, with an EBITDA margin of 34.1%. The Company’s EBITDA has been growing steadily at a CAGR of 25% over the past four years. Profit After Tax (PAT) stood at Rs 4,608 million, with the PAT margin being 22.8%. CAGR of NATCO’s PAT over the past four comes to 30.9%.

The market capitalisation of the Company as on 31st March 2020 stood at ~`92 billion. For the year ending March 31st 2020 NATCO has declared an equity dividend of 337.50%, amounting to Rs 6.75 per share (face value of each share being Rs 2). Altogether, dividends worth Rs 1,536 million (including dividend distribution tax) have been paid to the shareholders in FY 2019-20, as compared to Rs 1,108 million (including dividend distribution tax) in FY 2018-19.

Moreover, even in such tough and challenging market, the Company has been able to maintain its Return on Equity (ROE) at 12% and Return on Capital Employed (ROCE) at 15% for its shareholders during FY 2019-20. Based on the business prospects for the coming years, the company expect both metrics to make appreciable improvements.

FY2021 Result

NATCO has recorded consolidated total revenue of Rs.2155.7 Crores for the year ended March 31, 2021, as against Rs.2022.4 Crores for the last year reflecting a revenue growth of 6.6% year over year. Net profit for the period on a consolidated basis was Rs.442.4 Crores as against Rs.458.1 Crores last year showing a slight decline of about 3.4%. For the Q4 ended March 31, 2021, the company recorded a net revenue of Rs.359.7 Crores on a consolidated basis as against Rs.477.2 Crores during Q4 of FY2020. Profit after tax on a consolidated basis was recorded as Rs.53 Crores for the Q4 as against Rs.93.2 Crores same quarter last year. As the company mentioned in its note in spite of the significant negative impact of the pandemic on its base business, the company was able to sustain its revenue during the year. The company expects strong growth during the current year due to multiple high value product launches in the US, rebound in the domestic India business with new product launches and contribution from the crop had generous. 5

References

- ^ https://www.natcopharma.co.in/about/mission-heritage/

- ^ https://www.natcopharma.co.in/about/facilities/

- ^ https://www.natcopharma.co.in/our-business/

- ^ https://www.natcopharma.co.in/wp-content/uploads/2020/09/Annual-Report-2019-20-1.pdf

- ^ https://www.natcopharma.co.in/wp-content/uploads/2021/06/InvestecCap-NatcoPharma-18June-2021.pdf