NovaGold Resources

Summary

- NovaGold Resources is a pure gold play focused on Alaska’s Donlin Gold project in equal partnership with Barrick Gold.

- Donlin is positioned to be one of the world’s largest gold mines, with 39 million ounces in measured and indicated mineral resources at a high average grade of 2.24 grams per tonne1 on a mineralized trend that occupies just 5 percent of its land package.

- The companies' mines are among the world's most significant gold projects with an anticipated 27 year life.

Company Overview

NovaGold Resources (TSX:NG, NYSE: NG) is a pure gold play focused on Alaska’s Donlin Gold project in equal partnership with Barrick Gold. Donlin is positioned to be one of the world’s largest gold mines, with 39 million ounces in measured and indicated mineral resources at a high average grade of 2.24 grams per tonne1 on a mineralized trend that occupies just 5 percent of its land package. The company believe it offers investors extraordinary leverage to gold.1

NOVAGOLD has a cash balance of US $169.1 million as of November 30, 2021, expected to be sufficient to continue advancement on the Donlin Gold project and fulfill all of its current financial obligations towards a construction decision.

Operations & Infrastructure

Mine Operations

Donlin Gold is expected to be a conventional open pit, truck-and-shovel operation. Mining is expected to occur over 26 years, inclusive of one year of pre-stripping. The process plant will be fed with stockpiled low-grade ore for two additional years following the completion of mining. Peak production rates are expected to reach 155 million tonnes per year (425,000 tonnes per day). The mining equipment required includes large hydraulic shovels, front-end loaders, ultra-class haul trucks, rotary blast hole drills, and various support equipment including track dozers, wheel dozers, graders, water trucks, and excavators.2

Metallurgy And Processing

The run-of-mine (ROM) ore from the Donlin Gold deposit will be crushed in a gyratory crusher and then milled using semi-autogenous grinding (SAG) and two-stage ball milling. Average throughput is expected to be 53,500 tonnes per day. The gold-bearing sulphides will be recovered by flotation to produce a 7% sulphur concentrate representing around 15% of the original mass with an average gold grade of approximately 13 g/t. The concentrate is refractory and will be pre-treated in a pressure oxidation circuit (autoclave) prior to cyanidation (Carbon-In-Leach). Overall gold recovery from flotation, pressure oxidation and cyanidation is estimated at 89.8%. Excess acid from the autoclave circuit will be neutralized with flotation tailings and slaked lime. Prior to being combined with flotation tails, CIL tails will be detoxed. All tailings from this process will be impounded in the tailings storage facility. During operations, water will be reclaimed for re-use in the process plant.

Supporting Infrastructure

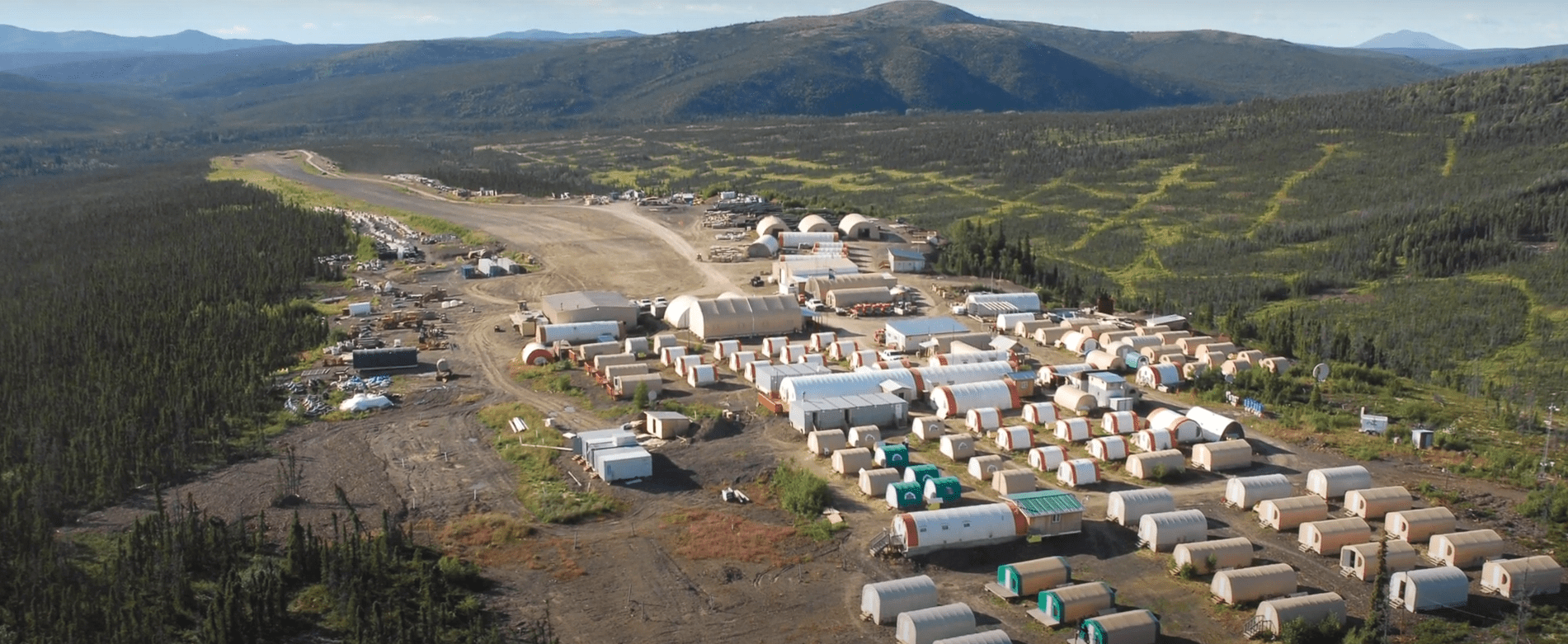

Due to the remote location of Donlin Gold, infrastructure required to support the mine and process operations include a marine cargo port near Bethel, an upriver port near Jungjuk Creek, ocean and river barging operations, an access road from the upriver port to site, a permanent camp, an airstrip, power generation facilities, fuel storage facilities, water management facilities, and a natural gas pipeline.

Natural Gas Pipeline

Donlin Gold is proposing to build a buried natural gas pipeline to serve as the energy source for on-site power generation. The 315 mile-long (507-kilometer-long), 14-inch-diameter (356 mm) steel pipeline would transport natural gas from the Cook Inlet region to the project site.

This natural gas pipeline is a better economic alternative over the life of mine to the previously considered barging of diesel fuel. Operating costs assume a delivered gas pricing which includes importing liquefied natural gas (LNG) to Anchorage; total delivery costs associated with purchase, transportation, and regasification of the LNG; delivery through the Cook Inlet pipeline network (existing 20-inch-diameter (508mm) natural gas pipeline near Beluga); and operating costs for the Cook Inlet-to-Donlin Gold pipeline.

Capital Cost Estimate

The total estimated cost to design and build the Donlin Gold project, is $7.4 billion per the the NI 43-101 Technical Report on the Donlin Gold Project, Alaska, USA, effective June 1, 2021 and the S-K 1300 Technical Report Summary on the Donlin Gold Project, Alaska, USA, November 30, 2021.

Sustaining Capital Cost Estimate

The sustaining capital cost estimate for the life of the mine totals $1.7 billion, or $57 per ounce of gold sold.

Operating Cost Estimate

Operating costs at Donlin Gold, estimated in the NI 43-101 Technical Report on the Donlin Gold Project, Alaska, USA, are generally categorized into mining, processing, general and administrative (G&A), and land & royalty payments. Mine operating costs are expected to total approximately $8.4 billion over the life of mine (LOM), or $2.58 per tonne mined. Process operating costs are expected to total $6.9 billion over the LOM, or $13.70 per tonne processed. G&A costs are expected to total $1.8 billion over the LOM, or $3.49 per tonne processed. Royalty and land use costs are expected to total $2.2 billion over the LOM at a gold price of $1,500 per ounce. Total operating costs over the LOM are estimated to be $19.3 billion or $38.21 per tonne processed or $635 per gold ounce sold (based on LOM operating costs of $19.2 billion and 30.4 million ounces of gold sold). Significant drivers of operating costs include diesel fuel, natural gas (for generating electric power), labor, processing reagents and consumables, explosives, tires, fixed and mobile maintenance supplies, and consulting and contracting services.

Mineral Reserves & Mineral Resources

| Donlin Gold | Tonnage | Grade | Metal content 100% basis | Attributable to NOVAGOLD 50% |

| GOLD | kt | g/t Au | koz Au | koz Au |

| Reserves | ||||

| Proven | 7,683 | 2.32 | 573 | 287 |

| Probable | 497,128 | 2.08 | 33,276 | 16,638 |

| P&P | 504,811 | 2.09 | 33,849 | 16,925 |

| Resources,exclusive of Reserves | ||||

| Measured | 869 | 2.23 | 62 | 31 |

| Indicated | 69,402 | 2.44 | 5,435 | 2,718 |

| M&I | 70,271 | 2.43 | 5,497 | 2,749 |

| Inferred | 92,216 | 2.02 | 5,993 | 2,997 |

| Resources,inclusive of Reserves | ||||

| Measured | 7,731 | 2.52 | 626 | 313 |

| Indicated | 533,607 | 2.24 | 38,380 | 19,190 |

| M&I | 541,337 | 2.24 | 39,007 | 19,503 |

| Inferred | 92,216 | 2.02 | 5,993 | 2,996 |

Financial Highlights

Fiscal Year 2021 Financial Results

Jan. 26, 2022; NOVAGOLD released its 2021 year-end financial results for the year ended November 30, 2021 and an update on its Tier One 1 gold development project, Donlin Gold, which NOVAGOLD owns equally with Barrick.3

In 2021, NOVAGOLD achieved the following milestones:

- NOVAGOLD and Barrick successfully completed the 2021 drilling at Donlin Gold:

- 79 core holes, upsized from the original work plan, were drilled in the ACMA and Lewis pit areas. The total drill program encompassed 24,264 meters.

- With extensive communication and the application of health and safety protocols, COVID-19 cases at site were minimal and there were no Lost-Time Incidents.

- To date, Donlin Gold has reported assays for 36 complete and 22 partial holes from the 2021 drill program, encompassing approximately 65 percent or 15,700 meters of length drilled. Assays continue to support the global resource estimate, recent modelling concepts, and strategic mine planning work.

- Donlin Gold strives to aid local communities with support and resources, particularly when health and safety are of concern, along with other areas, such as environmental management, training and education, as well as cultural initiatives in the Yukon-Kuskokwim (Y-K) region. Specifically, Donlin Gold worked with its Alaska Native partners, Calista Corporation (“Calista”) and The Kuskokwim Corporation (TKC), as well as other key representatives of Y-K communities to:

- Sponsor the Calricaraq team from the Yukon-Kuskokwim Health Corporation to travel to area villages to support residents and families who have lost loved ones to suicide – a heightened challenge in remote villages, especially during the COVID-19 pandemic.

- Partner with KSKO Radio to purchase hand-held radios for five middle Kuskokwim villages. This initiative expands the reach of public radio to communities where internet connectivity is lacking.

- Enter into a sponsorship agreement with the Alaska School Activities Association to underwrite statewide sports.

- With key Federal and State permits in hand, Donlin Gold advanced additional State permits:

- In November 2021, the ADF&G issued two Special Area Permits required for pipeline facilities located within the Susitna Flats State Game Refuge.

- In December 2021, the ADEC approved a third extension of the air quality permit to June 30, 2023.

President’s Message

As the company start a new year, the company can reflect on 2021 as a year of important achievements for the Donlin Gold project. Despite the formidable challenges caused by a global pandemic that continues to affect its daily lives, the company reached and exceeded several milestones as the company advanced Donlin Gold up the value chain. The company's drill campaign was successful not only because of the strong drill results, but also because the company managed to conduct its business with the utmost attention to the health and safety of its employees, their families, its contractors, and visitors as well as members of the communities in which the company operate. Donlin Gold delivered many tremendous benefits to many people.

To further solidify its understanding of the structural controls on mineralization, a decision was made to expand the parameters of the 2021 program mid-year. The ability to complete this expanded program within the 2021 drill season was facilitated by its efficient and effective onsite team.

The original 2021 drill program plan was expanded by 13 drill holes to gather more closely spaced data to assess the dominant controls and orientations of gold mineralization. This infill program has been instrumental in supporting its updated ore domaining approach and will be expanded in 2022. Overall, the 2021 drill program was designed to complete the work necessary to validate and increase confidence in recent geologic modelling concepts to support future feasibility work. The drill program included confirmation and extension drilling that focused on further testing of orebody continuity and structural controls, as well as data collection for geotechnical and geometallurgical purposes. A total of 79 drill holes totaling approximately 24,264 meters were completed in both the ACMA and Lewis deposit areas.

The assay results released to date have returned significant high-grade intercepts. They continue to support the global resource estimate, recent modelling concepts and strategic mine planning work. Recent top intervals include 57.25 m grading 6.87 g/t gold starting at 270.35 m drilled depth, including a sub-interval of 4.05 m grading 18.13 g/t, starting at 288.95 m drilled depth (DC21-1976); and 19.15 m grading 12.57 g/t gold starting at 173.19 m drilled depth, including a sub-interval of 12.15 m grading 17.28 g/t, starting at 179.19 m drilled depth (DC21-1970), as per the December 1, 2021 Donlin Gold joint media release , final results from the 2021 drill program are expected to be disclosed in the coming months.

Largest Planned Budget in 2022 for Donlin Gold in Over a Decade

In September 2021, the combined executive team from NOVAGOLD and Barrick conducted management review meetings with Donlin Gold LLC in Alaska. The objective was to chart a course toward advancing the project up the value chain. As a result, the Donlin Gold LLC board approved additional funding in 2021 to conduct specific studies and increase staffing in preparation for the 2022 work program. In addition, senior executives met with local stakeholders as well as senior Alaska, Federal, and State government officials who expressed their continued strong support for the project. With a progression plan in place, the necessary groundwork was laid to prepare for a feasibility study update, subject to Donlin Gold LLC board approval.

In 2022, the proposed overall budget for the Donlin Gold LLC (100%) is set at $60 million (of which NOVAGOLD’s portion is 50 percent). It is the largest project budget in more than a decade and is designed to:

- update geologic modelling and interpretation work for an updated resource model and engineering activities for use in an updated project feasibility study;

- undertake approximately 34,000 meters of planned technical and in-pit and below-pit exploration drilling;

- support fieldwork and permitting for the Alaska Dam Safety Certifications;

- support environmental activities; and

- support community and external affairs efforts. Tremendous work by all was undertaken to plan the path forward for the Donlin Gold project, and the company look forward to the next phase with enormous enthusiasm.

Consistent Engagement with Stakeholders

NovaGold Resources is truly fortunate to have long-term Alaska Native partners in the Y-K region. The Donlin Gold project is unlike most other mining assets in Alaska, or indeed, globally. The reason lies in its location on private land that was designated for mining activities five decades ago. Alaska Native Elders realized that the land and resources at Donlin Gold should benefit the Y-K region. Donlin Gold is a party to life-of-mine and surface use agreements with Calista, which owns the subsurface mineral rights and some surface rights, and TKC, which owns the surface rights. During the 2021 drill program season, 70 percent of Donlin Gold direct hires were Alaska Natives from 20 Y-K communities. With each year that passes, the parties work more and more closely together.

Donlin Gold sponsored the Calricaraq (“to practice good health”) team from the Yukon Kuskokwim Health Corporation to travel to area villages to support residents and families who have lost loved ones to suicide – a heightened challenge in remote villages, especially during the COVID-19 pandemic. This program helps communities deal with generational trauma and find healthy ways to grieve.

In April, Donlin Gold was the primary sponsor for the Lower Kuskokwim School District’s annual College and Career fair – a virtual event which more than 42 vendors and 100 students attended. In the fall, Donlin Gold entered into a sponsorship agreement with Alaska School Activities Association to underwrite statewide sports, music programs, and other activities in the Y-K region and across Alaska.

In March 2021, the Thomas Lodge in Crooked Creek near the project site suffered a major fire. The Company provided support to repair the damage caused by the fire. The Thomas Lodge is the only lodging facility in the village and in proximity to the project site.

Donlin Gold partnered with KSKO Radio to purchase hand-held radios for five middle Kuskokwim villages. This initiative expands the reach of public radio to communities where internet connectivity is lacking. Every home will now have an information source for important updates from the Y-K region, including local news and weather updates.

Donlin Gold is a sponsor of the RurAL CAP Elder Mentor Program that connects youth with Elders in Alaska to share their values and knowledge with younger generations and support academic engagement and school readiness statewide.

Donlin Gold’s environment, health and safety commitment is embodied in its support of the 2021 Clean-up Green-up program that ran throughout the summer and reached a record 50-plus Tribes and municipalities who participated in the event. Donlin Gold held the fourth and most successful “In It For The Long Haul” backhaul project last summer that removed approximately 180,000 pounds of hazardous and electronic waste from 26 villages throughout the Y-K region. Over the last five years, along with community and Tribal partners, nearly 400,000 pounds of waste were collected and removed that would otherwise end up in landfills, in waterways, or in other areas that could be harmful to local communities.

While many initiatives are rightfully focused on the Donlin Gold project and the greater Y-K region and State of Alaska, NOVAGOLD actively supports organizations in its local communities and in Alaska. In May, NOVAGOLD sponsored and participated in the Mining for Miracles Pie Throw, an annual fundraising event in support of the British Columbia (“BC”) Children’s Hospital. As CEO, I was happy to participate in this event and help raise funds for the hospital charity. In 2021, NOVAGOLD was recognized for its outstanding contribution to the Lotus Light COVID-19 Community Caring campaign which helped distribute over 1.25 million pounds of hand sanitizers and wipes to thousands of organizations in BC, Ontario and overseas, as well as its financial support of the Lotus Light Emergency Kitchen, providing care packages, disposable masks, and weekly hot meals to Vancouver’s downtown eastside impoverished community. In December, the Company was again a significant co-sponsor of the Homes for the Holidays fundraising event for Kids Help Phone – an initiative that offers free, 24/7 e-mental health services to young people in Canada.

In January 2022, NOVAGOLD established the NOVAGOLD Mining and Geological Engineering Scholarship at the University of Alaska (at UA Fairbanks and UA Anchorage) to help support and encourage undergraduate students to seek bachelor’s degrees in Mining or Geological Engineering, with a focus on supporting underrepresented students. This scholarship is one way NOVAGOLD is taking action to foster diversity.

During the fourth quarter of 2021, the company incurred a net loss of $10.3 million compared to a net loss of $7 million for the comparable period in 2020. The increase in net loss primarily resulted from lower accretion income on Newmont Corp. notes receivable in 2021; activity at Donlin Gold extended into the fourth quarter of 2021; a provision for remediation of the former New Gold House mineral property near Nome, Alaska in 2021; and the recovery of income taxes in 2020 due to the filing of a consolidated income tax return for U.S. subsidiaries.

Net loss increased from $33.6 million ($0.10 per share) in 2020 to $40.5 million ($0.12 per share) in 2021, primarily due to the higher permitting and legal costs related to appeals filed on various State of Alaska permits and completion of assays from the 2020 drill program in 2021, and higher share-based compensation expense resulting from higher amortization of stock options and performance share units (PSUs). Interest income decreased by $1.3 million due to lower interest rates earned on cash and term deposits, partially offset by higher cash balances due to the receipt of $75 million from Newmont on July 27, 2021; a remediation provision expense adjustment for the historic former New Gold House property near Nome, Alaska; lower accretion on notes receivable due to the maturity of the $75 million note receivable; and a recovery of deferred income taxes in 2020 resulting from the Company’s decision to file a consolidated U.S. income tax return for its U.S. subsidiaries commencing with the fiscal year ended November 30, 2020. The increase in expenses was partially offset by favorable foreign exchange movements and a gain on the sale of its interest in the San Roque mineral property in Argentina.

Liquidity and Capital Resources

Donlin Gold funding increased by $2.3 million in 2021 from 2020 primarily due to higher permitting and legal costs due to legal challenges to the State’s CWA Section 401 certification and the State’s ROW agreement and lease authorization for the buried natural gas pipeline, and completion of assays from the 2020 drill program in 2021.

In 2021, the net increase in cash and cash equivalents of $30.2 million primarily resulted from the $75 million note proceeds received from Newmont, partially offset by Donlin Gold funding of $17.6 million, net investments in term deposits of $17.2 million, and corporate operating activities of $9.9 million.

Net spending on operating activities marginally decreased in 2021 from 2020 primarily due to the timing of corporate liability insurance payments; and COVID-19 resulting in reduced corporate travel, offset by higher salaries and benefits; and lower interest received on cash and term deposits due to lower interest rates.

NOVAGOLD’s current cash position as of November 30, 2021, was $91.1 million, with term deposits of $78 million, for a total of $169.1 million. This figure includes the July 2021 payment of $75 million from Newmont Corp. related to the sale of NOVAGOLD’s 50% interest in the Galore Creek project in 2018. Note that a second payment from Newmont of $25 million comes due in 2023, along with a further $75 million contingent payment due when the Galore Creek project is approved for construction by its owners. The Company believes that its cash, term deposits, and receivables are sufficient to cover anticipated corporate general and administrative costs and funding of the Donlin Gold project through to a construction decision.

2022 Outlook

The company anticipate spending approximately $46 million in 2022, which includes $13 million for corporate general and administrative costs; $3 million for withholding taxes on PSUs and other working capital; and $30 million to fund its share of expenditures at the Donlin Gold project, including:.

- $17 million for the 2022 drill program (approximately 34,000 meters of core drilling)

- Grid drilling (mineralization continuity and geologic structural controls in three areas of the deposit)

- In-pit and below-pit exploration

- Platform mapping to confirm mineralization continuity and key geological controls in representative areas of the deposit

- $9 million for external affairs, permitting, environmental, land and legal activities, and

- $4 million for project planning and fieldwork (dam and water structures, metallurgical testing, mining studies, hydrogeology and geochemistry, and infrastructure planning).

NOVAGOLD’s primary goals in 2022 are to continue to advance the Donlin Gold project toward a construction decision; maintain or increase support for Donlin Gold among the project’s stakeholders; promote a strong safety, sustainability, and environmental culture; maintain a favorable reputation of NOVAGOLD, its governance practices and its project among shareholders; and manage the Company treasury effectively and efficiently, including streamlining the corporate structure. The company's operations primarily relate to the delivery of project milestones, including the achievement of various technical, environmental, sustainable development, economic and legal objectives, obtaining necessary permits, completion of feasibility studies, preparation of engineering designs and the financing to fund these objectives.