National Aluminium Co Ltd

Summary

- National Aluminium Company Limited (NALCO) is a Navratna CPSE under Ministry of Mines.

- NALCO is one of the largest integrated Bauxite-Alumina-Aluminium- Power Complex in the Country.

- NACO reported a nine-fold rise in consolidated profit at Rs 935.74 crore for the quarter ended March 31, 2021

Company Overview

National Aluminium Company Limited (NALCO) (NSE :NATIONALUM) is a Navratna CPSE under Ministry of Mines. It was established on 7th January, 1981, with its registered office at Bhubaneswar. The Company is a group ‘A’ CPSE, having integrated and diversified operations in mining, metal and power. From the days of first commercial operation since 1987 the Company has continuously earned profits for last 34 years. Despite the Global COVID-19 pandemic NALCO has posted an impressive net turnover and net profit of Rs.8,869.29 crore and Rs.1,299.56 crore respectively in FY20-21. Presently, Government of India holds 51.28% equity of NALCO. 1

NALCO is one of the largest integrated Bauxite-Alumina-Aluminium- Power Complex in the Country. The Company has a 68.25 lakh TPA Bauxite Mine & 21.00 lakh TPA (normative capacity) Alumina Refinery located at Damanjodi in Koraput district of Odisha, and 4.60 lakh TPA Aluminium Smelter & 1200MW Captive Power Plant located at Angul, Odisha. NALCO has bulk shipment facilities at Vizag port for export of Alumina/Aluminium and import of caustic soda and also utilizes the facilities at Kolkata and Paradeep Ports. The Company has registered sales offices in Delhi, Kolkata, Mumbai, Chennai and Bangalore and 9 operating stockyards at various locations in the Country to facilitate domestic marketing.

Globally, NALCO has achieved the distinction of being the lowest cost producer of Bauxite and Alumina in the world as per the latest report of Wood Mackenzie. The Company rated 2nd highest net export earning CPSE in 2018-19 as per Public Enterprise Survey report.

NALCO is the first Public Sector Company in the country to venture into international market in a big way with London Metal Exchange (LME) registration since May, 1989. The Company is listed at Bombay Stock Exchange (BSE) since 1992 and National Stock Exchange (NSE) since 1999.

Products

Aluminium Metal

- Ingots

- Alloy Ingots

- T-Ingots

- Sows

- Billets

- Wire Rods

Alumina & Hydrate

- Calcined Alumina

- Alumina Hydrate

Zeolite-A

Special Products

Rolled Product

- Aluminium Rolled Products

- Aluminium Chequered Sheets

Business Overview

Bauxite Mines

On Panchpatmali hills of Koraput district in Odisha, a fully mechanized opencast mine is in operation since November, 1985, serving feedstock to Alumina Refinery at Damanjodi located on the foothills. Present capacity of Mines is 68.25 lakh TPA. Panchpatmali plateau stands at elevation of 1154 m to 1366 m above mean sea level. Bauxite occurs over the full length of the Panchpatmali plateau, which spans over 18 kms.2

- Area of deposit – 16 sq. KM.

- Resource – 310 million tonnes.

Alumina Refinery

The Alumina Refinery is located at Damanjodi, Odisha, approximately 14 KM from the bauxite mine at Panchpatmali. The mined-out bauxite is transported from captive mine to refinery by a 14.6 KM long single-light multi-curve 1800 tonnes per hour (TPH) capacity cable belt conveyor. The alumina produced is transported to aluminium smelter at Angul (Odisha) and to Vizag (Andhra Pradesh) port by rail.

The present capacity of Alumina Refinery is 22.75 lakh TPA. Alumina produced is used to meet Company’s requirements for production of primary aluminium at smelter. The surplus alumina is sold to third parties in the export markets.

Aluminium Smelter

The present capacity of smelter is 4.60 lakh TPA. Alumina is converted into primary aluminium through a smelting process by using electrolytic reduction. From the pot-line, the molten aluminium is routed to either the casting units, where the aluminium can be cast into ingots, sow ingots, tee ingots, billets, wire rods, cast strips and alloy ingots, or to RPU where the molten aluminium is rolled into various cold-rolled products or cast into aluminium strips. Aluminium products are sold in the domestic market and also exported through Kolkata, Paradeep & Vizag ports.3

Nalco acquired and subsequent merged International Aluminium Products Limited (IAPL), the 50,000 tpa export-oriented Rolled Products Unit with Nalco. The RPU is integrated with the Smelter Plant at Angul for production of aluminium cold rolled sheets and coils from continuous caster route based on the advanced technology of FATA Hunter, Italy. It has also started production of another variety of rolled product named as chequered sheet with thickness ranging from 0.60mm to 3.0mm.

Captive Power Plant

Presently the Captive Thermal Power Plant has a generation capacity of 1200 MW (10X120MW). While the captive thermal power plant provides entire electric power requirement of aluminium smelter, it also feeds for approximately 35 MW of the power requirement to the alumina refinery through the State Grid. 4

The location of captive thermal power plant at Angul is also strategic to the availability and supply of coal from nearby Talcher Coalfields. The 18.5 KM captive railway system links the captive thermal power plant to the Talcher coalfields, enabling transport of the critical and bulk requirement of coal.

The water for the Plant is drawn from River Brahmani through a 7 KM long triple circuit pipeline. The coal demand is met from a mine of 3.5 Million TPA capacity opened up for Nalco, initially at Bharatpur in Talcher by Mahanadi Coalfields Limited. The Power Plant is inter-connected with the State Grid.

Rolled Products Unit

Nalco has set up a 50,000 MT per annum Rolled Products Unit, integrated with the Smelter Plant at Angul, for production of aluminium cold rolled sheets and coils from continuous caster route, based on the advanced technology of FATA Hunter, Italy.

Port Facilities

On the Northern Arm of the Inner Harbour of Visakhapatnam Port on the Bay of Bengal, Nalco has established mechanized storage and ship handling facilities for exporting Alumina in bulk and importing Caustic Soda.

- Maximum ship size for loading Alumina : 40,000MT DWT

- Maximum Alumina loading rate : 2,200 TPH (Avg. 1,500 TPH)

- Alumina storage capacity: 3 x 25,000MT RCC Silos.

- Caustic soda Lye storage capacity: 3 x 10,000LMT.

Wind Power Plants

The 1st wind power plant of capacity 50.4 MW (2.1MW, 24 nos. WEGs) in Gandikota, Andhra Pradesh was commissioned in December 2012 and the 2nd wind power plant of capacity 47.6 MW (0.85 MW, 56 nos. WEGs) at Ludarwa site, in Jaisalmer, Rajasthan was commissioned in Jan’2014. 3rd wind power plant of capacity 50 MW (2 MW, 25 nos. WEG) at Devikot site, Jaisalmer, Rajasthan and a 50.4 MW (2.1MW, 24 nos. WEGs) Wind Power Plant at Sangli, Maharashtra commissioned in FY 2016-17.

Solar Power

NALCO utilised the entire available roof top space in Corporate Office, Township and NRTC at Bhubaneswar for setting up of 310 kWp solar power plant.

Industry Structure and Developments

Alumina

During the year 2019, total world production of Metallurgical Grade Alumina (MGA) was 123.53 Million Tonnes, registering a decrease of 1.1% compared to 124.86 Million Tonnes produced during 2018. Alumina consumption during 2019 was 123.15 Million Tonnes as against 124.72 Million Tonnes consumed during 2018, exhibiting a YoY decrease of 1.3%. China was the major contributor in both production and consumption, having 55% share in production and 55.9% share in consumption of Alumina. World metallurgical grade alumina demand is expected to be 124.96 Million Tonnes in 2020, representing a modest year-on-year increase of 1.5%. Overall, the Alumina market is expected to remain in slight deficit of 0.6 Million Tonnes in 2020 with an expected production of 124.34 Million Tonnes.5

Total Alumina production in India during the financial year 2019-20 was 66.36 Lakh Tonnes, thereby registering a YoY growth of 2.1%. Out of this, the company’s contribution was 20.9 Lakhs (31.5%). Some of the key factors that pulled the alumina prices lower during 2019-20 were excess production, owing to the resumption of Alunorte Refinery and commencement of production at Al-Taweelah Refinery in the UAE. The price decline was also due to slow global demand for aluminium, with user industries underperforming throughout the year. International Alumina prices have recovered a little during May-June, 2020, as major consumer China’s economy seems to be recovering well from the COVID-19 pandemic

World bauxite production during 2019 was around 339.1 Million Tonnes, which is 3.7% higher than 327.0 Million Tonnes produced in 2018. Global bauxite production during 2020 is expected to be around 354.2 Million Tonnes. According to US Geological Survey's Mineral Commodity Summerizes Report, India's Bauxite production in 2018 was 23 million tonnes, which increased to 26 million tonnes in 2019.

China has continued to import enormous tonnages of bauxite. During April, 2020, 9.9 Million Tonnes of bauxite were imported by China, which were mainly sourced from Guinea, Australia and Indonesia.

Aluminium

World production of Aluminium during the year 2019 was 63.08 Million Tonnes, registering a fall of 1.3% compared to production figures of 63.92 Million Tonnes achieved in 2018. At the same time, worldwide consumption of Aluminium also declined by 1.75% from 65.25 Million Tonnes in 2018 to 64.11 Million Tonnes in 2019. The market, thus, stayed in deficit of around 1.03 Million Tonnes during 2019. China was the largest producer as well as consumer during the year, contributing 55.7% share (35.10 Million Tonnes) of the world production and 55.8% (35.77 Million Tonnes) of the world consumption of Aluminium. China registered a negative aluminium production growth of 3.1% during 2019, while the rest of the world exhibited 1.0% growth in production. As far as Aluminium consumption is concerned, China’s figures remained flat during 2019, while the rest of the world registered a contraction of 3.8%. During FY 2019-20, consumption of Aluminium in India fell by 5.6%.

The average LME Cash Settlement price during the financial year 2019-20 was USD 1,749 per MT, dropping 14.1% against the corresponding figure of USD 2,035 per MT during 2018-19. The price has fallen further during the first quarter of FY 2020-21. This trend is likely to continue for some more time.

Estimated global Aluminium stocks at the end of financial year 2019-20 stood at 13.00 Million Tonnes, registering a growth of 6.45% against stocks of 12.21 Million Tonnes at the end of FY 2018-19.

In contrast to global market deficit of about 1.0 Million Tonnes in 2019, a huge market surplus of about 5.5 Million Tonnes is expected in 2020, mainly due to sharp drop in demand owing to COVID-19 without any significant production cuts.

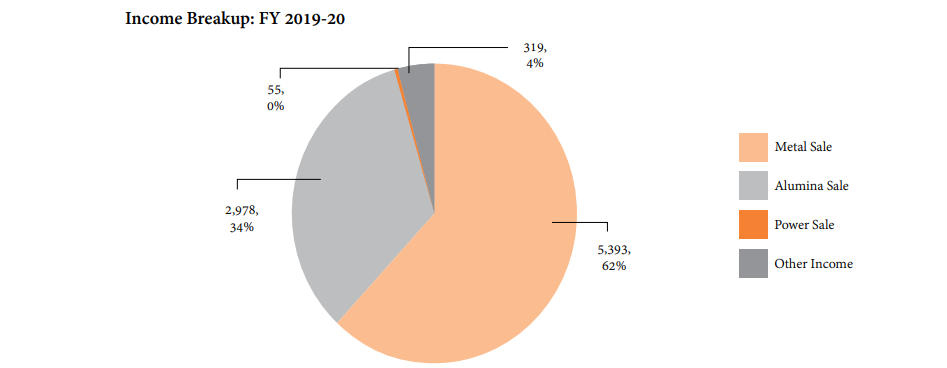

Financial Highlights

The turnover during FY 2019-20 has decreased from ₹11,386.32 crores to ₹8,425.75 crores as compared to previous financial year resulting in a drop in sales by about 26%. Falling LME is mainly attributable for such declined sales turnover.

Average sales realization of Aluminium has decreased from ₹1,54,872 to ₹1,36,257 per MT and that of Alumina has decreased from ₹33,935 to ₹22,280 per MT as compared to the previous year. From the volume front, sales quantity of Alumina, Aluminium and wind power has decreased by about 1%, 10% and 51% respectively

Other Operating Income during the year has decreased from ₹113.00 crores to ₹46.09 crores as compared to the previous financial year. This drop of operating income by about 59% is mainly due to lower export incentive caused by lower sales realization of Alumina and Aluminium and lower incentive earnings on renewable power generated caused by the lower quantum of sales and the lower trading price of Renewable Energy Certificates (REC) at the designated exchanges.

NALCO registers 9 fold increase in Net Profit for FY 2020-21

National Aluminium Co Ltd (Nalco) on Monday reported a nine-fold rise in consolidated profit at Rs 935.74 crore for the quarter ended March 31, 2021, helped by strong operational performance and favourable prices.6

The company had posted a consolidated profit of Rs 100.51 crore in the year-ago period, Nalco said in a filing to BSE.

The consolidated income of the company increased to Rs 2,874.47 crore, compared to Rs 2,042.27 crore in the year-ago period.

"After the peak period of COVID-19 outbreak and with the opening of the markets, the company witnessed a significant recovery in the second half of the financial year of 2020-21.

"With further easing of restrictions and resumption of economic activities, NALCO is optimistic for a robust growth in the long run with its focus on increasing the production in mining and refining segments and opening up of the new coal blocks," Nalco CMD Sridhar Patra said.

Attributing the success to the teamwork and dedication of the employees, Patra said the company has made exemplary contributions in promoting and putting focus on plant, production, productivity and people.

The results were driven by strong operational performance by units, with effective sales strategy, cost saving measures, supported by favourable LME price, the company said.

References

- ^ https://nalcoindia.com/company/about-us/

- ^ https://nalcoindia.com/business/operation/bauxite-mines/

- ^ https://nalcoindia.com/business/operation/aluminium-smelter/

- ^ https://nalcoindia.com/business/operation/captive-power-plant/

- ^ https://nalcoindia.com/wp-content/uploads/2020/09/NALCO_-Annual-Report-2019-2020-1.pdf

- ^ https://www.moneycontrol.com/news/trends/sports-trends/olympic-games-tokyo-2020-top-sponsor-toyota-pulls-games-related-tv-ads-7194261.html